Financial Risk Management: Module 4 Derivatives

Financial Risk Management: Module 4 Derivatives

Uploaded by

Chuck YintCopyright:

Available Formats

Financial Risk Management: Module 4 Derivatives

Financial Risk Management: Module 4 Derivatives

Uploaded by

Chuck YintOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Financial Risk Management: Module 4 Derivatives

Financial Risk Management: Module 4 Derivatives

Uploaded by

Chuck YintCopyright:

Available Formats

Financial Risk Management

Module 4 Derivatives

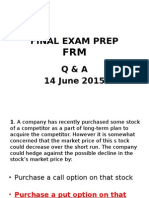

Question 1

Which of the following statements best describes when a market is said to be in contango?

a. The forward price is lower than the current spot price.

b. The current spot price exceeds the forward price.

c. The forward price exceeds the current spot price.

d. The current spot price equals the forward price.

Question 2

You are the corporate treasurer of an Australian-based gold producer. You believe that the price of gold is going

to rise and you would like to benefit from any increase in price, but would also like to hedge against a lower gold

price should the market fall. Which of the following hedge instruments would achieve this result?

a. Sell gold forward.

b. Sell gold futures.

c. Sell a gold call option.

d. Buy a gold put option.

Question 3

You are the corporate treasurer at OzCo Ltd (OzCo) and you have just purchased an AUD put/USD call currency

option from BigBank. Which one of the following statements is most correct?

a. The option gives OzCo the right, but not the obligation, to buy AUD and sell USD.

b. The option gives BigBank the right, but not the obligation, to buy AUD and sell USD.

c. The option requires BigBank to buy USD and sell AUD if OzCo exercises the option.

d. The option gives OzCo the right, but not the obligation, to buy USD and sell AUD.

Question 4

OzGold is considering purchasing a gold put option to hedge its exposure to falls in gold price. Which of the

following factors is/are likely to cause the price of the gold put option to increase?

I. An increase in the gold price.

II. An increase in the strike price of the option.

III. An increase in the volatility of the gold price.

IV. An increase in the time to expiry of the option.

a. I only.

b. II and III only.

c. I, II and IV only.

d. II, III and IV only.

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 1

Question 5

An Australian aluminium producer has purchased an aluminium put/AUD call with a strike price of AUD

2800/tonne. Ifthe spot price on the expiry date and time of the option was at AUD 2750/tonne, how should the

aluminium producer respond?

a. Exercise the option and buy aluminium at AUD 2800/tonne.

b. Allow the option to lapse without exercising it.

c. Exercise the option and sell aluminium at AUD 2800/tonne.

d. Exercise the option and sell aluminium at AUD 2750/tonne.

Question 6

Which of the following statements are correct with respect to options?

I. For an option buyer, the maximum loss is the premium.

II. Downside risk is transferred from the buyer of the option to the seller.

III. The use of options is appropriate when hedging uncertain cash flows.

a. I and II only.

b. I and III only.

c. II and III only.

d. I, II and III.

Question 7

With respect to options, who has the credit risk?

a. The option seller.

b. The option buyer.

c. Both the seller and the buyer.

d. Neither the seller nor the buyer as contracts are optional.

Question 8

Which one of the following is not a factor in determining the price of an AUD/USD forward exchange contract?

a. The expected movement in spot exchange rate.

b. The current spot rate.

c. The Australian domestic interest rate.

d. The US interest rate.

Question 9

Assume that you have bought an oil call option at a strike price of USD 90.00 per barrel. You have paid a

premium of USD 2.50 per barrel. What is the net price per barrel that you would pay if the spot price of oil at

option expiration is USD 100.00 per barrel?

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 2

a. USD 90.00.

b. USD 92.50.

c. USD 100.00.

d. USD 102.50.

Question 10

OzCo Ltd (OzCo) has entered into an interest rate swap (IRS) with a bank to receive floating-rate payments and

pay a fixed rate of 6.50 per cent, based on a principal of AUD 10 000 000. If there were 91 days in the current

interest period, the fixed-rate amount would be AUD 162 054.79 and the floating-rate amount AUD 124 657.53.

What is the cash flow between OzCo and the bank?

a. OzCo pays the bank AUD 162 054.79.

b. The bank pays OzCo AUD 124 657.53.

c. The bank pays OzCo AUD 37 397.26.

d. OzCo pays the bank AUD 37 397.26.

Question 11

An Australian company is exporting goods to Germany and receiving payment in euro (EUR).

You are given the following information.

I The AUD/EUR spot rate is 0.8000.

I AUD interest rate is 4.5 per cent per annum.

I EUR interest rate is 1.5 per cent per annum.

Which of the following statements are correct?

I. The Australian company needs to buy AUD at a future date.

II. The Australian company needs to buy EUR at a future date.

III. The forward rate would be higher than the current spot rate.

IV. The forward rate would be lower than the current spot rate.

a. I and III only.

b. I and IV only.

c. II and III only.

d. II and IV only.

Question 12

A copper producer buys a copper put option at a strike price of USD6000 per tonne at a premium of USD100

pertonne. On maturity, the spot copper price is USD5800 per tonne.

What is the effective price received by the copper producer?

a. USD5700 per tonne.

b. USD5900 per tonne.

c. USD6000 per tonne.

d. USD6100 per tonne.

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 3

Question 13

ImportCo Ltd is considering whether to accept a 10 per cent discount on buying imported machinery from China

at USD2000 each (after discount price USD1800) or continue to buy them in Australia at AUD2300 each.

Payment is to be made on arrival of the machines in one years time.

Relevant information:

What should ImportCo do?

a. Continue to purchase at AUD2300.

b. Accept the discount, buy at USD1800 and purchase the USD now at AUD/USD0.8000.

c. Accept the discount, buy at USD1800 and purchase the USD in one year at AUD/USD 0.7700.

d. Buy the machines at the undiscounted price of USD2000 and purchase the USD in one year at

AUD/USD0.8000.

Question 14

What is the correct strategy for an aluminium producer who wants to fix the price of its aluminium sales?

a. Buy aluminium forward.

b. Buy aluminium put options.

c. Sell aluminium forward.

d. Sell aluminium call options.

Question 15

Which of the following is correct in relation to futures?

I. They have standardised characteristics such as contract size and maturity date.

II. They are transacted on an exchange and settled through a clearing house.

III. They are subject to margin calls.

IV. They generally carry less counterparty risk compared to a forward contract.

a. I and III only.

b. I, II and III only.

c. II, III and IV only.

d. I, II, III and IV.

Question 16

An Australian aluminium smelter sells 1000 tonnes of aluminium to a customer at USD2000 per tonne.

Thecompany has previously hedged the aluminium price risk via a cash settled forward sale of 1000 tonnes of

aluminium at USD1800 per tonne, and the AUD/USD exchange rate risk by selling USD1 800 000 forward under

an FEC at a rate of AUD/USD1.0500.

Exchange rate (spot) AUD/USD 0.8000

Forward (outright) exchange rate AUD/USD 0.7700

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 4

Assuming the physical sale and both the derivatives settle on the same day, what additional purchase or sale of

USD will the company need to make on that day?

a. Sell USD200 000.

b. Buy USD200 000.

c. No further purchases or sales of USD is necessary.

d. Sell USD1 800 000.

Question 17

A company is submitting a tender to purchase an oil rig. It is concerned that interest rates may rise but does not

want to fix rates in case it does not win the tender and interest rates fall (in which case it will lose money on the

hedge). What type of interest rate derivative transaction would be most suitable for hedging this exposure?

a. Interest rate futures.

b. FRAs.

c. Interest rate swaps.

d. Interest rate options.

Question 18

ExportCo has been offered the following alternatives for a container load of its custom-designed surfboards,

which are to be delivered to, and paid for by, the customer in one year from today.

I AUD1 000 000 paid one year from today.

I USD950 000 paid one year from today.

I The AUD equivalent of USD950 000 converted at the current AUD/USD forward rate, and paid in AUD

one year from today.

I The AUD equivalent of USD960 000 converted at the current AUD/USD spot rate and paid in AUD one

year from today.

Additional information

I The AUD/USD forward rate is 0.9450.

I The AUD/USD spot rate is0.9500.

Which course of action should ExportCo choose if it wants to take no risk and maximise known returns?

a. Accept AUD1 000 000 payable in one year.

b. Accept USD950 000 payable in one year, and enter into a forward exchange contract to hedge the

exchange rate risk.

c. Accept the AUD equivalent of USD950 000 converted at the current AUD/USD forward rate, and paid in

AUD one year from today.

d. Accept the AUD equivalent of USD960 000 converted at the current AUD/USD spot rate and paid in

AUD one year from today.

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 5

Question 19

Megabank has just emailed its clients to say that, while interest rates in the US and Australia are steady at

present, there is almost universal agreement that they will soon become volatile and the exchange rate will also

become unstable.

As a result, Megabank has raised all its forward exchange rate quotes by + 200 basis points to compensate.

What is most likely to happen?

a. Megabank will lose a lot of money.

b. Megabank will gain a lot of money.

c. Nothing.

d. Megabanks share price is likely to increase as it now is a market leader.

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 6

Solutions

Question 1

Correct Answer: c

Contango is the situation where the forward price exceeds the current spot price.

Options A and B are incorrect. When the forward price is lower than the spot price the market is said to be

inbackwardation.

Option D is incorrect. When the spot and forward prices are equal the market is neither in contango nor

backwardation.

You can review this topic area in the study materials under the section entitled Contango and backwardation in

commodity forward markets.

Question 2

Correct Answer: d

If the gold price increases, the producer can let the option expire and sell gold at the favourable current price.

Ifthe gold price falls, the producer can exercise the option and sell gold at the option strike price.

Option A is incorrect. A gold forward would lock in the price of gold and not provide any benefit from an

increased gold price.

Option B is incorrect. Gold futures would also lock in the sale price of gold and not provide any benefit to the

producer from an increased gold price.

Option C is incorrect. Selling a gold call would put a ceiling on the gold price. The producer wishes to put a floor

under the gold selling price.

You can review this topic area in the study materials under the section entitled Hedging using options.

Question 3

Correct Answer: d

As buyer of the option, OzCo has the right but not the obligation to sell (put) AUD and buy (call) USD.

Option A is incorrect. An AUD put/USD call option gives the buyer the right to sell AUD and buy USD.

Option B is incorrect. The seller of an option has the obligation but not the right to buy and sell the

currency/commodity.

Option C is incorrect. BigBank sold an AUD put/USD call, so it has granted the right to sell AUD and buy USD

to OzCo. Accordingly, BigBank has the obligation to buy AUD and sell USD.

You can review this topic area in the study materials under the section entitled Options.

Question 4

Correct Answer: d

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 7

I. This item is incorrect. An increase in the gold price would cause the gold put option to become cheaper.

II. This item is correct. An increase in the strike price would make the option more expensive.

III. This item is correct. An increase in volatility would make the option price more expensive.

IV. This item is correct. An increase in the time to expiry of the option would make it more expensive.

You can review this topic area in the study materials under the section entitled Options (Key determinants in

option value table).

Question 5

Correct Answer: c

The producer would exercise the option and sell aluminium at AUD 2800/tonne, AUD 50/tonne over the current

market price.

Option A is incorrect. The option gives the producer the right to sell aluminium, not buy it.

Option B is incorrect. The producer would give up revenues of AUD 50/tonne by forgoing the opportunity to

sell at AUD50/tonne over the current market price.

Option D is incorrect. The option would be exercised at the strike price of AUD 2800/tonne, not the current

market price of AUD 2750/tonne.

You can review this topic area in the study materials under the section entitled Options.

Question 6

Correct Answer: d

All the statements are correct.

You can review this topic area in the study materials under the section entitled Options (Comparison between

options and forwards table).

Question 7

Correct Answer: b

If the buyer exercises the option, the seller must perform its obligation to honour the contract to buy or sell at

the agreed price. The buyer is therefore at risk if the seller fails to honour that obligation.

Options A and C are incorrect as generally the seller is paid the premium up front and the buyer thereby fulfils all

its obligations.

Option D is incorrect as an option contract does involve an obligation on the part of the seller.

You can review this topic area in the study materials under the section entitled Options (Other option

terminology).

Question 8

Correct Answer: a

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 8

The forward price of an asset or commodity is sometimes incorrectly regarded as a forecast of the spot price at

the time of settlement. This is a misunderstanding in the case of most financial derivatives, as the forward rate is

derived from other market rates, not forecasts.

Options B, C and D are all inputs to the forward foreign exchange rate formula as described in the study guide.

You can review this topic area in the study materials under the section entitled Foreign exchange forward

contracts.

Question 9

Correct Answer: b

As the spot oil price at option expiry is USD 100.00 per barrel, you would exercise your right to buy at USD 90.00

per barrel. Your net price would therefore be USD 90.00 per barrel purchase price plus USD2.50 per barrel

premium.

With a bought call option the effective cost (if exercised) is: Strike price + Call option premium. The call option

provides the buyer with the right to buy the underlying instrument. By adding the premium, they effectively pay

more than otherwise.

You can review this topic area in the study materials under the section entitled Options (Hedging using

options).

Question 10

Correct Answer: d

OzCo would pay the fixed-rate payment of AUD 162 054.79 and receive the floating-rate payment of

AUD124657.53, resulting in a net payment from OzCo to the bank of AUD 37 397.26.

Option A is incorrect. OzCo would pay the bank the fixed-rate payment of AUD162 054.79 but would

simultaneously receive the floating-rate payment of AUD124 657.53, meaning OzCo would pay the net amount

of AUD37 397.26 to the bank.

Option B is incorrect. The bank would pay OzCo the floating-rate payment of AUD124 657.53 but the bank

would simultaneously pay the fixed-rate payment of AUD162 054.79, meaning OzCo would pay the net amount

of AUD37397.26 to the bank.

Option C is incorrect. The net amount of AUD37 397.26 is correct but OzCo would pay the fixed-rate payment of

AUD162054.79 and receive the floating-rate payment of AUD124 657.53, resulting in a payment from OzCo to

the bank of AUD37397.26.

You can review this topic area in the study materials under the section entitled Interest rate swaps.

Question 11

Correct Answer: b

Item I is correct. The Australian exporter would receive EUR and need to sell EUR and buy AUD.

Item IV is correct. The forward is given by the formula

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 9

In this case, the terms currencys (EUR) interest rate in the numerator is less than the base currencys (AUD)

interest rate in the denominator, so the forward rate will be less than the spot rate.

You can review this topic area in the study materials under the section entitled Foreign exchange forward

contracts.

Question 12

Correct Answer: b

The producer would exercise the option and sell (put) the copper at USD6000 per tonne. Net of premium paid

(USD100 per tonne), this results in a net price of USD5900 per tonne.

With a bought put option the effective cost (if exercised) is: Strike price Put option premium. The put option

provides the buyer with the right to sell the underlying instrument. By subtracting the premium, they effectively

receive less than otherwise.

You can review this topic area in the study materials under the section entitled Options (Hedging using

options).

Question 13

Correct Answer: a

ImportCo wants to pay the lowest amount of AUD (payable in one year). ImportCo would minimise its cost by

buying the machines in 12 months time at AUD 2300.

If we accept the discount and convert USD into AUD at the spot rate of 0.8000, it will only cost AUD 2250,

which is less than AUD 2300. However, the question assumes that funds are exchanged at the spot rate now,

with payment in a year. We would ideally try to match the currency conversion with the payment date. If we

convert AUD 2250 to USD 1800 now, we will need to invest USD 1800 for 12 months. Transaction costs and FX

exposure would arise when we attempt to convert any interest earned back into AUD. Option B is therefore

incorrect.

Option C is incorrect as USD 1800 @ 0.7700 results in a higher price of AUD 2338.

Option D is incorrect as it uses the spot rate rather than the forward rate to convert and would still be more

expensive.

The following example further explains why Option B is incorrect.

The spot rate is 0.8000 and the forward rate (calculated by the relative differences in interest rates) is 0.7700.

Lets assume that the US interest rate is 6.1 per cent and the Australian interest rate is 10.25 per cent. Note that

this is just an assumption to make the implied forward rate work. That is, (0.8000 1.061)/1.1025 = 0.7700.

So, to obtain USD 1800 in one year, we would need to invest (1800/1.061) = USD 1 696.51. That is, investing

USD1696.51 at an interest rate of 6.1 per cent would give us USD 1800 in one year.

To obtain USD 1696.51 today, we would need to convert (1696.51/0.8000) = AUD 2120.64. That is, converting

AUD 2120.64 today at an exchange rate of 0.8000 would give us USD 1696.51.

Forward rate =

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 10

This looks favourable, because it only costs us AUD 2120.64 to buy the machines. However, to compare like

with like, what if we had invested the AUD 2120.64 at the Australian interest rate of 10.25 per cent for a year?

Inthis case, we would receive (2120.64 1.1025) = AUD 2338.00. This is the same result as Option C,

whichconverts the AUD at the forward exchange rate of 0.7700.

The end result being that Option A is still preferred.

You can review this topic area in the study materials under the sections entitled Key concepts and definitions

and Foreign exchange forward contracts.

Question 14

Correct Answer: c

The producer wishes to sell aluminium and therefore would need to sell a forward, which locks in the price.

Option A is incorrect. Buying aluminium would increase the producers exposure to the aluminium price.

Option B is incorrect. Buying puts, while potentially a valid hedge strategy, would not fix the aluminium price as

the producer would benefit from prices over and above the put option strike price.

Option D is incorrect. Selling calls would not fix the aluminium price. The producer would be exposed to falls in

the aluminium price.

You can review this topic area in the study materials under the Hedging an aluminium exposure example and

the Option matrix table.

Question 15

Correct Answer: d

All these statements are true of futures.

You can review this topic area in the study materials under the section entitled Futures.

Question 16

Correct Answer: c

The smelter will receive USD 2 000 000 of sales revenue from the physical sale to the customer: 1000 tonnes

USD 2000 per tonne.

The smelter will pay USD 200 000 to the counterparty under the aluminium forward hedge: 1000 tonnes

(USD1800/tonne forward price USD 2000/tonne spot price).

The resulting USD 1 800 000 inflow has already been sold under the FEC (i.e. USD 1 800 000 convered to AUD

at1.0500), leaving a net zero cash flow on the day.

As such, the Australian company does not need to enter into any further agreements in order to settle the

physical sale to the customer, the aluminium forward, or the foreign exchange forward.

Note that the question asks what additional purchase or sale of USD will be needed. The company does not

need to buy AUD and sell USD 200 000 (i.e. Option A). It will receive an additional USD 200 000 from the sale to

the customer and simply hand this over to the counterparty of the forward.

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 11

You can review this topic area in the study materials under the Hedging an aluminium exposure example.

Question 17

Correct Answer: d

The most correct answer is interest rate options. Interest rate futures, FRAs and interest rate swaps would all

lock the company into a fixed-interest rate. If it did not win the tender, it would be exposed to hedge losses if

interest rates fell. By using options, the maximum downside is limited to the option premium. As a borrower,

thecompany would buy a call option on interest rates (i.e. a cap). If interest rates rise, the company exercises the

call option. If interest rates fall, the company can let the interest rate options expire worthless and simply borrow

at the lower rates.

You can review this topic area in the study materials under the section entitled Options.

Question 18

Correct Answer: d

ExportCo wants to receive the highest amount of AUD (receivable in one year), which is AUD 1 010 526

(i.e.USD 960 000/the spot rate of 0.95000).

Option A equals AUD 1 000 000.

Option B equals AUD 1 005 291 (USD 950 000/the forward rate of 0.9450)

Option C equals AUD 1 005 291 (USD 950 000/the forward rate of 0.9450)

Note that Option D is converted at the current spot rate, but is paid in one years time. As such, the net AUD

receipt is higher than all the other options and there are no further foreign exchange exposures or transaction

costs.

Note that the wording of this question is slightly different to the question in relation to ImportCo Ltd. In this

question, ExportCo is accepting the current spot rate in one years time. This suggests that the counterparty has

offered the current spot rate for conversion in one years time. In the question in relation to ImportCo Ltd,

ifImportCo Ltd buys at the current spot rate, it would need to hold on to USD for the 12-month period.

You can review this topic area in the study materials under the section entitled Forwards.

Question 19

Correct Answer: a

Forward rates are not based on forecasts, so Megabanks reasoning for the rate rise is illogical.

Since its forward rates are now out of line with market rates, other banks will arbitrage them and take profits from

the difference between Megabanks rates and those set by the current interest rates and spot rate. As a result,

Megabank will systematically lose money until it reverts to the correct forward prices.

Option B is incorrect. Where Megabank is overcharging, no one should transact; where it is undercharging

(importers or exporters), the bank will be buying high, selling lowor systematically losing money.

Option C is incorrect; other banks at least will see the arbitrage opportunity and exploit it.

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 12

Option D is incorrect; increased losses do not lead to increasing the value of a company.

You can review this topic area in the study materials under the section entitled Forwards (Example of

pricearbitrage).

Module 4 Derivatives (FRM)

Semester 2, 2013 Page 13

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- CMFAS Module 8A (1 Edition) Mock Paper: © Singapore College of InsuranceDocument13 pagesCMFAS Module 8A (1 Edition) Mock Paper: © Singapore College of InsuranceMalvin Tan100% (2)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)No ratings yet

- Test Bank Options Futures and Other Derivatives 9th Edition HullDocument7 pagesTest Bank Options Futures and Other Derivatives 9th Edition Hullmaba424100% (2)

- Chapter - 7 - Solution Hull Option, Futures and Other DerivativesDocument3 pagesChapter - 7 - Solution Hull Option, Futures and Other DerivativesAn Kou50% (2)

- Multiple Choice Questions Chap 8 - Options FuturesDocument6 pagesMultiple Choice Questions Chap 8 - Options FuturesThao LeNo ratings yet

- IF MCQsDocument6 pagesIF MCQsNaoman ChNo ratings yet

- MCQDocument41 pagesMCQLockdown BoatNo ratings yet

- Multinational Finance-Tutorial 7 AsnwerDocument24 pagesMultinational Finance-Tutorial 7 Asnwerchun88100% (2)

- Aci Dealing Certificate Q&aDocument152 pagesAci Dealing Certificate Q&aWesta GeafricaNo ratings yet

- FRM 6 EsatDocument0 pagesFRM 6 EsatChuck YintNo ratings yet

- Fin 4486 Chap 3 AnswersDocument10 pagesFin 4486 Chap 3 Answerskingme157No ratings yet

- 7 PDFDocument23 pages7 PDFKevin Che0% (1)

- Mcqmate Com Topic ...Document31 pagesMcqmate Com Topic ...yabib31815No ratings yet

- Instant Download For International Financial Management 7th Edition Eun Test Bank 2024 Full Chapters in PDFDocument51 pagesInstant Download For International Financial Management 7th Edition Eun Test Bank 2024 Full Chapters in PDFdehomcobs100% (1)

- Gki Đầu Tư 239 240Document15 pagesGki Đầu Tư 239 240Nguyễn Thị Xuân MaiNo ratings yet

- Midterm-Exam IBS304 - World Financial MarketsDocument4 pagesMidterm-Exam IBS304 - World Financial MarketsThùy TrangNo ratings yet

- FINAN430 Exam 2 Sample QuestionsDocument6 pagesFINAN430 Exam 2 Sample Questionsviper_4554No ratings yet

- Test Bank Nam MadeDocument18 pagesTest Bank Nam MadePé MưaNo ratings yet

- Forward ExerciseDocument2 pagesForward ExerciseThanh TuyềnNo ratings yet

- Homework Topic 7 9Document4 pagesHomework Topic 7 9kenrioterNo ratings yet

- Test Bank Quản Trị Rủi Ro Tài ChínhDocument46 pagesTest Bank Quản Trị Rủi Ro Tài ChínhLinh YếnNo ratings yet

- Study Questions Exchange Rate + DerivativeDocument4 pagesStudy Questions Exchange Rate + DerivativeAlif SultanliNo ratings yet

- Chap007-Practice SolutionDocument80 pagesChap007-Practice SolutionVũ Trần Nhật ViNo ratings yet

- ExerciseDocument2 pagesExercisetramvnqs170004No ratings yet

- 22013010138_Tsania Rofine K_Kuis AKL II-LDocument8 pages22013010138_Tsania Rofine K_Kuis AKL II-Lzeniialee2No ratings yet

- Tutorial 1 (Chapters 1,2,3)Document76 pagesTutorial 1 (Chapters 1,2,3)Alok SinhaNo ratings yet

- Intl Review 2Document6 pagesIntl Review 2Zakir KhattakNo ratings yet

- BT Ôn TapDocument3 pagesBT Ôn TapRose PhamNo ratings yet

- Samlpe Questions FMP FRM IDocument6 pagesSamlpe Questions FMP FRM IShreyans Jain0% (1)

- CÂU HỎI TRẮC NGHIỆM IRP 1Document4 pagesCÂU HỎI TRẮC NGHIỆM IRP 1Nhi PhanNo ratings yet

- Answer For End ChapterDocument4 pagesAnswer For End ChapterAnura Kumara100% (1)

- What Characteristics Define The Money Markets?Document8 pagesWhat Characteristics Define The Money Markets?habiba ahmedNo ratings yet

- Chapter 08 Management of TRDocument90 pagesChapter 08 Management of TRLiaNo ratings yet

- Financial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsDocument15 pagesFinancial Issues Is Global Business - Fin 4218 Session: April 2017 TutorialsNg Chunye100% (1)

- Mid Term - IIIDocument2 pagesMid Term - IIIvasanthbabu26No ratings yet

- V1 - 20140410 FRM-2 - Questions PDFDocument30 pagesV1 - 20140410 FRM-2 - Questions PDFIon VasileNo ratings yet

- Part 2 Derivatives International Finance - Qs 20 Jul 2024Document16 pagesPart 2 Derivatives International Finance - Qs 20 Jul 2024gelyn.miralNo ratings yet

- ACI Dealing Certificate Session Assessment Questions and Solutions June 2021Document63 pagesACI Dealing Certificate Session Assessment Questions and Solutions June 2021MohamedNo ratings yet

- V1 20171229 阶段测试测试(产品&估值)题目 PDFDocument24 pagesV1 20171229 阶段测试测试(产品&估值)题目 PDFIsabelle ChouNo ratings yet

- Global Exam I Fall 2012Document4 pagesGlobal Exam I Fall 2012mauricio0327No ratings yet

- Chapter 9 Foreign Currency Transactions and Hedging Foreign Exchange RiskDocument32 pagesChapter 9 Foreign Currency Transactions and Hedging Foreign Exchange RiskYourMotherNo ratings yet

- Chapter 09 Foreign Currency Transactions and Hedging Foreign Exchange RiskDocument31 pagesChapter 09 Foreign Currency Transactions and Hedging Foreign Exchange Riskunknown100% (1)

- Exam 2Document7 pagesExam 2LonerStrelokNo ratings yet

- Final Correction International Finance 2022 - CopieDocument7 pagesFinal Correction International Finance 2022 - Copieschall.chloeNo ratings yet

- ACI Dealing Practice Exam 5 To DoDocument12 pagesACI Dealing Practice Exam 5 To DomorrienteskNo ratings yet

- TN RruiDocument47 pagesTN RruiLinh YếnNo ratings yet

- FINS 3616 Tutorial Questions-Week 4Document6 pagesFINS 3616 Tutorial Questions-Week 4Alex WuNo ratings yet

- Final Exam PrepDocument46 pagesFinal Exam PrepM Fani MalikNo ratings yet

- Homework 5Document5 pagesHomework 5uniguy123No ratings yet

- MGMT 3053 Exam 2018 PaperDocument8 pagesMGMT 3053 Exam 2018 PaperSamanthaNo ratings yet

- Trắc nghiệmDocument16 pagesTrắc nghiệmVân AnNo ratings yet

- Int Finance Practice - SolDocument7 pagesInt Finance Practice - SolAlexisNo ratings yet

- C) The Higher Prices of Foreign Goods Spurs Domestic Competitors To Cut PricesDocument10 pagesC) The Higher Prices of Foreign Goods Spurs Domestic Competitors To Cut PriceskbogdanoviccNo ratings yet

- NPO MidtermDocument4 pagesNPO MidtermPatrick Ferdinand AlvarezNo ratings yet

- Bùa Hộ Mệnh Tài ChínhDocument22 pagesBùa Hộ Mệnh Tài ChínhNguyệt Hằng HuỳnhNo ratings yet

- International Parity Relationship: Practical QuestionsDocument10 pagesInternational Parity Relationship: Practical Questionsmufu786No ratings yet

- Chapter 5: Currency DerivativesDocument21 pagesChapter 5: Currency DerivativesNotesfreeBookNo ratings yet

- For Each of The Following Transactions: Portfolio. CopenhagenDocument18 pagesFor Each of The Following Transactions: Portfolio. CopenhagenHiền NguyễnNo ratings yet

- BT Ôn Tap - AnswerDocument4 pagesBT Ôn Tap - AnswerThị Diệu Hương NguyễnNo ratings yet

- Financial Risk Management: Module 8 Controlling RisksDocument0 pagesFinancial Risk Management: Module 8 Controlling RisksChuck YintNo ratings yet

- Financial Risk Management: Module 7 Accounting For Derivatives and Hedge RelationshipsDocument0 pagesFinancial Risk Management: Module 7 Accounting For Derivatives and Hedge RelationshipsChuck YintNo ratings yet

- FRM 5 EsatDocument0 pagesFRM 5 EsatChuck YintNo ratings yet

- FRM 3 EsatDocument0 pagesFRM 3 EsatChuck YintNo ratings yet

- Financial Risk Management: Module 2 Management of Liquidity, Debt and EquityDocument0 pagesFinancial Risk Management: Module 2 Management of Liquidity, Debt and EquityChuck Yint100% (1)

- Module 1 Introduction To Financial Risk ManagementDocument0 pagesModule 1 Introduction To Financial Risk ManagementChuck YintNo ratings yet

- MBA 3 & 4th PDFDocument57 pagesMBA 3 & 4th PDFfixedaNo ratings yet

- Capital MarketDocument10 pagesCapital MarketEduar GranadaNo ratings yet

- Understanding Exchange RatesDocument14 pagesUnderstanding Exchange RatesJumoke FadareNo ratings yet

- Quiz 2Document40 pagesQuiz 2Amit MishraNo ratings yet

- EserciziDocument6 pagesEserciziAlessandro d'IserniaNo ratings yet

- Financial Mathematics Thesis PDFDocument4 pagesFinancial Mathematics Thesis PDFtashahollowaylittlerock100% (2)

- Swap Contract: What Is Swaps?Document12 pagesSwap Contract: What Is Swaps?Ubraj Neupane0% (1)

- Derivative Presentation 100 NA&TBDocument20 pagesDerivative Presentation 100 NA&TBNgọc AnhNo ratings yet

- Five-Caps, Floors & Swaptions 8Document8 pagesFive-Caps, Floors & Swaptions 8Akhilesh SinghNo ratings yet

- Futures Dec 2013Document53 pagesFutures Dec 2013anudora100% (1)

- IIM Bangalore Foreign Exchange MarketsDocument14 pagesIIM Bangalore Foreign Exchange MarketsGautam PatelNo ratings yet

- ACC501 SHORT NOTES For Midterm ExamDocument34 pagesACC501 SHORT NOTES For Midterm ExamMuhammad SherjeelNo ratings yet

- Foreign Exchange Risk ManagementDocument26 pagesForeign Exchange Risk ManagementAshwin RanaNo ratings yet

- MSc19.20 ATM Study Guide PDFDocument40 pagesMSc19.20 ATM Study Guide PDFJasmine ShenNo ratings yet

- Bank Assets & LiabilitiesDocument14 pagesBank Assets & LiabilitiesaarodollNo ratings yet

- Anz Asic Rate Libor BBSW Originating-Process Federal Court AustraliaDocument79 pagesAnz Asic Rate Libor BBSW Originating-Process Federal Court AustraliaSenateBriberyInquiryNo ratings yet

- DC Workbook New - BV 2021Document133 pagesDC Workbook New - BV 2021BabalolaTemitopeNo ratings yet

- Down The Rabbit Hole - The Eurodollar Market Is The Matrix Behind It AllDocument13 pagesDown The Rabbit Hole - The Eurodollar Market Is The Matrix Behind It AllKyle SalisburyNo ratings yet

- R35 The Term Structure and Interest Rate Dynamics Slides PDFDocument53 pagesR35 The Term Structure and Interest Rate Dynamics Slides PDFPawan RathiNo ratings yet

- Financial Risk Management: Module 4 DerivativesDocument0 pagesFinancial Risk Management: Module 4 DerivativesChuck YintNo ratings yet

- Swap Execution Facilities: Can They Improve The Structure OF Otc Derivatives Markets?Document19 pagesSwap Execution Facilities: Can They Improve The Structure OF Otc Derivatives Markets?MarketsWikiNo ratings yet

- IDB 2013 Annual ReportDocument45 pagesIDB 2013 Annual ReportDon HeymannNo ratings yet

- Banking Glossary E F D SPDocument47 pagesBanking Glossary E F D SPbob_rocksNo ratings yet

- Brock University: Financial Statements ofDocument34 pagesBrock University: Financial Statements oftibtibtitbibibibNo ratings yet

- International Finance CheatsheetDocument1 pageInternational Finance CheatsheetHoa Mai NguyễnNo ratings yet

- Transaction Reporting User PackDocument48 pagesTransaction Reporting User PackalepiojoNo ratings yet

- Chap 025Document40 pagesChap 025malek99No ratings yet