xcel energy 12_6XcelUtilityWeekSECwAppendix12062006

- 1. Building the Core Sustainable Growth Ben Fowke Vice President and CFO Wall Street Utility Group December 6, 2006

- 2. Safe Harbor This material includes forward-looking statements that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements include projected earnings, cash flows, capital expenditures and other statements and are identified in this document by the words “anticipate,” “estimate,” “expect,” “projected,” “objective,” “outlook,” “possible,” “potential” and similar expressions. Actual results may vary materially. Factors that could cause actual results to differ materially include, but are not limited to: general economic conditions, including the availability of credit, actions of rating agencies and their impact on capital expenditures; business conditions in the energy industry; competitive factors; unusual weather; effects of geopolitical events, including war and acts of terrorism; changes in federal or state legislation; regulation; costs and other effects of legal administrative proceedings, settlements, investigations and claims including litigation related to company-owned life insurance (COLI); actions of accounting regulatory bodies; the higher degree of risk associated with Xcel Energy’s nonregulated businesses compared with Xcel Energy’s regulated business; and other risk factors listed from time to time by Xcel Energy in reports filed with the SEC, including Exhibit 99.01 to Xcel Energy’s report on Form 10-K for year 2005.

- 3. Delivering Value — Now and in the Future Building the core — Meeting customers’ needs — Environmental leadership — Getting the rules right Accomplishments — Regulatory — Legislative Future growth Financing the plan

- 4. Building the Core Delivering competitively priced, reliable energy Cents per kWh (Retail) Source: Summer 2006 EEI Typical Bills 21 18 15 12 9 7.79 6.64 7.01 6 3 0 uis City ines City arillo aul cago ver ukee nix n DC iami ston Yor k oe en lwa hoe gto Pi o t. L Lak s M nsas Am /St. Ch M Bo ew Di S lt P hin N e ls M a D Mp K Sa as W

- 5. Building the Core Environmental Leadership Promoting Conservation and Load Management 8.2 Number of plants avoided 7.4 6.5 5.5 4.7 3.7 2.7 1.6 1992 1994 1996 1998 2000 2002 2004 2006 1 Plant = 250 MW

- 6. Building the Core Environmental Leadership Leader in renewables Largest U.S. wind provider Double wind supply by year end 2007 Community-based energy Largest U.S. solar photovoltaic announced Wood waste and refuse-derived fuel

- 7. Building the Core Environmental Leadership Reducing emissions, increasing efficiency Colorado Emission Reduction Program MERP Comanche 1 & 2 Plant uprates

- 8. Building the Core Environmental Leadership Adopting new technology IGCC with sequestration Wind Hydrogen Energy Xcel Energy in Dow Jones Sustainability Index

- 9. Getting the Rules Right Helping shape public policy – One of the most important things we can do Credibility and leadership to achieve consensus on the appropriate balance: — Customers — Communities — Environmentalists — Regulators — Legislators — Investors

- 10. Constructive Regulation Recent rate case outcomes Dollars in millions Dollar Increase Return on Equity Requested Granted Requested Granted Colorado Gas $34.5 $22.0 11.0% 10.5% Wisconsin Electric 53.1 43.4 11.9 11.0 Wisconsin Gas 7.8 3.9 11.9 11.0 Minnesota Electric 156 131/115 * 11.0 10.54 Colorado Electric 208 151 ** 11.0 10.50 * $131 million for 2006 reduced to $115 million in 2007 for large customer coming on-line January 1, 2007 ** $107 million base rates, $39.4 million PCCA and $4.6 million Windsource costs

- 11. Colorado Gas Rate Case Highlights Requested $41.5 million increase Gas rate base = $1.1 Billion 11% return on common equity Equity ratio = 60% Partial decoupling

- 12. Regulatory & Legislative Accomplishments MERP – Forward recovery Comanche 3 – Forward CWIP through rate case filing Transmission investment – Forward recovery – MN & SD Mercury reduction – Forward recovery – MN Environmental expenditures – Forward recovery – MN Renewable investments – Forward recovery – CO IGCC – Supportive legislation – CO Transmission investment: Recovery legislation – TX Recovery potential – CO, ND Purchased capacity cost adjustment – CO

- 13. Investment Opportunities 2006 - 2020 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 Committed MERP $700 A-MN A Estimated Comanche 3 P $900 F Cost $700 CapX 2020 Group 1 A A Potential $4 A A Colorado IGCC Investment $30 Mercury A-MN A Approved $60 A-MN Rider CAIR Recovery License Extension & Uprate: $300 Monticello F Forward Prairie Island $700 Regulatory Recovery Plant Repowering & Uprate $100 New Generation/Gas Storage Environmental Improvements A-MN CapX 2020 Group 2 A CapX 2020 Group 3 A

- 14. Funding Sustainable Growth Objectives 5 – 7% EPS growth * Dividend per share growth 2 – 4% per year Improve credit rating * Base of $1.30 per share, mid-point of 2006 guidance and successful COLI outcome

- 15. Capital Expenditure Forecast Dollars in millions Denotes enhanced recovery process 2006 2007 2008 2009 2010 Base & Other Capital Expenditures $ 850 $ 850 $ 830 $ 990 $ 980 MERP 350 270 180 40 10 Comanche 3 200 340 280 60 10 Minnesota Wind Transmission 60 120 10 50 20 CapX 2020 10 20 110 240 Nuclear Fuel 75 80 80 135 100 Balance 85 100 100 115 140 Total $1,620 $1,770 $1,500 $1,500 $1,500

- 16. Assumptions — Potential Sources and Uses of Cash The forecast scenario is illustrative of a potential outcome, and does not imply guidance or a most likely outcome EPS growth of 6% per year, mid-point of the 5 – 7% objective range, from 2006 midpoint of $1.30 Dividend rate increase 3% per year, mid-point of the 2 – 4% objective range Dividends increase in 2007 and 2008 for expected conversion of convertible notes Depreciation growth consistent with rate base No change in working capital or deferred taxes COLI successfully resolved

- 17. Potential Sources and Uses of Cash * Dollars in millions 2007 2008 2009 2010 Cash from Operations $ 1,650 $ 1,700 $ 1,800 $ 1,900 Cash from Investing Capital Expenditures (1,770) (1,500) (1,500) (1,500) Nuclear Decommissioning (45) (45) (45) (45) Cash from Financing DRIP 40 40 40 40 Dividends (370) (390) (420) (440) Financing Needed $ 495 $ 195 $ 125 $ 45 * This forecast scenario is illustrative of a potential outcome, and does not imply guidance or a most likely outcome

- 18. Financing Growth Current financing plan includes: — DRIP — Modest debt ($600 million) — Hybrid preferred ($300 million 2008) Financing plans to remain flexible: — Capital expenditure opportunities — Unanticipated credit events

- 19. Improving Credit Metrics * Percent equity capitalization 50 Financing needed funded with: 48.5 Current plan 47.5 100% debt 47 46.5 46 45.5 45 43.5 40 2006 2007 ** 2008 ** 2009 2010 * This forecast scenario is illustrative of a potential outcome, and does not imply guidance or a most likely outcome ** Assuming conversion of convertible notes into equity

- 20. 2006 Earnings Guidance Range * Dollars per share 2006 Regulated Utility $1.25 – $1.35 Holding Company and Other (0.10) COLI – Tax Benefit 0.10 Continuing Operations $1.25 – $1.35 ** * Assumptions in appendix ** Expectation is to end the year in the upper half of the guidance range

- 21. 2007 Earnings Guidance Range * Dollars per share 2007 Regulated Utility $1.39 – $1.49 Holding Company and Other (0.15) COLI – Tax Benefit 0.11 Continuing Operations $1.35 – $1.45 * Assumptions in appendix

- 22. Sustainable Growth Collaborative process that balances various interests and delivers value to customers and investors Constructive rate case outcomes Forward recovery on significant incremental investments Pipeline of investments beyond 2010 Attractive Total Return Sustainable 5 – 7% earnings per share growth Dividend yield 4% Dividend growth of 2 – 4% per year

- 24. Appendix

- 25. Northern States Power Company- Northern Minnesota States Power 44% Net Income Company- Wisconsin 5% Net Income Public Service Company of Colorado 39% Net Income 5th Largest Combination Electric and Gas Utility (based on customers) Southwestern Public Service Traditional Regulation 12% Net Income 2005 EPS $1.20 continuing operations 2006 Dividend $0.89 annualized

- 26. Xcel Energy Supply Sources 2005 2005 Owned Energy Supply Mix* Generating Facilities Unit Type Number MW Gas & Oil Nuclear 38% 10% Coal 36 8,138 Natural Gas 61 4,918 Renewables 7% Nuclear 3 1,617 Hydro 83 508 Oil 24 492 RDF 6 96 25 * Wind - Coal ** Total 15,794 45% * Xcel Energy supplies in * Includes purchases excess of 1100 MWs of ** Low-sulfur western coal wind power

- 27. Capital Expenditure Forecast by Operating Company Dollars in millions 2006 2007 2008 2009 2010 NSP – Minnesota $ 910 $ 880 $ 680 $ 810 $ 820 NSP – Wisconsin 60 70 70 50 60 PSCo 550 680 620 510 500 SPS 100 140 130 130 120 Total $1,620 $1,770 $1,500 $1,500 $1,500

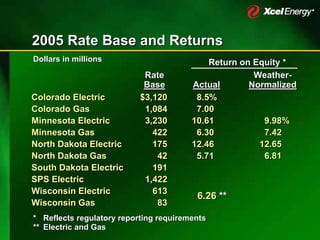

- 28. 2005 Rate Base and Returns Dollars in millions Return on Equity * Rate Weather- Weather- Base Actual Normalized Colorado Electric $3,120 8.5% Colorado Gas 1,084 7.00 Minnesota Electric 3,230 10.61 9.98% Minnesota Gas 422 6.30 7.42 North Dakota Electric 175 12.46 12.65 North Dakota Gas 42 5.71 6.81 South Dakota Electric 191 SPS Electric 1,422 Wisconsin Electric 613 6.26 ** Wisconsin Gas 83 * Reflects regulatory reporting requirements ** Electric and Gas

- 29. Senior Debt Ratings Secured Unsecured Fitch Moody’s S&P Fitch Moody’s S&P Holding Co. BBB+ Baa1 BBB- NSPM A+ A2 A- A A3 BBB- NSPW A+ A2 A- A A3 BBB PSCo A- A3 A- BBB+ Baa1 BBB- SPS A- Baa1 BBB

- 30. Texas Electric Rate Case Highlights Requested $63 million increase, capped at $48 million Electric rate base = $943 million 11.6% return on common equity Equity ratio = 51% Historical test year with adjustments for known and measurable Expect rates to be in effect second quarter 2007

- 31. Minnesota Gas Rate Case Highlights Requested $18.5 million increase Gas rate base = $440 million 11% return on common equity Equity ratio = 52% Forward test year Rates under bond $15.9 million January 8, 2007

- 32. Potential Additional Rate Cases with 2007 Impact North Dakota Electric Potential New Mexico Electric Potential South Dakota Electric Potential

- 33. Minnesota Cost Recovery Mechanisms Projected electric fuel and purchased energy costs billed for the current month with subsequent true-up; MISO energy and true-up; ancillary services being recovered through FCA. Projected purchased gas cost billed for the current month with subsequent true-up true-up Conservation Improvement Program rider which provides recovery of program costs plus incentives Metro Emission Reduction Program, Renewable Development Fund and State Energy Policy rider in place General Transmission rider authorized by law Mercury Reduction and Environmental Improvement rider authorized by law

- 34. Colorado Cost Recovery Mechanisms Quarterly Energy Cost Adjustment to recover electric fuel and purchased energy costs Monthly Gas Cost Adjustment recovers natural gas commodity, interstate pipeline and storage costs Annual Purchased Capacity Adjustment to recover demand component of purchased power contracts through the earlier of year-end 2010 or Comanche 3 completion Fuel Cost Adjustment recovers electric fuel and purchased energy costs from wholesale customers Demand-side Management Cost Adjustment rider (gas and electric) and Air Quality Improvement rider (recovers cost of emission controls on several Denver metro generation facilities) Recovery of Comanche 3 construction work-in-progress Recovery of expenditures for renewable mandate Rider recovery of IGCC investment

- 35. Corporate-Owned Life Insurance Litigation (COLI) The court’s opinion in the Dow case outlined three indicators of potential economic benefits to be examined in a COLI case. Positive pre-deduction cash flows pre-deduction Mortality gains The buildup of cash values In Xcel Energy’s COLI case, the plans: Were projected to have sizeable pre-deduction cash flows, based upon the relevant assumptions when purchased Presented the opportunity for mortality gains that were not eliminated either retroactively or prospectively Had large cash value increases that were not encumbered by loans during the first seven years of the policies Hearing likely second half of 2006

- 36. 2006 Key Earnings Guidance Assumptions Approval of Minnesota electric rate case decision No material incremental accruals in SPS regulatory proceedings Normal weather patterns for remainder of year Weather adjusted sales growth: — Retail electric 1.8 – 2.1% — Retail gas decline 1 – 2% Short-term wholesale and commodity trading margins of $30 – $40 million Operating and maintenance expenses increase 4%

- 37. 2006 Key Earnings Guidance Assumptions (continued) Depreciation increases $45 – $55 million, excluding decommissioning Decommissioning accruals increase approximately $20 million Interest expense increases $10 – $15 million AFUDC equity increases $5 – $10 million Continue to recognize COLI tax deduction Effective tax rate of 24 – 26% Average common shares are 430 million based on “if converted” method

- 38. 2007 Key Earnings Guidance Assumptions Approval of Minnesota electric rate case decision Approval of Colorado electric rate case settlement Reasonable rate recovery is approved — Texas electric rate request — Potential Minnesota gas rate request — Potential Colorado gas rate request No material incremental accruals in SPS regulatory proceedings Normal weather patterns Weather adjusted sales growth: — Retail electric 1.7 – 2.2% — Retail gas decline 1 – 2%

- 39. 2007 Key Earnings Guidance Assumptions (continued) Short-term wholesale and commodity trading margins of $15 – $25 million Capacity costs at NSPM and SPS increase $35 million Operating and maintenance expenses increase 2 – 3% Depreciation increases $45 – $55 million Interest expense increases $35 to $40 million AFUDC equity increases $17 – $23 million Continue to recognize COLI tax deduction Effective tax rate of 28 – 31% Average common shares are 433 million based on “if converted” method