FIN 5002 Business Finance Decisions

FIN 5002 Business Finance Decisions

Uploaded by

maheswaran perumalCopyright:

Available Formats

FIN 5002 Business Finance Decisions

FIN 5002 Business Finance Decisions

Uploaded by

maheswaran perumalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

FIN 5002 Business Finance Decisions

FIN 5002 Business Finance Decisions

Uploaded by

maheswaran perumalCopyright:

Available Formats

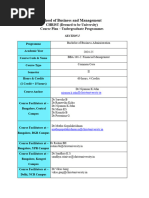

BACHELOR IN BUSINESS ADMINISTRATION (HONS) BUSINESS AND MANAGEMENT

Name of Course / Module Business Finance Decisions

Course Code FIN 5002

Name(s) of academic staff Mr Maheswaran Perumal

Rationale for the inclusion The rationale to include this module in the academic programme is because

of the course / module in this module is to provide a secure academic foundation in the core and

the programme closely related disciplines of accountancy and to maximize the number of

exemptions from the examinations of the professional accountancy bodies

through accreditation.

Semester and Year offered Year 2 Semester 1

Total Student Learning

Time (SLT) L = Lecturer Total Guided

Self- and

T = Tutorial Face to face

Learning Independence

P = Practical Learning

O = Others L T P O 120

64

28 14 0 14

Credit Value 3

Prerequisite (if any) None

Objectives The aims of the programme seek, inter alia, to provide:

1. a basis of academic learning and discipline suitable for a sound foundation

for a subsequent career as a professionally qualified accountant or for any

career in management and business administration; and

2. a qualification accredited for examination exemption purposes by the

Association of Chartered Certified Accountants [ACCA] and the Association

of International Accountants [AIA].

This module delivers against these [and the other aims stated in the

Programme Specification] by building upon the foundations provided at

Level 4 and develops the capacity to conceptualise problems and create

reasoned value judgments and opinions and to solve practical problems,

Critical reasoning and rational analysis is developed throughout this module.

In line with the University and Faculty goal of engaging closely with the

professional bodies, the module specification seeks to meet the

accreditation requirements [for examination exemption purposes] of the

Association of Chartered Certified Accountants and the Association of

International Accountants. This module is consistent with this philosophy since

it develops an understanding of the main financial objective of the firm and

the constraints that impact on that objective and by providing an

introduction to the main theories and concepts upon which the investment

and financing decisions of the firm are based and their applications in

practice. It provides a strong basis for further study and it should equip

students with up-to-date knowledge, of use in employment.

ERICAN COLLEGE @ FACULTY OF BUSINESS, IT & SOCIAL SCIENCE

BACHELOR IN BUSINESS ADMINISTRATION (HONS) BUSINESS AND MANAGEMENT

Course Learning Upon the completion of this module, students should be able to:

Outcomes (CLO) Evaluate the different competing financial objectives of the firm and

discuss the agency problem between shareholders and managers in

publicly listed companies.

Appraise simple investment projects using discounted cash-flow

techniques, the traditional methods, as well as explain the relative

merits and limitations of the methods.

Identify and explain the major types of long-term capital, their

distinguishing features, their relative advantages and disadvantages

[from the perspectives of investors and the firm] and calculate their

cost and the weighted average cost.

Discuss the importance of, and conceptual and practical issues

relating to, the management of working capital and its individual

components and evaluate the financial performance of a company

using financial ratios.

Transferable Skills: Formative assessments are those interim assessment opportunities whereby

Skills and how they are students can gain an enhanced understanding of how well they are

developed and assessed, progressing with their learning; such opportunities may include some tests

Project and practical being offered for the purposes of generating some feedback. Any mark

experience and Internship generated through formative assessment is for feedback purposes only and

will not contribute to the overall module grade. Formative assessments also

allow tutors to focus on the needs of the student group. Student activities

involve students working in groups to solve and discuss their solutions to preset

questions and exercises. Feedback will be provided during each session.

Teaching-learning and Lectures will introduce and examine the main principles of each topic.

assessment strategy Seminar/workshop sessions will be used to develop and apply the principles,

using a student-centred approach.

During tutorials students will be allocated work for completion individually and

in small groups, the outcomes of which will be formative.

Synopsis The programme philosophy is to provide a secure academic foundation in

the core and closely related disciplines of accountancy and to maximise the

number of exemptions from the examinations of the professional

accountancy bodies, through accreditation.

This module is consistent with this philosophy since it seeks to contribute to the

intellectual and personal development of students to the level of an honours

graduate by offering a body of current theoretical knowledge and technical

skills relevant to the advanced study of finance at level 5 and level 6.

It aims to develop a capacity for critical reasoning and rational analysis, the

ability to conceptualise problems, create reasoned value judgments and

opinions and the ability to solve practical problems.

Mode of Delivery For full-time students, the module will be delivered through a combination of

lectures and seminars.

All students will be given a programme of study that includes an outline of

lecture topics, recommended reading and assessment requirements.

To assist and reinforce further self-study, appropriate learning materials will be

available.

Assessment Methods and

Types

Assessment Component Distribution of Marks

Coursework 0%

Written examination 100%

TOTAL 100%

ERICAN COLLEGE @ FACULTY OF BUSINESS, IT & SOCIAL SCIENCE

BACHELOR IN BUSINESS ADMINISTRATION (HONS) BUSINESS AND MANAGEMENT

Mapping of the course / This course is one of the core major courses that provide students with the

module to the Programme prerequisite knowledge and skills to communicate by using visual elements,

Learning Outcome (PLO) images and typography

Note: 1 = Low Correlation, 2 = Medium Correlation, 3 = High Correlation

PLO PLO PLO PLO PLO

1 2 3 4 5

CLO 1 M L M M L

CLO 2 M M H H M

CLO 3 L M M M H

CLO 4 M L M H H

Programme Learning Outcome (PLO):

Prepare and analyse financial and management accounts,

statements and reports and give appropriate advice

Demonstrate an understanding of the constraints on accountants

and managers imposed by economic and legal factors

Prepare tax computations and give advice on personal and

corporate tax issues.

Apply financial management theory and techniques and give

appropriate advice on financing, investment and distribution

Apply the principles of internal and external auditing in relation to

financial review, control, accountability and assurance

Mapping of the course /

module to the Programme

SOCIAL SKILLS, TEAMWORK

Outcomes (PO)

THINKING AND SCIENTIFIC

COMMUNICATION SKILLS

ENTERPRENEURIAL SKILLS

VALUES, ETHICS, MORAL

AND PROFESSIONALISM

LIFELONG LEARNING

MANAGEMENT AND

AND RESPONSIBILITY

MANAGERIAL AND

PRACTICAL SKILLS

INFORMATION

KNOWLEDGE

SKILLS

LO1 LO2 LO3 LO4 LO5 LO6 LO7 LO8

PLO 1 H L H H L M M L

PLO 2 H M H M H M L L

PLO 3 H H L H L M M M

PLO 4 H H M H L H L L

PLO 5 H M L L H H M M

ERICAN COLLEGE @ FACULTY OF BUSINESS, IT & SOCIAL SCIENCE

BACHELOR IN BUSINESS ADMINISTRATION (HONS) BUSINESS AND MANAGEMENT

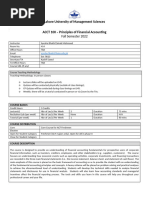

Content outline of the course / module and the SLT per topic

TOPICS L T P O SL TLT

Week 1 2 1 0 1 5 9

The financial objectives of the firm, agency problems and

solutions.

Week 2 2 1 0 1 5 9

The financial objectives of the firm, agency problems and

solutions.

Week 3 2 1 0 1 5 9

The financial objectives of the firm, agency problems and

solutions.

Week 4 2 1 0 1 3 7

Investment Appraisal Methods.

Week 5 2 1 0 1 3 7

Investment Appraisal Methods.

Week 6 2 1 0 1 3 7

Investment Appraisal Methods.

Week 7 2 1 0 1 5 9

Types and Sources of Long-term Capital and Cost of Capital.

Week 8 2 1 0 1 5 9

Types and Sources of Long-term Capital and Cost of Capital.

Week 9 2 1 0 1 5 9

Types and Sources of Long-term Capital and Cost of Capital.

Week 10 2 1 0 1 5 9

Types and Sources of Long-term Capital and Cost of Capital.

Week 11 2 1 0 1 5 9

Sources of Short-term Capital and Working Capital

Management.

Week 12 2 1 0 1 5 9

Sources of Short-term Capital and Working Capital

Management.

Week 13 2 1 0 1 5 9

Ratio Analysis – Evaluation of Company Performance Financial

Ratios.

Week 14 2 1 0 1 5 9

Ratio Analysis – Evaluation of Company Performance Financial

Ratios.

28 14 0 14 64 120

Main References Watson, D., and A. Head, 2010 (W&H), Corporate Finance – Principles

and Practice FT Prentice-Hall/Pearson Education, 5th edition.

Mclaney, E., 2011 (EM), Business Finance: Theory and Practice FT

Prentice-Hall/Pearson Education, 9th edition.

Atrill. P., 2012 (PA), Financial Management for Decision Makers, FT

Prentice Hall/Pearson Education, 6th edition.

Additional References Arnold. G., 2008. Corporate Financial Management, FT Prentice

Hall/Pearson Education, 4th Edition.

Pike. R., and B. Neale, 2009. Corporate Finance and Investment:

Decisions and Strategies. FT Prentice Hall/Pearson Education, 6th

edition.

ERICAN COLLEGE @ FACULTY OF BUSINESS, IT & SOCIAL SCIENCE

BACHELOR IN BUSINESS ADMINISTRATION (HONS) BUSINESS AND MANAGEMENT

Others Journals and Periodicals

You are encouraged to read the financial press, such as the Financial Times

or the Wall Street Journal, on a daily basis. In addition, you can also read the

Economist once a week.

ERICAN COLLEGE @ FACULTY OF BUSINESS, IT & SOCIAL SCIENCE

You might also like

- DLL - COOKERY 8 WEEK1Document3 pagesDLL - COOKERY 8 WEEK1Gracel Kay Valdez Gacisano100% (3)

- LAW1103 Regulatory Framework and Legal Issues in BusinessDocument15 pagesLAW1103 Regulatory Framework and Legal Issues in BusinessmarkNo ratings yet

- Syllabus - Bsa 3101-Accounting For Special TransactionsDocument10 pagesSyllabus - Bsa 3101-Accounting For Special TransactionsMaviel SuaverdezNo ratings yet

- ACC4002 Fundamental of Fin Acc IDocument6 pagesACC4002 Fundamental of Fin Acc Imaheswaran perumalNo ratings yet

- Meeting the Assessment Requirements of the Award in Education and TrainingFrom EverandMeeting the Assessment Requirements of the Award in Education and TrainingNo ratings yet

- Pmi Capm Certified Associate in Project Management: Verified Questions by IT ExpertsDocument4 pagesPmi Capm Certified Associate in Project Management: Verified Questions by IT ExpertsKofi AsaaseNo ratings yet

- S19 Syllabus - AIS 100Document11 pagesS19 Syllabus - AIS 100SPENCER HIKADENo ratings yet

- The Blind Side Activities KeysDocument3 pagesThe Blind Side Activities KeysgynacassiaNo ratings yet

- Lesson Plan - Listening & Speaking - A Ride in The Safari ParkDocument4 pagesLesson Plan - Listening & Speaking - A Ride in The Safari ParkNur Fatin Syahirah100% (2)

- ACC 5008 Financial ReportingDocument5 pagesACC 5008 Financial Reportingmaheswaran perumalNo ratings yet

- FIN 6009 Advanced Financial ReportingDocument6 pagesFIN 6009 Advanced Financial Reportingmaheswaran perumalNo ratings yet

- QME4004 Business Economics and Law IDocument5 pagesQME4004 Business Economics and Law Imaheswaran perumalNo ratings yet

- MGT402 - MAA - Course OutlineDocument6 pagesMGT402 - MAA - Course OutlineRajesh SinghNo ratings yet

- Syllabus_BUSINESS FINANCEDocument8 pagesSyllabus_BUSINESS FINANCEGenessa BasiliscoNo ratings yet

- Course Plan 2023-24 - FM 101-2Document25 pagesCourse Plan 2023-24 - FM 101-2ROHIT GOYAL 2123531No ratings yet

- FM MBA OUTLINE 05032023 094657pmDocument5 pagesFM MBA OUTLINE 05032023 094657pmdt0035620No ratings yet

- CURSOS CERTIFICACIONESDocument5 pagesCURSOS CERTIFICACIONESmiquiNo ratings yet

- Corporate Finance Course OutlineDocument6 pagesCorporate Finance Course OutlineHaroon Z. ChoudhryNo ratings yet

- Managerial Accounting Module DescriptorDocument4 pagesManagerial Accounting Module Descriptorవెంకటరమణయ్య మాలెపాటిNo ratings yet

- FM course planDocument32 pagesFM course planEkagra MohtaNo ratings yet

- 10292021121432_04172021062024_PO,PSO,CO-proforma B.com Final 12.10.20 (1)Document18 pages10292021121432_04172021062024_PO,PSO,CO-proforma B.com Final 12.10.20 (1)adfghjhjkhfzNo ratings yet

- PDF文档Document3 pagesPDF文档zakariahd42No ratings yet

- AF5115Document5 pagesAF5115Chin LNo ratings yet

- BAC 319 Assurance Principles Good Governance and Professional EthicsDocument18 pagesBAC 319 Assurance Principles Good Governance and Professional EthicsLemeryNo ratings yet

- Syllabus - Special Topics in FMDocument11 pagesSyllabus - Special Topics in FMGenessa BasiliscoNo ratings yet

- Cost Accounting Course OutlineDocument6 pagesCost Accounting Course OutlineTehreem BukhariNo ratings yet

- Intermediate Financial Accounting Hand Book (Bloomberg)Document11 pagesIntermediate Financial Accounting Hand Book (Bloomberg)KhAn Abbas100% (1)

- NLUN-BBALLB-PPM-Sushant Waghmare-14 JULY, 2022Document7 pagesNLUN-BBALLB-PPM-Sushant Waghmare-14 JULY, 2022sharang IngawaleNo ratings yet

- LUMS-Financial AccountingDocument7 pagesLUMS-Financial Accountingshazil.aliNo ratings yet

- Business Strategy: Program ObjectivesDocument6 pagesBusiness Strategy: Program ObjectivesRaja TajamalNo ratings yet

- Unit Descriptions 4 YrDocument13 pagesUnit Descriptions 4 YrniyitangamahorosamuellNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingAnkur SinghNo ratings yet

- ACCT 100-Principle of Financial Accounting-Saira RizwanDocument6 pagesACCT 100-Principle of Financial Accounting-Saira Rizwanraziqachaudhry9665No ratings yet

- ACT 1124 - Financial ManagementDocument13 pagesACT 1124 - Financial ManagementRonald LeabresNo ratings yet

- 8005CGOV - Brief - Effective T2 2023 - v7.2Document7 pages8005CGOV - Brief - Effective T2 2023 - v7.2Ross JorgensenNo ratings yet

- Course Syllabus: MGT 142 (FDocument4 pagesCourse Syllabus: MGT 142 (FMaria Romelyn MontajesNo ratings yet

- Course Outline PMGM7024 Business Lab - 2023 24 - 20231013Document10 pagesCourse Outline PMGM7024 Business Lab - 2023 24 - 20231013fangruiqi006No ratings yet

- Silabus Manajemen Keuangan 1Document4 pagesSilabus Manajemen Keuangan 1Mas DoniNo ratings yet

- Ahore Chool OF Conomics: Cost Accounting (ACC-302)Document8 pagesAhore Chool OF Conomics: Cost Accounting (ACC-302)he20003009No ratings yet

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Document14 pagesACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNo ratings yet

- BUS7AC Developing Skills For Bus LeadershipDocument5 pagesBUS7AC Developing Skills For Bus LeadershipHafsa YousufNo ratings yet

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalNo ratings yet

- Modulestrategic Management For Hospitality and EventsDocument4 pagesModulestrategic Management For Hospitality and EventsPavel ColladoNo ratings yet

- OBE Syllabus Financial Management San Francisco CollegeDocument4 pagesOBE Syllabus Financial Management San Francisco CollegeJerome SaavedraNo ratings yet

- Acc 1511-Management Accounting FundamentalsDocument7 pagesAcc 1511-Management Accounting FundamentalsJamil AbdullahNo ratings yet

- STRA302 - Business Policy and Strategic ManagementDocument5 pagesSTRA302 - Business Policy and Strategic ManagementAhmad DanielNo ratings yet

- Diploma In: Strategic Finance & Business PartneringDocument7 pagesDiploma In: Strategic Finance & Business PartneringAlifya ZahranaNo ratings yet

- Mma Syllabus Ay 19 20Document336 pagesMma Syllabus Ay 19 20Banita DsouzaNo ratings yet

- SpecificationDocument5 pagesSpecificationAnanya MalikNo ratings yet

- PRDN& Oprn July 2016 HorizontalDocument19 pagesPRDN& Oprn July 2016 HorizontalKaren MuhiNo ratings yet

- Course plan 2024-25 - FM 101-2Document23 pagesCourse plan 2024-25 - FM 101-2sumastudy2No ratings yet

- ACCT 100 POFA Course Outline Fall Semester 2022-23 updated (2)Document6 pagesACCT 100 POFA Course Outline Fall Semester 2022-23 updated (2)Shara xxNo ratings yet

- IIML APSL BrochureDocument17 pagesIIML APSL BrochurePranab SalianNo ratings yet

- Acco 30013 Accounting For Special Transactions 2019Document8 pagesAcco 30013 Accounting For Special Transactions 2019Azel Ann AlibinNo ratings yet

- CARD-MRI Development Institute, Inc. Pre-Final Term Module For Blended LearningDocument9 pagesCARD-MRI Development Institute, Inc. Pre-Final Term Module For Blended LearningCHRISTIAN LIDANNo ratings yet

- BAC 517 Auditing in A CIS EnvironmentDocument15 pagesBAC 517 Auditing in A CIS EnvironmentMiladel EjandaNo ratings yet

- CO FINS1613 Semester 2Document18 pagesCO FINS1613 Semester 2Jack LeeNo ratings yet

- Mba/Bba Course Outline To Be Used in Conjunction With The Subject SyllabusDocument4 pagesMba/Bba Course Outline To Be Used in Conjunction With The Subject SyllabusNithyananda PatelNo ratings yet

- Principles of FinanceDocument9 pagesPrinciples of FinanceOmar FarukNo ratings yet

- AF5312Document4 pagesAF5312Chin LNo ratings yet

- Amended BMP5006 Module GuideDocument15 pagesAmended BMP5006 Module GuideShawn MatNo ratings yet

- ACC3006 - Trimester 1, AY 2022 - 23 Student GuideDocument8 pagesACC3006 - Trimester 1, AY 2022 - 23 Student GuideCeline LowNo ratings yet

- FY021 Module Handbook September 2024Document11 pagesFY021 Module Handbook September 2024laiyba18No ratings yet

- OutlineDocument4 pagesOutlineVikin JainNo ratings yet

- Mye2023 S4 Bio P2Document15 pagesMye2023 S4 Bio P2maheswaran perumalNo ratings yet

- Mye 2023 S4 Maths P1Document19 pagesMye 2023 S4 Maths P1maheswaran perumalNo ratings yet

- 2022 - 2023 Sri KDU Secondary School Calendar (SSKDU Secondary) - 21042022Document3 pages2022 - 2023 Sri KDU Secondary School Calendar (SSKDU Secondary) - 21042022maheswaran perumalNo ratings yet

- Mye 2023 S4 English P4Document9 pagesMye 2023 S4 English P4maheswaran perumalNo ratings yet

- MR Hesh Tutorials 3756 SPM Prinsip Perakaunan Peperiksaan Pertengahan Tahun 2020Document1 pageMR Hesh Tutorials 3756 SPM Prinsip Perakaunan Peperiksaan Pertengahan Tahun 2020maheswaran perumalNo ratings yet

- Birthday ChartDocument2 pagesBirthday Chartmaheswaran perumalNo ratings yet

- Accounting Equation TemplateDocument1 pageAccounting Equation Templatemaheswaran perumalNo ratings yet

- Short Test EkonomiDocument2 pagesShort Test Ekonomimaheswaran perumalNo ratings yet

- ANNUAL SPORTS PREPARATION SCHEDULE 2020 MR Sara.ADocument15 pagesANNUAL SPORTS PREPARATION SCHEDULE 2020 MR Sara.Amaheswaran perumalNo ratings yet

- Cash BookDocument1 pageCash Bookmaheswaran perumalNo ratings yet

- Bad Debts and Provision For Doubtful Debts-FinalDocument20 pagesBad Debts and Provision For Doubtful Debts-Finalmaheswaran perumalNo ratings yet

- Baki Awal (I) (Ii) (Iii) (Iv) (V) (Vi) (Vii) (Viii) (Ix) (X) Baki AkhirDocument3 pagesBaki Awal (I) (Ii) (Iii) (Iv) (V) (Vi) (Vii) (Viii) (Ix) (X) Baki Akhirmaheswaran perumalNo ratings yet

- XYZ Trading Income Statement For The Year 31 December 2016 RM RM RM RMDocument1 pageXYZ Trading Income Statement For The Year 31 December 2016 RM RM RM RMmaheswaran perumalNo ratings yet

- ECON202 Tutorial 1&2 AnswerDocument6 pagesECON202 Tutorial 1&2 Answermaheswaran perumalNo ratings yet

- Dba3402 QuizDocument4 pagesDba3402 Quizmaheswaran perumalNo ratings yet

- Assignment Report Evaluation Form Name:: Relevant & Important TopicDocument8 pagesAssignment Report Evaluation Form Name:: Relevant & Important Topicmaheswaran perumalNo ratings yet

- Dia TT Jan17Document42 pagesDia TT Jan17maheswaran perumalNo ratings yet

- Shawn Trading Trial Balance As at 31 December 2016Document2 pagesShawn Trading Trial Balance As at 31 December 2016maheswaran perumalNo ratings yet

- Acc 1133 Accounting 1 AssignmentDocument1 pageAcc 1133 Accounting 1 Assignmentmaheswaran perumalNo ratings yet

- Furniture 16560 Motor Vehicles 36600 Fixtures 30030Document2 pagesFurniture 16560 Motor Vehicles 36600 Fixtures 30030maheswaran perumalNo ratings yet

- History of Thought: MPU 1213 Prepared By: Prabha KrishDocument9 pagesHistory of Thought: MPU 1213 Prepared By: Prabha Krishmaheswaran perumalNo ratings yet

- This Is To Inform You That I, - Know - Identity Number - For Almost - YearsDocument1 pageThis Is To Inform You That I, - Know - Identity Number - For Almost - Yearsmaheswaran perumalNo ratings yet

- Action Plan For The Construction of The Lavatory and Improvement of The Comfort RoomDocument6 pagesAction Plan For The Construction of The Lavatory and Improvement of The Comfort RoomMay-ann Ramos Galliguez ValdezNo ratings yet

- Barron's GRE 19th EditionDocument264 pagesBarron's GRE 19th Editionrakeka2719No ratings yet

- Bid Doc - KatharagamaDocument26 pagesBid Doc - KatharagamaPja ShanthaNo ratings yet

- Final DNB Seat Matrix For MD - Ms - Diploma Round 1Document347 pagesFinal DNB Seat Matrix For MD - Ms - Diploma Round 1garwesfvNo ratings yet

- PARM: A Classroom-Based Reading Intervention Program: Kelvin - Esposa@deped - Gov.phDocument25 pagesPARM: A Classroom-Based Reading Intervention Program: Kelvin - Esposa@deped - Gov.phLoraine DiazonNo ratings yet

- Research in Family Medicine in Developing Countries: Bruce L. W. SparksDocument5 pagesResearch in Family Medicine in Developing Countries: Bruce L. W. SparksKhaulla KarimaNo ratings yet

- Types of PlaigiarismDocument3 pagesTypes of PlaigiarismVaishali SharmaNo ratings yet

- Education No Emmindanao O F.: Yan de Oro CDocument23 pagesEducation No Emmindanao O F.: Yan de Oro CDazzelle BasarteNo ratings yet

- HRM in A Global EnvironmentDocument52 pagesHRM in A Global Environmentshubhakar100% (3)

- AP Honor List 2018Document2 pagesAP Honor List 2018Fauquier NowNo ratings yet

- The 3 Essays of RizalDocument7 pagesThe 3 Essays of RizalNathaniel PulidoNo ratings yet

- T8 Students DisciplineDocument27 pagesT8 Students DisciplineDhiahVersatil100% (1)

- Letter of Recommendation-Celeste TafeDocument1 pageLetter of Recommendation-Celeste Tafeapi-707119267No ratings yet

- Academic Records Request Form: For ApplicantsDocument2 pagesAcademic Records Request Form: For ApplicantsVarsha GowdaNo ratings yet

- Data Annotator New 25 Job Role EnglishDocument36 pagesData Annotator New 25 Job Role EnglishDipaliNo ratings yet

- Rizal: 1: Advent of A National HeroDocument9 pagesRizal: 1: Advent of A National HeroJanine Mae RañoaNo ratings yet

- Parent Conference DocumentsDocument17 pagesParent Conference Documentsapi-301874927No ratings yet

- Media and Information Literate Individual: K To 12 Senior High School Core Subject MIL - Media and Information LiteracyDocument24 pagesMedia and Information Literate Individual: K To 12 Senior High School Core Subject MIL - Media and Information LiteracyDizney Lobaton EsparteroNo ratings yet

- Investigating The Usability of Translation StrategiesDocument69 pagesInvestigating The Usability of Translation StrategiesIrina DraghiciNo ratings yet

- Ducation. London: King's Learning Institute.)Document6 pagesDucation. London: King's Learning Institute.)maddieNo ratings yet

- Exercise For Unit 1 Grade 1Document2 pagesExercise For Unit 1 Grade 1Trúc PhanNo ratings yet

- SkimmingDocument53 pagesSkimmingN100% (14)

- Self-Reflection Assignment #2Document5 pagesSelf-Reflection Assignment #2Julia Adams100% (1)

- Progress Report Card: Department of Education Division of Marikina City Sss Village Elementary SchoolDocument2 pagesProgress Report Card: Department of Education Division of Marikina City Sss Village Elementary SchoolGlen GorgonioNo ratings yet

- Free Education For All:) : Written by Pham Thi Le NaDocument2 pagesFree Education For All:) : Written by Pham Thi Le NaHuân QuangNo ratings yet