Whats ahead for the economy ASA

- 1. The Economic Outlook 2014 February , 14 - 2014 What’s Ahead For The Economy? Adel Abouhana Advisor

- 2. What’s next for the economy? Three possible paths in 2014. Scenario C GDP growth exceeding 3% Lodging Conference Economic cycle peaked Dec. 2007 2013 Scenario B Growth less than 2.5% 2012 Recession ends June 2009 2008 - 2009 recession Scenario A Economy slips into recession ADEL ABOUHANA

- 3. Scenario A: Recession Average life span of recovery is just 4.8 years. Sequester will do more damage. Market interest rates keep climbing. Consumers & businesses pull back; The comeback of Europe, China and emerging markets is just wishful thinking. >> Federal Reserve: Ramps up quantitative easing. Scenario B: Dull Growth: Less than 2.5%. US economy stuck in low gear. Higher market rates to restrain growth. Europe “staggers” out of recession. China avoids hard landing, but is beset with debt problems. U.S. confidence vacillates; Spending remains lackluster Employment: a miserly 100K/month >> Federal Reserve: No increase in QE, but may postpone tapering. Scenario C: Stronger Recovery: 3% or better US economy gains more traction. Higher confidence fuels both consumer & business spending Europe emerges from recession. “Worst is over.” Private capital returns to EZ Chinese leaders succeed in achieving growth target, even as it seeks reforms U.S. employment enters in 200K - 300K/month range >> Fed: On track to end QE mid-2014; Higher rates will NOT imperil the recovery. ADEL ABOUHANA

- 4. Scenario A: Recession 15% Average life span of recovery is just 4.8 years. Sequester will do more damage. Market interest rates keep climbing. Consumers & businesses pull back; The comeback of Europe, China and emerging markets is just wishful thinking. >> Federal Reserve: Ramps up quantitative easing. Scenario B: Dull Growth: Less than 2.5%. 35% US economy stuck in low gear. Higher market rates to restrain growth. Europe “staggers” out of recession. China avoids hard landing, but is beset with debt problems. U.S. confidence vacillates; Spending remains lackluster Employment: a miserly 100K/month >> Federal Reserve: No increase in QE, but may postpone tapering. Scenario C: Stronger Recovery: 3% or better 50% US economy gains more traction. Higher confidence fuels both consumer & business spending Europe emerges from recession. “Worst is over.” Private capital returns to EZ Chinese leaders succeed in achieving growth target, even as it seeks reforms U.S. employment enters in 200K - 300K/month range >> Fed: On track to end QE mid-2014; Higher rates will NOT imperil the recovery. ADEL ABOUHANA

- 5. The consumer is key to the economic outlook! Three main drivers of household spending: 1. Labor market conditions. Is the job market improving? Yes…slowly. 2. Household balance sheets. Have family debt burdens eased? Yes! 3. Household wealth. Have Americans seen their wealth increase? Yes! ADEL ABOUHANA

- 6. Unemployment rate has been dropping (….but at an agonizingly slow pace) Monthly change in non-farm payrolls Peaked at 10% Oct. 2009 7.3% August 2013 Biggest employers Leisure and hospitality Retail Temporary work Construction Energy Source: BLS Forecast: 6.5% by 2015 ADEL ABOUHANA

- 7. New applications for unemployment benefits keep falling 4-week moving average 2013 Source: Federal Reserve ADEL ABOUHANA

- 8. Source: Federal Reserve ADEL ABOUHANA

- 9. Motor vehicle sales New single-family home “lots” sold Retail sales, ex-vehicles Are Consumers Upbeat and Spending? • Conference Board: Latest consumer confidence near 5½yr high. • University of Michigan: Consumer sentiment is just below a 6 yr. peak. • Are households spending more on big-ticket items? Yes! Purchases of consumer durable goods accelerated in the last quarter. (IIQ) Sources: Federal Reserve, University of Michigan, Conference Board, Bloomberg PLC

- 10. New orders are accelerating to manufacturers and service firms; It portends greater output and faster hiring in coming months. August new orders to manufacturers were the highest in more than 2 yrs! Orders expanding Orders shrinking Source: Institute for Supply Management (ISM) August new orders to service firms are the highest in more than two years! ADEL ABOUHANA

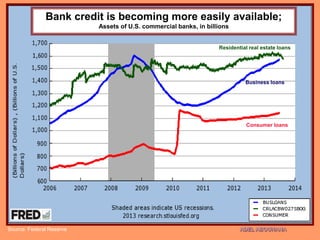

- 11. Bank credit is becoming more easily available; Assets of U.S. commercial banks, in billions Residential real estate loans Business loans Consumer loans Source: Federal Reserve ADEL ABOUHANA

- 12. Real (inflation-adjusted) U.S. exports of goods and services Homebuilders are struggling to keep up with permits filed for SFH STARTS of single-family home construction PERMITS filed for single-family home construction Business Confidence Private non-residential construction spending improving. Public non-residential construction spending is shrinking! • Homebuilder sentiment (NAHB) in August: Confidence surged to an 8-year high! Debt ceiling crisis / fiscal cliff fears • Small business confidence (NFIB): Optimism rose in July to 2nd highest in a year. • Quarterly CEO confidence survey by Conference Board (conducted in July): Sentiment highest in more than a year! Sources: Federal Reserve, Institute for Supply Management ADEL ABOUHANA

- 13. ADEL ABOUHANA

- 14. • Democrats & Republicans still butt heads over the budget. Q: Will the lack of an agreement imperil growth? A: No! The deficit is shrinking at the fastest pace since WW II. • Deficit in 2014 to drop to 3.4% of GDP, avg. of the last 30 yrs. Debt ceiling: No chance House will allow U.S. to default. 4 U.S. budget deficit as % of GDP 2 0 -2 -4 -6 -8 Forecast -10 -12 2000 2 4 6 8 2010 12 14 16 18 2020 • WHO SUCCEEDS BEN BERNANKE? Janet Yellen? Donald Kohn? Larry Summers? George Clooney? Makes little difference. Tapering to commence soon regardless. 10-yr. Treasury yields will hover 3.2% - 4.2% in 2014. Fed funds rate to remain 0% - ¼% until late 2015. The normalization of interest rates is a good sign! Source: CBO, The Economic Outlook Group ADEL ABOUHANA

- 15. The most important forces that will shape the global economy • GLOBAL MONETARY EASING IS DRAWING TO A CLOSE: More than 500 interest rate cuts have occurred worldwide since June 2007. The payoff: Faster growth in 2014 - 2015 • WHO IS THE NEWEST EMERGING COUNTRY? IT IS THE UNITED STATES! > Energy revolution = It will have a profound impact on aviation, travel, tourism, manufacturing and the dollar. OPEC and Russia to be losers. > U.S. to regain competitive advantage. Outsourcing becomes much less attractive. > Capital of innovation = iPhone, Google Glass, Tesla, 3-D printing, Robotics, Genomics. • EMERGING COUNTRIES NOW DEALING WITH “GROWTH PAINS”: > 3.5 BILLION PEOPLE will move from rural areas to cities in the next 5 to 10 years; $20 TRILLION to be spent on infrastructure to support this massive migration. > MORE THAN 50% of global GDP growth in the next 10 years will STILL come from emerging economies. • BRACE FOR MORE SERIOUS EXOGENOUS SHOCKS: Middle East, Asia, global terrorism, cyberwar ––– all pose great threats to business. Yet few firms perform stress tests to evaluate their vulnerabilities!! ADEL ABOUHANA

- 16. ADEL ABOUHANA