wyeth Cowen and Company Annual Health Care Conference

- 1. Cowen Health Care Conference Geno Germano President – U.S. and General Manager Wyeth Pharmaceuticals March 13, 2007

- 2. Forward-Looking Statement The statements in this presentation that are not historical facts are forward- looking statements based on current expectations of future events that involve risks and uncertainties including, without limitation, risks associated with the inherent uncertainty of pharmaceutical research, product development, manufacturing, commercialization, economic conditions including interest and currency exchange rate fluctuations, the impact of competitive or generic products, product liability and other types of lawsuits, the impact of legislative and regulatory compliance and obtaining approvals, and patent, and other risks and uncertainties, including those detailed from time to time in Wyeth’s periodic reports, including quarterly reports on Form 10-Q and the annual report on Form 10- K, filed with the Securities and Exchange Commission. Quarterly results, in particular, can vary due to issues which include, but are not limited to, changes in exchange rates, the timing of actions taken by the Company to ensure long-term improvements to our manufacturing processes, the timing of regulatory approval of new products and/or facilities and the timing of promotional programs. Actual results may vary materially from the forward-looking statements. The Company assumes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. 2

- 3. Wyeth Delivered Strong Growth in 2006 Net Revenue ($B) Net Income* ($B) Earnings Per Share* +15% $4.5 $3.50 $25 +14% +9% $4.0 $3.00 $4.3B $20 $3.5 $3.14 $2.50 $20B $3.0 $19B $3.7B $2.75 $15 $2.00 $2.5 $2.0 $1.50 $10 $1.5 $1.00 $1.0 $5 $0.50 $0.5 $0 $0.0 $0.00 FY 05 FY 06 FY 05 FY 06 FY 05 FY 06 * Excludes Certain Significant Items and Reflects the 2005 Pro Forma Effect 3 of Expensing Stock Options

- 4. Marketed Products Strong Growth In 2006 +20% $1,50 M (Wyeth) $4.4B Enbrel $2,880 M (Amgen) +8% Effexor $3.7 B +30% Prevnar $2.0 B Protonix +7% $1.8 B +17% Alliance Rev. $1.3 B +15% Nutritionals $1.2 B FY06 Pharma +16% Premarin $1.1 B Revenue +9% Zosyn Growth +10% $972 M +4% BeneFIX $358M +12% Rapamune $337M BMP-2 +30% $308 M $0 $1,000 $2,000 $3,000 $4,000 $5,000 (in millions) 4

- 5. 2006 Wyeth’s Leadership Positions #1 Antidepressant #1 RA & Psoriasis Biologic #1 Vaccine #1 HT #1 I.V. Antibiotic #1 Hemophilia B #1 Infant Formula (In Aggregate Market Where We Compete) 5

- 6. Efforts Continue to Contain Cost Structure While Allowing Support of Key Brands and R&D 2007 Guidance* Project Springboard • Increase Efficiency of • Pro Forma EPS +8% to +11% Marketing/Selling Approach • Revenue Growth Mid to High • Commercial Excellence Single Digit • Marketing Excellence • Gross Margin 72% to 74% • Enhance R&D Technical and • SG&A Increase at a Management Processes Significantly Lower Rate than Revenue • Learn and Confirm • Early Clinical Development • R&D Growth Mid Single Digit Centers • Optimize Manufacturing • Continue to Grow the Bottom Supply Chain Line at a Meaningfully Faster • 25 Sites in 2006 vs. 43 in Rate Than Revenue Growth 2000 6 * Excludes Certain Significant Items

- 7. New Commercial Model Recognizing the Need for More Positive Interactions With Physicians, Consumers, and Payors, Wyeth Sought to Create a New Commercial Model That Would: Meet the Needs of the Market, Our Customers, n and Shareholders Increase Effectiveness by Improving Access and n Interaction With Physicians Recognize Alternative Methods to Deliver Product n Messages to Physicians, Payors, and Consumers Re-establish Our Sales Representative Value n Proposition 7

- 8. New Primary Selling Model Operational Summary New Model Old Model Physician and Account Shared Physician Targets n n Responsibility Within POD Local Empowerment and n Headquarters-driven Plan n Decision Making of Action Individual Accountability n Shared Accountability n Portfolio Responsibility n One Primary Product n Custom Resource Allocation n Uniform Resource Allocation n DM Geographic Ownership n District Management Matrix n Physician Segmented n by Value Physician Segmented n by Volume Rep Incentive Value n Generation Rep Incentive Share/Volume n 8

- 9. Early Indications Reflect Favorable Physician Response Primary Care Company 2006 Rank 2005 Rank Wyeth 71% 1 57% 8 Eli Lilly 69% 2 51% 13 Pfizer 69% 3 77% 1 GlaxoSmithKline 67% 4 64% 5 Forest 66% 5 68% 2 Abbott 63% 6 48% 16 AstraZeneca 63% 7 62% 6 Merck 62% 8 55% 11 Takeda 62% 9 60% 7 Novartis 60% 10 68% 2 Boehringer-Ingelheim 59% 11 56% 10 Sanofi-Aventis 58% 12 51% 13 Schering-Plough 55% 13 66% 4 Bristol-Myers Squibb 50% 14 38% 17 TAP 50% 14 57% 8 Johnson & Johnson 47% 15 52% 12 Procter & Gamble 44% 16 50% 15 Roche 41% 17 N/A N/A Industry Average 59% N/A 58% N/A Source: Health Strategies Group “2006 State of the Selling Environment Study”. Question: Overall, how satisfied are you with this pharmaceutical representative? Rate on a scale from 1-7 where 1 is Not at all satisfied and 7 is Very satisfied.

- 10. Continuous Learning Sales Remain on Target With All Brands Achieving n or Exceeding Established Goals Strong Customer Relationships Enhanced or Maintained n 72% of Physicians Indicated the New Model Would Allow Them to Establish Stronger Relationships With Their Representatives Sales Representatives Report Improved Access in Many Offices As a Result of Account Ownership Increased Efficiency n Approximately 70% of Physicians Say the Current Model Is an Improvement That Provides More Value for Them/Their Staff Greater Flexibility for Market and Environmental Changes n Local Empowerment to Increase Productivity n and Job Satisfaction 10

- 11. Marketing Excellence Vision Innovating for Sustainable Advantage in a Changing Marketplace Build a Customer-focused Organization That: 1. Understands and Meets Our Customers’ Needs 2. Values and Rewards Innovation & Creativity 3. Optimizes Our Structure to Deliver Flawless Execution in a Cost-efficient Manner 4. Drives Preference for Our Brands 5. Is Recognized As a Leader at the Forefront of Change Create Sustainable Competitive Advantage 11

- 12. Other Industries Offer Rich Source of Learning for Wyeth Marketing Examples Customer Novel Approaches to Research (E.G., Anthropology, Insights Ethnography) to Capture Unique Insights Channel Use Multi-channels to Segment, Management Acquire and Retain Customers Payor As Deep Understanding of Payor Behavior Customer and Business Drivers Brand Systematic and Rigorous Approach to Planning Business Planning and Metrics Marketing Clearly Defined Roles and Rules of Engagement Organization Between Brand Team and Marketing Support 12

- 13. Marketing Excellence Build a Customer-focused Marketing Organization That Innovates to Achieve Sustainable Advantage in a Changing Marketplace Key Areas of Focus: Marketing Excellence Gain Deeper Customer Insights Enhance Customer-focused Payor HCP Consumer Marketing Excellence Relationship Engagement Marketing Increase Rigor to Marketing Processes and Talent Insights Powerhouse: Building Deep Customer Insights Powerhouse: Brand Planning: Creating a “Wyeth Way” of Planning Planning: Way” Talent Management: Strengthening Talent and Development Management: Focus on U.S. Business Business Alignment: Balancing Business Management & Demand Generation Alignment: 13

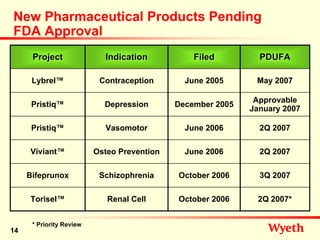

- 14. New Pharmaceutical Products Pending FDA Approval Project Indication Filed PDUFA Lybrel™ Contraception June 2005 May 2007 Approvable Pristiq™ Depression December 2005 January 2007 Pristiq™ Vasomotor June 2006 2Q 2007 Viviant™ Osteo Prevention June 2006 2Q 2007 Bifeprunox Schizophrenia October 2006 3Q 2007 Torisel™ Renal Cell October 2006 2Q 2007* * Priority Review 14

- 15. Pristiq™ – Proven SNRI Pharmacological Impact for Management of Depression Similar to Effexor XR® in Terms of Efficacy, n Safety and Tolerability Very Low Potential for Drug-drug Interaction n Well-established QTc Safety Profile n 15

- 16. Women Represent Over 70% of Patients Treated with an Antidepressant Treated Patients by Gender Female <40 Years 19% Female 71% Male 29% Female >40 Years 52% Source: SDI Longitudinal Patient Data, April 2006 (USA) 16

- 17. Transition Through Menopause Can Be Associated With New Onset or Recurrence of a Major Depressive Episode Estrogen Fluctuation or Decline May Diminish n Serotonin and Norepinephrine Functioning Dual Reuptake Inhibitor May Be a Better Fit n for Depression Associated With Menopause 17

- 18. Remission of Depression: Differential Response With Age SSRIs vs. SNRIs Pooled Analysis of 32 Depression Studies 50 Remission Rate, Week 8 (%) SSRIs* Effexor®/Effexor XR® †‡ †‡ P≤0.05 40 † 36% 30 Placebo 30% 20 10 0 <40 >55 <40 >55 <40 >55 (n=263) (n=108) (n=1041) (n=367) (n=1007) (n=355) Age *SSRIs=fluoxetine, fluvoxamine, paroxetine, sertraline, and citalopram. †P≤0.05 drug vs. placebo. ‡P≤0.05 vs. SSRIs. 18 Younger women = age ≤40; older women = age >55. Cohen LS, et al. Poster presented at ACNP Annual Meeting; San Juan, Puerto Rico; December 2004.

- 19. Providing Specific Benefits for Over 35 Million Women U.S. Prevalence Major Vasomotor Depression Symptoms Fibromyalgia 23 Million2 4 Million3 12 Million1 Women Women Women 1 National Institute of Mental Health. “What To Do When A Friend is Depressed…” Bethesda (MD): National Institute of Mental Health, National Institutes of Health, U.S. Department of Health and Human Services, 2001. 2 Wyeth /ICR Patient Study Dec 2005, projected to total population using U.S. census data 3 Patient Base by Decision Resources, August 2005 2006 Syndicated Depression Omnibus shows VMS and depression overlap of ~3M women, 2005 Depression Consumer Landscape Study shows fibromyalgia and depression overlap of ~1M women

- 20. Pristiq™ Differentiation With FDA-approval, the First Non-hormonal Treatment of Moderate-to-severe Vasomotor Symptoms (VMS) Associated With Menopause 20

- 21. A Small Percentage of the 23 Million Symptomatic Women Use Available Treatments Menopausal Women Hysterectomized Women Experiencing Hot Flushes Experiencing Hot Flushes 10% Use 30% Use Hormone Estrogen Therapy Therapy 15 Million Women 8 Million Women Sources: Wyeth/ICR Patient Study Dec 2005, projected to total population using U.S. census data 21

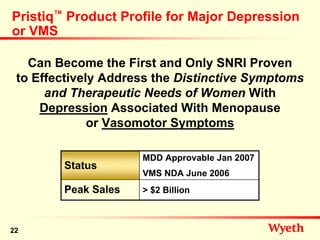

- 22. Pristiq™ Product Profile for Major Depression or VMS Can Become the First and Only SNRI Proven to Effectively Address the Distinctive Symptoms and Therapeutic Needs of Women With Depression Associated With Menopause or Vasomotor Symptoms MDD Approvable Jan 2007 Status VMS NDA June 2006 Peak Sales > $2 Billion 22

- 23. 2007 Planned FDA Submissions Project Indication Proposed Filing Opioid Induced Methylnaltrexone March 2007 Constipation Tygacil® CAP/HAP Mid 2007 ReFacto® AF Hemophilia Mid 2007 Menopausal Symptoms Aprela™ Late 2007 / Osteoporosis Late 2007/Early Methylnaltrexone Post Operative Ileus 2008 23

- 24. New Product Summary 7 NCE’s 11 New Indications Competing in Markets Worth >$30B in Annual Sales Late Stage Pipeline Addressed at 10/5/06 Analyst Meeting 24

- 25. Positioning Wyeth To Be A Stronger Company Build Breadth and Diversity Into Every Aspect of the n Company So Wyeth Will Never Be Dependent on One Product or Any One Research Program Continue to Improve Profitability by Enhancing Productivity n Achieve Solid Top Line Growth, Effectively Manage Costs, n and Grow the Bottom Line at a Meaningfully Faster Rate Than the Growth in Revenues Position Wyeth to Be a Stronger Company at the End of the n Decade Then We Are Today and Enter the Next Decade With Great Momentum 25

- 26. Questions? Geno Germano President – U.S. and General Manager Wyeth Pharmaceuticals