List of Favourite SFM Examination Questions

List of Favourite SFM Examination Questions

Uploaded by

Ankit RastogiCopyright:

Available Formats

List of Favourite SFM Examination Questions

List of Favourite SFM Examination Questions

Uploaded by

Ankit RastogiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

List of Favourite SFM Examination Questions

List of Favourite SFM Examination Questions

Uploaded by

Ankit RastogiCopyright:

Available Formats

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

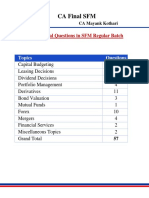

LIST OF FAVOURITE SFM EXAMINATION QUESTIONS

This is the list of fav ques which examiner use as filler. According to opinion of author these ques

cover 10 16 marks of sfm cover.

This list is diff from list of important ques of each chap

Q1

The 6 month forward price of a security is Rs 208.18. The borrowing rate is 8% p.a

payable with monthly rests. What should be the spot price? N06 derivative Q64 pg 2.2

Q2

Calculate the price of 3 months PQR futures, if PQR (FV Rs 10) quotes Rs 220 on NSE

and the 3 months future price quotes at Rs 230 and the one month borrowing rate is given

as 15% and the expected annual dividend yield is 25% p.a payable before expiry. Also

examine the arbitrage opportunities

N08 (derivative Q74 pg 2.3)

Q3

A company is long on 10MT of copper @ Rs 474 per Kg (spot) and intends to

remain

so for the ensuing quarter. The standard deviation of changes of its spot and future prices

are 4% and 6% respectively, having correlation coefficient of 0.75.What is its hedge ratio?

What is the amount of the copper future it should short to achieve a perfect hedge?

May-12 5 marks

derivative Q100 pg 2.10

Q4

On Jan 28, 2005 an importer customer requested a Bank to remit Singapore $(SGD)

25,00,000 under an irrevocable L.C. However due to Bank strikes , the bank could affect

the remittance only on Feb 4,2005.

The inter Bank market rates were as follows

Bombay US$ 1

London 1

London 1

28 jan

Rs 45.85/ 45.90

US$ 1.7841/1.7850

SGD 3.1575/3.1590

4 feb

Rs 45.91/ 45.97

US$ 1.7765/1.7775

SGD 3.1380/3.1390

Bank wishes to retain an exchange margin of 0.125% on SGD. How much does the

customer stand to gain or lose due to the delay? (calculate rates in multiples of .0001)

(May 05), N11, M14

( forex Q17 pg 3.4)

Q5

You sold HKD 1 Lac value spot to your customer at Rs 5.70 & covered yourself in London

market on the same day, when the exchange rates were

US $ 1

=

HK $ 7.5880 7.5920

N05

Local interbank market rates for US $ were

Spot US $ 1 = Rs 42.70 42.85

(forex Q149 3.46)

Calculate cover rate & ascertain the profit or loss in the transaction. Ignore brokerage

Q6

Spot

Canadian $ 0.665/DM

Interest Rate (DM) =

3 months forward Canadian $ 0.670/ DM

Interest Rate ( can$)=

Explain arbitrage?

(Forex Q86 pg 3.22)

7%

9%

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

Q7

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

XYZ Ltd. is considering merger with ABC Ltd. XYZ Ltd.'s shares are currently traded at Rs.

25. It has 2,00,000 shares outstanding and its earning after taxes (EAT) amount to Rs.

4,00,000. ABC Ltd. has 1,00,000 shares outstanding, its current market price is Rs. 12.50

and its EAT is Rs. 1,00,000. The mergerwill be effected by means of a stock swap

(exchange). ABC Ltd. has agreed to a plan under which XYZ Ltd. will offer the current

market value of ABC Ltd.'s shares.

(i)

What is the pre-merger Earnings Per Share (EPS) and P /E ratios of both the

companies?

(ii)

If ABC Ltd.'s P /E ratio is 8, what is its current market price? What is the

exchange ratio? What will XYZ Ltd.'s post merger EPS be ?

(iii)

What must the exchange ratio be for XYZ Ltd.'s pre-merger and post-merger

EPS to be the same?

(M05)

(merger Q7 pg 4.3)

Q8

An investor is holding 1,000 shares of Fatless company. Presently the rate of dividend being

paid by the company is Rs 2 per share and the share is being sold at Rs 25 per share in the

market. However, several factors are likely to change during the course of the year as

indicated below:

Existing

Revised

Risk free rate

12%

10%

(portfolio q75 pg 5.17)

Market risk premium

6%

4%

value

1.4

1.25

Expected growth rate

5%

9%

In view of the above factors whether the investor should hold or sell the shares?

Q9

On the basis of following informationCurrent dividend (D0)

Rs 2.50

Discount rate

10.50%

Growth rate

2%

a. Calculate the present value of stock of ABC Ltd.

N07, M02, N12

b. Is its stock overvalued if stock price is Rs 35, ROE 9% and EPS Rs 2.25? show

detailed calculation

(div Q28 pg 6.7)

Q10 A share of Tension-free Economy Ltd. is currently quoted at, a price earning ratio of

7.5times. The retained earning per share being 37.5% is Rs. 3 per share. Compute:

1.

The company's cost of equity, if investors expect annual growth rate of 12%.

2.

If anticipated growth rate is 13% p.a., calculate the indicated market price, with

same cost of capital.

3.

If the company's cost of capital is 18% and anticipated growth rate is 15% p.a.,

calculate the market price per share, assuming other conditions remain the same

( div Q36 pg 6.9)

Q11 A company has a book value per share ofRs. 137.80. Its return on equity is 15% and it

follows a policy of retaining 60% of its earnings. If the Opportunity Cost of capital is 18%,

what is the price of share today? M02

(div Q11 pg 6.3)

Q12 A company is presently working with an earnings before interest and taxes (EBIT) of Rs 45

lakhs. Its present borrowings are:

(Rs Lakhs)

12% term loan

150

Working capital:

Borrowing from bank at 15%

100

Public deposit at 11%

45

2

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

The sales of the company is growing and to support this the company proposes to

obtain additional borrowing of Rs 50 lakhs expected to cost 16%. The increase in

EBIT is expected to be 16%. Calculate the change in interest coverage ratio after

additional borrowings and commitment

(Q8 misc pg 13.3)

Q13

ABC Company is considering acquisition of XYZ LTD which has 1.5 crores shares

outstanding and issued. The market price per share is Rs 400 at present. ABCs

average cost of capital is 12%. Vailable information from XYZ indicates its expected

cash accruals for the next 3 years as follows: year 1 Rs 250 crores, Year 2 Rs 300

crores, Year 3 Rs 400 crores. Calculate the range of valuation that ABC has to

consider

( val of bs q3 pg 12.2)

X Ltd reported a profit of Rs 65 Lakhs after 35% Tax for the financial year 2007 08.

An analysis of the accounts revealed that the income included extra-ordinary items Rs

10 lakhs and an extra-ordinary loss of Rs 3 lakhs. The existing operations, except for

the extra-ordinary items, are xpected to continue in the future. In addition, the results

of the launch o a new product are expected to be as follows

Rs lakhs

Sales

60

Material costs

15

Labour costs

10

Fixed costs

8

You are required to

a. Compute the value of the business, given the capitalization rate is 15%

b. Determine the market price per equity share, with X Ltds share capital being

comprised of 1,00,000 11% preference shares of Rs 100 each and 40,00,000 Equity

shares of Rs 10 each, and PE ratio being 8 times M09 (val of bs Q2 pg 12.1)

Q14

Q15

A has invested in 3 mutual fund scheme as per details below:

N04, N09

MF A

MF B

MF C

Date of investment

01.12.03

01.01.04

01.03.04

Amount of investment

Rs 50,000 Rs 1,00,000 Rs50,000

NAV at entry date

Rs 10.50

Rs 10

Rs 10

Dividend received upto 31.03.04

Rs 950

Rs1,500

nil

NAV as at 31.03.04

Rs 10.40

Rs 10.10

Rs 9.80

What is the effective yield on per annum basis in respect of each of the 3 schemes to

Mr A upto 31.03.04

( Mutual fund Q10 pg 9.3)

Q16

Based on the credit rating of bonds, Mr Z has decided to apply the following discount

rates for valuing bonds

Credit Rating

Discount Rate

AAA

364 day T-Bill+ 3% Spread

AA

AAA + 2% spread

A

AAA + 3% spread

He is considering to invest in AA rated, Rs 1,000 face value bond currently

selling at Rs 1,025.86. The bond has five years to maturity and the coupon rate on the

bond is 15% p.a. payable annually. The next interest payment is due one year from

today and the bond is redeemable at par. (Assume 364 day T- bill rate to be 9%)

You are required to calculate the intrinsic value of the bond for Mr Z. Should

he invest in the bond? Also calculate the current yield and the YTM of the bond.

(BONd val Q31 pg 8.5)

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

Q17

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

Agrani Ltd. Is in the business of manufacturing bearings. Some more product lines are

being planned to be added to the existing system. The machinery required may be

bought or may be taken on lease. The cost of machine is Rs 40,00,000 having a useful

life of 5 years with the salvage value of Rs 8,00,000. The full purchase value of

machine can be financed by 20% loan repayable in 5 equal installments due at the end

of each year.

Alternatively, the machine can be procured on a 5 years lease, year end lease

rentals being Rs 12,00,000 p.a. The company follows the WDV method of Depriciation

@ 25%. Companys tax rate is 35% and cost of capital is 16%:

i.

Advise the company which option it should choose- lease or borrow.

ii.

Assess the proposal from lessors point of view examining whether leasing the

machine is financially viable @ 14% cost of capital

(Detailed working notes should be given. Calculations can be rounded off to Rs. Lakhs)

(leasing Q5 pg 7.2)

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

Solutions to list of favourite questions

Q1

Value of future = cost of asset + cost to carry asset

208.18 =

x(1+

208.18 =

x(

208.18 =

X

0.08

12

)6

12.08 6

)

12

CA FINAL SFM / IPC COST-FM by

CA PRAVIIN MAHAJAN

9871255244

1.0066)6

x(

208.18

(1.0066)6

208.18

X

=

= 200.173

1.040

Stock price is Rs 200.173

Spot price + carrying cost dividend

=

220 + 220 x 0.15 x 0.25 10 x 0.25

=

220 + 8.25 2.5

=

Rs 225.75

Q2

Value of future =

Q3

A company is long on Copper to the amount of 10 x 1000 x 474

4

Hedge ratio = = r

= 0.75 = 0.5 0r 50%

47,40,000

To obtain perfect hedge Company will short Copper future for

47,40,000 x 0.5 = 23,70,000

An importer requested Bank to remit SGD$ 25,00,000 on 28 Jan 2005, However due to bank strike

Bank was able to remit payment on 4th Feb.

Q4

Since Importer has to buy SGD $, thus from cross rate

relevant rate is Ask rate

Amount to be paid for purchasing 25,00,000 SGD $ if bank had remitted on 28th jan 2005.

On 28th jan 2005 importer could purchase SGD $ at

45.90 x 1.7850 x 3.1575

=

=

25.948219

+ Exchange margin 0.125 %

+ 0.032435

25.980654

Payment to be made for remitting 25,00,000 SGD on 28th Jan 2005

25,00,000 x 25.980654 = Rs 649,51,635

Amount actually paid for purchasing 25,00,000 SGD $ on 4th jan 2005.

On 4th 2005 importer could purchase SGD $ at

=

+ Exchange margin 0.125 %

45.97 x 1.7775 x 3.1380

=

=

26.039412

+ 0.032549

26.071961

Payment made for remitting 25,00,000 SGD on 4th Feb 2005

25,00,000 x 26.071961 = Rs 651,79,903

Thus net loss to importer due to delay in payment = 651,79,903 - 649,51,635

= Rs 2,28,268

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

Q5

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

Trader sold HKD 1,00,000 @ 5.70 / HKD

Trader also covered himself in london market i.e he book a contract to purchase

1,00,000 HKD in London

Statement of profit

Amount received on sale of HKD, 1,00,000 x 5.70

5,70,000

Amount payable on Purchase of 1,00,000 HKD

= 42.85 x

1

7.5880

= 5.647 / HKD

5,64,700

5300

Profit on cover deal

Q6

Spot rate

Can $ 0.665 per DM

3

12

3

0.07 x

12

1+0.09 x

Synthetic forward rate

0.665 x

=

3 month forward rate

0.665 x

1+

1.0225

1.0175

can $ 0.6682678 per DM

Can $ 0.670 / DM

Synthetic rate is less than forward rate. Investor will borrow can $ and deposit DM

-

Suppose investor borrowed 1,00,000 can $ @ 9% p.a for 3 months

Amount payable after 3 months 1,00,000 x 1.0225 = can $ 1,02,250

He will convert 1,00,000 Can $ into DM @ can $ 0.665 / DM

1,00,000

He will receive

= 1,50,375.938 DM

0.665

He will deposit DM 1,50,375.938 DM @ 7% for 3 months and receive

1,50,375.938 x 1.0175 = DM 1,53,007.5187 DM

He will purchase DM at 3months forward rate of can$ 0.670 / DM

He will receive 1,53,007.5187 x 0.670 = Can $ 1,02,515.0375 per DM

After repayment of amount borrowed, net profit is

1,02,515.0375 1,02,250

=

Q7

265.0375 can $

XYZ

25

2,00,000

4,00,000

MP

No. of shares

Earnings

ABC

12.50

1,00,000

1,00,000

XYZ

a. Pre merger EPS

Pre merger PE ratio

Total earnings

4,00,000

No.of shares

MP

2,00,000

25

EPS

b. If ABC ltd PE ratio is 8, its MP will be

MP

=

=

PE x EPS

8x1 =

ABC

=2

= 12.5

1,00,000

1,00,000

12.5

1

=1

= 12.5

Rs 8

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

Exchange ratio of the basis of MP

post merger EPS

MP of ABC

25

= 0.32 : 1

Combined earnings

No.of shares after acquisition

4,00,000 + 1,00,000

2,00,000+1,00,000 x 0.32

=

c.

MP of XYZ

Rs 2.16

for XYZ ltds pre merger and post merger EPS to be same, Exchange ratio should be on the

basis of EPS

Exchange ratio =

EPS of ABC

EPS of XYZ

= 0.5 : 1

= i.e 0.5 share in XYZ for 1 share in ABC

Q8

D0 = 2 P0 = 25

Required Return

P0

(.)

..

= RF + (RM - RF)

= 12 + 1.4 (6) = 20.4%

=

=

= R 13.63

Existing price is more than equilibrium price, so currently share is overvalued

Revised RR

Required Return

= RF + (RM - RF)

= 10 + 1.25(4) = 15%

P0

(.)

= (. .) = 36.33

Existing price is less than revised equilibrium price, so currently share is undervalued,

Investor should hold the share.

Q9

a.

Current market price of share is present value of all future dividends.

P0

=

=

i.

1

2.5 ( 1.02 )

0.1050 0.02

Rs 30

According to PE model

BV

=

EPS / ROE

=

2.25 / 0.09

=

25

MP

=

35

Since MP > BV so share is overvalued

ii.

PRAVINN

MAHAJAN

CA CLASESS

Earning Price Model

P0

=

=

1

2.25 ( 1.02 )

0.09 0.02

Rs 32.786

If Current market price per share is Rs 35 , share is overvalued

Q10

PE ratio = 7.5

Retained earnings

Total earnings

Rs 3 (37.5%)

3

= Rs 8 per share

i.

PE x EPS

MP

0.375

Div per sh = 8 3 = 5

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

=

=

KE

=

=

ii.

P0

=

=

=

iii.

P0

=

=

=

Q11

7.5 x 8

Rs 60

1

+ g

0

5(1.12)

60

+ 0.12

21.33%

1

5(1.13)

.2133 .13

Rs 67.80

1

5(1.15)

0.18 .15

Rs 191.67

MP per share according to Gordon Model

Book value per share =

Rs 137.80

Return on Equity

=

15%

Thus earnings

=

15% x 137.80

=

Rs 20.67

DP Ratio

=

=

P0

PRAVINN

MAHAJAN

CA CLASESS

1 - 0.6

0.4 or 40%

( 1 )

.

20.67 ( 1 0.6 )

0.18 0.6 0.15

Rs 91.87

MP per share according to Walter Model

+

P0

( )

8.268 +

0.15

( 20.67

0.18

8.268)

0.18

Rs 103.35

MP per share according to perpetual growth model

P0

0.18 0.09

=

Q12

8.27

Rs 91.89

statement of current interest obligation

12% term loan

18

15% bank loan

15

11% public deposits

4.95 37.95

Interest coverage ratio =

45

37.95

= 1.19

Interest obligation after additional borrowing = 37.95 + 8 = 45.95

Interest coverage ratio after additional borrowing

45 (1.16)

45.95

1.14

Due to additional borrowings intt covrg ratio is reduced by 4.20 %

8

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

Q13

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

Range of valuation of company refers to Maximum and minimum value of business

Minimum value of business means premerger value of business i.e 1.5 cr x 400

600 cr

Maximum value of business is present value all future cash flows

1

250

0.893

223.25

2

300

0.797

239.1

3

400

0.712

284.84

747.15

Q14

Current value of business is capitalised value of all future maintainable profits

Statement of FMP

b.

PAT

PBT

Extrordinary income

Extraordinary exp

Income of new project

FMP before tax

Tax 35 %

FMP after tax

65

100

(10)

3

27

120

42

78

Value of business

78

0.15

FMP

Pref dividend

Profir for equity

No. of shares

EPS

MP

78

(11)

67 lac

40 lac

67

= 1.675

40

= EPS X PE

=

1.675 x 8

=

13.4

Q15

A

50,000

10.50

4761.905

950

0.1995

122

Amount of Investment

NAV at entry date

Number of units purchased

Dividend

Dividend per unit

Period of investment

(days)

Return on M.F =

A

B

1,00,000

10

10,000

1500

0.15

91

C

50,000

10

5,000

nil

nil

31

+ +

10.40 + 0.1995 10.50

10.50

0.0995

10.50

0.9476

Annual =

B

= 520

10.10 + 0.15 10

10

Annual =

122

0.25

10

2.5

91

x 100

0.9476

x 365 = 2.835%

x 100

x 365 =

= 2.5%

10.03%

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

C

9.80 + 0 10

10

(.20)

10

2

Annual =

Q16

31

x 100

x 365 =

(2) %

(23.548)%

Z is considering investment in AA rated bonds.

Discount rate of AA rated bond =

AAA + 2 % spread

=

364 T- bill + 3% spread + 2% spread

=

9% + 3% + 2%

=

14%

Current market price of bond is =

1025

Rate of Interest

=

15%

Value of bond or current market price of bond is present value of all future cash outflows of the

bond at Expected rate of return or cost of capital. It is also known as Intrinsic value or equilibrium

price.

Value of the bond

=

P.V of all cash outflow

Current market price

P.V of Interest at 14%

For 5 years

P.V of redeemable

amount of bond @ 14% for 5th year

=

150 x 3.433

+

1000 x 0.519

=

514.95

+

519

=

1033.95

Intrinsic value of the bond is more than current market price, investor should buy this bond.

Current yield of the bond is interest earned on Bond on its current market price

Current Yield

150

1025.86

14.62%

YTM is the rate of return on bond if it is purchased at current market price and held till the date of

maturity. It is the rate at which present value of cash outflows of the bond is equal to present value of

cash inflows or current market price of the bond.

+

2

+

Approximate YTM

10001025.86

5

1000 + 1025.86

2

150 +

=

YTM of bond

Present value of Cash outflow at 14%

=

P.V of interest @ 14% for 5 years

+

=

150 x 3.433

+

=

514.95

+

=

1033.95

Present value of cash outflows at 15%

=

P.V of interest @ 15% for 5 years

=

150 x 3.352

=

502.8

=

999.8

10

= 14.29%

P.V of redeemable value @ 14%

1000 x 0.519

519

+

+

+

P.V of redeemable value @ 15%

1000 x 0.497

497

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

YTM is the rate at which present value of cash outflow is equal to present value of cash inflows i.e

present value of cash outflow = Rs 1025.86

For Present value of cash outflow of 1033.95

Rate is 14%

For Present value of cash outflow of 999.8

Rate is 15%

For present value of cash outflow of 1025.86 , rate is

=

14%

8.09

34.15

1033.95 . 14%

1025.86

?

999.80 . 15%

x1

14.237%

For change in PV of (1033.95 999.80) 34.15

change in rate is 1%.

For change in PV of (1033.95 1025.86) 8.09

Change in rate (from 14%) is

8.09

14% +

x1

34.15

Q17

Agrani ltd needs a machine costing Rs 40,00,000. Company has 2 options

Option 1

Acquire the Machine on Lease at an annual lease rent of Rs12,00,000

Lease Rent p.a

Tax saving on lease rent

Rs 12,00,000

12,00,000 x 0.35

4,20,000

Statement of Present value of cash outflows

(if Asset is taken on lease)

Lease Rent

Tax Savings on

lease rent

Amount

Period

Present value

1 5 end

Factor

@ 16%

3.274

12,00,000

4,20,000

1 5 end

3.274

13,75,080

39,28,800

Present Value of Cash outflow

Option 2

Purchase the asset by borrowing from bank

Amount of Loan

=

25,53,720

Rs 40,00,000 @ 20%

Loan is payable in 5 equal Installments. Amount of each installment is :

Amount x factor (5 yrs, 20% )

Amount x 2.991

Amount

Year

1end

2end

3end

4end

5end

= 40,00,000

= 40,00,000

= 13,37,345

Statement of Principal and Interest

Installment

Interest

Principal

@ 20%

13,37,345

8,00,000

5,37,345

13,37,345

6,92,531

6,44,814

13,37,345

5,63,568

7,73,777

13,37,345

4,08,813

9,28,532

13,37,345

2,21,813

11,15,532

Principal

Outstanding

34,62,655

28,17,841

20,44,064

11,15,532

-

Tax saving

on intt @ 35%

2,80,000

2,42,386

1,97,249

1,43,085

77,635

(13,37,345 11,15,532)

11

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

9871 255 244

CA FINAL SFM CLASSES by CA PRAVIIN MAHAJAN

Depreciation @ 25% p.a WDV basis

Cost

40,00,000

Tax saving on dep @ 35%

Dep 1 year

10,00,000

3,50,000

30,00,000

Dep 2nd yr

7,50,000

2,62,500

22,50,000

Dep 3rd yr

5,62,500

1,96,875

16,87,500

Dep 4th yr

4,21,875

1,47,656

12,65,625

Dep 5th yr

3,16,406

1,10,742

WDV after 5 years

9,49,219

Salvage value after 5 yrs

8,00,000

Capital loss

1,49,219

Tax savings on cap loss

52,226

(1,49,219 x 0.35)

Net salvage value

8,00,000 + 52,226 =

8,52,226

Statement of Present value of cash outflow if Loan is taken from Bank

Amount

Period

Installment (Principal

+ interest)

Tax savings on

Interest and dep

factor

@ 16%

Present

value

13,37,345

1 5 end

3.274

43,78,468

6,30,000

1e

0.862

(5,43,060)

0.743

(3,75,130)

(2,80,000 + 3,50,000)

504,886

2e

(2,42,386 + 2,62,500)

3,94,124

2,90,741

1,88,377

8,52,226

(2,52,633)

(1,60,490)

(89,667)

Salvage value

(4,05,660)

25,51,828

Present value of Cash ouflow in loan option is lower than present value of cash outflow in lease

option, so company should purchase the asset by borrowing from Bank

b.

3e

4e

5e

5e

(0.641)

(0.552)

(0.476)

(0.476)

Evaluation of Proposal from the point of view of lessor, If lessors cost of capital is 14%

Lessor will receive Lease rent and pay tax on such lease rent

Lessor will claim depreciation on asset and tax saving on such depreciation and will claim

salvage value

Cash outflow will be purchase price of machine.

Statement of NPV of Lessor @ 14%

Amount

Period

factor

Present

@ 14%

value

Present value of cash inflows

Lease rent (net of tax)

12,00,000 (1 0.35)

7,80,000

1 5e

3.433

26,77,740

Tax savings on Depreciation

3,50,000

1e

0.877

3,06,950

2,62,500

2e

0.769

2,01,863

1,96,875

3e

0.675

1,32,891

1,47,656

4e

0.592

87,412

1,10,742

5e

0.519

57,475

Salvage value

8,52,226

5e

0.519

4,42,305

Cash Inflows

39,06,636

Present value of cash outflows

Purchase price of machine

40,00,000

0

1

40,00,000

NPV

(93,364)

Since NPV of lease is negative, so lessor should not lease the Asset

12

CA PRAVINN MAHAJAN SFM CLASSES 9871 255 244

You might also like

- Sample Accounting Policies and Procedures Manual Adopted May 20XXDocument33 pagesSample Accounting Policies and Procedures Manual Adopted May 20XXAnkit Rastogi100% (3)

- ACCA F9 Financial Management Solved Past Papers 2Document304 pagesACCA F9 Financial Management Solved Past Papers 2Daniel B Boy Nkrumah100% (1)

- SOP 13 - BudgetingDocument8 pagesSOP 13 - BudgetingAnkit RastogiNo ratings yet

- Financial Modeling Chapter - 1Document20 pagesFinancial Modeling Chapter - 1bhanu.chandu100% (4)

- CH 3 SolutionsDocument12 pagesCH 3 SolutionsLucia100% (3)

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- Mock Board Fin Acctg Vol 2Document24 pagesMock Board Fin Acctg Vol 2Allen Fey De Jesus67% (3)

- By Yufeng Guo: Deeper Understanding, Faster Calculation - Exam FM Insights & ShortcutsDocument625 pagesBy Yufeng Guo: Deeper Understanding, Faster Calculation - Exam FM Insights & ShortcutsGeet Maurya100% (1)

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Sem IV (Internal 2010)Document15 pagesSem IV (Internal 2010)anandpatel2991No ratings yet

- Ca Final May 2012 Exam Paper 2Document7 pagesCa Final May 2012 Exam Paper 2Asim DasNo ratings yet

- BFDDocument4 pagesBFDaskermanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaamitmdeshpandeNo ratings yet

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDocument9 pagesPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNo ratings yet

- Financial Management: Thursday 9 June 2011Document9 pagesFinancial Management: Thursday 9 June 2011catcat1122No ratings yet

- Financial, Treasury and Forex ManagementDocument8 pagesFinancial, Treasury and Forex ManagementnikhilNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementshinuanusha50No ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- Risk N ReturnDocument6 pagesRisk N ReturnRakesh Kr RouniyarNo ratings yet

- Business - Analysis Dec-11Document3 pagesBusiness - Analysis Dec-11SHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- Super 60 Questions CA Final AFM For MAy 24 ExamsDocument42 pagesSuper 60 Questions CA Final AFM For MAy 24 ExamsHenry HundersonNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- Paper - 2: Management Accounting and Financial Analysis Questions SwapDocument31 pagesPaper - 2: Management Accounting and Financial Analysis Questions Swapअंजनी श्रीवास्तवNo ratings yet

- Module 5 - Cost of Capital - QuestionsDocument7 pagesModule 5 - Cost of Capital - QuestionsLAKSHYA AGARWALNo ratings yet

- Question Bank 2023Document31 pagesQuestion Bank 2023Zodwa JudyNo ratings yet

- Naranlala School of Industrial Management & Computer Science, Navsari-396450 Module Test-1 Subject: Financial Management Date: 12-03-2015Document3 pagesNaranlala School of Industrial Management & Computer Science, Navsari-396450 Module Test-1 Subject: Financial Management Date: 12-03-2015Divyesh GandhiNo ratings yet

- Equity Valuation Updated FN22 Onwards - 1103750Document15 pagesEquity Valuation Updated FN22 Onwards - 1103750Dipika MalpaniNo ratings yet

- Additional Question Sheet LawiDocument27 pagesAdditional Question Sheet LawiPratyusha khareNo ratings yet

- Ca-Final SFM Question Paper Nov 13Document11 pagesCa-Final SFM Question Paper Nov 13Pravinn_MahajanNo ratings yet

- TEST Paper 1Document7 pagesTEST Paper 1Abhu ArNo ratings yet

- d15 Hybrid f9 Q PDFDocument8 pagesd15 Hybrid f9 Q PDFhelenxiaochingNo ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- Business Finance Decisions: T I C A PDocument4 pagesBusiness Finance Decisions: T I C A PImran AhmadNo ratings yet

- CF Pre Final 2022Document3 pagesCF Pre Final 2022riddhi sanghviNo ratings yet

- CS Final - Financial Tresurs and Forex Management - June 2004Document4 pagesCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhNo ratings yet

- Annuity Tables p6Document17 pagesAnnuity Tables p6williammasvinuNo ratings yet

- Financial Management: Friday 9 December 2011Document8 pagesFinancial Management: Friday 9 December 2011Hussain MeskinzadaNo ratings yet

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- Advanced Financial Management: Thursday 10 June 2010Document10 pagesAdvanced Financial Management: Thursday 10 June 2010Waleed MinhasNo ratings yet

- Final Exam Review W21 Questions OnlyDocument14 pagesFinal Exam Review W21 Questions Only費長威No ratings yet

- Financial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988Document7 pagesFinancial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988EshanMishraNo ratings yet

- Capii Financial Management July2015Document14 pagesCapii Financial Management July2015casarokarNo ratings yet

- P 4 Cktqns 1 BPDFDocument10 pagesP 4 Cktqns 1 BPDFBinnie Kaur100% (1)

- End Term ExamDocument4 pagesEnd Term ExamKeshav Sehgal0% (2)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document12 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (3)

- 2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013Document9 pages2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013theatresonicNo ratings yet

- Cost of Capital - TaskDocument15 pagesCost of Capital - TaskAmritesh MishraNo ratings yet

- Question Book PDFDocument65 pagesQuestion Book PDFHarsha VardhanNo ratings yet

- AL Financial Management May Jun 2016Document4 pagesAL Financial Management May Jun 2016hyp siinNo ratings yet

- RTP CA Final Old Course Paper 2 Management Accounting and FinDocument38 pagesRTP CA Final Old Course Paper 2 Management Accounting and FinSajid AliNo ratings yet

- ACCA F9 Financial Management Solved Past PapersDocument304 pagesACCA F9 Financial Management Solved Past PapersSalmancertNo ratings yet

- CA Final SFM RTP For May 2023Document18 pagesCA Final SFM RTP For May 2023remoratilemothekheNo ratings yet

- Cost of CapitalDocument8 pagesCost of CapitalAreeb BaqaiNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- SA End Term QP - 2022-23Document12 pagesSA End Term QP - 2022-23xyzcompany52No ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Mqp1 10mba Mbafm02 AmDocument4 pagesMqp1 10mba Mbafm02 AmDipesh JainNo ratings yet

- Financial Treasury and Forex Management: NoteDocument7 pagesFinancial Treasury and Forex Management: Notesks0865No ratings yet

- Dividend Decision Question-3Document10 pagesDividend Decision Question-3Savya Sachi50% (2)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Title Develop Tannery Production Processes For Product Development Level 5 Credits 40Document5 pagesTitle Develop Tannery Production Processes For Product Development Level 5 Credits 40Ankit RastogiNo ratings yet

- Sub-Section I: Procurement ProcessDocument7 pagesSub-Section I: Procurement ProcessAnkit RastogiNo ratings yet

- Purchasesop 140305221543 Phpapp01Document11 pagesPurchasesop 140305221543 Phpapp01Ankit RastogiNo ratings yet

- Standard Operating Procedures (Sops) Finance Department Pak Pap (PVT) LTD, KarachiDocument14 pagesStandard Operating Procedures (Sops) Finance Department Pak Pap (PVT) LTD, KarachiAnkit RastogiNo ratings yet

- Process Management and Process Oriented Improvement ProgramsDocument52 pagesProcess Management and Process Oriented Improvement ProgramsAnkit RastogiNo ratings yet

- Business Research Methods Imt-120Document1 pageBusiness Research Methods Imt-120Ankit RastogiNo ratings yet

- Standard Operating Procedures For Manufacturing & ServiceDocument26 pagesStandard Operating Procedures For Manufacturing & ServiceAnkit RastogiNo ratings yet

- Please Affix Recent Passport Size Photo (Colour)Document1 pagePlease Affix Recent Passport Size Photo (Colour)Ankit RastogiNo ratings yet

- Magicon Impex Pvt. LTD.: Pay Slip For The Month of Aug-2013Document1 pageMagicon Impex Pvt. LTD.: Pay Slip For The Month of Aug-2013Ankit RastogiNo ratings yet

- First Admission List VALID UPTO 28-06-2012: Maitreyi College: New Delhi - 110021Document3 pagesFirst Admission List VALID UPTO 28-06-2012: Maitreyi College: New Delhi - 110021Ankit RastogiNo ratings yet

- Mathematics of InvestmentsDocument14 pagesMathematics of InvestmentsYocib OtnicajNo ratings yet

- Chapter Three-Time Value of MoneyDocument52 pagesChapter Three-Time Value of MoneySamuel AbebawNo ratings yet

- B 933 Ca 4 e 25 BB 3 D 654 C 06Document14 pagesB 933 Ca 4 e 25 BB 3 D 654 C 06sammeracobre-7155No ratings yet

- Capital Budgeting ExercisesDocument16 pagesCapital Budgeting ExercisesMhel EspanoNo ratings yet

- Financial Management - BS-4th Semester'Document21 pagesFinancial Management - BS-4th Semester'Rehman RehoNo ratings yet

- MI (L-05 & 06) Mesbah SirDocument29 pagesMI (L-05 & 06) Mesbah SiradghtfgjlNo ratings yet

- Dissenting Opinion of J. LeonenDocument5 pagesDissenting Opinion of J. LeonenjoshmagiNo ratings yet

- Module 6 Homework Answer KeyDocument7 pagesModule 6 Homework Answer KeyMrinmay kunduNo ratings yet

- Sensitivity % Change in OutputDocument22 pagesSensitivity % Change in OutputPrincessNo ratings yet

- BPS Prelim Exam KADocument19 pagesBPS Prelim Exam KASheena Calderon100% (1)

- Time Value of MoneyDocument108 pagesTime Value of MoneyHaider WaseemNo ratings yet

- Practice Exam #2 SolutionsDocument2 pagesPractice Exam #2 Solutionscath naparatoNo ratings yet

- Lengo Savings Plan PremierDocument9 pagesLengo Savings Plan PremierPado DjochieNo ratings yet

- FINC 721 Project 1Document5 pagesFINC 721 Project 1Sameer BhattaraiNo ratings yet

- How To Write A Business CaseDocument39 pagesHow To Write A Business Caseapi-3832481100% (1)

- Activity Sheets: Quarter 2 - MELC 3Document8 pagesActivity Sheets: Quarter 2 - MELC 3Lalaine Jhen Dela CruzNo ratings yet

- Zeus MillanDocument7 pagesZeus MillanannyeongNo ratings yet

- Objective Type Questions For Practice (Covers All Modules)Document40 pagesObjective Type Questions For Practice (Covers All Modules)AdityaNo ratings yet

- CA Foundation Math Stats LR Q MTP 1 June 2024 Castudynotes ComDocument18 pagesCA Foundation Math Stats LR Q MTP 1 June 2024 Castudynotes ComNived Narayan PNo ratings yet

- Statistics Unit 2Document42 pagesStatistics Unit 2Yuvnesh KumarNo ratings yet

- The Enhancement Program Handouts FarpdfDocument36 pagesThe Enhancement Program Handouts FarpdfCaile SalcedoNo ratings yet

- Answer-Introduction To FinanceDocument10 pagesAnswer-Introduction To FinanceNguyen Hong HanhNo ratings yet

- Earnout: Acquisitions by Robert F. Bruner. See Chapter 22 For Further Discussion of Earnout ValuationDocument3 pagesEarnout: Acquisitions by Robert F. Bruner. See Chapter 22 For Further Discussion of Earnout ValuationLuisMendiolaNo ratings yet

- Simple Interest and Simple DiscountDocument4 pagesSimple Interest and Simple DiscountRochelle Joyce CosmeNo ratings yet

- Executive Summary: Unification of Discount Rates Used in External Debt Analysis For Low-Income CountriesDocument11 pagesExecutive Summary: Unification of Discount Rates Used in External Debt Analysis For Low-Income CountriesLiliya RepaNo ratings yet

- Ac2091 ZB - 2019Document15 pagesAc2091 ZB - 2019duong duongNo ratings yet