Webcast 4 Q11 Eng

- 1. OPERATING AND FINANCIAL RESULTS 4Q11

- 2. Agenda ► Introduction ► Highlights ► Operating Results ► Financial Results 2

- 3. Agenda ► Introduction ► Highlights ► Operating Results ► Financial Results 3

- 4. Introduction Presentation of Operating and Financial Information ► The financial information contained herein is presented in consolidated figures, pursuant to Brazilian Corporate Law, based on revised financial information. The consolidated financial information represents: i) 100% of CEMAR’s results, excluding 34.89% related to minority interests, ii) 25% of Geramar’s results and iii) 100% of Equatorial Soluções’ results, which in turn consolidated 100% of Sol Energias’ results, excluding 49% of minority interest before Net Income. ► The operating information presented herein consolidates 100% of CEMAR’s results and 25% of Geramar’s results. ► The following information was not reviewed by the independent auditors: i) non-financial information relating to CEMAR, Light and the PLPT (Programa Luz para Todos - Light for All Program); ii) pro forma information and its comparison with the results presented in the period; and iii) management expectations regarding the future performance of the Companies. 4

- 5. Agenda ► Introduction ► Highlights ► Operating Results ► Financial Results 5

- 6. Operating Highlights ► CEMAR’s billed energy volume totaled 1,161.0 GWh in 4Q11, 6.1% more than in 4Q10. ► CEMAR’s last-12-month energy losses totaled 21.0% of required energy in 4Q11, 1.0 p.p. less than the 4Q10 ratio. ► CEMAR’s last-12-month DEC and FEC indices came to 21.4 hours and 11.6 times, respectively, in 4Q11, 0.3% and 17.1% down on the 4Q10 figures. 6

- 7. Financial Highlights ► Net operating revenues (NOR) totaled R$602.3 million in 4Q11, 17.9% up on 4Q10, reflecting a 13.5% increase by CEMAR and the beginning of Sol Energias consolidation. ► 4Q11 adjusted EBITDA came to R$142.0 million, 1.7% lower than the amount reported in 4Q10. ► Adjusted Net income totaled R$52.9 million in the quarter, 9.3% down on the adjusted amount reported in the same period last year. ► Equatorial’s consolidated investments amounted to R$191.5 million in 4Q11, 52.0% up year-on-year. In CEMAR (excluding direct investments in the Light For All Program), total capex amounted to R$141.3 million, 110.0% growth. Light For All Program investments totaled R$50.1 million. ► At Equatorial’s Board of Directors meeting, the dividends proposal of R$50.4 million was approved, corresponding to approximately R$ 0.46 per share. Such proposal should be submitted to the Company’s Annual General Meeting, whose date is still to be defined. 7

- 8. Agenda ► Introduction ► Highlights ► Operating Results ► Financial Results 8

- 9. CEMAR – Electricity Sales Volume ► CEMAR: 4Q11 energy sales moved up by 6.1%, reaching 1,161 GWh. Electricity Consumption per Segment (GWh) CONSUMPTION SEGMENTS * (GWh) 4Q10 3Q11 4Q11 Chg. 2010 2011 Chg. Residential 507.0 526.4 550.0 8.5% 1,916.6 2,041.3 6.5% Industrial 111.3 122.8 110.5 -0.7% 426.4 442.4 3.7% Commercial 215.5 226.6 233.8 8.5% 817.6 871.6 6.6% Other 259.8 270.2 266.6 2.6% 984.0 1,016.3 3.3% TOTAL 1,093.6 1,146.0 1,160.8 6.1% 4,144.6 4,371.7 5.5% (*) Does not consider own consumption and sales to CEPISA. Energy Balance (GWh) ENERGY BALANCE (GWh) 4Q10 3Q11 4Q11 Chg. 2010 2011 Chg. Required Energy 1,420,895 1,456,156 1,491,056 4.9% 5,325,550 5,539,391 4.0% Sold Energy (*) 1,095,389 1,148,445 1,161,321 6.0% 4,151,447 4,378,510 5.5% Losses 325,507 307,711 329,736 1.3% 1,174,103 1,160,881 -1.1% (*) Considers sale to the segments, own consumption and sales to CEPISA 9

- 10. Distribution – Energy Losses in CEMAR Total Losses over Required Energy (last 12 months) 28.7% 28.9% 28.6% 28.9% 28.5% 28.1% 28.1% 26.4% 25.2% 24.2% 23.1% 22.2% 22.2% 22.0% 21.6% 21.4% 21.2% 21.0% 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Regulatory Target Total Losses (from Aug-11 until Jul-12) Non-technical Losses over Low-Voltage Market (last 12 months) 30.4% 30.6% 29.9% 30.0% 29.0% 28.7% 27.3% 23.7% 21.5% 19.5% 18.9% 15.7% 15.9% 15.7% 15.2% 15.4% 15.3% 15.3% 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Regulatory Target Non-technical Losses (from Aug-11 until Jul-12) 10

- 11. Distribution – DEC and FEC (Last 12 months) ► CEMAR: The DEC index improved 0.3% compared with 4Q10 and the FEC index improved 17.1% in the same period. DEC (hours) FEC (times) -0.3% 14.0 21.5 21.4 -17.1% 11.6 4Q10 4Q11 4Q10 4Q11 11

- 12. Agenda ► Introduction ► Highlights ► Operating Results ► Financial Results 12

- 13. Adjusted EBITDA Adjusted EBITDA -1.7% -0.1 15.0 129.4 144.4 142.0 142.1 EBITDA Legal Adj. EBITDA Adj. EBITDA Meter EBITDA 4Q10 Deposits 4Q10 4Q11 Structure 4Q11 ► Meter Structure: During 4Q11, R$12.9 million were reported in Other Revenues, due to the sale of the metering equipment structure, when installed. There are associated costs (R$10.8 million), reported in the Company’s PMSO, and taxes (R$1.9 million) in Deductions from Operating Revenues, ending in EBITDA’s net effect of R$0.1 million. 13

- 14. Adjusted Net Income Adjusted Net Income -9.3% 14.5 8.3 19.3 -0.1 35.5 58.3 52.9 33.7 33.7 NI Judicial Monetary Adj. Adj. NI Adj. NI Cut offs Meter NI 4Q10 Deposits Provisions 4Q10 4Q11 Structure 4Q11 ► Write-off: Besides the effect of the metering structures sale recognition already mentioned in EBITDA, Net Income was extraordinarily reduced by R$19.3 million due to the write-offs reported in the quarter. It occurs due to the accounting write-off of older equipment that are replaced by new ones, given the investment level being implemented by CEMAR. 14

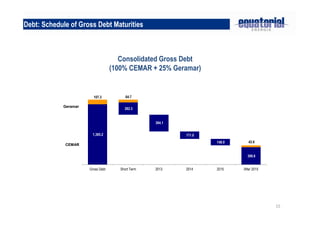

- 15. Debt: Schedule of Gross Debt Maturities Consolidated Gross Debt (100% CEMAR + 25% Geramar) 107.3 64.7 Geramar 282.3 - 384.1 - 1,385.2 171.0 - 148.0 42.6 CEMAR 399.8 Gross Debt Short Term 2013 2014 2015 After 2015 15

- 16. Net Debt - Consolidated 100% CEMAR + 25% Geramar Net Debt (R$MM)(*) and Net Debt/ EBITDA Net Debt Reconciliation (R$MM) (Last 12 months) 2.1 2.0 2.0 1.5 1.5 41.8 445.5 758.7 752.8 994.2 974.6 1,005.1 1,492.5 1,005.1 4Q10 1Q11 2Q11 3Q11 4Q11 Gross Debt Net Cash Net Debt Regulatory Asset 16

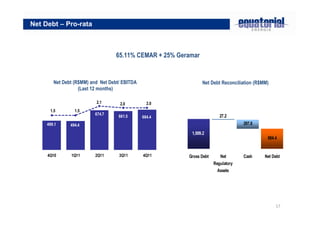

- 17. Net Debt – Pro-rata 65.11% CEMAR + 25% Geramar Net Debt (R$MM) and Net Debt/ EBITDA Net Debt Reconciliation (R$MM) (Last 12 months) 2.1 2.0 2.0 1.5 1.5 674.7 27.2 661.5 684.4 499.1 494.4 297.6 1,009.2 684.4 4Q10 1Q11 2Q11 3Q11 4Q11 Gross Debt Net Cash Net Debt Regulatory Assets 17

- 18. Capex - Equatorial ► CEMAR: In the 4Q11, total capex reached R$191.4 million, of which R$141.3 million are own capex and R$50.1 million regarding the Light for All Program (PLPT). ► Ever since the conclusion of the construction of its plants in 1Q10, Geramar has only maintenance capex. INVESTMENTS (R$MM) 4Q10 3Q11 4Q11 Chg. 2010 2011 Chg. CEMAR Own (*) 67.3 74.5 141.3 110.0% 197.0 322.3 63.6% Light For All Program 58.3 40.0 50.1 -14.1% 202.1 174.6 -13.6% Total 125.6 114.5 191.4 52.4% 399.1 496.9 24.5% Geramar Generation 0.4 0.1 0.1 -73.6% 16.2 0.4 -97.7% TOTAL 126.0 114.6 191.5 52.0% 415.4 497.3 19.7% (*) Including indirect Light For All Program investments 18

- 19. Contacts Eduardo Haiama CFO and IRO Thomas Newlands Investor Relations Telephone 1: +0 55 (21) 3206-6635 Telephone 2: +0 55 (21) 3206-6607 Email: ir@equatorialenergia.com.br Website: http://www.equatorialenergia.com.br/ir 19

- 20. Disclaimer • This presentation may contain forward-looking statements, which are subject to risks and uncertainties, as they were based on the expectations of Company’s management and on available information. These prospects include statements concerning the Company’s current intentions or expectations for our clients; this presentation will also be available at our website www.equatorialenergia.com.br/ir and in the IPE system of the Brazilian Securities and Exchange Commission (CVM). • Forward-looking statements refer to future events which may or may not occur. Our future financial situation, operating results, market share and competitive positioning may differ substantially from those expressed or suggested by said forward-looking statements. Many factors and values that can establish these results are outside Company’s control or expectation. The reader/investor is advised not to completely rely on the information above. • The words “believe", “can", “predict", “estimate", “continue", “anticipate", “intend", “forecast" and similar words, are intended to identify estimates, which refer only to the date on which they were expressed. Hence, the Company has no obligation to update said statements. • This presentation does not constitute any offering, invitation or request of subscription offer or purchase of any marketable securities. And, this statement or any other information herein, does not constitute the basis for any contract or commitment of any kind. 20