10-Revdevt at Quizzer 10 Audit Evidence

10-Revdevt at Quizzer 10 Audit Evidence

Uploaded by

Rachel LeachonCopyright:

Available Formats

10-Revdevt at Quizzer 10 Audit Evidence

10-Revdevt at Quizzer 10 Audit Evidence

Uploaded by

Rachel LeachonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

10-Revdevt at Quizzer 10 Audit Evidence

10-Revdevt at Quizzer 10 Audit Evidence

Uploaded by

Rachel LeachonCopyright:

Available Formats

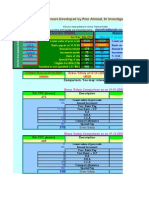

DE LA SALLE UNIVERSITY MANILA

RVR COB DEPARTMENT OF ACCOUNTANCY

REVDEVT 1ST Term AY 14-15

Auditing Theory

Prof. Francis H. Villamin

AT Quizzer 10

===============================================================================

PSA 500 Redrafted Audit Evidence

1. All the information used by the auditor in arriving at the conclusions on which the audit opinion is

based is called

a. Audit information

b. Audit evidence

c. Accounting records

d. Corroborating information

2. Audit evidence comprises

I. Information that supports and corroborates managements assertions

II. Any information that contradicts managements assertions

a. I only

b. II only

c. Neither I nor II

d. Both I and II

3. Which of the following is not an assertion relating to classes of transactions?

a. Accuracy

b. Consistency

c. Cutoff

d. Occurrence

4.

Which of the following is a general principle relating to the reliability of audit evidence?

a. Audit evidence obtained from inherent sources rather than directly is more reliable than

evidence obtained directly by the auditor

b. Audit evidence provided by copies is more reliable than that provided by facsimiles

c. Audit evidence obtained from knowledge independent sources outside the client company is

more reliable than audit evidence obtained from non-independent sources

d. Audit evidence provided by original document is more reliable than audit evidence generated

through a system of effective controls

5. Which of the following types of audit evidence is the most persuasive?

a. Prenumbered client purchase order forms

b. Client work sheets supporting cost allocations

c. Bank statements obtained from the client

d. Client representation letter

6. Which of the following presumptions is correct about the reliability of audit evidence?

a. Information obtained indirectly from outside sources is the most reliable audit evidence

b. To be reliable, audit evidence should be convincing rather than persuasive

c. Reliability of audit evidence refers to the amount of corroborative evidence obtained

d. Effective internal control provides more assurance about the reliability of audit evidence

7. Which of the following statements relating to the appropriateness of audit evidence is always

true?

a. Audit evidence gathered by an auditor from outside an enterprise is reliable

b. Accounting data developed under satisfactory conditions of internal control are more

relevant than data developed under unsatisfactory internal control conditions.

c. Oral representations made by management are not valid evidence

d. Evidence gathered by auditors must be both valid and relevant to be considered appropriate

8. An entitys accounting records generally include the records of initial entries and supporting

records including

a. Confirmations from third parties

b. Information obtained by the auditor from such audit procedures as inquiry, observation, and

inspection.

c. Worksheets and spreadsheets supporting cost allocations.

d. Other information developed by, or available to, the auditor to permit him/her to reach

conclusions through valid reasoning.

AT Quizzer 10

Audit Evidence

9. Audit evidence is information used to draw reasonable conclusions on which to base the auditors

opinion. Audit evidence is obtained by performing

I. Risk assessment procedures

II. Further audit procedures

a. I only

b. II only

c. Either I or II

d. Both I and II

10. Which of the following statements concerning audit evidence is correct?

a. Appropriateness is the measure of the quantity of audit evidence.

b. Sufficiency is the measure of the quality of audit evidence, that is, its relevance and reliability.

c. The quantity of audit evidence needed is affected by its quality and the risk of misstatement.

d. The sufficiency and appropriateness of audit evidence are not interrelated.

11. Those procedures specifically outlined in an audit program are primarily designed to

a. Prevent litigations

b. Detect errors or irregularities

c. Test internal systems

d. Gather evidence

12. Evidential matter is generally considered competent when

a. It has the qualities of being relevant, objective, and free from known bias.

b. There is enough of it to afford reasonable basis for opinion on financial statements.

c. It has been obtained from random selection.

d. It consists of written statements made by managers of enterprise under audit.

13. Evidential matter supporting the financial statements consists of underlying accounting data and

all corresponding information available to the auditor. Which of the following is an example of

corroborating information?

a. Minutes of meetings

b. General and subsidiary ledgers

c. Accounting manuals

d. Worksheet supporting cost allocations

14. The strongest criticism of the reliability of audit evidence that the auditor physically observes is

that

a. The client may conceal its items from the auditor.

b. The auditor may not be qualified to evaluate the items, which he or she is observing.

c. Such evidence is too costly in relation to its reliability.

d. The observation must occur at a specific time, which is often difficult to arrange.

15. To be competent, evidence must be both

a. Timely and substantial

b. Reliable and documented

c. Valid and relevant

d. Useful and objective

16. Which of the following is generally not true about sufficiency of audit evidence?

a. The amount of evidence that is sufficient varies inversely with the competency of the

evidence

b. The amount of evidence concerning a particular account varies directly with the materiality of

the account

c. The amount of evidence concerning a particular account varies inversely with the inherent

risk of the account

d. When the evidence is competent with respect to an account is also sufficient

17. An independent auditor gathers evidence to

a. Appraise management

b. Assess and evaluate internal control

c. Form an opinion on the financial statements

d. Discover fraud

18. Which of the following type of documentary audit evidence is the most reliable?

a. Physical examination by the auditor

b. Documentary evidence calculated by the auditor from company records

c. Confirmations received directly from third parties

d. Internal documents

AT Quizzer 10

Audit Evidence

19. Which of the following is the least persuasive documentation in support of an auditors opinion?

a. Schedules of details of physical inventory count conducted by the client

b. Notation of inferences drawn from ratios and trends

c. Notation of appraisers conclusions documented in the auditors working papers

d. Lists of negative confirmation requests for which the auditor received no response

20. Theoretically, which of the following would not have an effect on the amount of audit evidence

gathered by the auditor?

a. The type of opinion to be issued

b. The auditors evaluation of internal control

c. The types of evidence available to the auditor

d. Whether the client reports to the SEC

21. Which of the following types of audit evidence is the least persuasive?

a. Prenumbered purchase order forms

b. Bank statements obtained from client

c. Test counts of inventory performed by the auditor

d. Correspondence from the clients attorney about litigation

22. A basic premise underlying the application of analytical procedures that

a. The study of financial ratios is an acceptable alternative to the investigation of unusual

fluctuations

b. Statistical tests of financial information may lead to the discovery of material misstatements

in the financial statements

c. Plausible relationships among data may reasonably be expected to exist and continue in the

absence of known conditions to the contrary

d. These procedures cannot replace tests of balances and transactions

23. For all audits of financial statements made in accordance with PSAs, the use of analytical

procedures is required to some extent

In the planning stage

As a substantive test

In the review stage

a.

Yes

No

Yes

b.

No

Yes

No

c.

No

Yes

Yes

d.

Yes

No

No

24. Which of the following is the best example of a substantive test?

a. Examine a sample of cash disbursements to test whether expenses have been properly

approved

b. Confirmation of balances of accounts receivable

c. Comparison of signatures on checks to a list of authorized signers

d. Flowcharting of the clients cash receipts system

25. The objective of tests of details of transactions performed as substantive tests to

a. Comply with generally accepted auditing standards.

b. Attain assurance about the reliability of the accounting system.

c. Detect material misstatements in the financial statements.

d. Evaluate whether managements policies and procedures operated effectively.

26. In the context of an audit of financial statements, substantive tests are audit procedures that

a. May be eliminated under certain conditions

b. Are designed to discover significant subsequent events

c. May be either tests of transactions, direct tests of financial balances, or analytical tests

d. Will increase proportionately with the auditors reliance on internal control

27. An auditor will examine invoices from lawyers primarily in order to

a. Substantiate accruals.

b. Assess the legal ramifications of litigation in progress.

c. Estimate the peso amount of contingent liabilities.

d. Identify possible unasserted litigation, claims and assessments.

28. When auditing inventories, an auditor would least verify that

a. The financial statement presentation of inventories is appropriate.

b. Damaged goods and obsolete items have been properly accounted for.

c. All inventory owned by the client is on hand at the time of the count.

d. The client has used proper inventory pricing.

AT Quizzer 10

Audit Evidence

29. Which of the following is the best reason why the auditors should consider observing a clients

distribution of regular payroll checks?

a. Separation of payroll duties is less than adequate for effective internal control.

b. Total payroll costs are a significant part of total operating costs.

c. The auditors did not observe the distribution of the entire payroll during the audit in the prior

year.

d. Employee turnover is excessive.

30. Which of the following procedures would an auditor most likely perform for year-end accounts

receivable confirmation when the auditor did not receive replies to second requests?

a. Review the cash receipts journal for the month prior to the year-end.

b. Intensify the study of internal control structure concerning the revenue cycle.

c. Increase the assessed level of detection risk for the existence assertion.

d. Inspect the shipping records documenting the merchandise sold to debtors.

31. Which of the following is not a procedure performed by auditors on segment information?

a. Evaluate reasonableness of managements methods of compiling the information.

b. Apply analytical procedures to test its reasonableness.

c. Confirm major segments with appropriate creditors.

d. Evaluate the reasonableness of methods of allocating operating expense among segments.

32. Which of the following statements is correct concerning the use of negative confirmation

requests?

a. Unreturned negative confirmation requests rarely provide significant explicit evidence.

b. Negative confirmation requests are effective when detection risk is low.

c. Unreturned negative confirmation requests indicate that alternative procedures are

necessary.

d. Negative confirmation requests are effective when understatements of account balances are

suspended.

33. While observing a clients annual physical inventory, an auditor recorded test counts for several

items and noticed that certain test counts were higher than recorded quantities in the clients

perpetual records. This situation could be the result of the clients failure to record

a. Purchase discounts

b. Purchase returns

c. Sales

d. Sales returns

34. The auditors primary means of obtaining corroboration of managements information concerning

litigation is a:

a. Letter of audit inquiry to the clients lawyer.

b. Letter of corroboration from the auditors lawyer upon review of the legal documentation.

c. Confirmation of claims and assessments from the other parties to the litigation.

d. Confirmation of claims and assessments from an officer of the court presiding over the

litigation.

35. Auditors often request that the audit client send a letter of inquiry to those attorneys who have

been consulted with respect to litigations, claims, or assessments. The primary reason for this

request is to provide the auditor with

a. An estimate of the peso amount of the probable loss.

b. An expert opinion as to whether a loss is possible, probable or remote.

c. Information concerning the progress of cases to date.

d. Corroborative evidential matter.

36. A refusal by a lawyer to furnish the information related to litigation included in the letter of inquiry

is likely to result in

a. Confirmation of related lawsuits with the claimants.

b. Qualifications of the audit report.

c. An assessment that loss of the litigation is probable.

d. An adverse opinion.

37. In which of the following circumstances would the use of the negative form of accounts

receivable most likely justified?

a. A substantial number of accounts may be in dispute and the accounts receivable balances

arises from sales to few major customers.

b. A substantial number of accounts may be in dispute and the accounts receivable balances

arises from sales to many customers with small balances.

c. A small number of accounts may be in dispute and the accounts receivable balances arises

from sales to a few major customers.

d. A small number of accounts may be in dispute and the accounts receivable balances arises

from sales to many customers with small balances.

AT Quizzer 10

Audit Evidence

38. Returns of positive confirmation requests for accounts receivable were very poor. As an

alternative procedure, the auditor decided to check subsequent collections. The auditor has

satisfied himself that the client satisfactorily listed the customer name next to each check listed

on the deposit slip; hence, he decided that for each customer for which a confirmation was not

received that he would add all amounts shown for that customer on each validated deposit slip

for the two months following the balance sheet date. The major fallacy in the auditors

procedures is that

a. Checking of subsequent collections is not an accepted alternative auditing procedure for

confirmation of accounts receivable.

b. By looking only at the deposit slip the auditor would not know if the payment was for the

receivable at the balance sheet date or a subsequent transaction.

c. The deposit slip would not be received directly by the auditor as a confirmation would be.

d. A customer may not have made a payment during the two-month period.

39. It is sometimes impracticable or impossible for an auditor to use normal accounts receivable

confirmation procedures. In such situations, the best alternative procedure the auditor might

resort to would be:

a. Examining subsequent receipts of year-end accounts receivable.

b. Reviewing accounts receivable aging schedules prepared at the balance sheet date and at a

subsequent date.

c. Requesting that management increase the allowance for uncollectible accounts by an

amount equal to some percentage of the balance in those accounts that cannot be

confirmed.

d. Performing an over-all analytical review of accounts receivable and sales on a year-to-year

basis.

40. When there is a large number of relatively small account balances, negative confirmation of

accounts receivable is feasible if internal accounting control is

a. Strong and the individuals receiving the confirmation requests are unlikely to give them

adequate consideration.

b. Weak and the individuals receiving the confirmation requests are likely to give them

adequate consideration.

c. Strong and the individuals receiving the information requests are likely to give them

adequate consideration.

d. Weak and the individuals receiving the confirmation requests are unlikely to give them

adequate consideration.

41. Which of the following is not a procedure that is designed to provide evidence about the

existence of loss contingencies?

a. Obtaining a lawyers letter.

b. Confirming accounts payable.

c. Reviewing the minutes of board of directors meetings.

d. Review correspondence with banks.

42. Which of the following is an audit procedure that an auditor most likely would perform concerning

litigations, claims and assessments?

a. Request the clients lawyer to evaluate whether the clients pending litigation, claims and

assessments indicate a going-concern problem.

b. Examine the legal documents in the clients lawyers possession concerning litigation, claims

and assessments to which the lawyer has devoted substantive attention.

c. Discuss with management its policies and procedures adopted for evaluating and accounting

for litigations, claims and assessments.

d. Confirm directly with the clients lawyer that all litigations, claims and assessments have

been recorded or disclosed in the financial statements.

43. Which of the following is not an audit procedure that the independent auditor would perform

concerning litigation, claims, and assessments?

a. Obtain assurance from management that it has disclosed all unasserted claims that the

lawyer has advised are probable of assertion and must be disclosed.

b. Confirm directly with the clients lawyer that all claims have been recorded in the financial

statements.

c. Inquire of and discuss with management the policies and procedures adopted for identifying,

evaluating and accounting for litigation, claims and assessments.

d. Obtain from management a description and evaluation of litigation, claims and assessments

existing at the balance sheet.

44. In representing that the financial statements are presented fairly in all material respects, in

accordance with generally accepted accounting principles, management implicitly or explicitly

makes ___________ regarding the recognition, measurement, presentation and disclosure of

the various elements of financial statements and related disclosures.

a. Assertions

b. Allegations

c. Conclusions

d. Assurances

AT Quizzer 10

Audit Evidence

45. The auditor is required to use assertions for classes of transactions, account balances, and

presentation and disclosures in sufficient detail to form a basis for the assessment of risks of

material misstatement and the design and performance of further audit procedures. Assertions

about classes of transactions include occurrence, completeness, accuracy, cutoff and

a. Valuation and allocation

b. Rights and obligations

c. Existence

d. Classification

46. The following are assertions about account balances at the period end, except

a. Existence

b. Rights and Obligations

c. Valuation and allocation

d. Cutoff

47. The following are assertions about presentation and disclosure, except

a. Occurrence and rights and obligations

b. Accuracy and valuation

c. Classification and understandability

d. Existence

48. Which of the following statements concerning the auditors use of assertions is correct?

a. The auditor may combine the assertions about transactions and events with the assertions

about account balances.

b. In every audit engagement, the auditor should use the assertions as described in PSA 500,

i.e., the assertions should always fall into three categories: assertions about classes of

transactions and events, account balances, and presentation and disclosure.

c. There should always be a separate assertion related to cutoff of transactions and events.

d. The completeness assertion deals only with whether all transactions and events that should

have been recorded have been recorded.

49. Which of the following statements concerning audit objectives is incorrect?

a. The auditor should resolve any substantial doubt about any of managements material

financial statement assertions.

b. Selection of tests to meet audit objectives should depend upon the understanding of internal

control.

c. There should be a one-to-one relationship between audit objectives and procedures.

d. Audit objectives should be developed in light of management assertions about the financial

statement elements.

50. The primary difference between an audit of the balance sheet and an audit of the income

statement is that the audit of the income statement addresses the verification of

a. Cutoffs

b. Authorizations

c. Transactions

d. Costs

51. The auditor would unlikely perform early substantive testing of account balances when:

a. A number of significant deviations from control policies and procedures were detected during

tests of controls

b. Due to economic factors, the fourth quarter activity this year is expected to be somewhat

sluggish

c. The client uses a natural business year

d. The taking of the clients inventory is performed at an early date

52. As the acceptable level of detection risk decreases, an auditor may change the:

a. Timing of substantive tests by performing them at an interim date rather than at year-end

b. Nature of substantive tests from a less effective to a more effective procedure

c. Timing of tests of controls by performing them at several dates rather at one time

d. Assessed level of inherent risk to a higher amount

53. The extent of testing normally applies:

a. Exclusively to the number of items to be tested

b. To both the numbers of items tested and the number of tests performed

c. Exclusively to the number of substantive tests performed

d. To both the nature of items tested and the number of tests performed

54. Auditors usually try to plan the audit to minimize the use of tests of details of balances because:

a. Other types of audit tests are more reliable

b. Other types of audit tests are less costly

c. Other types of audit tests require less experienced audit personnel

d. All three of the above are true

AT Quizzer 10

Audit Evidence

55. The independent auditor selects several transactions in each functional area and traces them

through the entire accounting system, paying special attention to evidence about whether or not

the control features are in operation. This is an example of:

a. A sequence test

b. A test of controls

c. A substantive test

d. A functional test

56. Ending account balances may be audited through the use of which of the following types of audit

procedures?

a. Tests of details of balances

b. Analytical procedures

c. Tests of controls

d. Analytical procedures and tests of details of balances

57. Which of the following represents an incorrect pairing of a type of audit test and evidence?

a. Procedures to obtain an understanding of internal controls Documentation

b. Analytical procedures Ratio analysis

c. Substantive tests of transactions Confirmation

d. Tests of details of balances Physical examination

58. After finishing the procedures to obtain an understanding of internal control, the auditor should

perform tests of controls on:

a. Key controls that have a material effect on the financial statements

b. A random sample of key controls that were reviewed

c. Key controls upon which the auditor intends to rely and plans to assess control risk below

maximum

d. Key controls which represent material weaknesses

59. Where the auditor has assessed control risk of a particular area at a reduced level, he will then:

a. Eliminate the need to gather evidence in that area

b. Test the effectiveness of the controls in that area

c. Proceed to expand the sample sizes in that area

d. Negotiate with management to determine which controls will be tested in that area

60. Upon completion of all the necessary audit procedures, the auditor should combine the

information obtained to reach an overall conclusion as to whether the financial statements are

fairly presented. This is highly subjective process that relies heavily on:

a. Generally accepted auditing standards

b. Generally accepted accounting principles

c. The auditors professional judgment

d. The management representation letter

*******************

You might also like

- Att (1) GHJDocument1 pageAtt (1) GHJRaul Antequera FzNo ratings yet

- The Lovelace/Loveless Family in America Part TwoDocument42 pagesThe Lovelace/Loveless Family in America Part TwoT.J. WhiteNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Forex Trading Made E-ZDocument75 pagesForex Trading Made E-ZRobert Gray100% (1)

- Document:Syllabus COURSE: Auditing and Assurance Principles Copies Issued ToDocument10 pagesDocument:Syllabus COURSE: Auditing and Assurance Principles Copies Issued ToIm Nayeon100% (1)

- Project On CSR, NTPCDocument36 pagesProject On CSR, NTPCBINAYAK SHANKAR50% (4)

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Auditing Theory - MockDocument10 pagesAuditing Theory - MockCarlo CristobalNo ratings yet

- Auditing Concepts Psa Based QuestionsDocument665 pagesAuditing Concepts Psa Based QuestionsMae Danica CalunsagNo ratings yet

- Lesson Number: 01 Topic: Fundamentals of Assurance Services Learning ObjectivesDocument19 pagesLesson Number: 01 Topic: Fundamentals of Assurance Services Learning ObjectivesDavid alfonsoNo ratings yet

- At Quizzer 6 - Planning and Risk Assessment - FEU MktiDocument18 pagesAt Quizzer 6 - Planning and Risk Assessment - FEU Mktiiyah0% (1)

- AT Quizzer 4 (Audit Documentation)Document5 pagesAT Quizzer 4 (Audit Documentation)JimmyChaoNo ratings yet

- V. Preliminary Engagement ActivitiesDocument8 pagesV. Preliminary Engagement ActivitiesKrizza Mae100% (1)

- 007 SHORT QUIZ - Substantive Testing - ACTG411 Assurance Principles, Professional Ethics & Good GovDocument2 pages007 SHORT QUIZ - Substantive Testing - ACTG411 Assurance Principles, Professional Ethics & Good GovMarilou PanisalesNo ratings yet

- AUD THEO BSA 51 Mr. LIMHEYADocument137 pagesAUD THEO BSA 51 Mr. LIMHEYAMarie AzaresNo ratings yet

- Pre Week, PDocument21 pagesPre Week, PCindy Karla SalnoNo ratings yet

- AT ReviewerDocument10 pagesAT Reviewerfer maNo ratings yet

- MODULE 6 - Audit PlanningDocument9 pagesMODULE 6 - Audit PlanningRufina B VerdeNo ratings yet

- Preweek Auditing Theory 2014Document31 pagesPreweek Auditing Theory 2014Charry Ramos33% (3)

- ACCOUNTING 12-07 - Audit-Assurance-Ethics-and-GovernanceDocument11 pagesACCOUNTING 12-07 - Audit-Assurance-Ethics-and-GovernanceNico evansNo ratings yet

- AT-02 Q Assurance and Non-Assurance ServicesDocument43 pagesAT-02 Q Assurance and Non-Assurance ServicesNicale JeenNo ratings yet

- Take Home Quiz Audit Theory-CPA BoardDocument7 pagesTake Home Quiz Audit Theory-CPA BoardJc GappiNo ratings yet

- Auditing Theory Overview of The Audit Process With AnswersDocument44 pagesAuditing Theory Overview of The Audit Process With AnswersNikolajay MarrenoNo ratings yet

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocument29 pagesSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100No ratings yet

- At.3217 - Completing The Audit and Post-Audit ResponsibilitiesDocument7 pagesAt.3217 - Completing The Audit and Post-Audit ResponsibilitiesDenny June CraususNo ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- At Quizzer 8 - Internal Control T2AY2223Document7 pagesAt Quizzer 8 - Internal Control T2AY2223Rheea de los SantosNo ratings yet

- AuditingDocument60 pagesAuditingarianasNo ratings yet

- Audit of ReceivablesDocument2 pagesAudit of ReceivablesCarmelaNo ratings yet

- At Reviewer Part II - (May 2015 Batch)Document22 pagesAt Reviewer Part II - (May 2015 Batch)Jake BundokNo ratings yet

- RFBT Plmor-4-7Document9 pagesRFBT Plmor-4-7KyohyunNo ratings yet

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- Auditing Theory Test BankDocument26 pagesAuditing Theory Test Bankdfgmlk dsdwNo ratings yet

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsDocument10 pagesQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyNo ratings yet

- At TestbankDocument5 pagesAt TestbankMartinez JomarNo ratings yet

- Quizzer 5Document6 pagesQuizzer 5RarajNo ratings yet

- Fraud Error NoclarDocument17 pagesFraud Error NoclarChixNaBitterNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument6 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- Fraud Error Non-Compliance and Legal Liability Final1 PDFDocument7 pagesFraud Error Non-Compliance and Legal Liability Final1 PDFJa NilNo ratings yet

- Practice Final PB AuditingDocument14 pagesPractice Final PB AuditingBenedict BoacNo ratings yet

- Topic 1Document65 pagesTopic 1Carl Dhaniel Garcia SalenNo ratings yet

- CH 13Document19 pagesCH 13pesoload100No ratings yet

- Audit of Current LiabilitiesDocument4 pagesAudit of Current LiabilitiesMark Anthony TibuleNo ratings yet

- Chapter 7 Audit Planning: Assessment of Control RiskDocument21 pagesChapter 7 Audit Planning: Assessment of Control RiskLalaine JadeNo ratings yet

- Auditing Theory 2021 by SalosagcolDocument25 pagesAuditing Theory 2021 by SalosagcoljaybellelatrasNo ratings yet

- IAT 2020 Final Preboard (Source SimEx4 RS)Document15 pagesIAT 2020 Final Preboard (Source SimEx4 RS)Mary Yvonne AresNo ratings yet

- Materials Comprehensive AUd TheoryDocument15 pagesMaterials Comprehensive AUd TheoryAnonymous EgTu8E6O100% (1)

- Chap8 PDFDocument63 pagesChap8 PDFFathinus SyafrizalNo ratings yet

- UNIT 1 Fundamentals of Assurance ServicesDocument43 pagesUNIT 1 Fundamentals of Assurance ServicesDia Mae Ablao GenerosoNo ratings yet

- AT Quizzer 13 - Reporting Issues (2TAY1718) PDFDocument10 pagesAT Quizzer 13 - Reporting Issues (2TAY1718) PDFWihl Mathew Zalatar0% (1)

- 01 RESA FAR 4210 Investment Property Other Fund Investments PDFDocument5 pages01 RESA FAR 4210 Investment Property Other Fund Investments PDFby ScribdNo ratings yet

- Fundamentals of Audit and Assurance ServicesDocument50 pagesFundamentals of Audit and Assurance ServicesAndrea ValdezNo ratings yet

- Auditing Theory - 100Q: Audit Report CMPDocument10 pagesAuditing Theory - 100Q: Audit Report CMPMaria PauNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- Auditing Theory - Auditing in EDP (Technology) 1Document16 pagesAuditing Theory - Auditing in EDP (Technology) 1Andy0% (1)

- Other PSAs and PAPSsDocument7 pagesOther PSAs and PAPSsnikNo ratings yet

- DocxDocument86 pagesDocxMubarrach MatabalaoNo ratings yet

- FAR 2733 - Share-Based-Payment PDFDocument4 pagesFAR 2733 - Share-Based-Payment PDFPHI NGUYEN HOANGNo ratings yet

- Auditing Theory Overview of The Audit Process With Answers CompressDocument44 pagesAuditing Theory Overview of The Audit Process With Answers CompressJohn Rich GamasNo ratings yet

- Psa 300Document22 pagesPsa 300Joanna CaballeroNo ratings yet

- At MCQ Salogsacol Auditing Theory Multiple ChoiceDocument32 pagesAt MCQ Salogsacol Auditing Theory Multiple ChoiceJannaviel MirandillaNo ratings yet

- Lesson 1 - Fundamentals of Auditing and Assurance ServicesDocument32 pagesLesson 1 - Fundamentals of Auditing and Assurance ServicesrylNo ratings yet

- Ap106 Investments and Intangible AssetsDocument5 pagesAp106 Investments and Intangible Assetsbright SpotifyNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument7 pagesExcel Professional Services, Inc.: Discussion Questionskæsiii100% (1)

- AT Quizzer 10 - Audit Evidence S2AY2122Document7 pagesAT Quizzer 10 - Audit Evidence S2AY2122Ferdinand MangaoangNo ratings yet

- San Beda College of Law: Dividend in InsolvencyDocument2 pagesSan Beda College of Law: Dividend in InsolvencyRachel LeachonNo ratings yet

- The Fourth Asian Roundtable On Corporate Governance: Moving Towards Transparency of Ownership and Control: A Case StudyDocument15 pagesThe Fourth Asian Roundtable On Corporate Governance: Moving Towards Transparency of Ownership and Control: A Case StudyRachel LeachonNo ratings yet

- G.R. No. 119308 - People v. Espanola y PaquinganDocument22 pagesG.R. No. 119308 - People v. Espanola y PaquinganRachel LeachonNo ratings yet

- Eugenio v. VelezDocument4 pagesEugenio v. VelezRachel LeachonNo ratings yet

- 2d-3d LaborDocument4 pages2d-3d LaborRachel LeachonNo ratings yet

- San Beda College of Law: Emory IDDocument1 pageSan Beda College of Law: Emory IDRachel LeachonNo ratings yet

- 6banking - Eto TalagaDocument23 pages6banking - Eto TalagaRachel LeachonNo ratings yet

- Hiyas Savings and Loan Bank v. Acuna PDFDocument4 pagesHiyas Savings and Loan Bank v. Acuna PDFRachel LeachonNo ratings yet

- Back Page - CivilDocument1 pageBack Page - CivilRachel LeachonNo ratings yet

- Supplement in Criminal Law: Entralized AR PerationsDocument2 pagesSupplement in Criminal Law: Entralized AR PerationsRachel LeachonNo ratings yet

- MercialDocument38 pagesMercialRachel LeachonNo ratings yet

- STATCON Midterms - Legal MaximsDocument5 pagesSTATCON Midterms - Legal MaximsRachel LeachonNo ratings yet

- 1code of CommerceDocument5 pages1code of CommerceRachel LeachonNo ratings yet

- Article 10Document2 pagesArticle 10Rachel LeachonNo ratings yet

- San Beda College of Law: 2005 C B O Annex B T R CDocument3 pagesSan Beda College of Law: 2005 C B O Annex B T R CRachel LeachonNo ratings yet

- Case Digests: OF DoctrinesDocument25 pagesCase Digests: OF DoctrinesRachel LeachonNo ratings yet

- 2digest CivilDocument121 pages2digest CivilRachel LeachonNo ratings yet

- Case Digests: OF DoctrinesDocument25 pagesCase Digests: OF DoctrinesRachel LeachonNo ratings yet

- 2table Jurisdiction RemDocument7 pages2table Jurisdiction RemRachel LeachonNo ratings yet

- 1sod CivilDocument47 pages1sod CivilRachel LeachonNo ratings yet

- Endencia V DavidDocument1 pageEndencia V DavidRachel LeachonNo ratings yet

- Codal LaborDocument5 pagesCodal LaborRachel LeachonNo ratings yet

- Custom Search: Today Is Sunday, May 13, 2018Document4 pagesCustom Search: Today Is Sunday, May 13, 2018Rachel LeachonNo ratings yet

- Addendum in Remedial Law: San Beda College of LawDocument9 pagesAddendum in Remedial Law: San Beda College of LawRachel LeachonNo ratings yet

- G.R. No. 215383Document5 pagesG.R. No. 215383Rachel LeachonNo ratings yet

- Day 1A - Receivables - AM SeatworkDocument7 pagesDay 1A - Receivables - AM SeatworkdgdeguzmanNo ratings yet

- List of Top CompaniesDocument17 pagesList of Top Companiesabhishek aroraNo ratings yet

- Distribution of Profits or Losses Based On Partner'sDocument20 pagesDistribution of Profits or Losses Based On Partner'sJOANNA ROSE MANALONo ratings yet

- CVaR - Acerbi 2002Document11 pagesCVaR - Acerbi 2002Jaime Ignacio Moreira RojasNo ratings yet

- Screenshot 2023-12-27 at 10.23.31Document2 pagesScreenshot 2023-12-27 at 10.23.31yuggolaniNo ratings yet

- Adani Enter AR 2019 PDFDocument325 pagesAdani Enter AR 2019 PDFPoonam AggarwalNo ratings yet

- MSO Vol IIDocument395 pagesMSO Vol IISaurav Ghosh0% (1)

- Prakash 123Document47 pagesPrakash 123Prakash VishwakarmaNo ratings yet

- Accounts Test CH - PSRDocument2 pagesAccounts Test CH - PSRnishthadudeja21No ratings yet

- Lecture 29 Credit+Analysis+-+Credit+RisksDocument11 pagesLecture 29 Credit+Analysis+-+Credit+RisksTaanNo ratings yet

- Sale of Goods Act-1930Document25 pagesSale of Goods Act-1930Shuvo VioletNo ratings yet

- Form 101 (See Rule 5) Application For Certificate of RegistrationDocument5 pagesForm 101 (See Rule 5) Application For Certificate of RegistrationLatisha MorrisonNo ratings yet

- M8 PracticeDocument22 pagesM8 PracticeleeminleeNo ratings yet

- Financial Statements December 31, 2010 and 2009Document48 pagesFinancial Statements December 31, 2010 and 2009b21t3chNo ratings yet

- KK BoddulaDocument5 pagesKK BoddulaNishanth Baba MaddalaNo ratings yet

- OPP ID Midterm InstabeatAnalysisDocument10 pagesOPP ID Midterm InstabeatAnalysisAkash SrivastavaNo ratings yet

- Ch.2 Accounting For Bonus and Right IssueDocument12 pagesCh.2 Accounting For Bonus and Right IssueCA INTERNo ratings yet

- Introduction To HEINEKENDocument20 pagesIntroduction To HEINEKENTuwshoo GanbatNo ratings yet

- c4 U1Document14 pagesc4 U1Anonymous WoiD6sbdDNo ratings yet

- Voltamp Transformers LTD.: Key Share DataDocument5 pagesVoltamp Transformers LTD.: Key Share DataDarwish MammiNo ratings yet

- Corporate Governance and Role of DirectorDocument32 pagesCorporate Governance and Role of DirectorjohnNo ratings yet

- Executive Summary PDFDocument3 pagesExecutive Summary PDFmistieNo ratings yet

- Notification For Selection of Managing Director Chief Executive OfficerDocument7 pagesNotification For Selection of Managing Director Chief Executive OfficerKrishna MyakalaNo ratings yet

- Lecture 5 - Composition or Scheme of ArrangementDocument4 pagesLecture 5 - Composition or Scheme of ArrangementveercasanovaNo ratings yet

- Art of Investment in Power Novaya Gazeta 26 Sep 2016Document18 pagesArt of Investment in Power Novaya Gazeta 26 Sep 2016i343529No ratings yet

- Partnership Operations Lecture NotesDocument12 pagesPartnership Operations Lecture NotesRuby GoNo ratings yet