Chemical Feedstock Alternatives

Chemical Feedstock Alternatives

Uploaded by

Andrzej SzymańskiCopyright:

Available Formats

Chemical Feedstock Alternatives

Chemical Feedstock Alternatives

Uploaded by

Andrzej SzymańskiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chemical Feedstock Alternatives

Chemical Feedstock Alternatives

Uploaded by

Andrzej SzymańskiCopyright:

Available Formats

CONFERENCE

ON

CHEMICAL FEEDSTOCK ALTERNATIVES

PROCEEDINGS

Any opinions, findings, conclusions

or recommendations expressed in this

publication are those of the author(s)

and do not necessarily reflect the views

of the National Science Foundation.

This conference, sponsored by the American Institute of Chemical Engineers and the

National Science Foundation, was held from October 2 to 5, 1977, in Houston, Texas.

American Institute of Chemical Engineers

345 East 47 Street New York, New York 10017

NTIS is authoriZ81rto reproduce andsellthis

report. Permission tor further reproduction

must be obtainedfrom the copyright proprietor.

Copyright 1978

American Institute of Chemical Engineers

345 East 47 Street, New York, N.Y. 10017

Library of Congress Cataloging in Publication Data

Conference on Chemical Feedstock Alternatives,

Houston, Tex., 1977.

Conference on Chemical Feedstock Alternatives.

1. Feedstock-Congresses. 2. Chemical industries-

Congresses. I. Van Antwerpen, Franklin John,

1912- II. American Institute of Chemical

Engineers. III. United States. National Science

Foundation.

TP319.C55 1977 664'.6 78-3720

Printed in the United States of America by

Lew A. Cummings Co., Inc.

II

FOREWORD

The idea behind this conference belongs to Harold A.

SpuWer. As Director of Resource Systems, Advanced Energy

and Resources Research and Technology of the National Sci-

ence Foundation, Dr. SpuWer could but be concerned about

the threat to the chemical process industries and to the eco-

nomic welfare of the United States posed by the anticipated

unavailability of natural gas. Whether caused by government

fiat (insistence, for instance, that natural gas be used only for

home heating), by complete exhaustion of the United States'

supplies, or by the gas's being priced out of the market, the

shortage prompted questions. Would biomass be an acceptable

alternative chemical feedstock? Would coal substitute? What

was the potential in shale oil?

Dr. SpuWer approached the AIChE about holding a con-

ference to explore answers to these questions. The challenge

was such and the implications to the chemical process indus-

tries so overwhelming that AIChE promptly agreed. Conse-

quently, I formed an advisory committee ofH. P. Brokaw of

the Council on Environmental Quality; K. E. Coulter,

Manager, Gulf Coast Olefin Project, Dow Chemical Company;

I. Falkehag, Section Leader, Westvaco Research; M. G.

Fryback, Manager, Synthetic Fuels, Sunoco Energy Develop-

ment Company; J. E. Johnson, Associate Manager, Energy

and Feedstock Policy Office, Union Carbide Corporation;

L. W. Leggett, Synthetic Fuels Adviser, Carter Oil Company

(affiliate of Exxon Corporation); and James Wei, then A.P.

Colburn Professor at the University of Delaware and now

Warren K. Lewis Professor of Chemical Engineering and

Head of the Department of Chemical Engineering, Massa-

chusetts Institute of Technology.

The Committee met several times to layout a program and

to help name speakers and other experts in the areas which

we decided on: (1) oil and shale oil, (2) coal, and (3) biomass.

None of the theoretical alternatives for natural gas proved to

be a simple, straightforward substitution. Consequently, it

was decided that each had to be explored from three direc-

tions-first, the potential chemicals from alternative raw

materials; second, the economics of producing those chemi-

cals; and, fmally, the research still needed to make the surro-

gate for natural gas possible and economical.

The conference was held in Houston at the Shamrock

Hilton Hotel, from October 3 to 5, 1977. After a day of

prepared presentations and open discussion the attendees

were divided into three workshops, each concentrating on

one of the potential feedstocks.

The oil and shale oil workshop called for the commitment

of the remaining petroleum, natural gas, and natural gas

liquid exclusively to end uses where the physical and chem-

ical properties are essential and to the moving of the large-

B.t.u. consumers of energy towards coal and nuclear sources.

It also recommended a national objective of producing at

least 2 million barrels a day of shale oil by the year 2000.

As a feedstock, however, shale oil is a substance with which

iii

the group was uncomfortable because it "simply does not

have the information base necessary to make the use of shale

oil feasible." It concluded that the first utilization of shale

oil would be as a fuel, which would free regular petroleum

and natural gas for use in petrochemical production. Al-

though, according to the experts at the workshop, severe

hydrotreating of shale oil might make it an adequate and

possibly superior petrochemical feedstock, research will be

necessary to evaluate the potential.

One defensive posture recommended by the participants in

another workshop was that the U.S. promptly gain experience

with coal combustion. (We appear to remember little about

how to do it.) They also believed that producing low- and

intermediate-B.t.u. gas for process heat would delay the pro-

duction of liquid fuel from coal. The techniques to be ex-

plored, in their opinion, were the fluidized combustion of

coal and the use of coal-derived methyl fuel for gas turbines

in the power industry. The workshop view was that the

chemical industry would not be able to retain natural gas

for feedstock purposes; anything saved would enter a large

pool of gas subject to political allocation with no special

privileges to the chemical industry.

The economics of a free-standing plant for chemicals from

coal was not good, it was concluded, and the future would

see joint ventures whereby chemical companies would use

materials developed by the syngas or coal-liqUids plants of

their partner power companies.

The proponents of biomass had no immediate solution for

the CPI, not because biomass cannot produce the necessary

materials in the quantities needed, but because of economics.

As with coal, there seemed to be a consensus that biomass

chemicals would be dependent on an economy in which

biomass was used for primary products, with the chemicals

as byproducts. Then, too, the discussion on biomass tended

to consider its use as a power source because it, like coal and

oil, is both a fuel and a potential feedstock. The golden age

of biomass might come when oil gets to be $25 a barrel,

predicted to occur sometime in the late 1980's or early 90's.

Perhaps one exception might be the production of phenol

from biomass instead of coal. Biomass economics are so hazy

that the most that can be done now is to continue with R&D

work.

As brought out by those at the meeting, the biggest problem

facing the chemical process industries, was not fmding new

sources of feedstocks, but determining the Government's

intentions for the process industries. When the meeting was

held, it was still uncertain whether feedstocks would carry

a use tax and whether the Government was going to place

limitations on the amount of natural gas the petrochemical

industry might use. Despite that, not one of the experts in

attendance foresaw the quick elimination of natural gas as

the prime feedstock whether by government fiat, cost, or

source depletion.

Panelists and audience alike found it difficult to ignore the

importance of the proposed alternatives as potential energy

sources. In some cases consideration of a material as a chem-

ical source was seen as contingent on its use for power. The

economic problem did not seem to be the development of

chemical sources, but rather the switching of industry from

natural gas and oil to substitute energy materials.

All agreed that the conference was timely. If the chemical

process industries for one reason or another could not use

natural gas, it was agreed that the way was going to be rough

indeed, not only for those who produce chemicals but for the

nation as a whole. The positive trade balance generated by

the U.S. petrochemical industry would be in trouble-, en-

vironmental problems would exacerbate, and there was little

hope of a speedy transition that would be free and easy. But

there 'was no doubt in anyone's mind that if they had to

switch to a source other than natural gas, the chemical pro-

cess industries would meet the challenge.

I wish to thank the advisory committee, all of the panelists,

and the workshop chairmen who cooperated in this study.

They are identified in the volume, and I hope that they feel

rewarded for their participation by the quality of the inter-

change. In this rather unique conference, where proponents

of multifarious materials came together to speak their minds

as they explored the arguments for and the feasibility of each

raw material, the conclusions reached will form the basis for

future congresses and, we hope, for more closely oriented

research. The economic problems that face the American

chemical process industries are illumined and made plainer

by the efforts of everyone who participated.

F. J. Van Antwerpen

Executive Director, AIChE

Program Chairman, Conference on

Chemical Feedstock Alternatives

This conference was supported in part by the National

Science Foundation under Grant No. AER77-15727.

A n ~ opinions, findings, and conclusions or recommen-

dations expressed in this pUblication are those of the

author(s) and do not necessarily reflect the views of the

National Science Foundation.

iv

TABLE OF CONTENTS

Page

Foreword F. J. Van Antwerpen iii

Introduction A. S. West 1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . H. A. Spuhler 1

K. D. Timmerhaus 2

Oil and Oil Shale

Presentation J. W. Hand 3

.................................................. F.A.M.Buck 5

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E. J. Higgins 9

Discussors Bruce Me1aas 14

R. G. Keister 14

C. J. Roth 16

G. J. Butkovitch 16

Discussion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Workshop E. J. Higgins, Chainnan 20

Coal

Presentation H. G. Davis 25

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . J. R. Dosher 29

A. M. SqUires 35

Discussors W. H. Bowman, III 41

H. F. Feldmann 42

N. E. Jentz 44

Discussion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

Workshop A. 'M. Squires, Chainnan 45

Biomass

Presentation I. S. Goldstein 61

Raphael Katzen 66

K. V. Sarkanen 74

Discussors W. M. Hearon 78

D. W. Goheen 81

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . R. H. Bogan 83

Discussion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Workshop K. V. Sarkanen, Chairman 96

Conclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 102

Index of Participants. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 125

v

INTRODUCTION

A. S. West, President of the American Institute of Chemical

Engineers in 1977, is closely involved with the energy re-

sources problem through his work as Manager of the Petro-

leum Chemicals Research Department of Rohm and Haas

Company.

Spuhler 1

A. SUMNER WEST

The American Institute of Chemical Engineers is pleased to

cooperate with the National Science Foundation on this ven-

ture. I don't think we can underestimate the importance of

technical feedstocks in the chemical industry, and obviously

chemical engineers have an interest in the health of the chemi-

cal industry. The chemical industry in the United States, with

about $100 billion a year in sales, is highly dependent on

petrochemical feedstocks. The net value added to these feed-

stocks, after the cost of raw materials and energy, is something

like $25 billion a year, and there is a net positive trade balance

of something like $4 billion a year. With that little economic

perspective, it is obvious that we must consider the future

availability of chemical feedstocks, and that is the purpose of

this conference. We want it to be a highly interactive one. We

look forward to a very lively conference, and we appreciate

very much the work that the authors and discussers have done

in preparing their papers.

HAROLD A. SPUHLER

Dr. H. A. Spuhler is the Director of Resource Systems,

Advanced Energy and Resources Research and Technology,

for the National Science Foundation. For the Foundation

he has been Head of Institutional Planning, Deputy Head of

Oceanographic Facilities, and Program Manager for Solar

Energy, among other positions. Dr. Spuhler is an electrical

engineer, with experience largely in systems, engineering,

process control, and management and decision analysis.

I think I should, at the outset, say a few words about the

National Science Foundation. The National Science Founda-

tion was established in 1950. Its enabling act authorized the

support of basic research, primarily at academic institutions.

In 1968 the enabling act was amended to authorize support

of private research. In 1972, by Executive Order of the Presi-

dent, the NSF was directed to provide support to the industrial

sector. As a consequence, NSF now supports a mix of basic

and applied research.

The interest of the Foundation in natural resources stems

from some rather elementary questions, such as what are the

total resource requirements of the United States? to what ex-

tent are these requirements satisfied by the utilization of de-

pletable resources or the utilization of renewable resources?

are there substitutions that will minimize the depletion of

those resources that become scarce? is there a need to look at

not just supply and demand, but availability? Certainly in the

geopolitical sense, the raw materials may be there-the supply

is there-but they may not be available, sometimes for po-

litical, sometimes for economic, sometimes for technical

reasons. As a consequence, then, my group has the objective

of identifying the critical issues that are associated with the

development, management, and utilization of natural re-

sources.

The principal concern is how do these systems interact?

Obviously, if one looks at anyone resource such as coal or

oil, or now solar energy, it is within the purview of mission-

oriented Federal agencies. The unique character of NSF is

that it cuts across those issues. NSF has no axes to grind, it is

2 Timmerhaus CHEMICAL FEEDSTOCK ALTERNATIVES

not mission oriented in that sense, and as a consequence it has

access to the expertise of both the public and the private

sector and can bring together conferences such as this to pro-

vide an open forum in which issues are identified and dis-

cussed. NSF does not seek consensus. I would be horrified if

I got consensus out of this. If you want to assume, for ex-

ample, that natural gas will be used in the year 2050 and we

have no problem, state it, but some other people might have

different opinions. We want to air both opinions, and when we

have finished we hope that we shall have identified the gaps,

the current state of technology.

Let me remind you that we are trying to surface issues in

this broad problem. We are not trying to develop consensus.

We want to have different opinions. If you don't agree with

the speakers or discussers, or even with participants, say so.

We want you to participate.

Dr. K. D. Timmerhaus, Associate Dean of Engineering at the

University of Colorado, was President of AIChE in 1976. He

presided over the Conference on Chemical Feedstock

Alternatives.

KLAUS D. TIMMERHAUS

We shall have presentations in three different areas: Oil and

shale oil, coal, and biomass, followed by discussion on each

area. The attendees will then separate into workshops for each

area, and then the fmdings of the workshops will be summar-

ized for the entire conference. Two luncheon speakers will

consider the general problems of fuel and feedstocks. Open

discussion will complete the three-day meeting.

The presentations, workshops, and discussions will be re-

corded and transcribed as the proceedings of the conference.

OIL AND SHALE OIL Hand 3

OIL AND SHALE OIL

J. W. Hand, Managerial Vice President at Cameron Engineer-

ing, Incorporated, Denver, is involved with major project

management and administrative work. He has five patents in

the fields of mineral processing and coal gasification.

J. W.HAND

My education being in chemical engineering and my experi-

ence in industrial minerals and fuels-particularly in oil shale

and coal-my remarks will center on'the potential chemicals

from oil shale. Also, whatever may be said of the use of shale

oil as a feedstock for chemicals will generally apply to crude

petroleum.

OIL SHALE RESOURCE

Oil shale is a sedimentary rock containing a solid combustible

organic material called kerogen. This kerogen is largely insol-

uble in petroleum solvents but when heated will decompose

into oil, gas, water, and residual carbon. Some of the other

common names given to various oil shales around the world

are bituminous shale, black shale, carbonaceous shale, cannel

shale, torbanite, kukersite, tasmanite, and kerogen shale.

Oil shale has been produced commercially and used in the

production of liquid fuels for about 140 years, The first pro-

duction was in France. The oil shale industry in Scotland

dates back to 1850 and grew to much larger proportions than

the one in France. It existed for more than 100 years pro-

ducing fuels, waxes, and chemicals. There was a small shale

oil industry in the eastern United States as early as 1860, but

it was shut down after oil was discovered in Pennsylvania. Be-

tween 1850 and 1950 oil shale industries were also established

at various times in Australia, Estonia, Sweden, Spain, Man-

churia, the Republic of South Africa, and Germany. All the

oil shale industries except those in the People's Republic of

China and the U.S.S.R. have since disappeared because of

competition from conventional oil.

The magnitude of the total stored energy in organic-rich

shales in the land areas of the world staggers the imagination.

D. C. Duncan and V. E. Swanson of the U.S. Geological Survey

estimated in 1965 that in the United States alone there could

be as much as 120 trillion tons of oil shale containing from 10

to 65 percent organic matter having an energy-equivalent con-

tent of about 60 trillion barrels of oil. Multiply this by four-

teen, and you have an estimate of the world's resource.

Most of the older oil shale deposits are siliceous black shales

of marine origin which yield relatively small amounts of oil

upon retorting. These will more likely be developed for gas

production rather than oil. The carbonate-rich shales of most

importance to us are the nonmarine, or lacustrine, deposits of

the tertiary age located in the Green River formation in Color-

ado, Utah, and Wyoming and in the Paraiba Valley in Brazil.

The Green River formation is typically a hard, competent,

layered or varved rock which has no significant micropore

structure. A rich oil shale zone which occurs in the Colorado

and Utah portions of the formation is named the "Mahogany

Zone" after its wood-grain surface appearance. The amount of

organic matter in the Green River deposits varies widely from

near 0 to as high as 60 weight percent. Shale containing 14

weight percent organic matter will yield about 25 gallons of

oil per ton as determined by the modified Fischer assay meth-

ods. The amount of organic matter has a pronounced effect

on the chemical and physical properties of shale.

Most of the exposed rock surface of a 25,000-square-mile

area covering portions of Colorado, Utah, and Wyoming com-

prises the Green River formation. The area is undeveloped and

sparsely populated. Duncan and Swanson, previously referred

to, have estimated that the shales, averaging 25 or more gal-

lons of oil per ton, contain the equivalent of 600 billion

barrels of oil in place in this area. This, then, is the size of the

resource which is generally considered to be capable of being

developed with today's technology and in competition with

new petroleum production. In the heartland of the United

States we have a source of feedstocks for the chemical industry

to take care of our needs for centuries to come.

SHALE OIL

The kerogen, or the oil-forming insoluble organic material in

Green River oil shale, is of two types, the major portion being

a yellow material and the minor portion a brownish black sub-

stance, as observed under the microscope. According to W. H.

Bradley of the U.S. Geological Survey, the biological pro-

genitors of the organic substances in Green River shale could

only have been microscopic algae and other microorganisms

that grew and accumulated in the central parts oflarge, shal-

low lakes that existed under a subtropical climate. The only

nonlacustrine organic components were wind-blown or water-

borne pollens and waxy spores. These, however, made up a

large and important part of the organic-rich sediment. Bradley

4 Hand CHEMICAL FEEDSTOCK ALTERNATIVES

pointed out that pollen grains contain higher percentages of

long-chain hydrocarbons and alcohols than most plant

materials.

A major problem confronting researchers into the nature of

kerogen is to account for the progressive hydrogenation and

subsequent polymerization of the relatively oxygen-rich con-

stituents of algae such as the polysaccharides, amino acids,

amino sugars, and fatty acids into the insoluble pyrobitumens

that constitute the kerogen fraction of the Green River oil

shale.

At a temperature of about 325C. Green River kerogen

softens, swells, and darkens. Water is formed at 300 to

405C., together with ammonia, other volatile nitrogen com-

pounds, and hydrogen sulfide. Heavy oil vapors form at about

390C. and continue up to 500 or 600. At 350 Green

River kerogen degrades to 10 to 15 percent straight-chain

alkanes, 20 to 25 percent cycloalkanes, 10 to 15 percent

aromatic structures, and 45 to 60 percent heterocyclic ma-

terial. These materials are said to represent structures prob-

ably present in the original kerogen and suggest that kerogen

is predominantly a heterocyclic material connected to or asso-

ciated with smaller amounts of hydrocarbon material consist-

ing of straight-chain alkane, cyclic, and aromatic groups.

When pyrolyzed at 500C. kerogen yields approximately 66

percent oil, 9 percent gas,S percent water, and 20 percent

carbon residue. Approximately two thirds of the organic car-

bon and hydrogen are represented in the oil, two thirds of the

oxygen is converted to gas and water, nitrogen is distributed

evenly between the oil and the residue, and two thirds of the

sulfur is in the oil and one third is evolved as gas. The principal

gas constituents are hydrogen sulfide, carbon dioxide, am-

monia, hydrogen, methane, ethane, and alkanes.

The elemental composition of kerogen is approximately

80.5 percent carbon, 10.3 percent hydrogen, 2.4 percent ni-

trogen, 1 percent sulfur and 5.8 percent oxygen. This material

has a carbon-to-hydrogen weight ratio of 7.8. The crude shale

oil obtained by pyrolisis of the kerogen has a carbon-to-

hydrogen ratio of between 7.2 and 7.5 depending upon the

grade of oil shale being retorted and the retorting method used.

RETORTING METHODS

Since the characteristic of the shale oil produced is some-

what dependent on the method of retorting, the methods

available should be considered. Retorting oil shale can be ac-

complished either by mining, by crushing and retorting the

material above ground, or by fracturing the shale while it re-

mains in the ground and retorting it in situ.

Above-ground retorting processes may be placed in four gen-

eral classes: Class I, where heat is applied to the outside of the

retort and is conducted through the wall to heat the shale;

Class II, where the shale is heated by internal combustion

within the retort; Class III, where heat is transferred to the

shale by forcing externally heated gases through the shale bed;

and Class IV, where the heat is transferred to the shale by the

introduction of heated solids into the bed of shale.

The Class I retort is exemplified by the Fischer assay retort,

which is used as the standard method of determining the

amount of oil producible from a given shale. Another Class I,

which was used commercially in Scotland and other European

countries, was the Pumpherston retort. This retort was suit-

able for small-scale production; the oil from it contained 15 to

20 percent naphtha and a low percentage of residuum.

The Class II retorts are those that were developed by the

Bureau of Mines (the Gas Combustion Retort) and by the

Union Oil Company of California. In these systems, where

combustion takes place in the shale bed to generate the heat

required for retorting, there is a substantial loss in the naphtha

fraction due to combustion and cracking to gaseous products.

The Class III retort is represented today by the Petrosix

Process being developed in Brazil by Petrobras. In this system

the off-gas from the retort is heated in an external heater and

is introduced back into the retort to provide process heat. The

product gas has a high heating value, as does the process gas

from other indirectly heated retorting systems.

The Class IV retort is exemplified in this country by the

Tosco II Retorting Process, which uses ceramic balls to trans-

fer the heat from a ball heater to the bed of shale, which is

comminuted in the process. Another Class IV retorting pro-

cess, which is being developed in Germany by the Lurgi Com-

pany, uses hot spent shale as the transfer medium.

The current development in Colorado, on Federal tracts

which were leased to private companies several years ago, in-

volves creating underground retorts by a combination of min-

ing and blasting with conventional explosives and then retort-

ing these rubblized chambers by means of combustion systems.

ASSOCIATED MINERALS AND BY-PRODUCTS

As stated previously, the retorting and refining of shale oil

will produce substantial quantities of ammonia and sulfur by-

products. In addition, there are some saline minerals present

in the Green River oil shale which can be mined separately or

in conjunction with the production of oil shale for their or-

ganic content.

Chief among these saline minerals are trona, a sodium sesqui-

carbonate, and nahcolite, a sodium bicarbonate mineral. The

trona beds in the Green River oil shale formation of Wyoming

are currently producing most of this nation's soda ash. The

very large reserves of nahcolite in the Colorado portion of the

Green River formation will be produced in time and will com-

pete with trona as a source of soda ash or sodium carbonate.

Halite is also deposited in Colorado.

In addition to these, some of the richest oil shale sections in

the Piceance Creek basin of Colorado contain substantial quan-

tities of dawsonite, which is a sodium aluminum carbonate.

With careful r.etorting of the oil shale, it is possible to render

the dawsonite soluble, and this will provide a feedstock for

both soda ash and alumina production.

There is one other occurrence in the oil shale formations,

the extent of which is not known at the present time but

which offers some intriguing prospects as a feedstock for the

chemical industry. This is a black water or black trona brine,

which has been found in several areas of the .Green River for-

mation of Wyoming. This black trona brine appears to be

primarily a sodium salt of a polymeric acid in solution with

substantial amounts of sodium carbonate and sodium bicar-

bonate. The polymeric acid has a molecular weight on the

OIL AND SHALE OIL Buck 5

order of 1500 and can be retorted to yield materials similar to

products from retorting kerogen in oil shale. In addition to

this polymeric acid, there seems to be a substantial percentage

of sodium salts of dicarboxylic acids having from four to four-

teen carbon atoms.

POTENTIAL CHEMICALS

We must conclude that our vast lacustrine deposits ofthe

Green River formation in the heartland of the nation consti-

tute a veritable treasure chest of feedstocks for future chemical

production. Their easy accessibility, their high organic-matter

content, and their association with other valuable mineral de-

posits argue for rather early development for this purpose.

The variances in the formation both laterally and vertically

and the variety of processing techniques which may be em-

ployed permit the operator to have considerable control over

the product mix obtained from exploitation of the resource.

The potential chemicals derived from retorting and refining

oil shales and the resulting shale oil range from synthesis gas

components, hydrogen and carbon monoxide, through a full

range of hydrocarbons-paraffinic, olefinic, and aromatic-to a

large suite of organic and inorganic acids and bases. Some per-

spective of the potential can be gained by considering a hypo-

thetical chemical refinery based on oil shale.

Consider an underground mine producing 100,000 tons a

day of shale containing 30 gallons per ton of oil and 5 percent

dawsonite. This raw material would be retorted by one of the

indirect heating methods, and the retorted shale processed to

recover the products from the dawsonite. The naphthas

would be cracked to produce petrochemicals. The heavy oil

would be coked and hydrogenated to produce a fuel oil.

Under these conditions our hypothetical chemical refinery

could produce the following products, giving no credit to the

gas production, which could supply plant heat, hydrogen, and

power.

Alumina 1,500 tons/day

Soda ash 1,500 tons/day

Fuel oil 55,000 barrels/day

Coke 750 tons/day

Sulfur 100 tons/day

Ammonia 325 tons/day

Ethylene 1.3 million pounds/day

Propylene 600,000 pounds/day

Butadiene 200,000 pounds/day ,

BTX 500,000 pounds/day

The fuel oil could, of course, be further cracked to yield addi-

tional organic chemicals.

The resource of available high-grade oil shale in the heartland

of America can supply almost a complete spectrum of chemi-

cal feedstocks for centuries to come. Its utilization awaits the

development of the need and the refinement of the economics

in competition with other alternatives.

REFERENCES

1. Duncan, D. C., and V. E. Swanson, "Organic-Rich Shale of the

United States and World Land Areas," U.S. Geological Survey Circu-

lar 523 (1965).

2. Young, N. B., and J. W. Smith, "Dawsonite and Nahcolite Analyses

of Green River Formation Oil Shale Sections-Piceance Creek Basin,

Colorado, U.S. Bureau ofMines RJ 7445 (1970).

3. Hendrickson, T. A., "Synthetic Fuels Data Handbook," Cameron

Engineers, Denver, Colorado (1975).

4. Cameron Engineers, Inc., "Synthetic Fuels" (June and September

1970).

5. Phillips, T. E., "A Survey of Potential Methods for Resource Re-

covery from Black Water of the Upper Green River Basin," M.S.

thesis, University of Wyoming (May 1976).

6. Stork, K., C. H. Viens, P. C. Yeung, "Petrochemical Challenge for

2000," Petroleum/2000 (August 1977).

7. Atwood, M. T., "Above-Ground Oil Shale Retorting, the Status of

Available Technology, E/MJ (September 1977).

Dr. F. A. M. Buck, Business Representative for Shell Chemical

Company in Houston, has been with Shell Oil and Shell Chem-

ical for the past twenty-six years, including a release year in

the U.S. Office of Oil and Gas, where he was Industrial Spe-

cialist. He is currently chairman of AIChE's Energy Coordi-

nating Committee and is past Chairman of its Fuels and

Petrochemicals Division.

F. A. M. BUCK

The assignment I have this morning is to talk about the eco-

nomics of making petrochemicals from petroleum and shale.

I think you will agree that's a pretty broad topic. The fairly

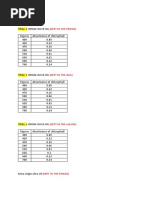

simple and abridged Table 1 indicates the distribution of the

sources of the raw materials in the petrochemical industry.

If you sum up the total hydrocarbon material, this includes

petroleum-derived material, natural gas, and natural gas liquids,

all expressed in million barrels per day of crude oil equivalent.

A million barrels a day is something like 2 trillion cubic feet

of gas; a million barrels a day is the 2 quads that people talk

about. (The total U.S. economy operates at 75 to 80 quads.)

6 Buck CHEMICAL FEEDSTOCK ALTERNATIVES

TABLE 1

Natural gas liquids are essentially all used as feedstocks.

For example, all the ethane used in the United States is found

in chemical plants, as is a pretty significant fraction of the pro-

pane, but by no means all; a lot of propane is used by the

farmers of the United States.

A pretty small fraction of crude oil is used by the petro-

chemical industry, about 2.6 million barrels a day of crude

The significant thing is that that's only 10 percent of the

natural gas that we use in the nation. In very rough terms,

in the United States about half the natural gas is for what we

call residential and commercial use, and about half is used in

heavy industry. That half of the natural gas used in heavy

industry, of course, includes today a lot of natural gas that is

used to raise steam in boilers for electric power generation.

It just seems to me that that's something that has to go. As

Dr. Spuhler said, the concepts there are not amenable to

short.range economics, and we have to acquire somehow or

other in this country the incentives that make industry move

away from burning natural gas, not only in boilers but in our

chemical plants. A lot of natural gas can be replaced by heavy

oils that are not suitable for residential or the light commercial

consumers, and we'll do that, but it will take a little time.

U.S. CHEMICAL INDUSTRY

1974 USAGE - 10

6

BID COE

oil equivalent, which is a mere 7 percent of the nation's en-

ergy budget. I guess most of that would be for the manufac

ture of ammonia and some methanol.

Figure 1 is a simple illustration of the liquid petroleum

demand in the U.S. Of course, this is a mixture of actual and

projected, and you notice that we are not bold enough to

project a constant increase here. We are at the S part of the

curve now, which I think makes common sense, but look at

the difference between what our demand line is and what

we think we can get from domestic sources. Look further

at what's going to happen to production from what we know

to be existing reserves. That's a pretty optimistic projection;

in fact I am not sure how Texas A & Mdid it. We in Shell

make projections ofthis nature, and I know our future dis-

covery volume makes simple assumptions such as we will be

twice as efficient or effective per dollar invested in exploration

as we were in the past ten years. Uyou don't use assumptions

like that, you have a pretty bleak picture. This OPEC material

comes in at what we call world prices. I don't know whether

they are going to change or who has influence on setting them,

but they are certainly different from what the regulations

permit us to' charge for our domestic material. You just can-

not imagine that we can continue in a situation where our

resources are being sold at anything else than world prices.

It doesn't make any sense whatsoever, especially if it leads

to situations like our exporting some of our raw materials

on the basis of our fictitious low prices. Another thing is

that the unconventional materials like, for example, those

that John Hand was talking about will augment this domestic

source, but they won't do it very rapidly, and in terms of the

units that we have here, they will hardly be detectable through

1990, perhaps 1 million barrels a day. Would anybody be

bolder than that? Ask yourself, at what price will this material

come to market? The answer has to be at the world price.

Nobody is going to produce something that's scarce and bring

it in at other than the world price; so to me it's obvious that

until we get everything operating on the world price, we will

really impede the production rate of these substitute materials,

whether it's liquid or gases from coal or from shale.

6

4

7

8

21

10

TOTAL,

%U.S. CONS.

.25

.21

.37

.71

1.54

FUEL

.41

.34

.36

1.11

FEEDSTOCK

ELECTRICITY

TOTAL

COAL

CRUDE OIL

NGL

NATURAL GAS

U.S. OIL SUPPLY

OPEC

1980

~ - - " " __"'-FUTURE

...., DISCOVERIES

........

.....,

EXISTING RESERVES .....

1975

YEAR

Fig. 1

25

>

20

c(

C

0:

w

0.

en 15

oJ

w

a:

a:

c(

ttl

Z 10

Q

oJ

oJ

DOMESTIC

~

5

0

1960 1965

OIL AND SHALE OIL Buck 7

Now, I've talked about competition here, and I guess this is

the object of the meeting. The question of interest, then, is

how will the monomer cost of petrochemicals vary as a func-

tion of feedstock type? I am going to stop at the monomer

because that's as far as this conference really ought to go;

we are not going to be talking about the downstream costs in

making finished petrochemicals. In monomers I guess I can

include ethylene and propalene and butadiene and BTX

aromatics. I really ought to include ammonia and methanol,

and here I am less comfortable, and so I will depend on others

to help me. If there is some shortfall or less natural gas liquid

than desired,how will this affect the economics of making

petrochemical monomers? We can make all we want from

crude because, as Table 1 showed, the petrochemical indus-

try draws down only 4 percent of the crude budget; that's a

very small amount, and so there ought to be a lot there, and

there is. I guess it is true that there is not very much ethane

around that people can acquire to build olefm plants, for

example. I think it's academic for us to discuss at too great

length what the relative economics are of making olefins out

of natural gas liquids or out of crude, because the simple fact

of the matter is that except for some imports, there aren't

enough natural gas liquids around to serve as significant raw

material for olefin plants.

There are 11 or 12 or 13 new world-scale olefin plants under

construction right now in the Gulf Coast area, and only one of

those is based on natural gas liquids. The decision 12 to 1 was

not really made by economics so much as by the fact that the

other 12 guys could not find the ethane or the propane to

feed their plants with. So let's agree that the determining

economic factor for olefin plants in the future is going to be

the cost of crude, that is of the fractions derived from crude

oil.

Of course, some shale liquids will come to market in the

1980's, possibly the 1990's, but volume won't be very large

and they will come at world prices; so you ask yourselves,

given a shale-liquid fraction and comparing it with a similar

fraction from crude, does it affect the cost of making mono-

mers? I think the answer is no. The liquids out of shale are

acceptable feedstocks. I am not quite sure that we are con-

fident we know enough about the nitrogen content; there

may be some costs that relate to nitrogen content and the

effect of nitrogen on the catalysts, and such matters, but

these are details that I think we won't get into in this

summary.

As for coal and lignite, I would think that the statement

about shale liquids covers the liquids from coal and lignite as

well. There is one area that is quite different, though, and

that is the gasification of coal and lignite, in which one would

aim at getting a monomer, not something like ethylene or

propalene or butadiene, but carbon monoxide and hydrogen.

That's a pretty reactive monomer mixture, and I suggest to

you that that is an area we better keep our eye on because if

you take coal (and I apologize to the experts here) at say $1

a million B.t.u., which seems to be something that people will

accept as possible, and gasify it, the simple arithmetic that I

do says that this gives you carbon monoxide and hydrogen

at something between 3 and 6 cents a pound. That's a big

spread. I've given myself a possible error of 100 percent, but

even without that error I end with 3 to 6 cents a pound, and

against ethylene, anotherreactive monomer, at say 12 to 13

cents a pound, I think there is some potential there for chem-

ical development.

Imported natural gas liquid is an area that we don't have the

fmal word on, I feel sure. There is a move under way to im-

port into the United States some propane, some liquefied

petroleum gas as propane. There is a good market, and many

people are confident that we can do this economically. The

producing nations, as you know, not being impeded by some

of our antitrust laws, are indulging in a little thing called the

"tie-in sale," by which if you want propane you have to take

some butanes; so there will be a lot of butane coming into the

United States, which may exceed our requirements for things

like gasoline, and so we may have some butane available as

natural gas liquids for the petrochemical industry. Further-

more, there are some people around who say that you can

even afford to bring in ethane, liquefied low-temperature

ethane, discharge it, and use it as a raw material. I assume

that the alternative natural gas sources in this nation, say

Arctic gas or gas from coal, are going to cost something

between $4 and $6 a million B.t.u., and so you say to your-

self, "If I can bring this material to market at $4 to $6...."

Work out what ethane would cost as a petrochemical feed-

stock at $4 a million B.t.u.; it's within the realm of possibility,

and I am sure there are some people somewhere who would

rather import ethane than shut down their existing ethane

cracker. If you get up in the $6 range, and that's the range

of my error, importing is pretty unlikely, but at the $4

range it's not out of the question.

When you work all these factors back, the basic raw material

for many of the petrochemicals (excluding ammonia as I said)

is going to be crude fractions, and so I thought we had better

look into the future to see what we can find out.

Today in the United States crude costs around $12 a barrel.

(These are pretty severely rounded numbers.) Ethylene is

selling for 12 to 13 cents a pound, and there is not much fat

in the ethylene business at that price. Benzene is at 75 to 85

cents and going down. A lot of people are predicting what

crude will be in the future, and I picked up an estimate by the

U.S. Tariff Commission just because it had a nice round num-

ber-$25 a barrel. Ask yourself what will that mean to the

principal petrochemical monomers? The coefficient on this

8 Buck CHEMICAL FEEDSTOCK ALTERNATIVES

CRUDE COST VS MONOMER PRICES

I think you would come to the conclusion, however, that

there is no particular reason why their petrochemical mono-

mers or first derivative products would invade our nation,

because their basic cost of manufacture, except for the fuel

cost, is no better than ours; in fact, their capital cost and

maintenance cost and such are going to be higher. Of course,

the refiners on the Persian Gulf have the ability to work the

numbers any way they want. If they want to take a different

capital return or assign themselves a different raw material

cost, they can do it. I would think, therefore, that we shall

see some material in the United States coming from the

Persian Gulf. The question is really one of timing, and I sup-

pose it won't happen very quickly.

In summary, there should be a continued growth of the

petrochemical industry, and as I see it, this growth is not

antisocial. It is a small percentage of the energy budget. It

does make a lot of jobs and support a large fraction of the

United States economy and the people. There will be con-

tinued growth based primarily on the petroleum feedstocks,

but I don't see any urgent need to get rid of the small fraction

of natural gas that is used. There will be some penetration in

the U.S. supply pattern by coal and lignite, and I think that is

surely coming, primarily in the area of ammonia and possibly

methanol. Biomass I'll put a question mark on, because I am

uncertain about it. Surely we shall see some imports from the

Persian Gulf.

price increase I took from Braunstein's recent book. He

works out how the profited cost of ethylene will change as a

function of crude cost, and this would be the Braunstein

coefficient. Similarly, benzene (I think the price also comes

from Braunstein) will be about $1.50; so that's a doubling of

the monomer cost. The next question we have to ask our-

selves is what this is going to do to the competitive position

of these materials.

Now, the first thing to ask yourselves on foreseeing these

large price increases is will we have a market to sell to? There

is such a thing as pricing yourself out of the market. What

about natural products? And here I am talking about paper

and wood and aluminum and steel and so on. A recent paper

given at the American Chemical Society concluded that even

with this doubling of monomer prices, many of the principal

markets of the petrochemicals will remain competitive; that is,

even though our raw material cost is going up, reflecting the

real cost of energy, so is the cost of aluminum and lumber

and so on keeping pace with the cost of energy. We'll remain

competitive, that's my conclusion.

We really ought to analyze what we can do against the rest

of the world. What can the Japanese do? They are on world-

scale prices,just as we are. Their economics isn't any better

than ours. Their wage rates are high, and petrochemical mono-

mers are not labor-intensive materials anyway. We therefore

have no need to fear masses of imports from Europe and

Japan.

I can't say very much about the Persian Gulf, because I

don't think we know too much about it. If, however, you

were to logically construct the cost of monomers or the first

derivative products in the United States which you hypothe-

size were made in the Persian Gulf, and if you use alternate

value economics, which is a nice, sensible way of doing your

economics, you might say to yourself, once the Arab nations

or the North African nations get ethane collected at a source,

they can either feed it to an olefm plant and make ethylene,

or they can sell that ethane. It might be possible to liquefy

ethane and transport it to the United States. If you use those

CRUDE, $/BBL

ETHYLENE, CPP

BENZENE,CPG

1977

12

12-13

75-85

1985

25

23-25

CA. 150

OIL AND SHALE OIL Higgins 9

E. J. Higgins, Manager, Olefins Technology Division, Exxon

Chemical Company, Florham Park, N.J., is involved in re-

search and development, being responsible, in particular, for

developing processes for various feedstocks.

E. J. HIGGINS

80

60

ETHYLENE PRODUCTION FROM FEEDSTOCKS OTHER THAN NGL

Fig. 1

o L - - - - ~ - - - - - r - - - - _ r _ - - - _ _ .

1965 1970 1975 1980 1985

20

40

feedstock only, and it is kind of an inverted scale, the per-

centage of ethylene that is generated from sources other than

natural gas liquids. As you can see, in 1976 only about 26

percent of all ethylene in the United States was produced

from feedstocks other than natural gas liquids. However,

at the same time in Japan 100 percent of the ethylene came

from petroleum-based naphtha and heavier fractions, and in

Europe about 98 percent came from other than natural gas

liquids. The forecast shows that in the United States the

need for feedstocks other than natural gas liquids will increase

to about 55 percent by 1985. During the same period in

Europe the dependence upon natural gas liquids will actually

increase to about 5 percent.

Exxon, which is not typical of the industry, has over the

years had petrochemicals operations predominantly dependent

upon petroleum liquids (Figure 2). In 1976 only 8 percent of

its ethylene came from natural gas liquids. In the United

States the figure was only about 6 percent. Moreover, most of

the increase tailing off out into the 1985 period comes from

operations outside the United States.

Well, the message from all of this is that the industry is not

really faced with breaking virgin ground. There is a great deal

I will concentrate my comments primarily in the olefins area.

As I see it, the other tonnage petrochemicals that come from

natural gas liquids or natural gas are ammonia and methanol,

which I don't see petroleum or shale making inroads into at

all. I think the shift there is more likely to be into synthesis

gas from coal-derived sources. For the other major area, the

aromatic derivatives, the natural gas liquids are not a major

factor anyway. We are really looking at by-products of petro-

leum processing and refining or pyrolisis products from either

pyrolisis of liquids for olefins or pyrolisis of coal; so I am going

to give kind of short shrift to everything other than the olefins

area, where there is a lot to be said. Depending on your view-

point, the declining domestic supplies of natural gas liquids for

chemical feedstocks can be considered anywhere along the

range between a mere forecast of adjustment of industry pat-

terns on the one end and imminent doom on the other. Regard-

less of your position, we need to keep things in perspective. We

need to remember, first, that the petroleum industry was born

without natural gas liquids, and, second, that the industry

flourishes in most parts of the world without natural gas liquids.

The petrochemical industry started in 1920 at Bayway,

where thermocracking severity had reached the point where

by-product fuel was uncontainable. In response, a process was

installed to convert propylene to isopropol alcohol to eliminate

the need for flaring the excess gas. This was such an economic

success that it was followed by process modification which

permitted increased yield ofolefms, and this eventually evolved

into the production of ethane and butadiene and the beginning

of a major change in the chemical industry which backed out

the older acetylene-based chemistry. It was not until the early

1940's that someone got the bright idea to take advantage of

the glut of natural gas liquids being thrown up by the ever-

increasing production of natural gas on the U.S. Gulf Coast.

These provided cheap, convenient feedstocks, which became

the basis for a phenomenal growth in the petrochemical indus-

try in the United States.

Figure 1 shows, among other things, the results of this de-

velopment. This figure is on a completely different basis from

Dr. Buck's. This has none of the fuel shown in it. This is

10 Higgins CHEMICAL FEEDSTOCK ALTERNATIVES

u.s. PETROLEUM PRODUCT DEMAND OUTLOOK

unpredictable success. The availability of domestic crude oil

will continue to decrease. The V.S. balance of payments will

be seriously affected by oil imports, thereby providing a major

drive to reduce imports. There will be a constant threat of an

abrupt OPEC price action, and then there are the possible V.s.

government actions which could impose restrictions or pro-

scriptions on the use or the end use of fuels and possibly could

provide support or encouragement to the development of

domestic oil, gas, shale oil, coal conversion, or tosens; so this

array of interacting uncertainties really precludes confident

forecasting. Nevertheless, here is a chart (Figure 4) that may

help. I have no real pride in the exact shape of these curves,

and the time scales across the four figures are not necessarily

the same.

MOGAS

TIME _

1975

TIME _

1975

1-------

T

of technology already available, and it is more a question of

adjusting and adapting, unless one happens to be sitting there

with a modern efficient facility capable of cracking only

natural gas liquids.

At the risk of running into headlong conflict with John

Hand, I would like to deal very briefly with shale oil. Figure

3 shows the estimates on shale oil availability out to the turn

of the century as a percentage of total crude oil consumed in

the Vnited States. It shows that shale will be only a very minor

fraction of the overall energy feedstock equation and that the

most optimistic estimates of shale oil availability in 1990 is

less than 5 percent. Moreover, as the shale oil fraction could

be cracked in facilities suitable for cracking petroleum liquids,

no major special research is involved. As a final note on shale,

it is clear that the crude shale oil fractions, before they have

been hydrogenated to remove n1trogen, are pretty deficient in

hydrogen and really not very prime candidates for olefin-

generation feedstocks; so let's go on to see what petroleum

feedstocks will be the prime candidates for ftlling the gap in

natural gas liquids.

Whatever happens will be caused by alarge number of factors,

significant among which is the decrease in natural gas supplies,

which will affect the consumption of all alternate fuels.

Atomic power and coal burning will be running the gauntlet of

administrative and environmental impediments with somewhat

ETHYLENE PRODUCTION FROM FEEDSTOCKS OTHER THAN NGL

TIME _

CRUDE

T

Fig. 4

TIME _ 1975

HEAVY FUEL OIL

._---

1975

However, I do see gasoline demand going up through a peak

and then finally settling back. Fuel oil demand will increase to

displace waning natural gas supplies and then will fmally give

way to increasing coal and nuclear utilization. Total crude oil

consumption, whether produced domestically, imported as

crude, or imported as refmed products, will grow ever more

slowly and then finally drop off. Only distillate demand seems

to be rising out to the limit of my vision, as distillate fuel takes

over from natural gas and as dieselization of automobiles be-

comes effective.

Both decreasing lead levels and decreasing gasoline demand

will tend to move limited volumes of low octane, light virgin

naphtha, and erathonates from aromatic extraction in the

chemical feedstocks. However, in spite of the strong demand

for distillates for other uses, which should give them a price

premium that will tend to discourage their use as chemical

feedstocks, they will probably have to balance the need.

Meanwhile, the incentive to use heavy fuel oil boiling-range

material will grow, and so it could become a factor of un-

magnitude.

1990

--

--

'985

Fig. 3

'980

EXXON (WORLD WIDE)

'965

IL.....-_--.-,__--,-,__-,-,_-------"

1910 1975 1980 1985

1975

20

4.

8.

'0

Fig. 2

'00 -fEUROPE

/===EX::X::ON::'U::S::Al=======-_-_-_--::- __ __

U.S. SHALE OIL PRODUCTION AS A PERCENT OF OIL DEMAND

OIL AND SHALE OIL

Clearly, in this unpredictable situation temporary gluts and

shortages are almost certainly developed from time to time in

each of the major petroleum categories. Therefore prudence

dictates securing all the feedstocks flexibility possible. Except

for the heavier fractions, the technology is generally available

to crack the feedstocks we expect to see. Then, what are the

R and D needs?

Figure 5 shows the major areas that should demand industry

attention. These are the investment level, the selectivity to

obtain the desired olefins, energy consumption, and then feed-

stock flexibility.

Figure 6 shows why the investment level needs to be the

subject of R and D activity. This curve, which was published

recently in the Oil and Gas Journal, shows dramatically that as

AREAS FOR FURTHER R&D

INVESTMENT REDUCTION

Higgins

ETHYLENE PLANT INVESTMENT AS A FUNCTION OF FEEDSTOCK

120% r-----------------___.

110

100

90

80 L-j---+---+--+---I----I-__+----J

SOURCE: OIL & GAS JOURNAL

Fig. 6

ENERGY EFFICIENCY IMPROVEMENTS IN ETHYLENE STEAM CRACKERS

100 ~ - - - - - - - - - - - - - - - _ _ _ .

11

IMPROVED SELECTIVITY

IMPROVED ENERGY EFFICIENCY

FEEDSTOCK FLEXIBILITY

Fig. 5

so

60

least continue these trends in an effort to approach as closely

as possible the theoretical minimum represented by the heat

of cracking. Of course, there are other problems all the laws

ofthermodynarnics working against our bringing that down-

but these curves over the period indicated have not shown any

slackening off. We are not starting to work into the asymptote,

as we will at some point, but it is interesting to note that on

the total light olefin basis, the ethane crackers use more energy

than the naphtha crackers.

One of the very effective ways of reducing energy consump-

tion per ton of olefin is to improve the selectivity of the

process. Figure 8 shows what has happened over the years in

this area. For a given light bridge and naphtha feedstock,

selectivity to ethylene has gone up by 60 percent over the base

which represents the best achievable in 1962. There appears

to be significant potential for further improvement if the prob-

lem is attacked on a wide front by means of both the extrapo-

lation of existing techniques and the exploration of yet un-

the feedstocks get heavier, the investment per ton of ethylene

goes up dramatically. This situation is really not as bad as

depicted here if there are outlets for the coproduced heavier

olefins, but this is what happens to the investment per ton of

ethylene, and no matter whether you have outlets for every-

thing or not, the price tag of a major heavy-liquids cracking

facility is certainly on the order of 72 billion dollars for an

industry-size unit, and this gives a really major incentive for

trying to find ways of reducing this capital demand.

Research and development will probably be carried out

primarily by major international contractors, as it has been

over the past two decades. Energy consumption and olefin

generation have always been very high. Depending upon the

feedstock utilized, the hydrocarbon consumed as fuel has been

as much as or more than the amount going directly to ethylene.

Moreover, even with the rapidly escalating fuel cost experi-

enced over the past few years, there has been a great deal of

successful effort applied to reducing this consumption.

Figure 7 shows the impact of this effort. This is a plot of

the total energy consumption, including fuel, steam, and elec-

tricity per ton of light olefins, including propylene and the

C4's, versus the start-up year of the plant for various types of

plants. As you can see, fuel consumption is quite sensitive to

the feedstock employed, but not nearly as sensitive to that as

it is to the effort that has been applied in trying to reduce the

amount of fuel consumption.

The move toward heavier feedstocks, coupled with escalating

energy costs, provides a huge incentive for the industry to at

40 -

20

1955 1965

Fig. 7

1975 1985

12 Higgins CHEMICAL FEEDSTOCK ALTERNATIVES

commercialized techniques. A lot of people are working in

this area.

Finally, there is the need to explore further techniques for

extending the commercially viable range of feedstocks, and

Figure 9 shows some of the areas in which effort is under way

and which show promise of extending feedstock utilization

down into the heavier, less costly fractions.

The first of these is vacuum-gas/oil cracking. This is a mere

extrapolation of the normally accepted pyrolisis technique,

which has had limited application already, and since it does

give a great possibility of extending into the higher boiling

ranges, it will warrant further development.

The Carbide Korea Kyoto process, employing partial com-

bustion with oxygen, shows promise of high selectivity to

petrochemicals when feeding the asphalt-of-oil coal crude.

The industry will be watching this very active development

with a great deal of interest.

The hydropyrolysis process under development in France

employs very-short-residence-time cracking in the presence of

SELECTIVITY IMPROVEMENT IN ETHYLENE

STEAM CRACKERS

200 ,-------------------,

hydrogen at relatively high pressure. It will provide a high

degree of feedstock flexibility and produce flexibility because

it can recycle unwanted fractions. It will accommodate a

fairly wide range of possibilities. This process has reached the

semicommercial demonstration phase and warrants further

watching.

Molten salt cracking will accept almost any conceivable

feedstock. It has been under development by a number of

companies for several years but has not nearly reached

commercialization yet.

High-temperature fluid coking is under development by the

Japanese petrochemical industry under the sponsorship of the

government. If successful, it will crack almost anything.

In summary, I can see that the Rand D task facing the

industry is not one of starting from ground zero. Over the

years each of the major international contractors involved

in ethylene plant construction has been actively involved in

Rand D. More recently there has been a significant increase

in the activity in this area on the part of both the petroleum-

based and the chemical-based major petrochemical producers.

These efforts, which have been yielding dramatic results, can

be expected to continue to do so as both the efforts and the

incentives intensify.

>

f-

;;

i=

o

w

~

w

en

w

Z

w

~

>

:I:

f-

w

150

100

50

1960 1970

Fig. 8

1980

RESIDUUM CRACKING PROCESSES

VACUUM GAS OIL CRACKING

CARBIDE/KUREHA/CHIYODA PROCESS

HYDROPYROLYSIS

MOLTEN SALT CRACKING

HIGH TEMPERATURE FLUID COKING

Fig. 9

OIL AND SHALE OIL

DISCUSSORS

Higgins 13

R. G. Keister, Program Manager, Advanced Cracking Reactor,

Union Carbide Corporation, South Charleston, West Virginia,

has worked in R&D, coal hydrogenation, the Fischer-Tropsch

Processes, and also in biodegradable detergents, new agricul-

tural chemicals, and terpolymer monomers.

George Butkovich, Coordinator of Synthetic Fuels, Marketing

Service Department, UOP Process Division, Des Plaines,

Illinois, has performed economic evaluations and refinery

process studies, using planning models, and has served on a

task force studying the environmental impacts of UOP pro-

cesses. Earlier he worked at Amoco Oil Company on large-

scale optimization planning models.

C. J. Roth, Manager of Feedstocks and Fuels for U.S. Petro-

chemical Division, Gulf Oil Company, Houston, is responsible

for the acquisition of raw materials and fuels for the chemical

company's U.S. operation and for pipeline operations to sup-

port feedstock and product movement.

Dr. Bruce A. Melaas, Director of Energy Affairs at Celanese

Chemical Company, New York, is responsible for formulating

energy policy and for coordinating the energy conservation

program at Celanese. Dr. Melaas is Chairman of the Petro-

chemical Energy Group, composed of twenty-one independent

petrochemical companies representing about eighty percent

of the petrochemical industry in the United States.

14 Keister CHEMICAL FEEDSTOCK ALTERNATIVES

BRUCE MELAAS

Before I disagree or agree with the speakers, I would like to

mention that there are two elements of the chemical or petro-

chemical industry. One is the independent type that is not

afflliated with the oil industry, is not integrated to natural

resources in the ground. Second, a number of the companies

are becoming joint-venture partners with the major innovative

oil companies now. Each of these groupshas different

problems.

I agree with Mr. Higgins that we are concerned with what

happens if natural gas is taken away. The answer is relatively

simple; we go to coal I think, and I think that is what he in-

timated as well. Therefore, you have to assume that natural

gas liquids are also at stake and that they, by government first

or whatever, would be removed from the potential feedstocks

as well. That is where one of the big differentiations between

the independent petrochemical companies and the integrated

petrochemical companies occurs.

The other element of concern would certainly be that those

companies which now have plants within the United States to

consume natural gas liquids or natural gas would, if govern-

ment rationing did occur, be able to continue to operate on

some sort of feedstock that they are used to, which would

allow them to be competitive.

The topic of this conference is oil versus coal shale, and as

I am not an economics man, I still don't know what the price

of a barrel of oil produced from shale will be relative to the

price of crude oil.

payments problem and that it contributes very heavily to that

positive balance brought about by the agricultural industry.

If the petrochemical and chemical industries are faced with

going to shale oil as a feedstock, that change, coupled with

President Carter's energy plan, which would take us above

world prices and add on to that what must be a higher priced

raw material from shale oil, would mean cutbacks and the loss

of jobs within our industry due to loss of markets around the

world and also to the capability of the other large petrochem-

ical and chemical companies throughout the world to import

material into our markets in this country and thus further

depress our industry.

I think I said I generally agree with Dr. Buck, who said that

we would be using petroleum as far as we can see. I am con-

cerned about the shortage of natural gas liquids, which the in-

dependent sector of the petrochemical industry has grown on.

I think we all ought to take care that those materials,that are

already in short supply are not diverted to other fuel uses,

some of which include synthetic natural gas.

I agree with Dr. Buck's comment that the petrochemical

products, whether they be plastics or rubber tires, will remain

competitive and probably make further inroads if we remain

on petroleum feedstock.

As far as shale oil goes, since we are in a competitive region

and since it does appear to be a lot more expensive than

petroleum, I would suggest first that the oil and products that

come from shale oil certainly be pumped into the gasoline

market and not serve to create economic disincentives for the

petrochemical and chemical industry in the United States.

I agree with the consensus here that petrochemical feed-

stocks will be produced from crude oil fractions of some

type, certainly in the next twenty to thirty years. The

number was tossed out that we use only 1.1 out of 7,as

feedstocks. The chemical industry, I am sure, is willing to

switch its boiler fuel to the other forms of B.t.u. energy where

only the B.t.u. matters, not the real form of the molecule.

Twenty percent of the production of the U.s. petrochemical

industry is shipped overseas. I think Mr. West stated that the

petrochemical industry has a positive $4 billion balance of

R. G. KEISTER

Carbide has been working with Chiyoda Chemical Engineer-

ing and Constructors in Japan and Kureha, also from Japan,

on a process since about 1973. We at Union Carbide pretty

much made our minds up that the natural gas element will be

supplied through coal and through synthesis gas and that there

will be crude oils available for converting to petrochemicals.

We crack in the burner of our ACR at some 2,000 degrees.

We can crack crude oil or any distillates. In the Ozaki Quench

OIL AND SHALE OIL Keister 15

Cooler we have a pitch stream and we have a heavy tar stream;

there is a gasoline fraction, a little different from what I think

you have been used to seeing. The temperatures are consider-

ably higher than conventional. We collect, of course, the grip-

piing or pyrolysis gasoline. The gas goes on to compression

and acid gas removal. Among other advantages, and I think

the most important one, that we have at Union Carbide is

flexibility. We can crack naphtha gas oil, atmospheric gas oil,

or vacuum gas oil. We find that the economics of it tends to

make us want to crack the whole distillate, and that is the way

we built our program. We have the ability to crack any of

those in any form and in the same reactor. We can recycle

gases to the same reactor. The recycled ethane, propane, and

nonbutadiene C4's can be recycled directly to the reactor.

We don't at this point worry about sulfur. The gases may

be sour. We don't have problems processing a sour crude. I

believe last count was something like 350 to 400 runs on

various feedstocks. About 200 of those have been done in

Japan and about 150 in the United States. We processed the

distillates from Arabian and Iranian light, the heavies, and the

light distillates. We have no problems with sulfur at this point.

We think, one, that due to our flexibility we can move,

regardless of what the fuels market does, to those feedstocks

which are rejected or are discarded from the petroleum in-

dustry at favorable prices.

The second element, the raw material efficiency, and of

course this refers to 1985, is that we think we'll have a pilot

plant, what we call a demonstration unit, at Sea Drift operat-

ing in 1979. We think a commercialization date of '79 or '80

would be very reasonable, and we think that our first plant

will be in '85. We are looking at the time frame of '85 on,

with this type of technology. As for our raw material ef-

ficiencies, we count 70 percent chemical-valued products

from the ACR vs. around forty-four from conventional

plants. Ever since we put out that figure, we have checked

our numbers and checked them again because it is an incredible

comparison, and we find that it is true, leaving out the recycles,

of course, and the fuel products which we discard. From

crudeoH, it truly is a60 to 70 percent number.

Also, we can feed five or six selected crudes to this process;

as I said, Kureha feeds Sereha. Particular crudes that have

low conrads and carbon content can be fed directly. We

think that with the value added we could preferentially buy

these crudes because of the type of products we make and the

value that we add.

When you talk about energy efficiency, we think the com-

bination of injecting the feedstock directly into the flame and

recovering the heat with the Ozaki probably will put us well

down on the energy efficiency curve. The Ozaki and the

Flame-in give us an opportunity to recover the whole stream.

Some people worry about whether we can keep it on stream.

This specific process has had a IS-day scheduled run in Japan,

and it lasted fine, no fouling problems. I think our fall-back

position on this is that Kureha, which has operated a more

severe program than ours, more severe in regard to the ethylene

to acetylene ratio, at conditions very close to ours with high-

temperature steam and feeding of crude oil, is approaching

three years between shutdowns. I think this compares with

conventional cracking of 40- to 60-day tum around on the

fumace.

The third element is product flexibility. We operated our

process down to 8. The Kureha Process is about 1. We

have operated from 8 to 25. We have some data near

50 where conventional technology operates. In this type of

economics we always value ethylene and acetylene equally,

at parity. This is a convenience for us at this time, and we see

no reason to change it. In a commercial operation, however,

whether they are equal as far as offerings are concemed is a

matter of a commercial judgment at the time. Finding or

reversing the trend that takes the derivatives of acetylene over

into ethylene might be a useful problem for our future. Will

it be in a pound ethylene plant? We talk about 50 to 80 mil-