World market of bottled water

- 1. World market of bottled water Amelia Díaz Miquel Salgot Universitat de Barcelona

- 2. Bottling market & companies Dynamic market where great number of companies are competing Sector where a big part of the world market is still controlled by local firms Three main types of companies

- 3. Types of bottling companies Small or big companies created purposely for the commercialization of a specific brand of bottled water Several of them are centennial and family owned. Nevertheless, most of them grouped or are controlled by big worldwide corporations like Nestlé and Danone 1

- 4. Big food and beverage corporations, like Coca-Cola and PepsiCo. For those corporations, water is a key component (raw material) for their products and entered the bottled water market to improve the efficiency of and by using their worldwide distribution network 2

- 5. Urban water supply companies (network companies), using their knowledge on water treatment and purification to enter a more profitable business 3

- 6. Here comes your footer Page 6

- 8. NESTLÉ 63 brands http://www.nestle- waters.com/brands/ all-brands Located in 36 countries 97 bottling factories Distribution in 130 markets

- 9. NESTLÉ Brands: Internationally prestigious Functional brands Nestlé ‘s trademark waters Brands portfolio: 3 main types Natural sources’ waters

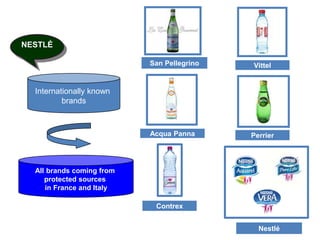

- 10. Internationally known brands All brands coming from protected sources in France and Italy San Pellegrino Acqua Panna Vittel Perrier NESTLÉ Contrex Nestlé

- 11. Functional brands Natural source’s waters located in national territories, well positioned in the national or regional markets Nestlé brand waters, all having identical quality but produced in different places to minimize transport costs NESTLÉ

- 12. Nestlé’s brand waters Nestlé Pure Life NESTLÉ

- 13. Nestlé Pure Life Commercialized in 27 countries, in emergent markets and in North America 2008, just in 10 years, became the worldwide leader brand of bottled water NESTLÉ 2008: more than 5 billion liters sold in the world 2009: 14% increase

- 14. NESTLÉ 2013: 11,7% market share. Nestlé sales’ leader in North America, Europe and Latin America Buying local well known companies Introduction of their own brand Nestlé water or Main expansion strategy

- 15. Inroducción de su marca de agua Nestlé NESTLÉ Saudí Arabia (2002) Al Manhal, Springs Nigeria and Algeria (2005) Turkey (2006) Erikli, Alaçam Switzerland (2007) Henniez, Cristalp Mexico (2007): Gerber, Sta. María Brazil (2009) Sta Bárbara, Petrópolis China (2009) Da Shan, Waterman, Deep Spring Introduction of Nestlé water brand Chile (2007) Cachantun, Manantial, Porvenir

- 16. DANONE Owns 2 of the first 5 worldwide selling leader brands : Evian and Volvic Sales: 18 billion liters 81 bottling factories Market share : 8,5%

- 21. Local brands leaders of the market

- 22. MAIN LEVERS FOR GROWTH IN 2013

- 24. 2nd bigger bottled water producer in Europe and important supplier in Asia- Pacific and Latin America Its 2 bigger factories, both located in France, represent approximately 15% of the total bottling capacity of the group DANONE Its 2 bigger factories for bottling water in large containers, both located in Indonesia, represented nearly 8% of total production

- 25. DANONE 2009: exported to 150 countries EVIAN The main exported product of the group is bottled water, mainly under the brands Evian and Volvic Leader brand in the UK and second in Japan

- 26. DANONE Leader brand in Germany First imported brand in Japan VOLVIC

- 27. COCA - COLA Es la mayor compañía de bebidas sin alcohol y el tercer productor de agua embotellada en el mundo 2009: 79% of the total volume of units sold worldwide were commercialized through the associated bottling partners The main company for non-alcoholic beverages and the third bottled water producer in the world The beverages are produced, distributed and sold through the local associated bottling companies, privately owned and administered

- 28. Here comes your footer Page 28 Brands

- 29. We believe that water must be respected as well as water is respecting us

- 30. Our sources: different places, the same quality water

- 31. COCA - COLA This water comes from the public distribution network and is then purified DASANI In 1999 was introduced in the States with the bigger publicity budget in the bottled water industry Its first brand

- 32. Mexico (2008) El Agua de los Ángeles Colombia (2009) Brisa Bolivia (2009) Mineragua Bolivia (2009) Vital Japan (2009) I Lohas COCA - COLA Apart, has been increasing its water business during the precedent years through the purchase of companies in several countries

- 33. PepsiCo In the mid nineties entered the bottling water markets by launching the brand Aquafina In 1999, became the fourth bottled water supplierin the USA, with a 5,5% market share

- 34. 2014: was the fourth ranked bottled still water brand of the United States with about 0.86 billion U.S. dollars worth of sales AQUAFINA PepsiCo Purified public network water Its first brand

- 35. Rusia Minerale Acqua Mexico Electropura United Kingdom V Water PepsiCo Apart from Aquafina in the USA, PepsiCo owns other brands in several countries

- 36. Global market forecast 2011-2021

- 38. In the next five years, as a general tendency, the main four companies will mainly center their efforts in the USA and Europe markets, mature and consolidated, but still heavily fragmented

- 39. The immediate future of the industry will be strongly related to the results of the main companies in the world water market

- 40. Will be interesting to follow the next steps of PepsiCo and Coca- Cola: in only 10 years, with Aquafina and Dasani brands, started from zero and are now the first and second selling brands in the USA Next step: both companies will attempt to control/dominate the world market and challenge the present leaders command: Nestlé and Danone

- 41. Due to the market contraction in the last years, all the big players in the bottled water market are trying to position themselves in the quickly growing markets in developing countries

- 42. Approach to the commercial flows

- 43. The WTO (World Trade Organization) estimated that the world water trade is limited to bottled water and just represents 0,02% of the value of worldwide goods 25% of the billion bottles sold every year in the world is sold out of its country of origin 75% is produced and distributed at regional level

- 44. More than 90% of Nestlé’s Water volume is sold out in the country where it is produced Vichy Catalán, from the three main water bottlers in Spain, exported 3% of its production to 29 countries

- 45. In the next future, the tendency seems to be an increase to the bottling water flows at the local, regional, national and international levels The big bottling water corporations did found a market niche in the emergent countries The strategy for growing is right now the acquisition of local, well positioned companies

- 46. To finish... The comparatively high price and the consideration of the difficulties to recycle the water containers is generating certain rejection from the public

- 47. New York and Boston cities launched a campaign pushing the citizens to return to tap water consumption Several USA and Australia universities banned to sold bottled water in the campus