unum group 4Q 07_Statistical_Supplement_and_Notes

0 likes168 views

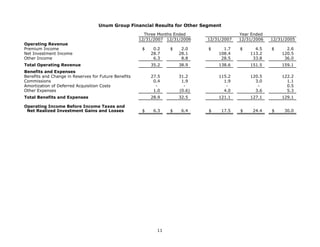

The document is Unum Group's statistical supplement for the fourth quarter of 2007. It includes financial highlights, income statements, sales data, and balance sheets. Some key details are: - Net income for Q4 2007 was $160.5 million compared to $276.1 million in Q4 2006. - Premium income for 2007 was $7.901.1 billion compared to $7.948.2 billion in 2006. - Total sales decreased 4.3% to $379 million in Q4 2007 from $396.2 million in Q4 2006. - Total assets as of December 31, 2007 were $52.432.7 billion.

1 of 41

Download to read offline

Recommended

unum group 3Q 08_Stat_Supp

unum group 3Q 08_Stat_Suppfinance26 This document provides financial highlights and statistical data for Unum Group for quarters 3 and 9 months ended September 30, 2008 and 2007 and years ended December 31, 2007, 2006 and 2005. It includes information on premium income, revenues, benefits expenses, net income, earnings per share, sales data by segment and quarterly performance. Key figures shown are total revenue of $2.4 billion for Q3 2008, net income of $108 million for Q3 2008, and group long-term disability sales increasing 31.4% for Unum US segment in Q3 2008 compared to prior year.

unum group 1Q 08_Statistical_Supplement_Notes

unum group 1Q 08_Statistical_Supplement_Notesfinance26 The document is Unum Group's statistical supplement for the first quarter of 2008. It includes financial highlights showing metrics such as premium income, revenues, income, assets and equity. It also includes segment operating results, quarterly historical results by segment, financial results and statistics by business segment (Unum US, Unum UK, Colonial Life, etc.), reserves data, investment information and statutory basis financial information. The supplement provides detailed quarterly and annual financial information about Unum Group to analyze performance by business segment.

unum group 2Q 08_StatisticalSupplement

unum group 2Q 08_StatisticalSupplementfinance26 This document is a statistical supplement from Unum Group for the second quarter of 2008. It includes financial highlights and consolidated financial statements for Unum for quarters, six month periods, and full years 2005-2007. It also includes sales data by segment (Unum US, Unum UK, Colonial Life, etc.) and notes on non-GAAP measures and items affecting results for specific periods. The document provides an overview of Unum's financial and operating results over several years through tables, charts, and explanatory notes.

unum group 5_2_20071stQtr2007StatSupp

unum group 5_2_20071stQtr2007StatSuppfinance26 This document provides financial highlights and statistical data for Unum Group for the first quarter of 2007. Some key details include:

- Premium income was $1.944 billion for the first quarter of 2007, down slightly from $1.970 billion in the same period of 2006.

- Net income was $178.3 million for the first quarter of 2007, up significantly from $73.4 million for the first quarter of 2006.

- Total assets as of March 31, 2007 were $52.324 billion, up slightly from $50.471 billion as of March 31, 2006.

- The document provides segmented financial results and statistics for Unum US, Unum UK, Colonial, Individual

unum group 4Q 08_Statistical_Supplement

unum group 4Q 08_Statistical_Supplementfinance26 The document is Unum Group's statistical supplement for the fourth quarter of 2008. It includes financial highlights, income statements, sales data, balance sheets, and segment results for Unum US, Unum UK, Colonial Life, Individual Disability - Closed Block, and Corporate. Some key figures are total revenue of $2.3 billion for Q4 2008 and $10 billion for full year 2008, net income of $41.8 million for Q4 2008 and $553.2 million for full year 2008, and premium income of $1.9 billion for Q4 2008 and $7.8 billion for full year 2008. Sales increased 6% in Q4 2008 compared to Q4 2007, led by a 12

unum group 8_1_1_2Q07StatisticalSupplementandNotes

unum group 8_1_1_2Q07StatisticalSupplementandNotesfinance26 The document is a statistical supplement from Unum Group providing financial highlights and results for the second quarter and first half of 2007, as well as annual results for 2006, 2005, and 2004. Some key details include:

- Premium income for the second quarter was nearly $2 billion, similar to the prior year. Net income increased 23% to $153 million compared to the second quarter of 2006.

- Segment operating revenue for the first half of 2007 was over $5 billion, a slight increase from the prior year. Net income increased 68% to $332 million for the first six months of 2007.

- Total assets exceeded $52 billion as of June 30, 2007, an increase from the end of

unum group 3Q 07_Statistical_Supplement_and_Notes

unum group 3Q 07_Statistical_Supplement_and_Notesfinance26 The document is a statistical supplement from Unum Group providing financial highlights and consolidated statements of operations for various periods in 2007 and comparisons to prior years. It includes information on premium income, revenue, income and losses from continuing and discontinued operations, assets, equity, per share information, dividends paid, book value, and stock prices. Certain years are noted as including claim reassessment charges, costs related to debt retirement, broker settlement expenses, and tax benefits or refunds received.

unum group 1_294Q06StatisticalSupplement

unum group 1_294Q06StatisticalSupplementfinance26 This document provides financial highlights and statistical data for UnumProvident Corporation for the fourth quarter and full year of 2006. Some key details include:

- Full year 2006 net income was $411 million compared to $514 million in 2005.

- Premium income for 2006 was $7.948 billion compared to $7.816 billion in 2005.

- Total assets as of December 31, 2006 were $52.823 billion compared to $51.867 billion at the end of 2005.

- Sales from continuing operations increased 12.8% from $1.078 billion in 2005 to $1.106 billion in 2006, led by strong growth in the Unum US segment.

unum group Q1 06

unum group Q1 06finance26 The document is a statistical supplement from UnumProvident providing financial highlights and results for the first quarter of 2006. Some key details include:

- Premium income for the quarter was $1.97 billion, up slightly from $1.935 billion in the first quarter of 2005.

- Net income for the quarter was $73.4 million, down from $152.2 million in the first quarter of 2005, due to a $86 million claim reassessment charge.

- Total assets as of March 31, 2006 were $50.471 billion, down slightly from $50.836 billion at March 31, 2005.

unum group _Q306

unum group _Q306finance26 The document is a statistical supplement from UnumProvident for the third quarter of 2006 that includes financial highlights and statistics for the company. Some key details from the financial highlights include:

- For the third quarter of 2006, UnumProvident reported a net loss of $63.7 million compared to net income of $52.6 million for the same quarter the previous year.

- For the first nine months of 2006, UnumProvident reported net income of $134.9 million compared to $376.1 million for the same period in 2005.

- Total assets for UnumProvident as of September 30, 2006 were $52.2 billion, up slightly from $51.1 billion at

unum group StatSupp_Q405

unum group StatSupp_Q405finance26 The document provides financial highlights and statistical data for UnumProvident Corporation for the fourth quarter and full year of 2005. Some key details include:

- Total revenue for 2005 was $10.4 billion compared to $10.5 billion in 2004.

- Net income for 2005 was $513.6 million compared to a net loss of $253 million in 2004.

- Total assets increased to $51.9 billion in 2005 from $50.8 billion in 2004, with most of the increase occurring in fixed maturity securities.

- Premium income for 2005 was $7.8 billion, consistent with the prior year.

unum group 2Q 06_Statistical_Supplement

unum group 2Q 06_Statistical_Supplementfinance26 This document provides a statistical supplement for UnumProvident Corporation for the second quarter of 2006. It includes financial highlights and consolidated statements of operations, balance sheets, and sales data. Some key details are:

- For the second quarter of 2006, total revenue was $2.67 billion and net income was $125.2 million.

- Premium income for the first six months of 2006 was $3.96 billion and net income was $198.6 million.

- Financial sales data shows growth in most product lines for the U.S. Brokerage segment compared to the second quarter and first six months of 2005.

unum group StatSupp_Q305

unum group StatSupp_Q305finance26 UnumProvident Statistical Supplement Third Quarter 2005

- Provides financial highlights and statistics for UnumProvident for Q3 2005, the first three quarters of 2005, and full years 2004-2002.

- Premium income was $1.952 billion for Q3 2005. Net income was $52.6 million which included charges related to a settlement agreement and income tax benefits.

- Assets were $51.147 billion as of Q3 2005 and stockholders' equity was $7.238 billion.

- Sales of fully insured products in the U.S. Brokerage segment increased 4.3% in Q3 2005 compared to Q3 2004, while ASO products sales increased significantly.

unum group _10/17/05

unum group _10/17/05finance26 This document provides a statistical supplement for UnumProvident Corporation's second quarter 2005 financial results, adjusted to reflect new segment reporting implemented in the third quarter of 2005. It includes key financial highlights such as total premium income of $1.94 billion for the quarter. The supplement presents financial data and statistics for the quarter and year to date by business segment, including income statements, balance sheets, investment portfolios, and statutory capital. Notes are provided to give additional context to the financial information presented.

unum group _1Q 05_Supplement_rev

unum group _1Q 05_Supplement_revfinance26 The document is a statistical supplement from UnumProvident for the first quarter of 2005. It provides financial highlights and statistics for UnumProvident for the quarters and years ending March 31, 2005, March 31, 2004 and December 31, 2004 and 2003. Some key figures include total revenue of $2.6 billion for the quarter, net income of $152 million compared to a net loss of $562 million in the prior year quarter, and total assets of $50.8 billion and stockholders' equity of $7.1 billion as of March 31, 2005.

goodrich 4Q06_Slides

goodrich 4Q06_Slidesfinance44 - Goodrich Corporation reported fourth quarter 2006 results with sales growth of 10% and segment operating margin increase from 11.2% to 12.5% compared to fourth quarter 2005.

- Net income per diluted share was $0.78, reflecting 39% growth including tax adjustments and stock-based compensation expenses.

- For full year 2006, sales grew 9% and segment operating margin increased from 11.5% to 13.0% compared to full year 2005. Net income per diluted share grew 79%.

EP1Q2007Earnings_FINAL(Web)

EP1Q2007Earnings_FINAL(Web)finance49 - The company reported financial and operational results for the first quarter of 2007, with pipeline and E&P results on target.

- Pipeline throughput was up 9% from the first quarter of 2006 due to new supply, expansions, power loads, and colder weather. Several pipeline expansion projects were completed or underway.

- E&P production was on target and a South Texas acquisition was completed for $254 million. Exploration continued in Brazil and the organization's capabilities were increased.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 This document summarizes Raytheon's financial results for the fourth quarter and full year of 2008. Key points include: Raytheon reported solid financial results for Q4 and full year 2008, with record backlog of $38.9 billion; Q4 sales were $6.1 billion and adjusted EPS was $1.13; Full year sales grew 9% to $23.2 billion and adjusted EPS grew 23% to $4.06; Raytheon reaffirmed its financial guidance for 2009 and expects continued growth.

bank of new york mellon corp 3q 07 earnings

bank of new york mellon corp 3q 07 earningsfinance18 The Bank of New York Mellon reported its 3Q07 quarterly earnings. Key highlights include:

- GAAP income after-tax from continuing operations was $642 million, up 37% from 3Q06. GAAP EPS was $0.56.

- Non-GAAP income after-tax from continuing operations excluding merger/integration costs and non-operating items was $754 million, up 32% from 3Q06. Non-GAAP EPS was $0.66.

- Non-GAAP income after-tax from continuing operations excluding merger/integration costs, non-operating items, and intangible amortization was $838 million, up 43% from 3Q06. Non-

celanese q2_2006_presentation

celanese q2_2006_presentationfinance44 This document provides details on Celanese Corporation's second quarter 2006 earnings conference call, including an agenda with the CEO and CFO as speakers. It also provides financial highlights for Q2 2006 such as an 11% increase in net sales and an 18% rise in operating EBITDA. Celanese issues guidance for full year 2006 of adjusted EPS between $2.50-$2.80.

ameriprise 1Q07_Release

ameriprise 1Q07_Releasefinance43 - Ameriprise Financial reported a 14% increase in net income for Q1 2007 to $165 million compared to Q1 2006. Adjusted earnings, which exclude non-recurring separation costs, increased 16% to $220 million.

- Revenues grew 6% to $2.1 billion, driven by 11% growth in management fees and 14% growth in distribution fees. However, net investment income declined 10% due to lower balances in annuity fixed accounts and certificates.

- Earnings growth was achieved through a strategic shift toward fee-based products and greater advisor productivity, though this was partially offset by declines in spread income from annuity and certificate businesses.

bank of new york mellon corp 1q 08 earnings

bank of new york mellon corp 1q 08 earningsfinance18 - The Bank of New York Mellon reported first quarter 2008 earnings, with revenue up 14% versus first quarter 2007 on a pro forma combined basis.

- Pre-tax income was up 26% versus first quarter 2007, driven by strong revenue growth of 15% across business segments, partially offset by higher expenses which grew 6%.

- Assets under management totaled $1.105 trillion, up 8% from first quarter 2007, while assets under custody and administration totaled $23.1 trillion, up 9%.

pepsi bottling 4Q Non Gaap

pepsi bottling 4Q Non Gaapfinance19 The document summarizes Pepsi Bottling Group's (PBG) fourth quarter 2007 earnings conference call. It provides non-GAAP financial measures to allow for meaningful year-over-year comparisons. Items affecting comparability in 2007 include a tax contingency reversal, tax law changes, and restructuring charges. The document also reconciles 2007 and Q4 2007 reported results to comparable results. Guidance for 2008 reported and comparable operating income growth and EPS is also provided.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 Raytheon reported strong financial results for Q2 2008, with sales up 11% and EPS up 27%. All business segments saw sales growth. Raytheon increased full-year guidance for sales, EPS, operating cash flow and return on invested capital. The company also reported solid bookings of $6 billion for Q2 and a backlog of $37.5 billion.

EPElPasoCorporation1Q06WebcastFinal

EPElPasoCorporation1Q06WebcastFinalfinance49 El Paso Corporation reported financial and operational results for the first quarter of 2006. Key highlights included:

- EBIT of $888 million, up significantly from $463 million in the first quarter of 2005.

- Pipelines segment EBIT of $478 million, up 16% year-over-year, driven by growth projects and acquisitions.

- Exploration and Production segment EBIT of $199 million, in line with prior year despite lower production volumes impacted by hurricanes.

- $1.3 billion in gross debt reduction year-to-date through asset sales and cash flow. Balance sheet metrics continue to improve.

- 130 Bcf of 2007 production hedged to provide

XEL_Q305_10Q

XEL_Q305_10Qfinance26 This document is an SEC Form 10-Q filing by Xcel Energy Inc. for the quarterly period ended September 30, 2005. It includes Xcel Energy's consolidated financial statements and notes. The financial statements show operating revenues of $2.3 billion for the quarter and $6.7 billion for the nine months. Net income was $196 million for the quarter and $401 million for the nine months. Earnings per share were $0.48 and $0.99 respectively. Assets totaled $21.5 billion and liabilities totaled $7.1 billion as of September 30, 2005.

unum group Updated_Citigroup

unum group Updated_Citigroupfinance26 The document summarizes Unum Group's fourth quarter 2007 results and provides an overview of the company. Key points include:

- Fourth quarter profits increased 15.8% year-over-year and the group disability benefit ratio declined.

- Unum US had strong sales growth while Unum UK sales declined due to legislative changes in the prior year.

- Colonial continued favorable benefit ratio trends and higher sales.

- Unum Group has diversified its earned premium base across business segments and geographies compared to prior years.

XEL_092805_color

XEL_092805_colorfinance26 This document summarizes Dick Kelly's presentation at the Merrill Lynch Global Power & Gas Leaders Conference on September 28, 2005. It outlines Xcel Energy's strategy of investing in utility assets to earn their allowed return on equity. Key points include a capital expenditure forecast of $6.9 billion from 2005-2009, drivers of value creation through increasing rate base and regulatory returns, and guidance for 2005 EPS of $1.18-1.28 per share. Rate cases are also discussed that could increase revenues in 2006 and 2007.

eTwinning - internationale faglige fællesskaber

eTwinning - internationale faglige fællesskaberClaus Berg eTwinning – Internationale faglige fællesskaber. Silkeborg, den 8. okt. 2010.

Claus Berg

Chefkonsulent

UNI-C

eTwinning NSS:

etwinning@uni-c.dk

More Related Content

What's hot (17)

unum group Q1 06

unum group Q1 06finance26 The document is a statistical supplement from UnumProvident providing financial highlights and results for the first quarter of 2006. Some key details include:

- Premium income for the quarter was $1.97 billion, up slightly from $1.935 billion in the first quarter of 2005.

- Net income for the quarter was $73.4 million, down from $152.2 million in the first quarter of 2005, due to a $86 million claim reassessment charge.

- Total assets as of March 31, 2006 were $50.471 billion, down slightly from $50.836 billion at March 31, 2005.

unum group _Q306

unum group _Q306finance26 The document is a statistical supplement from UnumProvident for the third quarter of 2006 that includes financial highlights and statistics for the company. Some key details from the financial highlights include:

- For the third quarter of 2006, UnumProvident reported a net loss of $63.7 million compared to net income of $52.6 million for the same quarter the previous year.

- For the first nine months of 2006, UnumProvident reported net income of $134.9 million compared to $376.1 million for the same period in 2005.

- Total assets for UnumProvident as of September 30, 2006 were $52.2 billion, up slightly from $51.1 billion at

unum group StatSupp_Q405

unum group StatSupp_Q405finance26 The document provides financial highlights and statistical data for UnumProvident Corporation for the fourth quarter and full year of 2005. Some key details include:

- Total revenue for 2005 was $10.4 billion compared to $10.5 billion in 2004.

- Net income for 2005 was $513.6 million compared to a net loss of $253 million in 2004.

- Total assets increased to $51.9 billion in 2005 from $50.8 billion in 2004, with most of the increase occurring in fixed maturity securities.

- Premium income for 2005 was $7.8 billion, consistent with the prior year.

unum group 2Q 06_Statistical_Supplement

unum group 2Q 06_Statistical_Supplementfinance26 This document provides a statistical supplement for UnumProvident Corporation for the second quarter of 2006. It includes financial highlights and consolidated statements of operations, balance sheets, and sales data. Some key details are:

- For the second quarter of 2006, total revenue was $2.67 billion and net income was $125.2 million.

- Premium income for the first six months of 2006 was $3.96 billion and net income was $198.6 million.

- Financial sales data shows growth in most product lines for the U.S. Brokerage segment compared to the second quarter and first six months of 2005.

unum group StatSupp_Q305

unum group StatSupp_Q305finance26 UnumProvident Statistical Supplement Third Quarter 2005

- Provides financial highlights and statistics for UnumProvident for Q3 2005, the first three quarters of 2005, and full years 2004-2002.

- Premium income was $1.952 billion for Q3 2005. Net income was $52.6 million which included charges related to a settlement agreement and income tax benefits.

- Assets were $51.147 billion as of Q3 2005 and stockholders' equity was $7.238 billion.

- Sales of fully insured products in the U.S. Brokerage segment increased 4.3% in Q3 2005 compared to Q3 2004, while ASO products sales increased significantly.

unum group _10/17/05

unum group _10/17/05finance26 This document provides a statistical supplement for UnumProvident Corporation's second quarter 2005 financial results, adjusted to reflect new segment reporting implemented in the third quarter of 2005. It includes key financial highlights such as total premium income of $1.94 billion for the quarter. The supplement presents financial data and statistics for the quarter and year to date by business segment, including income statements, balance sheets, investment portfolios, and statutory capital. Notes are provided to give additional context to the financial information presented.

unum group _1Q 05_Supplement_rev

unum group _1Q 05_Supplement_revfinance26 The document is a statistical supplement from UnumProvident for the first quarter of 2005. It provides financial highlights and statistics for UnumProvident for the quarters and years ending March 31, 2005, March 31, 2004 and December 31, 2004 and 2003. Some key figures include total revenue of $2.6 billion for the quarter, net income of $152 million compared to a net loss of $562 million in the prior year quarter, and total assets of $50.8 billion and stockholders' equity of $7.1 billion as of March 31, 2005.

goodrich 4Q06_Slides

goodrich 4Q06_Slidesfinance44 - Goodrich Corporation reported fourth quarter 2006 results with sales growth of 10% and segment operating margin increase from 11.2% to 12.5% compared to fourth quarter 2005.

- Net income per diluted share was $0.78, reflecting 39% growth including tax adjustments and stock-based compensation expenses.

- For full year 2006, sales grew 9% and segment operating margin increased from 11.5% to 13.0% compared to full year 2005. Net income per diluted share grew 79%.

EP1Q2007Earnings_FINAL(Web)

EP1Q2007Earnings_FINAL(Web)finance49 - The company reported financial and operational results for the first quarter of 2007, with pipeline and E&P results on target.

- Pipeline throughput was up 9% from the first quarter of 2006 due to new supply, expansions, power loads, and colder weather. Several pipeline expansion projects were completed or underway.

- E&P production was on target and a South Texas acquisition was completed for $254 million. Exploration continued in Brazil and the organization's capabilities were increased.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 This document summarizes Raytheon's financial results for the fourth quarter and full year of 2008. Key points include: Raytheon reported solid financial results for Q4 and full year 2008, with record backlog of $38.9 billion; Q4 sales were $6.1 billion and adjusted EPS was $1.13; Full year sales grew 9% to $23.2 billion and adjusted EPS grew 23% to $4.06; Raytheon reaffirmed its financial guidance for 2009 and expects continued growth.

bank of new york mellon corp 3q 07 earnings

bank of new york mellon corp 3q 07 earningsfinance18 The Bank of New York Mellon reported its 3Q07 quarterly earnings. Key highlights include:

- GAAP income after-tax from continuing operations was $642 million, up 37% from 3Q06. GAAP EPS was $0.56.

- Non-GAAP income after-tax from continuing operations excluding merger/integration costs and non-operating items was $754 million, up 32% from 3Q06. Non-GAAP EPS was $0.66.

- Non-GAAP income after-tax from continuing operations excluding merger/integration costs, non-operating items, and intangible amortization was $838 million, up 43% from 3Q06. Non-

celanese q2_2006_presentation

celanese q2_2006_presentationfinance44 This document provides details on Celanese Corporation's second quarter 2006 earnings conference call, including an agenda with the CEO and CFO as speakers. It also provides financial highlights for Q2 2006 such as an 11% increase in net sales and an 18% rise in operating EBITDA. Celanese issues guidance for full year 2006 of adjusted EPS between $2.50-$2.80.

ameriprise 1Q07_Release

ameriprise 1Q07_Releasefinance43 - Ameriprise Financial reported a 14% increase in net income for Q1 2007 to $165 million compared to Q1 2006. Adjusted earnings, which exclude non-recurring separation costs, increased 16% to $220 million.

- Revenues grew 6% to $2.1 billion, driven by 11% growth in management fees and 14% growth in distribution fees. However, net investment income declined 10% due to lower balances in annuity fixed accounts and certificates.

- Earnings growth was achieved through a strategic shift toward fee-based products and greater advisor productivity, though this was partially offset by declines in spread income from annuity and certificate businesses.

bank of new york mellon corp 1q 08 earnings

bank of new york mellon corp 1q 08 earningsfinance18 - The Bank of New York Mellon reported first quarter 2008 earnings, with revenue up 14% versus first quarter 2007 on a pro forma combined basis.

- Pre-tax income was up 26% versus first quarter 2007, driven by strong revenue growth of 15% across business segments, partially offset by higher expenses which grew 6%.

- Assets under management totaled $1.105 trillion, up 8% from first quarter 2007, while assets under custody and administration totaled $23.1 trillion, up 9%.

pepsi bottling 4Q Non Gaap

pepsi bottling 4Q Non Gaapfinance19 The document summarizes Pepsi Bottling Group's (PBG) fourth quarter 2007 earnings conference call. It provides non-GAAP financial measures to allow for meaningful year-over-year comparisons. Items affecting comparability in 2007 include a tax contingency reversal, tax law changes, and restructuring charges. The document also reconciles 2007 and Q4 2007 reported results to comparable results. Guidance for 2008 reported and comparable operating income growth and EPS is also provided.

raytheon Q4 Earnings Presentation

raytheon Q4 Earnings Presentationfinance12 Raytheon reported strong financial results for Q2 2008, with sales up 11% and EPS up 27%. All business segments saw sales growth. Raytheon increased full-year guidance for sales, EPS, operating cash flow and return on invested capital. The company also reported solid bookings of $6 billion for Q2 and a backlog of $37.5 billion.

EPElPasoCorporation1Q06WebcastFinal

EPElPasoCorporation1Q06WebcastFinalfinance49 El Paso Corporation reported financial and operational results for the first quarter of 2006. Key highlights included:

- EBIT of $888 million, up significantly from $463 million in the first quarter of 2005.

- Pipelines segment EBIT of $478 million, up 16% year-over-year, driven by growth projects and acquisitions.

- Exploration and Production segment EBIT of $199 million, in line with prior year despite lower production volumes impacted by hurricanes.

- $1.3 billion in gross debt reduction year-to-date through asset sales and cash flow. Balance sheet metrics continue to improve.

- 130 Bcf of 2007 production hedged to provide

Viewers also liked (7)

XEL_Q305_10Q

XEL_Q305_10Qfinance26 This document is an SEC Form 10-Q filing by Xcel Energy Inc. for the quarterly period ended September 30, 2005. It includes Xcel Energy's consolidated financial statements and notes. The financial statements show operating revenues of $2.3 billion for the quarter and $6.7 billion for the nine months. Net income was $196 million for the quarter and $401 million for the nine months. Earnings per share were $0.48 and $0.99 respectively. Assets totaled $21.5 billion and liabilities totaled $7.1 billion as of September 30, 2005.

unum group Updated_Citigroup

unum group Updated_Citigroupfinance26 The document summarizes Unum Group's fourth quarter 2007 results and provides an overview of the company. Key points include:

- Fourth quarter profits increased 15.8% year-over-year and the group disability benefit ratio declined.

- Unum US had strong sales growth while Unum UK sales declined due to legislative changes in the prior year.

- Colonial continued favorable benefit ratio trends and higher sales.

- Unum Group has diversified its earned premium base across business segments and geographies compared to prior years.

XEL_092805_color

XEL_092805_colorfinance26 This document summarizes Dick Kelly's presentation at the Merrill Lynch Global Power & Gas Leaders Conference on September 28, 2005. It outlines Xcel Energy's strategy of investing in utility assets to earn their allowed return on equity. Key points include a capital expenditure forecast of $6.9 billion from 2005-2009, drivers of value creation through increasing rate base and regulatory returns, and guidance for 2005 EPS of $1.18-1.28 per share. Rate cases are also discussed that could increase revenues in 2006 and 2007.

eTwinning - internationale faglige fællesskaber

eTwinning - internationale faglige fællesskaberClaus Berg eTwinning – Internationale faglige fællesskaber. Silkeborg, den 8. okt. 2010.

Claus Berg

Chefkonsulent

UNI-C

eTwinning NSS:

etwinning@uni-c.dk

Marr spresentation97katyupdate

Marr spresentation97katyupdateLarry Rostetter MARRS provides audio programming to improve quality of life for blind and visually impaired individuals in Western North Carolina. It broadcasts local newspaper readings, news, and special features via radio signals, cable TV, and online streaming. MARRS relies on volunteers and local foundations for funding and distributes special radios to clients at no cost. Resource limitations constrain programming and outreach efforts.

Digital Trends & Opportunities - Tourism Victoria

Digital Trends & Opportunities - Tourism VictoriaMike Hauser This document summarizes digital trends and opportunities in tourism for Victoria, Australia. It notes that digital usage is growing rapidly worldwide, with over 2 billion internet users and mobile internet expected to surpass desktop usage by 2014. The summary highlights opportunities for tourism organizations to engage with key digital strategies like search optimization, social media, mobile responsive design, and leveraging digital channels from Tourism Victoria. It provides examples of successful digital campaigns from brands like Oreo and event organizers. The document advocates developing an integrated digital strategy that considers emerging trends and focuses on the growing mobile audience.

Similar to unum group 4Q 07_Statistical_Supplement_and_Notes (20)

unum group _10/17/05

unum group _10/17/05finance26 This document provides a statistical supplement with pro forma financial information for UnumProvident Corporation for the second quarter and first half of 2005, reflecting a new segment reporting structure implemented in the third quarter of 2005. It includes highlights of financial results, statements of operations, sales data, balance sheets, and results by business segment. Key figures presented are premium income, operating revenue, net income, assets, stockholders' equity, earnings per share, dividends paid, and book value.

goodrich 4Q06_Slides

goodrich 4Q06_Slidesfinance44 Goodrich Corporation reported fourth quarter and full year 2006 results on February 1, 2007. Some key highlights include:

- Fourth quarter 2006 sales grew 10% year-over-year with growth in all segments and major market channels. Segment operating margin increased from 11.2% to 12.5%.

- Net income per diluted share was $0.78, reflecting 39% growth over fourth quarter 2005.

- For the full year 2006, sales grew 9% year-over-year. Segment operating income increased 22% and margin increased 1.5% to 13.0%. Net income increased 83%.

- The company cautions that any forward-looking statements are subject to risks and uncertainties that could cause

ConAgra QAFY06Q4

ConAgra QAFY06Q4finance21 - Major brands in the Consumer Foods segment that posted sales growth in Q4 FY06 included Blue Bonnet, Chef Boyardee, DAVID, Egg Beaters, Hebrew National, and Hunt's. Brands that posted sales declines included ACT II, Banquet, Healthy Choice, Peter Pan, Slim Jim, Snack Pack, and Van Camp's.

- Consumer Foods volume declined 2% in Q4 while Food and Ingredients volume increased 1%.

- Total depreciation and amortization for Q4 was approximately $85 million and approximately $353 million for all of FY06. Capital expenditures were approximately $92 million for Q4 and $288 million for FY

.progressive mreport-11/06

.progressive mreport-11/06finance18 The Progressive Corporation reported its November 2006 results. Net premiums written decreased 3% to $959.2 million compared to November 2005. Net income increased 58% to $131.9 million compared to November 2005. The combined ratio improved 2.9 percentage points to 87.0 compared to November 2005. Progressive also announced that its Board of Directors confirmed its intention to use a variable dividend formula to determine the annual dividend payout in 2007, replacing quarterly dividends. The variable payout will be based on annual after-tax underwriting income multiplied by a shareholder target factor set by the Board and a gainshare factor between 0-2 depending on growth and profitability.

.progressive mreport-11/06

.progressive mreport-11/06finance18 The Progressive Corporation reported its November 2006 results. Net premiums written decreased 3% to $959.2 million compared to November 2005. Net income increased 58% to $131.9 million compared to November 2005. The combined ratio improved 2.9 percentage points to 87.0 compared to November 2005. Progressive also announced that its Board of Directors confirmed its intention to use a variable dividend formula to determine the annual dividend payout in 2007, replacing quarterly dividends. The variable payout will be based on annual after-tax underwriting income multiplied by a shareholder target factor set by the Board and a gainshare factor between 0-2 depending on growth and profitability.

.progressive mreport-07/06

.progressive mreport-07/06finance18 The Progressive Corporation reported its July 2006 results:

- Net premiums written increased 2% to $1.427 billion and net income increased 3% to $148.8 million compared to July 2005.

- The combined ratio improved slightly to 86.6% from 86.9% in July 2005.

- Progressive also announced a joint marketing agreement with Homesite Insurance to offer homeowners insurance to eligible auto insurance customers in a three-state test program by the end of 2006.

.progressive mreport-07/06

.progressive mreport-07/06finance18 The Progressive Corporation reported its July 2006 results, including:

- Net premiums written increased 2% to $1.427 billion and net income increased 3% to $148.8 million compared to July 2005.

- Earnings per share increased 6% to $0.19.

- The combined ratio improved slightly to 86.6% from 86.9% in July 2005.

- Progressive also announced a joint marketing agreement with Homesite Insurance to offer homeowners insurance to eligible auto insurance customers in a three-state test program by the end of 2006.

progressive mreport-06/05

progressive mreport-06/05finance18 The Progressive Corporation held a conference call to discuss its quarterly financial results. For the second quarter of 2005, the Company's net written premiums increased 7% to $3.594 billion and net income increased 2% to $394.3 million compared to the same period in 2004. The combined ratio, a measure of profitability, improved slightly to 86.1% from 85.4% the prior year. The Company also reported that its conference call to discuss third quarter results is scheduled for August 9, 2005.

progressive mreport-06/05

progressive mreport-06/05finance18 The Progressive Corporation held a conference call to discuss its quarterly financial results. For the second quarter of 2005, the Company's net written premiums increased 7% to $3.594 billion and net income increased 2% to $394.3 million compared to the same period in 2004. The combined ratio, a measure of profitability, improved slightly to 86.1% from 85.4% the prior year. The Company also reported that its conference call to discuss third quarter results is scheduled for August 9, 2005.

.progressive mreport-12/06

.progressive mreport-12/06finance18 The Progressive Corporation announced financial results for December 2006 and the full year 2006. For December, net income increased 13% year-over-year to $138.9 million. For the full year, net income increased 18% to $1.647.5 billion. Progressive will hold a conference call on March 2, 2007 to discuss full year 2006 results.

.progressive mreport-12/06

.progressive mreport-12/06finance18 The Progressive Corporation announced financial results for December 2006 and the full year 2006. For December, net income increased 13% to $138.9 million compared to December 2005. For the full year, net income increased 18% to $1.647 billion compared to 2005. The company also announced it would hold a conference call on March 2, 2007 to discuss annual results and file its annual report with the SEC.

.progressive mreport-08/06

.progressive mreport-08/06finance18 The Progressive Corporation reported its financial results for August 2006. Progressive's net premiums written increased 1% to $1,099 million compared to August 2005. Net income increased substantially to $122.7 million compared to $56.8 million in August 2005. The combined ratio also improved significantly to 88.5% from 96.3% in the prior year period. Progressive offers auto insurance to both personal and commercial customers throughout the United States.

.progressive mreport-08/06

.progressive mreport-08/06finance18 The Progressive Corporation reported its financial results for August 2006. Progressive's net premiums written increased 1% to $1,099 million compared to August 2005. Net income increased substantially to $122.7 million compared to $56.8 million in August 2005. The combined ratio also improved significantly to 88.5% from 96.3% in the prior year period. Progressive offers auto insurance to both personal and commercial customers throughout the United States.

citigroup April 16, 2007 - First Quarter Financial Supplement

citigroup April 16, 2007 - First Quarter Financial SupplementQuarterlyEarningsReports Citigroup reported financial results for the first quarter of 2007, with the following highlights:

- Net income decreased 11% to $5.012 billion compared to $5.639 billion in the first quarter of 2006.

- Revenues increased 15% to $25.459 billion from $22.183 billion, driven by growth in Markets & Banking and Global Consumer segments.

- Markets & Banking revenues increased 23% to $8.957 billion, while Global Consumer revenues grew 10% to $13.106 billion.

- Results were impacted by a $871 million after-tax restructuring charge related to expense reduction initiatives.

citigroup April 17, 2006 - First Quarter Financial Supplement

citigroup April 17, 2006 - First Quarter Financial SupplementQuarterlyEarningsReports Citigroup reported financial results for the first quarter of 2006. Income from continuing operations increased 9% compared to the first quarter of 2005 to $5.6 billion. Global Consumer revenues decreased 1% to $12 billion, with U.S. Consumer revenues decreasing 9% due to declines in cards, retail distribution, and consumer lending. Corporate and Investment Banking revenues increased with Capital Markets and Banking revenues up 20% and Transaction Services up 22%. Overall, Citigroup revenues remained strong with continuing growth in international markets helping to offset declines in the U.S.

monsanto 11-10-05

monsanto 11-10-05finance28 This document provides forward-looking statements and non-GAAP financial information for Monsanto's investor day on November 10, 2005. It includes reconciliations of free cash flow, non-GAAP EPS, and return on capital for fiscal years 2004-2007. The document also notes that references to fiscal years refer to Monsanto's year ending August 31 and lists several of Monsanto's trademarks.

progressive mreport-05/05

progressive mreport-05/05finance18 The Progressive Corporation reported its results for May 2005. Net premiums written increased 2% compared to May 2004. Net income increased 16% to $126.1 million, while earnings per share increased 27% to $0.63. The combined ratio improved 0.8 percentage points to 85.8%. Personal lines policies in force grew 11% year-over-year.

progressive mreport-05/05

progressive mreport-05/05finance18 The Progressive Corporation reported its results for May 2005. Net premiums written increased 2% compared to May 2004. Net income increased 16% to $126.1 million, while earnings per share increased 27% to $0.63. The combined ratio improved 0.8 percentage points to 85.8%. Personal lines policies in force grew 11% year-over-year.

Capital Product Partners Fourth Quarter 2008 Earnings

Capital Product Partners Fourth Quarter 2008 Earningsearningsreport Capital Product Partners L.P. reported strong fourth quarter 2008 results with net income of $14.3 million and operating surplus of $17.4 million. They announced a non-recurring exceptional cash distribution of $1.05 per unit, returning profit sharing revenues earned in 2008. Despite a weak shipping market outlook, the company has long-term contracts with reputable counterparties and adequate financial reserves to weather uncertain market conditions.

EP1Q2007Earnings_FINAL(Web)

EP1Q2007Earnings_FINAL(Web)finance49 - The company reported financial and operational results for the first quarter of 2007, with pipeline and E&P results on target.

- Pipeline throughput was up 9% from the first quarter of 2006 due to new supply, expansions, power loads, and colder weather. Several pipeline expansion projects were underway.

- E&P production was on target and a South Texas acquisition was completed for $254 million. Exploration continued in Brazil and the production program was on budget.

More from finance26 (20)

xcel energy merrill_09/16//03

xcel energy merrill_09/16//03finance26 This document provides an overview and financial projections for Xcel Energy. It discusses Xcel Energy's integrated utility operations, forecasts steady customer and earnings growth, and outlines plans to reduce emissions and refurbish coal plants. It also summarizes Xcel Energy's liquidity and debt refinancing plans, provides 2003 earnings guidance, and outlines priorities including resolving its involvement with bankrupt company NRG.

xcel energy merrill_09/16/03

xcel energy merrill_09/16/03finance26 This document provides an overview and financial projections for Xcel Energy. It discusses Xcel Energy's integrated utility operations, forecasts steady customer and earnings growth, and outlines plans to reduce emissions and refurbish coal plants. It also summarizes Xcel Energy's liquidity and debt refinancing plans, provides 2003 earnings guidance, and outlines priorities including resolving its NRG investment and maintaining its dividend.

xcel energy merrill_09/16/03

xcel energy merrill_09/16/03finance26 This document provides an overview and financial projections for Xcel Energy. It discusses Xcel Energy's integrated utility operations, forecasts steady customer and earnings growth, and outlines plans to reduce emissions and refurbish coal plants. It also summarizes Xcel Energy's liquidity and debt refinancing plans, provides 2003 earnings guidance, and outlines priorities including resolving its involvement with bankrupt company NRG.

xcel energy BofA_09/16/03

xcel energy BofA_09/16/03finance26 This document summarizes Xcel Energy's presentation at the 2003 Banc of America Securities Investment Conference. It outlines Xcel Energy's operations as an integrated utility across multiple US states, financial metrics including earnings growth and dividend yield, efforts to divest from the unprofitable NRG Energy business, and capital expenditure plans including converting coal plants to natural gas to reduce emissions. It also provides guidance for 2003 earnings per share and outlines financing plans to redeem higher interest debt.

xcel energy BofA_09/16/03

xcel energy BofA_09/16/03finance26 This document summarizes Xcel Energy's presentation at the 2003 Banc of America Securities Investment Conference. It outlines Xcel Energy's operations as an integrated utility across multiple US states, its financial performance and guidance, initiatives to reduce emissions in Minnesota, and capital expenditure and financing plans. It highlights Xcel Energy's regulated business model, commitment to dividends, efforts to resolve issues related to its former subsidiary NRG, and expectations for continued earnings growth.

xcel energy BofA_09/16/03

xcel energy BofA_09/16/03finance26 This document summarizes an investor presentation by Xcel Energy on its business operations and financial outlook. It discusses Xcel Energy's integrated utility operations, positive cash flow generation, plans to divest its stake in NRG Energy through bankruptcy proceedings, financial guidance for 2003 including earnings per share, and capital expenditure plans. The presentation also provides comparisons of Xcel Energy's operating metrics to industry peers.

xel_102303b

xel_102303bfinance26 This document provides an overview of Xcel Energy's financial performance and objectives presented at the Edison Electric Institute Financial Conference in October 2003. Key points include: Xcel achieved several accomplishments in 2003 including settling with NRG creditors and maintaining investment grade ratings. Objectives are to invest in utility assets, provide competitive returns, and improve credit ratings. Earnings guidance for 2003 is $1.48-$1.53 per share and $1.15-$1.25 for 2004, driven by utility operations and tax benefits from NRG. The presentation outlines capital expenditures, financing plans, and regulatory strategies.

xel_102303b

xel_102303bfinance26 This document provides an overview of Xcel Energy's financial performance and objectives presented at the Edison Electric Institute Financial Conference in October 2003. Key points include: Xcel achieved several accomplishments in 2003 including settling with NRG creditors and maintaining investment grade ratings. Objectives are to invest in utility assets, provide competitive returns, and improve credit ratings. Earnings guidance for 2003 is $1.48-$1.53 per share and $1.15-$1.25 for 2004, driven by utility operations and tax benefits from NRG. The presentation outlines capital expenditures, financing plans, and regulatory strategies.

xel_102303b

xel_102303bfinance26 This document provides an overview of Xcel Energy from their presentation at the Edison Electric Institute Financial Conference in October 2003. Key points include Xcel achieving several accomplishments in 2003 including settling with NRG creditors, maintaining investment grade ratings, and refinancing debt. Projections for 2004 include earnings of $1.15-1.25 per share assuming NRG emerges from bankruptcy. The presentation outlines Xcel's objectives, investments, regulatory strategy, and earnings drivers to emphasize the company as a low-risk, integrated utility with a total return of 7-8%.

xel_111403

xel_111403finance26 This document provides an overview of Xcel Energy from their presentation at the Banc of America Securities Energy & Power Conference in November 2003. Key points include that Xcel achieved several accomplishments in 2003 including settling with NRG creditors and maintaining investment grade ratings. Objectives for 2004 include investing additional capital in utilities, providing competitive returns to shareholders, and improving credit ratings. Earnings guidance for 2003 is $1.48-$1.53 per share and $1.15-$1.25 per share for 2004.

xel_111403

xel_111403finance26 This document summarizes Xcel Energy's presentation at the Banc of America Securities Energy & Power Conference on November 17-19, 2003. It discusses Xcel Energy's accomplishments in 2003, objectives for investment, earnings growth, and credit ratings improvement. It also provides guidance on projected 2003 and 2004 earnings, cash flows, utility investments, and the expected timeline for NRG's emergence from bankruptcy.

xel_111403

xel_111403finance26 This document summarizes Xcel Energy's presentation at the Banc of America Securities Energy & Power Conference on November 17-19, 2003. It discusses Xcel Energy's accomplishments in 2003, objectives for investment, earnings growth, and credit ratings improvement. It also provides guidance on projected 2003 and 2004 earnings, cash flows, utility investments, and the expected timeline for NRG's emergence from bankruptcy.

xel_021104

xel_021104finance26 This document provides an overview of Xcel Energy Inc. for investors attending the EEI International Financial Conference. It summarizes Xcel's financial performance, business segments, generation assets, environmental commitments, regulatory strategy, and earnings guidance. The presentation outlines Xcel's strengths as a utility, investment merits, and objectives to invest additional capital in its utility business and improve credit ratings while providing competitive returns.

xel_021104

xel_021104finance26 This document provides an overview of Xcel Energy Inc. for investors attending the EEI International Financial Conference. It summarizes Xcel's financial performance, business segments, generation assets, environmental commitments, regulatory strategy, and earnings guidance. The presentation outlines Xcel's strengths as a growing utility, its investment merits, and capital expenditure plans to improve its credit ratings and provide competitive returns.

xel_021104

xel_021104finance26 This document provides an overview of Xcel Energy Inc. for investors attending the EEI International Financial Conference. It summarizes Xcel's business segments, strengths, investment merits, capital investment plans, power supply, environmental commitments, and financial performance. Projections for 2004 earnings per share and cash flow are also presented. Key points include Xcel being the 4th largest US electric and gas utility, a growing service area, low rates, and a goal of providing competitive total returns of 7-9% to shareholders.

xel_072804

xel_072804finance26 Xcel Energy reported improved second quarter 2004 earnings compared to the second quarter of 2003. Net income for the quarter was $86 million, or $0.21 per share, compared to a net loss of $283 million, or $0.71 per share in 2003. Regulated utility earnings from continuing operations improved to $89 million in 2004 from $77 million in 2003. Results from discontinued operations were earnings of $5 million in 2004 compared to losses of $337 million in 2003. The company maintained its annual earnings guidance of $1.15 to $1.25 per share.

xel_090804

xel_090804finance26 This document summarizes a presentation given by Dick Kelly, president and COO of Xcel Energy, at a Lehman Brothers energy conference on September 8, 2004. Kelly outlines Xcel Energy's strategy of investing $900-950 million annually in its utility assets to meet growth, while also pursuing specific generation projects, including a $1 billion coal plant expansion in Colorado. Kelly projects total shareholder return of 7-9% annually through earnings growth of 2-4% and a dividend yield of around 5%.

xel_092404

xel_092404finance26 Wayne Brunetti is the Chairman and CEO of Xcel Energy, a major electric and gas utility. The document discusses Xcel Energy's business strategy, which involves continued investment in its utility assets to meet growth. Key capital projects include a $1 billion emissions reduction program in Minnesota and a proposed $1.3 billion coal plant in Colorado. The summary also provides Xcel Energy's earnings guidance for 2004 and discusses its dividend policy. Brunetti emphasizes that Xcel Energy needs clarity on public policy regarding energy and the environment to effectively plan and invest.

xel_092404

xel_092404finance26 Wayne Brunetti is the Chairman and CEO of Xcel Energy, a major electric and gas utility. The document discusses Xcel Energy's business strategy, which involves continued investment in its utility assets to meet growth. Key capital projects include a $1 billion emissions reduction program in Minnesota and a proposed $1.3 billion coal plant in Colorado. The summary also outlines Xcel Energy's financial metrics, earnings guidance, and dividend policy. Brunetti emphasizes that Xcel Energy needs clarity on public policy regarding energy and the environment to effectively plan and invest.

xel_092404

xel_092404finance26 Wayne Brunetti is the Chairman and CEO of Xcel Energy, a major electric and gas utility. The document discusses Xcel Energy's business strategy, which involves continued investment in its utility assets to meet growth. Key capital projects include a $1 billion emissions reduction program in Minnesota and a proposed $1.3 billion coal plant in Colorado. The summary also provides Xcel Energy's earnings guidance for 2004 and discusses its dividend policy. Brunetti emphasizes that Xcel Energy needs clarity on public policy regarding energy and the environment to effectively plan and invest.

Recently uploaded (20)

Business Growth Analysis - Tata Consultancy Services | NSE:TCS | FY2024

Business Growth Analysis - Tata Consultancy Services | NSE:TCS | FY2024Business Analysis Qualitative Fundamental Analysis of Tata Consultancy Services (NSE:TCS) based on company's Annual Report of FY2024.

Get a sense of the potential growth that TCS can achieve in medium to long term. By understanding its values, business and plan (strategies & opportunities).

YouTube video: https://youtu.be/5Y_jk4tYgG8

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.

Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdf

Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdfMatiasMendoza46 Libro de Varoufakis sobre la evolución del sistema capitalista.

RECOVER YOUR SCAMMED FUNDS AND CRYPTOCURRENCY HIRE iFORCE HACKER RECOVERY

RECOVER YOUR SCAMMED FUNDS AND CRYPTOCURRENCY HIRE iFORCE HACKER RECOVERYlonniecort7 iFORCE HACKER RECOVERY consists of professional hackers who specialize in securing compromised devices, accounts, and websites, as well as recovering stolen bitcoin and funds lost to scams. They operate efficiently and securely, ensuring a swift resolution without alerting external parties. From the very beginning, they have successfully delivered on their promises while maintaining complete discretion. Few organizations take the extra step to investigate network security risks, provide critical information, or handle sensitive matters with such professionalism. The iFORCE HACKER RECOVERY team helped me retrieve $364,000 that had been stolen from my corporate bitcoin wallet. I am incredibly grateful for their assistance and for providing me with additional insights into the unidentified individuals behind the theft.

Webpage; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. com

whatsapp; +1 240. 803. 3. 706

HBS Study examines which freelance groups ChatGPT and AI is replacing on onli...

HBS Study examines which freelance groups ChatGPT and AI is replacing on onli...HostJane.com Harvard Business School led 2024 study used Google Trends to prove freelance jobs based on manual-intensive skills (e.g., data entry and virtual office services, music and video services requiring human performers, and online tutoring services) were less affected by the proliferation of Generative AI and ChatGPT on online marketplaces like HostJane.com and Upwork over automation-prone jobs (e.g., writing, software development, iOS/Android app development, and WordPress web development).

NITI AAYOG: INDIA'S POLICY THINK TANK

NITI AAYOG: INDIA'S POLICY THINK TANKSunita C This PowerPoint presentation provides a comprehensive overview of NITI Aayog, covering its structure, objectives, key functions, major initiatives, and future outlook. It also compares NITI Aayog with the Planning Commission, discusses challenges, and highlights its role in India's policy-making landscape. Ideal for academic, research, and policy discussions.

Veritas Financial statement presentation 2024

Veritas Financial statement presentation 2024Veritas Eläkevakuutus - Veritas Pensionsförsäkring The return on Veritas' fixed-income investments was 6.7 per cent during the year, equity investments 12.7 per cent, real estate investments -0.7 per cent and other investments 7.9 per cent.

What would be the protection gap in Motor Insurance for future

What would be the protection gap in Motor Insurance for futureBalkir Demirkan Motor insurance, protection gap, autonomus vehicles, liability, balkir demirkan, gsr, gsr2, vehicles type approval

Biography and Professional Career of Drew Doscher

Biography and Professional Career of Drew DoscherDrew Doscher Drew Doscher has demonstrated financial acumen and upheld a substantial ethical standard, earning him the reputation of “honest guy in a dishonest business.” His transparent dealings and leadership during crises, such as the Barclays-Lehman merger, have only bolstered his standing in the finance community.

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...Інститут економічних досліджень та політичних консультацій The Monitoring presents the analysis of Ukraine's exports and imports, key trends, and business impediments. In December 2024, exports increased by only 2% yoy, while in January 2025, they fell by 8% yoy due to declining agricultural stocks. The physical volumes of wheat, corn, and sunflower oil exports continue to decline, although export prices remain relatively high.

The Monitoring also includes an analysis of key impediments for exporters, such as labor shortages, rising raw material costs, and the impact of the energy situation. Special attention is given to the Comprehensive Economic Partnership between Ukraine and the UAE, which grants duty-free access for 96.6% of Ukrainian goods.

More details are available on the website.

Silver One March 2025 Corporate Presentation

Silver One March 2025 Corporate PresentationAdnet Communications Silver One March 2025 Corporate Presentation

Business Analysis - Suzlon Energy | NSE:SUZLON | FY2024

Business Analysis - Suzlon Energy | NSE:SUZLON | FY2024Business Analysis Qualitative Fundamental Analysis of Suzlon Energy share for future growth potential (based on the Annual Report FY2024)

Get a sense of the Suzlon Energy's business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/_b9Km8N3Y4I

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.

Farmer Producer Organizations (FPOs) in India: Strengthening Agricultural Val...

Farmer Producer Organizations (FPOs) in India: Strengthening Agricultural Val...Sunita C This presentation explores the role of FPOs in empowering small and marginal farmers, improving market access, enhancing bargaining power, promoting sustainable agriculture, and addressing challenges in agricultural trade, financing, and policy support.

Strategic Resources March 2025 Corporate Presentation

Strategic Resources March 2025 Corporate PresentationAdnet Communications Strategic Resources March 2025 Corporate Presentation

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...

Exports fell by 8% yoy in January due to declining agricultural stocks. Forei...Інститут економічних досліджень та політичних консультацій