National Guidelines On Internal Control Systems

National Guidelines On Internal Control Systems

Uploaded by

Dean S. MontalbanCopyright:

Available Formats

National Guidelines On Internal Control Systems

National Guidelines On Internal Control Systems

Uploaded by

Dean S. MontalbanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

National Guidelines On Internal Control Systems

National Guidelines On Internal Control Systems

Uploaded by

Dean S. MontalbanCopyright:

Available Formats

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

CHAPTER ONE

INTRODUCTION

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

1.1 OBJECTIVES OF THE NGICS The National Guidelines on Internal Control Systems (NGICS) is an initiative taken by the national government to affirm its commitment to the citizenry towards accountability, effective operations, prudence in finances, and quality service. It unifies in one document existing Philippine laws, rules and regulations on internal controls to serve as a benchmark towards designing, installing, implementing and monitoring internal controls in the public service. The NGICS contains the fundamental principles, policies and general standards that will guide each government agency in developing its detailed and comprehensive system of internal controls. Agency characteristics such as mandate, functions, nature of activities, operating environment, manpower profile, size and organizational structure will have to be considered in developing or improving the individual controls. A strong and responsive internal control system (ICS) is an essential component of an organizations internal and external processes. It can significantly enhance the integrity of operations and improve organizational outcomes and results to achieve sectoral goals. The benefits of an internal control system include: Stronger accountability; Ethical, economical, efficient and effective operations; Improved ability to address risks to achieve general control objectives; Better systems of responding to the needs of citizens; and Quality outputs and outcomes and effective governance.

In essence, the NGICS aims to update and further broaden public sector understanding of internal control processes to sharpen agency capacity in their development, implementation, monitoring and evaluation. 1.2 LEGAL BASES FOR INTERNAL CONTROL The installation, implementation and strengthening of internal control systems in the Philippine bureaucracy has been mandated under the 1987 Philippine Constitution, existing laws, and administrative rules and regulations. The concepts and principles outlined in various legislative acts and administrative issuances are complemented by best

2

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

practices and guidelines issued by the Commission on Audit (COA) and various international organizations, such as the International Organization for Standardization (ISO) and the International Organization of Supreme Audit Institutions (INTOSAI), of which the Philippines is a member. The primary legal bases for internal controls in the Philippines are: a) Section 123 of Presidential Decree (PD) 1445 dated June 11, 1978, as amended (Ordaining and Instituting a Government Auditing Code of the Philippines), which defines internal control as the plan of organization and all the coordinate methods and measures adopted within an organization or agency to safeguard its assets, check the accuracy and reliability of its accounting data, and encourage adherence to prescribed managerial policies. b) Section 124 of PD 1445, as amended, which states that [i]t shall be the direct responsibility of the agency head to install, implement, and monitor a sound system of internal control. c) Section 2(1), Article IX-D (Commission on Audit) of the 1987 Constitution, which provides that where the internal control system of the audited agencies is inadequate, the Commission may adopt such measures, including temporary or special preaudit, as are necessary and appropriate to correct the deficiencies. d) Section 1, Chapter 1, Subtitle B, Book V of the Administrative Code of 1987, which provides that [a]ll resources of the government shall be managed, expended or utilized in accordance with law and regulations and safeguarded against loss or wastage through illegal or improper disposition to ensure efficiency, economy and effectiveness in the operations of government. The responsibility to take care that such policy is faithfully adhered to rests directly with the chief or head of the government agency concerned. e) Section 1 of Administrative Order No. 119 dated March 29, 1989 (Directing the Strengthening of the Internal Control Systems of Government Offices, Agencies, Governmentowned or Controlled Corporations and Local Government Units in their Fiscal Operations), which states that [t]he responsibility for the fiscal operations of offices and agencies

3

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

of government is hereby declared to reside primarily with the respective Heads of each office, agency, government-owned or controlled corporation and local government unit. For this purpose, each and every office, agency, corporation, and local government unit is mandated to strengthen its internal control system and/or organize systems and procedures to that effect in coordination with the Department of Budget and Management. f) Memorandum Order No. 277 dated January 19, 1990, which directs the Department of Budget and Management to promulgate the necessary rules, regulations or circulars for the strengthening of the internal control systems of government offices, agencies, government-owned or controlled corporations and local government units, in the implementation of AO 119; Provided, That said rules, regulations or circulars shall not be interpreted to diminish the powers and functions of the Commission on Audit as set by the Constitution and by law, including its power to adopt necessary and appropriate measures to correct deficiencies where the internal control system of the audited agencies is inadequate.

g) Article 9, Public Procurement and Management of Public Finances, Chapter II, Preventive Measures, of the United Nations Convention against Corruption (UNCAC), which states that: 2. Each State Party shall, in accordance with the fundamental principles of its legal system, take appropriate measures to promote transparency and accountability in the management of public finances. Such measures shall encompass, inter alia: (a) Procedures for the adoption of the national budget; (b) Timely reporting on revenue and expenditure; (c) A system of accounting and auditing standards and related oversight; (d) Effective and efficient systems of risk management and internal control; and (e) Where appropriate, corrective action in the case of failure to comply with the requirements established in this paragraph.

4

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

1.3 METHODOLOGY FOR THE NGICS FORMULATION A generic set of guidelines on internal control (IC) is necessary. The Department of Budget and Management (DBM), in collaboration with the Office of the President Internal Audit Office, initiated the preparation of the NGICS. The process entailed the organization of a Reference Panel and Resource Agencies to which the draft NGICS was presented for comments in a series of meetings. The DBM chaired the meetings of the Reference Panel and Resource Agencies. The members of the Panel came from the Department of Education (DepEd), Department of Finance (DOF), Department of Health (DOH), Department of the Interior and Local Government (DILG), Department of Public Works and Highways (DPWH), Department of Transportation and Communications (DOTC), National Economic and Development Authority (NEDA), and Development Academy of the Philippines (DAP). The Resource Agencies were the Commission on Audit (COA) and the Presidential Anti-Graft Commission (PAGC). The NGICS will be issued as a general guidance document for all government agencies. It will be piloted in two agencies, the DPWH and the DepEd, where a detailed plan of organization, methods and measures, and systems and processes will be installed to comprise the respective agency internal controls.

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

CHAPTER TWO

CONCEPT OF INTERNAL CONTROL

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

2.1

DEFINITIONS OF INTERNAL CONTROL

Internal control refers to the plan of organization and all the coordinated methods and measures adopted within an organization or agency to safeguard its assets, check the accuracy and reliability of its accounting data, and encourage adherence to prescribed managerial policies (Section 123 of Presidential Decree No. 1445, as amended). This legal definition is supplemented by the policy that [a]ll resources of the government shall be managed, expended or utilized in accordance with law and regulations and safeguarded against loss or wastage through illegal or improper disposition to ensure efficiency, economy and effectiveness in the operations of government. The responsibility to take care that such policy is faithfully adhered to, rests directly with the chief or head of the government agency concerned (Section 1, Chapter 1, Subtitle B, Book V of the Administrative Code of 1987). The definition of internal control is amplified in the COA Government Accounting and Auditing Manual (GAAM) Volume III which states that internal control comprises the plan of organization and all the methods and measures adopted within an agency to ensure that resources are used consistent with laws, regulations and policies; resources are safeguarded against loss, wastage and misuse; financial and non-financial information are reliable, accurate and timely; and operations are economical, efficient and effective (Section 32, Title 2, Volume III of the GAAM). The Philippines internal control standards is complemented by prevailing international best practices such as the Guidelines for Internal Control Standards for the Public Sector issued by the INTOSAI, an international organization of supreme audit institutions from 184 countries (including the Philippines). The INTOSAI Guidelines provide a framework for internal control in the public sector against which internal control can be evaluated. The framework does not limit or interfere with the duly granted authority related to the legislative, rule-making, or other discretionary policy-making powers of an organization. The INTOSAI defines internal control as an integral process that is effected by an entitys management and personnel, and is designed to address risks. It provides reasonable assurance that in pursuit of the entity's mission, the following general objectives are achieved:

7

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

executing orderly, ethical, economical, efficient and effective operations; fulfilling accountability obligations; complying with applicable laws and regulations; safeguarding resources against loss, misuse and damage.

The United States Government Accountability Office (USGAO) also defines internal control as an integral component of an organizations management that provides reasonable assurance that the following objectives are being achieved: 2.2 effectiveness and efficiency of operations, reliability of financial reporting, and compliance with applicable laws and regulations.

CONCEPT OF INTERNAL CONTROL

2.2.1 Internal Control as an Integral Process. Internal control is a series of actions that occur throughout an entitys operations on an ongoing basis. It is best intertwined with an entitys activities and built into its infrastructure as an integral part of the essence of an organization. Internal control is built in rather than built on. By building in internal control, it is embedded with the management processes of planning, organizing, budgeting, staffing, implementing and monitoring. This way, an organization avoids unnecessary procedures and costs by not adding separate controls, but integrating controls instead into the management and operating activities (INTOSAI Guidelines for Internal Control Standards for the Public Sector). Internal controls are not stand alone or separate specialized systems within an agency. They consist of control features interwoven into and made an integral part of each system that management uses to regulate and guide its operations (Section 33, Title 2, GAAM Volume III). This built-in characteristic of internal control minimizes bureaucratic red tape and avoids duplication of functions, thereby creating conditions that promote economy and efficiency in the delivery of government services.

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

2.2.2 Internal Control is Management Control. Management utilizes internal controls to regulate and guide its operations. In this sense, internal controls are management controls. The USGAO Standards for Internal Control in the Federal Government similarly states that internal control which is synonymous with management control, helps government program managers achieve desired results through effective stewardship of public resources. As a management control, internal control requires the participation and involvement of the agency head, officials and personnel at all levels, including the various organizational units therein, in order to obtain reasonable assurance that an agencys mandate and sectoral goals are achieved efficiently, effectively and economically. 2.2.3 Limitations of Internal Control. The design and implementation of internal control is subject to certain limitations and can only provide reasonable not absolute assurance to management. Internal control can be influenced by outside factors that affect an organizations ability to meet its mandates and objectives. Among the limitations of internal control are: 1) human error (i.e., errors in judgment, negligence, misunderstanding, fatigue, distraction, collusion, abuse or override); 2) shifts in government policies or programs; 3) resource constraints; 4) organizational changes; and (5) management attitude. The benefits of internal control must be achieved at reasonable costs. A realistic balance among resource investments, implementation strategies, risks and probable gains should be considered for optimum realization of the internal control objectives. 2.3 ELEMENTS OF INTERNAL CONTROL

The Administrative Code of 1987 serves as a legal reference in defining the two (2) elements of internal control: Plan of Organization, and Coordinated Methods and Measures. As a general law, the Administrative Code incorporates in a single document the major structural, functional and procedural principles and rules of governance of the Philippine government. It embodies the basic administrative structures and procedures designed to serve the people. It covers both the internal administration of government (i.e., internal

9

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

organization, personnel and recruitment, supervision and discipline), and the effects of the functions performed by administrative officials on private individuals or parties outside government. 2.3.1 Plan of Organization. This comprises the organizational structure and the staffing complement that enable an organization to carry out its functions. This plan defines and distributes powers, functions and responsibilities to various units and personnel in an organization to enable the various parts to meet the overall objectives (Section 38(a), Title 2, GAAM Volume III). 2.3.2 Coordinated Methods and Measures. Coordinated methods and measures are the systems of authorization, policies, standards, accounting systems and procedures and reports used by the agency to control its operations and resources and enable the various units to meet its objectives (Section 38(b), Title 2, GAAM Volume III). These include systems and work processes integral to the operations of an agency and consistently applied by all units in the public service. These procedures or activities are implemented in order to achieve the control objectives of safeguarding resources, ensuring the accuracy of data and enabling adherence to laws, policies, rules and regulations. 2.4 OBJECTIVES OF INTERNAL CONTROL

In fulfilling its mandates and mission, an agency must consider and achieve as well the separate but interrelated general objectives of internal control. That public office is a public trust demands that a higher set of general objectives be established, a step beyond the internal control practices that prevail in private sector organizations. Hence, internal control in the public sector must conform to five (5) general objectives: Safeguard assets; Check accuracy and reliability of accounting data; Ensure economical, efficient and effective operations; Comply with laws and regulations; and Adhere to managerial policies.

These objectives are based on Section 123 of PD 1445, as amended, and the policy in the operations of government as provided for

10

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

in Section 1, Chapter 1, Subtitle B, Book V of the Administrative Code of 1987. 2.4.1 Safeguard Assets. Responsible stewardship of public resources requires that all moneys and property officially received by a public officer in any capacity or upon any occasion must be accounted for as government funds and government property. Government property shall be taken up in the books of the agency concerned at acquisition cost or an appraised value. (Sec. 42, Chapter 7, Subtitle B, Book V, Title I, EO 292 or the Administrative Code of 1987). Safeguarding assets in the public sector involves the judicious use of government funds, facilities, including documents, records, and human resource in the delivery of public services. Proper documentation and recording are appropriate controls that eliminate the vulnerability of assets to misuse, loss, destruction and other hazards. Proper procurement and use of the Philippine Government Electronic Procurement System (PHILGEPS) improves the likelihood that quality goods and services are obtained at the least cost and in a timely and transparent manner. Policies and procedures of an agency should also be designed to prevent or detect loss of assets and records on a timely basis. 2.4.2 Check Accuracy and Reliability of Accounting Data. Essential to control and decision making is the generation of correct and credible financial information. This may be achieved through government accounting that will [a]im to produce information concerning past operations and present conditions; provide a basis for guidance for future operations; provide for control of the acts of public bodies and officers in the receipt, disposition and utilization of funds and property; and report on the financial position and results of operations of government agencies for the information of all persons concerned ( Section 41, Chapter 6, Subtitle B, Book V, Title I, EO 292 or the Administrative Code of 1987). 2.4.3 Ensure Economical, Efficient and Effective Operations. Public service requires that agency outputs and outcomes are measured in terms of how these directly affect the quality of public service delivery through economical, efficient and effective operations. Economical. This means being able to perform functions and tasks using the least amount of resources within a specific timeframe. Agencies are enjoined to exercise prudence and restraint in the use of

11

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

their resources by focusing on their core functions and prioritizing their programs, projects and activities to those which would contribute best to the attainment of agency objectives. Adherence to the Procurement Law (Republic Act 9184) will also help in ensuring this. Efficient. This means doing things right given the available resources and within a specified timeframe. This is about delivering a given quantity and quality of outputs with minimum inputs or maximizing outputs with a given quantity and quality of inputs. The principle of prioritization and leveraging of resources has been espoused in government operations. Effective. This means doing the right things. Every agency has legislated mandate and functions. Each operating unit has a responsibility in achieving the agencys mandate and functions. But effective operations means that the operating units are able to deliver their major final outputs and outcomes and are able to contribute to the attainment of the agencys sectoral goals in particular, and of the societal goals in general. The core/major/vital functions of a Department are performed by its operating units (Item III of CSC-DBM Joint Resolution No. 1, s. 2006). Government performs public service, which refers to [t]he result of one or several processes performed by the public sector organization. The processes referred to are the set of interrelated or interacting activities of the public sector organization which transform input elements (policies, resources, citizen needs and expectations, etc.) into outputs/results (the products and services) provided to the citizens (Government Quality Management System Standards (GQMSS) Quality Management System - Guidance Document for the Application of ISO 9001:2000 (now ISO 9001:2008) in Public Sector Organizations). The governments call towards quality service is laid down in Republic Act 9013 (An Act Establishing the Philippine Quality Award in Order to Encourage Organizations in Both the Private and Public Sectors to Attain Excellence in Quality in the Production and/or Delivery of Their Goods and Services), which provides that the State shall encourage all sectors of the economy to aim for optimum productivity and improved quality and shall recognize their contribution to raising the quality of life for all, especially the underprivileged. An agency has to prescribe the processes by which its operations have to be carried out. These processes and procedures have to

12

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

integrate internal controls that are cost efficient and are meant to prevent unnecessary or overlapping effort, protect the operations against waste or inefficient use of resources and ensure services that will lead to the achievement of expected outputs and results. 2.4.4 Comply with Laws, Rules and Regulations. Government operations conform to the basic tenet that powers and authorities of a government office or agency are usually prescribed in the law creating such office or agency. Powers of administrative agencies depend largely, if not wholly, on the provisions of the statute creating or empowering such agency. Management and operational compliance are among the things evaluated to assess conformity with laws and other regulatory requirements. Similarly, [i]n government, the organizations, programs, activities, and functions are usually created by law and are subject to specific rules and regulations (Sec. 10 (a), Ch. 3, Title 1 - Government Auditing Standards and Procedures, Volume III, GAAM, COA Circular 91-368, 19 December 1991). In line with this, [a]ny public official or employee who shall apply any government fund or property under his administration or control to any use other than for which such fund or property is appropriated by law, shall suffer the penalty imposed under the appropriate penal laws (Chapter 7, Book VI, Title I, EO 292 or the Administrative Code of 1987). 2.4.5 Adhere to Managerial Policies. Managerial policies are directives and courses of action given by the agency head or management committee towards achieving defined objectives. They provide guidance to personnel in the proper execution of the work of their unit and individual tasks that collectively contribute to the attainment of organizational goals. This particular objective is operationalized through the mechanisms provided for under the Administrative Code of 1987. The administrative relationships discussed under Section 38, Chapter 7, Book IV of the Code provide the manner by which agency activities may be controlled, supervised and coordinated. a) Supervision and Control. This includes the authority to act directly whenever a specific function is entrusted by law or regulation to a subordinate; direct the performance of duty; restrain the commission of acts; review, approve, reverse or modify acts and decisions of

13

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

subordinate officials or units; determine priorities in the execution of plans and programs; and prescribe standards, guidelines, plans and programs. b) Administrative Supervision. This is limited to the authority of a department or its equivalent to generally oversee the operations of such agencies and ensure that they are managed effectively, efficiently and economically without interference with day-to-day activities. The department can require the submission of reports and cause the conduct of management audit, performance evaluation and inspection to determine compliance with policies, standards and guidelines; and take action as may be necessary for the proper performance of official functions, including rectification of violations, abuses and other forms of maladministration. The department also has the authority to review and pass upon the budget of such agencies under its administrative supervision but it may not increase or add to it. c) Attachment. This refers to the lateral relationship between a department or its equivalent and the attached agency for purposes of policy and program coordination. The coordination may be through representation in the governing board of the attached agency or corporation, if it is permitted by the charter; having the latter comply with a system of periodic reporting which shall reflect the progress of programs and projects; and having the department or its equivalent provide general policies through its representative in the board, which shall serve as the framework for the internal policies of the attached agency. Supervision and control is usually the relationship between a department and the bureaus under it. Administrative supervision is the relationship of a department with regulatory agencies under it. Attachment is the relationship of a department with a corporation and other agencies as may be provided by law. Department Secretaries and its management committee are enjoined to strengthen their supervision on component agencies and other entities and corporations under their administrative supervision or attached to their department to ensure that all rules and regulations hew and effectively contribute to the attainment of sector goals and objectives.

14

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

CHAPTER THREE

COMPONENTS OF INTERNAL CONTROL

15

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

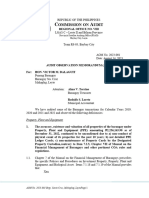

COMPONENTS OF INTERNAL CONTROL Internal control components are necessary to achieve internal control objectives. These constitute a recommended approach for the installation of internal controls in public service organizations and provide bases through which these controls can be evaluated and improved, as necessary. Internal control components apply to all the operating aspects of an organization. There are five interrelated internal control components, namely: 1) control environment; 2) risk assessment; 3) control activities; 4) information and communication; and 5) monitoring. As shown in the Internal Control Framework in Figure 1 (adapted from INTOSIA), there is a direct relationship between the general control objectives, which represent what an entitys internal controls strive to achieve, and the internal control components, which represent what are needed to achieve the general control objectives of an agency.

Figure 1 Internal Control Framework

The vertical enumeration represents the five (5) internal control objectives while the internal control components are depicted by the horizontal enumerations, with each component cutting across all five general objectives.

16

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

For example, the generation of financial and non-financial data from internal and external sources, which falls under the information and communication component, is directly related to the accurate accounting of information. The data are also needed to adhere to managerial policies, comply with applicable laws, manage operations and safeguard assets. Internal control components are considered effective when they satisfactorily achieve the five general objectives. On the other hand, internal control objectives are evaluated based on their ability to realize their statutory purpose and planned outcome. 3.1 CONTROL ENVIRONMENT

Control environment is the scope and coverage of an organizations internal control system which impacts on its structural and operational framework. It integrates all internal control components, elements and features to influence the direction and shape of an agencys strategies and outcomes. This component constitutes essential internal and external aspects, including the organizational structure, coordinated methods and measures, discipline, attitudes, and managerial policies. The control environment operates in a cross-functional network of organizations and sectors that influence the control consciousness not only of the management and personnel of an agency, but also of their constituents, other public service organizations, and stakeholders. Within the field of the control environment, structures and measures are continually monitored and, if necessary, configured, to balance the effects of varying circumstances which, in turn, may affect the overall quality of the internal control system. The control environment is affected by the needs of the citizenry and drives government agencies to act positively and address public expectations. Similarly, the control environment effects internal control by serving as an instrument to oblige public organizations to provide better service or utilize resources in a more effective and transparent manner. Public awareness and participation, among others, set the tone of the control environment. All agencies need to develop a complete approach in fulfilling their mandates and missions, including the necessary networking within and outside government to attain better coordination or convergence of efforts in the execution of their responsibilities. This means that the control

17

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

system has to be in place in their sectoral or functional area of responsibilities. 3.1.1 Public Service Sector Context. The control environment in a public sector organization is not restricted by organizational boundaries. Internal control being a pervasive system, its environment must be understood within the framework of public service accountability where government, its partners and agents, assume fiduciary responsibilities towards the public they serve. These include the following: Public Service Organizations providing public services as mandated or authorized by law; Constituents or the Public to Serve; and Other Stakeholders.

a) Public Service Organizations. Public Service Organizations are classified into two: 1) Public Entities; and 2) Private Entities Providing Public Services. Public Entities generally pertain to: 1) Agencies of Government, and 2) Public Offices. Agencies of Government refer to any of the various units of government, including a department, bureau, office, instrumentality, or government-owned and/or -controlled corporation, or a local government or distinct unit therein (Section 2, Introductory Provision of the Administrative Code of 1987). A Public Office, on the other hand, is defined as having the right, authority and duty, created and conferred by law, by which, for a given period, either fixed by law or enduring at the pleasure of the creating power, an individual is invested with some portion of the sovereign functions of the government, to be exercised by him for the benefit of the public. The individual so invested is a public officer (Laurel vs. Desierto, G.R. 145368, 12 April 2002 and Serana vs. Sandiganbayan, GR 162059, 22 January 2008). Private Entities Providing Public Services include: 1) Utility and Service Providers; 2) Withholding Tax Agents; 3) Procurement Observers; 4) Private Contractors; and 5) Volunteers.

18

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

Utility and Service Providers include private corporations and entities that render public service, supply public wants, or pursue other social oriented objectives. While purposely organized for the gain or benefit of their members, they are required by law to discharge functions for public benefit. Examples of these corporations and entities are telephone, power and water supply corporations, transportation companies, hospitals and similar service providers. A Withholding Tax Agent is constituted to be the agent of both the government and the taxpayer. Therefore, any tax withholding or collecting agent is a governments agent (Section 22(k), Chapter I, Title II, RA 8424, or the National Internal Revenue Code). Observers in the government procurement process are considered as private entities providing public service. Section 13, Article V of RA 9184 provides for the institution of observers. The law states that, to enhance the transparency of the process, the BAC shall, in all stages of the procurement process, invite, in addition to the representative of the Commission on Audit, at least two (2) observers to sit in its proceedings, one from a duly recognized private group in a sector or discipline relevant to the procurement at hand, and the other from a non-government organization: Provided, however, that they do not have any direct or indirect interest in the contract to be bid out. The observers should be duly registered with the Securities and Exchange Commission and should meet the criteria for observers as set forth in the Implementing Rules and Regulations (IRR) of RA 9184. Contractors in the procurement process are private entities that will provide service to the government or to the public and are bound to accomplish the objectives and expected results of the contract. Section 17.2, Rule VI of RA 9184 provides that, the bidding document shall clearly and adequately define, among others, the objectives, scope and expected results of the proposed contract. Voluntary Service in government is covered by Section 1, Rule XII, RA 6713 or the Rules Implementing the Code of Ethical Standards of Public Officials and Employees, which provides that those who render free voluntary service to the government are covered by laws on rewards and incentives, norms of conduct and ethical standards, duties and obligations of public officers and employees, and prohibitions and sanctions.

19

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

b) Constituents or Public to Serve. Internal control relates directly or indirectly to two types of publics: 1) Internal Public; and 2) External Public. Internal Public refers to the individuals or groups within the organization. External Public refers to the recipients of services outside the agency that are directly or indirectly affected by an agencys operations. This is illustrated in an administrative case where Conduct Grossly Prejudicial to the Best Interest of the Service is indicated as the act committed by a government official or employee that has unduly prejudiced the service. This means that it has one way or the other affected the efficient distribution of service to the public. Moreover, depending on the particular duties and responsibilities attached to the position of the official or employee concerned, this can mean service to the public in general or the employees of the agency to which the latter belongs. (CSC Resolution Nos. 010973 [Rimas, Anthony] dated 01 June 2001 and 040688 [Saldana, Carmelo R.] dated 21 June 2004) External publics are further categorized into: 1) Subjects of public service; and 2) Objects of public service. In agencies performing regulatory, adjudicatory, investigatory and prosecutorial functions, the direct receivers of the public service, such as the regulatee and the licensee, are considered as Subjects. On the other hand, Objects of public service are the general public or the specific sector that may be affected, protected or benefited by the service of the regulatory, adjudicatory, investigatory and prosecutorial bodies. The subject-object concept is illustrated in the case decided by the Supreme Court, where it held that [p]ersons who desire to engage in the learned professions requiring scientific or technical knowledge may be required to take an examination as a prerequisite to engaging in their chosen careers. This regulation takes particular pertinence in the field of medicine, to protect the public from the potentially deadly effects of incompetence and ignorance among those who would practice medicine (PRC vs. De Guzman, et al, GR No. 144681, 21 June 2004). In this case, the applicants are considered the Subjects of the PRCs service since

20

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

medical professionals are covered by the mandate of the agency to regulate the practice of their profession. The Object of the PRCs service is the general public, given its regulatory function which encompasses the protection of the general welfare of the people. c) Stakeholders. These include persons or organizations that can affect, be affected by, or perceive themselves to be affected by a decision or activity. Stakeholders are categorized into two: 1) internal stakeholders; and 2) external stakeholders. Internal stakeholders are the individuals and groups that are affected by agencys operation within a particular public service sector. Conversely, external stakeholders are the persons, organizations and other service groups that are outside a specific public service sector but may have an interest on and can influence the effective performance of the sectoral goals of an agency concerned. To illustrate, the DepEd internal stakeholders in the education sector include the parents, communities, local government units concerned, and Congressional committees on education, to name a few. Its external stakeholders comprise other public service areas such as the public works sector (i.e., DPWH and its internal stakeholders) for roads going to schools; health sector (i.e., DOH and its internal stakeholders) for the health and nutrition of the students. 3.1.2 Elements of the Control Environment. The elements of the control environment determine and influence how controls are to be structured. They are: a) Plan of Organization. The plan of organization is an essential element of the control environment. It consists of the organizational structure, as well as the management and personnel set-up of an agency. The creation of an agency is always for a specific purpose. Therefore, the structure of an agency should be based on its particular mandate, mission and functions. Organizational Structure. The structure, authority and functions of the various departments in the national government are drawn primarily from the Administrative Code, which provides that [t]he Executive Branch shall have such Departments as are necessary for the functional distribution of the work of the President and for the performance of their functions.

21

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

Section 2, Chapter I, Book IV of the Code provides the policy that 1) The Departments shall be organized and maintained to ensure their capacity to plan and implement programs in accordance with established national policies; 2) Bureaus and offices shall be grouped primarily on the basis of major functions to achieve simplicity, economy, and efficiency in government operations and minimize duplication and overlapping of activities; and 3) The functions of the different Departments shall be decentralized in order to reduce red tape, free central officials from administrative details concerning field operations, and relieve them from unnecessary involvement in routine and local matters. Adequate authority shall be delegated to subordinate officials. Administrative decisions and actions shall, as much as feasible, be at the level closest to the public. An organizational structure provides the framework within which the activities of an agency are planned, executed, controlled, and reviewed. It considers key areas of authority and responsibility and the appropriate lines of reporting. Management and Personnel. Sec. 32, Chapter 9, Book I of the Administrative Code operationalizes the Constitutional canon that public office is a public trust. Said provision lays down the foundation and the nature of public office which states that public officers and employees must at all times be accountable to the people, serve them with utmost responsibility, integrity, loyalty, and efficiency, act with patriotism and justice and lead modest lives. This principle relates to accountability, norms of conduct and ethical standards, and performance of the management and staff, including the manner by which an agency operates and provides public service. Government employees are expected to commit and demonstrate competence in the conduct of their duties and responsibilities. Each one, from the head of agency, to the rank and file, has to work for the achievement of the agencys objectives. They must show full support for internal control and the continual improvement of systems and processes that would increase the efficiency and effectiveness of the agency. b) Coordinated Methods and Measures. These are the control processes that are implemented and which form part of the normal recurring operations of an organization. They comprise the policies, rules and regulations in every agency management system that support and become integral to the operations. They guide and communicate

22

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

management actions at all levels and ensure that operating activities are performed within the standards prescribed in each system. Human Resource Management System. This system encompasses the processes from recruitment, retention, training, supervision and discipline, until an employees severance from the service either through retirement, resignation, or separation. Examples of human resource policies found in existing laws are discussed in the succeeding paragraphs. Sec. 7, Chapter 2, Book V of the Administrative Code provides that the Career Service shall be characterized by (1) entrance based on merit and fitness to be determined as far as practicable by competitive examination, or based on highly technical qualifications; (2) opportunity for advancement to higher positions; and (3) security of tenure. The merit and fitness principle does not end with the recruitment process. Periodic and continuing review of the performance of officials and employees have to be undertaken. Sec. 33, Chapter I, Subtitle A, Title I, Book V of the Administrative Code provides that there shall be established a performance evaluation system (PES) which shall be administered in accordance with rules, regulations and standards promulgated by the Civil Service Commission (CSC), for all officers and employees in the first and second levels of the career service. The PES is being implemented based on the principle of performance-based security of tenure and provides motivation and basis for incentives to performers and applies sanctions to non-performers. For the third level of the career service, the Career Executive Service Performance Evaluation System (CESPES) is in place. The CESPES is a tool that provides for a periodic performance evaluation of CESOs, CES eligibles, and incumbents of CES positions in various departments and agencies of the national government, including in GOCCs and GFIs. The Career Executive Service Board (CESB), created through PD 1 dated 1 September 1972, is mandated to promulgate rules, standards and procedures on the selection, classification, compensation and career development of the members of the CES. The performance and incentive mechanism is complemented by the policy on discipline as provided under Section 46, Chapter 6, Subtitle A, Title I, Book V of the Administrative Code of 1987 where it is stated

23

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

that (a) No officer or employee in the Civil Service shall be suspended or dismissed except for cause as provided by law and after due process. Financial Management System. Although frequently viewed to involve merely the aspects of budgeting, accounting and financial reporting, financial management system has broadened its sphere to link financial information with agency performance. The limited financial resources and the demand for efficient and effective utilization of government resources has led public sector organizations to be more discerning towards utilization of their resources. Among the prevailing legal policies on the matter are: Sec. 3, Chapter 2, Book VI of the Administrative Code which provides that the budget shall be supportive of and consistent with the socio-economic development plan and shall be oriented towards the achievement of explicit objectives and expected results, to ensure that funds are utilized and operations are conducted effectively, economically and efficiently. Expected result means the service, product, or benefit that will accrue to the public, estimated in terms of performance measures or targets. The evaluation of agency performance covers the financial position and the results of operation of an agency. Sec. 51, Chapter 6, Book VI of the Administrative Code provides that the President, through the Secretary [of Budget and Management], shall evaluate on a continuing basis the quantitative and qualitative measures of agency performance as reflected in the units of work measurement and other indicators of agency performance, including the standards and actual costs per unit of work. The Organizational Performance Indicator Framework (OPIF) is a useful tool in expenditure and budget accountability. The OPIF directs resources of an agency towards its major final outputs (MFOs) which are linked to sectoral and societal goals. Through it, policymakers and implementors become more aware of their accountabilities, not only in the accomplishment of their performance outputs, but also in the attainment of their contribution to sectoral and societal outcomes. Sec. 40, Chapter 6, Subtitle B, Book V of the same Code defines [g]overnment accounting to include the processes of analyzing, recording, classifying, summarizing and communicating all transactions involving the receipt and disposition of government funds and property,

24

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

and interpreting the results thereof. As provided for under Sec. 41 of the Code and as discussed in the objectives of internal control, [g]overnment accounting shall aim to produce information concerning past operations and present conditions; provide a basis for guidance for future operations; provide for control of the acts of public bodies and officers in the receipt, disposition and utilization of funds and property; and report on the financial position and the results of operations of government agencies for the information of all persons concerned. In accordance with its Constitutional mandate to promulgate accounting and auditing rules and regulations, the COA crafted the New Government Accounting System, which is a simplified set of accounting concepts, guidelines and procedures designed to correct, complete and record in a timely manner all government financial transactions, and produce accurate and relevant financial reports. Quality Management Systems. As a commitment towards establishing a national quality improvement system, the government mandated the policy to [e]ncourage all sectors of the economy to aim for optimum productivity and improved quality and shall recognize their contribution to raising the quality of life for all, especially the underprivileged (RA 9013, An Act Establishing the Philippine Quality Award in Order to Encourage Organizations in Both the Private and Public Sectors to Attain Excellence in Quality in the Production and/or Delivery of Their Goods and Service, 28 February 2001). Executive Order No. 605 dated February 23, 2007 (Institutionalizing the Structure, Mechanisms and Standards to Implement the Government Quality Management Program) was issued to ensure quality in the methods, systems and processes in government operations. It directs all departments and agencies of the Executive Branch, including all government-owned and/or -controlled corporations (GOCCs) and government financial institutions (GFIs) to adopt ISO 9001:2000 (now ISO 9001:2008) Quality Management Systems as part of the implementation of a Government-wide Quality Management Program. In designing and implementing the quality management system, public sector organizations should consider: [i]ts business environment, changes in that environment, or risks associated with that environment; its varying needs; its particular objectives; the products it provides; the processes it employs; its size and organization structure (Section 0.1, ISO 9000:2008 Quality Management System).

25

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

The ISO 9001:2000 (now ISO 9001:2008) Quality Management Systems Guidance Document promotes the adoption of a process approach when developing, implementing and approving the effectiveness of a management system, to enhance public satisfaction by meeting citizens requirements. The application of a system of processes within an organization, together with the identification and interactions of these processes, and their management to produce the desired outcome, can be referred to as the process approach (Section 0.2, ISO 9001:2008 Quality Management System). This approach emphasizes the importance of: Understanding and meeting citizens requirements; Considering processes in terms of added value; Obtaining results in the performance of functions; and Continually improving processes.

An agency should identify its clients and other interested parties, as well as their requirements, needs and expectations to define the agencys intended outputs. ISO 9001:2008 stated that [a]s one of the indicators of the performance of the quality management system, the organization shall monitor information relating to customer perception as to whether the organization has met customer requirements. The methods for obtaining and using this information shall be determined. It was noted further that, [m]onitoring customer perception may include obtaining input from sources such as customer satisfaction surveys, customer data on delivered product quality, user opinion surveys, lost business analysis, compliments, warranty claims, dealer reports (Section 8.2 ISO 9001:2008, EO 605 s.2007 and RA 9013). The Government Quality Management Systems Standards (GQMSS) requires an audit and certification process. The audit programme shall include a two-stage initial audit, surveillance audits in the first and second years, and a rectification audit in the third year prior to the expiration of the certification. Audits may be performed through first-party or third party audits. Internal audits, sometimes called first-party audits, are conducted by, or on behalf of, the organization itself for management review and other internal purposes x x x. (Note 1, Item 3.1, PNS ISO 19011:2002 Guidelines for quality and/or environmental management systems auditing) Third-party audits are conducted by external, independent auditing organizations, such as those providing registration or certification

26

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

of conformity to the requirements of ISO 9001 or ISO 14001. (Note 2, Item 3.1, PNS ISO 19011:2002) Performance Management System. The performance evaluation system of a department or agency is provided under Sec. 8, Chapter 2, Book IV of the Code which states that the Secretary shall formulate and enforce a system of measuring and evaluating periodically and objectively the performance of the Department and submit the same annually to the President. Control Policies and Measures. The most common control policies and procedures that are part of the coordinated measures and procedures include, but are not limited to, the following: Delegation of authority and supervision. This requires a written policy which must be well understood by the employees concerned. The authority has to be clear in terms of the particular transactions which could be acted upon by a delegatee, the limitations in the authority, and the particular purposes for which said authority may be used. Delegation of authority is followed by supervision. Competent supervision helps ensure that internal control objectives are achieved. Assigning, reviewing, and approving an employees work encompasses: clearly communicating the duties, responsibilities, and accountabilities assigned to each staff member; systematically reviewing each personnel or staff members work to the extent necessary; and approving work at critical points to ensure that it flows as intended.

The delegation of work should not diminish the supervisors accountability for the units mission and outputs. Supervisors should also provide their employees with the necessary guidance and training to help ensure that errors, wastage, and wrongful acts are minimized or totally eliminated and that management directives are understood and undertaken. Segregation of duties. Key duties and responsibilities need to be divided or segregated among different people to reduce the risk of

27

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

error or fraud. This includes separating the assignment of responsibilities for processing, reviewing, recording, custody and approval/authorization of certain transactions. Access over resources, assets and facilities. Office policies on physical controls over vulnerable resources or assets are needed to secure and safeguard them from theft, loss and misuse. These include security for and limited access to such assets as cash, inventories of facilities, supplies and equipment, data or records, and information. Office policies must be clear on the responsible staff or employee authorized to have access to these resources or assets and the processes in safeguarding and maintaining such resources or assets. Periodic physical count and inspection of assets and facilities should be made and compared with the records to address the risk of error, fraud, misuse or unauthorized alteration. Checking completeness of transaction documents and reports. Transaction documentation has to be complete in order to substantiate the transaction. Operational and financial reports are tools for monitoring performance, subsequent planning, and decision making. These reports have to be checked at the source and by the management of the operating unit concerned. These reports have to be certified as to their accuracy by the management of the office concerned before these are submitted to the users of the reports. Verification. This refers to the review of transactions to check the propriety and reliability of documentation, costing or mathematical computation. It is also checking the conformity of acquired goods and services with agreed quantity and quality specifications. The verification procedures should be built-in in every transaction. This is an internal checking procedure to avoid errors or fraud. Reconciliation of financial and non-financial data. Operating procedures of every office require that the cash records of the Accounting and the Cash units should be regularly reconciled. The records of the depository banks pertaining to the cash accounts of an agency should be reconciled with the records of the Accounting and Cash units. This process will detect errors or fraud either by the bank, the Accounting unit or the Cash unit. Physical count of inventories, equipment and documents of custodians should be done periodically and reconciled with the records of

28

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

the Accounting unit and the General Services unit. This process will address the risk of theft, pilferage or misuse of these resources. 3.1.3 Coherence of Policies. Internal controls, being integrated in the processes or methods of operation of an agency, should be in place within the organization and across organizations. Policies and procedures of other public sector organizations, as well as private entities providing public goods and services, must be compatible with and complementary to the needs of the sector. As examples, under the health sector, policies and standards of the DOH on hospital and clinic operations should be consistently applied and complementary with private hospitals and clinics, as well as by other public service organizations providing health services. The Bureau of Internal Revenue (BIR) should see to it that policies and practices of withholding and collecting tax agents, whether in public organizations or private entities, are consistent with those of the BIR. Failure to withhold tax or delay of tax remittances by withholding and collecting tax agents will directly affect the performance level of the BIR. To ensure complementary policies and processes of withholding and collecting tax agents, the BIR issues revenue regulations and regularly coordinates and monitors compliance of these agents. 3.2 RISK ASSESSMENT

Risk assessment is the overall process of risk identification, analysis and evaluation to ascertain existing and potential risks and determine the appropriate response that may affect the successful achievement of agency objectives. It is the basis for determining how those risks should be managed, to assess the relative susceptibility of agencies to uncertainties due to internal and external opportunities and threats, conscious or unintended abuse, misuse of resources, errors or factors which could affect operational efficiency. The Philippine Government mandates the establishment of standards on risk management in public service organizations. The context for risk assessment may be external and internal. The external context can include, but is not limited to: Cultural, political, legal, regulatory, financial, technological, economic, natural and competitive environment, whether international, national, regional or local;

29

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

Key drivers and trends having impact on the objectives of the organization; and Perceptions and values of external stakeholders.

On the other hand, the internal context can include, but is not limited to: Capabilities, understood in terms of resources and knowledge (e.g., capital, time, people, processes, systems and technologies); Information systems, information flows, and decision making processes; Internal stakeholders; Policies, objectives, and the strategies that are in place; Standards and reference models adopted by an organization; Structures (e.g., governance roles and accountabilities).

3.2.1 Risk Identification. This refers to the identification of opportunities and threats to the achievement of the control objectives. The purpose of doing risk identification is to generate a comprehensive list of risks based on factors that might enhance, prevent, degrade or delay the achievement of the general control objectives. This will include identifying the risks in case of not pursuing an opportunity. Comprehensive identification is very important because a risk that is not identified will not be included in the next step of analyzing risks. Risk identification is important to identify the most important areas to which resources in risk assessment should be channelled. It would also determine responsibility for the management of the risk. An organization should apply risk identification tools and techniques which are suited to its objectives and capabilities, and to the risks faced. Relevant and up-to-date information is important in identifying risks. This should include suitable background information where possible. People with appropriate knowledge should be involved in identifying risks. After the identification, it is necessary to consider possible causes and scenarios that would show what consequences can occur. All significant causes should be considered (ISO/DIS 31000). 3.2.2 Risk Analysis. Risk analysis is the systematic use of information to identify sources and to estimate the risk (PNS ISO/IEC

30

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

Guide 73:2002). This is about developing an understanding of the risk and providing an input to risk evaluation and to decisions on whether risks need to be responded to, as well as on the most appropriate response strategies and methods. This involves consideration of the causes and sources of risks. Factors that affect consequences and likelihood should be identified. An event can have multiple consequences and can affect multiple objectives. Thus, existing risk controls and their effectiveness should be taken into account. The way in which consequences and likelihood are expressed and the way in which they are combined to determine a level of risk will vary according to the type of risk, the information available, and the purpose for which the risk assessment output is to be used. These should all be consistent with the risk criteria. It is also important to consider the interdependence of different risks and their sources. The confidence in the determination of risks and their sensitivity to preconditions and assumptions should be considered in the analysis, and communicated effectively to decision makers and other stakeholders, if required. Risk analysis can be undertaken with varying degrees of detail depending on the risk, the purpose of the analysis, and the information, data and resources available (ISO/DIS 31000). 3.2.3 Risk Evaluation. This is the process of evaluating the significance of the risk and assessing the likelihood of its occurrence. With risk evaluation, management would become aware of the actions which need to be undertaken and their relative priority. The objective of evaluating risks is to assist in coming up with a decision on which risks need treatment based on the results of the risk analysis. The results of risk evaluation are an input to prioritizing treatment implementation. Decisions should take into consideration the tolerance of the risks by parties other than those which benefit from the same and should be made in accordance with legal, regulatory and other requirements. In some cases, risk evaluation may lead to a decision to undertake further analysis or a decision not to treat the risk in any way but maintain existing risk controls (INTOSAI Guidelines for Internal Control Standards for the Public Sector). 3.3 CONTROL ACTIVITIES

Control activities are the policies and procedures established to address risks and to achieve the entitys objectives. The most common of

31

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

these are those discussed on pages 27 to 28. They are the response to a risk designed to contain the uncertainty of an outcome that has been identified. The procedures that an organization establishes to treat risks are called internal control activities (INTOSAI Guidelines for Internal Control Standards for the Public Sector). Once implemented, control activities are absorbed and ingrained into the control environment of the agency. Control activities must be appropriate, cost effective, comprehensive, reasonable and directly relate to the control objectives and the agency mission. Appropriate means that the control activity is in the right place and is commensurate to the risk involved. Cost effective means the cost of implementation of the control activity should not outweigh its benefits. Comprehensive and reasonable means that the control activity directly relates to the control objectives. Finally, the control activities should be doable and function consistent with the design or plan. Implementation of control activities form part of the control environment. 3.3.1 Risk Response. Responses to risks can be divided into four categories. In some instances, risks can be transferred, tolerated or terminated. However, in most instances, the risk will have to be treated. Risk treatment is pertinent to internal controls because an effective control system is the key to the treatment of risks that may directly or indirectly prevent the achievement of the control objectives and the attainment of an agencys mission. For some risks, the best response is to transfer them. An example of a risk transfer is through insurance coverage, that is, by paying a third party to take the risk in another way. Another example of transferring a risk is through contractual stipulations. Tolerating a risk is done when the ability to do something about it may be limited, or the cost of taking any action is disproportionate to the potential benefits that could be derived. There are also some risks which could only be addressed or contained to acceptable levels by terminating the activity. There may also be instances when control measures may have to be decreased to prevent bureaucratic red tape. This would depend on the risk assessment results and after evaluating the effectiveness of the controls even if a decrease is effected.

32

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

3.3.2 Performance Review. Performance review of operations has to be performed by all units of an agency. Operating performance is reviewed against a set of standards on a regular basis, assessing effectiveness and efficiency. If performance reviews determine that accomplishments do not meet established objectives or standards, the processes and activities established to achieve the objectives should be reviewed to determine if improvements are needed. The design and implementation of improvements are the control activities. These improvements, when adopted, become part of the control environment. 3.3.3 Compliance Review. It is not enough that a unit regularly reviews the level of its performance. It also has to review compliance with ethical and quality procedures, standards, cost-efficiency principles, applicable laws and managerial policies. The review aims to ensure that operations are conducted in accordance with laws, policies and regulations. The regular supervision activity of the head of a unit should be able to detect non-compliance of its personnel and staff to applicable laws, policies, work and ethical standards and prescribed managerial policies. In the event of non-compliance, the formulation and implementation of controls will eventually be part of the control environment. This type of review of the actual operations of a unit or agency should be clearly distinguished from the monitoring of internal control which is discussed as part of the Monitoring component. 3.4 INFORMATION AND COMMUNICATION

Information and communication are vital in attaining the control objectives. They go hand in hand and cut across all other internal control components. Relevant information must be communicated throughout the agency, as well as to its network of organizations and sectors. All employees of an agency must understand their roles and responsibilities, including the effective communication of actions to external parties. All must receive a clear message from management on their internal control responsibilities. Likewise, other organizations within the sector must have a clear understanding of the standards set by an agency, including the reportorial obligations of these organizations to the agency, if any.

33

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

3.4.1 Information. The prompt recording and proper classification of transactions and events is a precondition to reliable and relevant information. Relevant information should be identified, captured and communicated in a form and timeframe that enable personnel to carry out internal controls and other responsibilities. The internal control system and all transactions and significant events should be fully documented. Managements ability to make appropriate decisions is affected by the quality of information, which implies that information should be appropriate, timely, current, accurate and accessible. Accurate and timely recording of transactions and events is required as these will serve as valuable inputs to management in decision-making and controlling operations. The GQMSS provides that records are a special type of document that gives information and should be controlled accordingly. Document control is necessary to ensure that all documents needed are kept up-todate and are readily available for use by those who need them. Thus, an agency should establish a documented procedure describing the following: Mechanisms to issue, revise and approve internal documents, including their identification and revision status; Mechanisms for controlling external documents, such as policies on applicable legal documents, emergency procedures and others which could be made available to the public as appropriate; and Mechanisms that allow access to the documents for use by the public service organization personnel, contractors, and other interested parties, as necessary.

All public documents should be made accessible to, and readily available for, inspection by the public, within reasonable working hours. However, public officials and employees should not use or divulge confidential or classified information officially known to them by reason of their office and not make available to the public either: To further their private interests, or give undue advantage to anyone; or To prejudice public interest.

34

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

Performance reports are required to document accomplishments for a particular period. Section 56, Chapter 6, Book VI of the Administrative Code provides that The heads of departments, bureaus, offices or agencies of the government shall submit a semi-annual report of their accomplishments, both work and financial results. It is further indicated that these reports shall be designed and used for the purpose of monitoring the efficiency and effectiveness with which budgeted funds are being utilized, and generally for verifying the attainment of goals established in the budget process. There are a number of laws in the Philippines that obligate information to the public. Sec. 6 of RA 9485, An Act to Improve Efficiency in the Delivery of Government Service to the Public by Reducing Bureaucratic Red Tape, Preventing Graft and Corruption, and Providing Penalties Thereof, provides for the establishment of a Citizens Charter in the form of information billboard which should be posted at the main entrance of offices or at the most conspicuous place, and in the form of published materials written either in English, Filipino, or in the local dialect, that detail the following: The procedure to obtain a particular service; The person responsible for each step; The document/s to be presented by the customer, if necessary; The amount of fees, if necessary; and The procedure for filing complaints.

Sec. 2 of Rule IV of the IRR of RA 6713, Code of Conduct and Ethical Standards for Public Officials and Employees, requires the establishment of information systems that will inform the public of the following: Policies, rules, and procedures; Work programs, projects, and performance targets; Performance reports; and All other documents as may be classified as public information.

The Constitution provides for the right of the people to know matters of public concern. Sec. 8(A), Statements of Assets and Liabilities and Financial Disclosure of RA 6713 states that [a]ll public officials and employees, except those who serve in an honorary capacity, laborers and

35

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

casual and temporary workers, shall file under oath their Statements of Assets, Liabilities and Net Worth and a Disclosure of Business Interests and Financial Connections and those of their spouses and unmarried children under eighteen (18) years of age living in their households. Identification and disclosure of relatives is likewise required under Section 8(B) thereof, which provides that [i]t shall be the duty of every public official or employee to identify and disclose, to the best of his knowledge and information, his relatives in the Government in the form, manner and frequency prescribed by the Civil Service Commission. Sec. 7 of RA 3019, Anti-Graft and Corrupt Practices Act, provides that every public officer and employee shall prepare and file a true detailed and sworn statement of assets and liabilities, including a statement of the amounts and sources of his income, the amounts of his personal and family expenses and the amount of income taxes paid for the next preceding calendar year: x x x. 3.4.2 Communication. Effective communication should flow down, across, and up the organization, throughout all components in the entire structure. There should also be effective communication with external individuals and organizations concerned. An agency and its management must be kept up-to-date on the performance, developments, risks and the functioning of internal controls, as well as other relevant events and issues. An agency should ensure that there are adequate means of communicating with, and obtaining information from, external parties as external communications can provide inputs that may have highly significant impact on the extent to which an agency achieves its goals. Towards this end, Section 8, Rule III, of the Rules Implementing RA 6713 states that [g]overnment officials shall make themselves available to their staff for consultation and dialogues. Sec. 5 thereof provides that [e]very department, office and agency shall consult the public they serve for the purpose of gathering feedback and suggestions on the efficiency, effectiveness and economy of services. They shall establish mechanisms to ensure the conduct of public consultations and hearings. Public service organizations are expected to [c]ommunicate frequently with customers and other interested parties to ensure continual understanding of their requirements, needs and expectations. (Item 5.5.1, ISO 9000, Introduction and Support Package: Guidance on

36

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

the Concept and Use of the Process Approach for Management Systems, ISO/TC 176/SC 2/N 544R2, 13 May 2004) The GQMSS provides that agencies should strengthen citizen participation in their service-related processes as a mechanism for transparency and public accountability. An agency should establish effective measures that assure communication and promotion of public services based on the requirements, characteristics, availability, cost, procedures and criteria. These communication and feedback mechanisms could, among others, be information modules, phone service, website, email, citizen service desk, complaints and suggestions box, and use of mass media. 3.4.3 Information Technology: General and Application Controls. In an information technology (IT) environment, general and application controls are two broad groups of information systems/technology control. General controls are the structure, policies and procedures that apply to all or a large segment of an entitys information systems that help ensure their proper operation. Application controls are the structure, policies and procedures that apply to separate individual application systems. These are controls designed to prevent, detect, and correct errors and irregularities as information flows through the system. As information technology has advanced, organizations have become increasingly dependent on information technology systems to carry out their operations and to process, maintain, and report essential information. As a result, the reliability and security of electronic data and of the systems that process, maintain, and report these data are a major concern to both management and stakeholders. Although information systems imply specific types of control activities, information technology is not a stand alone control issue. It is an integral part of the internal control components. 3.5 MONITORING OF INTERNAL CONTROL

Internal control should be a dynamic process that has to keep pace with the risks and challenges that an organization faces. Monitoring of the internal control system is necessary to help ensure that internal control systems remain attuned to the changes in objectives, environment, resources and risks.

37

NATIONAL GUIDELINES ON INTERNAL CONTROL SYSTEMS

Monitoring internal control systems is aimed at ensuring that controls are operating as intended and that they are modified appropriately for changes in conditions. Monitoring should also assess whether, in pursuit of an agencys mission, the general objectives of internal control are being achieved. Internal control systems need to be monitored a process that assesses the quality of the control systems' performance over time. Monitoring of internal control systems is accomplished through ongoing monitoring activities, separate evaluations, or a combination of both. Monitoring the internal control activities themselves should be clearly distinguished from reviewing the operations of a unit which is an internal control activity performed by the unit. (See discussion under 3.3.2 and 3.3.3, Control Activities). 3.5.1 Ongoing Monitoring. Ongoing monitoring occurs in the course of operations. It is built into the normal, recurring activities of an agency and in all its units. It is performed regularly and on a real-time basis, responds dynamically to changing conditions and is embedded in an agencys operation. It is aimed at ensuring that controls are functioning as intended and that they are modified appropriately for changes in conditions. The scope of on-going monitoring activities should cover each of the internal control components of the control environment, risk assessment, control activities and information and communication. Ongoing monitoring of internal control is both a function of all units and of the top management of an agency. In the agency structure, the Management Division/Unit (MD/MU) of the Financial and Management Service (FMS) is tasked to assist agency management in the ongoing monitoring of internal controls. Under DBM Circular Letter No. 2008-05, the task of the MD/MU related to on-going monitoring of internal controls is to: d. Conduct regular management surveys of the organizational structure, manpower and operations, and perform studies on special problems as assigned;