Webcast 2T09

- 1. Conference call / Webcast RESULTS ANNOUCEMENT Almir Guilherme Barbassa 2nd Quarter 2009 CFO and Investor Relations Officer (Brazilian Corporate Law) August 18, 2009 Pre‐salt reservoir 1

- 2. Disclaimer Disclaimer The presentation may contain forecasts about future events. Such forecasts merely reflect the expectations of the Company's management. Such terms as "anticipate", "believe", "expect", "forecast", "intend", "plan", "project", "seek", "should", along with similar or analogous expressions, are used to identify such forecasts. These predictions evidently involve risks and uncertainties, whether foreseen or not by the Company. Therefore, the future results of operations may differ from current expectations, and readers must not base their expectations exclusively on the information presented herein. The Company is not obliged to update the presentation/such forecasts in light of new information or future developments. CAUTIONARY STATEMENT FOR US INVESTORS The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation, such as oil and gas resources, that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. 2

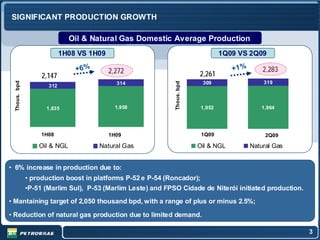

- 3. SIGNIFICANT PRODUCTION GROWTH Oil & Natural Gas Domestic Average Production 1H08 VS 1H09 1Q09 VS 2Q09 +6 % 2,272 +1 % 2,283 2,147 2,261 319 Thous. bpd 309 Thous. bpd 314 312 1,835 1,958 1,952 1,964 1H08 1H09 1Q09 2Q09 Oil & NGL Natural Gas Oil & NGL Natural Gas • 6% increase in production due to: • production boost in platforms P-52 e P-54 (Roncador); •P-51 (Marlim Sul), P-53 (Marlim Leste) and FPSO Cidade de Niterói initiated production. • Mantaining target of 2,050 thousand bpd, with a range of plus or minus 2.5%; • Reduction of natural gas production due to limited demand. 3

- 4. INCREASING ACTIVITY IN SANTOS PRE SALT • Drilling 3 new wells – IRACEM A and TUPI NORDESTE in BM S-11 and ABARÉ in BMS-9 • 2 Formation Tests – IAR A E GUARÁ • 2 new rigs will be allocated to the pre salt cluster this year; • 6 new rigs in 2010; • Contracting 2 Pilots for 2013-14 and 8 FPSOs hulls by the end of this year. Wells Drilled Drilling Formation Test Extended Well Test 4

- 5. OIL PRICES ARE RISING (US$ per barrel) 121.37 114.78 96.9 Average 2Q09 88.69 105.46 74.87 68.76 86.13 100.58 Average 1Q09 76.75 58.79 64.42 54.91 57.04 44.40 48.68 47.95 32.23 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 Average Sales Price Brent (average) • The increase in oil price and the decrease of light-heav y differential contributed to a substantial improvement in our upstream segment’s margins and income . 5

- 6. STABLE LIFTING COSTS R$/barrel US$/barrel 121.37 114.78 51.14 54.40 54.91 58.79 41.48 38.86 44.40 34.80 36,.9 34.24 22.39 16.33 21.28 31.08 30.27 21.20 20.06 18.11 14.69 19.50 16.34 17.61 19.09 17.91 17.58 9.87 6,87 10.78 9.88 10.21 8.24 7,82 8.72 2Q08 3Q08 4Q08 1Q09 2Q09 2Q08 3Q08 4Q08 1Q09 2Q09 Lifting Cost Gov. Take Lifting Cost Gov. Take Brent In the 2Q09, the increase in the price of oil and the strengthening of the Real caused a small increase in lifting costs in US. Dollars. Reflecting the influence of the exchange rate, lifting costs were flat when expressed in Reais. 6

- 7. SUCCESFUL LONG TERM PRICE POLICY 2Q08 1Q09 2Q09 2Q08 1Q09 2Q09 US$/bbl R$/bbl 219.26 160 132.49 250 178.03 140 107.46 120 200 163.59 160.79 77.34 135.56 100 70.53 65.79 150 122.82 80 53.09 60 100 40 50 20 0 0 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 ARP USA ARP Petrobras ARP USA ARP Petrobras Differential between international and domestic prices have recovered with price s near parity; Stable prices, in the long run, have benefited Brazilian consumers. Long term price policy has stabilized cash flows; 7

- 8. IMPORTAÇÃO E SALES VOLUMES IN DOMESTIC MARKET RECOVERY OF EXPORTAÇÃO DE PETRÓLEO E DERIVADOS Natural Gas Oil Products 1,765 1,763 1,609 Others* 170 218 95 128 89 Fuel Oil 75 97 76 152 76 Jet Fuel 152 165 Naphtha Thous. boed Thous. boed 217 212 195 LPG 302 Gasoline 303 288 Diesel 315 215 235 754 658 715 2Q08 1Q09 2Q09 2Q08 1Q09 2Q09 Growth in sales volume of diesel followed the recovery of GDP in the quarter and seasonal effects; Small reduction in sales of gasoline due to increased de mand for ethanol; Replace ment of fuel oil for natural gas, which had lower prices and greater volume offered. * Others: Coke, Asphalt, Propylene Lubricant, otherss liquified gas and others oil products. 8

- 9. OPTIMIZING THE REFINING SYSTEM Feedstock Oil Products Production 1,783 1,753 -2,0% 1,811 1,775 385 363 141 147 Diesel 70 73 Gasoline 288 237 Naphtha LPG 144 137 Thous. bbl/d Jet Fuel Thous. bbl/d 146 136 Fuel Oil Others* 1,398 1,390 346 333 4,9% 710 40% 37% 677 1H/2008 1H/2009 International Oil Feed Stock 1H/2008 1H/2009 Domestic Oil Feed Stock • Refining syste m improve ments enhancing margins and trade balance ; • Total diesel production growing as a result of the Diesel Maximization Program •In 1st se mester of ´09, national diesel production surpassed domestic de mand. * Others: Coke, Asphalt, Propylene Lubricant, otherss liquified gas and others oil products. 9

- 10. SIGNIFICANT IMPROVEMENTS IN THE TRADE BALANCE 1H08 (thousand barrels/day) 1H09 (thousand barrels/day) 621 708 594 226 524 252 198 131 369 396 482 393 184 27 Exports Impo rts Net Exports Exports Impo rts Net Exports Oil Oil Products Oil Oil Products Financial Volume (US$ Million) - US$ 567 + US$ 1,302 • Positive net exports and financial 12,067 11,500 surplus driven by higher oil 6,208 production, improvements to our 4,906 refining system and reduced internal demand. 1H08 1H09 Im ports Exports 10 10

- 11. SOLID OPERATING PERFORMANCE IN THE QUARTER OPERATING INCOME CHANGE (R$ MILLION – 1Q09 VS 2Q09) 500 13,896 1,166 2,010 10,220 1Q08 Operating 2Q09 Operating Income Revenues COGS Expenses Operating Income • Increase Net Operating Revenue due to higher in sales volume s and prices; • COGS decreased due to inventories formed in the first quarter; • Operating expense s were reduced from the prior quarter by a decline in freight costs, lower G&A due to cost cutting efforts, as well as reduced write-offs for dry hole s, no inventory reductions, and no other impairme nts. 11

- 12. SUBSTANTIAL NET INCOME NET INCOME CHANGE (R$ MILLION – 1Q09 VS 2Q09) 3,676 (1,612) 645 (1,535) 744 7,734 5,816 1Q09 Operating Financial Equity Minority 2Q09 Taxes Net Income Income Result Income Interest Net Income • Higher financial expense due to the Real’s appreciation against Dollar and commercial hedge; • Decrease in taxes due to fiscal benefits regarding provision of interest on capital in 2Q09; • Negative effect on minority interest due to FX variation over SPE debt obligation in Dollars. 12

- 13. SIGNIFICANT GROWTH OF OPERATING INCOME IN UPSTREAM EXPLORATION AND PRODUCTION - EVOLUTION OF OPERATING INCOME (R$ MILLION – 1Q09 VS 2Q09) 714 (400) (451) 451 8,246 4,239 3,693 1Q09 Oper. Price Effect Volume Effect Cost Effect Volume Effect Operational 2Q09 Oper. Income on Revenues on Revenues on average on COGS Expenses Income COGS • Doubling of Operating Income due targets to increase in realization prices; • Raise in production and international oil prices explain the increased of COGS with govern. take. 13 3 1

- 14. CONTINUING RECOVERY OF OPERATING INCOME IN DOW NSTREAM DOWNSTREAM- EVOLUTION OF OPERATING PROFIT (R$ MILLIONS – 1Q09 VS 2Q09) 866 (404) (607) 894 50 7,914 7,115 1Q09 Oper. Price Effect Volume Effect Cost Effect Volume Effect Operational 2Q09 Oper. Income on Revenues on Revenues on average on COGS Expenses Income COGS • Increasing domestic demand accompanied by the stability of Average Realization Price; • Realization of inventories at lower prices in the previous quarter positively impacted COGS. 14 14

- 15. GAS & ENERGY, INTERNATIONAL and DISTRIBUTION (1Q09 VS 2Q09) 1Q09 2Q09 VS. Operating Result: (R$ 99 million) R$ 576 milion Gas & Energy • Growing capacity based on greater supply of natural gas and completed infrastructure; • Elimination of contractual penalties. 1Q09 2Q09 Operating Result: VS. R$ 25 million R$ 224 million International • Higher international oil prices; • Growing oil production in Nigéria (Akpo started up last March) and gas in Bolívia ( higher supply for thermo-eletric generation). 1Q09 VS. 2Q09 Operating Result: R$ 386 million R$ 466 million Distribution •Costs Reduction resulted an increase of 9% in the sales margins; • 5% upturn in the sales volume (higher demand). 15 5 1

- 16. CONTINUED GROWTH IN CAPITAL SPENDING Capex in 1H08 – R$ 20.9 billion Capex in 1H09 – R$ 32.7 billion 12% 3% 8% 2% 2% 0,7 1 % 1,1 2,6 0,4 5,3 2% 2,5 0,4 0,7 0,1 0,2 1% 0,4 1,0 0,2 13% 4,2 4 5% 47% 14,8 2,7 9,7 1,5 7,1 13% 3,1 1,1 9% 2,8 3,7 6,4 4% 18% 20% Upstream Corporate EBITDA (R$ million) Dowstream SPE Gas & Energy Projects under Negociation 32,814 30,936 International Distribution Increase in the Company’s capex supported by a cash generation. 1H08 1H09 16

- 17. WIDE ACCESS TO FINACIAL SOURCES (1) Development Banks/Export Promotion Agencies Date Lender Value Term April 29 US EximBank US$ 2 billions 5 - 10 years May 19 China Development Bank US$ 10 billions 10 years July 30 BNDES US$ 13.3 billions (2) 19 years e 8 months (1) Values not disbursed up to 07/31//09 (2) R$ 25 billion converted by the FX rate in 07/30/09 Capital Market US$ 6,5 billions, acquired in the first half, to be changed to bonds issues, with two years Bridge Loan maturity. Yield to Conclusion Date Issue type Value Maturity investor Bonds Issues February 11 Global Notes US$ 1.5 billion 8.125% March 15, 2019 July 09 Global Notes US$ 1.25 billion 6.875% March 15, 2019 17

- 18. COMMITMENT TO SOUND FINANCIAL STRUCTURE R$ million 06/30/2009 03/31/2009 28% Short Term Debt 13,086 15,609 26% 26% Long Term Debt 55,782 54,698 Total Debt 68,868 70,307 21% Cash and Cash 19% 10,072 19,532 19% Equivalents 17% 21% Short Term Debt 58,796 50,775 18% Capital Structure 49% 49% 6/30/2007 12/31/2007 30/6/2008 12/31/2008 6/30/2009 US$ million 6/30/2009 3/31/2009 Net Debt/ Net Capt. Total Debt 35,288 30,368 • Financial leverage well within our financial targets; • Cash and cash equivalents reducted to fund capex (R$18,329 millions) and dividends (R$ 6,398 millions). 18

- 19. For more information: Investor Relations www.petrobras.com.br/ri +55 21 3224-1510 petroinvest@petrobras.com.br 19