XBRL - Experience and Best Practice

- 1. Experience and Best Practice From International Case Studies Presented by: Liv Apneseth Watson Sr. Director of Strategic Customer Initiatives Workiva, Inc (NYSE: WK) August 14, 2019

- 2. August 14, 2019 Agenda XBRL History and Background A New Ear Of Regulatory Reporting and Compliance Lesson Learned and Best Practices Three Key Takeaways

- 3. The early question..... What problem is it that we are trying to solve? "XBRL will make it dramatically easier to generate, validate, aggregate, and analyze business and financial information—which in turn will improve the quality of the information companies use to make decisions".

- 4. 7th of Nov XBRL South Africa 1998 XFRML 2000 The Launch of the XBRL Specification 1.0. First SEC Filing Morgan Stanley + XBRL for General Ledger Taxonomy was Released SEC adopts rule requiring XBRL for public company and mutual fund reporting as well as credit rating agency disclosures 2001 20192005 2008 XBRL Goes Main Stream 2018 It has been a Journey? XBRL Mandate 2007 The HBR List of Breakthrough Ideas 2009 I am Honored to be here! SOURCE: https://www.slideshare.net/livapnesethwatson/xfrml- 2020

- 5. Who Uses XBRL ? Analysts and Investors Analysts that need to understand relative risk and performance. Investors that need to compare potential investments and understand the underlying performance of existing investments. Business Registrars Business Registrars that need to receive and make publicly available a range of corporate data about private and public companies, including annual financial statements. Financial Regulators Financial market regulators that need significant amounts of complex performance and risk information about the institutions that they regulate. Securities Regulators & Stock Exchanges Securities regulators and stock exchanges that need to analyze the performance and compliance of listed companies and securities, and need to ensure that this information is available to markets to consume and analyze. Data Providers Specialist data providers that use performance and risk information published into the market place and create comparisons, ratings and other value-added information products for other market participants. Governments Government agencies that are simplifying the process of businesses reporting to government and reducing red tape, by either harmonizing data definitions or consolidating reporting obligations (or both). Accountants & Auditors Accountants use XBRL in support of clients reporting requirements and are often involved in the preparation of XBRL reports. Auditors that audit statutory reports. Companies Companies that need to provide information to one or more of the regulators mentioned

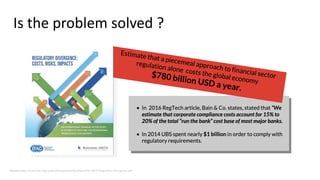

- 6. Is the problem solved ? Source: https://www.ifac.org/system/files/publications/files/IFAC-OECD-Regulatory-Divergence.pdf

- 7. The problem is getting worse

- 8. Main Factors Contribution to Compliance Costs

- 9. Business reporting has never been more complex

- 13. A New Era of Regulatory Reporting and Compliance RegTech + XBRL An opportunities for More Efficient and Effective Regulatory Supervision and Compliance COMPLIANCE TECHNOLOGY (CompTech) The use of the latest technology by firms to manage compliance challenges more efficiently and effectively SUPERVISORY TECHNOLOGY (SupTech) The use of the latest technology by regulators to manage supervision challenges more efficiently and effectively. urce: https://www.milkeninstitute.org/sites/default/files/reports-pdf/RegTech-Opportunities-White-Paper-FINAL-.pdf

- 14. (CompTech) - Best Practice XBRL Implementation Approaches

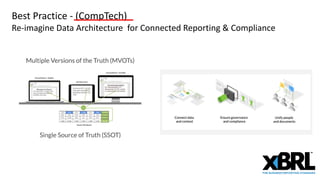

- 15. Best Practice - (CompTech) Re-imagine Data Architecture for Connected Reporting & Compliance

- 16. (SupTech) - Best Practice XBRL Implementation Approaches Source: https://xbrl.us/wp-content/uploads/2007/12/20060202FFIECWhitePaper.pdf

- 17. Best Practice (SupTech) Re-imagine Data Architecture for Reducing Compliance Costs and Risks 1 2

- 18. 3 Key Takeaways

- 19. The costs and risks of corporate statutory reporting (i.e., RegData) keeps growing, while complexity is starting to out-pace human understanding 1

- 20. 2

- 21. We Need Data Standards in the 4th Industrial Revolution 3

- 23. Thank you XBRL South Africa!

- 24. Liv Apneseth Watson Sr. Director of Strategic Customer Initiatives Honors-Awards Year 2018 - IMA's Lybrand Certificate of Merit /Article titled "XBRL AND THE CLOUD" Year 2018 - Eurofiling Hall of Fame - Recognition to Outstanding Contributors Year 2016 - IMA Global Distinguished Member Award Year 2006 - Lybrand Silver Medal for article titled " Possible Second-Wave Benefits of XBRL" Year 2002 - IMA's Certificate of Merit Awarded / Article titled "XBRL it Can Improve Today's Business Environment Liv A. Watson is a Senior Director of Strategic Customer Initiatives at Workiva Inc. (NYSE:WK). Watson recently served as Chair of the Institute of Management Accountants (IMA) Technology Trends Subcommittee, member of the Institute of Chartered Accountants in England and Wales (ICAEW) Sustainability Committee, member of the Global Reporting Initiative (GRI) Technology consortium, and an active member of the XBRL International Funding Task Force. Watson authored one of the IMA's most successful CPE courses, Accounting System Technology for the 21st Century. She has published numerous articles for international publications and journals, including Harvard Business Review and Strategic Finance. She has also written a monthly column on financial and business reporting trends for CPA2Biz.com. Watson is the co-author and contributing author to several books, including XBRL for Dummies as well as Governance, Risk, and Compliance Handbook published by Wiley. She is also a contributing author of the Harvard Business School’s first e-books titled, The Landscape of Integrated Reporting, and Effective Auditing for Corporations published by Bloomsbury.