Webcast 1Q12

- 1. RESULTS ANNOUNCEMENT 1st Quarter 2012 (IFRS) Conference Call/Webcast May 17th, 2012

- 2. DISCLAIMER FORWARD-LOOKING STATEMENTS: DISCLAIMER The presentation may contain forward-looking statements We undertake no obligation to publicly update or about future events within the meaning of Section 27A of revise any forward-looking statements, whether as the Securities Act of 1933, as amended, and Section 21E a result of new information or future events or for of the Securities Exchange Act of 1934, as amended, that any other reason. Figures for 2012 on are are not based on historical facts and are not assurances of estimates or targets. future results. Such forward-looking statements merely reflect the Company’s current views and estimates of future economic circumstances, industry conditions, All forward-looking statements are expressly company performance and financial results. Such terms qualified in their entirety by this cautionary as "anticipate", "believe", "expect", "forecast", "intend", statement, and you should not place reliance on "plan", "project", "seek", "should", along with similar or any forward-looking statement contained in this analogous expressions, are used to identify such forward- presentation. looking statements. Readers are cautioned that these statements are only projections and may differ materially from actual future results or events. Readers are referred NON-SEC COMPLIANT OIL AND GAS RESERVES: to the documents filed by the Company with the SEC, CAUTIONARY STATEMENT FOR US INVESTORS specifically the Company’s most recent Annual Report on Form 20-F, which identify important risk factors that could We present certain data in this presentation, such cause actual results to differ from those contained in the as oil and gas resources, that we are not permitted forward-looking statements, including, among other to present in documents filed with the United things, risks relating to general economic and business States Securities and Exchange Commission (SEC) conditions, including crude oil and other commodity under new Subpart 1200 to Regulation S-K because prices, refining margins and prevailing exchange rates, such terms do not qualify as proved, probable or uncertainties inherent in making estimates of our oil and possible reserves under Rule 4-10(a) of Regulation gas reserves including recently discovered oil and gas S-X. reserves, international and Brazilian political, economic and social developments, receipt of governmental approvals and licenses and our ability to obtain financing. 2

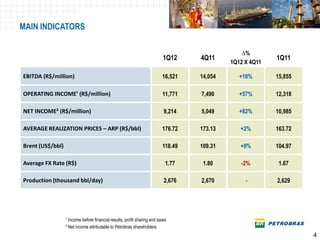

- 3. HIGHLIGHTS OF THE QUARTER » Net income of R$ 9,214 million and EBITDA of R$ 16,521 million » Daily average production of 2,676 thous. boed (+2% in relation to 1Q11) » Pre-Salt discoveries: Carioca Sela and Carcará in Santos Basin, Pão de Açúcar in Campos Basin » Post-Salt discoveries: Leste do Igarapé Chibata in Solimões Basin and Tambuatá in Espírito Santo Basin » Oil products: output increase (+3% ) and sales increase (+10%) in relation to 1Q11 » Production start-up of Cascade deep water field in Gulf of Mexico » Raising of U.S.$7,2 billion of bonds in the international capital markets, at record low rates » Capital expenditures of R$ 18,020 million, 52% of which were invested in Exploration & Production 3

- 4. MAIN INDICATORS ∆% 1Q12 4Q11 1Q11 1Q12 X 4Q11 EBITDA (R$/million) 16,521 14,054 +18% 15,855 OPERATING INCOME¹ (R$/million) 11,771 7,490 +57% 12,318 NET INCOME² (R$/million) 9,214 5,049 +82% 10,985 AVERAGE REALIZATION PRICES – ARP (R$/bbl) 176.72 173.13 +2% 163.72 Brent (US$/bbl) 118.49 109.31 +8% 104.97 Average FX Rate (R$) 1.77 1.80 -2% 1.67 Production (thousand bbl/day) 2,676 2,670 - 2,629 ¹ Income before financial results, profit sharing and taxes ² Net income attributable to Petrobras shareholders 4

- 5. OIL AND GAS PRODUCTION Total Production Brazilian Production (daily average) (daily average) 2,670 2,676 2,416 2,430 2,629 2,385 244 254 246 364 341 367 (thous bpd) (thous bpd) 2,385 2,416 2,430 2,044 2,049 2,066 1Q2011 4Q 2011 1Q2012 1Q2011 4Q 2011 1Q2012 Natural Gas Oil and NGL Brazil Brazil International International » Increased production in new systems more than offset the natural decline in production from mature fields » Natural gas production increased due to the start up of Mexilhão and Uruguá production » Production targets are dependent on the revaluation of the efficiency of production assets and defining the return of the Frade field and will be released in conjunction with the review of the Company's Business Plan 5

- 6. OIL AND GAS PRODUCTION (BRAZIL) +1% Thous. bbl/day (+22 thous. bpd) 2,066 2,044 85 New Systems + 273 thous. bbl/day 358 New Systems 1,959 - 251 thous. bbl/day 1,708 1Q11 1Q12 » Decrease in existing systems: » 1T12 vs 1T11 below expectations due to lower operating efficiency in Campos Basin » Increasing attention being given to maintenance of older systems to recover efficiency » Reservoir potential remains within expected levels » Principal contributions from new systems (∆ 1T11 / 1T12) : P-56 +113 mil bpd, P-57 +86 mil bpd, Piloto de Lula +31 mil bpd, TLD de Aruanã +20 mil bpd 6

- 7. PRE-SALT Santos Basin Santos Basin » 13 drilling rigs operating in Santos Pre-salt cluster Petrobras’ wells: drilling, completion or testing Expectation to have 20 rigs by the end of the year » Lula Pilot: » 4th producion well connected in March » Drilling of 1st horizontal well » Current oil production: 94,000 bpd » To date: 46 drilled wells (33 exploratory wells); 2012 forecast: 32 additional wells »1Q12 Production:71,100 bpd (Petrobras + partners) Campos Basin » 1Q12 Production: 63,600 bpd (Baleia Franca, Tracajá, Carimbé e Brava) 7

- 8. PRICES Oil Prices (US$/bbl) Average Realization Price (R$/bbl) Spread Spread US$ 11 US$ 6 Average Average Average 1Q11 4Q11 1Q12 240 211.64 117 118 206.84 120 113 180.94 105 109 176.72 112 190 173.13 100 109 103 103 163.72 86 76 78 77 94 80 75 80 140 70 73 74 72 60 90 40 20 40 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Petrobras Oil (average) Brent USA ARP Petrobras ARP » International oil price increase and spread reduction between light and heavy crude resulting in higher Petrobras oil price relative to 1Q11 (US$ 112/bbl X US$ 94/bbl) » Higher Average Realization Prince in Brazil due to readjustment in diesel (+2%) and gasoline (+10%) prices in November/11 8

- 9. COSTS Lifting Cost (R$/barrel) Refining Cost (R$/barrel) 60.04 61.73 55,14 54.11 50.66 8.78 8.56 8.57 37.57 39.03 7.57 7.54 34.21 31.80 31.66 19.00 20.93 22.31 22.47 22.70 1Q11 2Q11 3Q11 4Q11 1Q12 1Q11 2Q11 3Q11 4Q11 1Q12 Government Take Lifting Cost » Lifting Cost: » Higher expenses with interventions due to increase in activities and increasing average rig rates » Higher maintenance costs to recover efficiency in older systems » Refining Cost: » Lower costs with programmed stoppages and materials in 1Q12 9

- 10. PRODUCTION AND SALES PRODUCTION SALES 2,229 2,168 1,877 1,949 1,942 1,968 448 439 553 518 426 Thousand barrels/ day 534 224 214 Thousand barrels/ day 141 141 208 134 547 545 390 389 431 439 819 866 852 895 1.010 970 1Q11 4Q11 1Q12 1Q11 4Q11 1Q12 Diesel + Jet Fuel Gasoline LPG Others » Gasoline and diesel production increase due to optimization of existing refineries and operational efficiency (utilization factor 94%) » 10% growth in oil products sales 1Q12/1Q11: » 24% boost in gasoline volume as a result of competiveness vis a vis ethanol, and fleet increase » 9% boost in diesel volume due to increase in economic activities » Seasonal demand responsible for decrease in sales relative to 4Q11 10

- 11. TRADE BALANCE Exports* Imports 714 764 774 217 548 406 394 187 Thous bpd 497 361 358 380 1Q12 4Q11 1Q12 4Q11 Oil Products Oil » Higher imports of oil products in 1Q12 , especially in March, to meet demand in 2Q12 » Higher crude oil exports due to the sales from inventories produced in 4Q 2011 * Recognized in the financial reports 11

- 12. NATURAL GAS Sales* Supply +10% 69,5 +13% 63,3 0,7 1,2 50.8 26,2 44.8 26,7 11.4 6.3 Million cu.m/day Million cu.m/day 38.5 39.4 42,6 35,4 1Q11 1Q12 1Q11 1Q12 Thermoelectrical Non Thermoelectrical Import LNG Import Bolivia Domestic » Demand from thermoelectric increased as a result of diminishing reservoir levels in the Southeast and energy exports to Uruguay » Additional demand was met through domestic production, improving margins * Sales do not consider transferences within Petrobras system (Refining, Fafens e UTEs) nor BR sales. 12

- 13. OPERATING INCOME 1Q12 VS 4Q11 (R$ million) 1,091 11,771 2,061 252 7,490 877 4Q11 Sales Revenue COGS SG&A Other Expenses 1Q12 Operating Income Operating Income » Increase in operating income » Higher sales revenue due to higher prices and increase of oil exports (+38%) due to increase in production and sales from inventories built at the end of 2011 » Decrease in COGS due to lower sales volume in the domestic market and a lower percentage of oil products imports in COGS » Absence of extraordinary items which occurred in the 4Q11 - impairment, extemporaneous depreciation and higher exploratory costs 13

- 14. NET INCOME 1Q12 VS 4Q11 (R$ million) 4,281 65 41 (187) 9,214 (35) 5,049 4Q11 Operating Financial Equity Income Taxes Minority Interest 1Q12 Net Income Income Results Net Income » Higher Net Income » Increase in operating income » Stable financial results 14

- 15. E&P 1Q12 VS 4Q11 Operating Income (R$ million) 632 18.846 , 2.160 , (32) 531 30 15.525 , 4Q11 Price effect on Volume effect on Average cost Volume effect on Operational 1Q12 Operational revenue revenue effect in COGS COGS Expenses Operational Results Results » Higher revenues due to higher oil prices » COGS reduction due to lower depletion as a result of reserves revision and extemporaneous depreciation occurred on the 4Q11 » Lower operating expenses due to the recognition of losses in 4Q11 (dryhole expense, impairment and other) 15

- 16. DOWNSTREAM 1Q12 VS 4Q11 Operating Income (R$ million) 1,191 (6,557) 1,732 (2,626) (1,027) (7,101) 186 4Q11 Revenue Volume effect on Average cost Volume effect in Operational 1Q12 Operational price effect revenue effect in COGS COGS Expenses Operational Results Results » Increase in oil products price, especially gasoline and diesel » Positive revenue from volumes due to higher exports, primarily of sales from inventories of oil produced in 4Q 2011 » Higher COGS due to higher level of acquisition costs/internal transfer prices, partially offset by lower sales of oil products and lower share of imports in the sales volume (especially diesel) 16

- 17. CAPITAL STRUCTURE Net Debt/EBITDA Net Debt/Net Cap.** 5,5 40% 22% 24% 24% 3,5 17% 17% 20% 1.41 1.66 1.61 1,5 1.03 1.07 0% -0,5 -20% 1Q11 2Q11 3Q11 4Q11 1Q12 R$ Billion 03/31/12 12/31/11 Short-term Debt 18.0 19.0 » Operating income supported investment levels, keeping leverage ratios stable Long-term Debt 146.1 136.6 Total Debt 164.1 155.6 » Continued maintenance of high level of liquidity (-) Cash and cash equivalents * 57.9 52.6 » Access to capital markets: US$ 7.2 billion of bond issuance, with tenor of up to 30y, at record low rates = Net Debt 106.2 103.0 US$ Billion 03/31/12 12/31/11 Net Debt 58.3 54.9 * Includes tradable securities (maturing in more than 90 days) ** Net Debt / (Net Debt + shareholder’s equity) 17

- 18. Information: Investor Relations +55 21 3224-1510 petroinvest@petrobras.com.br 18