6.4 Trading Arrangements: 6.4.1 The Pool

6.4 Trading Arrangements: 6.4.1 The Pool

Uploaded by

James Ernes Llacza CarmeloCopyright:

Available Formats

6.4 Trading Arrangements: 6.4.1 The Pool

6.4 Trading Arrangements: 6.4.1 The Pool

Uploaded by

James Ernes Llacza CarmeloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

6.4 Trading Arrangements: 6.4.1 The Pool

6.4 Trading Arrangements: 6.4.1 The Pool

Uploaded by

James Ernes Llacza CarmeloCopyright:

Available Formats

rfd"|D.

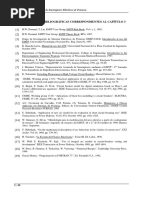

Figure 6.5 The Caiifonua ISO snd power market

6.4

Trading Arrangements

It is possible to conceptualise and model (he new trading structures itito a few altemative categories as discussed below.

6.4.1

The Pool

In the pool model sbown in Figure 6.6, competition is initiated in Ihe generation business by creating more than one Cenco and is gradualiy broughi to the distribution side whcre relailers could be separated from Discos and where consumers could be aowed ta phase in a choice of retail supply. The Iransmission syatcm is centrally controlled by a combinatiou o f an indcpendent syslein operalor and a power exchange (ISO+PX) which is disassociatcd from ali market participanls and ensures open access. The ISO+PX oprales the electricity pool to fKrform a price-based dspatch and provides a forum for sctting the system pnces and bandling electricity trades. Hedging contracts become a niajor optlon and are popular in the E&W system under the ame 'Contracts for DifTerencc'. The restructuring modeis in Chile, Argentina and East Australia aiso fail inte this category with some modifications to the basic structure of Figure 6.6.

sales y Energy 6.6 in the Figure Trading power pool

Energy flow

-4......Coordination

6.4.2

Pool and Bilateral Trades

The most likely arrangement, which will emerge in pmctical systems in the fiiture, is that a pool will cxist smultaneously with bilateral and multilateral transactions. The significant difference behveen this model and the pool model is that the transmission sector is anbundied into a 'market' sector and a 'security' sector (sce Figure 6,7). In the maitet sector, there are mltiple seprate energy maricets, conlainiag a pool market taken care of by the PX and bilateral contracts estabshed by the SCs. The ISO is responsible for system operatioii and giiarantics system security and in operatioaal raatters hoids a superior position over the PX and SCs. The existencc of a power pooi ig no mandatory in this model but will invariably be the case. Market participants may not oniy bid into the pool but also raake bilateral contracts with each other. TTiercfore, this model piX)vi(ies more flexible options for transmission access. The California model is a representative of this category. The Nordic modei and the New Zealand model also fall into this category with some modifications. Olher modeis such as the New York power pool (NYPP) and the PJM model fall somewhere in between thesn three categories. The power system in the new environment could be further disaggregated and reference [9] has proposod a fully disaggregated competitive electriciy market. The model envisages what it calis 'eo-ordinflted multilateral trading' and completely dispenses with the PX in favour ofa multitude of individual market-driven transactions.

Gencos

Energy sales

Energy low

Coordination

Figure 6.7 Ttwling with pcxii and bilateral contracts

.'f.S

Muliilateral Trades

Muililateial trades are a generalsation of baleral transactions where an SC or power broker pu!s together a group of energy producers and buyers to form a balanced transaction. In practice, raultiiatcra! and bilateral transactions wl coexisi with a power pool. Conceptually the extreme case is where the concepts of pool and the PX disappear into this mult-marfcet stmcture as illustrated in Figure 6.8. Each market is mauaged by an SC or a broker under its individual rules. Differences in the rules of the different markets could give rise to different stratcgies for participajits. In this model, the ISO is a MicroISO whose objectives are restricted to opcration and security, The contracts in lse energy markels will be respecled by the ISO without discrimination. Oniy when system security is threatened wil! the ISO intafere in managing contracted dispatches, Changes in the electricity supply business bring opportunities for new participants. Many of the new entrants will be intermediarie; e,g. SCs are aggregators for better deals. Marketers, who buy and Ihen resell electricity supply contracts, and brokers who arrange transactions between buyers and sellers, wUf enter the markets, These intermediaries will have a constructive role in promoting competition but there is also the danger of pricc volatility and market instability and many concems have been voiced. Furthermore, some companies may play more than one role in this scenario. For instance, a Cenco could also be a broker or a marketer and many business acquisitions have aready taken place.

Geneos

SCs

ISO

<

l

TOa

Reiailm

c :>

V

Consumcrs EncrRy flow M........Coordination Enerf(Y sales

Figure 6.8 Stmcture with bilatcral/muUibtora) tradcs only Changos iii thc industry also bring opportunities to manage risk associated with a competitive environment. In order to hedge agaiiist price volatjiily due to market eompetition, fuel availabitity and load fluctuations, financia) instruments, such as Contrais for Differences and other forward market variations, are uaed. Futures contrais, in which the right to take delivery of electricity can be bought or sold, are another tool for trading

186_

Tower System Rcstnictiiring and Deregulation

off price and risk. For ejcampie, futures markets have been set up in the Nord Poo! and the USA. The distinclion between a forward market and a futures market is that thc former rcgulatcs specic transactions atid is a technical and economic nstninient while the latter is a purely financial instrument tradablc in a futures exchange.

6.5

6.5.1

Transmissioti Pricing in Open-access Systems

Introduclion

A key feature of the open Iransmission system in an unbundicd cnviroruncnt is the need to eharge all custoraers on a non-discrimioatory basis for transmission services. Derivation of chargcs for the dierent kinds of transmission services should be simple and transparent and the signis ibese charges provide should be stable, 'Correct' pricing of transmission services is useful in providing economic signis for cfTicient short-run operations, recovery of costs, long-term capital investments md fair allocation of costs among participants. There are five lypes of costs associated with transmission services; operatitig costs, capital or embedded costs, opportunity coste, reliability costs and system expansin costs. These are described briefly below. Operating costs inciude transmission losses, costs incurred by generation redispaich due to operating constraints such as transmission and bus voltage limits, co.sts incurred in the previsin of ancillary services and management and maintenance expenses, Recovery ofcapital conta ofthe transm.ssion system ovcr the lifetime of the facilities ta likely to be larger than the operating coats of the grid system. Individual transmission facilitics are variably loaded as system conditions change with time, and the extent to which any particular supplier-to-consumer transmission transaction utilises atiy particular circuit is dilTicult lo discem.

Opportunity costs aie the benefits that the grid company forgoes as a consequence of operating constraints that arisc owing to a specifc tramaction, Each transmission transaction may change the service reliability leve! and this afects expccted oulage cost and henee results in reliabilly costs. Reliability costs are very difficult to assess because they are related to many factors such as the tiraing, the duration, the extent of the service outage, the backup power avaable to the customer and custoraer location. These costs have bcen ignorad in the past in designing transmission service rates. fyi-iem expansin costs include investment to accommodate new users and the extreniely important issue of long-temi transmission expansin in cteveloping countries. Transmission pridng is onc of the most coraplicated issues in restnicturing electricity supply becaiise of the physical laws that govem power flow in the transmission network, and the need to balance supply and demand at all times. Since generators and customers are a connected to the same network, actions by one paiticipant can have signicant consequences on others making it dificult to investgate the cost each particpant is responsible for. In addition to operating costs, enibedded costs and financng of future expansin should be reflected in the tariff structure. Since embedded costs in the transnnission system are very large compared with operating expenses, il is especially important to dcsign a reasonable pricing structure for its reeoveiy xim all participants on a reasonable basis. As to expansin, it is largcly driven by pocy objectives. Therc are thiee main pricing paradigms; rolled-in meiods, incremcntal raethods and composite embeddcd/incremental (marginal) methods [10]. A brief introduction is provided belo>' followed by a concise descrption of the transmission pricing mcthod used in the NGC, UK.

6.5.2

Rolled-in Pricing Methods

The simple.it method of charging for transmission services is the so-cal!ed postage stamp method, whch dcpends oniy on the amount of power moved and the duration of use, irrespective of supply and devery points, distance of transmission usagc or the distribution of ioading imposed on different transmission circuits by a specifc transaction. The main disadvantage of this method is the igncH'ance of the impact of any particular transaction on actual system operalions. As a result, it is likely o send incorrect economic signis to uscrs. A particpant who uses the liansmisaion sj'stem ightly, i.e. at a short electrical distance, actually subsidises others who use the system heavily. Obviously, this method is not equitable among users. TTie MW-Miie method is an attempt to compnsate for these shortcomings. The basic concept is that the loading of each transmission ne due to each transaction is to be obtained separateiy; this is multiped by the line length and then suntmed over all linas in the grid to obtain a measure of how much each transaction uses the grid. Different transactons are then charged in ptoportion to their utilisation of the grid, Negieeting the charge temporal considerations this may be expressed mathematically by setting levied on traijsaction T where

(6.1)

and Pj.j is the loading of linej due to transaction T Fj is the revenue required from this has to be computed using a saisitivity method or some linearised approach. TTie MW-Mile method is a more equitable approach for transmission pricing bnt contines to suer from the defects of iumping operating and embedded costs together and from a failure to distinguish between the relative importance of different Unes for the secute operation of the system as a whole and to the rehability of each transmission transactioc. lic.

6.5.3

ncremental (Marginal) Pricing Method.<!

Nodal Frcng Tbe most complicatcd but accuratc pricing method is nodal pricing derived from marginal cost theory. Nodal pricing can be short-run marginal (Incremental) cost based or long-nin marginal Oncremental) cost based, depending on whether the recovery of operaling costs, capital cots t expansin costs is desircd. Short-nm tnarginal pricing is discussed next, similar proccdure can be applied (o the othcr cases.

188 Power Systein Rcstnicturing and Ueregulalion

This method determines prices for power at each bus of the system accounting for all costs and transmisston constraints. The nodal prices are typically calculated as dual variables or Lagrange multipliers of an optimal power flow (OPF) calculation [11], Marginal transmission pnces, or tnarginal wheeling rates as they are sometimes called, are derived directly from nodal prices. If MP/ and MP, are the marginal nodal prices of electricily at buses i andj, the tnarginal transmission pnce is MP,- MPj and is a measure of what it costs the grid to accept an additional unit of power at i and to dcliver it atj. Short-nm nodal pnces change dynamically as a finction of load distributions, system siructure and generation output patterns. Therefore, they must be recomputed on a periodic basis. This pricing scheme rcflects only operating costs, so that capital recovery and managemetit cos must be added. A major advantage of this method is that the right operational pricing signis are revealed. The major disadvantage is Ihe necd for a separate revenue reconciliation exercise. This pricing scheme has thrce irther disadvantages. The first is the intense real-time computational effbrt rcqutrcd. The second Is the Incentive problcm; Ihis method produces a perverse incentive for the moDopoly transmission owner to cause, or not to relieve, constraints. Another disadvantage is the dramatic volatility of the pnce. Up to now, there is no fiilly operative example of nodal piieing in the industry. The nodal pricing method can be applied to the pricing of real as well as reactive power [12], The pricing of real power can be canied out, approximateiy, solely by using a DC load flow model. Howe\'er, the pricing of reactive power has to be done using an AC load flow model simultaneously with real power pricing and also incorporating operating constraints, especially thosc concerning reactive power (such as reactive power balances at all buses and bus voltage limits). Zonal Pricing Notwithstanding its compelling theoretlcal basis the nodal pricing method has been decmed to be too complicated for applications, at least in the foreseeable fiiture. The zonal pricing scheme has becn proposed and uscd as an altemative. This pricing method represents a combination of the postage stamp method and the nodal pricing method and attempts to simplify the pricing process and at the same time to reflect the varylng costs of snpplying power to dilereni areas. Like the nodal pricing method the zonal pricing method can be short-nm marginal (Incremental) cost based or long-run marginal (incremental) cost based, depending on the objective as mcntioned before. Generally, the nodal pricing method is first utilised to obtain the prices in all buses, and thcn a weighcd avcrage valu of all nodal prices within a zone is set as the zonal price. This is done periodically to account for the change of system conditions. The nodal prices at all bases in a zone should be rcasonably cise to each other for the method to be meaningful. Otlierwise zonal boundaries should be adjusted. The Norwegian electricity markct uses this approach with four or five zones. A long-run marginal-cost-based zonal pricing method is employed in the NGC, UK, for rucovety of capital costs [13,14], Another important pmpose of zonal pricing is congestin management. Congestin occurs when tlie dispatch of all pool and contracted transactions in ill would result in the violation of operational constraints. For example, in California, there are 24 adjustable price zones. Under normal circumsUinces without congestin, all zones have the same

You might also like

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesFrom EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesNo ratings yet

- 11.EEE Transmission .FullDocument10 pages11.EEE Transmission .FullTJPRC PublicationsNo ratings yet

- Wiley The Journal of Industrial Economics: This Content Downloaded From 182.255.4.243 On Mon, 01 Apr 2019 08:16:03 UTCDocument33 pagesWiley The Journal of Industrial Economics: This Content Downloaded From 182.255.4.243 On Mon, 01 Apr 2019 08:16:03 UTCNur ElitamiNo ratings yet

- Charging Schemes For Multiservice Networks: FrankDocument8 pagesCharging Schemes For Multiservice Networks: FrankjomasoolNo ratings yet

- PSRD PDFDocument19 pagesPSRD PDFTushar ChoudharyNo ratings yet

- Joskow Tirole 2005Document32 pagesJoskow Tirole 2005LouisYuanNo ratings yet

- Computation and Decomposition of Spot Prices For Transmission PricingDocument10 pagesComputation and Decomposition of Spot Prices For Transmission PricingSajjad AbediNo ratings yet

- Transmission Pricing For Power Trading in Restructured Power System PDFDocument4 pagesTransmission Pricing For Power Trading in Restructured Power System PDFAkshay Sharma100% (1)

- Congestion Management in Restructed Electricity MarketDocument23 pagesCongestion Management in Restructed Electricity MarketShaliniNo ratings yet

- Unit 7Document34 pagesUnit 7bha45tNo ratings yet

- Energies 12 03126Document20 pagesEnergies 12 03126ArmanNo ratings yet

- Pricing of Transmission Network Usage and Loss AllocationDocument40 pagesPricing of Transmission Network Usage and Loss AllocationSSSRGI TURNITINNo ratings yet

- A Multiyear Dynamic Approach For Transmission Expansion Planning and Long-Term Marginal Costs ComputationDocument9 pagesA Multiyear Dynamic Approach For Transmission Expansion Planning and Long-Term Marginal Costs Computationjoonie5No ratings yet

- Market Architecture: Robert WilsonDocument22 pagesMarket Architecture: Robert WilsonSiddharth VenkatNo ratings yet

- 5.2 Transmission Network in Electricity MarketDocument2 pages5.2 Transmission Network in Electricity MarketDheeraj KumarNo ratings yet

- New Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketsDocument8 pagesNew Market Power Driven Multistage Trans-Mission Expansion Strategy in Power MarketssunitharajababuNo ratings yet

- Book Review: Restructured Electric Power Systems: Operation, Trading, and VolatilityDocument3 pagesBook Review: Restructured Electric Power Systems: Operation, Trading, and VolatilityDevi ChaitanyaNo ratings yet

- Evaluating Flexibility Values For Congestion Management in DistributionDocument5 pagesEvaluating Flexibility Values For Congestion Management in DistributioncribinternosNo ratings yet

- CCPS: A User'S PerspectiveDocument6 pagesCCPS: A User'S PerspectiveMuralidharNo ratings yet

- Computing Market EquilibriumDocument8 pagesComputing Market EquilibriumLTE002No ratings yet

- A Knowledge Management Platform For Supporting Smart Grids Based On Peer To Peer and Service Oriented Architecture TechnologiesDocument6 pagesA Knowledge Management Platform For Supporting Smart Grids Based On Peer To Peer and Service Oriented Architecture TechnologiesfkazasisNo ratings yet

- Privacy-Preserving Billing For Local Energy MarketsDocument31 pagesPrivacy-Preserving Billing For Local Energy MarketsBimmo BadukiNo ratings yet

- Final Determination-AEMC- December 19 2024Document140 pagesFinal Determination-AEMC- December 19 2024Boxer BoxerNo ratings yet

- Price Capping For Power Purchase in Electricity Markets: Nu0 Xu'Document5 pagesPrice Capping For Power Purchase in Electricity Markets: Nu0 Xu'api-3697505No ratings yet

- Barocheetal 2019Document11 pagesBarocheetal 2019rathorsumit2006No ratings yet

- Forecasting Electricity MarketsDocument9 pagesForecasting Electricity MarketsThiyagarjanNo ratings yet

- A New Framework For Capacity Market in Restructured Power SystemsDocument17 pagesA New Framework For Capacity Market in Restructured Power SystemsAnnaRajNo ratings yet

- Axioms 12 00614Document24 pagesAxioms 12 00614KURAKULA VIMAL KUMARNo ratings yet

- Wheeling ChargeDocument6 pagesWheeling Chargegopal sapkotaNo ratings yet

- Optimization of Ancillary Services For System SecurityDocument8 pagesOptimization of Ancillary Services For System Securityjjm_8679641No ratings yet

- Modelling of Power Generation Investment Incentives Under Uncertainty in Liberalised Electricity MarketsDocument28 pagesModelling of Power Generation Investment Incentives Under Uncertainty in Liberalised Electricity MarketsLevan PavlenishviliNo ratings yet

- IEGC 2010 - VijayDocument132 pagesIEGC 2010 - Vijayvijay2407No ratings yet

- Electricity Act 2003 - Opportunities For Investment & GrowthDocument24 pagesElectricity Act 2003 - Opportunities For Investment & GrowthPratap KumarNo ratings yet

- Electrical Power and Energy Systems: Anusha Pillay, S. Prabhakar Karthikeyan, D.P. KothariDocument8 pagesElectrical Power and Energy Systems: Anusha Pillay, S. Prabhakar Karthikeyan, D.P. KothariHAMZA KHANNo ratings yet

- IET Gerardo Daniel Third Draft PDFDocument25 pagesIET Gerardo Daniel Third Draft PDFabviaudNo ratings yet

- Costs of Electric Service, Allocation Methods, and Residential Rate TrendsDocument62 pagesCosts of Electric Service, Allocation Methods, and Residential Rate TrendsCesar Andrés Prada VegaNo ratings yet

- Restructured Power SystemsDocument30 pagesRestructured Power SystemsDhivya BNo ratings yet

- Locational Marginal Pricing A Fundamental ReconsiderationDocument12 pagesLocational Marginal Pricing A Fundamental Reconsiderationjack.hadrian15No ratings yet

- Ofgem Fi Flexibility Platforms in Electricity MarketsDocument31 pagesOfgem Fi Flexibility Platforms in Electricity MarketschopinaNo ratings yet

- SMB/5190/R: Strategic Business Plan (SBP)Document7 pagesSMB/5190/R: Strategic Business Plan (SBP)Hernando RomeroNo ratings yet

- Batteries-10-00228 Mdpi 2024Document24 pagesBatteries-10-00228 Mdpi 2024jamel-shamsNo ratings yet

- Paper 0370Document10 pagesPaper 0370Chetan KotwalNo ratings yet

- DownloadDocument12 pagesDownloadDr Vijay PandeNo ratings yet

- Marginal Transmission Pricingng ParadigmDocument16 pagesMarginal Transmission Pricingng ParadigmECE 21 MOHANA GURU VNo ratings yet

- 2024 Promises and Challenges of Grid Forming Transmission System Operator Manufacture and Academic View PointsDocument35 pages2024 Promises and Challenges of Grid Forming Transmission System Operator Manufacture and Academic View PointsJorge Luis Vega HerreraNo ratings yet

- A Consortium Blockchain-Enabled Double Auction Mechanism For Peer-to-Peer Energy Trading Among ProsumersDocument16 pagesA Consortium Blockchain-Enabled Double Auction Mechanism For Peer-to-Peer Energy Trading Among ProsumersPooja HarishchandreNo ratings yet

- Congestion Management in Deregulated Power System: A ReviewDocument7 pagesCongestion Management in Deregulated Power System: A ReviewGJESRNo ratings yet

- Customer Characterization Options For Improving The Tariff OfferDocument7 pagesCustomer Characterization Options For Improving The Tariff OfferJuan CarlosNo ratings yet

- Power System II EE 602 - Unit VDocument15 pagesPower System II EE 602 - Unit VBabbu DograNo ratings yet

- Transmission and Wheeling Service Pricing: Trends in Deregulated Electricity MarketDocument16 pagesTransmission and Wheeling Service Pricing: Trends in Deregulated Electricity MarketJeya PriyaNo ratings yet

- Article 6 Narayan15Oct2013Document8 pagesArticle 6 Narayan15Oct2013Mohammed FaizanNo ratings yet

- The Future of Electricity Rate Design - McKinseyDocument10 pagesThe Future of Electricity Rate Design - McKinseyNuno MonteiroNo ratings yet

- Catalogo Caccia Nr.14 2019Document10 pagesCatalogo Caccia Nr.14 2019Nuno MonteiroNo ratings yet

- Trading Electricity and Ancillary Services in The Reformed England and Wales Electricity MarketDocument4 pagesTrading Electricity and Ancillary Services in The Reformed England and Wales Electricity Marketapi-3697505No ratings yet

- Transmission Expansion Cost Allocation Based On EcDocument7 pagesTransmission Expansion Cost Allocation Based On Ecmuhammad iqbalNo ratings yet

- total M4 and M5Document20 pagestotal M4 and M5Nk KumarNo ratings yet

- Energies 11 00822Document19 pagesEnergies 11 00822anu_2013No ratings yet

- PSOC JNTUA 5th Chapter Prepared by Saikrishna DasariDocument29 pagesPSOC JNTUA 5th Chapter Prepared by Saikrishna Dasarisai krishnaNo ratings yet

- Co-Simulation Platform For The Assessment of Transactive Energy Systems - ScienceDirectDocument8 pagesCo-Simulation Platform For The Assessment of Transactive Energy Systems - ScienceDirectYoussef romadiNo ratings yet

- Regulation of Tariffs and Interconnection: Case Studies: Sidharth SinhaDocument20 pagesRegulation of Tariffs and Interconnection: Case Studies: Sidharth Sinhabpsc08No ratings yet

- 3.8.-Referencias Bibliográficas Correspondientes Al Capítulo 3Document16 pages3.8.-Referencias Bibliográficas Correspondientes Al Capítulo 3James Ernes Llacza CarmeloNo ratings yet

- Texcan Teck 5KV UnshieldedDocument2 pagesTexcan Teck 5KV UnshieldedJames Ernes Llacza CarmeloNo ratings yet

- FP - Sin G - A4027Document1 pageFP - Sin G - A4027James Ernes Llacza CarmeloNo ratings yet

- Sin G - A4030Document1 pageSin G - A4030James Ernes Llacza CarmeloNo ratings yet

- Texcan Teck 1KVDocument4 pagesTexcan Teck 1KVJames Ernes Llacza CarmeloNo ratings yet

- Cables AetnaDocument1 pageCables AetnaJames Ernes Llacza CarmeloNo ratings yet

- Catálogo AlumosteelDocument5 pagesCatálogo AlumosteelJames Ernes Llacza CarmeloNo ratings yet

- ABI High Voltage Engineering and Testing 3rd EditionDocument1 pageABI High Voltage Engineering and Testing 3rd EditionJames Ernes Llacza CarmeloNo ratings yet

- Shunt Reactor Switching Transients at High Compensation LevelsDocument14 pagesShunt Reactor Switching Transients at High Compensation LevelsJames Ernes Llacza Carmelo100% (1)

- SEL Power Your Future ScholarshipDocument2 pagesSEL Power Your Future ScholarshipJames Ernes Llacza CarmeloNo ratings yet

- Submission Procedure For "CIGRE Science & Engineering"Document4 pagesSubmission Procedure For "CIGRE Science & Engineering"James Ernes Llacza CarmeloNo ratings yet

- Dissolved Gas Analysis: Huntingdon Valley PA 19006 2100 Byberry RoadDocument2 pagesDissolved Gas Analysis: Huntingdon Valley PA 19006 2100 Byberry RoadJames Ernes Llacza CarmeloNo ratings yet