Webcast 4 t11 inglês final

- 1. 4th Quarter and Year End 2011 Results (IFRS) Conference Call / Webcast Almir Guilherme Barbassa CFO and Investor Relations Officer February 14th 2012

- 2. Disclaimer FORWARD-LOOKING STATEMENTS: DISCLAIMER The presentation may contain forward-looking statements We undertake no obligation to publicly update or about f b future events within the meaning of Section 27A of h h f f revise any forward-looking statements, whether as the Securities Act of 1933, as amended, and Section 21E a result of new information or future events or for of the Securities Exchange Act of 1934, as amended, that any other reason. Figures for 2012 on are are not based on historical facts and are not assurances of estimates or targets. future results. Such forward-looking statements merely reflect th C fl t the Company’s current views and estimates of ’ t i d ti t f future economic circumstances, industry conditions, All forward-looking statements are expressly company performance and financial results. Such terms qualified in their entirety by this cautionary as "anticipate", "believe", "expect", "forecast", "intend", statement, and you should not place reliance on "plan", "project", "seek", "should", along with similar or any forward-looking statement contained in this analogous expressions are used to identify such forward expressions, forward- presentation. t ti looking statements. Readers are cautioned that these statements are only projections and may differ materially from actual future results or events. Readers are referred NON-SEC COMPLIANT OIL AND GAS RESERVES: to the documents filed by the Company with the SEC, specifically the Company’s most recent Annual Report on Company s CAUTIONARY STATEMENT FOR US INVESTORS Form 20-F, which identify important risk factors that could We present certain data in this presentation, such cause actual results to differ from those contained in the as oil and gas resources, that we are not permitted forward-looking statements, including, among other to present in documents filed with the United things, risks relating to general economic and business States Securities and Exchange Commission (SEC) conditions, conditions including crude oil and other commodity under new Subpart 1200 to Regulation S-K because prices, refining margins and prevailing exchange rates, such terms do not qualify as proved, probable or uncertainties inherent in making estimates of our oil and possible reserves under Rule 4-10(a) of Regulation gas reserves including recently discovered oil and gas S-X. reserves, international and Brazilian political, economic and social developments, receipt of governmental approvals and licenses and our ability to obtain financing. 2

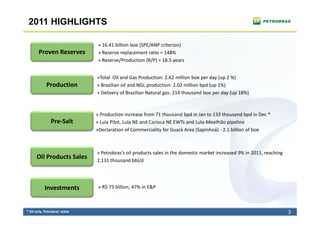

- 3. 2011 HIGHLIGHTS » 16.41 billion boe (SPE/ANP criterion) Proven Reserves » Reserve replacement ratio = 148% » Reserve/Production (R/P) = 18.5 years »Total Oil and Gas Production: 2.62 million boe per day (up 2 %) Production » Brazilian oil and NGL production: 2.02 million bpd (up 1%) p p ( p ) » Delivery of Brazilian Natural gas: 214 thousand boe per day (up 18%) »P d i i Production increase f from 71 thousand b d i J to 133 thousand b d i D * h d bpd in Jan h d bpd in Dec Pre‐Salt » Lula Pilot, Lula NE and Carioca NE EWTs and Lula‐Mexilhão pipeline »Declaration of Commerciality for Guará Area (Sapinhoá) ‐ 2.1 billion of boe » Petrobras’s oil products sales in the domestic market increased 9% in 2011, reaching Oil Products Sales 2,131 thousand bbl/d Investments » R$ 73 billion, 47% in E&P * Oil only. Petrobras’ stake 3

- 4. Proven Reserves (ANP/SPE Criterion) Proven Reserves 2011 16.4 Bi boe Ultradeep Water p (>1.500m) International Deep Water Brazil 4% 96% (300‐1.500m) (300 1 500m) Shallow Water Onshore O h Proven Reserves in Brazil (billion boe) RRR in Brazil above 100% for the 20th consecutive year 15,71 15,28 » 2011 Reserve Replacement Ratio = 152% 5.3 % p.y. 53%py » Reserve/Production = 19 2 years 19.2 14,17 » Proven reserves incorporatedn in 2011: 1.242 bi boe » Pre‐salt = 0.978 bi boe 2009 2010 2011 » Highlights: Sapinhoá (Santos Basin) Albacora (Campos Basin) 4

- 5. Exploratory Activity 2011 Discoveries Success Index Espírito Campos p Santos S t Santo 57% 59% Post‐salt Post‐salt Post‐salt 40% Guanabara Patola Malombe Tucura Brigadeiro Pre‐salt Pre‐salt Abaré Pé‐de‐moleque Gávea 2009 2010 2011 Biguá Quindim Forno Exploratory Wells p y » Since 2007 total estimated recoverable volume was higher Since 2007, total estimated recoverable volume was higher than 2.5 billion boe/year 2011 2012 » Finding costs in 2011 of US$1.56/boe. Business Plan 2011‐ » Onshore – 76 » Offshore 66 » Offshore – 66 2015 forecasts finding costs around US$ 2/boe 2015 forecasts finding costs around US$ 2/boe » Offshore – 47 » Campos (16) » In 2011, R$ 9 billion invested in exploration. In 2012, R$ » Pre‐salt (17) » Santos (18) 10.1 billion estimated » Espírito Santo (11) 5

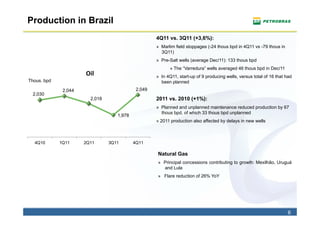

- 6. Production in Brazil 4Q11 vs. 3Q11 ( 3 6%) (+3,6%): » Marlim field stoppages (-24 thous bpd in 4Q11 vs -79 thous in 3Q11) » Pre-Salt wells (average Dec/11): 133 thous bpd Pre Salt » The “Varredura” wells averaged 46 thous bpd in Dec/11 Oil » In 4Q11, start-up of 9 producing wells, versus total of 16 that had Thous. bpd been planned 2,044 2,049 2,030 2,018 2011 vs. 2010 (+1%): » Planned and unplanned maintenance reduced production by 67 thous bpd of which 33 thous bpd unplanned bpd, 1,978 » 2011 production also affected by delays in new wells 4Q10 1Q11 2Q11 3Q11 4Q11 Natural Gas » Principal concessions contributing to growth: Mexilhão, Uruguá p g g , g and Lula » Flare reduction of 26% YoY 6

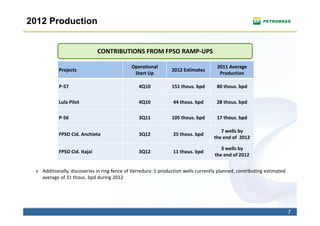

- 7. 2012 Production CONTRIBUTIONS FROM FPSO RAMP‐UPS Operational 2011 Average Projects 2012 Estimates Start Up Production P 57 P‐57 4Q10 151 thous. bpd 151 thous. bpd 80 thous. 80 thous. bpd Lula Pilot 4Q10 44 thous. bpd 28 thous. bpd P‐56 3Q11 105 thous. bpd 17 thous. bpd 7 wells by FPSO Cid. Anchieta 3Q12 25 thous. bpd the end of 2012 the end of 2012 3 wells by FPSO Cid. Itajaí 3Q12 11 thous. bpd the end of 2012 » Additionally, discoveries in ring fence of Varredura: 5 production wells currently planned, contributing estimated average of 31 thous. bpd during 2012 7

- 8. Santos Basin Pre-salt 2011 ACOMPLISHMENTS Petrobras’ Wells : drilling, completion or testing (Dec/11) » Production Start up of Lula Pilot (Dec/2011): 65.000 bpd Franco 2 NW (with integrated production wells) ( i h3i d d i ll ) Concession » Declaration of Commerciality for Guará Sapinhoá Field (BM‐S‐09) Transfer of Rights » 17 wells drilled, totaling 37 wells in Santos Basin Pre‐salt » Start St t up of L l NE EWT f Lula » Start up of Carioca NE EWT Iara Oeste Iara Oeste » 4 hulls already contracted to be converted to the first FPSOs for the Transfer of Rights areas Nordeste de Tupi Lula Alto ADR Piloto Lula IWAG‐ Piloto Lula IWAG‐5 2012 ACTIVITIES Carcará Piloto Lula P8H Piloto Lula P8H Carioca Sela Carioca Sela » Start up of FPSO in Sapinhoá (BM‐S‐09) – Cid. de Lula Sul Guará Norte São Paulo: end of 2012 » Start up of Franco EWT (Transfer of Rights): end of 2012 » EWTs in Cernambi South, Sapinhoá North and another one to be defined » 10 drilling rigs operating in the cluster. Forecast to double the number by the end of 2012 8

- 9. Campos Basin Pre-Salt Status on Dec/11 » Jubarte: 14 000 bpd (ESS 103) 14.000 (ESS‐103) » Baleia Franca: 21.500 bpd (BRF‐1 + BRF‐6) » Brava: 6.500 bpd (MRL‐199D) » Carimbé: 19.000 bpd (CRT‐43) Discoveries » Tracajá: 20.000 bpd (MLL‐70) » Total: 81.000 bopd 2012 activities 2012 activities » 9 ring‐fence exploratory wells (post‐ salt and pre‐salt) » New production wells in Barracuda, Marlim Leste and Albacora Leste (total potential of 35 thousand bpd) * Petrobras’ production + partners 9

- 10. Drilling Rigs FLOATING RIGS UNDER CONTRACT (2,000 m – 3,000 m) Estimates of +15 19 New Rigs 13 5 3 2008 2009 2010 2011 2012 Demand for Rigs Construction of 33 rigs in Brazil » Medium term rig needs are now adequately » Average daily rates in line with international supplied by contracted rigs prices » Petrobras permanently analyzes and revises its » Governmental support with financing, future rigs needs, based on production plans future rigs needs, based on production plans guaranties, and tax benefits guaranties, and tax benefits that are continuously updated by actual results » Local content index between 55% and 65% » Petrobras continuously monitors the rig market » Deliveries contracted for 2015 and beyond to to ensure availability for future needs meet long‐term demand 10

- 11. E&P Economics Breakdown of realization price per boe produced i B il B kd f li i i b d d in Brazil R$ per barrel realization price % share of realization price 180 160 100% 140 25% 31% 33% R$ 52 80% 120 R$ 39 22% 100 60% 21% 21% R$ 26 R$ 34 80 R$ 26 13% R$ 22 40% 16% 60 R$ 27 17% R$ 13 R$ 20 23% 40 18% R$ 25 20% 16% R$ 24 R$ 22 20 R$ 21 17% 14% 13% R$ 17 R$ 18 0 0% 2009 2010 2011 2009 2010 2011 Lifting Cost Exploratory costs + DD&A + Others * Income Tax Govt take Net Income » I relative t In l ti terms, stable costs t bl t » In nominal terms, net income per barrel doubled in the last two years *Others include tax expenses, R&D, SG&A 11

- 12. Prices Oil Prices (US$/bbl) Average Realization Price (R$/bbl) Average 2011 240 Petrobras ARP: 167.87 117 113 USA ARP 194.46 120 105 109 100 109 190 86 103 103 75 76 78 94 80 77 80 140 73 74 72 4Q11: spread decrease 60 70 Average 2010 Light/heavy oils Petrobras ARP: 158.43 b 90 40 USA ARP: 150.48 20 40 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Petrobras Oil (average) Brent USA ARP Petrobras ARP » Gasoline and diesel price increases in Nov 2011 » USA Average Realization Price increased in 4Q11, in Reais, due to an average depreciation of the Real by 10% 12

- 13. Domestic Refining and Sales PRODUCTION SALES 2,208 2,229 1,910 1 910 1,886 1 886 1,949 2,052 , rrels / day 448 Thous. barr / day 435 552 479 570 511 235 224 rels 219 Thous. bar 134 133 141 488 547 378 406 389 414 828 836 866 940 1,050 1,010 4Q10 3Q11 4Q11 4Q10 3Q11 4Q11 Diesel + Jet Fuel Gasoline LPG Other Diesel+Jet Fuel Gasoline LPG Other » Increase in domestic production of diesel and gasoline in the existing refineries in 2011 refineries, » 9% growth on oil products sales in year over year comparison: » 24% increase in gasoline volumes due to more attractive prices relative to ethanol and an increase in the vehicles fleet » 9% increase in diesel volumes due to the growth of economic activity and agroindustry » 18% drop on fuel oil sales (included in ‘Other') due to the substitution for natural gas 13

- 14. Highlights - Downstream 2011 ACHIEVEMENTS » Records in processed feedstock (+4%) and production of oil products (+3%) » Utilization Factor of 92% » 14 new units completed and operational, largely to improve product quality » Distribution of S‐50 diesel in 56 additional municipalities in the states of São Paulo and Rio de Janeiro 2012 PERSPECTIVES » Conversion: Start up of REPAR’s Coke + HDT Start‐up REPAR s » Diesel Quality Portfolio : RLAM and REPAR » Additional sales volume of 500.000 m3/month of lower sulfur diesel » PROMEF I and II: 2 Suezmax, 3 product carriers and 1 Bunker carrier , p MAJOR ONGOING PROJECTS » RNEST: FIrst train in June 2013 and Second train in January 2014 » COMPERJ: First train in September 2014 » Approximately 90% of investments in quality and conversion will be completed during 2013 completed during 2013 14

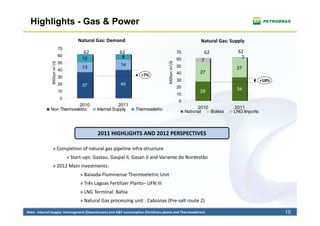

- 15. Highlights - Gas & Power Natural Gas: Demand Natural Gas: Supply 70 62 62 70 62 62 60 8 2 12 60 7 Million m3/d d 50 Million m3/d d 14 50 13 27 40 40 27 30 +7% 30 +18% 20 37 40 37 40 20 34 34 10 28 28 10 0 0 2010 2011 Non Thermoeletric Internal Supply Thermoeletric 2010 2011 National a o a Bolívia o a LNG Imports G po s 2011 HIGHLIGHTS AND 2012 PERSPECTIVES » Completion of natural gas pipeline infra‐structure » Start‐ups: Gastau, Gaspal II, Gasan II and Variante do Nordestão » 2012 M i i Main investments: » Baixada Fluminense Thermoeletric Unit » Três Lagoas Fertilizer Plants– UFN III » LNG Terminal: Bahia l h » Natural Gas processing unit : Cabiúnas (Pre‐salt route 2) Note: Internal Supply: Intersegment (Downstream) and G&P consumption (Fertilizers plants and Thermoeletrics) 15

- 16. Operating Income 2010 vs 2011 (R$ million) ( $ ll ) 32,334 (31,322) 46,394 (1,238) (765) 45,403 2010 Sales COGS Selling, Other 2011 Operating Revenue general and expenses Operating Income adm. Income » Higher sales revenues due to the domestic market growth (+6%) and higher oil and oil product prices (Brent: +40%; Petrobras Average Realization Price: +6%) » Increase in COGS reflected higher imports of oil and oil products, higher international prices on imports and higher production taxes » Increase in operational expenses due to higher exploratory costs and R&D 16

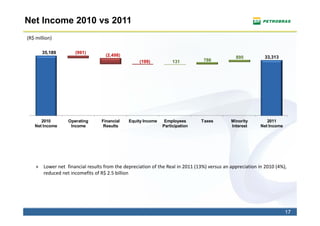

- 17. Net Income 2010 vs 2011 (R$ million) ( $ ll ) 35,189 (991) (2,498) 895 33,313 (199) 131 786 2010 Operating Financial Equity Income Employees Taxes Minority 2011 Net Income Income Results Participation Interest Net Income » Lower net financial results from the depreciation of the Real in 2011 (13%) versus an appreciation in 2010 (4%), reduced net incomefits of R$ 2.5 billion 17

- 18. Operating Income 3Q11 vs 4Q11 (R$ million) ( $ ll ) 1,703 (4,465) 12,372 12 372 (306) (1,552) 7,752 3Q11 Sales COGS SG&A Other 4Q11 Operating Revenue expenses Operating Income Income » Increase in diesel and gasoline prices in Nov/11 contributed to higher revenues » Increase in COGS due to: » GGrowth on sales volume with hi h share of i th l l ith higher h f imports t » Foreign exchange effect (+10%) in costs in dollars » Change in the special participation tax rate due to production growth » Higher depreciation recognized from as a result of more assets to be amortized and retroactive amortization » Increase in expenses with impairment and dry hole costs 18

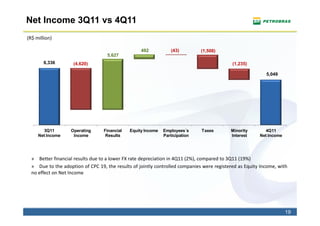

- 19. Net Income 3Q11 vs 4Q11 (R$ million) ( $ ll ) 492 (43) (1,508) 5,627 6,336 6 336 (4,620) (1,235) 5,049 3Q11 Operating Financial Equity Income Employees´s Taxes Minority 4Q11 Net Income Income Results Participation Interest Net Income » Better financial results due to a lower FX rate depreciation in 4Q11 (2%), compared to 3Q11 (19%) » Due to the adoption of CPC 19, the results of jointly controlled companies were registered as Equity Income, with no effect on Net Income 19

- 20. Potential factors deviating from market expectations R$ million Operating Variation 4Q11 vs 3Q11* Income EBITDA Average FX rate effect on costs 2,609 2,609 Share of imports in the sales mix (from 28% to 32%) 1,163 1,163 Inventories formed abroad 738 738 738 738 Deconsolidation of jointly controlled companies (CPC 19) 736 1.069 Dry hole costs 693 693 Impairment 690 ‐ Extemporaneous depreciation 670 ‐ * Estimates 20

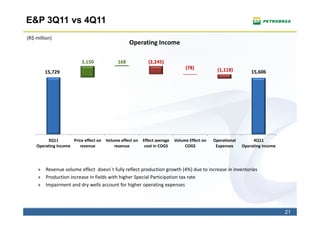

- 21. E&P 3Q11 vs 4Q11 (R$ million) ( $ ll ) Operating Income 3,150 3 150 168 (2,245) (2 245) (78) (1,118) 15,729 15,606 3Q11 Price effect on Volume effect on Effect average Volume Effect on Operational 4Q11 Operating Income revenue revenue cost in COGS COGS Expenses Operating Income » Revenue volume effect doesn´t fully reflect production growth (4%) due to increase in inventories » Production increase in fields with higher Special Participation tax rate » Impairment and dry wells account for higher operating expenses 21

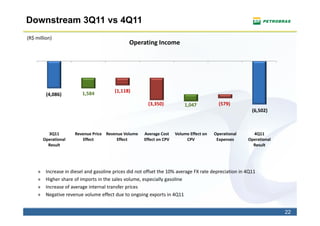

- 22. Downstream 3Q11 vs 4Q11 (R$ million) ( $ ll ) Operating Income 1,584 (1,118) (4,086) (3,350) 1,047 (579) ( (6,502) ) 3Q11 Revenue Price Revenue Volume Average Cost Volume Effect on Operational 4Q11 Operational O ti l Effect Eff t Effect Eff t Effect on CPV Eff t CPV CPV Expenses E Operational O ti l Result Result » Increase in diesel and gasoline prices did not offset the 10% average FX rate depreciation in 4Q11 » Higher share of imports in the sales volume, especially gasoline » Increase of average internal transfer prices » Negative revenue volume effect due to ongoing exports in 4Q11 22

- 23. Investments 2012 INVESTMENT BUDGET 2011 INVESTMENTS R$ 87.5 Billion R$ 72.5 Billion 5% 5% 5% 48% 38% E&P Downstream G&P International Other » E&P: focus on increasing production capacity and development of the pre‐salt » Downstream: modernization and expansion of refining capacity, improved quality of oil products and petrochemical assets » G&P: completions of the 1st cycle of investments (infrastructure and logistics of natural gas) » Average FX rate appreciation of 5% in 2011 contributed to reduce investments when expressed in R$ 23

- 24. Capital Structure Net Debt/EBITDA Net Debt./Net.Cap 50% 5,5 40% 4,5 , 24% 22% % 30% 3,5 16% 17% 17% 20% 2,5 1.66 10% 1.41 1,5 1.03 1.03 1.07 0% 0,5 ‐10% ‐0,5 ‐20% 4Q10 1Q11 2Q11 3Q11 4Q11 R$ Billion 12/31/11 12/31/10 Short-term Debt 19.0 15.1 » Funding of $ 18 billion in 2011, with $ 9.6 g $ , $ Long-term Debt 136.6 100.9 billion in bonds issuances, including Euro and Total Debt 155.6 116.0 Sterling (-) Cash and cash equivalents * 52.6 55.0 » Feb/2012 issuance of $ 7 billion in four = Net Debt 103.0 61.0 tranches of 3, 5, 10 and 30 years, helping to reduce the cost of capital US$ Billion 12/31/11 12/31/10 Net Debt 54.9 36.6 * Includes tradable securities (maturing in more than 90 days) 24

- 25. Information: Investor Relations +55 21 3224-1510 petroinvest@petrobras.com.br 25