© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

amitmdeshpandeCopyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

amitmdeshpandeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

amitmdeshpandeCopyright:

Available Formats

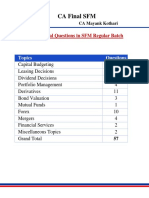

PAPER 2: STRATEGIC FINANCIAL MANAGEMENT

QUESTIONS

Replacement Decision

1. Trouble Free Solutions (TFS) is an authorized service center of a reputed domestic air

conditioner manufacturing company. All complaints/ service related matters of Air

conditioner are attended by this service center. The service center employs a large

number of mechanics, each of whom is provided with a motor bike to attend the

complaints. Each mechanic travels approximately 40000 kms per annuam. TFS decides

to continue its present policy of always buying a new bike for its mechanics but wonders

whether the present policy of replacing the bike every three year is optimal or not. It is of

believe that as new models are entering into market on yearly basis, it wishes to

consider whether a replacement of either one year or two years would be better option

than present three year period. The fleet of bike is due for replacement shortly in near

future.

The purchase price of latest model bike is ` 55,000. Resale value of used bike at current

prices in market is as follows:

Period `

1 Year old 35,000

2 Year old 21,000

3 Year old 9,000

Running and Maintenance expenses (excluding depreciation) are as follows:

Year Road Taxes Insurance etc.

(`)

Petrol Repair Maintenance etc.

(`)

1 3,000 30,000

2 3,000 35,000

3 3,000 43,000

Using opportunity cost of capital as 10% you are required to determine optimal

replacement period of bike.

Merger &Acquisition

2. Hanky Ltd. and Shanky Ltd. operate in the same field, manufacturing newly born babiess

clothes. Although Shanky Ltd. also has interest in communication equipments, Hanky

Ltd. is planning to take over Shanky Ltd. and the shareholders of Shanky Ltd. do not

regard it as a hostile bid.

The following information is available about the two companies.

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

59

Hanky Ltd. Shanky Ltd.

Current earnings ` 6,50,00,000 ` 2,40,00,000

Number of shares 50,00,000 15,00,000

Percentage of retained earnings 20% 80%

Return on new investment 15% 15%

Return required by equity shareholders 21% 24%

Dividends have just been paid and the retained earnings have already been reinvested in

new projects. Hanky Ltd. plans to adopt a policy of retaining 35% of earnings after the

takeover and expects to achieve a 17% return on new investment.

Saving due to economies of scale are expected to be ` 85,00,000 per annum.

Required return to equity shareholders will fall to 20% due to portfolio effects.

Requirements

(a) Calculate the existing share prices of Hanky Ltd. and Shanky Ltd.

(b) Find the value of Hanky Ltd. after the takeover

(c) Advise Hanky Ltd. on the maximum amount it should pay for Shanky Ltd.

3. A Ltd.s (Acquirer company) equity capital is ` 2,00,00,000. Both A Ltd. and T Ltd.

(Target Company) have arrived at an understanding to maintain debt equity ratio at 0.30 :

1 of the merged company. Pre-merger debt outstanding of A Ltd. stood at ` 20,00,000

and T Ltd at ` 10,00,000 and marketable securities of both companies stood at

` 40,00,000.

You are required to calculate total fund requirements of A Ltd. to acquire T Ltd. against

cash payment at mutually agreed price of ` 65,00,000.

Index Futures

4. BSE 5000

Value of portfolio `10,10,000

Risk free interest rate 9% p.a.

Dividend yield on Index 6% p.a.

Beta of portfolio 1.5

We assume that a future contract on the BSE index with four months maturity is used to

hedge the value of portfolio over next three months. One future contract is for delivery of

50 times the index.

Based on the above information calculate:

(i) Price of future contract.

(ii) The gain on short futures position if index turns out to be 4,500 in three months.

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

60

(iii) Value of Portfolio using CAPM.

5. Suppose current price of an index is `13,800 and yield on index is 4.8% (p.a.). A 6-

month future contract on index is trading at `14,340.

Assuming that Risk Free Rate of Interest is 12%, show how Mr. X (an arbitrageur) can

earn an abnormal rate of return irrespective of outcome after 6 months. You can assume

that after 6 months index closes at ` 10,200 and ` 15,600 and 50% of stock included in

index shall pay divided in next 6 months.

Also calculate implied risk free rate.

Portfolio Management

6. Following data is related to Company X, Market Index and Treasury Bonds for the current

year and last 4 years:

Year Company X Market Index

Average

Share Price

(P)

Dividend

Per Share

(D)

Average

Market

Index

Market

Dividend

Yield

Return on

Treasury

Bonds

2009 ` 139 ` 7.00 1300 3% 7%

2010 ` 147 ` 8.50 1495 5% 9%

2011 ` 163 ` 9.00 1520 5.5% 8%

2012 ` 179 ` 9.50 1640 4.75% 8%

2013 (Current Year) ` 203.51 ` 10.00 1768 5.5% 8%

With the above data estimate the beta of Company Xs share.

7. The rates of return on the security of Company X and market portfolio for 10 periods are

given below:

Period Return of Security X (%) Return on Market Portfolio (%)

1 20 22

2 22 20

3 25 18

4 21 16

5 18 20

6 5 8

7 17 6

8 19 5

9 7 6

10 20 11

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

61

(i) What is the beta of Security X?

(ii) What is the characteristic line for Security X?

Foreign Exchange Management

8. Columbus Surgicals Inc. is based in US, has recently imported surgical raw materials

from the UK and has been invoiced for 480,000, payable in 3 months. It has also

exported surgical goods to India and France.

The Indian customer has been invoiced for 138,000, payable in 3 months, and the

French customer has been invoiced for 590,000, payable in 4 months.

Current spot and forward rates are as follows:

/ US$

Spot: 0.9830 0.9850

Three months forward: 0.9520 0.9545

US$ /

Spot: 1.8890 1.8920

Four months forward: 1.9510 1.9540

Current money market rates are as follows:

UK: 10.0% 12.0% p.a.

France: 14.0% 16.0% p.a.

USA: 11.5% 13.0% p.a.

You as Treasury Manager are required to show how the company can hedge its foreign

exchange exposure using Forward markets and Money markets hedge and suggest

which the best hedging technique is.

9. ABN-Amro Bank, Amsterdam, wants to purchase `15 million against US$ for funding

their Vostro account with Canara Bank, New Delhi. Assuming the inter-bank, rates of

US$ is `51.3625/3700, what would be the rate Canara Bank would quote to ABN-Amro

Bank? Further, if the deal is struck, what would be the equivalent US$ amount.

Mutual Fund

10. A Mutual Fund Co. has the following assets under it on the close of business as on:

1

st

February 2012 2

nd

February 2012

Company No. of Shares Market price per share Market price per share

` `

L Ltd 20,000 20.00 20.50

M Ltd 30,000 312.40 360.00

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

62

N Ltd 20,000 361.20 383.10

P Ltd 60,000 505.10 503.90

Total No. of Units 6,00,000

(i) Calculate Net Assets Value (NAV) of the Fund.

(ii) Following information is given:

Assuming one Mr. A, submits a cheque of ` 30,00,000 to the Mutual Fund and the Fund

manager of this company purchases 8,000 shares of M Ltd; and the balance amount is

held in Bank. In such a case, what would be the position of the Fund?

(iii) Find new NAV of the Fund as on 2nd February 2012.

Dividend Decision

11. X Ltd., has 8 lakhs equity shares outstanding at the beginning of the year 2012. The

current market price per share is ` 120. The Board of Directors of the company is

contemplating ` 6.4 per share as dividend. The rate of capitalisation, appropriate to the

risk-class to which the company belongs, is 9.6%:

(i) Based on M-M Approach, calculate the market price of the share of the company,

when the dividend is (a) declared; and (b) not declared.

(ii) How many new shares are to be issued by the company, if the company desires to

fund an investment budget of ` 3.20 crores by the end of the year assuming net

income for the year will be ` 1.60 crores?

Leasing

12. Sundaram Ltd. discounts its cash flows at 16% and is in the tax bracket of 35%. For the

acquisition of a machinery worth `10,00,000, it has two options either to acquire the

asset by taking a bank loan @ 15% p.a. repayable in 5 yearly installments of `2,00,000

each plus interest or to lease the asset at yearly rentals of `3,34,000 for five (5) years. In

both the cases, the instalment is payable at the end of the year. Depreciation is to be

applied at the rate of 15% using written down value (WDV) method. You are required to

advise which of the financing options is to be exercised and why.

Year 1 2 3 4 5

P.V factor @16% 0.862 0.743 0.641 0.552 0.476

Security Valuation

13. Calculate the value of share from the following information:

Profit of the company ` 290 crores

Equity capital of company ` 1,300 crores

Par value of share ` 40 each

Debt ratio of company 27

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

63

Long run growth rate of the company 8%

Beta 0.1; risk free interest rate 8.7%

Market returns 10.3%

Capital expenditure per share ` 47

Depreciation per share ` 39

Change in Working capital ` 3.45 per share

Money Market Instrument

14. Nominal value of 10% bonds issued by a company is `100. The bonds are redeemable at

`110 at the end of year 5.

Determine the value of the bond if required yield is (i) 5%, (ii) 5.1%, (iii) 10% and (iv)

10.1%.

Economic Value Added

15. Consider the following operating information gathered from 3 companies that are

identical except for their capital structures:

P Ltd. Q Ltd. R Ltd.

Total invested capital 100,000 100,000 100,000

Debt/assets ratio 0.80 0.50 0.20

Shares outstanding 6,100 8,300 10,000

Before-tax cost of debt 14% 12% 10%

Cost of equity 26% 22% 20%

Operating income, (EBIT) 25,000 25,000 25,000

Net Income 8,970 12,350 14,950

Tax rate 35% 35% 35%

(a) Compute the weighted average cost of capital, WACC, for each firm.

(b) Compute the Economic Value Added, EVA, for each firm.

(c) Based on the results of your computations in part b, which firm would be considered

the best investment? Why?

(d) Assume the industry P/E ratio generally is 15 . Using the industry norm, estimate

the price for each share.

(e) What factors would cause you to adjust the P/E ratio value used in part d so that it

is more appropriate?

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

64

Indian Capital Market

16. Abhishek Ltd. has a surplus cash of `90 lakhs and wants to distribute 30% of it to the

shareholders. The Company decides to buyback shares. The Finance Manager of the

Company estimates that its share price after re-purchase is likely to be 10% above the

buyback price; if the buyback route is taken. The number of shares outstanding at

present is 10 lakhs and the current EPS is `3.

You are required to determine:

(a) The price at which the shares can be repurchased, if the market capitalization of the

company should be ` 200 lakhs after buyback.

(b) The number of shares that can be re-purchased.

(c) The impact of share re-purchase on the EPS, assuming the net income is same.

17. A Mutual Fund is holding the following assets in ` Crores :

Investments in diversified equity shares 90.00

Cash and Bank Balances 10.00

100.00

The Beta of the portfolio is 1.1. The index future is selling at 4300 level. The Fund

Manager apprehends that the index will fall at the most by 10%. How many index futures

he should short for perfect hedging so that the portfolio beta is reduced to 1.00? One

index future consists of 50 units.

Substantiate your answer assuming the Fund Manager's apprehension will materialize.

Swap

18. A Inc. and B Inc. intend to borrow $200,000 and $200,000 in respectively for a time

horizon of one year. The prevalent interest rates are as follows:

Company Loan $ Loan

A Inc 5% 9%

B Inc 8% 10%

The prevalent exchange rate is $1 = 120.

They entered in a currency swap under which it is agreed that B Inc will pay A Inc @ 1%

over the Loan interest rate which the later will have to pay as a result of the agreed

currency swap whereas A Inc will reimburse interest to B Inc only to the extent of 9%.

Keeping the exchange rate invariant, quantify the opportunity gain or loss component of

the ultimate outcome, resulting from the designed currency swap.

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

65

Commodity Futures

19. A company is long on 10 MT of copper @ ` 474 per kg (spot) and intends to remain so

for the ensuing quarter. The standard deviation of changes of its spot and future prices

are 4% and 6% respectively, having correlation coefficient of 0.75.

What is its hedge ratio? What is the amount of the copper future it should short to

achieve a perfect hedge?

20. Write a short note on

(a) How financial policy is linked to strategic management

(b) Zero date of a Project in project management

(c) Cross Border Leasing

(d) Offer for Sale

(e) External Commercial Borrowings (ECBs)

SUGGESTED ANSWERS/HINTS

1. In this question the effect of increasing running cost and decreasing resale value have to

be weighted upto against the purchase cost of bike. For this purpose we shall compute

Equivalent Annual Cost (EAC) of replacement in different years shall be computed and

compared.

Year Road

Taxes

(`)

Petrol

etc.

(`)

Total

(`)

PVF

@10%

PV

(`)

Cumulative

PV (`)

PV of

Resale

Price

(`)

Net

Outflow

(`)

1 3,000 30,000 33,000 0.909 29,997 29,997 31,815 (1,818)

2 3,000 35,000 38,000 0.826 31,388 61,385 17,346 44,039

3 3,000 43,000 46,000 0.751 34,546 95,931 6,759 89,172

Computation of EACs

Year Purchase

Price of Bike

(`)

Net Outflow

(`)

Total

Outflow

(`)

PVAF

@ 10%

EAC

(`)

1 55,000 (1,818) 53,182 0.909 58,506

2 55,000 44,039 99,039 1.735 57,083

3 55,000 89,172 1,44,172 2.486 57,993

Thus, from above table it is clear that EAC is least in case of 2 years, hence bike should

be replaced every two years.

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

66

2. (a) Existing share price of Hanky (P) Ltd.

g = r x b

r = 15%

b = 20%

g = 0.15 x 0.2

= 0.03

Ex dividend market value =

g

e

k

dividend s year' Next

=

0.03 0.21

x1.03 0.8 x 0 6,50,00,00

= ` 29,75,55,556

= ` 59.51 per share

Existing share price Shanky (P) Ltd.

g = r x b

= 0.15 x 0.8

= 0.12

Ex dividend market value =

g

e

k

dividend s year' Next

=

2,40,00,000 x 0.2x1.12

0.24 - 0.12

= ` 4,48,00,000

= ` 29.87 per share

(b) Value of Hanky Ltd. after the takeover

Care must be taken in calculating next years dividend and the subsequent growth

rate. Next years earnings are already determined, because both companies have

already reinvested their retained earnings at the current rate of return. In addition,

they will get cost savings of ` 85,00,000.

The dividend actually paid out at the end of next year will be determined by the new

35% retention and the future growth rate will take into account the increased return

on new investment.

Growth rate for combined firm, g = 0.17 x 0.35 = 0.0595

New cost of equity = 20%

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

67

Next years earnings = ` 6,50,00,000 x 1.03 + ` 2,40,00,000 x 1.12 + ` 85,00,000

= ` 10,23,30,000

Next years dividend = ` 10,23,30,000 x 0.65

= ` 6,65,14,500

Market value =

6,65,14,500

0.20- 0.0595

`

= ` 47,34,12,811

(c) Maximum Hanky Ltd. should pay for Shanky Ltd.

Combined value = ` 47,34,12,811

Present Value of Hanky Ltd. = ` 29,75,55,556

= ` 17,58,57,255

3.

`

Debt capacity of merged company (2,00,00,000 0.30) 60,00,000

Less: Debt of A Ltd and T Ltd. 30,00,000

30,00,000

Add: Marketable securities of both companies 40,00,000

70,00,000

Since the combined liquidity of merged company shall remain comfortable, it shall be

feasible to pay cash for acquiring the T Ltd. against tentative price of ` 65,00,000.

4. (i) Current future price of the index = 5000 + 5000 (0.09-0.06)

12

4

= 5000+ 50= 5,050

Price of the future contract = ` 50 5,050 = ` 2,52,500

(ii) Hedge ratio = 1.5

2,52,500

10,10,000

= 6 contracts

Index after there months turns out to be 4500

Future price will be = 4500 + 4500 (0.09-0.06)

12

1

= 4,511.25

Therefore, Gain from the short futures position is = 6 (5050 4511.25) 50 = ` 1,61,625

(iii) To use CAPM we require risk-free rate of return, beta of portfolio and Market

Return. Since risk-free rate of return and beta of portfolio is given first we shall

calculate market return as follows:

Change in Index Value = 4500-5000 = -500

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

68

Return from Index =

100

5000

500 -

= -10% for 3 months

Dividend yield on index p.a. = 6% and for 3 months shall be 1.5%.

Thus return to investor for investment in index for three months= -10%+1.5% = -8.5%

Now we can use CAPM to compute expected return for 3 months:

Expected Return = R

f + (Rm Rf)

= 2.25% + 1.50(- 8.5 - 2.25%)

= 2.25% + 1.50 (-10.75%)

= -13.875%

The expected value of portfolio (without hedging) after 3 months will be:

` 10,10,000[1+(-0.13875)]= `8,69,862.25

The expected value of portfolio with hedging after 3 months will be:

= Expected Value of portfolio (without hedging) + Gain from the future Index

= `8,69,862.25 + `1,61,625 = `10,31,487.25

5. The fair price of the index future contract can calculated as follows:

FC = 13,800 + [(13,800 0.12

6

12

- 13,800 4.8% 0.50)]

= 13,800 + [828 331.20] = ` 14,296.80

Since presently index is trading at ` 14,340, hence it is overpriced.

To earn an abnormal rate of return, Mr. X shall take following steps:

1. Mr. X shall buy a portfolio which comprising of shares as index consisted of.

2. Mr. X shall go for short position on index future contract.

Now we shall calculate return to Mr. X under two given situations:

(i) Return of Mr. X, if index closes at ` 10,200

`

Profit from short position of futures (`14,340 `10,200) 4,140.00

Cash Dividend on Portfolio (`13,800 4.8% 0.5) 331.20

Loss on sale of portfolio (`10,200 `13,800) (3,600.00)

871.20

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

69

(ii) Return of Mr. X if index closes at ` 15,600

`

Loss from short position in futures. (`14,340 `15,600) (1,260.00)

Cash dividend on portfolio 331.20

Profit on sale of underlying portfolio (`15,600 `13,800) 1,800.00

871.20

6 months Return

871.20

100

13,800

= 6.31%

Annualised Return = 6.31 2 = 12.63%

6. First of we shall calculate expected return from share of Company X

(i) Average annual capital gain (%)

Let g = average annual capital gain, then:

`203.51(1+g)

= `139

Then g = (203.51/139)

-1 = 0.10 i.e. 10%

(ii) Average annual dividend yield (%)

Year Dividend/Share Price Dividend Yield

2009 `7.00/`139 0.050

2010 `8.50/ `147 0.058

2011 `9.00/ `163 0.055

2012 `9.50/ `179 0.053

2013 (Current Year) `10.00/ `203.51 0.049

0.265

Average Yield = 0.265/5= 0.053 i.e. 5.3%

Thus with this data expected return of share of Company X can be given as follows:

E(rX) = Average Annual Capital Gain + Average Annual Dividend

= 10% + 5.3% = 15.3%

Then we shall calculate expected return from market index as follows:

(i) Average annual capital gain (%)

1300 (1+g)

= 1768

Then g = (203.51/139)

-1 = 0.08 i.e. 8%

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

70

(ii) Average annual dividend yield (%)

3% + 5% + 5.5% + 4.75% + 5.5% = 23.75%/5 = 4.75%

Thus expected return on Market Index E(rM) = 8% + 4.75% = 12.75%

Average annual risk-free rate of return

7% + 9% + 8% + 8% + 8% = 40%/5 = 8%

Now with the above information we compute Beta () of share company X using

CAPM as follows:

E(r

X) = rf + [E(rM) - rf]

15.3% = 8% + [12.75% - 8%]

= 1.54

7. (i)

Period

X

R

M

R

X

X

R R M

M

R R

( ) X

X

R R

( ) M

M

R R

( )

2

M

M

R R

1 20 22 5 10 50 100

2 22 20 7 8 56 64

3 25 18 10 6 60 36

4 21 16 6 4 24 16

5 18 20 3 8 24 64

6 -5 8 -20 -4 80 16

7 17 -6 2 -18 -36 324

8 19 5 4 -7 -28 49

9 -7 6 -22 -6 132 36

10 20 11 5 -1 -5 1

150 120 357 706

RX RM

) R R )( R (R M

M

X

X

2

M

M

) R R (

X R

= 15

M R

= 12

2

M =

n

R R

2

M M

=

10

706

= 70.60

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

71

CovX M=

n

R R R R

M M X X

=

10

357

= 35.70

Betax =

M

2

M X

Cov

=

60 . 70

70 . 35

= 0.505

(ii)

X R = 15

M R

= 12

y = + x

15 = + 0.505 12

Alpha () = 15 (0.505 12)

= 8.94%

Characteristic line for security X = + RM

Where, RM = Expected return on Market Index

Characteristic line for security X = 8.94 + 0.505 RM

8. Exposure

Since Columbus has a receipt ( 138,000) and payment of ( 480,000) maturing at the

same time i.e. 3 months, it can match them against each other leaving a net liability of

342,000 to be hedged.

(i) Forward market hedge

Buy 3 months' forward contract accordingly, amount payable after 3 months will be

342,000 / 0.9520 = US$ 359,244

(ii) Money market hedge

To pay after 3 months' Columbus shall requires to borrow in US$ and translate to

and then deposit in .

For payment of 342,000 in 3 months (@2.5% interest) amount required to be

deposited now

( 342,000 1.025) = 333,658

With spot rate of 0.9830 the US$ loan needed will be = US$ 339,429.

Loan repayable after 3 months (@3.25% interest) will be = US$ 350,460.

In this case the money market hedge is a cheaper option.

Receipt

Amount to be hedged = 590,000

Now we Convert exchange rates to home currency

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

72

/ US$

Spot 0.5285 0.5294

4 months forward 0.5118 0.5126

(i) Forward market hedge

Sell 4 months' forward contract accordingly, amount receivable after 4 months

will be

( 590,000 / 0.5126) = US$ 1,150,995

(ii) Money market hedge

For money market hedge Columbus shall borrow in and then translate to

US$ and deposit in US$

For receipt of 590,000 in 4 months (@ 5.33% interest) amount required to be

borrowed now

(590,000 1.0533) = 560,144

With spot rate of 0.5294 the US$ deposit will be = US$ 1,058,073

deposit amount will increase over 3 months (@3.83% interest) will be = US$ 1,098,597

In this case, more will be received in US$ under the forward hedge.

9. Here Canara Bank shall buy US$ and credit ` to Vostro account of ABN-Amro Bank.

Canara Banks buying rate will be based on the Inter-bank Buying Rate (as this is the

rate at which Canara Bank can sell US$ in the Interbank market)

Accordingly, the Interbank Buying Rate of US$ will be ` 51.3625 (lower of two)

Equivalent of US$ for `15 million at this rate will be

=

51.3625

15,000,000

= US$ 2,92,041.86

10. (i) NAV of the Fund

=

` ` ` ` 4,00,000 93,72,000 72,24,000 3,03,06,000

6,00,000

+ + +

=

` 4,73,02,000

6,00,000

=` 78.8366 rounded to ` 78.84

(ii) The revised position of fund shall be as follows:

Shares No. of shares Price Amount (`)

L Ltd. 20,000 20.00 4,00,000

M Ltd. 38,000 312.40 1,18,71,200

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

73

N Ltd. 20,000 361.20 72,24,000

P Ltd. 60,000 505.10 3,03,06,000

Cash 5,00,800

5,03,02,000

No. of units of fund = 6,00,000

30,00,000

78.8366

+ = 6,38,053

(iii) On 2

nd

February 2012, the NAV of fund will be as follows:

Shares No. of shares Price Amount (`)

L Ltd. 20,000 20.50 4,10,000

M Ltd. 38,000 360.00 1,36,80,000

N Ltd. 20,000 383.10 76,62,000

P Ltd. 60,000 503.90 3,02,34,000

Cash 5,00,800

5,24,86,800

NAV as on 2

nd

February 2012 =

` 5,24,86,800

6,38,053

= ` 82.26 per unit

11. Modigliani and Miller (M-M) Dividend Irrelevancy Model:

e

1 1

0

K 1

D P

P

+

+

=

Where,

Po = Existing market price per share i.e. ` 120

P1 = Market price of share at the year-end (to be determined)

D1 = Contemplated dividend per share i.e. ` 6.4

Ke = Capitalisation rate i.e. 9.6%.

(i) (a) Calculation of share price when dividend is declared:

e

1 1

0

K 1

D P

P

+

+

=

0.096 1

6.4 P

120

1

+

+

=

120 1.096 = P1 + 6.4

P1 = 120 1.096 6.4

= 125.12

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

74

(b) Calculation of share price when dividend is not declared:

e

1 1

0

K 1

D P

P

+

+

=

0.096 1

0 P

120

1

+

+

=

120 1.096 = P1 + 0

P1 = 131.52

(ii) Calculation of No. of shares to be issued:

(` in lakhs)

Particulars If dividend

declared

If dividend not

declared

Net Income 160 160

Less: Dividend paid 51.20 ------

Retained earnings 108.80 160

Investment budget 320 320

Amount to be raised by issue of new shares (i) 211.20 160

Market price per share (ii) 125.12 131.52

No. of new shares to be issued (ii) 1,68,797.95 1,21,654.50

Or say 1,68,798 1,21,655

12. Alternative I: Acquiring the asset by taking bank loan:

Years 1 2 3 4 5

(a) Interest (@15% p.a. on

opening balance)

150,000 120,000 90,000 60,000 30,000

Depreciation (@15%WDV) 150,000 127,500 108,375 92,119 78,301

300,000 247,500 198,375 152,119 108,301

(b) Tax shield (@35%) 105,000 86,625 69,431 53,242 37,905

Interest less Tax shield (a)-(b) 45,000 33,375 20,569 6,758 (-)7,905

Principal Repayment 2,00,000 2,00,000 2,00,000 2,00,000 2,00,000

Total cash outflow 2,45,000 2,33,375 2,20,569 2,06,758 1,92,095

Discounting Factor @ 16% 0.862 0.743 0.641 0.552 0.476

Present Value 2,11,190 1,73,398 1,41,385 1,14,130 91,437

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

75

Total P.V of cash outflow = `731,540

Alternative II: Acquire the asset on lease basis

Year Lease Rentals

`

Tax Shield

@35%

Net Cash

Outflow

Discount

Factor

Present

Value

1 3,34,000 1,16,900 2,17,100 0.862 1,87,140

2 3,34,000 1,16,900 2,17,100 0.743 1,61,305

3 3,34,000 1,16,900 2,17,100 0.641 1,39,161

4 3,34,000 1,16,900 2,17,100 0.552 1,19,839

5 3,34,000 1,16,900 2,17,100 0.476 1,03,340

Present value of Total Cash out flow 7,10,785

Advice -By making Analysis of both the alternatives, it is observed that the present value

of the cash outflow is lower in alternative II by `20,755 (i.e. ` 7,31,540 ` 7,10,785)

Hence, it is suggested to acquire the asset on lease basis.

13. No. of Shares =

crores 40

crores 300 , 1

`

`

= 32.5 Crores

EPS =

shares No.of

PAT

EPS =

crores 5 . 32

crores 290 `

= ` 8.923

FCFE = Net income [(1-b) (capex dep) + (1-b) ( WC)]

FCFE = 8.923 [(1-0.27) (47-39) + (1-0.27) (3.45)]

= 8.923 [5.84 + 2.5185]

= 0.5645

Cost of Equity = Rf + (Rm Rf)

= 8.7 + 0.1 (10.3 8.7)

= 8.86%

Po =

g K

g) FCFE(1

e

+

=

0086 . 0

60966 . 0

08 . 0886 . 0

) 08 . 1 ( 5645 . 0

=

= ` 70.89

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

76

14. Case (i) Required yield rate = 5%

Year Cash Flow` DF (5%) Present Value `

1-5 10 4.3295 43.295

5 110 0.7835 86.185

Value of bond 129.48

Case (ii) Required yield rate = 5.1%

Year Cash Flow` DF (5.1%) Present Value `

1-5 10 4.3175 43.175

5 110 0.7798 85.778

Value of bond 128.953

Case (iii) Required yield rate = 10%

Year Cash Flow` DF (10%) Present Value `

1-5 10 3.7908 37.908

5 110 0.6209 68.299

Value of bond 106.207

Case (iv) Required yield rate = 10.1%

Year Cash Flow` DF (10.1%) Present Value `

1-5 10 3.7811 37.811

5 110 0.6181 67.991

Value of bond 105.802

15. (a) WACCP = [14.0%(1 - 0.35)](0.80) + 26.0%(0.20) = 12.48%

WACCQ = [12.0%(1 - 0.35)](0.50) + 22.0%(0.50) = 14.90%

WACCR = [10.0%(1 - 0.35)](0.20) + 20.0%(0.80) = 17.30%

(b) EVA = EBIT(1 - T) - (WACC x Invested capital)

EVAP = 25,000(1 - 0.35) - (0.1248 x 100,000)

= 16,250 - 12,480

= 3,770

EVA

Q = 25,000(1 - 0.35) - (0.1490 x 100,000)

= 16,250 - 14,900

= 1,350

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

77

EVAR = 25,000(1 - 0.35) - (0.1730 x 100,000)

= 16,250 - 17,300

= -1,050

(c) EVA

P > EVAQ > EVAR; Thus, P Ltd. would be considered the best investment. The

result should have been obvious, given that the firms have the same EBIT, but

WACCP < WACCQ < WACCR.

(d) P Ltd. Q Ltd. R Ltd.

EBIT 25,000 25,000 25,000

Interest

a

(11,200) ( 6,000) ( 2,000)

Taxable income 13,800 19,000 23,000

Tax (35%) ( 4,830) ( 6,650) ( 8,050)

Net income 8,970 12,350 14,950

Shares 6,100 8,300 10,000

EPS 1.470 1.488 1.495

Stock price: P/E = 15x 22.05 22.32 22.43

a

InterestP = 100,000(0.80) x 0.14 = 11,200

InterestQ = 100,000(0.50) x 0.12 = 6,000

InterestR = 100,000(0.20) x 0.10 = 2,000

(e) Given the three firms have substantially different capital structures, we would

expect that they also have different degrees of financial risk. Therefore, we might

want to adjust the P/E ratios to account for the risk differences.

16. (a) Let P be the buyback price decided by Abhishek Ltd.

Market Capitalisation After Buyback:

1.1 P (Original Shares Shares Bought back)

= )

P

lakhs 90 of 30%

- Lakhs (10 P 1.1

= 11 Lakhs x P 27 lakhs x 1.1

= 11 lakhs x P 29.7 lakhs

Market capitalization rate after buyback is 200 lakhs.

Thus, we have:

11 Lakhs x P 29.7 lakhs = `200 lakhs

or 11P = 200 + 29.7

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

78

or P = 88 . 20

11

7 . 229

` =

(b) Number of shares to be bought back:

) ly Approximae ( lakhs 29 . 1

88 . 20

Lakhs 27

= =

(c) New Equity Shares

= (10 1.29) lakhs = 8.71 lakhs

EPS = 44 . 3 . Rs

L 71 . 8

L 30

lakhs 71 . 8

lakhs 10 3

= =

Thus EPS of Abhishek Ltd., increases to `3.44

17. Number of index future to be sold by the Fund Manager is:

1.1 90,00,00,000

4,300 50

= 4,605

Justification of the answer:

Loss in the value of the portfolio if the index falls by 10% is

=

10(1.10)

90 Crore

100

` =

11

x 90 Crore

100

`

= ` 9.90 Crore.

Gain by short covering of index future is:

0.1 4,300 50 4,605

1,00,00,000

= 9.90 Crore

This justifies the answer cash is not part of the portfolio.

18.

Opportunity gain of A Inc under currency

swap

Receipt Payment Net

Interest to be remitted to B. Inc in $

2,00,0009%=$18,000

Converted into ($18,000120)

21,60,000

Interest to be received from B. Inc in $

converted into Y

(6%$2,00,000 120)

14,40,000 -

Interest payable on Y loan - 12,00,000

14,40,000 33,60,000

Net Payment 19,20,000 -

33,60,000 33,60,000

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

79

$ equivalent paid 19,20,000 (1/120) $16,000

Interest payable without swap in $ $18,000

Opportunity gain in $ $ 2,000

Opportunity gain of B inc under currency

swap

Receipt Payment Net

Interest to be remitted to A. Inc in ($

2,00,000 6%)

$12,000

Interest to be received from A. Inc in Y

converted into $ =21,60,000/120

$18,000

Interest payable on $ loan@10% - $20,000

$18,000 $32,000

Net Payment $14,000

$32,000

-

$32,000

Y equivalent paid $14,000 X 120 16,80,000

Interest payable without swap in

($2,00,000 X 120X8%)

19,20,000

Opportunity gain in Y 2,40,000

Alternative Solution

Cash Flows of A Inc

(i) At the time of exchange of principal amount

Transactions Cash Flows

Borrowings $2,00,000 x 120 + 240,00,000

Swap - 240,00,000

Swap +$2,00,000

Net Amount +$2,00,000

(ii) At the time of exchange of principal amount

Transactions Cash Flows

Interest to the lender 240,00,000X5% 12,00,000

Interest Receipt from B Inc. 2,00,000X120X6% 14,40,000

Net Saving (in $) 2,40,000/120 $2,000

Interest to B Inc. $2,00,000X9% -$18,000

Net Interest Cost -$16,000

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

80

A Inc. used $2,00,000 at the net cost of borrowing of $16,000 i.e. 8%. If it had not

opted for swap agreement the borrowing cost would have been 9%. Thus there is

saving of 1%.

Cash Flows of B Inc

(i) At the time of exchange of principal amount

Transactions Cash Flows

Borrowings + $2,00,000

Swap - $2,00,000

Swap $2,00,000X120 +240,00,000

Net Amount +240,00,000

(ii) At the time of exchange of principal amount

Transactions Cash Flows

Interest to the lender $2,00,000X10% - $20,000

Interest Receipt from A Inc. +$18,000

Net Saving (in ) -$2,000X120 - 2,40,000

Interest to A Inc. $2,00,000X6%X120 - 14,40,000

Net Interest Cost - 16,80,000

B Inc. used 240,00,000 at the net cost of borrowing of 16,80,000 i.e. 7%. If it had

not opted for swap agreement the borrowing cost would have been 8%. Thus there

is saving of 1%.

19. The optional hedge ratio to minimize the variance of Hedgers position is given by:

H=

S

F

Where

S= Standard deviation of S

F=Standard deviation of F

= coefficient of correlation between S and F

H= Hedge Ratio

S = change in Spot price.

F= change in Future price.

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

81

Accordingly

H = 0.75 x

0.04

0.06

= 0.5

No. of contract to be short = 10 x 0.5 = 5

Amount = 5000 x ` 474 = ` 23,70,000

20. (a) The success of any business is measured in financial terms. Maximising value to

the shareholders is the ultimate objective. For this to happen, at every stage of its

operations including policy-making, the firm should be taking strategic steps with

value-maximization objective. This is the basis of financial policy being linked to

strategic management.

The linkage can be clearly seen in respect of many business decisions. For

example:

(i) Manner of raising capital as source of finance and capital structure are the

most important dimensions of strategic plan.

(ii) Cut-off rate (opportunity cost of capital) for acceptance of investment

decisions.

(iii) Investment and fund allocation is another important dimension of interface of

strategic management and financial policy.

(iv) Foreign Exchange exposure and risk management.

(v) Liquidity management

(vi) A dividend policy decision deals with the extent of earnings to be distributed

and a close interface is needed to frame the policy so that the policy should be

beneficial for all.

(vii) Issue of bonus share is another dimension involving the strategic decision.

Thus from above discussions it can be said that financial policy of a company

cannot be worked out in isolation to other functional policies. It has a wider appeal

and closer link with the overall organizational performance and direction of growth.

(b) Zero Date of a Project means a date is fixed from which implementation of the

project begins. It is a starting point of incurring cost. The project completion period

is counted from the zero date. Pre-project activities should be completed before

zero date. The pre-project activities should be completed before zero date. The pre-

project activities are:

a. Identification of project/product

b. Determination of plant capacity

c. Selection of technical help/collaboration

d. Selection of site.

The Institute of Chartered Accountants of India

FINAL EXAMINATION: NOVEMBER, 2013

82

e. Selection of survey of soil/plot etc.

f. Manpower planning and recruiting key personnel

g. Cost and finance scheduling.

(c) Cross-border leasing is a leasing agreement where lessor and lessee are situated in

different countries. This raises significant additional issues relating to tax avoidance

and tax shelters. It has been widely used in some European countries, to arbitrage

the difference in the tax laws of different countries.

Cross-border leasing have been in practice as a means of financing infrastructure

development in emerging nations. Cross-border leasing may have significant

applications in financing infrastructure development in emerging nations - such as

rail and air transport equipment, telephone and telecommunications, equipment,

and assets incorporated into power generation and distribution systems and other

projects that have predictable revenue streams.

A major objective of cross-border leases is to reduce the overall cost of financing

through utilization by the lessor of tax depreciation allowances to reduce its taxable

income, The tax savings are passed through to the lessee as a lower cost of

finance. The basic prerequisites are relatively high tax rates in the lessor's country,

liberal depreciation rules and either very flexible or very formalistic rules governing

tax ownership.

(d) Offer for sale is also known as bought out deal (BOD). It is a new method of offering

equity shares, debentures etc., to the public. In this method, instead of dealing

directly with the public, a company offers the shares/debentures through a sponsor.

The sponsor may be a commercial bank, merchant banker, an institution or an

individual. It is a type of wholesale of equities by a company. A company allots

shares to a sponsor at an agreed price between the company and sponsor. The

sponsor then passes the consideration money to the company and in turn gets the

shares duly transferred to him. After a specified period as agreed between the

company and sponsor, the shares are issued to the public by the sponsor with a

premium. After the public offering, the sponsor gets the shares listed in one or more

stock exchanges. The holding cost of such shares by the sponsor may be

reimbursed by the company or the sponsor may get the profit by issue of shares to

the public at premium.

Thus, it enables the company to raise the funds easily and immediately. As per

SEBI guidelines, no listed company can go for BOD. A privately held company or an

unlisted company can only go for BOD. A small or medium size company which

needs money urgently chooses to BOD. It is a low cost method of raising funds. The

cost of public issue is around 8% in India. But this method lacks transparency.

There will be scope for misuse also. Besides this, it is expensive like the public

issue method. One of the most serious short coming of this method is that the

securities are sold to the investing public usually at a premium. The margin thus

The Institute of Chartered Accountants of India

PAPER 2 : STRATEGIC FINANCIAL MANAGEMENT

83

between the amount received by the company and the price paid by the public does

not become additional funds of the company, but it is pocketed by the issuing

houses or the existing shareholders.

(e) ECB include bank loans, supplier credit, securitised instruments, credit from export

credit agencies and borrowings from multilateral financial institutions. These

securitised instruments may be FRNs, FRBs etc. Indian corporate sector is

permitted to raise finance through ECBs within the framework of the policies and

procedures prescribed by the Central Government. Multilateral financial institutions

like IFC, ADB, AFIC, CDC are providing such facilities while the ECB policy

provides flexibility in borrowing consistent with maintenance of prudential limits for

total external borrowings, its guiding principles are to keep borrowing maturities

long, costs low and encourage infrastructure/core and export sector financing which

are crucial for overall growth of the economy. The government of India, from time to

time changes the guidelines and limits for which the ECB alternative as a source of

finance is pursued by the corporate sector. During past decade the government has

streamlined the ECB policy and procedure to enable the Indian companies to have

their better access to the international financial markets.

The government permits the ECB route for variety of purposes namely expansion of

existing capacity as well as for fresh investment. But ECB can be raised through

internationally recognized sources. There are caps and ceilings on ECBs so that

macro economy goals are better achieved. Units in SEZ are permitted to use ECBs

under a special window.

The Institute of Chartered Accountants of India

You might also like

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- 30779rtpfinalnov2013 2Document26 pages30779rtpfinalnov2013 2Waqar AmjadNo ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- Ca Final May 2012 Exam Paper 2Document7 pagesCa Final May 2012 Exam Paper 2Asim DasNo ratings yet

- Paper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingAyushNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- RTP CA Final Old Course Paper 2 Management Accounting and FinDocument38 pagesRTP CA Final Old Course Paper 2 Management Accounting and FinSajid AliNo ratings yet

- Afm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Document2 pagesAfm Mms Individual Assignment Submission Deadline: 3pm On 22 August, 2013Abhishek BangNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentIsyfi SyifaaNo ratings yet

- Paper - 2: Management Accounting and Financial Analysis Questions SwapDocument31 pagesPaper - 2: Management Accounting and Financial Analysis Questions Swapअंजनी श्रीवास्तवNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- Capital Structure: Particulars Company X Company YDocument7 pagesCapital Structure: Particulars Company X Company YAbhishek GavandeNo ratings yet

- CS Final - Financial Tresurs and Forex Management - June 2004Document4 pagesCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhNo ratings yet

- Inter FMSM MTP2Document16 pagesInter FMSM MTP2renudevi06081973No ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- CA Inter FM Eco RTP May 2023Document27 pagesCA Inter FM Eco RTP May 2023tirthpatel406No ratings yet

- Paper - 2: Strategic Financial Management Questions Index FuturesDocument26 pagesPaper - 2: Strategic Financial Management Questions Index FutureskaranNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Additional Question Sheet LawiDocument27 pagesAdditional Question Sheet LawiPratyusha khareNo ratings yet

- FM & SM QuestionsDocument10 pagesFM & SM QuestionsHITESH RAMNANINo ratings yet

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Financial Management-1Document6 pagesFinancial Management-1chelseaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingShyam virsinghNo ratings yet

- Business - Analysis Dec-11Document3 pagesBusiness - Analysis Dec-11SHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDocument9 pagesPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNo ratings yet

- IMT-59 Financial Management M2Document6 pagesIMT-59 Financial Management M2solvedcareNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsDocument4 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- IMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Document5 pagesIMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)No ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- Corporate Valuation NumericalsDocument47 pagesCorporate Valuation Numericalspasler9929No ratings yet

- Cost of Capital Question BankDocument4 pagesCost of Capital Question BankQuestionscastle Friend100% (1)

- Paper - 2: Strategic Financial Management Questions Sensitivity AnalysisDocument27 pagesPaper - 2: Strategic Financial Management Questions Sensitivity AnalysisRaul KarkyNo ratings yet

- All Math pdf2Document6 pagesAll Math pdf2MD Hafizul Islam HafizNo ratings yet

- CA Final SFM RTP For May 2023Document18 pagesCA Final SFM RTP For May 2023remoratilemothekheNo ratings yet

- Advanced Financial Management: Thursday 10 June 2010Document10 pagesAdvanced Financial Management: Thursday 10 June 2010Waleed MinhasNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh Jain100% (1)

- Ca-Final SFM Question Paper Nov 13Document11 pagesCa-Final SFM Question Paper Nov 13Pravinn_MahajanNo ratings yet

- Business Finance Decisions: T I C A PDocument4 pagesBusiness Finance Decisions: T I C A PImran AhmadNo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Advanced FM Group AssignmentDocument5 pagesAdvanced FM Group Assignmentnesradinkemal2No ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- SFM Exam Capsule Question Part Old Syllabus PDFDocument77 pagesSFM Exam Capsule Question Part Old Syllabus PDFKrishna AdhikariNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- BFDDocument4 pagesBFDaskermanNo ratings yet

- Financial Management Strategy Nov 2007Document4 pagesFinancial Management Strategy Nov 2007samuel_dwumfourNo ratings yet

- 05 s601 SFM - 3 PDFDocument4 pages05 s601 SFM - 3 PDFMuhammad Zahid FaridNo ratings yet

- Section e - QuestionsDocument4 pagesSection e - QuestionsAhmed Raza MirNo ratings yet

- Financial Management: Thursday 9 June 2011Document9 pagesFinancial Management: Thursday 9 June 2011catcat1122No ratings yet

- Forex Extra QuestionsDocument9 pagesForex Extra QuestionsJuhi vohraNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet