3 Income Taxation Final PDF

3 Income Taxation Final PDF

Uploaded by

william091090Copyright:

Available Formats

3 Income Taxation Final PDF

3 Income Taxation Final PDF

Uploaded by

william091090Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

3 Income Taxation Final PDF

3 Income Taxation Final PDF

Uploaded by

william091090Copyright:

Available Formats

TAXATION LAW | Income Taxation

SEC. 22-23

DEFINITION AND PRINCIPLES

of tax rates and covered by different tax

returns (global system).

INCOME all such gains or profits from

whatever source. It is a flow of services

rendered by capital by the payment of money

from it or any benefit rendered by a fund of

capital in relation to such fund through a

period of time (Madrigal v. Rafferty, G.R. No.

12287, August 8, 1918).

An income is an amount of money coming to a

person or corporation within a specified time,

whether as payment for services, interest or

profit from investment. Unless otherwise

specified, income means cash or its equivalent

(Conwi v. Commissioner, G.R. No. 48532

August 31, 1992).

Income includes earnings, lawfully or

unlawfully acquired, without consensual

recognition, express or implied, of an

obligation to repay and without restriction as to

their disposition (James v. U.S., 366 U.S.

213).

Features of Philippine Income Tax

1. Direct tax tax burden is borne by the

income tax recipient upon whom the tax is

imposed

2. Progressive tax tax rate increases as the

tax base increases. It is founded on the

ability to pay principle.

3. Comprehensive system adopts the

citizenship

principle,

the

residence

principle, and the source principle.

4. Semi-schedular or semi-global taxable

income (i.e. gross income less allowable

deductions and exemptions) is subjected

to one graduated tax rates (if an individual)

or normal corporate income tax rate (if a

corporation) (scheduler system); Passive

investment incomes subject to final tax

and capital gains from sale of shares of

stocks of a domestic corporation and real

properties remain subject to different sets

5. American in origin- Great weight should be

given to the construction placed upon a

revenue law, whose meaning is doubtful,

by the department charged with its

execution (Madrigal v. Rafferty, supra).

Functions of Income Tax

1. To provide large amounts of revenues

2. To offset regressive taxes

3. To mitigate the evils arising from

inequalities in the distribution of income

and wealth which are considered

deterrents to social progress, by a

progressive scheme of taxation. (Report of

the Tax Commission of the Phil., vol. II,

1938, p. 12)

Basis of the right of the government to

tax income: PARTNERSHIP THEORY

The right of the government to tax income

emanates from its partnership in the

production of income by providing the

protection, resources, incentive and proper

climate

for

such

production.

(CIR v. Lednicky, G.R. L-18169, July 31,

1964)

Tests in determining income

1. Flow of Wealth Test The test of

taxability is the "source"- the property,

activity or service that produced the

income. Determine whether any gain was

derived from the transaction.

2. Realization/Severance Test also

known as the Macomber test. There is no

taxable income until there is a separation

from capital of something of exchangeable

value, thereby supplying the realization or

transmutation which would result in the

receipt of income. The essence of the test

is that in order for income to be taxed, it is

to be severed from the property from

which it was derived.

EXECUTIVE COMMITTEE:

MIKHAIL MAVERICK TUMACDER overall chairperson, ARTHUR JOHN ARONGAT chairperson for academics, JASSEN RALPH LEE

chairperson for hotel operations, KIMBERLY JOY BARAOIDAN vice-chairperson for operations, KATRINA AYN AYZA FALLORINA CUE

vice-chairperson for secretariat, IAN MICHEL GEONANGA vice-chairperson for finance, JOSE ANGELO DAVID vice-chairperson for

electronic data processing, IAN LUIS AGUILA vice-chairperson for logistics

SUBJECT COMMITTEE:

RAHABANSA DAGALANGIT subject chair, ARIANNE MALABANAN assistant subject chair, ARMIDA GERONIMO edp, DIANA

FAJARDO general principles, AVRIL ELAINE GAMBOA income taxation, MADONNA LYN CASARES tax administration and

enforcement, BRYANT CANASA value-added tax, SHERWIN MARASIGAN transfer taxes, APRIL MANUEL and GABRIEL GUY

OLANDESCA nirc remedies, ARNALDO MALABANAN JR. court of tax appeals, JOSE MARI ANGELO DIONIO real property and local

taxation, RAY ANN CO tariff and customs laws

MEMBERS:

Baby Perian Arcega, Ethel Joy Arriola, Adrian Aumentado, Paula Tricia Bagnes , Benedicto Beley, Jingle Chua, Luis Voltaire

Formilleza, Aiza Gonzales, Roniel Muoz, Gerwin Panghulan, Maria Katrina Rivera, April Salamatin, Eve Hazel Santos, Salvador

Andrew Tugade, Neo Valerio, and Janice Ivy Valparaiso

Income Taxation | TAXATION LAW

The Court analogized "capital" as being

separate from "income" in the way that a

tree is separate from its fruit. It requires

the presence of a tax event which is an

event which triggers a transfer of

ownership of property. (Eisner v.

Macomber, 252 US 189)

3. Claim of Right Doctrine a taxable gain

is conditioned upon the presence of a

claim of right to the alleged gain and the

absence of a definite unconditional

obligation to return or repay that which

would otherwise constitute a gain.

The taxpayer needs unlimited control on

the use or disposition of the funds, and the

taxpayer must hold and treat the income

as his own.

Notes:

The claim of right doctrine typically

applies where a taxpayer receives an

income item in one year and reports it

as income, even though there is a

chance that the taxpayer will have to

repay the amount in a future year. If

the amount is repaid in a future tax

year, the doctrine allows the taxpayer

an income tax deduction in the year of

REPAYMENT.

The money received under a mistake

of fact is a realized income. Though

embezzled funds are not included in

the enumeration, the same is taxable

under the claim of right doctrine. This

is an exception to the rule that if there

is an obligation to return, there is a

mere return of capital. In the case of

embezzled funds, there is no

consensual agreement that there is an

obligation to return.

Principle of Constructive Receipt of

Income - Income which is credited to the

account of, or set apart for a taxpayer and

which may be drawn upon by him at any

time is subject to tax for the year during

which so credited or set apart, although

not then actually reduced to possession.

Examples of income constructively

received are:

a. Matured interest coupons, due and

payable, not yet collected by the

taxpayer;

b. Interest credited on savings bank

deposit;

c.

Dividends applied by the corporation

against the indebtedness of a

stockholder;

d. Intended payment deposited in court

(e.g. rental payments refused by the

lessor, when the lessee tendered

payment and the latter made a judicial

deposit of the rental due.)

e. Share in the profits of a partner in a

general professional partnership.

4. All-events Test For income or expense

to accrue, this test requires: (1) fixing of a

right to income or liability to pay; and (2)

the availability of the reasonable accurate

determination of such income or liability.

The amount of liability does not have to be

determined exactly; it must be determined

with reasonable accuracy. (CIR v.

Isabela Cultural Corporation, G.R. No.

172231, Feb. 12, 2007)

5. Economic benefit test or doctrine of

proprietary interest. It states that any

economic benefit to the employee that

increases his net worth, whatever may

have been the mode by which it is

effected, is taxable. Thus, in stock options,

the difference between the fair market

value of the shares at the time the option

is exercised and the option price

constitutes

additional

compensation

income to the employee at the time of

exercise (not upon the grant or vesting of

right) (Commissioner v. Smith, 324 US

177)

6. Control Test power to procure the

payment of income and enjoy the benefit

thereof (Helvering v. Horst, 311 U.S. 112)

Capital vs. Income (Madrigal v. Rafferty,

supra)

Income

Capital

Denotes a flow of

wealth during a definite

period of time. All

wealth other than as a

mere return of capital.

Service of wealth

Income is subject to

tax

Fruit

Fund or property,

existing at one distinct

point of time, which

can be used in

producing goods or

services

Wealth

Return of capital is not

subject to tax

Tree

Requisites for taxability of income

1. There must be a gain or profit whether in

cash or its equivalent;

2. The gain must be realized or received;

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

49

TAXATION LAW | Income Taxation

Exception: If by reason of appraisal, the

cost basis of property is increased and the

resulting basis is used as the new tax

base for purposes of computing the

allowable depreciation expense, the net

difference between the original cost basis

and new basis due to appraisal is taxable

under the economic benefit principle. (BIR

Ruling No. 029-98)

Note: There is difference between a

realized income and a recognized income.

An income is realized if there is a gain or

profit derived from a closed and completed

transaction. An income is recognized if

there is a provision of law recognizing or

taxing that income. Thus, not all realized

income is taxable. To be taxable, an

income must be realized and at the same

time, recognized.

2.

3.

4.

5.

3. The gain must NOT be excluded by law or

treaty from taxation.

6.

Types of Taxable Income

1. Compensation Income income derived

from the rendering of services under an

employer-employee relationship.

2. Professional Income fees derived from

engaging in an endeavor requiring special

training as professional as a means of

livelihood, which includes, but is not

limited to the fees of CPAs, doctors,

lawyers, engineers and the like.

3. Business Income gains or profits

derived from rendering services, selling

merchandise, manufacturing products,

farming and long-term construction

contracts.

4. Passive Income income in which the

taxpayer merely waits for the amount to

come in, which includes, but is not limited

to, interest income, royalty income,

dividend income, winnings and prizes.

5. Capital Gain gain from dealings in

capital assets.

Significance of Knowing the Type of

Income

It is important to know the types of income

realized by the taxpayer since the Philippines

has adopted the semi scheduler/ semi-global

tax system, thus some types of income are

subjected to a graduated tax rates others are

not.

General Principles of Income Taxation

(Sec. 23, NIRC)

1. A citizen of the Philippines, residing

therein is taxable on all income derived

50

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

from sources within and without the

Philippines.

A non-resident citizen is taxable only on

income derived from sources within the

Philippines.

An individual citizen of the Philippines who

is working and deriving income from

abroad as an Overseas Contract Worker

is taxable only on income from sources

within the Philippines: Provided, that a

seaman who is a citizen of the Philippines

and receives compensation abroad as a

member of the complement of a vessel

engaged exclusively in international trade

shall be treated as an overseas contract

worker.

An alien individual, whether a resident or

not of the Philippines is taxable only on

income derived from sources within the

Philippines.

A domestic corporation is taxable on all

income derived from sources within and

without the Philippines.

A foreign corporation, whether engaged

or not in trade or business in the

Philippines is taxable only on income

derived

from

sources

within

the

Philippines.

Criteria in Imposing Philippine Income Tax

1. Citizenship Principle A citizen taxpayer

is subject to income tax:

a. On his worldwide income, if he resides

in the Philippines; or

b. Only on his income from sources

within the Philippines, IF he qualifies

as non-resident citizen. Hence, his

income from sources outside the

Philippines shall be exempt from

Philippine income tax.

2. Residence Principle a resident alien is

liable to pay income tax on his income

from sources within the Philippines but

exempt from tax on his income from

sources outside the Philippines.

3. Source Principle a non-resident alien is

subject to Philippine income tax because

he derives income from sources within the

Philippines such as dividend, interest, rent,

or royalty.

Classification of Sources of Income (Sec.

42, NIRC)

1. Income

from

sources

within

the

Philippines;

2. Income from sources without the

Philippines;

3. Income from sources partly within and

partly without the Philippines.

Income Taxation | TAXATION LAW

Factors in determining the source of

income (Source Rules)

1. Interests Residence of the debtor

2. Dividends Residence of the corporation

paying the dividend

3. Services Place of performance of the

service

4. Mining income location of the mines

5. Farming income place of farming

activities

6. Rentals and royalties Location of

property or interest in such property

7. Sale of real property Location of the

property

8. Sale of personal property

Rule:

a. Personal

property

PURCHASED

within and sold without or purchased

without and sold within - Country in

which sold

b. Personal property PRODUCED (in

whole or in part) by the taxpayer within

and sold without or produced (in whole

or in part) without and sold within Sources partly within and partly

without the Philippines

Exception: Sale of Shares of Stock in a

Domestic Corporation shall be treated as

derived entirely from sources within the

Philippines regardless of where said

shares are sold.

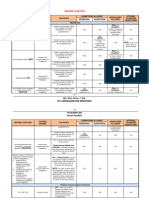

CLASSIFICATION OF TAXPAYER

TAXPAYER means any person subject to

tax imposed by Title II (Sec. 22 (N), NIRC)

I.

Individual

A. Citizen

1. Resident citizen (RC)

2. Non-resident citizen (NRC)

3. Filipinos occupying managerial

and/or

technical

positions

employed

by

Regional

Headquarters

(RHQ)

and

Regional Operating Headquarters

(ROH)

of

Multinational

Companies; by Offshore Banking

Units (OBU); or by petroleum

service

contractor

and

subcontractor

4. Minimum Wage Earner

B. Aliens

1. Resident aliens (RA)

2. Non-resident aliens (NRA)

a. Engaged in trade or business

within the Philippines (NRAETB)

b. Not engaged in trade or

business within the Philippines

(NRA-NETB)

3. Alien

individual

occupying

managerial

and/or

technical

positions employed by Regional

Headquarters

(RHQ)

and

Regional Operating Headquarters

(ROH)

of

Multinational

Companies; by Offshore Banking

Units (OBU); or by petroleum

service

contractor

and

subcontractor

II. Corporations

A. Domestic (DC)

Special Domestic Corporations

1. Proprietary

Educational

Institutions and Non-Profit

Hospitals

2. Government

Owned

and

Controlled

Corporations

(GOCC),

agencies

or

instrumentalities

3. Domestic Depositary Banks

(Foreign Currency Deposit

Units)

B. Foreign

1. Resident

foreign

corporation

(RFC)

Special Resident Foreign

Corporations

a. International Carriers

b. Offshore Banking Units

authorized by the BSP

c. Resident

Depositary

Banks (Foreign Currency

Deposit Units)

d. Regional

or

Area

Headquarters

of

Multinational Companies

e. ROH

of

Multinational

Companies

2. Non-resident foreign corporation

(NRFC)

Special Non-Resident Foreign

Corporations

a. Non-resident

Cinematographic

film

owners,

lessors

or

distributors

b. Non-resident owner or

lessor

of

vessels

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

51

TAXATION LAW | Income Taxation

c.

chartered by Philippine

nationals

Non-resident owner or

lessor of aircraft and other

equipment

III. Estates the taxable estate entity is one

under administration or judicial settlement.

If not under judicial, testamentary or

intestate proceedings, it is not a taxable

entity. The income thereof is taxable

directly to the heir or beneficiary.

IV. Trusts taxable trust:

A. Trust, the income of which is

accumulated

B. Trust, in which the fiduciary may, at

his discretion, either distribute or

accumulate the income

V. Partnerships

A. General Professional Partnership

B. Taxable or Business Partnership

C. General Co-partnership

INDIVIDUALS

A. Resident Citizen (RC) - citizen of the

Philippines residing therein is taxable on

all income derived from sources within and

without the Philippines.

B. Non-Resident Citizen (NRC) - taxed on

income derived from sources within the

Philippines. He is a citizen of the

Philippines who: (WELP)

1. Establishes to the satisfaction of the

Commissioner the fact of his physical

presence abroad with a definite

intention to reside therein;

2. Leaves the Philippines during the

taxable year to reside abroad, either

as an immigrant or for employment on

a permanent basis;

3. Works and derives income from

abroad and whose employment

thereat requires him to be physically

present abroad most of the time

during the taxable year;

Notes:

Exception: Overseas Contract

Worker (OCW) (OCWs are

OFWs not all OFWs are OCWs)

(See following discussion)

52

The phrase most of the time

means at least 183 (365 2)

days.

His presence abroad

however, need not be continuous.

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

(Mamalateo, Philippine

Taxation, p. 27)

Income

4. Has been previously considered as a

non-resident and who arrives in the

Philippines at anytime during the

taxable year to reside thereat

permanently shall be considered nonresident for the taxable year in which

he arrives in the Philippines with

respect to his income derived from

sources abroad until the date of his

arrival (Sec.22 (E), NIRC)

An OCW is an individual who is

physically present abroad most of the

time during the taxable year and

taxable only on income derived from

sources within the Philippines. (Sec.

23 (C), NIRC)

Note: To be considered as an OCW

they must be duly registered as such

with the POEA. (R.R. No. 1-2011)

Furthermore, they must have a valid

working contract to work abroad.

TNTs are therefore not covered.

Those who do not meet the above

qualifications

(and

are

nonimmigrants) are considered RC

because they work abroad without a

contract and they have not manifested

their intention to permanently reside

abroad.

Seaman is considered as an OCW

provided the following requirements

are met:

a. Receives

compensation

for

services rendered abroad as a

member of the complement of a

vessel; and

b. Such

vessel

is

engaged

exclusively in international trade.

Note: The taxpayer shall submit proof to

the Commissioner to show his intention of

leaving

the

Philippines

to

reside

permanently abroad or to return to and

reside in the Philippines as the case may

be.

C. Resident Alien (RA) - an individual who is

not a citizen of the Philippines but a

resident thereof is taxable only on income

derived from sources within the Philippines

(Sec.22 (F), NIRC).

One who comes to the Philippines for

a definite purpose which in its nature

Income Taxation | TAXATION LAW

would require an extended stay, and

makes his home temporarily in the

country becomes a resident alien.

Length of stay is indicative of intention

(alien who shall have stayed in the

Philippines for more than one year by

the end of the calendar year is a

resident alien).

One who considers the Philippines as

his domicile.

D. Non-Resident Alien Engaged in Trade

or Business (NRA-ETB) - an individual

whose residence is not within the

Philippines and who is not a citizen thereof

but doing business therein is taxable only

on income from sources within (Sec.22(G),

NIRC).

The term trade or business includes

the performance of the functions of a

public office (Sec. 22(S), NIRC) but

excludes performance of services by

the taxpayer as an employee (Sec. 22

(CC), NIRC).

A NRA who shall come to the

Philippines and stay for an aggregate

period of more than 180 days during

any calendar year shall be deemed a

non-resident alien doing business in

the

Philippines

Section

22(G)

notwithstanding. (Sec. 25(A)(1), NIRC)

R.R. 2-98 has expanded the coverage

of the term, engaged in trade or

business to include the exercise of a

profession.

E. Non-Resident Alien Not Engaged in

Trade or Business (NRA-NETB) - an

individual whose residence is without the

Philippines and who is not a citizen and

not doing business therein is liable for

income derived from sources within the

Philippines.

F. Special

Classes

of

Individual

Employees (see. p. 62 for complete list)

CORPORATIONS

A. Domestic Corporation (DC) - a

corporation created or organized in the

Philippines or under its laws and is liable

for income from sources within and

without. (Sec. 22(C), NIRC)

B. Resident Foreign Corporation (RFC) - a

corporation which is not domestic and

engaged in trade or business in the

Philippines is liable for income from

sources within.

The term doing business includes:

1. Soliciting orders, service contracts,

opening offices, whether called

"liaison" offices or branches;

2. Appointing

representatives

or

distributors

domiciled

in

the

Philippines or who in any calendar

year stay in the country for a period or

periods totaling one hundred eighty

(180) days or more;

3. Participating in the management,

supervision or control of any domestic

business, firm, entity or corporation in

the Philippines;

4. Any other act or acts that imply a

continuity of commercial dealings or

arrangements, and contemplate to

that extent the performance of acts or

works, or the exercise of some of the

functions normally incident to, and in

progressive

prosecution

of,

commercial gain or of the purpose and

object of the business organization;

(Sec. 3 (d), R.A. No. 7042, Foreign

Investments Act of 1991)

In order that a foreign corporation may

be regarded as doing business within

a State, there must be continuity of

conduct and intention to establish a

continuous business, such as the

appointment of a local agent, and not

one of a temporary character (CIR v.

British Overseas Airways Corp., G. R.

No. L-65773-74, April 30, 1987)

C. Non-Resident

Foreign

Corporation

(NRFC) - a corporation which is not

domestic and not engaged in trade or

business in the Philippines is liable for

income from sources within. (Sec. 22(I),

NIRC)

D. Special Types of Corporations

1. Proprietary educational institutions

and non-profit hospitals;

2. GOCCs, agencies or instrumentalities

of the government;

3. Domestic depositary bank (foreign

currency deposit units);

4. Resident on-line international air

carriers;

5. Offshore banking units;

6. Regional or Area Headquarters and

Regional Operating Headquarters of

multinational companies;

7. Non-resident cinematographic film

owners, lessors or distributors;

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

53

TAXATION LAW | Income Taxation

8. Non-resident owners or lessors of

vessels chartered by Philippine

nationals;

9. Non-resident lessors of aircraft,

machinery and other equipment.

Corporation Includes

1. Partnerships, no matter how created or

organized;

No matter how created or organized even if the partnership was created

pursuant to law or not, whether non-stock,

nonprofit, it is still deemed a corporation

because of the possibility of earning profits

from sources within the Philippines.

2. Joint-stock companies;

3. Joint accounts (cuentas en participacion)

4. Associations;

5. Insurance companies (Sec. 22(B), NIRC)

Corporation Excludes

1. General professional partnerships (GPPs);

A partnership formed by persons for the

sole

purpose

of

exercising

their

profession, NO part of the income of which

is derived from any trade or business.

Rule: a partnership is a corporation and

thus, subject to corporate income tax.

Exception: GPP

Exception to the exception: if the GPP

derives income from other sources, it is

considered a corporation, thus liable to

pay corporate income tax.

2. Joint venture or consortium formed for the

purpose of:

Undertaking construction projects; or

Engaging

in

petroleum,

coal,

geothermal

and

other

energy

operations pursuant to an operating or

consortium agreement under a service

contract with the Government.

Corporations Exempt from Income Tax

1. Those enumerated under Sec. 30, NIRC.

(see p. 73 for complete list)

Exempt corporations are subject to

income tax on their income from any

of their properties, real or personal, or

from any other activities conducted for

profit, regardless of the disposition

made of such income. They are only

exempt for income realized as such.

2. With respect to GOCCs:

Rule: These corporations are taxable as

any other corporation.

Exceptions:

a. Government

Service

Insurance

System (GSIS);

b. Social Security System (SSS);

c. Philippine

Heath

Insurance

Corporation (PHIC);

d. Philippine Charity Sweepstakes Office

(PCSO)

Note: PAGCOR is now subject to income

tax under R.A. No. 9337 but remains

exempt from the imposition of valueadded-tax (PAGCOR v. BIR, G.R. No.

172087, March 15, 2011)

3. Regional or Area Headquarters under Sec.

22 (DD), NIRC they are exempted

because they do not earn or derive income

from the Philippines

Note: Regional Operating Headquarters

under Sec. 22(EE) shall pay a tax of 10%

of their taxable income.

ESTATES AND TRUSTS

A. Estate refers to the mass of properties left

by a deceased person.

Note: The status of the estate is

determined by the status of the decedent

at the time of his death; so an estate, as

an income taxpayer can be a citizen or an

alien.

Rules on Taxability of Estate

When a person who owns property dies,

the following taxes are payable under the

provisions of the income tax law:

1. Income tax for individuals under Sec.

24 and 25 (to cover the period

beginning January to the time of

death);

2. Estate income tax under Sec. 60 if the

estate is under administration or

judicial settlement.

For Estates under Judicial Settlement

1. During the Pendency of the

Settlement

Rule: Subject to income tax in the

same manner as individuals

Exceptions:

a. Entitlement to personal exemption

is limited only to P20, 000;

54

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

Income Taxation | TAXATION LAW

Note:

ST

1

VIEW R.A. No. 9504

amended the NIRC increasing the

basic

personal

exemption

amounting to Fifty thousand pesos

(P50,000) for each individual

taxpayer. Estates and trusts are

considered in the Tax Code as

individual taxpayers and therefore

the exemption allowed to them

should also be increased from

P20,000 to P50,000.

nd

2 VIEW Tax exemptions

strictly construed.

Section

NIRC explicitly provides that

exemption allowed to estates

trusts is P20,000.

are

62,

the

and

nd

Better VIEW 2 View. One

must not read into the law what

obviously was not intended by

Congress. That would be nothing

less than judicial legislation.

b. No additional exemption is

allowed;

c. Distribution to the heirs during the

taxable year of estate income is

deductible from the taxable

income of the estate (distributed

income shall form part of the

respective heirs taxable income)

Where no such distribution to the

heirs is made during the taxable

year when the income is earned,

and such income is subjected to

income tax payment by the estate,

the subsequent distribution thereof

is no longer taxable on the part of

the recipient.

Summary

The taxable year is 2011.

Distributions were made in 2011.

Taxpayer

in 2011

Corpus or principal of the estate

Income in 2010

NONE

NONE

Income in 2011

Retention by the estate of the

income of 2011

HEIR

ESTATE

2. Termination of Judicial Settlement

(where the heirs still have NOT

divided the property)

If the heirs contribute to the estate

money, property, or industry with

intention to divide the profits

between/among them, an unregistered

partnership is created and the estate

becomes liable for the payment of

corporate income tax (Evangelista v.

Collector, G.R. No. L-9996, October

15, 1957)

If the heirs, without contributing

money, property or industry to improve

the estate, simply divide the fruits

thereof between/among themselves, a

co-ownership

is

created,

and

individual income tax is imposed on

the income received by each of the

heirs, payable in their separate and

individual capacity

(Pascual v.

Commissioner, G.R. No. L-78133,

October 18, 1988)

For Estates NOT under Judicial

Settlement

Pending the extrajudicial settlement, the

income tax liability depends on whether or

not the unregistered partnership or coownership is created.

B. Trusts

A right to the property, whether real or

personal, held by one person for the

benefit of another.

The status of a trust depends upon the

status of the grantor or trustor or creator of

the trust. Hence, a trust can also be a

citizen or an alien.

When Trusts Taxable:

1. Trust income is to be accumulated;

2. Trust income is to be distributed

currently by the fiduciary to the

beneficiaries;

3. Income collected by a guardian of an

infant which is to be held or distributed

as the court may direct;

4. Trust in which the fiduciary may, at his

discretion,

either

distribute

or

accumulate the income.

Taxability of the Income of a Trust

Rules:

1. If income is distributed to beneficiaries,

the beneficiaries shall file and pay the

tax;

2. If income is to be accumulated or held

for future distribution, the trustee or

beneficiary shall file and pay the tax

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

55

TAXATION LAW | Income Taxation

Exceptions:

1. In a revocable trust, the income of the

trust shall be included in computing the

taxable income of the grantor.

Revocable trust - where at any time the

power to revest in the grantor title to any

part of the corpus of the trust is vested

a. in the grantor either alone or in

conjunction with any person not

having a substantial adverse interest

in the disposition of such part of the

corpus or the income therefrom, or

b. in any person not having a

substantial adverse interest in the

disposition of such part of the

corpus or the income therefrom.

(Sec. 63, NIRC)

Note: The trustor, not the trust itself, is

subject to the payment of income tax on

the trust income

2. In a trust where the income is held for

the benefit of the grantor, the income of

the trust becomes income to the grantor;

3. In a trust administered in a foreign

country, the income of the trust,

undiminished by any amount distributed

to the beneficiaries shall be taxed to the

trustee.

Irrevocable Trusts irrevocable both as to

corpus and as to income

The trust itself, through the trustee or

fiduciary, is liable for the payment of

income tax.

Taxed exactly in the same way as

estates under judicial settlement and its

status as an individual is that of the

trustor.

It is entitled to the minimum personal

exemption (P20,000) and distribution of

trust income during the taxable year to

the beneficiaries is deductible from the

trusts taxable income.

Consolidation of Income of Two or More

Trusts

Where two or more trusts are created by the

same grantor, and the beneficiary in each

instance is the same person, the fiduciaries

shall file a separate return for, and pay the

income tax of, each trust, but the CIR shall

cause the income tax to be computed on the

consolidated taxable income of the several

trusts, allowing one exemption only of

P20,000.

The income tax computed on the

consolidated taxable income shall be

allocated between the several trusts in

proportion to their respective taxable income.

56

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

Summary

Income Is

Taxpayer

For the benefit of the grantor

GRANTOR

Retained by the trust

FIDUCIARY

Distributed to beneficiary

BENEFICIARY

Employees Trust is Exempted provided:

1. Employees trust must be part of a pension,

stock bonus or profit sharing plan of the

employer for the benefit of some or all of his

employees;

2. Contributions are made to the trust by such

employer, or such employees, or both;

3. Such contributions are made for the purpose of

distributing to such employees both the

earnings and principal of the fund accumulated

by the trust; and

4. The trust instrument makes it impossible for

any part of the trust corpus or income to be

used for or diverted to, purposes other than the

exclusive benefit of such employees (Sec.

60(B), NIRC).

Tax exemption is likewise to be enjoyed by the

income of the pension trust; otherwise, taxation

of those earnings would result in a diminution

of accumulated income and reduce whatever

the trust beneficiaries would receive out of the

trust fund (Commissioner v. CA, G.R. No.

95022, March 23, 1992).

Any amount actually distributed to any

employee or distributee shall be taxable to him

in the year in which so distributed to the extent

that it exceeds the amount contributed by such

employee or distributee.

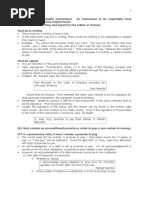

Table of Comparison Between Taxable

Estates and Taxable Trusts

Taxable Estate

Taxable Trust

The taxable income

shall be determined in

the same way as that

of individuals, but with

a special deduction for

any amount of income

paid,

credited

or

distributed to the heirs.

The taxable income

shall be determined in

the same way as that

of individuals, but with

A special deduction

for any amount of

income

paid,

credited

or

distributed to the

heirs.

A special deduction

for any amount of

the income applied

for the benefit of the

grantor.

The

exemption

is

20,000

The income tax rates

for individuals apply.

There is a creditable

withholding tax on the

heir of 15%.

The income tax return

shall be filed if the

The

exemption

is

20,000

The income tax rates

for individuals apply.

There is a creditable

withholding tax on the

heir of 15%.

The income tax return

shall be filed if the

Income Taxation | TAXATION LAW

Taxable Estate

Taxable Trust

gross

income

is

P20,000 or more and

the tax paid by the

executor

or

administrator.

gross

income

is

P20,000 or more and

the tax paid by the

fiduciary.

PARTNERSHIPS

Kinds of Partnership under the NIRC

A. General Professional Partnerships

formed by persons for the sole purpose of

exercising a common profession and no

part of the income of which is derived from

engaging in any trade or business. (Sec.

22 (B), NIRC).

B. Taxable OR Business Partnership:

1. All other partnerships no matter how

created or organized;

2. Includes unregistered joint ventures

and business partnerships

However,

unregistered

joint

ventures are not taxable as

corporations when:

a. Undertaking

construction

projects;

b. Engaged in petroleum, coal

and other energy operation

under a service contract with

the government.

C. General Co-Partnerships (GCP) or

companies

colectivas

are

legally

contemplated as corporations.

The partnership itself is subject to

corporate taxation while individual partners

are

considered

stockholders

and,

therefore, profits distributed to them by the

partnership are taxable as dividends

The taxable income for a taxable year,

after deducting the corporate income tax

imposed therein, shall be deemed to have

been actually or constructively received by

the partners in the same taxable year and

shall be taxed to them in their individual

capacity whether actually distributed or not

(Sec. 73(D), NIRC)

Liability of a Partnership

1. General Professional Partnership - not

subject to income tax, but the partners are

required to file returns of their income for

the purpose of furnishing information as to

the share of each partner in the net gain or

profit, which each partner shall include in

his individual return.

Partnership acts as withholding agent;

Net income (income for distribution)

shall be computed in the same

manner as a corporation and the

return is filed on or before April 15 of

each year.

The partners themselves are liable for

the payment of income tax in their

individual capacity computed on their

distributive shares of the partnership

profit.

2. Taxable or Business Partnership - income

tax is computed and taxed like that of a

corporation which is required to file a

quarterly corporate income tax return and

annual return due on or before April 15 of

the following year.

Liability of a Partner

Share Of A Partner

In GPP

Share of A Partner

In Taxable or

Business

Partnership

If net income, it shall

form part of the gross

income of each partner

based on his agreed

ratio subject to 10%

creditable withholding

tax.

If net income, it shall

be treated as dividend

and shall be subject to

a final tax as follows:

a. RC, NRC, RA 10%

b. NRA-ETB 20%

c. NRA-NETB 25%

If net loss, it may be

taken by the individual

partner in his return of

income.

If net loss, it may be

taken by the individual

partner in his return of

income;

Payments made to a

partner for services

rendered

shall

be

considered

as

compensation income

subject to Sec. 24(A).

Payments made to a

partner for services

rendered

shall

be

considered as ordinary

business

income

subject to Sec. 24(A).

Notes:

As a result of the application of the

Constructive Receipt of dividends by the

partners of a business partnership, they

are placed at a disadvantaged position vis-vis the stockholders of a corporation,

who would be subject to the 10% dividend

tax only when there is an actual

declaration of dividends and payment

thereof.

Compared to their counterpart partners of

a GPP, the partners of a business

partnership are placed at an even more

disadvantageous position because there is

a second-tier of taxation imposed on their

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

57

TAXATION LAW | Income Taxation

shares

of

the

partnership

profit.

(Mamalateo, Philippine Income Tax, 2004,

p. 42).

CO-OWNERSHIP

There is co-ownership when:

1. Two or more heirs inherit an undivided

property from a decedent;

2. A donor makes a gift of an undivided

property in favor of two or more donees.

Before partition of property:

It is NOT TAXABLE when the activities are

limited to the preservation of the co-owned

property and the collection of the income

therefrom. Each co-owner is taxed individually

on his distributive share. Before partition and

distribution, all the income belongs to all the

heirs.

After partition of property:

Should the co-owners invest the income of the

co-ownership

in

any income-producing

properties after partition, they would be

constituting themselves into an unregistered

partnership which is subject to income tax as a

corporation.

SEC. 24-26 TAX ON

INDIVIDUALS

subject to FINAL TAX, derived for each

taxable year by:

1. Resident citizen (RC) from all sources

within and without;

2. Non-resident citizen (NRC) including OCW

from all sources within;

3. Resident alien (RA) from all sources

within;

4. Non-resident alien engaged in trade or

business (NRA-ETB) from sources within;

(Sec. 24(A), NIRC)

Note: NRA-NETB is NOT subject to the

graduated rates. All income (except capital

gains) received by him from sources within are

considered as gross income subject to 25%

final withholding tax and no deductions are

allowed. On the other hand, the special

classes of employees (e.g. managerial

employees of RHQ/RAH) are subjected to a

preferential tax rate imposed on their gross

income.

Formula

Gross Compensation Income

Less:

Personal Exemptions

Premium Payments on Health and/or

Hospitalization Insurance (if qualified)

= Net Compensation Income

TAXABLE INCOME

Pertinent items of gross income specified in

the NIRC, less deduction and/or personal and

additional exemptions, if any (Sec. 31, NIRC).

EXEMPTION

OF

MINIMUM

WAGE

EARNERS (MWEs)

Minimum Wage Earners worker in the

private sector paid the statutory minimum

wage OR an employee in the public sector

with compensation income of not more than

the statutory minimum wage in the nonagricultural sector where he/she is assigned

MWEs shall be exempt from the payment of

income tax on their taxable income. The

holiday pay, overtime pay, night shift

differential pay and hazard pay received by

such minimum wage earners shall likewise be

exempt from income tax.

Income Subject to Graduated Rates

Taxable income, OTHER than PASSIVE

INCOME AND CAPITAL GAINS which are

58

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

Add:

Net business income or

Net professional income*

Other income

= Taxable Income subject to graduated rates

* Net Business Income or Net Professional

Income

Gross Business / Professional Income

Less: Itemized deductions or optional

standard deduction (OSD)

= Net business / professional income

Income Subject to Graduated Rates:

1. Compensation income;

2. Business and professional income;

3. Capital gains not subject to final tax;

4. Passive income not subject to final tax;

5. Other income.

Income Taxation | TAXATION LAW

Graduated Tax Table - Top marginal rate

shall be 32% effective January 1, 2000.

Tax

Due

5%

500

2,500

8,500

Plus

10,000

30,000

70,000

But

Less

Than

10,000

30,000

70,000

140,000

140,000

250,000

22,500

25%

250,000

500,000

50,000

30%

125,

000

32%

Income

Over

500,000

10%

15%

20%

Of

Excess

Over

10,000

30,000

70,000

140,

000

250,

000

500,

000

CONSOLIDATED RULES ON PASSIVE

INCOME SUBJECT TO FINAL TAX

Final Tax means tax withheld from source,

and the amount received by the income earner

is the net income after the final tax has been

withheld already. The tax withheld by the

income payor is remitted by him to the BIR.

The income having been tax-paid already, it

need not be included in the income tax return

at the end of the year because the (passive).

Income tax withheld constitutes the full and

final payment of the income tax due from the

payee on the said income.

Note: Passive investment incomes subject to

withholding taxes are taxed on the gross

amount, without any deduction of cost and

expenses of sale.

A. Interest Income

1. From any currency bank deposit and

yield or any other monetary benefit

from deposit substitutes and from trust

funds and similar arrangements.

Yield the difference between the

amount

the

lender/investor

loaned/placed and the amount he

received upon maturity of the

deposit/debt instruments which shall in

no case be lower than the interest rate

prevailing at the time of the issuance

or renewal of said debt instruments.

(R.R. No. 12-80)

Deposit substitute - shall mean an

alternative form of obtaining funds

from the public (20 or more lenders)

other than deposits

Final Tax Rate:

RC, NRC, RA, NRA-ETB 20%

NRA-NETB 25%

Exceptions:

1. If the loan is granted by a foreign

government or an international or

regional

financing

institution

established by governments, the

interest income of the lender shall

NOT be subject to the final

withholding tax.

2. If the depositor is an employee

trust fund or other accredited

retirement plan, such interest

income, yield or other monetary

benefit is exempt from the final

withholding tax. (CIR v. CA & GCL

Retirement Plan, G.R. No. 95022,

March 23, 1992)

Note:

The above rule on interests only

applies if the interest income is

derived from banks. If the interest

income is derived from a source

other than a bank (e.g., interest

paid on 5-6 business), then the

graduated rates shall apply.

Interests must be derived from a

bank located within the Philippines

to be considered as passive

income.

If the bank from which the interest

is derived is located outside the

Philippines:

a. Graduated rates in the case

of an RC

b. Exempt NRA-NETB NRC,

RA, NRA-ETB.

2. From a depositary bank under the

Expanded Foreign Currency Deposit

System

Final Tax Rate:

RC, RA - 7

NRC, NRA-ETB, NRA-NETB =exempt

Note: Only resident

subject to this tax

individuals

are

3. From long-term deposit or investment

in the form of:

a. Savings,

b. Common or individual trust funds,

c. Deposit substitutes,

d. Investment management accounts

and

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

59

TAXATION LAW | Income Taxation

e. Other investments evidenced by

certificates

in

such

form

prescribed by the BSP.

Final Tax Rates:

RC, NRC, RA, NRA-ETB

Held for 5 years or more exempt

In case of pretermination, where the

HOLDING PERIOD was:

4 years to less than 5 years 5%

3 years to less than 4 years 12%

Less than 3 years

20%

NRA-NETB 25%

60

Characteristics/conditions that should

be present to enjoy income tax

exemption of interest income derived

from long term deposit or investment

(RMC No. 18-2011)

1. The depositor or investor is an

individual citizen (resident or nonresident) or resident alien or

nonresident alien engaged in

trade or business in the Phil. and

not a corporation.

2. The

LTD

or

investments

certificates should be under the

name of the individual and not

under the name of the corporation

or the bank or the trust

department/unit of the bank.

3. The LTD or investments must be

in the form of savings, common or

individual trust funds, deposit

substitutes,

investment

management accounts and other

investments

evidenced

by

certificates

in

such

form

prescribed by the BSP.

4. The LTD or investments must be

issued by banks only and not by

other financial institutions

5. The LTD or investments must

have a maturity period of not less

than 5 years.

6. The LTD or investments must be

in denominations of P10,000 and

other denominations as may be

prescribed by the BSP.

7. Only the interest income from LTD

or investments certificates are

covered by the income tax

exemption.

8. Income tax exemption does not

cover any other income such as

gains

from

trading,

foreign

exchange gain.

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

9. The LTD or investments should

not be terminated by the investor

th

before the 5 year, otherwise it

shall be subjected to the

graduated rates of 5%, 12%, or

20% on interest income earnings.

B. Royalties

1. Royalties in General (e.g. patents and

franchises) Fixed sum either in cash

or property equivalent, to be paid at a

definite period for the use or

enjoyment of a thing or right.

Final Tax Rate:

RC, NRC, RA, NRA-ETB 20%

NRA-NETB 25%

Exception: From books, literary works

and musical compositions.

Final Tax Rate:

RC, NRC, RA, NRA-ETB 10%

NRA-NETB 25%

Note:

Royalties must be derived from

sources within the Philippines to be

considered as passive income.

If royalty is derived from sources

outside the Philippines:

a. graduated rates in the case of a

RC,

b. exempt NRA-NETB NRC, RA,

NRA-ETB.

It covers both payments made: (1) under a

license; and (2) compensation which a

person would be obliged to pay for

fraudulently copying or infringing the right.

C. Prizes and Winnings

Prizes results of efforts

Winnings products of chance or luck

Note:

In case of doubt, a game is

deemed to be one of chance.

Prizes: exceeding P10,000;

Winnings: regardless of amount

Final Tax Rates:

RC, NRC, RA, NRA-ETB 20%

Note:

NRA-NETB 25% (prizes

winnings regardless of amount)

AND

Exception: PCSO and lotto winnings are

NOT subject to final tax.

Income Taxation | TAXATION LAW

Note:

Prizes amounting to P10,000 or less,

although exempt from final tax, are to

be included in gross income and

subject to the graduated rates.

Prizes and winnings from sources

without are included in the gross

income.

D. Dividends

Any distribution made by a corporation to

its stockholders out of its earnings or

profits and payable to its shareholders,

whether in money or other. (par. 1, Sec.

73(A), NIRC)

Forms of Dividend Income

1. Cash dividend;

2. Property dividend;

3. Stock dividend;

4. Scrip dividend;

5. Indirect dividend; and

6. Liquidating dividend.

Scrip Dividend is issued in the form of

promissory note and is taxable to the

extent of its fair market value. It is taxable

in the year when the warrant was issued.

(Sec. 25, R.R. No. 2)

Liquidating Dividend - Where a

corporation distributes all of its assets in

complete or partial liquidation or

dissolution, the gain realized or loss

sustained by the stockholders whether

individual or corporate, is a taxable income

or deductible loss, as the case may be.

(par. 2, Sec. 73(A), NIRC)

The reckoning point is the time of

declaration and NOT the time of payment

of dividends as it is taxable whether

actually or constructively received.

Dividends declared are considered to have

been made from the recently accumulated

profits.

The previously accumulated

profits NOT declared as dividends may be

subjected to improperly accumulated

earnings tax (IAET) if accumulation was

done to evade taxation.

Tax on income is different from tax on the

dividends; therefore, there is no double

taxation (Afisco Insurance Corp. v. CA,

G.R. No.112675, Jan. 25, 1999)

1. Cash and/or property dividends from a

domestic corporation or from a joint

stock company, insurance or mutual

fund

companies

and

regional

operating

headquarters

of

multinational companies.

2. Share in the distributable net income

after tax of a taxable or business

partnership.

3. Share in the net income after tax of an

association, a joint account, or a joint

venture or consortium taxable as a

corporation of which he is a member

or co-venturer.

Final Tax Rates:

RC, NRC, RA 10%

NRA-ETB 20%

NRA-NETB 25%

4. Cash and/or property dividends from a

foreign corporation.

Tax Rates:

RC graduated rates

NRC, RA (if considered from sources

within) graduated rates

Note: The above rule with respect to

NRC and RA is subject to Sec.

42(A)(2)(b), NIRC which provides

that: If for the 3-year period

preceding the declaration of such

dividend,

the

ratio

of

such

corporations Philippine income to the

world (total-within and without)

income is:

a) Less than 50% - entirely without;

b) 50% to 85% - proportionate; and

c) more than 85% entirely within

Formula:

Philippine Gross Income x Dividend

Received Entire Gross Income

= Income Derived Within

Rule: A stock dividend representing the

transfer of surplus to capital account shall

NOT be taxable. (Sec. 73(B), NIRC)

Rationale:

Stock

dividends,

strictly

speaking, represent capital and do not

constitute income to its recipient. So that

the mere issuance thereof is not subject to

income tax as they are nothing but

enrichment through increase in value v.

capital investment.

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

61

TAXATION LAW | Income Taxation

Exceptions: (DDUROG)

1. When

there

is

Redemption

or

Cancellation essentially equivalent to

distribution of taxable dividends (Sec.

73(B), NIRC);

2. It gives the shareholder an interest

Different from that which his former

stock represented;

3. The recipient is Other than the

shareholder;

4. Dividends declared in the Guise of

treasury stock dividend to avoid the

effects of income taxation (CIR v.

Manning, G.R. No. L-28398, Aug. 6,

1975);

5. Stock

dividend

is

taxable

to

Usufructuary; and

6. Different classes of stocks that were

issued.

Proceeds from redemption of shares is:

a. NOT TAXABLE, if its source is the

original capital subscription or initial

capital investment as it is considered not

as an income but a mere return of

capital;

b. TAXABLE, if from other than initial

capital investment, as the proceeds of

redemption is additional wealth.

E. Capital Gains

Note: See Consolidated Rules on Capital

Gains and Losses, p.127.

SPECIAL

CLASSES

OF

INDIVIDUAL

EMPLOYEES

Individuals whether FILIPINO or ALIEN

employed by:

1. Regional or area headquarters and

regional operating

headquarters

of

multinational companies in the Philippines.

2. Offshore banking units established in the

Philippines;

3. Foreign service contractor or subcontractor

engaged

in

petroleum

operations in the Philippines.

Note: Multinational Company - a foreign firm

or entity engaged in international trade with

affiliates or subsidiaries or branch offices in

the Asia-Pacific Region and other foreign

markets.

Tax Rate: 15%

Tax Base: Gross income received as salaries,

wages, annuities, compensation, remuneration

and other emoluments, such as honoraria and

allowances.

62

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

Does Not Apply To: Rank-and-file employees

of said establishments.

Rationale: Only alien individuals occupying

managerial and technical positions in said

establishments are subject to the 15% final

income tax under R.R. No. 2-98.

Note: The term technical position is limited

only to positions which are:

1. Highly technical in nature;

2. Where there are no Filipinos who are

competent, able, and willing to perform the

services for which aliens are desired.

(RMC No. 41-2009)

The same tax treatment shall apply to Filipinos

employed and occupying the same positions

as those of aliens employed by these

multinational companies, offshore banking

units and petroleum service contractors and

subcontractors.

Note: Regardless of whether or not there is an

alien executive occupying the same position.

(RMC No. 41-2009)

Filipinos employed in said establishments

have the option to pay by way of:

1. 15% Final income tax; or

Tests to be met by Filipino to be

allowed the option to be taxed at 15%

(R.R. No. 11-2010):

a. Position and Function Test must

occupy managerial and technical

position

AND

actually exercise

managerial and technical functions

pertaining thereto;

b. Compensation Threshold Test must

have received, or is due to receive

under a contract of employment, a

gross annual taxable compensation of

at least P975,000 (whether or not

actually received); and,

c. Exclusivity Test the Filipino

managerial or technical employee

must be exclusively working for the

RHQ or ROHQ as a regular employee

and not just as a consultant or

contractual personnel.

2. Regular income tax rate on taxable

compensation income. (R.R. No.12-01)

Note: For other sources within the Philippines,

income shall be subject to pertinent income

tax (graduated tax rates, final tax on passive

Income Taxation | TAXATION LAW

income, capital gains, depending whether a

citizen or an alien), as the case may be.

Capital Assets Subject to Capital Gains Tax

and Corresponding Exemptions

(see discussion under Consolidated Rules,

Capital Gains and Losses Sale or Other

Disposition of Real Property, p.128)

Capital Gains and Losses Other Capital

Assets (NOT subject to capital gains tax)

(see discussion under Consolidated Rules,

Capital Gains and Losses Other Capital

Assets, p. 130)

SEC. 27-29

TAX ON CORPORATIONS

OUTLINE

OF

THE

TAXES

ON

CORPORATIONS:

A. Normal Corporate Income Tax (NCIT)

B. Capital Gains Tax

C. Final Tax on Passive Income

D. Minimum Corporate Income Tax (MCIT)

E. Gross Income Tax (GIT)

F. Improperly Accumulated Earnings Tax

(IAET)

G. Branch Profit Remittance Tax

H. Final Tax on (other) Gross Income From

Sources Within the Philippines

A. NORMAL CORPORATE INCOME TAX

(NCIT)

Corporations Liable: DC and RFC

Tax Rates: 30% effective Jan. 1, 2009

Net Income Tax Formula

Gross Sales

Less: Sales Returns

Sales Allowances

Sales Discounts

------------------------------------------------------NET SALES

Less: Cost of Goods Sold

------------------------------------------------------GROSS INCOME FROM SALES

Add:

Incidental income/ Other income

------------------------------------------------------NORMAL TAX GROSS INCOME

Less: Allowable deductions

------------------------------------------------------NET TAXABLE INCOME

Multiplied by: Applicable tax rate

------------------------------------------------------= NET INCOME TAX DUE

===============================

B. CAPITAL GAINS TAX

Corporations Liable: DC, RFC, NRFC

Same rules as those imposed on

individuals

Note: There is no provision for capital

gains tax on sale or disposition of real

properties for RFC and NRFC because

foreign corporations cannot own real

properties in the Philippines.

C. FINAL TAX ON PASSIVE INCOME

Corporations Liable: DC, RFC, NRFC

Same rules as those imposed on

individuals

Rules on Inter-corporate Dividends:

1. Received by a DC

a. From a domestic corporation

exempt

b. From a foreign corporation 30%

normal corporate income tax

Note: Foreign income tax paid or withheld

on such dividend may be credited against

the Philippine income tax due.

2. Received by a RFC

a. From a domestic corporation

exempt

b. From a foreign corporation:

i. If from sources within 30%

normal corporate income tax

ii. If from sources without exempt, as a general rule

Note: Dividends received by a RFC from a

FC are not automatically exempt from

taxation. Sec. 42(A)(2)(b) of the NIRC

which provides that: If for the 3-year

period preceding the declaration of such

dividend, the ratio of such corporations

Philippine gross income to the world gross

income (total-within and without) is:

a. Less than 50% - entirely without;

b. 50% to 85% - proportionate; and

c. more than 85% entirely within

Formula

Normal Corporate Income

X Dividend

Received Entire Gross Income

= Dividends derived from within

3. Received by a NRFC from a Domestic

Corporation

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

63

TAXATION LAW | Income Taxation

Rule: It is subject to final tax of 15%,

as long as the country in which the

NRFC is domiciled allows a tax credit

for taxes deemed paid in the

Philippines equivalent to 15% or does

not impose tax on dividends.

Deemed paid does not imply tax

credit actually granted by the foreign

government. The fact that the country

in which the NRFC is domiciled does

not impose any tax on the dividends

received by such corporation should

be held as a full satisfaction of the

condition for the availment of the 15%

final tax. (CIR v. Wander Philippines

Inc., G.R. No. L-68375, April 15, 1988)

Exception: It is subject to final tax of

30% IF the country within which the

NRFC is domiciled does NOT allow a

tax credit.

Rationale: For the purpose

encouraging foreign investors

conduct business in the country.

of

to

Tax Sparing Rule The 15%

represents the difference between the

regular income tax of 30% on

corporations and the 15% tax on

dividends. It is the amount of tax

forgone by the Philippine government

in

favor

of

the

non-resident

corporation.

Rationale: The source country has

provided a tax holiday or other tax

incentive to foreign investors as an

encouragement to invest or conduct

business in the source country.

Note: The same rule on dividends

under Sec. 42(A)(2)(b) received by a

RFC from a FC applies to the

dividends received by a NRFC from a

FC.

D. MINIMUM CORPORATE INCOME TAX

(MCIT)

Corporations Liable: DC and RFC

Tax Rate: 2%

Tax Base: Gross income EXCEPT income

exempt from income tax and income

subject to final withholding tax

Rationale: It was devised as a relatively

simple and effective revenue-raising

instrument compared to the normal

64

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

income tax which is more difficult to

control and enforce. It is a means to

ensure that everyone will make some

minimum contribution to the support of

public sector.

It is designed to forestall the prevailing

practice of corporations of over claiming

deductions (TAX SHELTERS) in order to

reduce their income tax payments.

Limitations:

1. MCIT does NOT apply if the DC or

RFC is not subject to NCIT;

2. For DC whose operations are partly

covered by the NCIT and partly

covered under a special income tax

system, the MCIT shall apply on

operations covered by the NCIT;

3. For RFC, only the gross income from

sources within the Philippines shall be

considered

for

determining

applicability of MCIT.

MCIT FORMULA for Sale of Goods

Gross Sales

Less: Sales Returns

Sales Allowances

Sales Discounts

---------------------------------------------------------NET SALES

Less: Cost of Goods Sold

---------------------------------------------------------Gross income from Sales

Add: Other Income

---------------------------------------------------------GROSS INCOME

Multiplied by: 2%

---------------------------------------------------------= MCIT PAYABLE

MCIT FORMULA for Sale of Services

Gross Receipts

Less: Sales Returns

Sales Allowances

Sales Discounts

---------------------------------------------------------NET SALES

Less: Cost of Services

---------------------------------------------------------Gross income from Sales

Add: Other income

---------------------------------------------------------GROSS INCOME

Multiplied by: 2%

--------------------------------------------------------= MCIT PAYABLE

Income Taxation | TAXATION LAW

Cost of Goods Sold includes all

business expenses directly incurred to

produce the merchandise and bring them

to their present location such as direct

labor, direct materials, and overhead

expenses

Cost of Services all direct costs and

expenses necessarily incurred to provide

the services required by the customers

and clients including:

1. Salaries and employee benefits of

personnel, consultants, and specialists

directly rendering the service; and

2. Cost of facilities directly utilized in

providing the service

Gross income - includes all items of

gross income enumerated under Section

32(A) of the Tax Code, as amended,

except income exempt from income tax

and income subject to final withholding tax

described (R.R. No. 12-2007).

Certainly, an income tax is arbitrary and

confiscatory if it taxes capital because

capital is not income. In other words, it is

income, not capital, which is subject to

income tax. However, the MCIT is not a

tax on capital. The MCIT is imposed on

gross income which is arrived at by

deducting the capital spent by a

corporation in the sale of its goods, i.e. the

cost of goods and other direct expenses

from gross sales. Clearly, the capital is

not being taxed. (Chamber of Real Estate

and Builders Associations, Inc., v. The

Honorable Executive Secretary, G.R. No.

160756, March 9, 2010 )

2. It can be credited against the NCIT

due in the next 3 immediately

succeeding taxable years;

3. Any excess not credited in the next 3

years shall be forfeited;

4. Carry forward (annually or quarterly) is

possible only if NCIT is greater than

MCIT;

5. The maximum amount that can be

credited is up to the amount of the

NCIT.

Illustration:

A domestic corporation had the following data

on computation of the normal corporate

income tax (NCIT) and the minimum corporate

income tax (MCIT) for five years.

Year4 Year5 Year6 Year7 Year8

MCIT 80k

50k

30k

40k

35k

NCIT 20k

30k

40k

20k

70k

The excess MCIT over NCIT carry-forward is

shown below:

Year4 Year5 Year6 Year7 Year8

MCIT

80k

50k

30k

40k

35k

NCIT

20k

30k

40k

20k

70k

NCIT is n/a

higher

Less:

MCIT

carryforward

40k

n/a

(40k)*

70k

(20k)

(20k)

From Y4

From Y5

From Y7

____________________________________

Tax Due 80k

When MCIT is applicable

1. IF taxable income is zero or negative;

OR

2. IF MCIT is greater than NCIT due.

n/a

When does MCIT commence?

th

MCIT is imposed beginning the fourth (4 )

taxable year immediately following the

year

in

which

such

corporation

commenced its business operations,

which is the year when the corporation

registers with the BIR and NOT when the

corporation started commercial operation.

Rules on Carry Forward of the Excess

MCIT:

1. The excess of MCIT over the NCIT

can be carried forward on an annual

and quarterly basis;

50k

40k

30k

Arrow pointing downward means that

the NCIT is higher so that there can

be an excess MCIT carry-forward

against it.

The figure with asterisk (*) - Cannot

carry-forward an amount higher than

NCIT, hence only the 40k of the

excess of 60k from Year4 was may be

carried forward against the NCIT in

Year 6. The unused 20k remaining

from Year4 cannot be used in Year8

because Year 8 was beyond three

years from Year 4.

In year 4, the taxpayer will pay the

MCIT of 80k because the MCIT is

higher than the regular income tax.

The excess MCIT of 60k (80k-20k)

San Beda College of Law

2012 CENTRALIZED BAR OPERATIONS

65

TAXATION LAW | Income Taxation

can be carried forward in the next

three years.

In year 5, the taxpayer will pay the 50k

MCIT since it is still higher than the

regular income tax rate. The excess

MCIT of 60k in year 4 cannot be used

in this instance. But the excess MCIT

of 20k can be carried forward in the

next three years.

In year 6, where the regular income

tax of 40k is higher than the MCIT of

30k, the taxpayer is allowed to claim

as credit the excess MCIT of year 4

but up to 40k only. Hence, the

taxpayer will not be liable to pay any

tax. The remaining MCIT in year 4 of

20k (60k-40k) may still be carried

forward in year 7 and the excess

MCIT in year 5 of 20k may still be

carried up to Year 8.

Imposition of MCIT may be suspended

if substantial losses are sustained due

to any of the following (Sec. 27(E)(3),

NIRC); Memorandum No. 6-2002):

1. Prolonged labor dispute losses

arising from a strike by the employees

for more than 6 months within a

taxable period causing temporary

shutdown of business operations

2. Force majeure cause due to an

irresistible force as by "act of god" like

lightning, earthquake, storm, flood and

the like; also include armed conflicts

like war and insurgency

3. Legitimate business reverses

include substantial losses sustained

due to fire, robbery, theft, or

embezzlement, or for other economic

reasons as determined by the

Secretary of Finance

Entities EXEMPT from MCIT:

1. Domestic proprietary

educational

institutions;

2. Domestic non-profit hospital;

3. Domestic depository banks under the

expanded foreign currency deposit

system;

4. Resident foreign international carrier;

5. Resident foreign offshore banking

units;

6. Resident foreign regional operating

headquarters; and

7. Firms enjoying special income tax rate

under

the

PEZA

law,

Bases

Conversion and Development Act of