Section-XXI Chapter-98

Section-XXI Chapter-98

Uploaded by

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులCopyright:

Available Formats

Section-XXI Chapter-98

Section-XXI Chapter-98

Uploaded by

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Section-XXI Chapter-98

Section-XXI Chapter-98

Uploaded by

శ్రీనివాసకిరణ్కుమార్చతుర్వేదులCopyright:

Available Formats

Section- XXI 639 Chapter-98

CHAPTER 98

Project imports; laboratory chemicals; passengers' baggage,

personal importations by air or post; ship stores

NOTES :

1. This Chapter is to be taken to apply to all goods which satisfy the conditions

prescribed therein, even though they may be covered by a more specific heading elsewhere

in this Schedule.

2. Heading 9801 is to be taken to apply to all goods which are imported in accordance

with the regulations made under section 157 of the Customs Act, 1962 (52 of 1962) and

expressions used in this heading shall have the meaning assigned to them in the said

regulations.

3. Heading 9802 covers all chemicals, organic or inorganic, whether or not chemically

defined, imported in packings not exceeding 500 gms or 500 millilitres and which can be

identified with reference to the purity, markings or other features to show them to be

meant for use solely as laboratory chemicals.

4. Headings 9803 and 9804 are taken not to apply to :

(a) motor vehicles;

(b) alcoholic drinks;

(c) goods imported through courier service.

5. Heading 9803 is to be taken not to apply to articles imported by a passenger or a

member of a crew under an import licence or a Customs Clearance Permit either for his

own use or on behalf of others.

6. Heading 9804 is to be taken not to apply to articles imported under an import

licence or a Customs Clearance Permit.

Tariff Item Description of goods Unit Rate of duty

Standard Prefer-

ential

Areas

(1) (2) (3) (4) (5)

9801 ALL ITEMS OF MACHINERY INCLUDING PRIME MOVERS,

INSTRUMENTS, APPARATUS AND APPLIANCES, CONTROL GEAR

AND TRANSMISSION EQUIPMENT, AUXILIARY EQUIPMENT

(INCLUDING THOSE REQUIRED FOR RESEARCH AND

DEVELOPMENT PURPOSES, TESTING AND QUALITY CONTROL),

AS WELL AS ALL COMPONENTS (WHETHER FINISHED OR NOT)

OR RAW MATERIALS FOR THE MANUFACTURE OF THE

AFORESAID ITEMS AND THEIR COMPONENTS, REQUIRED FOR

THE INITIAL SETTING UP OF A UNIT, OR THE SUBSTANTIAL

EXPANSION OF AN EXISTING UNIT, OF A SPECIFIED :

(1) INDUSTRIAL PLANT,

(2) IRRIGATION PROJECT,

(3) POWER PROJECT,

(4) MINING PROJECT,

(5) PROJECT FOR THE EXPLORATION FOR OIL OR OTHER

MINERALS, AND

(6) SUCH OTHER PROJECTS AS THE CENTRAL GOVERNMENT

Section- XXI 640 Chapter-98

MAY, HAVING REGARD TO THE ECONOMIC DEVELOPMENT OF

THE COUNTRY NOTIFY IN THE OFFICIAL GAZETTE IN THIS

BEHALF; AND SPARE PARTS, OTHER RAW MATERIALS

(INCLUDING SEMI-FINISHED MATERIAL) OR CONSUMABLE

STORES NOT EXCEEDING 10% OF THE VALUE OF THE GOODS

SPECIFIED ABOVE PROVIDED THAT SUCH SPARE PARTS, RAW

MATERIALS OR CONSUMABLE STORES ARE ESSENTIAL FOR THE

MAINTENANCE OF THE PLANT OR PROJECT MENTIONED IN (1)

TO (6) ABOVE

9801 00 - All items of machinery including prime movers,

instruments, apparatus and appliances, control gear

and transmission equipment, auxiliary equipment

(i ncl udi ng t hose requi red f or research and

development purposes, testing and quality control),

as well as all components (whether finished or not) or

raw materials for the manufacture of the aforesaid

items and their components, required for the initial

setting up of a unit, or the substantial expansion of an

existing unit, of a specified :

(1) industrial plant,

(2) irrigation project,

(3) power project,

(4) mining project,

(5) project for the exploration for oil or other minerals,

and

(6) such other projects as the Central Government may,

having regard to the economic development of the

country notify in the Official Gazette in this behalf;

and spare parts, other raw materials (including semi-

finished materials of consumable stores) not exceeding

10% of the value of the goods specified above,

provided that such spare parts, raw materials or

consumable stores are essential for the maintenance

of the plant or project mentioned in (1) to (6) above :

--- Machinery :

9801 00 11 ---- For industrial plant project kg. 10% -

9801 00 12 ---- For irrigation plant kg. 10% -

9801 00 13 ---- For power project kg. 10% -

9801 00 14 ---- For mining project kg. 10% -

9801 00 15 ---- Project for exploration of oil or other minerals kg. 10% -

9801 00 19 ---- For other projects kg. 10% -

9801 00 20 --- Components (whether or not finished or not) kg. 10% -

or raw materials for the manufacture of

aforesaid items required for the initial

setting up of a unit or the substantial

expansion of a unit

9801 00 30 --- Spare parts and other raw materials kg. 10% -

(including semi-finished materials or

consumable stores for the maintenance

of plant or project

____________________________________________________________________________________________________

9802 00 00 LABORATORY CHEMICALS kg. 10% -

____________________________________________________________________________________________________

9803 00 00 ALL DUTIABLE ARTICLES, IMPORTED BY A PASSENGER OR A kg. 100% -

MEMBER OF A CREW IN HIS BAGGAGE

____________________________________________________________________________________________________

9804 ALL DUTIABLE ARTICLES, INTENDED FOR PERSONAL USE,

IMPORTED BY POST OR AIR

9804 10 00 - Drugs and medicines kg. 35% -

9804 90 00 - Other kg. 35% -

____________________________________________________________________________________________________

(1) (2) (3) (4) (5)

Section- XXI 641 Chapter-98

9805 THE FOLLOWING ARTICLES OF STORES ON BOARD OF A VESSEL

OR AIRCRAFT ON WHICH DUTY IS LEVIABLE UNDER THE

CUSTOMS ACT, 1962 (52 OF 1962), NAMELY:

9805 10 00 - Prepared or preserved meat, fish and vegetables; kg. 10% -

dairy products; soup; lard; fresh fruits

9805 90 00 - All other consumable stores excluding fuel, kg. 10% -

lubricating oil, alcoholic drinks and tobacco

products

____________________________________________________________________________________________________

PROJECT IMPORTS

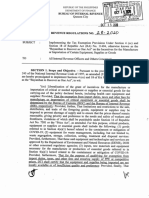

Project Imports Regulations, 1986

[Notfn. No. 230/86-Cus. dt. 3.4.1986 as amended by Notfn. Nos. 17/92, 142/92, 153/95, 54/97,

92/02, 37/03, 16/04, 17/06, 30/07 and 15/10]

In exercise of the powers conferred by section 157 of the Customs Act, 1962 (52 of

1962) and in supersession of the Project Imports (Registration of Contract) Regulation, 1965,

except as respect things done or omitted to be done before such supersession, the Central Board

of Excise and Customs hereby makes the following regulations, namely:-

1. Short title and commencement:

(1) These regulations may be called the Project Imports (Amendment)

Regulation, 2007

(2) They shall come into force on the 1st day of March, 2007.

2. Application:- These regulations shall apply for assessment and clearance of the goods

falling under heading No. 98.01 of the First Schedule to the Customs Tariff Act, 1975

(51 of 1975).

3. Definition:- For the purposes of these regulations:-

(a) "industrial plant" means an industrial system designed to be employed directly

in the performance of any process of series of processes necessary for manufacture,

production or extraction of a commodity, but does not include;-

(i) establishment designed to offer services of any description such as hotels,

hospitals, photographic studios, photographic film processing laboratories, photocopying

studios, laundries, garages and workshops; or

(ii) a single machine or a composite machine, within the meaning assigned to it, in

Notes 3 and 4 to section XVI of the said First Schedule;

Explanation. For the purposes of sub-clause(i), the expression "establishments

designed to offer services of any description" shall not include video recording or editing

units, cinematographic studios, cinematographic film processing laboratories and

sound recording, processing, mixing or editing studios;

(b) "Sponsoring authority" means authority specified in the Table annexed to these

regulations;

(1) (2) (3) (4) (5)

Section- XXI 642 Chapter-98

(c) "substantial expansion" means an expansion which will increase the existing

installed capacity by not less than 25 per cent;

(d) "unit" means any self-contained portion of an industrial plant or any self

contained portion of a project specified under the said heading No. 98.01 and having an

independent function in the execution of the said project.

4. ELIGIBILITY:- The assessment under the said heading No. 98.01 shall be available

only to those goods which are imported (whether in one or more than one consignment)

against one or more specific contracts, which have been registered with the appropriate

Custom House in the manner specified in regulation 5 and such contract or contracts has

or have been so registered:-

(i) before any order is made by the proper officer of customs permitting the clearance of the

goods for home consumption;

(ii) in the case of goods cleared for home consumption without payment of duty subject to

re-export in respect of fairs, exhibitions, demonstrations, seminars, congresses and

conferences, duly sponsored or approved by the Government of India or Trade Fair

Authority of India, as the case may be, before the date of payment of duty.

5. REGISTRATION OF CONTRACTS:- (1) Every importer claiming assessment of the

goods falling under the said heading No. 98.01, on or before their importation shall apply

in writing to the proper officer at the port where the goods are to be imported or where

the duty is to be paid for registration of the contract or contracts, as the case may be:

Provided that in the case of consignments sought to be cleared through a

Custom House other than the Customs House at which the contract is registered, the

importer shall produce from the Custom House of registration such information as the

proper officer may require.

(2) The importer shall apply, as soon as may be, after he has obtained the Import

trade control licence wherever required for the import of articles covered by the contract

and in case of imports covered by the Open General Licence or imports made by Central

Government, any State Government, statutory Corporation, public body or Government

undertaking run as a joint stock company (hereinafter referred to as "Government

Agency") as soon as clearance from the Directorate General of Technical Development

or the concerned sponsoring authority, as the case may be, has been obtained.

(3) The application shall specify:-

(a) the location of the plant or project:

(b) the description of the articles to be manfuactured, produced, mined or

explored;

(c) the installed or designed capacity of the plant or project and in the case

of substantial expansion of an existing plant or project the installed

capacity and the proposed addition thereto;

(d) such other particulars as may be considered necessary by the proper

officer for purposes of assessment under the said heading.

Section- XXI 643 Chapter-98

(4) The application shall be accompanied by the original deed of contract together

with a true copy thereof, the import trade control licence, wherever required and an

approved list of items from the Directorate General of Technical Development or the

concerned sponsoring authority,

(5) The importer shall also furnish such other documents or other particulars as

may be required by the proper officer in connection with the registration of contract.

(6) The proper officer shall, on being satisfied that the application is in order

register the contract by entering the particulars thereof in a book kept for the purpose,

assign a number in token of the registration and communicate that number to the

importer and shall also return to the importer all the original documents which are no

longer required by him.

6. AMENDMENT OF CONTRACT:- (1) If any contract referred to in regulation 5 is

amended, whether before or after registration, the importer shall make an application for

registration of the amendments to the said contract to the proper officer.

(2) The application shall be accompanied by the original deed of contract relating

to the amendments together with a true copy thereof and the documents, if any,

permitting consequential amendments to the import trade control licence, wherever

required, for the import of articles covered by the contract and in the case of imports

covered by Open General Licence, as soon as clearance from the Directorate General of

Technical Development or the concerned sponsoring authority, as the case may be, has

been obtained along with a list of articles referred to in clause (4) of regulation 5, duly

attested.

(3) On being satisfied that the application is in order, the proper officer shall make

a note of the amendments in the register.

7. FINALISATION OF CONTRACT - The importer shall within three months from the

date of clearance for home consumption of the last consignment of the goods or within

such extended period as the proper officer may allow, submit a statement indicating the

details of the goods imported together with necessary documents as proof regarding the

value and quantity of the goods so imported in terms of this Regulation and any other

document that may be required by the proper officer for finalisation of the contract.

TABLE

_________________________________________________________________________________________

S.No. Name of the Plant or Project Sponsoring Authority

1. 2. 3.

___________________________________________________________________________________________________

1. All plants and projects under SSI Units. Director of Industries of the concerned State.

2. All Power Plants and Transmission Projects National Thermal Power Corporation Ltd.

NTPC under,- Bhavan, Scope Complex,

(a) National Thermal Power Corporation Ltd. 7, Lodhi Road., Institutional area,

New Delhi-110 003.

(b) Tehri Hydro Development Corporation Ltd. Tehri Hydro Development Corporation Ltd.,

Bhagirathi Bhawan (Top terrace), Bhagirathipuram,

Tehri (Garhwal) 249 001 (UP).

(c) Nathpa Jhakri Power Corporation Ltd. Nathpa Jhakri Power Corporation Ltd., Himfed

Section- XXI 644 Chapter-98

Building Khalini, Shimla (HP).

(d) North Eastern Electric Power Corporation Ltd. North Eastern Electric Power Corporation Ltd.,

Brookland Compound Lower New Colony

Shillong-793 001.

(e) National Hydroelectic Power Corporation Ltd. National Hydroelectric Power Corporation

Ltd., NHPC Office Complex Sector-33, Faridabad,

Faridabad (Haryana).

(f) Bhakra Beas Management Board. Bhakra Beas Management Board Madhya

Marg, Sector-19/B Chandigarh-160 019.

(g) Central Power Research Institute. Central Power Research Institute, Prof. C.V.

Raman Road, Raj Mahal Vilas Extn. II, Stage

P.O., P.B.No.9401, Bangalore -560 094.

(h) National Power Training Institute. National Power Training Institute Sector 33,

Faridabad Haryana - 121 003.

(i) Power Grid Corporation of India Ltd. Power Grid Corporation of India Ltd. Hemkunt

Chambers, 6th Floor, 87, Nehru Place

New Delhi-110 019.

3. Power Plants & Transmission Projects other than Secretary to the State Goverment or Union

those mentioned at Sl.No.2 above. Territory concerned dealing with the subject of

power or electricity.

3A. Drinking Water Supply Projects for supply of Collector/District Magistrate/Deputy

water for human or animal consumption. Commissioner of the District in which the

project is located.

3B. Aerial Passenger Ropeway Project Joint Secretary to the Government of India

in the Ministry of Tourism or the Secretary to a

State Government dealing with subject

of tourism.

3C. Water Supply Projects Collector/District Magistrate/Deputy

Commissioner of the District in which the project is located

3D Pipeline projects for the transporation of crude Ministry of Petroleum and Natural Gas.

oil, petroleum products or natural gas.

3E (a) Digital Cinema development projects Ministry of Information and Broadcasting.

(b) Digital head end project

3F. Monorail projects for urban public transport Concerned State Government

3G. Project for installation of mechanized handling systems Ministry of Agriculture

and pallet racking systems in mandis and warehouses

for food grains, sugar and horticulture produce.

3H. Cold storage, cold room (including farm level pre-cooling) or Ministry of Food processing Industries

industrial projects for preservation, storage or processing of

agricultureal, apiary, horticultural, dairy, poultry, aquatic

and marine produce and meat

3I. Green house set up for protected cultivation of Ministry of Agriculture

horticulture and floriculture produce.

4. Any other Plant and Project. Concerned Administrative Ministry or

Department.

Projects Notified under Heading 98.01

[Notfn. No. 42/23.7.1996 as amended by 14/97,45/97,29/99,21/00,103/01,24/02,91/02,28/03,

15/04, 18/06, 46/06, 7/07, 31/07,18/10, 17/12.]

In exercise of the powers conferred by sub-item (6) of heading No.98.01 of the First

Schedule to the Customs Tariff Act, 1975 (51 of 1975), the Central Government, having regard to

the economic development of the country, hereby notifies each of the projects specified below as

a project for the purpose of assesment under the said heading.

1. Port Mechanical Ore Handling Plant.

2. Salaya-Koyali Mathura Crude Oil Pipe Line Project.

3. Bombay Water Supply and Severage Project

___________________________________________________________________________________________________

1. 2. 3.

___________________________________________________________________________________________________

Section- XXI 645 Chapter-98

4. Mathura-Delhi-Ambala-Jullundur Product Pipeline Project.

5. Operation Flood III Project of National Dairy Development Board.

6. Bombay-Pune Product Pipeline Project.

7. Gas Pipeline Projects of the Gas Authority of India Ltd.

8. Pipeline Expansion Phase IIIA - Jorhat to Bongaigaon.

9. Railway Electrification Project.

10. Research and Development Project of Research, Designs and Standards

Organisation of the Indian Railway, Lucknow.

11. Calcutta Metro Railway project.

12. Konkan Railway project.

13. Kandla-Bhatinda Pipeline Project.

14. SEA-ME-WE2 Submarine Cable project.

15. National Stock Exchange Project.

16. Port Development Projects.

17. Bombay - Manmad Manglya (Indore) Pipeline Project.

18. Vishakh - Vijaywada-Secunderabad Pipeline Project.

19. Power Transmission Projects of 66 KV and above.

20. Road Development Projects of the National Highways Authority of India

21. Urban Distribution Development Projects of Andhra Pradesh State

Electricity Board

in Hyderabad and Tirupathi Towns.

22. Cochin International Airport project.

23. LNG Terminal of Petronet LNG Project at Dahej

24. Koyali-Navagam-Viramgam-Sidhpur-Kot-Sanganer Product Pipeline

Project.

25. Delhi MRTS Project.

26. Drinking Water Supply Projects for supply of water for human or animal

consumption.

Explanation- Drinking water supply Project includes a plant for

desalination, demineralization or purification of water or for carrying out

any similar process of processes intended to make the water fit for human

or animal consumption, but does not include a plant supplying water for

industrial purposes.

26A. Water Supply Projects

Explanation- Water supply Project includes a plant for desalination,

demineralization or purification of water or for carrying out any similar

process or processes intended to make the water fit for agricultural or

industrial use.

27. LNG Terminal Project of M/s Hazira LNG Private Limited at Hazira

(Gujarat).

28. Mandra-Kandla Crude Oil Pipeline Project.

29. Panipat-Rewari Product Pipeline Project.

30. Project for conversion of Kandla-Panipat Section of Kandla-Bhatinda Pipeline

Project into Crude Oil service.

31. Project for LNG Regassification Plant.

32. Aerial Passenger Ropeway Project".

Section- XXI 646 Chapter-98

33. Pipeline Projects for transporation of crude oil, petroleum products or natural

gas.

34. National Automotive Testing and Research and Development Infrastructure

Project ( NATRIP).

35. Airport development projects

36. Metro Road projects.

37. Digital Cinema development projects.

38. Monorail projects for urban public transport.

39. Digital headend projects.

40. Project for installation of mechanized handling systems and pallet racking

systems in mandis and warehouses for food grains, sugar and horticulture

produce.

41. Cold storage, cold room (including farm level pre-cooling) or industrial projects

for preservation, storage or processing of agricultureal, apiary, horticultural,

dairy, poultry, aquatic and marine produce and meat.

42. Green house set up for protected cultivation of horticulture and floriculture

produce.

EXEMPTION NOTIFICATIONS

Exemption to Water Supply Projects:

[Notfn. No. 14/04-Cus. dt. 8.1.2004]

In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act,

1962 (52 of 1962), the Central Government, being satisfied that is is necessary in the public interest

so to do, hereby exempts Water Supply Projects, falling under heading 9801 of the First Schedule

to the Customs Tariff Act, 1975 (51 of 1975), from the whole of the duty of customs leviable thereon

under the said First Schedule, and from whole of the additional duty leviable thereon under section

3 of the said Customs Tariff Act.

Explanation: Water Supply project includes a plant for desalination, demineralization or

purification of water or for carrying out any similar process or processes intended to make the water

fit for agricultural or industrial use.

2. This notification shall come into force on the 9th day of January, 2004

Concessional rate of duty for specified goods imported by a passenger as baggage

[Notfn. No. 49/23.7.1996 as amended by 23/97, 28/98, 37/99, 20/00, 20/01, 24/02,

122/03, 12/04 and 32/07.]

In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act,

1962 (52 of 1962), the Central Government, being satisfied that it is necessary in the public interest

so to do, hereby exempts the goods specified in column (2) of the Table hereto annexed and falling

under heading No.98.03 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), when

imported into India by a passenger as baggage, from so much of that portion of the duty of customs

leviable thereon under the said First Schedule, as is in excess of the amount calculated at the rate

specified in the corresponding entry in column (3) of the said Table, but for the classification of

such goods under heading No.98.03 of the said First Schedule, subject to the conditions, if any

specified in the corresponding entry in column (4) of the said Table.

Section- XXI 647 Chapter-98

TABLE

_________________________________________________________________________________________________________

S.No. Description Rate Condition

_________________________________________________________________________________________________________

(1) (2) (3) (4)

_________________________________________________________________________________________________________

1. The Following, namely:- Rate specified Conditions, if

(I) Goods specified in the notification of the Government in the said any, specified

of India in the Ministry of Finance (Department of Revenue notifications in the said

and Banking or Department of Revenue and insurance or notifications

Deptt. of Revenue as the case may be.) Nos. 174/66-Customs,

dated the 24th September, 1966, 80/70-Customs, dated the

29th August, 1970, 207/89-Customs, dated the 17th July, 1989.

148/94-Customs, dated the 13th July, 1994 (S.Nos. 5 and 6).

154/94-Customs, dated the 13th July, 1994 and 51/96 Customs,

dated the 23rd July, 1996 and 121/2003-Customs, dated the

1st August, 2003

(II) The goods specified in the Table to the notification of the

Government of India in the Ministry of Finance (Department of

Revenue) :- No. 21/2002- Customs dt. 1st March, 2002 against

Sl. No. 83, in column (3) at item Nos. (A) and (C) S.No.132, in

column (3) at item No.(1) (Cinematograph films, exposed but not

developed) and S.Nos. 140, 160, 161 (only blank travellers

Cheques), 164, 245, 247, 349, 363, 367, 369 and 370.

(III) The goods specified against item Nos. A and B of the Table

to the notification of the Government of India in the Ministry of

Finance (Department of Revenue) No.37/96-Customs, dated the

23rd July, 1996.

2. Newspapers (including periodicals falling within heading Rate specified in --

No.49.02, music manuscripts falling within heading No.49.04, the said First

topographical plans falling within heading No. 49.05, plans, Schedule

drawings and designs falling within heading no. 49.06 postage

stamps falling within heading No. 97.04 and medals falling under

heading No.97.05 of the First Schedule to the said Customs Tariff Act.

__________________________________________________________________________________________

Exemption to one laptop computer when imported into India by a passenger of the age of

18 years or above:

[Notfn. No. 11/04-Cus. dt. 8.1.2004]

In exercise of the powers conferred by sub-section (1) of section 25 of the Customs

Act, 1962 (52 of 1962), the Central Government, being satisfied that it is necessary in the public

interest so to do, hereby exempts one laptop computer (notebook computer) falling under tariff

item 98030000 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) when imported

into India by a passenger of the age of 18 years or above (other than member of crew ) from

whole of the duty of Customs leviable thereon under the First Schedule to the said Customs

Tariff Act.

2. This notification shall come into force on and from the 9

th

day of January 2004.

Section- XXI 648 Chapter-98

Ch. 98: Refund of additional duty of Customs in certain cases:

[Section 124 of the Finance Bill 2002.]

Notwithstanding anything contained in section 25 of the Customs Act, barge mounted

power plants, falling under heading 98.01 of the First Schedule to the Customs Tariff Act, shall

be deemed to have been exempted from the whole of the additional duty of customs leviable

thereon under sub-section ( 1) of section 3 of the Customs Tariff Act, within the period

commencing from the 8th December, 2000 and ending with the 28th February, 2002 (both the

dates inclusive) and accordingly, notwithstanding anything contained in any judgment, decree or

order of any court, tribunal or other authority, barge mounted power plants shall be deemed to be,

and always to have been, exempted from the said additional duty of customs as if the exemption

given by this sub-section had been in force at all material times.

(2) For the purposes of sub-section ( 1), the Central Government shall have and shall be

deemed to have the power to exempt the goods referred to in the said sub-section with

retrospective effect as if the Central Government had the power to exempt the said goods under

sub-section ( 1) of section 25 of the Customs Act, retrospectively at all material times.

(3) Refund shall be made of all such additional duty of customs which have been collected

but which would have not been so collected if the exemption referred to in sub-section ( 1) had

been in force at all material times.

(4) Notwithstanding anything contained in section 27 of the Customs Act, an application for

the claim of refund of the additional duty of customs under sub-section (3) shall be made within

six months from the date on which the Finance Bill, 2002 receives the assent of the President.

You might also like

- RevReg 13-77Document12 pagesRevReg 13-77dppascua100% (1)

- Cement Industry Cost StructureDocument27 pagesCement Industry Cost StructureAshok Verma83% (6)

- FAR-AMT 2021: Federal Aviation Regulations for Aviation Maintenance TechniciansFrom EverandFAR-AMT 2021: Federal Aviation Regulations for Aviation Maintenance TechniciansRating: 5 out of 5 stars5/5 (2)

- Project On CSR, NTPCDocument36 pagesProject On CSR, NTPCBINAYAK SHANKAR50% (4)

- An Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionDocument21 pagesAn Import Is Any Good or Service Brought Into One Country From Another Country in A Legitimate FashionsolankikavitaNo ratings yet

- IV. Job Work Notifications General Exemption No. 23Document6 pagesIV. Job Work Notifications General Exemption No. 23Samy JainNo ratings yet

- Section XXI Chapter-98: ITC (HS), 2012 Schedule 1 - Import PolicyDocument4 pagesSection XXI Chapter-98: ITC (HS), 2012 Schedule 1 - Import Policysbos1No ratings yet

- Cost Rules Modified 18-11-13 On Discussion of CAB Officers 2Document8 pagesCost Rules Modified 18-11-13 On Discussion of CAB Officers 2bhuban020383No ratings yet

- Central VATDocument13 pagesCentral VATBharat ChoudharyNo ratings yet

- PRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsDocument6 pagesPRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsSudeep DuttNo ratings yet

- Fifth Schedule PDFDocument56 pagesFifth Schedule PDFAkber LakhaniNo ratings yet

- 2023111715113244746FifthSchedule 23 24Document74 pages2023111715113244746FifthSchedule 23 24sotodgpecNo ratings yet

- Companies CRAR 2019Document53 pagesCompanies CRAR 2019trijya.cma20No ratings yet

- Cenvat Credit Rules, 2004Document21 pagesCenvat Credit Rules, 2004Himanshu SawNo ratings yet

- Government of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)Document5 pagesGovernment of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)MOHSINNo ratings yet

- Custom & Excise DutyDocument177 pagesCustom & Excise DutysnehapargheeNo ratings yet

- Income Tax Act For A.Y. 2010-11Document2 pagesIncome Tax Act For A.Y. 2010-11sanjayedsNo ratings yet

- Ix. Exemption To Certain Goods and IndustriesDocument7 pagesIx. Exemption To Certain Goods and IndustriesManish GautamNo ratings yet

- 0775 31072006 Ipo PDFDocument80 pages0775 31072006 Ipo PDFsadafNo ratings yet

- Rates of Depreciation As Per Income Tax Act For A.YDocument11 pagesRates of Depreciation As Per Income Tax Act For A.YAshish SalujaNo ratings yet

- Handbook of Procedures (Vol. I) : 27 August 2009 - 31 March 2014Document21 pagesHandbook of Procedures (Vol. I) : 27 August 2009 - 31 March 2014connect2rahul4204No ratings yet

- Input Tax Credit Under GST Law FinalDocument7 pagesInput Tax Credit Under GST Law FinalBiswaRanjanPandaNo ratings yet

- Cenvat Credit ExplainedDocument21 pagesCenvat Credit ExplainedSameer HusainNo ratings yet

- Sez Rules2006Document94 pagesSez Rules2006bighnesh_nistNo ratings yet

- Sro 327-2008Document22 pagesSro 327-2008abid205No ratings yet

- PdfjoinerDocument115 pagesPdfjoinerSM TutorialsNo ratings yet

- PGBP Nov'22Document47 pagesPGBP Nov'22viraj042614No ratings yet

- Chapter 12Document32 pagesChapter 12Ram SskNo ratings yet

- RR No. 28-2020Document4 pagesRR No. 28-2020Jayvee OlayresNo ratings yet

- Sro 565-2006Document44 pagesSro 565-2006Abdullah Jathol100% (1)

- Amendment TaxDocument3 pagesAmendment TaxRaman SapraNo ratings yet

- ITC (HS), 2017 Schedule 1 Import PolicyDocument26 pagesITC (HS), 2017 Schedule 1 Import PolicyRaj AdityNo ratings yet

- A Missoula County Air Quality Permit Will Be Required For Locations Within Missoula County. A List of The Permitted Equipment Is Contained in Section I.A of The PermitDocument20 pagesA Missoula County Air Quality Permit Will Be Required For Locations Within Missoula County. A List of The Permitted Equipment Is Contained in Section I.A of The Permitmacross086No ratings yet

- Modvat Re-Christened As Cenvat - Modvat Has Been Renamed As 'Cenvat' W.E.F. 1-4-2000Document9 pagesModvat Re-Christened As Cenvat - Modvat Has Been Renamed As 'Cenvat' W.E.F. 1-4-2000sangramdeyNo ratings yet

- Notes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Document21 pagesNotes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Aayushi AroraNo ratings yet

- Depreciation Rates As Per Income Tax Act For 2015-16Document13 pagesDepreciation Rates As Per Income Tax Act For 2015-16rao_gmailNo ratings yet

- Sro 327 PDFDocument20 pagesSro 327 PDFOmer ToqirNo ratings yet

- Cost Accounting Records (Petroleum Industry) Rules 2002Document42 pagesCost Accounting Records (Petroleum Industry) Rules 2002api-3705877No ratings yet

- Sub: Technology Upgradation Fund Scheme (TUFS)Document5 pagesSub: Technology Upgradation Fund Scheme (TUFS)palanisamyannurNo ratings yet

- Second Schedule (Fifth Schedule)Document95 pagesSecond Schedule (Fifth Schedule)Adnan KhanNo ratings yet

- DTRERules Updatedversion Upto12.09.2019Document17 pagesDTRERules Updatedversion Upto12.09.2019abid205No ratings yet

- Hs Final 2017Document506 pagesHs Final 2017samerkalmoniNo ratings yet

- 18.07.25 - Seminar On Customs Facilities and Tax IncentivesDocument57 pages18.07.25 - Seminar On Customs Facilities and Tax IncentivesMuhammad AdnanNo ratings yet

- SEZ RULES, 2006: Incorporating Amendments Till May, 2009Document149 pagesSEZ RULES, 2006: Incorporating Amendments Till May, 2009tanwar_yogiNo ratings yet

- Industrial Entreprise Act 1992Document17 pagesIndustrial Entreprise Act 1992Dawa Lakje SherpaNo ratings yet

- file CENVAT CREDIT RULES, 2004Document26 pagesfile CENVAT CREDIT RULES, 2004vvalliraoNo ratings yet

- 2008SRO549Document5 pages2008SRO549Aakash RoyNo ratings yet

- CENVAT: A Fresh Perspective: Vivek Kohli, Ashwani Sharma, Anuj KakkarDocument8 pagesCENVAT: A Fresh Perspective: Vivek Kohli, Ashwani Sharma, Anuj Kakkarraju7971No ratings yet

- Cex0606 PDFDocument19 pagesCex0606 PDFbravoswagatNo ratings yet

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDocument10 pagesCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatNo ratings yet

- Guidelines - ManufacturerDocument4 pagesGuidelines - Manufacturerfcjr79No ratings yet

- Central Excise Tariff Notification No.12/2014 Dated 11th July, 2014Document6 pagesCentral Excise Tariff Notification No.12/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Notification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The CentralDocument5 pagesNotification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The Centralpatelpratik1972No ratings yet

- Indirect Tax AmendmentsDocument46 pagesIndirect Tax AmendmentsCeciro LodhamNo ratings yet

- Sro 575 Updated 200313Document40 pagesSro 575 Updated 200313Asaad ZahirNo ratings yet

- Dep Income Tax ActDocument7 pagesDep Income Tax ActVikash SuranaNo ratings yet

- Technology Up-Gradation Fund Scheme For Handloom Sector 1Document11 pagesTechnology Up-Gradation Fund Scheme For Handloom Sector 1designerbob21No ratings yet

- HBP2023 Chapter10Document30 pagesHBP2023 Chapter10hiteshNo ratings yet

- Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Invoice: Original Duplicate Triplicate QuadruplicateDocument2 pagesInvoice: Original Duplicate Triplicate Quadruplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Form E.R.-8 Original/DuplicateDocument4 pagesForm E.R.-8 Original/Duplicateశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Formats & Procedures: Import of Capital GoodsDocument16 pagesFormats & Procedures: Import of Capital Goodsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Before The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32EDocument3 pagesBefore The Customs and Central Excise Settlement Commission - Bench at - Form of Application For Settlement of A Case Under Section 32Eశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cenvat Credit: V S DateyDocument44 pagesCenvat Credit: V S Dateyశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- CLM-Logistics at LargeDocument21 pagesCLM-Logistics at Largeశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Registration Form: Dr. Radha RaghuramapatruniDocument2 pagesRegistration Form: Dr. Radha Raghuramapatruniశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Materials ManagementDocument3 pagesMaterials Managementశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Cold ChainDocument7 pagesCold Chainశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Explanation of CBEC and Non-CBEC Currency CalculationsDocument28 pagesExplanation of CBEC and Non-CBEC Currency Calculationsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Ebrc'-Faqs: S Questions GuidelinesDocument7 pagesEbrc'-Faqs: S Questions Guidelinesశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Electronic Fund Transfer HelpDocument11 pagesElectronic Fund Transfer Helpశ్రీనివాసకిరణ్కుమార్చతుర్వేదుల100% (1)

- Anilksinha@nic - in Rkjain-Ub@nic - in Jpm@nic - in S.raja@nic - in Rnyadav@nic - inDocument2 pagesAnilksinha@nic - in Rkjain-Ub@nic - in Jpm@nic - in S.raja@nic - in Rnyadav@nic - inశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Export Procedures in India - Export Documents Required, Documents Required For ExportDocument2 pagesExport Procedures in India - Export Documents Required, Documents Required For Exportశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Modified TufsDocument114 pagesModified Tufsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Tufsbookletsection4 Annex1Document38 pagesTufsbookletsection4 Annex1శ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Powerinfo PDFDocument62 pagesPowerinfo PDFravi196No ratings yet

- NTPC TrainingDocument32 pagesNTPC TrainingparvejNo ratings yet

- Solar Monthly Update March 2016Document12 pagesSolar Monthly Update March 2016Amrita SinghNo ratings yet

- Current Affairs Q&A PDF - July 2021 by AffairsCloud 1Document267 pagesCurrent Affairs Q&A PDF - July 2021 by AffairsCloud 1Darshan KaushikNo ratings yet

- Disha Publication Indian PanoramaDocument16 pagesDisha Publication Indian PanoramaanujNo ratings yet

- RST Order For FY 2022-23Document291 pagesRST Order For FY 2022-23sreevenkatesh.t8448No ratings yet

- Adfl Corporate BrocheureDocument6 pagesAdfl Corporate Brocheurepranjal92pandeyNo ratings yet

- Govt. Job Notification MCQ Corner Based On Current AffairsDocument12 pagesGovt. Job Notification MCQ Corner Based On Current Affairscareer saarthiNo ratings yet

- Final Project ReportDocument101 pagesFinal Project ReportSourab Khajuria0% (1)

- Estrin - Privatization in Developing CountriesDocument45 pagesEstrin - Privatization in Developing CountriesNuong PhanNo ratings yet

- Private SectorDocument33 pagesPrivate SectorApurv BajajNo ratings yet

- Chemin Profile PDFDocument146 pagesChemin Profile PDFElectrical CheminNo ratings yet

- Mou System: SPS Solanki AGM (CP)Document82 pagesMou System: SPS Solanki AGM (CP)SamNo ratings yet

- Gktoday MCQ June 2023Document55 pagesGktoday MCQ June 2023Nafis UnnisaNo ratings yet

- NTPC Ar 2011 12Document244 pagesNTPC Ar 2011 12Sanchit AgarwalNo ratings yet

- April MCQ (Eng) by AffairsCloudDocument292 pagesApril MCQ (Eng) by AffairsCloudworkmail.kekaNo ratings yet

- Organization Study Conducted at NTPC, KorbaDocument81 pagesOrganization Study Conducted at NTPC, KorbaAnsuman Singh ParidaNo ratings yet

- Plant Operational Data of NTPC StationsDocument47 pagesPlant Operational Data of NTPC Stationsrohit_me083No ratings yet

- Toshiba Motors IN India Tmeic Motors Manufactured AT T.D.Power India LTD BangaloreDocument12 pagesToshiba Motors IN India Tmeic Motors Manufactured AT T.D.Power India LTD BangalorepkguptaqaqcNo ratings yet

- Session 4 Module 2 Steam - Turbine - OptimizationDocument34 pagesSession 4 Module 2 Steam - Turbine - OptimizationArjun Mac100% (1)

- " " NTPC (Dadri) : BY: Kulvinder Singh B. Tech (IV Year) Electronics & Communication DepartmentDocument17 pages" " NTPC (Dadri) : BY: Kulvinder Singh B. Tech (IV Year) Electronics & Communication DepartmentKulvinder SinghNo ratings yet

- ThermalDocument19 pagesThermaldakshinNo ratings yet

- 8216 ChronologyDocument4 pages8216 Chronologybanker_mcaNo ratings yet

- CLSA Power Report (Jun 11)Document300 pagesCLSA Power Report (Jun 11)Deepak Saheb Gupta100% (1)

- Recruitment and Selection Process at DSCLDocument51 pagesRecruitment and Selection Process at DSCLHemraj NagarNo ratings yet

- MPERC TarOrd 2011 12 (Ii) PDFDocument204 pagesMPERC TarOrd 2011 12 (Ii) PDFSoumyadeep MaityNo ratings yet

- Corporate Carbon Accounting and Climate Responsibility: A Case of India's Largest Power ProducerDocument24 pagesCorporate Carbon Accounting and Climate Responsibility: A Case of India's Largest Power ProducerShivaraj JayakumarNo ratings yet

- List of Abbreviations: Abbreviation Full FormDocument2 pagesList of Abbreviations: Abbreviation Full FormSandhya JaiswalNo ratings yet

- DocumentDocument452 pagesDocumentRashmi KumariNo ratings yet