01 Leverages

01 Leverages

Uploaded by

ZerefCopyright:

Available Formats

01 Leverages

01 Leverages

Uploaded by

ZerefCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

01 Leverages

01 Leverages

Uploaded by

ZerefCopyright:

Available Formats

Chapter 4 - Leverages

Chapter 4

Financing Decision - Leverages

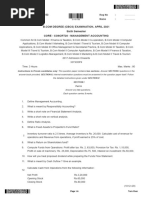

Question 1 - May 2022

Details of a company for the year ended 31st March, 2022 are given below:

Sales ₹ 86 lakhs

Profit Volume (P/V) Ratio 35%

Fixed Cost excluding interest expenses ₹ 10 lakhs

10% Debt ₹ 55 lakhs

Equity Share Capital of ₹ 10 each ₹ 75 lakhs

Income Tax Rate 40%

Required:

1. Determine company's Return on Capital Employed (Pre-tax) and EPS.

2. Does the company have a favourable financial leverage?

3. Calculate operating and combined leverages of the company.

4. Calculate percentage change in EBIT, if sales increases by 10%.

5. At what level of sales, the Earning before Tax (EBT) of the company will be equal to zero?

Question 2 - Nov 2022

The following information is available for SS Ltd.

Profit volume (PV) ratio 30%

Operating leverage 2.00

Financial leverage 1.50

Loan ₹ 1,25,000

Post-tax interest rate 5.6%

Tax rate 30%

Market Price per share (MPS) ₹ 140

Price Earnings Ratio (PER) 10

You are required to:

1. Prepare the Profit-Loss statement of SS Ltd. and

2. Find out the number of equity shares.

Question 3 - Rtp May 2022

Company P and Q are having same earnings before tax. However, the margin of safety of Company P is 0.20

and, for Company Q, is 1.25 times than that of Company P. The interest expense of Company P is ₹ 1,50,000

and, for Company Q, is 1/3rd less than that of Company P. Further, the financial leverage of Company P is 4

and, for Company Q, is 75% of Company P.

Other information is given as below:

Particulars Company P Company Q

Profit volume ratio 25% 33.33%

Tax rate 45% 45%

You are required to PREPARE Income Statement for both the companies.

Question 4 - Rtp Nov 2022

Debu Ltd. currently has an equity share capital of ₹ 1,30,00,000 consisting of 13,00,000 Equity shares. The

company is going through a major expansion plan requiring to raise funds to the tune of ₹ 78,00,000. To

finance the expansion the management has following plans:

Plan-I : Issue 7,80,000 Equity shares of ₹ 10 each.

Plan-II : Issue 5,20,000 Equity shares of ₹ 10 each and the balance through long-term borrowing at 12%

interest p.a.

Plan-III : Issue 3,90,000 Equity shares of ₹ 10 each and 39,000, 9% Debentures of ₹ 100 each.

Plan-IV : Issue 3,90,000 Equity shares of ₹ 10 each and the balance through 6% preference shares.

EBIT of the company is expected to be ₹ 52,00,000 p.a. Considering corporate tax rate @ 40%, you are required

to-

1. Calculate EPS in each of the above plans.

2. ASCERTAIN financial leverage in each plan and comment.

CA Nitin Guru | www.edu91.org 4.1

Chapter 4 - Leverages

Question 5 - Rtp May 2023

The selected financial data for A, B and C companies for the current year ended 31st March are as follows:

Particulars A B C

Variable Expenses as a % of sales 60 50 40

Interest ₹ 1,00,000 ₹ 4,00,000 ₹ 6,00,000

Degree of Operating Leverage 4:1 3:1 2.5:1

Degree of Financial Leverage 3:1 5:1 2.5:1

Income Tax Rate 30% 30% 30%

1. PREPARE income statement for A, B and C companies

2. COMMENT on the financial position and structure of these companies

Question 6 - Mock Oct 2022

Axar Ltd. has a Sales of ₹ 68,00,000 with a Variable cost Ratio of 60%.

The company has fixed cost of ₹16,32,000. The capital of the company comprises of 12% long term debt,

₹1,00,000 Preference Shares of ₹ 10 each carrying dividend rate of 10% and 1,50,000 equity shares.

The tax rate applicable for the company is 30%.

At current sales level, Determine the Interest, EPS and amount of debt for the firm if a 25% decline in Sales will

wipe out all the EPS.

Question 7 - Mock Oct 2022

The following information is related to Navya Company Ltd. for the year ended 31st March 2022:

Equity share capital (₹ 10 each) ₹ 65,50,000

12% Bonds of ₹ 1,00 each ₹ 60,91,400

Sales ₹ 111 lakhs

Fixed cost (excluding interest) ₹ 7,15,000

Financial leverage 1.55

Profit-volume Ratio 25%

Income Tax Applicable 30%

You are required to Calculate:

1. Operating Leverage.

2. Combined leverage; and

3. Earnings per share.

Show calculations upto two decimal points.

Question 8 - Study Material, Nov 07

CALCULATE the operating leverage for each of the four firms A, B, C and D from the following price and cost

data:

Firms

A(₹) B(₹) C(₹) D(₹)

Sale price per unit 20 32 50 70

Variable cost per unit 6 16 20 50

Fixed operating cost 60,000 40,000 1,00,000 Nil

What calculations can you draw with respect to levels of fixed cost and the degree of operating leverage

result? Explain. Assume number of units sold is 5,000.

Question 9 - Study Material, May 11

You are given two financial plans of a company which has two financial situations. The detailed information is

as under:

Installed Capacity 10,000 units

Actual Production and Sales 60% of installed capacity

Selling Price per unit ₹ 30

Variable cost per unit ₹ 20

Fixed cost Situation A = ₹ 20,000 Situation B = ₹ 25,000

Capital Structure of the company is as follows:

Financial Plans

XY (₹) XM (₹)

CA Nitin Guru | www.edu91.org 4.2

Chapter 4 - Leverages

Equity 12,000 35,000

Debt (Cost of Debt 12%) 40,000 10,000

52,000 45,000

You are required to calculate operating Leverage and Financial Leverage of both the plans.

Question 10 - Study Material, Rtp

(i) You are required to calculate the Operating leverage from the following data:

Sales ₹ 50,000

Variable Costs 60%

Fixed Costs ₹ 12,000

(ii) You are required to calculate the Financial Leverage from the following data:

Net Worth ₹ 25,00,000

Debt /Equity 3:1

Interest rate 12%

Operating Profit ₹ 20,00,000

Question 11 - Study Material

A Company produces and sells 10,000 shirts. The selling price per shirt is ₹ 500. Variable cost is ₹ 200 per

shirt and fixed operating cost is ₹ 25,00,000.

(a) Calculate operating leverage.

(b) If sales are up by 10%, then what is the impact on EBIT?

Question12 - Nov 12

Find Ltd. has estimated that for a new product, its operating break-even point is 2,000 units, if the item is sold

for ₹ 14 per unit. The cost accounting department has currently identified variable cost of ₹ 9 per unit.

Calculate the operating leverage for sales volume of ₹ 2,500 units and 3,000 units and their difference, if any?

Question 13 -

Ram Ltd. produces Mobile phones with a selling price per unit of ₹ 100. Fixed cost amount to ₹ 2,00,000. 5,000

units are produced and sold each year. Annual profits amount to ₹ 50,000. The company’s all equity-financed

assets are ₹ 5,00,000.

The company proposes to change its production process, adding ₹ 4,00,000 to investment and ₹ 50,000 to

fixed operational costs. The consequences of such a proposal are:

(i) Reduction in variable cost per unit by ₹ 10

(ii) Increase in output by 2,000 units

(iii) Reduction in selling price per unit to ₹ 95

Assuming a rate of interest on debt is 10%, examine the above proposal and advice whether or not the

company should make the change. Ignore taxation. Also measure the degree of operating leverage and overall

break-even-point.

Computation of Operating Leverage and Beta Analysis

Question14 - Nov 04, May 15

The following summarises the percentage changes in operating income, percentage changes in revenues, and

betas for four pharmaceutical firms.

Change in Operating

Firm Change in Revenue Income Beta

PQR Ltd. 27% 25% 1.00

RST Ltd. 25% 32% 1.15

TUV Ltd. 23% 36% 1.30

WXY Ltd. 21% 40% 1.40

Required:

(i) Calculate the degree of operating leverage for each of these firms. Comment also.

(ii) Use the operating leverage to explain why these firms have different beta.

CA Nitin Guru | www.edu91.org 4.3

Chapter 4 - Leverages

Computation of DOL, DFL and DCL

Question 15 - Nov 13

Calculate the degree of operating leverage, degree of financial leverage and the degree of combined leverage

for the following firms:

Particulars N S D

Production (in units) 17,500 6,700 31,800

Fixed cost (₹) 4,00,000 3,50,000 2,50,000

Interest on loan (₹) 1,25,000 75,000 Nil

Selling price per unit (₹) 85 130 37

Variable cost per unit (₹) 38.00 42.50 12.00

Question 16 - Nov 07

(i) Consider the following information for Omega Ltd.:

Particulars ₹ (In lakhs)

EBIT (Earnings before Interest and Tax) 15,750

Earnings before Tax (EBT) 7,000

Fixed Operating costs 1,575

Required:

Calculate percentage change in earnings per share, if sales increases by 5%.

Question 17 - Rtp May 2020

The following data have been extracted from the books of LM Ltd:

Sales - ₹ 100 lakhs

Interest Payable per annum - ₹ 10 lakhs

Operating leverage - 1.2

Combined leverage - 2.16

You are required to calculate:

(i) The financial leverage,

(ii) Fixed cost and

(iii)P/V ratio

Question 18 - Study Material, Nov 02

The data relating to two Companies are as given below:

Particulars Company A Company B

Equity Capital ₹ 6,00,000 ₹ 3,50,000

12% Debentures ₹ 4,00,000 ₹ 6,50,000

Output (units) per annum 60,000 15,000

Selling price/ unit ₹ 30 ₹ 250

Fixed Costs per annum ₹ 7,00,000 ₹ 14,00,000

Variable Cost per unit ₹ 10 ₹ 75

You are required to calculate the Operating leverage, Financial leverage and Combined leverage of two

Companies.

Question 19 - Study Material, May 97

A firm has sales of ₹ 75,00,000 variable cost of ₹ 42,00,000 and fixed cost of ₹ 6,00,000. It has a debt of ₹

45,00,000 at 9% and equity of ₹ 55,00,000.

(i) What is the firm’s ROI?

(ii) Does it have favourable financial leverage?

(iii) If the firm belongs to an industry whose asset turNover is 3, does it have a high or low assets leverage?

(iv) What are the operating, financial and combined leverages of the firm?

(v) If the sales drop to ₹ 50,00,000 what will be the new EBIT?

(vi) At what level the EBT of the firm will be equal to zero?

CA Nitin Guru | www.edu91.org 4.4

Chapter 4 - Leverages

Computation of DOL, DCL and DFL and Beta Analysis

Question 20 -

The following summarises the percentage change in E.P.S. percentage change in revenues & betas for four

companies in mobile business

Name of Companies Change in Revenues Change in EPS Beta

Nokia 10% 50% 1.40

Motorola 20% 80% 1.27

Samsung 25% 75% 1.18

Blackberry 30% 75% 1.10

(a) Calculate the Degree of Combined Leverage for each of these companies.

(b) If the Degree of operating leverage of these four companies is 2.5, 2, 2.25 & 1.2 respectively for Nokia,

Motorola, Samsung and Blackberry. Compute Degree of financial Leverage.

(c) Explain why these companies have different betas.

Question 21 - May 2017

You are given the following information of 5 firms of the same industry:

Name of the firm Change in revenue Change in operating Change in Earning

income per share

M 28% 26% 32%

N 27% 34% 26%

P 25% 38% 23%

Q 23% 43% 27%

R 25% 40% 28%

You are required to calculate:

(i) Degree of operating leverage and

(ii) Degree of combined leverage for all firms.

Computation of DOL, DFL, DCL with different fixed cost and Interest cost

Question 22 -

ABC Ltd. has its assets turNover ratio equal to 2. Its variable cost ratio is 60% of sales. Consider the following

three different capital structures and calculate the operating and financial leverages for the three different

fixed costs:-

(a) ₹ 4,000.

(b) ₹ 6,000.

(c) ₹ 8,000.

Capital Structure (In ₹)

Particulars A B C

Equity 60,000 40,000 20,000

10% Debt 20,000 40,000 60,000

Which combination has the highest & lowest DCL?

Computation of DOL, DFL, DCL – Risk Analysis

Question 23 - Mock Sept 2022

PI Limited has the following Balance Sheet as on March 31, 2020 and March 31, 2021:

Balance Sheet

Particulars March 31, 2020 March 31, 2021

Sources of Funds:

Shareholders’ Funds 87,500 87,500

Loan Funds 1,22,500 1,05,000

2,10,000 1,92,500

Applications of Funds:

Fixed Assets 87,500 1,05,000

Cash and bank 15,750 14,000

Receivables 49,000 38,500

Inventories 87,500 70,000

CA Nitin Guru | www.edu91.org 4.5

Chapter 4 - Leverages

Other Current Assets 35,000 35,000

Less: Current Liabilities (64,750) (70,000)

2,10,000 1,92,500

The Income Statement of the PI Ltd. for the year ended is as follows:

Particulars March 31, 2020 March 31, 2021

Sales 7,87,500 8,33,000

Less: Cost of Goods sold (7,30,100) (7,38,500)

Gross Profit 57,400 94,500

Less: Selling, General and Administrative expenses (38,500) (61,250)

Earnings before Interest and Tax (EBIT) 18,900 33,250

Less: Interest Expense (12,250) (10,500)

Earnings before Tax (EBT) 6,650 22,750

Less: Tax (1,995) (6,825)

Profits after Tax (PAT) 4,655 15,925

You are required to Calculate for the year 2020-21:

1. Inventory turNover ratio

2. Financial Leverage

3. Return on Capital Employed (after tax)

Practical Problems

Question 24 - Study Material, May 92

The following information is available in respect of two firms, P Ltd. and Q Ltd.:

(In ₹ Lacs)

Particulars P Ltd. Q Ltd.

Sales 500 1,000

Less: Variable Cost 200 300

Contribution 300 700

Less: Fixed Cost 150 400

EBIT 150 300

Less: Interest 50 100

Profit before tax 100 200

You are required to calculate different leverages for both the firms and also comment on their relative risk

position.

Question 25 - Study Material, May 2019

The capital structure of ABC Ltd. consist of an ordinary share capital of ₹ 5,00,000 (equity shares of ₹ 100

each at par value) and ₹ 5,00,000 (10% debenture of ₹ 100 each). Sales increased from 50,000 units to 60,000

units, the selling price is ₹ 12 per unit, variable cost amounts to ₹ 8 per unit and fixed expenses amount to ₹

1,00,000. The income tax rate is assumed to be 50%.

You are required to calculate the following:

(a) The percentage increase in earnings per share;

(b) The degree of financial leverage at 50,000 units and 60,000 units;

(c) The degree of operating leverage at 50,000 units and 60,000 units;

(d) Comment on the behaviour E.P.S., operating and financial leverage in relation to increases in sales from

50,000 units to 60,000 units.

Question 26 - Nov 2019 Similar

A company had the following Balance Sheet as on March 31, 2006:

Liabilities and Equity ₹ (In Crores) Assets ₹ (In Crores)

Equity Share Capital (1 10 Fixed Assets (Net) 25

crore shares of ₹ 10 each)

Reserves and Surplus 2 Current Assets 15

20

15% Debentures 20

Current Liabilities 8

40 40

CA Nitin Guru | www.edu91.org 4.6

Chapter 4 - Leverages

The additional information given is as under:

Fixed Costs per annum (excluding interest) ₹ 8 crores

Variable operating costs ratio 65%

Total Assets turNover ratio 2.5

Income-tax rate 40%

Required: Calculate the following and comment:

(i) Earnings per share (iii) Financial Leverage (v) Current Ratio

(ii) Operating Leverage (iv) Combined Leverage

Computation of Leverage, EBIT for required EPS

Question 27 - Study Material

The Sale revenue of TM excellence Ltd. @ ₹20 Per unit of output is ₹20 lakhs and Contribution is ₹10 lakhs. At

the present level of output the DOL of the company is 2.5. The company does not have any Preference Shares.

The number of Equity Shares are 1 lakh. Applicable corporate Income Tax rate is 50% and the rate of interest

on Debt Capital is 16% p.a. What is the EPS (At sales revenue of ₹ 20 lakhs) and amount of Debt Capital of the

company if a 25% decline in Sales will wipe out EPS.

Question 28 - Nov 09

Z Limited is considering the installation of a new project costing ₹ 80,00,000. Expected annual sales revenue

from the project is ₹ 90,00,000 and its variable costs are 60 percent of sales. Expected annual fixed cost other

than interest is ₹ 10,00,000. Corporate tax rate is 30 percent. The company wants to arranges the funds

through issuing 4,00,000 equity shares of ₹ 10 each and 12 percent debentures of ₹ 40,00,000.

You are required to:

(i) Calculate the operating, financial and combined leverages and Earnings per Share (EPS).

(ii) Determine the likely level of EBIT, if EPS is (1) ₹ 4, (2) ₹ 2, (3) ₹ 0.

Computation of Leverage and effects of changes in Sales on EPS.

Question 29 - Study Material

PL Forgings Ltd. has the following balance sheet and income statement information:

Balance Sheet as on March 31st

Liabilities ₹ Assets ₹

Equity Capital (₹ 10 per share) 8,00,000 Net Fixed Assets 10,00,000

10% Debt 6,00,000 Current Assets 9,00,000

Retained Earnings 3,50,000

Current Liabilities 1,50,000

19,00,000 19,00,000

Income Statement for the year ending March 31

Particulars ₹

Sales 3,40,000

Operating expenses (including ₹ 60,000 depreciation) (1,20,000)

EBIT 2,20,000

Less: Interest (60,000)

Earnings before tax 1,60,000

Less: Taxes (56,000)

Net Earnings (EAT) 1,04,000

(a) Determine the degree of operating, financial and combined leverages at the current sales level, if all

operating expenses, other than depreciation, are variable costs.

(b) If total assets remain at the same level, but sales (i) increase by 20 percent and (ii) decrease by 20 per

cent, what will be the earnings per share at the new sales level?

Question 30 - Study Material

The following information is available for a concern for the year ended 31.3.2011.

Total Sales (Quantity) 100,000 units

Fixed Cost ₹ 12,60,000

Variable Cost 55% of sales

CA Nitin Guru | www.edu91.org 4.7

Chapter 4 - Leverages

Debt (@ 10%) ₹ 54,00,000

Equity (Face value of each share of ₹ 10) ₹ 50,00,000

Income tax rate 35%

Selling price per unit ₹ 80

You are required to find out –

1. Income Statement for the year ended 31.3.2011.

2. Operating and Financial Leverage

3. Company’s Return on Investment

4. How much of the Company’s sales have to come down so that earning of the company before tax

comes down to zero?

Question 31 - Study Material

XYZ Ltd. sells 2,000 units @ ₹ 10 per unit. The variable cost of production is ₹ 7 and fixed cost is ₹ 1,000. The

company raised the required funds by issue of 100, 10% debentures @ ₹ 100 each and 2,000 equity shares @ ₹

10 per share. The sales of XYZ Ltd. are expected to increase by 20%. Assume tax rate of company is 50%. You

are required to calculate the impact of increase in sales on earning per share.

Reverse Working with DCL

Question 32 - Nov 08, May 09

A company operates at a production level of 1,000 units. The contribution is ₹ 60 per unit, operating leverage is

6, and combined leverage is 24. If tax rate is 30%, what would be its earnings after tax?

Reverse Working with DFL - ROE and ROI with Interest Rate and Leverage.

Question 33 - May 07

ABC Limited has an average cost of debt at 10 percent and tax rate is 40 per cent. The financial leverage ratio

for the company is 0.60. Calculate Return on Equity (ROE) if its Return on Investment (ROI) is 20%.

Reverse Working with DCL- ROE and ROI

Question 34 - Study Material

The net sales of Carlton Limited is ₹ 30 crores. Earnings before interest and tax of the company as a

percentage of net sales are 12%. The capital employed comprises ₹ 10 crores of equity, ₹ 2 crores of 13%

Cumulative Preference Share Capital and 15% Debentures of ₹ 6 crores. Income-tax rate is 40%.

(i) Calculate the Return-on-equity for the company and indicate its segments due to the presence of

Preference Share Capital and Borrowing (Debentures).

(ii) Calculate the Operating Leverage of the Company given that combined leverage is 3.

Reverse Working with All Leverages

Question 35 - May 07, Nov 2017

The following details of RST Limited for the year ended 31st March, 2006 are given below:

Operating leverage 1.4 times

Combined leverage 2.8 times

Fixed cost (Excluding interest) ₹ 2.04 lakhs

Sales ₹ 30.00 lakhs

12% Debentures of ₹ 100 each ₹ 21.25 lakhs

Equity Share Capital of ₹ 10 each ₹ 17.00 lakhs

Income tax rate 30 per cent

Required:

(i) Calculate Financial leverage.

(ii) Calculate P/V ratio and Earning per Share (EPS).

(iii) If the company belongs to an industry, whose assets turNover is 1.5, does it have a high or low

assets leverage?

(iv) At what level of sales the Earning before Tax (EBT) of the company will be equal to zero?

Question 36 - Study Material, Nov 15

From the following prepare Income statement of Company A, B and C.

Company A B C

Financial Leverage 3:1 4:1 2:1

CA Nitin Guru | www.edu91.org 4.8

Chapter 4 - Leverages

Interest ₹ 200 ₹ 300 ₹ 1,000

Operating Leverage 4:1 5:1 3:1

Variable cost as a percentage to 2

sales 66 3

% 75% 50%

Income tax rate 45% 45% 45%

Question 37 - Nov 09

From the following data of Company A and Company B, Prepare their Income Statement

Particulars Company A Company B

Variable cost ₹ 56,000 60% of sales

Fixed Cost ₹ 20,000 -

Interest Expense ₹ 12,000 ₹ 9,000

Financial Leverage 05:01 -

Operating Leverage - 04:01

Income tax rate 30% 30%

Sales - ₹ 1,05,000

Miscellaneous Practical Problems

Question 38 -

Show the effect of Trading on equity on ROE of an entity from the following information:-

Particulars (₹ in 000's)

Total Assets 2000

Debt Equity Ratio

Case I 0:1

Case II 1:4

Case III 2:3

Tax rate – 35%, Rate of Interest – 15%, Return on Investment – 30%.

Question 39 - Study Material

X Ltd. details are as under:

Sales (@ 100 per unit) ₹ 24,00,000

Variable Cost 50%

Fixed cost ₹ 10,00,000

It has borrowed ₹ 10,00,000 @ 10% p.a. and its equity share capital share capital is ₹ 10,00,000 (₹ 100 each).

The company is in a tax bracket of 50%. Calculate:

(a) Operating Leverage

(b) Financial Leverage

(c) Combined Leverage

(d) Return on Equity

(e) If the sales increases by ₹ 6,00,000; what will the new EBIT?

Question 40 - May 13, Nov 2016

The following information related to XL company Ltd. For the year ended 31st March, 2013 are available to you:

Equity share capital of ₹ 10 each ₹ 25 lakh

11% Bonds of ₹ 1000 each ₹ 18.5 lakh

Sales ₹ 42 lakh

Fixed cost (Excluding Interest) ₹ 3.48 lakh

Financial leverage 1.39

Profit-Volume Ratio 25.55%

Income Tax Rate Applicable 35%

You are required to calculate:

(i) Operating Leverage;

(ii) Combined Leverage; and

(iii) Earnings Per Share.

Question 41 - May 2018

CA Nitin Guru | www.edu91.org 4.9

Chapter 4 - Leverages

The following information is related to YZ Company Ltd. for the year ended 31st March, 2020:

Equity share capital (of ₹ 10 each) ₹ 50 lakhs

12% Bonds of ₹ 1,000 each ₹ 37 lakhs

Sales ₹ 84 lakhs

Fixed cost (excluding interest) ₹ 6.96 lakhs

Financial leverage 1.49

Profit-volume Ratio 27.55%

Income Tax Applicable 40%

You are required to CALCULATE:

(i)Operating Leverage;

(ii)Combined leverage; and

(iii)Earnings per share.

Show calculations up-to two decimal points.

Question 42 - Rtp May 2021

Following information has been extracted from the accounts of newly incorporated Textyl Pvt. Ltd. for the

Financial Year 2020-21:

Sales ₨ 15,00,000

P/V ratio 70%

Operating Leverage 1.4 times

Financial Leverage 1.25 times

Using the concept of leverage, find out and verify in each case:

(i) The percentage change in taxable income if sales increase by 15%.

(ii)The percentage change in EBIT if sales decrease by 10%.

(iii)The percentage change in taxable income if EBIT increase by 15%.

Question 43 - Jan 2021

The information related to XYZ Company Ltd. for the year ended 31st March, 2020 are as follows:

Equity Share Capital of ₹ 100 each ₹ 50 Lakhs

12% Bonds of ₹ 1000 each ₹ 30 Lakhs

Sales ₹ 84 Lakhs

Fixed Cost (Excluding Interest) ₹ 7.5 Lakhs

Financial Leverage 1.39

Profit-Volume Ratio 25%

Market Price per Equity Share ₹ 200

Income Tax Rate Applicable 30%

You are required to compute the

following:

(i)Operating Leverage

(ii)Combined Leverage

(iii)Earnings per share

(iv)Earning Yield

Question 44 - Jan 2021

The data of SM Limited for the year ended 31st March 2020 is given below:

Fixed Cost (Excluding Interest) ₹ 2.25 Lakhs

Sales ₹ 45 Lakhs

Equity Share Capital of ₹ 10 each ₹ 38.50 Lakhs

12% Debentures of ₹ 500 each ₹ 20 Lakhs

Operating Leverage 1.2

Combined Leverage 4.8

Income tax rate 30%

Required:

(i)Calculate P/V ratio, Earning per share Financial leverage and Assets turNover.

(ii)If asset turNover of an industry is 1.1, then comment on adequacy of assets

turNover of SM Limited.

(iii)At what level of sales the Earnings before tax (EBT) of SM Limited will be

equal to zero?

CA Nitin Guru | www.edu91.org 4.10

Chapter 4 - Leverages

Question 45 - Dec 2021

Information of A Ltd. is given below:

· Earnings after tax: 5% on sales

· Income tax rate: 50%

· Degree of Operating Leverage: 4 times

· 10% debentures in capital structure: ₹ 3 lakhs

· Variable costs: ₹ 6 lakhs

Required:

(i) From the given data complete the following statement:

Sales XXXX

Less: Variable Costs ₹ 6,00,000

Contribution XXXX

Less: Fixed Cost XXXX

EBIT XXXX

Less: Interest Expenses XXXX

EBT XXXX

Less: Income tax XXXX

EAT XXXX

(ii) Calculate the Financial Leverage and Combined Leverage.

(iii)Calculate the percentage change in earning per share, if sales increased by 5%.

CA Nitin Guru | www.edu91.org 4.11

You might also like

- Shareholders Agreement (Two Shareholders)Document18 pagesShareholders Agreement (Two Shareholders)Legal Forms92% (12)

- Project Elm: Independent Business Review 3 April 2014Document101 pagesProject Elm: Independent Business Review 3 April 2014BernewsAdminNo ratings yet

- Chapter-3Document20 pagesChapter-3rajes wariNo ratings yet

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Accountancy and Business Statistics Second Paper: Management AccountingDocument10 pagesAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- 6thSem-FM-Model QP by Puja Gupta - 26apr2020Document20 pages6thSem-FM-Model QP by Puja Gupta - 26apr2020sujitdey405No ratings yet

- LeverageDocument6 pagesLeveragesunraypower2010No ratings yet

- Unit 5 BBM 402 TutorialsDocument2 pagesUnit 5 BBM 402 Tutorialsartistic.nature.11No ratings yet

- 8 RTP Nov 21 1Document27 pages8 RTP Nov 21 1Bharath Krishna MVNo ratings yet

- MBG-206 2019-20 09-12-2021Document4 pagesMBG-206 2019-20 09-12-2021senthil.jpin8830No ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- Cim 8701 F.M. Question PaperDocument2 pagesCim 8701 F.M. Question Papersaurablamsal65No ratings yet

- Problems On Leverage AnalysisDocument4 pagesProblems On Leverage AnalysisMandar SangleNo ratings yet

- FM Previous Year Questions 2020-2023Document18 pagesFM Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- New ProjectDocument10 pagesNew Projectvishal soniNo ratings yet

- Ba ZG521 Ec-3r First Sem 2022-2023Document20 pagesBa ZG521 Ec-3r First Sem 2022-2023sethvijay075No ratings yet

- MTP 12 25 Questions 1696939932Document5 pagesMTP 12 25 Questions 1696939932harshallahotNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- 41 Leverages 1729250895Document5 pages41 Leverages 1729250895madhu.r3102022No ratings yet

- Corporate Finance AssignmentDocument8 pagesCorporate Finance AssignmentJainamNo ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Paper 18Document65 pagesPaper 18sjsjsj20061606No ratings yet

- 8 LeveragesDocument14 pages8 LeveragesMedha PanditaNo ratings yet

- Mbac 2001Document6 pagesMbac 2001sujithNo ratings yet

- Module 6 Leverage QuestionsDocument3 pagesModule 6 Leverage QuestionsJayashree ChakrapaniNo ratings yet

- Financial Management (Important Question)Document10 pagesFinancial Management (Important Question)tanisha agrawalNo ratings yet

- FM Super 50-LDR CompilerDocument25 pagesFM Super 50-LDR Compilerishanikaur09No ratings yet

- LeveragesDocument14 pagesLeverageshardikaggarwal0102No ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- Corporate Finance Assignment 2021Document8 pagesCorporate Finance Assignment 2021moshooNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- Paper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument32 pagesPaper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisVarun MurthyNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- MTP - FM ECO - Aug18 - Oct18 - Mar19 - Apr19 - Oct19 - May20 - Oct20 - Oct21 - Nov21Document158 pagesMTP - FM ECO - Aug18 - Oct18 - Mar19 - Apr19 - Oct19 - May20 - Oct20 - Oct21 - Nov21sersdrNo ratings yet

- Financing Decision Practice QuestionsDocument4 pagesFinancing Decision Practice QuestionsFaraz SiddiquiNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Capital Structure and Leverages-ProblemsDocument7 pagesCapital Structure and Leverages-ProblemsUday GowdaNo ratings yet

- CA Inter FM Eco RTP May 2023Document27 pagesCA Inter FM Eco RTP May 2023tirthpatel406No ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- MCOM Final Year Assignments 2020-2021Document8 pagesMCOM Final Year Assignments 2020-2021VARDHANNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument27 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument29 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisEFRETNo ratings yet

- Inter FMSM MTP2Document16 pagesInter FMSM MTP2renudevi06081973No ratings yet

- Assignment FMCFDocument4 pagesAssignment FMCFkumari.astha1309No ratings yet

- Leverage & Risk AnalysisDocument11 pagesLeverage & Risk AnalysisAnkush ChoudharyNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- QP CA Inter New Syllabus 5 FMSM Ns CA Int Feb 24 8563Document7 pagesQP CA Inter New Syllabus 5 FMSM Ns CA Int Feb 24 8563ayushkumar3766999No ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan S100% (1)

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- Management AccountingDocument6 pagesManagement Accountingsendmail2anjanaNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- CA Inter FM ECO RTP Nov23 Castudynotes ComDocument23 pagesCA Inter FM ECO RTP Nov23 Castudynotes Comspyverse01No ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 200619-Home Loan Intt Rates (Old - Past Ten Years)Document8 pages200619-Home Loan Intt Rates (Old - Past Ten Years)Anand Aryan SharmaNo ratings yet

- Why Financial Education Fails The Extremely PoorDocument15 pagesWhy Financial Education Fails The Extremely Poormarc angelo c. sanchezNo ratings yet

- Article 2085 2123Document3 pagesArticle 2085 2123Kyootie QNo ratings yet

- Compilation of Cases Credit TransactionsDocument347 pagesCompilation of Cases Credit TransactionsebenezermanzanormtNo ratings yet

- FRIA Finals ReviewerDocument15 pagesFRIA Finals ReviewerSamantha Reyes100% (1)

- Journal, Ledger TB - Problems SolutionsDocument14 pagesJournal, Ledger TB - Problems Solutionssri lekhaNo ratings yet

- Kornerstone CreditDocument10 pagesKornerstone Creditjames empNo ratings yet

- Bonds ReviewerDocument7 pagesBonds ReviewerDM MontefalcoNo ratings yet

- Thesis Topics For Banking and FinanceDocument8 pagesThesis Topics For Banking and Financebsr3rf42100% (2)

- CHR Report - 14 March 2024Document75 pagesCHR Report - 14 March 2024HSLV TALKIESNo ratings yet

- Module in Business Mathematics: Try To Discover!Document24 pagesModule in Business Mathematics: Try To Discover!Jay Kenneth BaldoNo ratings yet

- Startup Funding: Entrepreneurship and StartupsDocument95 pagesStartup Funding: Entrepreneurship and StartupsAhmed Hadad0% (1)

- CARODAN v. CHINA BANKING CORPORATIONDocument2 pagesCARODAN v. CHINA BANKING CORPORATIONEmmanuel Princess Zia SalomonNo ratings yet

- Presentation QDocument25 pagesPresentation QmukeshindpatiNo ratings yet

- Dib Banking Assignment 2023Document16 pagesDib Banking Assignment 2023zhekaiNo ratings yet

- FN1086535403 Loan Account Statement-2Document4 pagesFN1086535403 Loan Account Statement-2gaurav rawatNo ratings yet

- MONEY AND CREDIT Day 13 2024asdfghjkDocument2 pagesMONEY AND CREDIT Day 13 2024asdfghjkfivestar12042015No ratings yet

- Investment Security Contract TemplateDocument45 pagesInvestment Security Contract TemplateFerdee FerdNo ratings yet

- MCS - May 19 - StructuringDocument17 pagesMCS - May 19 - StructuringsangNo ratings yet

- FM Assignment-2Document8 pagesFM Assignment-2Rajarshi DaharwalNo ratings yet

- Tutorial 5 Secured LendingDocument5 pagesTutorial 5 Secured Lendingmajmmallikarachchi.mallikarachchiNo ratings yet

- Securitisation Asset Reconstruction & Enforcement of - Vinod Kothari - 2013 - Lexis Nexis - Anna's ArchiveDocument1,522 pagesSecuritisation Asset Reconstruction & Enforcement of - Vinod Kothari - 2013 - Lexis Nexis - Anna's ArchiveSankari BalasubramanianNo ratings yet

- The Six Steps To Financial IndependenceDocument67 pagesThe Six Steps To Financial Independenceancaye1962No ratings yet

- Group 1 PlanDocument10 pagesGroup 1 PlanSunnyNo ratings yet

- Unsur Ekorek N CashflowDocument21 pagesUnsur Ekorek N CashflowAlfina RohmaniahNo ratings yet

- 03 Self Balancing LedgersDocument5 pages03 Self Balancing LedgersAhmad FarazNo ratings yet

- Chapter 2 Excel TestDocument9 pagesChapter 2 Excel TestJasmine GuliamNo ratings yet