Balance Sheet Rs

Balance Sheet Rs

Uploaded by

Binesh BashirCopyright:

Available Formats

Balance Sheet Rs

Balance Sheet Rs

Uploaded by

Binesh BashirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Balance Sheet Rs

Balance Sheet Rs

Uploaded by

Binesh BashirCopyright:

Available Formats

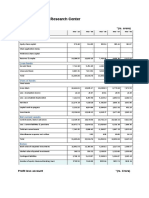

Balance sheet Rs.

cr

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Sources of funds

Owner's fund

Equity share capital 570.60 514.05 385.54 385.41 382.87

Share application money - - - - -

Preference share capital - - - - -

Reserves & surplus 14,208.55 11,855.15 7,428.45 6,458.39 5,127.81

Loan funds

Secured loans 7,742.60 5,251.65 2,461.99 2,022.04 822.76

Unsecured loans 8,883.31 7,913.91 3,818.53 1,987.10 2,114.08

Total 31,405.06 25,534.76 14,094.51 10,852.94 8,447.52

Uses of funds

Fixed assets

Gross block 18,416.81 13,905.17 10,830.83 8,775.80 7,971.55

Less : revaluation reserve 24.63 25.07 25.51 25.95 26.39

Less : accumulated depreciation 7,212.92 6,259.90 5,443.52 4,894.54 4,401.51

Net block 11,179.26 7,620.20 5,361.80 3,855.31 3,543.65

Capital work-in-progress 5,232.15 6,954.04 5,064.96 2,513.32 951.19

Investments 22,336.90 12,968.13 4,910.27 2,477.00 2,015.15

Net current assets

Current assets, loans & advances 12,329.48 10,836.58 10,781.23 10,318.42 9,812.06

Less : current liabilities & provisions 19,672.73 12,846.21 12,029.80 8,321.20 7,888.65

Total net current assets -7,343.25 -2,009.63 -1,248.57 1,997.22 1,923.41

Miscellaneous expenses not written - 2.02 6.05 10.09 14.12

Total 31,405.06 25,534.76 14,094.51 10,852.94 8,447.52

Notes:

Book value of unquoted investments 21,991.93 12,358.84 4,145.82 2,117.86 1,648.57

Market value of quoted investments 345.53 558.32 2,530.55 1,323.08 1,550.00

Contingent liabilities 3,708.33 5,433.07 5,590.83 5,196.07 2,185.63

Number of equity sharesoutstanding (Lacs) 5705.58 5140.08 3855.04 3853.74 3828.34

Profit loss account Rs. cr

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Income

Operating income 35,373.29 25,660.67 28,767.91 26,664.25 20,088.63

Expenses

Material consumed 24,759.49 19,039.41 20,931.81 19,529.88 14,376.11

Manufacturing expenses 1,652.22 1,171.59 1,230.14 1,200.36 929.82

Personnel expenses 1,836.13 1,551.39 1,544.57 1,367.83 1,143.13

Selling expenses 1,583.24 1,224.15 1,179.48 1,068.56 759.54

Adminstrative expenses 2,249.92 1,867.05 1,982.79 1,488.16 1,042.52

Expenses capitalised -740.54 -916.02 -1,131.40 -577.05 -308.85

Cost of sales 31,340.46 23,937.57 25,737.39 24,077.74 17,942.27

Operating profit 4,032.83 1,723.10 3,030.52 2,586.51 2,146.36

Other recurring income 402.27 841.54 359.42 887.23 685.18

Adjusted PBDIT 4,435.10 2,564.64 3,389.94 3,473.74 2,831.54

Financial expenses 1,246.25 704.92 471.56 455.75 350.24

Depreciation 1,033.87 874.54 652.31 586.29 520.94

Other write offs 144.03 51.17 64.35 85.02 73.78

Adjusted PBT 2,010.95 934.01 2,201.72 2,346.68 1,886.58

Tax charges 589.46 12.50 547.55 660.37 524.93

Adjusted PAT 1,421.49 921.51 1,654.17 1,686.31 1,361.65

Non recurring items 818.59 79.75 374.75 227.15 167.23

Other non cash adjustments - 15.29 - -0.07 -

Reported net profit 2,240.08 1,016.55 2,028.92 1,913.39 1,528.88

Earnigs before appropriation 3,926.07 2,399.62 3,042.75 2,690.15 2,094.54

Equity dividend 859.05 311.61 578.43 578.07 497.94

Preference dividend - - - - -

Dividend tax 132.89 34.09 81.25 98.25 69.84

Retained earnings 2,934.13 2,053.92 2,383.07 2,013.83 1,526.76

Tata Motors Ltd. - Research Center

500570 TATAMOTORS Group (A) BSE dataView Tips Add to : Portfolio | Watchlist | Game

Back to Company Page

Quarterly

Half yearly

Results

Annual

Balance sheet

P&L

Statement

Cash flow

Dividend

Bonus

Share holding

More

Capital structures

Ratio

(Rs crore)

Ratios

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Per share ratios

Adjusted EPS (Rs) 24.91 17.93 42.91 43.76 35.57

Adjusted cash EPS (Rs) 45.56 35.94 61.50 61.18 51.10

Reported EPS (Rs) 39.26 19.48 52.63 49.65 39.94

Reported cash EPS (Rs) 59.91 37.49 71.22 67.07 55.47

Dividend per share 15.00 6.00 15.00 15.00 13.00

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Operating profit per share (Rs) 70.68 33.52 78.61 67.12 56.06

Book value (excl rev res) per share (Rs) 259.03 240.60 202.54 177.33 143.58

Book value (incl rev res) per share (Rs.) 259.46 241.09 203.20 178.00 144.26

Net operating income per share (Rs) 619.98 499.23 746.24 691.91 524.73

Free reserves per share (Rs) 229.67 217.77 182.38 157.16 123.34

Profitability ratios

Operating margin (%) 11.40 6.71 10.53 9.70 10.68

Gross profit margin (%) 8.47 3.30 8.26 7.50 8.09

Net profit margin (%) 6.26 3.77 6.96 6.94 7.35

Adjusted cash margin (%) 7.26 6.97 8.13 8.55 9.41

Adjusted return on net worth (%) 9.61 7.45 21.18 24.67 24.77

Reported return on net worth (%) 15.15 8.09 25.98 28.00 27.81

Return on long term funds (%) 12.26 8.89 22.85 31.18 28.65

Leverage ratios

Long term debt / Equity 0.79 0.49 0.49 0.31 0.41

Total debt/equity 1.12 1.06 0.80 0.58 0.53

Owners fund as % of total source 47.05 48.44 55.43 63.05 65.23

Fixed assets turnover ratio 1.95 1.88 2.69 3.08 2.55

Liquidity ratios

Current ratio 0.62 0.84 0.89 1.24 1.24

Current ratio (inc. st loans) 0.44 0.43 0.64 0.85 1.07

Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06

Quick ratio 0.43 0.58 0.66 0.91 0.96

Inventory turnover ratio 13.50 13.47 14.44 13.26 12.63

Payout ratios

Dividend payout ratio (net profit) 44.28 34.52 32.51 35.34 37.13

Dividend payout ratio (cash profit) 29.02 17.94 24.02 26.16 26.73

Earning retention ratio 30.22 62.49 60.13 59.90 58.31

Cash earnings retention ratio 61.84 81.29 72.18 71.32 70.98

Coverage ratios

Adjusted cash flow time total debt 6.40 7.13 2.65 1.70 1.50

Financial charges coverage ratio 3.56 3.64 7.19 7.62 8.08

Fin. charges cov.ratio (post tax) 3.74 3.73 6.82 6.67 7.06

Component ratios

Material cost component (% earnings) 71.70 73.26 72.62 74.55 72.84

Selling cost Component 4.47 4.77 4.09 4.00 3.78

Exports as percent of total sales 8.61 9.49 9.88 10.18 11.87

Import comp. in raw mat. consumed 5.94 5.82 4.60 3.88 4.64

Long term assets / total Assets 0.75 0.71 0.58 0.45 0.39

Bonus component in equity capital (%) 19.50 21.64 28.86 28.87 29.

You might also like

- Balance Sheet: Sources of FundsDocument9 pagesBalance Sheet: Sources of FundsHrishit RakshitNo ratings yet

- LIC Housing Finance Ltd. - Research Center: Balance SheetDocument3 pagesLIC Housing Finance Ltd. - Research Center: Balance Sheetpriyankaanu2345No ratings yet

- Syndicate BankDocument5 pagesSyndicate BankpratikNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of FundsAbhisek SarkarNo ratings yet

- Balance Sheet Rs. in CroresDocument5 pagesBalance Sheet Rs. in CrorespratscNo ratings yet

- Tata Motors LTDDocument3 pagesTata Motors LTDRajesh BokadeNo ratings yet

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNo ratings yet

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata MotorsVivek SinghNo ratings yet

- Icici Bank LTDDocument3 pagesIcici Bank LTDSrinjoy SealNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDKrishna NimmakuriNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- 1 - Abhinav - Raymond Ltd.Document5 pages1 - Abhinav - Raymond Ltd.rajat_singlaNo ratings yet

- Apollo TyresDocument4 pagesApollo TyresGokulKumarNo ratings yet

- Top Companies in Oil and Natural Gas SectorDocument24 pagesTop Companies in Oil and Natural Gas SectorSravanKumar IyerNo ratings yet

- Wipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundDocument4 pagesWipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundManikantha PatnaikNo ratings yet

- Balance Sheet: Sources of FundsDocument14 pagesBalance Sheet: Sources of FundsJayesh RodeNo ratings yet

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Document3 pagesAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsNo ratings yet

- Capital Structure of Tata SteelDocument9 pagesCapital Structure of Tata SteelRaj KishorNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- ProyeksiDocument1 pageProyeksiIrwan SukmaNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of Fundssumit_pNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- JSW Steel SummaryDocument2 pagesJSW Steel Summaryprasad271299No ratings yet

- Balance Sheet: Sources of FundsDocument5 pagesBalance Sheet: Sources of FundsTarun VijaykarNo ratings yet

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BDocument7 pagesBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniNo ratings yet

- Abbott Laboratories (Pakistan) Limited-1Document9 pagesAbbott Laboratories (Pakistan) Limited-1Shahrukh1994007No ratings yet

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaNo ratings yet

- Financial Statement of Bharti Airtel LTD.: Balance SheetDocument3 pagesFinancial Statement of Bharti Airtel LTD.: Balance SheetGaurav KalraNo ratings yet

- Idbi Financial In4mationDocument9 pagesIdbi Financial In4mationKishor PatelNo ratings yet

- Reliance DataDocument10 pagesReliance DataTamseel FatimaNo ratings yet

- Project 3 - Ratio AnalysisDocument2 pagesProject 3 - Ratio AnalysisATANU GANGULYNo ratings yet

- Financials WorksheetDocument38 pagesFinancials WorksheetVishnu VardhanNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Maruti Suzuki India LTD 03Document5 pagesMaruti Suzuki India LTD 03sidhantbehl17No ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Balance Sheet of State Bank of IndiaDocument5 pagesBalance Sheet of State Bank of Indiakanishtha1No ratings yet

- 21 - Rajat Singla - Reliance Industries Ltd.Document51 pages21 - Rajat Singla - Reliance Industries Ltd.rajat_singlaNo ratings yet

- Progress at A Glance For Last 10 YearsDocument1 pageProgress at A Glance For Last 10 YearsAbhishek KumarNo ratings yet

- Ratio AnalysisDocument10 pagesRatio Analysisbikash_kediaNo ratings yet

- Asian PaintsDocument2 pagesAsian Paints3989poojaNo ratings yet

- IciciDocument9 pagesIciciChirdeep PareekNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurNo ratings yet

- Financial Modelling CIA 2Document45 pagesFinancial Modelling CIA 2Saloni Jain 1820343No ratings yet

- Balance Sheet of TCSDocument8 pagesBalance Sheet of TCSAmit LalchandaniNo ratings yet

- Balance Sheet of TCSDocument8 pagesBalance Sheet of TCSSurbhi LodhaNo ratings yet

- Integrated-Report (1) - 345-348Document4 pagesIntegrated-Report (1) - 345-348Sourav AgarwalNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNo ratings yet

- Lupin LTDDocument2 pagesLupin LTDTarique PathanNo ratings yet

- in Rs. Cr. - Key Financial Ratios of HDFC BankDocument8 pagesin Rs. Cr. - Key Financial Ratios of HDFC BankthodupunooripkNo ratings yet

- Profit and Loss Account of GodrejDocument4 pagesProfit and Loss Account of GodrejDeepak PatelNo ratings yet

- Bob P&LDocument4 pagesBob P&Lindusingh6880No ratings yet

- Balance Sheet: Sources of FundsDocument6 pagesBalance Sheet: Sources of FundsTarun GuptaNo ratings yet

- CV Assignment - Agneesh DuttaDocument14 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaNo ratings yet

- CHAPTER - 4 Data Analysis and InterpretationDocument12 pagesCHAPTER - 4 Data Analysis and InterpretationSarva ShivaNo ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- In Rs. Cr. Sources of Funds 2005 2005 2007 2008 Balance Sheet of Steel Authority of IndiaDocument5 pagesIn Rs. Cr. Sources of Funds 2005 2005 2007 2008 Balance Sheet of Steel Authority of Indiaabhay510No ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- GSM Gateway Smit 1937iDocument2 pagesGSM Gateway Smit 1937iHemant JoshiNo ratings yet

- Colegio Medicofarmaceutico de Filipinas Inc. vs. Lily Lin Et. AlDocument7 pagesColegio Medicofarmaceutico de Filipinas Inc. vs. Lily Lin Et. AlMariaFaithFloresFelisartaNo ratings yet

- Le 27 Sol @legaledgemockDocument16 pagesLe 27 Sol @legaledgemockcsgautam2024No ratings yet

- Jleonen Case Digest Political LawDocument96 pagesJleonen Case Digest Political LawfeeerNo ratings yet

- SQ, Sqe: Grundfos InstructionsDocument17 pagesSQ, Sqe: Grundfos InstructionsGonzalo QuinteroNo ratings yet

- BBPS4103Document12 pagesBBPS4103Ervana Yahya100% (1)

- Curriculum Vitae English ChefDocument8 pagesCurriculum Vitae English Chefafiwgxldd100% (1)

- Aznar V SucillaDocument1 pageAznar V SucillaJulius ManaloNo ratings yet

- RIS-2703-RST Iss 1Document19 pagesRIS-2703-RST Iss 1ΤΣΙΜΠΙΔΗΣ ΠΑΝΑΓΙΩΤΗΣNo ratings yet

- Certificate by Employer: Claim Form "E" Form NO 3787Document2 pagesCertificate by Employer: Claim Form "E" Form NO 3787Deep KhatiNo ratings yet

- ZXMSG 5200 Multiplex ServiceSIPDocument11 pagesZXMSG 5200 Multiplex ServiceSIPsagar323100% (1)

- MergedDocument35 pagesMergedMine SinalNo ratings yet

- Table of ContentsDocument22 pagesTable of ContentsDitiProGamezzzNo ratings yet

- Walther EichrodtDocument3 pagesWalther Eichrodtscott_callaham100% (1)

- Penilaian DireksiDocument6 pagesPenilaian DireksiSafa RamdhaniNo ratings yet

- Aircraft Reliability: Regulatory Authorities Oversight FunctionsDocument12 pagesAircraft Reliability: Regulatory Authorities Oversight FunctionsSaitama FishNo ratings yet

- The Laodicean Messenger - Memoirs of Pastor Russell, 1923Document245 pagesThe Laodicean Messenger - Memoirs of Pastor Russell, 1923sirjsslutNo ratings yet

- Scehdule of Charges - Card - 2019Document2 pagesScehdule of Charges - Card - 2019Salam DhaliNo ratings yet

- What Can Automation Can Tell Us About AgencyDocument22 pagesWhat Can Automation Can Tell Us About AgencyAndre Padilha100% (1)

- Pump Station ChecklistDocument7 pagesPump Station Checklistfrankjams100% (2)

- Ch1. - Paul Goldberger - Why Architecture MattersDocument73 pagesCh1. - Paul Goldberger - Why Architecture Mattersshravani salviNo ratings yet

- Corona Vs CADocument1 pageCorona Vs CAApril Gem BalucanagNo ratings yet

- Characteristics of A NegotiableDocument2 pagesCharacteristics of A NegotiableOmkar ShettyNo ratings yet

- Final Reqs AC51Document8 pagesFinal Reqs AC51Jaylou AguilarNo ratings yet

- Senarai Nama Murid 1 Sinergi 2020: Guru Kelas: Cik Suhada Binti Abd WahidDocument5 pagesSenarai Nama Murid 1 Sinergi 2020: Guru Kelas: Cik Suhada Binti Abd Wahidarif zaiNo ratings yet

- Chapter 1 3Document17 pagesChapter 1 3Hieu Duong Trong100% (3)

- Starnet Iptv ChannelsDocument16 pagesStarnet Iptv ChannelsAlexandruStratila50% (2)

- Kalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaDocument6 pagesKalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaAlokdev MishraNo ratings yet

- Sunsystems - 6.4.x Financials AdministrationDocument400 pagesSunsystems - 6.4.x Financials Administrationeverboqaileh mohNo ratings yet

- FACT SHEET - Scarlet and Gray Advantage Nov2021Document2 pagesFACT SHEET - Scarlet and Gray Advantage Nov2021Matt ThomasNo ratings yet