Webcast 3T15

- 1. RESULTS ANNOUNCEMENT 3rd Quarter 2015 Conference Call / Webcast November 13th, 2015

- 2. 2 DISCLAIMER FORWARD-LOOKING STATEMENTS: DISCLAIMER The presentation may contain forward-looking statements about future events within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are not based on historical facts and are not assurances of future results. Such forward-looking statements merely reflect the Company’s current views and estimates of future economic circumstances, industry conditions, company performance and financial results. Such terms as "anticipate", "believe", "expect", "forecast", "intend", "plan", "project", "seek", "should", along with similar or analogous expressions, are used to identify such forward-looking statements. Readers are cautioned that these statements are only projections and may differ materially from actual future results or events. Readers are referred to the documents filed by the Company with the SEC, specifically the Company’s most recent Annual Report on Form 20-F, which identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements, including, among other things, risks relating to general economic and business conditions, including crude oil and other commodity prices, refining margins and prevailing exchange rates, uncertainties inherent in making estimates of our oil and gas reserves including recently discovered oil and gas reserves, international and Brazilian political, economic and social developments, receipt of governmental approvals and licenses and our ability to obtain financing. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason. Figures for 2015 on are estimates or targets. All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this presentation. NON-SEC COMPLIANT OIL AND GAS RESERVES: CAUTIONARY STATEMENT FOR US INVESTORS We present certain data in this presentation, such as oil and gas resources, that we are not permitted to present in documents filed with the United States Securities and Exchange Commission (SEC) under new Subpart 1200 to Regulation S-K because such terms do not qualify as proved, probable or possible reserves under Rule 4- 10(a) of Regulation S-X.

- 3. 3 9M14 FX Rate – End of Period R$ 2.45 Exchange Rate FX Rate (R$/US$) 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Average 2.37 2.23 2.27 2.54 2.87 3.07 3.54 End of Period 2.26 2.20 2.45 2.66 3.21 3.10 3.97 R$ / US$ Source: Bloomberg – PTAX Exchange Rate 9M15 FX Rate – End of Period R$ 3.97 + 62 % 2,00 2,50 3,00 3,50 4,00 4,50 28%

- 4. 4 9M15 Average Brent US$ 55.39 9M14 Average Brent US$ 106.57 40 50 60 70 80 90 100 110 120 130 140 Oil Prices - Brent Average Brent 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 R$ 256.48 244.47 231.56 193.73 154.89 190.09 177.38 US$ 108.22 109.63 101.85 76.27 53.97 61.92 50.26 US$ / bbl Source: Platts - 48% -19%

- 5. 5 Results Highlights Higher oil, NGL and natural gas production (6%, +163 kboed), amounting 2,790 kboed Free cash flow of R$ 8.3 bn Improvement on oil and oil products trade balance (from -424 to -89 kbpd) Lower imports and government take expenses Pre-salt daily production* record of 1 million and 120 thousand barrels on September 15th 9M15 Highlights 3Q15 Highlights Higher oil, NGL and natural gas production (1%, +35 kboed), amounting 2,800 kboed Free cash flow of R$ 3.8 bn Higher domestic oil products demand (1%, +32 kbpd) Improvement of oil and oil products trade balance (from -27 to -21 kbpd) *Petrobras + Partners production

- 6. 6 9M15 Net Results: R$ 2,102 Million R$ Billion 9M15 9M14 ∆% Sales Revenues 236.5 252.2 Cost of Sales -164.8 -193.8 Gross Profit 71.7 58.4 23 Operational Expenses -43.1 -46.9 Operating Income 28.6 11.5 149 Financial Results -23.1 -2.1 Share of earning in equity-accounted investments 0.5 1.0 Profit-sharing -0.1 -0.8 Net income (loss) before income taxes 5.9 9.6 -38 Income Taxes -5.5 -4.6 Non-controlling interest 1.7 0.0 Net Income/Loss 2.1 5.0 -58 Net Income (US$ Billion) 1.0 2.4 -59 Adjusted EBITDA 56.8 39.1 45 Investments 55.5 62.5 -11 Free Cash Flow* 8.3 -12.3 167 Decrease of oil products sales volume in the domestic market Lower oil products exports Lower export prices Lower oil and oil products imports Lower government take expenses 2014 events: write-off of overpayments incorrectly capitalized, impairment of trade receivables from the electricity sector, write-off of Premium I and II and Voluntary Separation Incentive Plan (PIDV) Lower dry/subcommercial wells expenses Increase in tax expenses due to REFIS agreements Provisions for legal contingencies (labor and tax claims) Higher expense with pension and medical plan due to actuarial revision Impairments Higher exchange rate loss over foreign currency debt Higher financial expenses due to the increase in debt and lower interest capitalization * Free Cash Flow = Operating Cash Flow minus Investing Cash Flow

- 7. 7 Operating Expenses without Special Items 9M14 x 9M15 7.2 1.2 Other Operating Expenses Taxes Pension and Medical Plan Research and Development 9M15 Exploration costs Sales +6% General and Administrative 35.7 10.1 8.2 2.8 1.7 4.6 2.0 6.1 9M14 33.7 8.5 7.8 1.5 1.9 5.6 Amounts recovered - overpayments incorrectly capitalized +4% +19%* REFIS Agreement and State Tax Amnesty Program (ICMS) Provision for legal contingencies Asset sales Impairment Reversal of allowance for impairment of trade receivables – electricity sector * Higher logistical costs, mainly due to exchange rate variation R$ Billion Operating Expenses -8% Overpayments incorrectly capitalized Allowance for impairment of trade receivables Electricity Sector PIDV - Voluntary Separation Plan Impairment and Premium I and II Legal contingencies Asset Sales 9M15 5.8 1.1 2.5 -2.2 3.8 35.7 3.0 6.2 33.7 9M14 1.3 43.1 -0.9 46.9

- 8. 8 EBITDA without Special Items 9M14 x 9M15 Premium I and II Legal Contingencies and Asset Sales 9M15 62.9 56.8 -0.9 +37% 5.8 9M14 45.8 39.1 3.8 1.1 2.7 -2.2 EBITDA PIDV - Voluntary Separation Plan 2.5 24 15 27 18 0 5 10 15 20 25 30 9M159M14 % EBITDA Without Special Items EBITDA Margin EBITDA Margin Without Special Items EBITDA Margin Without Special Items +45% R$ Billion Amounts recovered - overpayments incorrectly capitalized Reversal of allowance for impairment of trade receivables – electricity sector REFIS Agreement and State Tax Amnesty Program (ICMS) Provision for legal contingencies Asset sales Allowance for impairment of trade receivables - Electricity Sector

- 9. 9 3Q15 Net Result: - R$ 3,759 Million R$ Billion 3Q15 2Q15 ∆% Sales Revenues 82.2 79.9 Cost of Sales -58.5 -54.4 Gross Profit 23.8 25.6 -7 Operational Expenses -17.9 -16.1 Operating Income 5.8 9.5 -39 Financial Results -11.4 -6.0 Share of earning in equity-accounted investments 0.2 0.2 Profit-sharing 0.2 0.0 Net income (loss) before income taxes -5.2 3.6 -245 Income Taxes 0.2 -2.7 Non-controlling interest 1.3 -0.4 Net Income/Loss -3.8 0.5 -808 Net Income (US$ Billion) -1.1 0.2 -721 Adjusted EBITDA 15.5 19.8 -22 Investments 19.3 18.3 5 Free Cash Flow* 3.8 5.7 -33 Higher exchange rate losses over FX-denominated debt Higher demand for domestic oil products Higher oil export prices Higher oil import costs Higher oil products sales Legal contingencies (labor and tax claims) Higher dry/subcommercial wells expenses * Free Cash Flow = Operating Cash Flow minus Investing Cash Flow

- 10. 10 9M14 Average 2,627 9M15 Average 2,790 Exploration & Production 400 411 441 453 467 463 476 2,799 2,150 106 90 4Q14 2,746 2,090 119 +1% 3Q14 2,765 2,111 102 89 1Q15 2,803 100 87 2,149 118 91 96 2Q14 2,600 1,972 122 95 1Q14 2,531 1,922Oil and NGL Brazil Natural Gas Brazil Oil and NGL Abroad Natural Gas Abroad 3Q15 2,800 2,136 98 90 2Q15 Oil and Natural Gas Production – Brazil and Abroad kboed +6% +7% 418 469 2.132 9M14 2.413 1.995 +8% 9M15 2.600 Oil and Natural Gas Production Brazil 23,7% of total production of 9M15 comes from pre-salt

- 11. 11 Exploration & Production Pre-Salt Production Pre-Salt Average Monthly Production (kpd) 0 100 200 300 400 500 600 700 800 900 1.000 Monthly Record on August 2015: 859 kbpd February 2013: 300 kbpd 2.9 x 1,120 kboed 901 kbpd Daily Production Record 09/15/2015 2008 2009 2010 2011 2012 2013 2014 September 2015 *Petrobras + Partners production

- 12. 12 Exploration & Production Connection of New Wells in Brazil 30 34 61 35 12 17 26 17 20 42 2014 87 2013 51 2012 4Q159M15 52 Producers Injectors 72

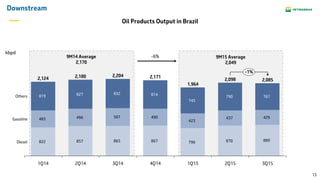

- 13. 13 9M14 Average 2,170 9M15 Average 2,049 Downstream kbpd 822 857 865 867 796 870 889 483 496 507 490 423 437 429 819 827 832 814 745 790 767 2,124 3Q15 2,180 1Q14 2,098 1Q15 -1% Diesel Gasoline Others 2Q15 2,204 2Q14 2,171 3Q14 2,085 1,964 4Q14 -6% Oil Products Output in Brazil

- 14. 14 Downstream Sales Volume in Brazil kbpd 947 999 907 923 953 601 619 616 644 573 537 540 823 825 868 833 750 790 789 2Q15 2,250 3Q14 2,533 1,049 Others Gasoline Diesel 1Q15 2,230 4Q14 2,487 1,010 1Q14 2,371 2Q14 2,443 +1% 3Q15 2,282 9M14 Average 2,449 9M15 Average 2,254 -8%

- 15. 15 Downstream Trade Balance Evolution (kbpd) (21)(27) (225) (390) (222) (633) (417) 3Q152Q151Q154Q143Q142Q141Q14 Trade Balance: Oil and Oil Products (kbpd) 414 292 219 351 399 298 (142) 150170 (180) 53 (244) 9M14 389 9M15 -89 9M14 -424 9M15 590 9M14 813 9M15 501 Oil ProductsOil Exports Imports Balance

- 16. 16 R$ Billion Income taxes -0.9 Financial Results -21.0 Operating Expenses 3.8 COGS 9M15 Net Income -58% Others 2.1 1.9 29.0 Sales Revenues -15.7 9M14 Net Income 5.0 Net Income Evolution 9M14 x 9M15

- 17. 17 R$ Billion Others* 9M15 Operating Income 28.6 Elimination +149% -0.6 Corporate -4.9 -0.6 Gas and Power 4.8 Exploration and Production -28.7 Downstream 47.1 9M14 Operating Income 11.5 Operating Income Evolution per Segment 9M14 x 9M15 *Others: Distribution, Biofuels and International Activities.

- 18. 18 R$ Billion -39% 3Q15 Operating Income 5.8 Elimination 9.5 3.0 Corporate 1.6 Others* -1.6 Gas and Power 1.4 Exploration and Production -4.7 Downstream -3.4 2Q15 Operating Income Operating Income Evolution per Segment 2Q15 x 3Q15 *Others: Distribution, Biofuels and International Activities.

- 19. 19 Costs Evolution in Brazil Refining Cost Lifting Cost* +6% 3Q15 40.82 11.24 2Q15 38.49 12.71 1Q15 38.13 13.27 R$/boeUS$/boe -1% 3Q15 7.89 2.12 2Q15 7.98 2.64 1Q15 8.16 2.84 Lower throughput and higher personnel expenses * Does not include government take 12,4014,70 39,16 33,59 +17% 9M159M14 -16% 2,52 2,96 8,01 6,80 +18% 9M159M14 -15% Excluding the impact of FX variation, lifting costs increased by 4% Higher expenses with well intervention and subsea engineering and maintenance in Campos Basin

- 20. 20 Indebtedness Indebtedness Indebtedness (R$ Billion) 12/31/2014 09/30/2015 Short-term Debt 31.6 53.4 Long-term Debt 319.5 453.2 Total Indebtedness 351.0 506.6 (-) Cash and Cash Equivalents¹ 68.9 104.2 = Net Debt 282.1 402.3 Indebtedness (US$ Billion) Net Debt 106.2 101.3 1) Includes government securities and time deposits (maturity longer than 90 days)

- 21. 21 4,8 4,8 5,0 4,6 5,2 43% 48% 52% 51% 58% 0% 10% 20% 30% 40% 50% 60% 70% 2,0 3,0 4,0 5,0 6,0 7,0 8,0 3Q14 4Q14 1Q15 2Q15 3Q15 Net Debt / LTM Adjusted EBITDA¹ Net Debt / Net Capitalization² Financial Ratios - Indebtedness 1) As of the 2Q15, the adjusted EBITDA used to calculate the ratio is the sum of the last 12 months 2) Net Debt / (Net Debt + Shareholders Equity)

- 22. 22 2015-2019 Business and Management Plan Adjustments 27 28 19 25 20162015 -10.7% -29.6% Revised on 10/05/152015-2019 BMP CAPEX (US$ Billion) 2015-2019 BMP Revised on 10/08/15 Brent (US$/bbl) 2015 60 54 2016 70 55 FXRate (R$/US$) 2015 3.10 3.28 2016 3.26 3.80 Assumptions

- 23. 23 Free Cash Flow US$ Billion * * 7.5 -5.6 2Q15 3Q15 1.9 -0.9 bi 6.1 -5.1 1.0 Operational Cash Flow -26.0Investments +7.8 bi 20.7 -5.3 9M159M14 2.5 19.3 -16.8 2Q15 x 3Q159M14 x 9M15

- 24. 24 2015 Cash Flow US$ Billion * Realized in 9M15. Operating Cash Flow excludes tax contingencies 26 22 11 21 3 4 InvestmentsOperating Cash Flow -17 2015 Initial Cash Position -23 -6 25 0,7 -20 Divestments 0,5 RolloversInterest, Amortizations, Tax Contingencies and Others 5 Funding Needs -26 14 2015 Final Cash Position -6 0,2 * * * * * *

- 25. RESULTS ANNOUNCEMENT 3rd Quarter 2015