Visualizing Financial Stress - Talk at European Central Bank

- 1. VISUALIZING FINANCIAL STRESS European Central Bank Frankfurt, Germany 20 April 2015 Kimmo Soramäki Founder and CEO FNA Ltd. FNA

- 2. First Financial Networks Fedwire Interbank Payment Network (Fall 2001) was one of the first network views into any financial system. Of a total of around 8000 banks, the 66 banks shown comprise 75% of total value. Of these, 25 banks completely connected The chart was subsequently used e.g. in congressional hearings to showcase the type of information that should be collected by financial institutions after the financial crisis. The research is cited in ~300 academic publications. Research paper: Soramaki, K. M Bech, J. Arnold, R.J. Glass and W.E. Beyeler, The Topology of Interbank Payment Flows, Physica A, Vol. 379, pp 317-‐333, 2007.

- 3. The Science is being Developed New Journal ‘Network Theory in Finance’ is launched in March 31, 2015 Editor in Chief: Kimmo Soramäki Editorial Board included e.g. Andrew Haldane, Bank of England Franklin Allen, Imperial College/Wharton Ignazio Angeloni, ECB “Journal of Network Theory in Finance is an interdisciplinary journal publishing rigorous and practitioner-focused research on the application of network theory in finance. The journal connects academia, regulators and practitioners in solving important issues around financial risk” 2nd Annual Conference on 9 September 2015 in Cambridge, UK.

- 4. The FNA Software consists of FNA Platform and FNA Apps. FNA Platform is the server side workhorse for analysis, simulation and visualization of financial networks used by all FNA Apps. FNA Software FNA Apps master particular uses cases with an interactive user experience. FNA Maps FNA Payments FNA HeavyTails

- 5. Network Maps Bank Equity Cross Holdings International RemittancesKorean Interbank Payments CLS Settlement SWIFT Message Flows US Inter-sectoral Trade flows Other past projects: Mapping interbank exposures (Bank of England, HKMA, ESRB) Ongoing projects: Hedge Fund - Asset Holdings, Interbank exposures (from public sources)

- 6. FNA HeavyTails - Visualizing Stress

- 7. Time Series and Correlations …" Example: Daily returns of asset prices (ETFs) Difficult to understand large-scale correlation or other dependence structures of financial assets. Objective is to: Efficiently represent a complex system moving in time Visualize and predicts stress events in their context Overlay multiple dimensions of the data to allow for visual inference

- 8. Correlation Networks Not all correlations are statistically significant. A sparse matrix is often well represented as a network. We encode correlations as links between the correlated nodes/ assets. Red link = negative correlation Black link = positive correlation Absence of link marks that asset is not significantly correlated. A B C A 1 0.5 0.8 B 0.5 1 0.2 C 0.8 0.2 1

- 9. Dimensionality Reduction Next, we identify the Minimum Spanning Tree (MST) and filter out other correlations. Rosario Mantegna (1999) ‘Hierarchical Structure in Financial Markets’ This shows us the backbone correlation structure where each asset is connected with the asset with which its correlation is strongest.

- 10. Visualization We use a radial tree layout algorithm by Bachmaier & Brandes (2005) that places the assets so that: • Shorter links in the tree indicate higher correlations • Longer links indicate lower correlations As a result, we also see how the assets cluster (analogous to single linkage clustering).

- 11. Encoding Non-spatial Data Node color indicates last daily return Green = positive Red = negative Node size indicates magnitude of absolute return Large node = high return Small node = small return

- 12. ‘Here be Dragons’ Didier Sornette (2009) Dragon King: “Extreme events can be predicted” Benoit B. Mandelbrot (1963) Volatility Clustering: “Large changes tend to be followed by large changes” -> Identify Value at Risk (VaR) exceptions (return outside 95% VaR bounds) -> Map them as bright green or red nodes

- 13. Summing up Many risk models can be improved by taking into account links in the data: interconnections, covariances, dependencies, flows, exposures, co-occurances, etc … Major challenges that we face are related to filtering signal from noise in large networks and presenting the information efficiently. Much of the work can be summed up as: Creating a Map - Placing you on Map - Providing Directions

- 14. Use Cases Collapse of Lehman Brothers 15 Sept 2008 EU Debt Crisis 2009 - Gold Crash of April 2013 Energy Meltdown 2014/2015

- 15. Collapse of Lehman Brothers on 15 Sept 2008 View Interactive Dashboard

- 16. Greek Debt Crisis 2009 - View Interactive Dashboard

- 17. Gold Crash of April 2013 View Video

- 18. Energy Meltdown 2014/2015 View Video

- 19. Kimmo Soramaki Founder and CEO kimmo@fna.fi FNA

- 20. The FNA Software consists of FNA Platform and FNA Apps. FNA Platform is the server side workhorse for analysis, simulation and visualization of financial networks used by all FNA Apps. FNA Software FNA Apps master particular uses cases with an interactive user experience. FNA Maps FNA Payments FNA HeavyTails

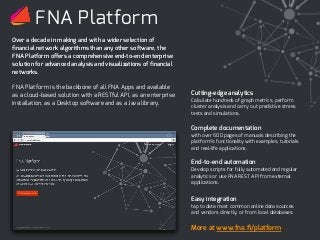

- 21. FNA Platform Over a decade in making and with a wider selection of financial network algorithms than any other software, the FNA Platform offers a comprehensive end-to-end enterprise solution for advanced analysis and visualizations of financial networks. FNA Platform is the backbone of all FNA Apps and available as a cloud-based solution with a RESTful API, as an enterprise installation, as a Desktop software and as a Java library. Cutting-edge analytics Calculate hundreds of graph metrics, perform cluster analysis and carry out predictive stress tests and simulations. Complete documentation with over 500 pages of manuals describing the platform’s functionality with examples, tutorials and real-life applications. End-to-end automation Develop scripts for fully automated and regular analytics or use FNA REST API from external applications. Easy integration tap to data most common online data sources and vendors directly, or from local databases. More at www.fna.fi/platform

- 22. FNA HeavyTails FNA HeavyTails helps risk managers and portfolio managers identify and communicate emerging risks and design adaptive stress tests. FNA combines advanced network theory and interactive data visualizations to detect hidden patterns in complex data. FNA HeavyTails implements cutting edge research in Financial CartographyTM by FNA and its collaborations with top universities. The HeavyTails dashboard makes these analytics readily accessible through a beautiful user interface. Monitor systemic risk with FNA’s unique correlation maps, Value-at-Risk (VaR) analytics and outlier detection. Stress test portfolios with FNA’s interactive ‘Rapid stress testing’ functionality and integrate them with your portfolio management and risk systems. Identify emerging risks with statistical and visual detection of outlier assets, days, and periods. Evaluate investment strategies with correlation and clustering analysis against benchmarks, and quickly identify hidden concentration risk. More at www.fna.fi/heavytails

- 23. FNA Maps FNA NetworkMaps helps financial institutions explore complex financial data for managing risks, identifying new opportunities and making better, data driven decisions. Combining advanced network theory with interactive visualizations FNA NetworkMaps gives its users the analytical power to answer the most difficult questions that they face. Find hidden patters with the help of hundreds of graph metrics, clustering analysis and and predictive stress tests and simulations. Connect the dots with fast interactive data exploration powered by algorithms that filter signal from noise and FNA’s beautiful network maps. Monitor the network in real-time and get alerted by abnormal events. Communicate Create interactive network maps from public or internal data sources and share them freely online or within your organization. More at www.fna.fi/maps

- 24. FNA Payments FNA PaymentSimulator helps financial market infrastructures and central banks model liquidity and operational risks, evaluate alternative system designs and carry out stress tests. FNA PaymentSimulator methodologies are based on leading research in network theory and financial infrastructures by FNA and its collaborations with top universities and central banks. The interactive dashboard makes these advanced analytics easily accessible through a well-thought user interface. Monitor system participants with comprehensive network maps and risk metrics, including FNA’s SinkRank™ and metrics proposed by BIS/BCBS. Identify emerging risks with statistical and visual detection of outliers activity. Get the big picture and drill into details. Uncover interlinkages and second-order effects with FNA’s unique network maps. Carry out predictive stress tests and payment simulations and explore the results visually or numerically. More at www.fna.fi/payments