73153bos58999 p8

73153bos58999 p8

Uploaded by

Sagar GuptaCopyright:

Available Formats

73153bos58999 p8

73153bos58999 p8

Uploaded by

Sagar GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

73153bos58999 p8

73153bos58999 p8

Uploaded by

Sagar GuptaCopyright:

Available Formats

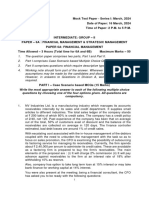

PAPER – 8: FINANCIAL MANAGEMENT AND ECONOMICS FOR FINANCE

PART A: FINANCIAL MANAGEMENT

QUESTIONS

Ratio Analysis

1. From the following information, find out missing figures and REWRITE the balance sheet

of Mukesh Enterprise.

Current Ratio = 2:1

Acid Test ratio = 3:2

Reserves and surplus = 20% of equity share capital

Long term debt = 45% of net worth

Stock turnover velocity = 1.5 months

Receivables turnover velocity = 2 months

You may assume closing Receivables as average Receivables.

Gross profit ratio = 20%

Sales is ` 21,00,000 (25% sales are on cash basis and balance on credit basis)

Closing stock is ` 40,000 more than opening stock.

Accumulated depreciation is 1/6 of original cost of fixed assets.

Balance sheet of the company is as follows:

Liabilities (`) Assets (`)

Equity Share Capital ? Fixed Assets (Cost) ?

Reserves & Surplus ? Less: Accumulated. Depreciation ?

Long Term Loans 6,75,000 Fixed Assets (WDV) ?

Bank Overdraft 60,000 Stock ?

Creditors ? Debtors ?

Cash ?

Total ? Total ?

Cost of Capital

2. Amrit Corporation has the following book value capital structure:

Equity Capital (50 lakh shares of ` 10 each). ` 5,00,00000

© The Institute of Chartered Accountants of India

100 INTERMEDIATE EXAMINATION: MAY, 2023

15% Preference share (50,000 shares ` 100 each) ` 50,00,000

Retained earnings ` 4,00,00,000

Debentures 14% (2,50,000 debentures ` 100 each) ` 2,50,00,000

Term loan 13% ` 4,00,00000

The companies last year earnings per share was ` 5, and it maintains a dividend pay-out

ratio of 60% and returns on equity is 10%. The market price per share is ` 20.8. Preference

share redeemable after 10 years is currently selling for ` 90 per share. Debentures

redeemable after 6 years are currently selling for ` 75 per debenture. The income tax rate

is 40%.

(a) CALCULATE the Weighted Average Cost of Capital (WACC) using market value

proportions.

(b) DETERMINE the Marginal Cost of Capital (MACC) if it needs ` 5,00,00000 next year

assuming the amount will be raised by 60% equity, 20% debt and 20% retained

earnings. Equity issues will fetch a net price of ` 14 and cost of debt will be 13%

before tax up to ` 40,00,000 and beyond ` 40,00,000 it will be 15% before tax.

Capital Structure

3. Current Capital Structure of XYZ Ltd is as follows:

Equity Share Capital of 7 lakh shares of face value ` 20 each

Reserves of ` 10,00,000

9% bonds of ` 3,00,00,000

11% preference capital: 3,00,000 shares of face value ` 50 each

Additional Funds required for XYZ Ltd are ` 5,00,00,000.

XYZ Ltd is evaluating the following alternatives:

I. Proposed alternative I: Raise the funds via 25% equity capital and 75% debt at 10%.

PE ratio in such scenario would be 12.

II. Proposed alternative II: Raise the funds via 50% equity capital and rest from 12%

Preference capital .PE ratio in such scenario would be 11.

Any new equity capital would be issued at a face value of ` 20 each. Any new preferential

capital would be issued at a face value of ` 20 each. Tax rate is 34%

DETERMINE the indifference point under both the alternatives.

Leverages

4. The selected financial data for A, B and C companies for the current year ended 31st March

are as follows:

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 101

Particulars A B C

Variable Expenses as a % of 60 50 40

sales

Interest ` 1,00,000 ` 4,00,000 ` 6,00,000

Degree of Operating Leverage 4:1 3:1 2.5:1

Degree of Financial Leverage 3:1 5:1 2.5:1

Income Tax Rate 30% 30% 30%

(a) PREPARE income statement for A, B and C companies

(b) COMMENT on the financial position and structure of these companies

Investment Decisions

5. Dharma Ltd, an existing profit-making company, is planning to introduce a new product

with a projected life of 8 years. Initial equipment cost will be ` 240 lakhs and additional

equipment costing ` 26 lakhs will be needed at the beginning of third year. At the end of 8

years, the original equipment will have resale value equivalent to the cost of removal, but

the additional equipment would be sold for ` 2 lakhs. Working Capital of ` 25 lakhs will be

needed at the beginning of the operations. The 100% capacity of the plant is of 4,00,000

units per annum, but the production and sales volume expected are as under:

Year Capacity (%)

1 20

2 30

3-5 75

6-8 50

A sale price of ` 100 per unit with a profit volume ratio (contribution/sales) of 60% is likely

to be obtained. Fixed operating cash cost are likely to be ` 16 lakhs per annum. In addition

to this the advertisement expenditure will have to be incurred as under:

Year 1 2 3-5 6-8

Expenditure (` Lakhs each year) 30 15 10 4

The company is subjected to 50% tax rate and consider 12% to be an appropriate cost of

capital. Straight line method of depreciation is followed by the company. ADVISE the

management on the desirability of the project.

Risk analysis in Capital Budgeting

6. Remi limited is a manufacturer of mobile phones in India. Currently the company is

dependent on the foreign supplier for import of the battery. It is considering investment of

` 55,00,000 in a new machine for manufacturing battery of mobile phones. The expected

© The Institute of Chartered Accountants of India

102 INTERMEDIATE EXAMINATION: MAY, 2023

life of machine is 5 years and has no scrap value. It is expected that 3 lakhs units will be

produced and sold each year at a selling price of ` 20 per unit. The estimated variable

costs and annual fixed costs will be` 12 per unit and ` 6,00,000 respectively. Consider

14% to be an appropriate cost of capital. Ignore the taxation and depreciation.

CALCULATE the expected net present value of the project.

You are also REQUIRED to measure the sensitivity of the projects NPV to a 10% decrease

in the project variables sale price per unit and sales volume and 10% increase in Fixed

Cost

Dividend Decisions

7. Rambo Limited Has 1,00,000 equity shares outstanding for the year 2022. The current

market price of the shares is ` 100 each. Company is planning to pay dividend of ` 10 per

share. Required rate of return is 15%. Based on Modigliani-Miller approach, calculate the

market price of the share of the company when the recommended dividend is 1) declared

and 2) not declared.

How many new shares are to be issued by the company at the end of the year on the

assumption that net income for the year is ` 40 Lac and the investment budget is

` 50,00,000 when dividend is declared, or dividend is not declared.

PROOF that the market value of the company at the end of the accounting year will remain

same whether dividends are distributed or not distributed.

Management of Receivables

8. River limited currently uses the credit terms of 1.5/15 net 45 days and average collection

period was 30 days. The company presently having sales of ` 50,00,000 and 30%

customers availing the discount. The chances of default are currently 5%. Variable cost

constitutes 65% and total cost constitute 85% of sales. The company is planning

liberalization of credit terms to 2/20 net 50 days. It is expected that sales are likely to

increase by ` 5,00,000, the default chances are 10% and average collection period will

decline to 25 days. There won't be any change in the fixed cost and 50% customers are

expected to avail the discount. Tax rate is 35%.

EVALUATE this policy in comparison with the current policy and recommend whether the

new policy should be implemented. Assume cost of capital to be 10% (post tax) and 360

days in a year.

Management of Working Capital

9. Kalyan limited has provided you the following information for the year 2021-22:

By working at 60% of its capacity the company was able to generate sales of ` 72,00,000.

Direct labour cost per unit amounted to ` 20 per unit. Direct material cost per unit was 40%

of the selling price per unit. Selling price was 3 times the direct labour cost per unit. Profit

margin was 25% on the total cost.

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 103

For the year 2022-23, the company makes the following estimates:

Production and sales will increase to 90% of its capacity. Raw material per unit price will

remain unchanged. Direct expense per unit will increase by 50%. Direct labour per unit will

increase by 10%. Despite the fluctuations in the cost structure, the company wants to

maintain the same profit margin on sales.

Raw materials will be in stock for one month whereas finished goods will remain in stock

for two months. Production cycle is for 2 months. Credit period allowed by suppliers is 2

months. Sales are made to three zones:

Zone Percentage of sale Mode of Credit

A 50% Credit period of 2 months

B 30% Credit period of 3 months

C 20% Cash Sales

There are no cash purchases and cash balance will be ` 1,11,000

The company plans to apply for a working capital financing from bank for the year 2022 -

23. ESTIMATE Net Working Capital of the Company receivables to be taken on sales and

also COMPUTE the maximum permissible bank finance for the company using 3 criteria of

Tandon Committee Norms. (Assume stock of finished goods to be a core current asset)

Miscellaneous

10. (a) HIGHLIGHT the similarities and differences between Samurai Bond and Bull Dog

Bond.

(b) EXPLAIN the process of Debt Securitisation.

SUGGESTED ANSWERS

1.

Liabilities (`) Assets (`)

Equity Share Capital 12,50,000 Fixed Assets (cost) 20,58,000

Reserves & Surplus 2,50,000 Less: Acc. Depreciation (3,43,000)

Long Term Loans 6,75,000 Fixed Assets (WDV) 17,15,000

Bank Overdraft 60,000 Stock 2,30,000

Payables 4,00,000 Receivables 2,62,500

Cash 4,27,500

Total 26,35,000 Total 26,35,000

© The Institute of Chartered Accountants of India

104 INTERMEDIATE EXAMINATION: MAY, 2023

Working Notes:

(i) Sales ` 21,00,000

Less: Gross Profit (20%) ` 4,20,000

Cost of Goods Sold (COGS) ` 16,80,000

Average Receivables

(ii) Receivables Turnover Velocity = 12

Credit Sales

Average Receivables

2= 12

` 21,00,000 75%

` 21,00,000 75% 2

Average Receivables =

12

Average Receivables = ` 2,62,500

Closing Receivables = ` 2,62,500

Average Stock

(iii) Stock Turnover Velocity = 12

COGS

Average Stock

Or 1.5 = 12

` 16,80,000

` 16,80,000 1.5

Or Average Stock =

12

Or Average Stock = ` 2,10,000

Opening Stock + Closing Stock

=` 2, 10, 000

2

Opening Stock + Closing Stock = ` 4,20,000…………………..(1)

Also, Closing Stock-Opening Stock = ` 40,000………………..(2)

Solving (1) and (2), we get closing stock = ` 2,30,000

Current Assets Stock + Receivables + Cash

(iv) Current Ratio= =

Current Liabilities Bank Overdraft + Creditors

` 2,30,000 + ` 2,62,500 + Cash

Or 2 =

` 60,000 + Creditors

Or ` 1,20,000 + 2 Payables = ` 4,92,500 + Cash

Or 2 Payables – Cash.= ` 3,72,500

Or Cash = 2 Payables – ` 3,72,500…………………………..….(3)

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 105

Current Assests - Stock Debtor + Cash

Acid Test Ratio = =

Current Liabilities Current Liabilities

3 ` 2,62,500 + Cash

Or =

2 60,000 + Creditors

Or ` 1,80,000 + 3 Payables = ` 5,25,000 + 2 Cash

Or 3 Payables – 2 Cash = ` 3,45,000 …………………… (4)

Substitute (3) in (4)

Or 3 Payables – 2(2 Payables – ` 3,72,500) = ` 3,45,000

Or 3 Payables – 4 Payables + ` 7,45,000= ` 3,45,000

(Payables) = ` 3,45,000 - ` 7,45,000

Payables = ` 4,00,000

So, Cash = 2 x ` 4,00,000 – ` 3,72,5000

Cash = ` 4,27,500

(v) Long term Debt = 45% of Net Worth

Or ` 6,75,000 = 45% of Net Worth

Net Worth = ` 15,00,000

(vi) Equity Share Capital (ESC) + Reserves = ` 15,00,000

Or ESC + 0.2ESC = ` 15,00,000

Or 1.2 ESC = ` 15,00,000

Equity Share Capital (ESC) = ` 12,50,000

(vii) Reserves = 0.2 x ` 12,50,000

Reserves = ` 2,50,000

(viii) Total of Liabilities=Total of Assets

Or ` 12,50,000 + ` 2,50,000 + ` 6,75,000 +` 60,000 + ` 4,00,000 + Fixes

Assets(FA) (WDV) + ` 2,30,000 + ` 2,62,000 +` 4,27,500

Or ` 26,35,000 = ` 9,20,000 + FA(WDV)

© The Institute of Chartered Accountants of India

106 INTERMEDIATE EXAMINATION: MAY, 2023

FA (WDV) =` 17,15,000

Now FA(Cost) – Depreciation = FA(WDV)

Or FA(Cost) – FA(Cost)/6 = ` 17,15,000

Or 5 FA(Cost)/6 = ` 17,15,000

Or FA(Cost) = ` 17,15,000x 6/5

So, FA(Cost) = ` 20,58,000

Depreciation = ` 20,58,000/6 = ` 3,43,000

2. (a) Calculation of Cost of Equity

(i) D0 = ` 5x 60%

D0 = ` 3

g=bxr

= (1-0.6) x 10% = 4%

D1 = D0 x (1 + g)

= 3 x (1 + 4%)

= 3 x 1.04 = 3.12

D1

Ke= +g

P0

3.12

Ke = + 0.04

20.8

Ke = 19%

(ii) Calculation of Cost of Preference Shares

N =10 years

NP = ` 90

PD = ` 15

RV = ` 100

PD + (RV - NP) / N

Kp = x100

(RV + NP )

15 + (100 - 90) / 10

Kp = x100

(100 + 90 ) / 2

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 107

Kp = 16/95 x 100

Kp= 16.84%

(iii) Calculation of Cost of Debentures

N = 6 years

NP = ` 75

Interest = ` 14

RV = ` 100

T = 40%

int (1 - t) + (RV - NP) / N

Kd = x 100

(RV + NP ) / 2

14 x (1 - 0.4) + (100 - 75) / 6

Kd = x 100

(100 + 75) / 2

8.4 - 4.17

Kd = x 100

87.5

Kd=14.37%

(iv) Cost of Term Loan

Kd = Interest rate (1-t)

Kd = 13% (1-40%)

Kd = 7.8%

Calculation of Weighted Average Cost of Capital (WACC) (using market

weights)

Capital Cost of Market Value Market Product

Capital Value (Cost x

Weights weights)

Equity 19.00% 20.8 x 50,00,000 `10,40,00,000 0.6218 11.81%

Preference Shares 16.84% 90 x 50,000 ` 45,00,000 0.0269 0.45%

Debentures 14.37% 75 x 2,50,000 ` 1,87,50,000 0.1121 1.61%

Term Loan 7.80% ` 4,00,00,000 0.2392 1.87%

Total `16,72,50,000 1 15.74%

WACC= 15.74%

© The Institute of Chartered Accountants of India

108 INTERMEDIATE EXAMINATION: MAY, 2023

(b) Calculation of Marginal Cost of Capital (MACC)

The required capital of ` 50,000,000 will be raised as follows:

Equity = 60% of ` 50,000,000 = ` 30,000,000

Deby = 20% of ` 50,000,000 = `10,000,000

Retained Earnings= 20% of ` 50,000,000 = ` 10,000,000

3.12

Marginal Cost of Equity = + 0.04

1.4

= 26.28%

Marginal Cost of Debt

13% of ` 40,00,000 + 15% of ` 60,00,000

Cost of Debt (before tax) =

` 1,00,00,000

` 5,20,000 + ` 9,00,000

= = 14.2%

` 1,00,00,000

Cost of Debt (after tax). = 14.2% (1-t)

= 14.2% (1-0.4)

= 8.52%

Calculation of marginal cost of capital

Capital Cost of Value Weights Product (Cost

Capital x weights)

Equity 26.28% ` 3,00,00,000 0.6 15.77%

Reserves 26.28% ` 1,00,00,000 0.2 5.26%

Debt 8.52% ` 1,00,00,000 0.2 1.70%

Total ` 5,00,00,000 1 22.73%

Marginal Cost of Capital (MACC) = 22.73%

3.

Current Capital Structure

Equity Share Capital ` 20 x 7 lakhs ` 1,40,00,000

Reserves ` 10,00,000

9% Bonds ` 3,00,00,000

11% Preference Share Capital ` 50 x 3 lakhs ` 1,50,00,000

Total Capital Employed ` 6,00,00,000

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 109

Proposed Capital Structure

Capital Working Proposal I Proposal II

Capital to be raised `5,00,00,000 `5,00,00,000

Equity 50000000 x 25% ` 1,25,00,000 -

50000000 x 50% - ` 2,50,00,000

Debt @ 10% 50000000 x 75% ` 3,75,00,000 -

Preference Shares @ 50000000 x 50% - ` 2,50,00,000

12%

Combined Capital Amount Amount

(proposal 1) (proposal 2)

Equity ` 2,65,00,000 ` 3,90,00,000

Reserves ` 10,00,000 ` 10,00,000

9% Bond ` 3,00,00,000 ` 3,00,00,000

10% Debt ` 3,75,00,000 -

11% Preference Shares ` 1,50,00,000 ` 1,50,00,000

12% Preference Shares - ` 2,50,00,000

` 11,00,00,000 ` 11,00,00,000

Interest for Proposal I = ` 3,00,00,000 x 9% + ` 3,75,00,000 x 10%

= ` 27,00,000 + ` 37,50,000

= ` 64,50,000

Preference Dividend for Proposal I = ` 1,50,00,000 x 11% = ` 16,50,000

Interest for Proposal II = ` 3,00,00,000 x 9% = ` 27,00,000

Preference Dividend for Proposal II = ` 1,50,00,000 x 11% + ` 2,50,00,000 x 12%

= ` 16,50,000 + ` 30,00,000 = ` 46,50,000

Let the indifference point be ` X

For Proposal I,

EPS =

( X - ` 64,50,000) x 0.66 - ` 16,50,000 (1)

13,25,000

For Proposal II,

EPS =

(X - ` 27,00,000 ) x 0.66 - ` 46,50,000

(2)

19,50,000

Equating (1) and (2),

© The Institute of Chartered Accountants of India

110 INTERMEDIATE EXAMINATION: MAY, 2023

EPS =

( X - ` 64,50,000 ) x 0.66 - ` 16,50,000 = ( X - ` 27,00,000 ) x 0.66 - ` 46,50,000

13,25,000 19,50,000

0.66 X ` 42,57,000 - ` 16,50,000 0.66X - ` 17,82,000 - ` 46,50,000

=

1,325 1,950

0.66X - ` 59,07,000 0.66X - ` 64,32,000

……… =

53 78

51.48X – ` 46,07,46,000 = 37.98X - `34,08,96,000

16.5X = ` 11,98,50,000

Indifference Point = X = ` 72,63,636.36

4. Income Statement of companies A, B and C

Particulars A B C

Sales `15,00,000 `30,00,000 `41,66,667

Less: Variable Expenses `9,00,000 `15,00,000 `16,66,667

Contribution `6,00,000 `15,00,000 `25,00,000

Less: Fixed Cost `4,50,000 `10,00,000 `15,00,000

EBIT `1,50,000 `5,00,000 `10,00,000

Less: Interest `1,00,000 `4,00,000 `6,00,000

PBT `50,000 `1,00,000 `4,00,000

Less: Tax @ 30% `15,000 `30,000 `1,20,000

PAT `35,000 `70,000 `2,80,000

Working Notes:

EBIT

(i) Degree of Financial Leverage =

EBIT - Interest

DFL x (EBIT – Int) = EBIT

DFL x EBIT – Int x DFL= EBIT

DFL x EBIT – EBIT =Int x DFL

EBIT(DFL – 1) = Int x DFL

int x DFL

EBIT =

DFL - 1

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 111

For A,

` 1,00,000 x 3

EBITA =

3-1

EBITA = `150000

For B

` 4,00,000 x 5

EBITB =

5-1

EBITB = `500000

For C

` 6,00,000 x 2.5

EBITc =

2.5 - 1

EBITc =10,00,000

Contribution

(ii) DOL=

EBIT

Contribution = DOL x EBIT

Contribution A = 4 x `1,50,000

Contribution A = `6,00,000

Contribution B = 3 x `5,00,000

Contribution B = `15,00,000

Contribution C = 2.5 x `10,00,000

Contribution C = `25,00,000

(iii) Fixed Cost = Contribution – EBIT

Fixed Cost A= `6,00,000 – `1,50,000 = `4,50,000

Fixed Cost B =`15,00,000 – `5,00,000 = `10,00,000

Fixed Cost C = `25,00,000 – `10,00,000 = `15,00,000

(iv) Contribution= Sales – VC

VC= Sales – Contribution

Sales x VC Ratio= Sales – Contribution

Contribution= Sales – Sales x VC Ratio

Contribution=Sales(1-VCR)

© The Institute of Chartered Accountants of India

112 INTERMEDIATE EXAMINATION: MAY, 2023

Contribution

Sales =

1- VCR

Sales A = `6,00,000/(1-0.6) = `15,00,000

Sales B = `15,00,000/(1-0.5) = `30,00,000

Sales C = `25,00,000/(1-0.4) = `41,66,667

Of all the companies, A has the highest degree of Operating Leverage, B has highest

degree of Financial Leverage and C is equally leveraged on both Operating and

Financial fronts. If we consider combined leverage companies will have the leverages

of 12, 15 and 6.25 (by multiplying both operating and financial leverages). This means

A is undertaking a higher degree of operating risk while B is undertaking a higher

degree of financial risk.

5. Calculation of Cash Flow After tax

Year 1 2 3 to 5 6 to 8

A Capacity 20% 30% 75% 50%

B Units 80000 120000 300000 200000

C Contribution p.u. `60 `60 `60 `60

D Contribution `48,00,000 `72,00,000 `1,80,00,000 `1,20,00,000

E Fixed Cash Cost `16,00,000 `16,00,000 `16,00,000 `16,00,000

Depreciation

F Original Equipment `30,00,000 `30,00,000 `30,00,000 `30,00,000

(`240Lakhs/8)

G Additional Equipment -- -- `4,00,000 `4,00,000

(`24Lakhs/6)

H Advertisement `30,00,000 `15,00,000 `10,00,000 `4,00,000

Expenditure

I Profit Before Tax (D- ` (28,00,000) `11,00,000 `1,20,00,000 `66,00,000

E-F-G-H)

J Tax savings/ `14,00,000 ` (5,50,000) ` (60,00,000) ` (33,00,000)

(expenditure)

K Profit After Tax ` (14,00,000) `5,50,000 `60,00,000 `33,00,000

L Add: Depreciation `30,00,000 `30,00,000 `34,00,000 `34,00,000

(F+G)

M Cash Flow After Tax `16,00,000 `35,50,000 `94,00,000 `67,00,000

Calculation of NPV

Year Particulars Cash Flows PV factor PV

0 Initial Investment ` (2,40,00,000) 1.000 ` (2,40,00,000)

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 113

0 Working Capital Introduced ` (25,00,000) 1.000 ` (25,00,000)

1 CFAT `16,00,000 0.893 ` 14,28,800

2 CFAT ` 35,50,000 0.797 ` 28,29,350

2 Additional Equipment ` (26,00,000) 0.797 ` (20,72,200)

3 CFAT ` 94,00,000 0.712 ` 66,92,800

4 CFAT ` 94,00,000 0.636 ` 59,78,400

5 CFAT ` 94,00,000 0.567 ` 53,29,800

6 CFAT ` 67,00,000 0.507 ` 33,96,900

7 CFAT ` 67,00,000 0.452 ` 30,28,400

8 CFAT ` 67,00,000 0.404 ` 27,06,800

8 WC Released ` 25,00,000 0.404 ` 10,10,000

8 Salvage Value ` 2,00,000 0.404 ` 80,800

Net Present Value `39,09,850

Since the NPV is positive, the proposed project should be implemented.

6. Calculation of NPV and sensitivity for different scenarios

Original Sale Price Sales Volume Fixed Cost

Scenario reduced by reduced by increased

10% 10% by 10%

Units 300000 300000 270000 300000

Sale Price p.u. `20 `18 `20 `20

VC p.u. `12 `12 `12 `12

Contribution p.u. `8 `6 `8 `8

Contribution `24,00,000 `18,00,000 `21,60,000 `24,00,000

Less: Fixed Cost `6,00,000 `6,00,000 `6,00,000 `6,60,000

Profit/Cash Flows `18,00,000 `12,00,000 `15,60,000 `17,40,000

PVAF (14%, 5 3.4331 3.4331 3.4331 3.4331

years)

PV of Cash Inflows `61,79,546 `41,19,697 `53,55,606 `59,73,561

Less: Initial ` (55,00,000) ` (55,00,000) ` (55,00,000) ` (55,00,000)

Investment

NPV `6,79,546 ` (13,80,303) ` (1,44,394) `4,73,561

% Change in NPV NA (303.12%) (121.25%) (30.31%)

Sensitivity NA 30.3121 12.1249 3.0312

times times times

© The Institute of Chartered Accountants of India

114 INTERMEDIATE EXAMINATION: MAY, 2023

Sales Price is the most sensitive variable of all and needs to be given due attention during

the life of the project.

7. CASE 1: Value of the firm when dividends are not paid.

Step 1: Calculate price at the end of the period

Ke = 15%, P₀ = `100, D₁ = 0

P1 + D1

Pₒ =

1 + Ke

P1 + 0

`100 =

1 + 0.15

P₁ = `115

Step 2: Calculation of funds required for investment

Earning ` 40,00,000

Dividend distributed Nil

Fund available for investment ` 40,00,000

Total Investment ` 50,00,000

Balance Funds required ` 50,00,000 - ` 40,00,000 = ` 10,00,000

Step 3: Calculation of No. of shares required to be issued for balance funds

No. of shares = Funds required/P 1

∆n = `10,00,000/`115

Step 4: Calculation of value of firm

nPₒ = [(n+∆n)P1-I+E]/(1+Ke)

nP₀ = [(100000+1000000/`115) `115 - `5000000 + `4000000]/(1.15)

= `1,00,00,000

CASE 2: Value of the firm when dividends are paid.

Step 1: Calculate price at the end of the period

Ke= 15%, P₀= `100, D₁= `10

P1 + D1

Pₒ =

1+ K e

P1 + 10

`100 =

1 + 0.15

P₁ = `105

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 115

Step 2: Calculation of funds required for investment

Earning ` 40,00,000

Dividend distributed 10,00,000

Fund available for investment ` 30,00,000

Total Investment ` 50,00,000

Balance Funds required ` 50,00,000 - ` 30,00,000 = ` 20,00,000

Step 3: Calculation of No. of shares required to be issued for balance fund

No. of shares = Funds Required/P1

∆n = `2000000/`105

Step 4: Calculation of value of firm

nPₒ = [(n+∆n)P1 – I+E]/(1+Ke)

nP₀ = [(100000 + 2000000/`105) `105 – `5000000 + `4000000]/(1.15)= `1,00,00,000

Thus, it can be seen from the above calculations that the value of the firm remains

the same in either case.

8. Evaluation of Credit Policies

Particulars 1.5/15 net 45 2/20 net 50

A Sales `50,00,000 `55,00,000

B Variable Cost (65%) `32,50,000 `35,75,000

C Fixed Cost (20% in 1st Case) `10,00,000 `10,00,000

D Bad Debts (5% and 10%) `2,50,000 `5,50,000

E Discounts

(`5000000x30%x1.5%) `22,500 -

(`5500000x50%x2%) - `55,000

F PBT (A-B-C-D-E) `4,77,500 `3,20,000

G Tax @ 35% `1,67,125 `1,12,000

H PAT `3,10,375 `2,08,000

I Opportunity Cost

(`3250000 + `1000000) x 30/360x10% `35,417 -

(`3575000 + `1000000) x 25/360 x 10% - `31,771

J Net Benefit `2,74,958 `1,76,229

The new policy leads to lower net benefit for the company. Hence it should not be

implemented.

© The Institute of Chartered Accountants of India

116 INTERMEDIATE EXAMINATION: MAY, 2023

9. Cost Structure

2021-22 2022-23

Particulars Calculations P.U. Amount Calculations P.U. Amount

(p.u. X units) (p.u. X units)

Direct 40% of SP `24 `28,80,000 Same as PY `24 `43,20,000

Material

Direct Given `20 `24,00,000 20*1.1 `22 `39,60,000

labour

Direct bal. fig. `4 `4,80,000 4*1.5 `6 `10,80,000

Expenses

Total Cost SP - Profit `48 `57,60,000 `52 `93,60,000

Profit (SP/125x25) `12 `14,40,000 52*25% `13 `23,40,000

Sales 3 x Direct `60 `72,00,000 `65 `1,17,00,000

Labour p.u.

*units= `72,00,000 / `60 =1,20,000 1,20,000/60 x

90=1,80,000

Operating Cycle

Raw material holding period 1 month

Finished Goods holding period 2 months

WIP conversion period 2 months

Creditor Payment Period 2 months

Receivables Collection Period 2/3 months

Estimation of Working Capital

Particulars Calculation Amount

Current Assets

Stock of Raw Material 43,20,000 x 1/12 `3,60,000

Stock of WIP

RM cost `43,20,000

Labour cost `19,80,000

Direct Exp cost `5,40,000

Total WIP Cost `68,40,000

Stock of WIP 68,40,000 x 2/12 `11,40,000

Stock of Finished Goods 93,60,000 x 2/12 `15,60,000

Receivables (on sales)

© The Institute of Chartered Accountants of India

PAPER – 8A: FINANCIAL MANAGEMENT 117

A 1,17,00,000 x 50% x 2/12 `9,75,000

B 1,17,00,000 x 30% x 3/12 `8,77,500

C NIL -

Cash Balance Given `1,11,000

Total Current Assets ` 50,23,500

Current Liabilities

Payables *`44,40,000 x 2/12 `7,40,000

Net Working Capital ` 42,83,500

Opening RM stock = 28,80,000 x 1/12= `2,40,000

* RM purchased = RM consumed – Opening Stock + Closing Stock

= `43,20,000 – `2,40,000 + `3,60,000

= `44,40,000

Computation of Maximum Permissible Bank Finance

Method Formula Calculation `

I 75% x (Current Assets- 75% x (`50,23,500 - `7,40,000) `32,12,625

Current Liabilities)

II 75% x Current Assets- 75% x `50,23,500 - `7,40,000 `30,27,625

Current Liabilities

III 75% x (Current Assets-Core 75% x (`50,23,500- `15,60,000) - `18,57,625

CA)- Current Liabilities `7,40,000

10. (a)

Samurai Bond • Samurai bonds are denominated in Japanese Yen JPY

• Issued in Tokyo

• Issuer Non- Japanese Company

• Regulations: Japanese

• Purpose: Access of capital available in Japanese

market

• Issue proceeds can be used to fund Japanese

operation

• Issue proceeds can be used to fund a company’s local

opportunities.

• It can also be used to hedge foreign exchange risk

Bulldog Bond • It is denominated in Bulldog Pound Sterling/Great

Britain Pound (GBP)

© The Institute of Chartered Accountants of India

118 INTERMEDIATE EXAMINATION: MAY, 2023

• Issued in London

• Issuer Non- UK Company

• Regulations: Great Britain

• Purpose: Access of capital available in UK market

• Issue proceeds can be used to fund UK operation

• Issue proceeds can be used to fund a company’s local

opportunities

(b) Securitisation is a process in which illiquid assets are pooled into marketable

securities that can be sold to investors. The process leads to the creation of financial

instruments that represent ownership interest in, or are secured by a segregated

income producing asset or pool of assets. These assets are generally secured by

personal or real property such as automobiles, real estate, or equipment loans but in

some cases are unsecured.

Example of Debt Securitisation:

A finance company has given a large number of car loans. It needs more money so

that it is in a position to give more loans. One way to achieve this is to sell all the

existing loans. But, in the absence of a liquid secondary market for individual car

loans, this is not feasible.

However, a practical option is debt securitisation, in which the finance company sells

its existing car loans already given to borrowers to the Special Purpose Vehicle

(SPV). The SPV, in return pays to the company, which in turn continue to lend with

this money. On the other hand, the SPV pools these loans and convert these into

marketable securities. It means that now these converted securities can be issued to

investors.

So, this process of debt securitization helps the finance company to raise funds and

get the loans off its Balance Sheet. These funds also help the company disburse

further loans. Similarly, the process is beneficial to the investors also as it creates a

liquid investment in a diversified pool of car loans, which may be an attractive option

to other fixed income instruments. The whole process is carried out i n such a way

that the original Receivables i.e. the car loan borrowers may not be aware of the

transaction. They might have continued making payments the way they are already

doing. However, these payments shall now be made to the new investors who have

emerged out of this securitization process.

© The Institute of Chartered Accountants of India

PAPER – 8: FINANCIAL MANAGEMENT AND ECONOMICS FOR FINANCE 119

SECTION: B: ECONOMICS FOR FINANCE

QUESTIONS

1. (a) What is the significance of Intermediate Good?

(b) What are the allocation instruments by which government can influence resource

allocation in the economy?

(c) Calculate the Depreciation from the following data?

` in Cr.

GDP at Market Price (GDP MP) 850000

Net Factor Income from abroad -250

Aggregate amount of Indirect taxes 560

Subsidies 50

National Income (NNP FC) 750000

2. (a) Describe the relevance of Circular Flow of Income in the Measurement of National

Income.

(b) What is lemon Problem in Market Failure?

(c) Calculate National Income by Expenditure Method and Income Method with the help

of following data:

Items ` In Crores

Compensation of employees 1000

Net factor income from Abroad 10

Net indirect taxes 150

Profit 900

Private final consumption expenditure 4,000

Net domestic capital formation 550

Consumption of fixed capital 120

Rent 600

Interest 720

Mixed income of self-employed 800

Net export 40

Govt. final consumption expenditure 1000

Operating surplus 160

© The Institute of Chartered Accountants of India

120 INTERMEDIATE EXAMINATION: MAY, 2023

Employer’s contribution to social security scheme 400

3. (a) How Public Debt is used as an Instrument of Fiscal Policy?

(b) What is Compensatory Spending?

(c) What are the Important Feature of Heckscher Ohlin Theory of International Trade?

(d) What is the Rationale of the Stabilization Function of the Government?

4. (a) Do you think if the developing Countries engage in liberal trade will be at

disadvantage?

(b) Explain the difference between the Classical and Keynesian theory of International

Trade?

(c) What is the motive for Speculative demand for money?

(d) What is Market Stabilisation Scheme?

5. (a) What are the effect of Tariff on an Imported Product?

(b) What are the determinant of money supply?

(c) What is CRR and its impact on Money Supply?

(d) Elaborate on the Export Related Measure in International Trade?

OR

What is Open market Operation?

ANSWERS

1. (a) Intermediate goods refer to those goods which are used either for resale or for

further production in the same year. They do not end up in final consumption and

are not capital goods either. The intermediate goods or services may be either

transformed or used up by the production process. They have derived demand.

Intermediate goods are used up in the same year; if they remain for more than one

year, then they are treated as final goods. Intermediate consumption consists of the

value of the goods and services consumed as inputs by a process of production,

excluding fixed assets whose consumption is recorded as consumption of fixed

capital. Intermediate goods used to produce other goods rather than being sold to

final purchasers are not counted as it would involve double counting.

(b) A variety of allocation instruments are available by which governments can

influence resource allocation in the economy. For example,

• government may directly produce an economic good

• government may influence private allocation through incentives and

disincentives

© The Institute of Chartered Accountants of India

PAPER – 8: FINANCIAL MANAGEMENT AND ECONOMICS FOR FINANCE 121

• government may influence allocation through its competition policies, merger

policies etc. which affect the structure of industry and

• governments’ regulatory activities such as licensing, controls, minimum wages,

and directives on location of industry influence resource allocation.

• government sets legal and administrative frameworks, and

• any mixture of intermediate methods may be adopted by governments

(c) GDPMP = NNPFC - NFIA + NIT +Depreciation

850000 = 750000- (-250) + (560-50) + Depreciation

850000 = 750000 + 250 + 510 + Depreciation

850000 = 750760 + Depreciation

Depreciation = 850000 – 750760

= ` 99240 cr

2. (a) Circular flow of income refers to the continuous circulation of production, income

generation and expenditure involving different sectors of the economy.

(i) In the production phase, firms produce goods and services with the help of

factor services.

(ii) In the income or distribution phase, the flow of factor incomes in the form of

rent, wages, interest and profits from firms to the households occurs

(iii) In the expenditure or disposition phase, the income received by different

factors of production is spent on consumption goods and services and

investment goods. This expenditure leads to further production of goods and

services and sustains the circular flow.

(b) When dealing with problems of asymmetric information, the most frequently cit ed

and studied example in Economics is the one developed by George Akerlof in

relation to the used car market, which distinguishes cars classified as good from

those defined as “lemons” (poor quality vehicles). The owner of a car knows much

more about its quality than anyone else. While placing it for sale, he may not

disclose all that he knows about the mechanical defects of the vehicle. Based on

the probability that the car on sale is a ‘lemon’, the buyers’ willingness to pay for

any particular car will be based on the ‘average quality’ of used cars. Not knowing

the honesty of the seller means, the price offered for the vehicle is likely to be less

than that of a good car, to account for this risk. However, anyone who sells a

‘lemon’ (an unusually poor car) stands to gain.

(c) By Expenditure method

GDPMP = Private final consumption expenditure + Government final

© The Institute of Chartered Accountants of India

122 INTERMEDIATE EXAMINATION: MAY, 2023

consumption expenditure + Gross domestic capital

formation (Net domestic capital formation+ depreciation) +

Net export

= 4000 + 1000 + (550+ 120) + 40= 5710 cr

NNPFC or NI = GDPMP- depreciation + NFIA – NIT

= 5710 – 120 + 10 – 150= 5450 cr

By Income method

NNPFC or NI = Compensation of employees+ Operating Surplus+ Mixed

income of self-employed + NFIA

= 1000+ 160+ 800+ 10= 1970 cr

3. (a) A rational policy of public borrowing and debt repayment is a potent weapon to fight

inflation and deflation. In the case of market loans, the government issues treasury

bills and government securities of varying denominations and duration which are

traded in debt markets. For financing capital projects, long-term capital bonds are

floated and for meeting short-term government expenditure, treasury bills are

issued.

The small savings represent public borrowings, which are not negotiable and are

not bought and sold in the market. In India, various types of schemes are introduced

for mobilising small savings e.g., National Savings Certificates, National

Development Certificates, etc. Borrowing from the public through the sale of bonds

and securities curtails the aggregate demand in the economy. Repayments of debt

by governments increase the availability of money in the economy and increase

aggregate demand.

(b) Compensatory spending is said to be resorted to when the government spending is

deliberately carried out with the obvious intention to compensate for the deficiency

in private investment.

(c) The Heckscher-Ohlin theory of trade states that comparative advantage in cost of

production is explained exclusively by the differences in factor endowments of the

nations. In a general sense of the term, ‘factor endowment’ refers to the overall

availability of usable resources including both natural and man-made means of

production. Nevertheless, in the exposition of the modern theory, only the two most

important factors—labour and capital—are taken into account.

The Heckscher-Ohlin Trade Theorem establishes that a country tends to specialize

in the export of a commodity whose production requires intensive use of its

abundant resources and imports a commodity whose production requires intensive

use of its scarce resources.

© The Institute of Chartered Accountants of India

PAPER – 8: FINANCIAL MANAGEMENT AND ECONOMICS FOR FINANCE 123

(d) Stabilization function is one of the key functions of fiscal policy and aims at

eliminating macroeconomic fluctuations arising from suboptimal allocation. The

stabilization function is concerned with the performance of the aggregate economy

in terms of labour employment and capital utilization, overall output and income,

general price levels, economic growth, and balance of international payments.

4. (a) International trade is often not equally beneficial to all nations. Potential unequal

market access and disregard for the principles of fair-trading system may even

amplify the differences between trading countries, especially if they differ in their

wealth. Economic exploitation is a likely outcome when underprivileged countries

become vulnerable to the growing political power of corporations operating globally. The

domestic entities can be easily outperformed by financially stronger transnational

companies.

Risky dependence of underdeveloped countries on foreign nations impairs

economic autonomy and endangers their political sovereignty. Such reliance often

leads to widespread exploitation and loss of cultural identity. Substantial

dependence may also have severe adverse consequences in times of wars and

other political disturbances.

(b) The classical economists maintained that the economy is self‐regulating and is always

capable of automatically achieving equilibrium at the ‘natural level’ of real GDP or

output, which is the level of real GDP that is obtained when the economy's

resources are fully employed. While circumstances arise from time to time that

cause the economy to fall below or to exceed the natural level of real GDP, wage

and price flexibility will bring the economy back to the natural level of real GDP. If

an excess in the labour force (unemployment) or products exist, the wage or price of

these will adjust to absorb the excess. According to them, there will be no

involuntary unemployment.

Keynes argued that markets would not automatically lead to full-employment

equilibrium and the resulting natural level of real GDP. The economy could settle in

equilibrium at any level of unemployment. Keynesians believe that prices and

wages are not so flexible; they are sticky, especially downward. The stickiness of

prices and wages in the downward direction prevents the economy's resources from

being fully employed and thereby prevents the economy from returning to the

natural level of real GDP. Therefore, output will remain at less than the full

employment level as long as there is insufficient spending in the economy. This was

precisely what was happening during the great depression.

(c) The speculative motive reflects people’s desire to hold cash in order to be equipped

to exploit any attractive investment opportunity requiring cash expenditure.

According to Keynes, people demand to hold money balances to take advantage of

the future changes in the rate of interest, which is the same as future changes in

bond prices. It is implicit in Keynes theory, that the ‘rate of interest’, i, is really the

© The Institute of Chartered Accountants of India

124 INTERMEDIATE EXAMINATION: MAY, 2023

return on bonds. Keynes assumed that that the expected return on money is zero,

while the expected returns on bonds are of two types, namely:

(i) the interest payment

(ii) the expected rate of capital gain.

(d) This instrument for monetary management was introduced in 2004 following a MoU

between the Reserve Bank of India (RBI) and the Government of India (GoI) with

the primary aim of aiding the sterilization operations of the RBI. (Sterilization is the

process by which the monetary authority sterilizes the effects of significant. foreign

capital inflows on domestic liquidity by off-loading parts of the stock of government

securities held by it). Surplus liquidity of a more enduring nature arising from large

capital inflows is absorbed through sale of short-dated government securities and

treasury bills. Under this scheme, the Government of India borrows from the RBI

(such borrowing being additional to its normal borrowing requirements) and issues

treasury-bills/dated securities for absorbing excess liquidity from the market arising

from large capital inflows.

5. (a) Tariffs encourage consumption and production of the domestically produced import

substitutes and thus protect domestic industries. By making imported goods more

expensive, tariffs discourage domestic consumers from consuming imported foreign

goods. Domestic consumers suffer a loss in consumer surplus because they must

now pay a higher price for the good and also because compared to free trade

quantity, they now consume lesser quantity of the good.

Tariffs encourage consumption and production of the domestically produced import

substitutes and thus protect domestic industries.

(b) There are two alternate theories in respect of determination of money supply.

According to the first view, money supply is determined exogenously by the central

bank. The second view holds that the money supply is determined endogenously by

changes in the economic activities which affect people’s desire to hold currency

relative to deposits, rate of interest, etc. The current practice is to explain the

determinants of money supply based on ‘money multiplier approach’ which focuses

on the relation between the money stock and money supply in terms of the

monetary base or high-powered money. The monetary base is the sum of currency

in circulation and bank reserves. This approach holds that total supply of nominal

money in the economy is determined by the joint behavior of the central bank, the

commercial banks and the public.

(c) Cash Reserve Ratio (CRR)refers to the fraction of the total net demand and time

liabilities (NDTL) of a scheduled commercial bank in India which it should maintain

as cash deposit with the Reserve Bank. Higher the CRR, lower the credit creation

capacity of banks. Reduce CRR during deflation- - banks to expand credit and

© The Institute of Chartered Accountants of India

PAPER – 8: FINANCIAL MANAGEMENT AND ECONOMICS FOR FINANCE 125

increase the supply of money available in the economy- increase the CRR to

contain credit expansion during – inflation.

(d) The Export Related measure in international trade is as under :

Ban on exports: Export-related measures refer to all measures applied by the

government of the exporting country including both technical and non- technical

measures. For example, during periods of shortages, export of agricultural products

such as onion, wheat etc. may be prohibited to make them available for domestic

consumption.

Export Taxes: The effect of an export tax is to raise the price of the good and to

decrease exports. Since an export tax reduces exports and increases domestic

supply, it also reduces domestic prices and leads to higher domestic consumption.

Export Subsidies and Incentives: Tariffs on imports hurt exports and therefore

countries have developed compensatory measures of different types for exporters

like export subsidies, duty drawback, duty-free access to imported intermediates

etc.

Voluntary Export Restraints: Voluntary Export Restraints (VERs) refer to a type of

informal quota administered by an exporting country voluntarily restraining the

quantity of goods that can be exported out of that country during a specified period

of time.

OR

Open Market Operations (OMO) is a general term used for market operations

conducted by the Reserve Bank of India by way of sale/ purchase of Government

securities to/ from the market with an objective to adjust the rupee liquidity

conditions in the market on a durable basis.

© The Institute of Chartered Accountants of India

You might also like

- (Your Company Name) : (Your Company Name) (Address) (City, State ZIP) Contact: (Name) Phone: XXX-XXX-XXXXDocument33 pages(Your Company Name) : (Your Company Name) (Address) (City, State ZIP) Contact: (Name) Phone: XXX-XXX-XXXXJames ZacharyNo ratings yet

- "Case Analysis-Cafés Monte Blanco: Building A Profit Plan": Managerial AccountingDocument8 pages"Case Analysis-Cafés Monte Blanco: Building A Profit Plan": Managerial Accountingvipul tutejaNo ratings yet

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Accounting Text and Cases 13th EditionDocument6 pagesAccounting Text and Cases 13th EditionJovert UyNo ratings yet

- Bus 145 Assignment 2Document18 pagesBus 145 Assignment 2Urvashi AroraNo ratings yet

- FM EcoDocument27 pagesFM Ecos suryaNo ratings yet

- CA Inter FM Eco RTP May 2023Document27 pagesCA Inter FM Eco RTP May 2023tirthpatel406No ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- 82834bos66905-p6Document48 pages82834bos66905-p6aagarwalritesh786No ratings yet

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- FM & SM QuestionsDocument10 pagesFM & SM QuestionsHITESH RAMNANINo ratings yet

- Cost of Capital PYQ's SolutionDocument26 pagesCost of Capital PYQ's SolutionOm kumar BajajjNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- FM SM Q MTP 2 Sept 2024Document10 pagesFM SM Q MTP 2 Sept 2024tandelmohik10No ratings yet

- Inter FMSM MTP2Document16 pagesInter FMSM MTP2renudevi06081973No ratings yet

- CA Inter FM ECO RTP Nov23 Castudynotes ComDocument23 pagesCA Inter FM ECO RTP Nov23 Castudynotes Comspyverse01No ratings yet

- Corporate Finance Assignment 2021Document8 pagesCorporate Finance Assignment 2021moshooNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- Financial Management and Strategic ManagementDocument49 pagesFinancial Management and Strategic ManagementYash KāmālNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- Inter FM Eco QuesDocument6 pagesInter FM Eco QueshanwantearyanNo ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- Assignment FMCFDocument4 pagesAssignment FMCFkumari.astha1309No ratings yet

- Paper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingAyushNo ratings yet

- Corporate Finance AssignmentDocument8 pagesCorporate Finance AssignmentJainamNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalSahil RupaniNo ratings yet

- Practice Questions by Gaurav Jain SirDocument105 pagesPractice Questions by Gaurav Jain Sirpournima.m.mulayNo ratings yet

- Leverages Only QuestionsDocument3 pagesLeverages Only QuestionsÐíñkár PáhâríýâNo ratings yet

- Paper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingDocument25 pagesPaper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingJINENDRA JAINNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument27 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- Cost of Capital QuestionDocument9 pagesCost of Capital QuestionMahesh KalyankarNo ratings yet

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankDocument9 pagesDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniNo ratings yet

- FM & SM MTP 1 Sept 24Document11 pagesFM & SM MTP 1 Sept 24thegauravkasar333No ratings yet

- 11 Chapter 5.2 - Capital StructureDocument15 pages11 Chapter 5.2 - Capital Structureatishayjjj123No ratings yet

- 8 RTP Nov 21 1Document27 pages8 RTP Nov 21 1Bharath Krishna MVNo ratings yet

- Module 5 - Cost of Capital - QuestionsDocument6 pagesModule 5 - Cost of Capital - QuestionsHarsh TandonNo ratings yet

- FM SM Full Syllabus Test Paper 01Document4 pagesFM SM Full Syllabus Test Paper 01sarthak bansalNo ratings yet

- Paper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingDocument27 pagesPaper - 2: Strategic Financial Management Questions Project Planning and Capital Budgetingkaranbandhe831No ratings yet

- Capital Structure Decisions: Assignment - 1Document18 pagesCapital Structure Decisions: Assignment - 1khan mandyaNo ratings yet

- FM Previous Year Questions 2020-2023Document18 pagesFM Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Additional Questions For PracticeDocument7 pagesAdditional Questions For Practicesuman.roy23-25No ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalkimjethaNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument29 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisEFRETNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- BBE Sem III CF - CBCS 2021 (OBE)Document4 pagesBBE Sem III CF - CBCS 2021 (OBE)Dhaireya JagyaNo ratings yet

- Finance questionDocument4 pagesFinance questionkrishnapddulalNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- Cost CalculationlDocument5 pagesCost CalculationlNiranjan PatelNo ratings yet

- Financial Management Question Paper 2022 Sem IVDocument4 pagesFinancial Management Question Paper 2022 Sem IVadityasinghvis2510No ratings yet

- Equity Valuation QuestionsDocument9 pagesEquity Valuation Questionssairaj bhatkarNo ratings yet

- Cost of Capital PaperrDocument6 pagesCost of Capital Paperrakshaykumarsingh24072005No ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- SM All Chapters Key Words..N!Document18 pagesSM All Chapters Key Words..N!Sagar GuptaNo ratings yet

- Low Potassium Diet Sheet 2016Document4 pagesLow Potassium Diet Sheet 2016Sagar Gupta100% (1)

- Lecture 27 Audit SamplingDocument8 pagesLecture 27 Audit SamplingSagar GuptaNo ratings yet

- Inter Audit MCQ and Case Studies - For Nov. 2023 ExamsDocument106 pagesInter Audit MCQ and Case Studies - For Nov. 2023 ExamsSagar GuptaNo ratings yet

- 2019 Cerner - Excerpts - FinalDocument10 pages2019 Cerner - Excerpts - FinalAlexa WilcoxNo ratings yet

- FCFE and FCFF Model SessionDocument25 pagesFCFE and FCFF Model SessionABHIJEET BHUNIA MBA 2021-23 (Delhi)No ratings yet

- Ch. 3 Financial Statement AnalysisDocument3 pagesCh. 3 Financial Statement AnalysishaleeNo ratings yet

- Ch-1 Accounting For Not-For-Profit OrganisationDocument59 pagesCh-1 Accounting For Not-For-Profit OrganisationerenNo ratings yet

- Ans Mini Case 2 - A171 - LecturerDocument14 pagesAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- ABC LTD.: Income Statement (Consolidated)Document7 pagesABC LTD.: Income Statement (Consolidated)Kushal PandyaNo ratings yet

- Business Analysis and Valuation: Fina2207Document15 pagesBusiness Analysis and Valuation: Fina2207longer zhangNo ratings yet

- Audit Problems CashDocument18 pagesAudit Problems CashYenelyn Apistar Cambarijan0% (1)

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- LabChapt P3-34 P3-35Document5 pagesLabChapt P3-34 P3-35Meisya VianqaNo ratings yet

- Ultratech Cement: Margin Stays Firm Outlook Remains HealthyDocument9 pagesUltratech Cement: Margin Stays Firm Outlook Remains HealthyHarsh ShahNo ratings yet

- Chapter 04Document38 pagesChapter 04thuytram640No ratings yet

- Business Combination and Consolidation On Acquisition Date SummaryDocument6 pagesBusiness Combination and Consolidation On Acquisition Date SummaryWilmar Abriol100% (1)

- Far110full 140911091633 Phpapp02Document56 pagesFar110full 140911091633 Phpapp02Is FarezNo ratings yet

- SBR Study HubDocument23 pagesSBR Study Hubpercy mapetereNo ratings yet

- Council Company Develops An Aged Schedule of Accounts Receivable atDocument1 pageCouncil Company Develops An Aged Schedule of Accounts Receivable atTaimour HassanNo ratings yet

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- Mergers and Acquisitions:: A Review of Valuation MethodsDocument5 pagesMergers and Acquisitions:: A Review of Valuation MethodsApooNo ratings yet

- Answer Key Midterm Examination LabDocument9 pagesAnswer Key Midterm Examination LabAMIKO OHYANo ratings yet

- NBK Annual Report 2011Document43 pagesNBK Annual Report 2011Mohamad RizwanNo ratings yet

- AccountsDocument5 pagesAccountsAlyssa CasimiroNo ratings yet

- Review Materials For Finals-QDocument20 pagesReview Materials For Finals-QLorraine Tomas83% (18)

- Accounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Document81 pagesAccounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Layla MainNo ratings yet

- AFA II Assignment IDocument12 pagesAFA II Assignment Iabdussemd2019No ratings yet

- CE On Intangible Assets T1 AY2020-2021Document2 pagesCE On Intangible Assets T1 AY2020-2021Luna MeowNo ratings yet