Webcast q306 ing

- 1. PETROBRAS Conference Call / Webcast 3rd Quarter 2006 (Brazilian Corporate Law) Almir Barbassa CFO and Investor Relations Officer November, 13th 2006 0

- 2. PETROBRAS Disclaimer The presentation may contain forecasts about future events. Such forecasts merely reflect the expectations of the Company's management. Such terms as "anticipate", "believe", "expect", "forecast", "intend", "plan", "project", "seek", "should", along with similar or analogous expressions, are used to identify such forecasts. These predictions evidently involve risks and uncertainties, whether foreseen or not by the Company. Therefore, the future results of operations may differ from current expectations, and readers must not base their expectations exclusively on the information presented herein. The Company is not obliged to update the presentation/such forecasts in light of new information or future developments. Cautionary Statement for US investors The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We use certain terms in this presentation, such as oil and gas resources, that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. 1

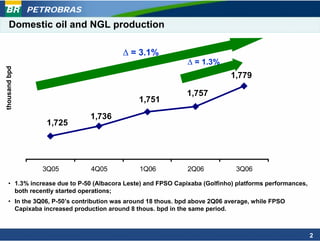

- 3. PETROBRAS Domestic oil and NGL production Δ = 3.1% Δ = 1.3% thousand bpd 1,779 1.790 1.780 1,757 1.770 1,751 1.760 1.750 1,736 1,725 1.740 1.730 1.720 1.710 1.700 3Q05 4Q05 1Q06 2Q06 3Q06 • 1.3% increase due to P-50 (Albacora Leste) and FPSO Capixaba (Golfinho) platforms performances, both recently started operations; • In the 3Q06, P-50’s contribution was around 18 thous. bpd above 2Q06 average, while FPSO Capixaba increased production around 8 thous. bpd in the same period. 2

- 4. PETROBRAS E&P – Oil Prices 69,62 US$ 10.80 bbl 69,49 64,74 61,53 61,75 66,07 56,9 57,59 56,39 58,69 51,59 58,2 US$/bbl 47,83 54,24 52,7 53,69 44,00 49,33 41,59 46,05 39,70 44,19 43,04 38,98 37,48 36,14 35,11 3T04 4T04 1T05 2T05 3T05 4T05 1T06 2T06 3T06 Average Sales Price Brent (average) Cesta OPEP • The spread between Brazilian oil and Brent decreased from US$ 11.42/bbl, in the 2Q06, to US$ 10.80/bbl, in the 3Q06. 3

- 5. PETROBRAS Domestic Lifting Costs without Government Participation Δ = 8.5% or US$ 0.52 6.32 6.64 6.07 6.12 US$/bbl 5.44 3Q 05 4Q 05 1Q06 2Q06 3Q06 Main Causes • Higher expenditure in: • Transportation, seismic and drilling for wells intervention; • Corrective maintenances; • Higher costs due to initial operational phase in Albacora Leste and Golfinho fields. 4

- 6. PETROBRAS Lifting Costs including Government Participation 26 70 61,5 56,9 69,6 69,5 51,6 60 21 47,5 61,8 17.5 18.1 50 38,2 17.3 15.2 16.1 16 40 28,8 13.6 13.9 63% US$/boe 24,8 11,5 30 63% 10.7 10,0 11,0 11,4 11 9,7 62% 7,7 8,4 59% 8.5 20 7.0 6,4 6 10 57% 5,1 4,0 6,0 5,4 5,4 6,1 6,3 6,1 6,6 0 3,0 3,4 4,3 1 -10 2002 2003 2004 1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 -4 -20 Lifting Cost Gov. Participation Brent • Government participation remained stable due to the stability of the Brent price, FX rate and production. Obs.: Lifting Cost w/ gov. part. series was adjusted (retroactive to 2002) due to new ANP interpretation of the expense deductibility for the Finance Project of Marlim Field, calculated as special participation. 5

- 7. PETROBRAS Refining and Sales in the Domestic Market 91 95 2.400 91 93 90 Thous. barrels/day 91 2.200 89 85 2.000 80 80 81 80 79 79 75 % 1.800 70 1.600 65 1.804 1.720 1.761 1.753 1.757 1.400 1.812 1.795 1.684 1.647 1.649 60 1.200 55 1.000 50 3Q05 4Q05 1Q06 2Q06 3Q06 D o m e s t ic o il pro duc t s pro duc t io n O il pro duc t s s a le s v o lum e P rim a ry pro c e s s e d ins t a lle d c a pa c it y - B ra zil ( %) D o m e s t ic c rude a s % o f t o t a l • 4 pp reduction in throughput due to: • Oil supply limitation; • More scheduled stoppages compared to 2Q06; • 1 pp decrease in domestic crude participation in processed feedstock due to operational problems in Golfinho (less light oil) and increase spread between fuel oil and domestic heavy oil (more profitable to export). • Increase in sales volume due to seasonality in agricultural diesel consumption, industrial fuel oil and substitution of imported naphtha. 6

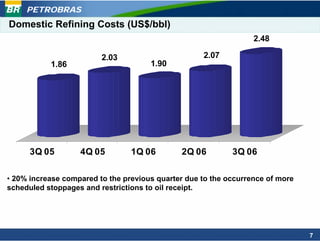

- 8. PETROBRAS Domestic Refining Costs (US$/bbl) 2.48 2.03 2.07 1.86 1.90 3Q 05 4Q 05 1Q 06 2Q 06 3Q 06 • 20% increase compared to the previous quarter due to the occurrence of more scheduled stoppages and restrictions to oil receipt. 7

- 9. PETROBRAS Average Realization Price - ARP 100 3Q05 2Q06 3Q06 Average Average Average 81,83 81,78 80 72,43 72,28 70,66 61,54 69,49 60 69,62 60,26 40 ARP Brazil (US$/bbl) Brent Average Price ARP USA (w/ volumes sold in Brazil) 20 Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 Mar-06 Jun-06 Sep-06 8

- 10. PETROBRAS Sales Volume Jan- Jan- Thousand bpd 3Q06 2Q06 % % Sept 06 Sept 05 Total Oil Products 1,757 1,684 4 1,697 1,658 2 Alcohol, Nitrogen and others 35 13 169 26 26 0 Natural Gas 250 239 5 240 224 7 Total Dom estic Market 2,042 1,936 5 1,963 1,908 3 Exports 564 536 5 540 498 8 International Sales 509 459 11 468 388 21 Total International Market 1,073 995 8 1,008 886 14 Total 3,115 2,931 6 2,971 2,794 6 • Increase in the sales of fuel oil, diesel, LPG and gasoline. 2006 includes ongoing exports 9

- 11. PETROBRAS Income Statement 3Q06 vs 2Q06 2Q06 3Q06 43.363 14.3% Net Revenues 37.948 R$ Million 27.066 27.3% COGS 21.260 12.912 -5.2% EBITDA 13.614 10.303 -8.6% Operating Profit 11.267 7.085 1.8% Net Income 6.959 • Net Revenues: 5% increase in the domestic sales volume, oil exports (33%) and ARP (2%); • COGS: ANP (National Petroleum Agency) new interpretation of special participation in the Marlim field (retroactive to 2002); expenses adjustment related to reinjected gas (Solimões, Campos and Esp. Santo Basins). • Net Income: R$ 1.492 billion in benefits due to Interest on Own Capital provision, reduced in R$ 321 million relative to bonds buyback. 10

- 12. PETROBRAS Operating Expenses Analysis 3Q06 vs 2Q06 2Q06 3Q06 1.546 14.3% Sales Expenses 1.353 R$ million General and 1.459 3.1% Administrative Exp. 1.415 531 Exploratory Costs 40.5% 378 1.342 Others 50.8% 890 • Operating Expenses increase mainly because of: • Sales Expenses: increase in domestic sales (5.5%) and oil exports volume (33%); • Exploratory Costs: write-off of dried wells (Brazil and abroad); • Others: hedge contract maturity with ANDINA (R$ 167 million) and others like consulting and technical consulting (R$ 285 million). 11

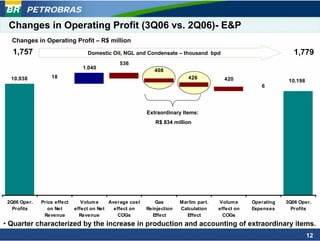

- 13. PETROBRAS Changes in Operating Profit (3Q06 vs. 2Q06)- E&P Changes in Operating Profit – R$ million 1,757 Domestic Oil, NGL and Condensate – thousand bpd 1,779 536 1.040 408 10.938 18 426 420 10.198 6 Extraordinary Items: R$ 834 million 2Q06 Oper. Price effect Volum e Average cost Gas Marlim part. Volum e Operating 3Q06 Oper. Profits on Net effect on Net effect on Reinjection Calculation effect on Expenses Profits Revenue Revenue COGs Effect Effect COGs • Quarter characterized by the increase in production and accounting of extraordinary items. 12

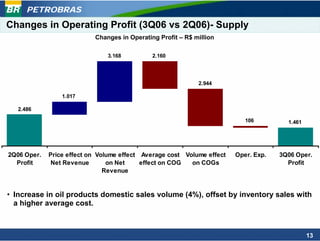

- 14. PETROBRAS Changes in Operating Profit (3Q06 vs 2Q06)- Supply Changes in Operating Profit – R$ million 3.168 2.160 2.944 1.017 2.486 106 1.461 2Q06 Oper. Price effect on Volume effect Average cost Volume effect Oper. Exp. 3Q06 Oper. Profit Net Revenue on Net effect on COG on COGs Profit Revenue • Increase in oil products domestic sales volume (4%), offset by inventory sales with a higher average cost. 13

- 15. PETROBRAS Changes in Net Profit – R$ million (3Q06 vs 2Q06) 1,757 Domestic Oil, NGL and Condensate – thousand bpd 1,779 5.415 4.982 Extraordinary Items and Bonds Buyback: R$ 1.145 million 6.959 149 7.085 824 573 1.603 341 321 2Q06 Net Revenues GOGS w/o Extr. Items Oper. Exp. Fin. and Non Bonds Taxes (Int. Minority 3Q06 Net Profit extraordinary Oper. Exp. Buyback Own Cap.) Interest Income items and Eq. Income • COGS: influenced by extraordinary effects (R$ 426 million reinjected gas and R$ 408 million special participation costs in Marlim field) and sales of higher costs inventories; • Operating Expenses: write-off of dried wells (Brazil and foreign); increase in the domestic sales and oil exports volume; maturity of the hedge with ANDINA and others. 14

- 16. PETROBRAS Net exports of oil and oil products Exports (thousand bpd) Imports (thousand bpd) 54 thous. bpd volume surplus in the 3Q06 536 564 559 512 519 510 446 424 446 459 409 209 109 442 249 257 269 137 213 105 94 115 88 228 355 450 319 352 344 354 373 233 263 262 267 181 2003 2004 2005 1Q06 2Q06 3Q06 2003 2004 2005 1Q06 2Q06 3Q06 Oil Oil Products Oil Oil Products • Oil exports increase due to scheduled stoppages in refineries with high complexity; • Oil products imports increase due to the seasonal increase in the diesel consumption. 2006 includes ongoing exports 15

- 17. PETROBRAS Leverage Petrobras’ Leverage Ratio R$ million 09/30/2006 06/30/2006 28% 27% Short Term debt (1) 11,858 12,214 26% 26% Long Term Debt (1) 32,280 31,307 24% Total Debt 44,138 43,521 23% 20% 19% 18% 17% Cash and Cash 24,519 22,713 Equivalents Net debt (2) 19,619 20,808 set/05 dez/05 mar/06 jun/06 set/06 Net Debt/Net Capitalization Short-Term Debt/Total Debt • Decrease in total and net debt: • Strong operating cash generation allows reduction of the debt (bonds buyback) (1)Includes debt contracted throughcash contracts of R$ 3.300 million on December 31, 2005, and R$ 4.021 million on December 31, 2004. and increase in leasing balance. (2)Total debt - cash and cash equivalents (1)Includes debt contracted through leasing contracts of R$ 2,729 million on September 30, 2006, and R$ 2,815 million on June 30, 2006. (2)Total debt - cash and cash equivalents 16

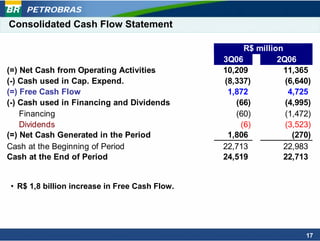

- 18. PETROBRAS Consolidated Cash Flow Statement R$ million 3Q06 2Q06 (=) Net Cash from Operating Activities 10,209 11,365 (-) Cash used in Cap. Expend. (8,337) (6,640) (=) Free Cash Flow 1,872 4,725 (-) Cash used in Financing and Dividends (66) (4,995) Financing (60) (1,472) Dividends (6) (3,523) (=) Net Cash Generated in the Period 1,806 (270) Cash at the Beginning of Period 22,713 22,983 Cash at the End of Period 24,519 22,713 • R$ 1,8 billion increase in Free Cash Flow. 17

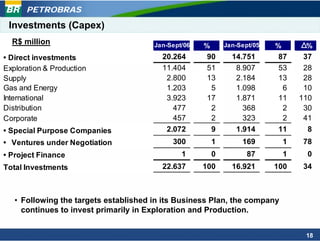

- 19. PETROBRAS Investments (Capex) R$ million Jan-Sept/06 % Jan-Sept/05 % % • Direct investments 20.264 90 14.751 87 37 Exploration & Production 11.404 51 8.907 53 28 Supply 2.800 13 2.184 13 28 Gas and Energy 1.203 5 1.098 6 10 International 3.923 17 1.871 11 110 Distribution 477 2 368 2 30 Corporate 457 2 323 2 41 • Special Purpose Companies 2.072 9 1.914 11 8 • Ventures under Negotiation 300 1 169 1 78 • Project Finance 1 0 87 1 0 Total Investments 22.637 100 16.921 100 34 • Following the targets established in its Business Plan, the company continues to invest primarily in Exploration and Production. 18

- 20. PETROBRAS QUESTION AND ANSWER SESSION Visit our website: www.petrobras.com.br/ri/english For further information please contact: Petróleo Brasileiro S.A – PETROBRAS Investor Relations Department Raul Adalberto de Campos– Executive Manager E-mail: petroinvest@petrobras.com.br Av. República do Chile, 65 - 22nd floor 20031-912 – Rio de Janeiro, RJ (55-21) 3224-1510 / 3224-9947 19