BSBWHS401 Risk Management Procedures PDF

BSBWHS401 Risk Management Procedures PDF

Uploaded by

davidCopyright:

Available Formats

BSBWHS401 Risk Management Procedures PDF

BSBWHS401 Risk Management Procedures PDF

Uploaded by

davidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

BSBWHS401 Risk Management Procedures PDF

BSBWHS401 Risk Management Procedures PDF

Uploaded by

davidCopyright:

Available Formats

Risk management procedures

Purpose and scope

In accordance with the BizOps Enterprises risk management policy, these procedures describe the

organisation’s standard process for risk management, including:

1. Risk identification

2. Risk rating

3. Risk controls

4. Risk monitoring and reporting

A standard approach to risk management allows risks to be correctly prioritised across all of BizOps’s

operations.

Responsibilities

The risk management policy committee oversees risk management and implementation on behalf of

the board and the Chief Executive Officer.

All BizOps employees are responsible for applying risk management principles and practices in their

work areas. Management is responsible for ensuring risk management principles are applied.

Employees must report risks and participate in risk management training.

Risk management process

A risk to BizOps is any event or action that could have a negative impact on the organisation. This

includes events that could lead to:

• death or injury

• financial loss to BizOps

• damage to BizOps’s reputation or adverse media coverage

• damage to the physical environment, including land, water or air quality

• failure to meet regulatory or legislative requirements.

The risk management policy specifies that:

• all business activities must undergo risk assessment prior to commencing and then undergo risk

management throughout

• risk identification, analysis, evaluation and treatment must be reported and recorded in the

BizOps risk register.

© Aspire Training & Consulting

Page 1 of 6

Document date: May 2015

Risk management procedures

1. Risk identification

Risk identification is a structured approach to identifying the events that, if they were to occur, could

have a negative impact on the organisation.

2. Risk rating

Risk rating is a process to analyse and understand each of the risks, including understanding what

causes the risk to occur and what controls are already in place to manage the risk. Risk assessment

also determines:

• how severe a potential impact could be

• the likelihood of the organisation being negatively impacted in this way.

Once the potential impact and likelihood have been assessed, the risk assessment process considers

whether the risk is acceptable to BizOps, or whether further treatments are required to reduce the

level of risk.

All identified risks shall be assessed to determine the overall ranking for the risk. Risks are ranked in

the following four categories:

• Extreme

• High

• Medium

• Low

The ranking of a risk determines:

• the nature of further action that is required

• the urgency with which further action should be undertaken

• the reporting requirements for the risk, including who the risk is reported to

• how the risk is monitored.

All risks within BizOps are ranked using a common scale that assesses:

• the potential consequences if the risk were to occur

• the likelihood of BizOps being impacted in that way.

A common approach to risk ranking is necessary to ensure that the largest risks to BizOps can readily

be identified and risk management can be prioritised in a way that has the greatest overall benefit to

the organisation.

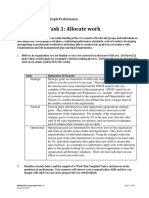

The following tables show how the consequences and likelihood of risks are assessed.

© Aspire Training & Consulting

Page 2 of 6

Document date: May 2015

Risk management procedures

Consequence table

Consequence Consequence category

Insignificant Minor Moderate Major Catastrophic

Financial <$5k >$5k <$10k >$10k <$100k >$100k <$300k >$300k

Reputation/market Isolated complaints Adverse capital Loss of market opportunity or Reputation damage or Will impact future

disruption from individuals; city/state media some loss of reputation; loss of major opportunity business operations in

minor local media coverage; ongoing adverse national media that has a major impact on catastrophic way;

coverage complaints attention BizOps’s operations continuous public

criticism

Regulatory and Minor breaches by Organisational Penalties for breach of Act or Major fines for breaches; Severe fines and/or

legislative individual staff breach legislation; third-party claims multiple third-party claims prison sentences

members

Environmental Brief spill incident Minor onsite spill Release of pollutant or Large spill or Long-term environmental

contained onsite incident; pollutant environmental incident; environmental incident damage with ongoing

with no contained and moderate environmental harm and significant associated liabilities and/or possible

environmental harm cleaned up cost EPA closure for

immediately undisclosed period

Safety Treated with first Medical attention Hospital treatment and ongoing Hospital treatment and Loss of a life

aid required rehabilitation possible serious

permanent injury

© Aspire Training & Consulting

Page 3 of 6

Document date: May 2015

Risk management procedures

Likelihood table

Likelihood rating is based on the number of times within a specified period that a risk may

occur either as a consequence of business operations or through failure of operating

systems, policies or procedures.

Rating Description Probability

Expected Expected to occur in most > 80%

circumstances

Probable Will probably occur in most 50%–80%

circumstances

Possible Might occur within a 1–2 year time 21%–49%

period

Improbable Could occur during a specified time 5%–20%

period

Rare May only occur in exceptional < 5%

circumstances

The risk rank is determined by combining the consequence and likelihood as shown as

follows:

Level of Level of impact

likelihood

1 2 3 4 5

(Insignificant) (Minor) (Moderate) (Major) (Catastrophic)

A (Expected)

Medium Medium High Extreme Extreme

B (Probable)

Medium Medium Medium High Extreme

C (Possible)

Low Medium Medium High High

D (Improbable)

Low Low Medium Medium High

E (Rare)

Low Low Low Medium Medium

Assessing likelihood

When assessing likelihood, it is important to note that the likelihood score for a risk needs to

reflect the likelihood of the consequence occurring, rather than the likelihood of the risk

occurring.

For example, there may be a risk that staff are injured as a result of a fire emergency. The

consequences of a fire may range from a relatively minor injury to death, depending on the

circumstances of the fire.

© Aspire Training & Consulting

Page 4 of 6

Document date: April 2015

Risk management procedures

While fire emergencies are fortunately not common within BizOps, the likelihood of staff

dying as a result of a fire is considered to be likely. There are therefore a number of ways of

scoring this risk.

Type of incident Consequence Likelihood Risk score

Minor incident Minor injury to individuals Possible Medium

Consequence: Moderate

Serious incident Serious harm to individual Possible High

Consequence: Major

Fatality Fatality as a result of the fire Possible High

Consequence: Catastrophic

Overall it is clear that this risk would be considered to be Medium to High. To highlight the

serious nature of the risk, it would therefore be appropriate to give this risk the risk scoring

that shows the High risk rating, and therefore score this risk with a consequence of

Catastrophic and a likelihood of Possible.

3. Risk controls

Controls represent a whole range of actions, measures and strategies taken by management

and employees to eliminate or reduce risks. The process of determining risk controls

includes assessing the consequences and likelihood of the risk and evaluating how to treat

the risk. This could include:

• avoiding the risk

• mitigating the risk

• transferring the risk

• accepting the risk.

A process should then be followed to identify efficient and effective ways to mitigate the risk.

This can occur by either:

• removing the risk

• reducing the likelihood of the risk impacting BizOps

• reducing the consequences if the risk were to occur

• a combination of these approaches.

Consider the hierarchy of control:

• Elimination

• Substitution

• Engineering controls

• Administrative controls

• Personal protective equipment

© Aspire Training & Consulting

Page 5 of 6

Document date: April 2015

Risk management procedures

4. Risk monitoring and reporting

Risk monitoring and reporting involves a process of regular review to ensure that:

• new risks are identified and considered as they arise

• existing risks are monitored to identify any changes that may impact the organisation

• new risk controls are being implemented

• existing risk controls are still in place and working effectively

• information about risks is adequately communicated.

All risks rated as moderate, significant or high in the risk identification process will be

reviewed by the risk management policy committee regularly. This review will be via either:

• the risk manager reporting on new risks identified by staff during the course of their work

since the last committee meeting

• risk owners providing a report on the status of their assigned risk to the committee (see

below)

• the risk manager reporting on reviews of the risk register following a Structured Risk

Identification Workshop each year, or any review of the risk register by the Executive.

The risk owner’s reports to the committee should outline that the risk controls are to indicate:

• causes of the risk

• implication of the risk with amendment to existing controls (if they exist)

• what any existing mitigating controls are

• what actions are being undertaken to put further controls in place, or maintain existing

controls, and by when

• who is responsible for ensuring the controls are in place.

© Aspire Training & Consulting

Page 6 of 6

Document date: April 2015

You might also like

- UntitledDocument184 pagesUntitledGabriela Peña100% (1)

- BSBWHS516 Assessment 1 V1 FinalDocument15 pagesBSBWHS516 Assessment 1 V1 FinalDiego GreccoNo ratings yet

- BSBADM 502 SolutionDocument9 pagesBSBADM 502 SolutionRabi KatwalNo ratings yet

- 09.indiana Jones És A Bölcsek KöveDocument245 pages09.indiana Jones És A Bölcsek KöveGyörgy PappNo ratings yet

- Student Assessment TaskDocument26 pagesStudent Assessment TaskEva ChenNo ratings yet

- Agile Presentation PDFDocument34 pagesAgile Presentation PDFjonnajon92100% (1)

- BSBRSK401 - PresentationDocument40 pagesBSBRSK401 - PresentationLindaLindyNo ratings yet

- BSBADM405 Assessment 2Document35 pagesBSBADM405 Assessment 2MarNo ratings yet

- BSBADM506LearnerWorkbookV1.1final FileDocument68 pagesBSBADM506LearnerWorkbookV1.1final Filesultan0% (2)

- Role of Frontline SupervisorDocument15 pagesRole of Frontline SupervisorMohamed BakheetNo ratings yet

- BSBCUS501 AT5 Customer SurveyDocument5 pagesBSBCUS501 AT5 Customer SurveyJoyee ChakmaNo ratings yet

- Bsbinm401a Implement Workplace Information System Assess 2Document13 pagesBsbinm401a Implement Workplace Information System Assess 2lilyNo ratings yet

- KM Guideline On The HSE First Aid ProgramDocument15 pagesKM Guideline On The HSE First Aid ProgramAntonios PapadopoulosNo ratings yet

- BSBPMG522 Student Version WITH GUIDELINES FOR STUDENTSDocument62 pagesBSBPMG522 Student Version WITH GUIDELINES FOR STUDENTSYang SIHANGNo ratings yet

- Sample Template Induction ManualDocument8 pagesSample Template Induction ManualVastrala Pavan KumarNo ratings yet

- BSBHRM521 Student Assessment TasksDocument32 pagesBSBHRM521 Student Assessment TasksKaneez BatoolNo ratings yet

- BSBSUS301 BSBADM311 Student Book V1.0715 PDFDocument177 pagesBSBSUS301 BSBADM311 Student Book V1.0715 PDFjosebravo16100% (4)

- Ass Bsbinm601 v1.1Document9 pagesAss Bsbinm601 v1.1LindaLindy0% (2)

- Bsbmgt502 Task 2Document2 pagesBsbmgt502 Task 2AiiuSrikk40% (5)

- Assessment Task 2 PDFDocument9 pagesAssessment Task 2 PDFpurva020% (1)

- BSBHRM405 Support Recruitment, Selection and Induction of Staff KM2Document17 pagesBSBHRM405 Support Recruitment, Selection and Induction of Staff KM2cplerkNo ratings yet

- BSBRSK501 Student Assessment Tasks V1.0Document46 pagesBSBRSK501 Student Assessment Tasks V1.0Ricka Mhel Garcia0% (1)

- BSB 401Document7 pagesBSB 401Fatima MirarNo ratings yet

- BSBMGT502Document20 pagesBSBMGT502Sergio Murillo Ortiz33% (3)

- Risk Management Task 4Document8 pagesRisk Management Task 4Naushal SachaniyaNo ratings yet

- Risk Management Report: BSBOPS504 - Manage Business RiskDocument12 pagesRisk Management Report: BSBOPS504 - Manage Business RiskMuhammad Sheharyar MohsinNo ratings yet

- Bsbcus401 Student Assessment GuideDocument20 pagesBsbcus401 Student Assessment GuideZHWNo ratings yet

- BSBADM506: Manage Business Document Design and DevelopmentDocument19 pagesBSBADM506: Manage Business Document Design and DevelopmentTee Li MinNo ratings yet

- Marketing Plan TemplateDocument51 pagesMarketing Plan TemplateshuvashishNo ratings yet

- Induction Guidance NotesDocument4 pagesInduction Guidance NotesBhaskar Rao PNo ratings yet

- Accreditation Process Manual 2020 Updated 26may2021Document50 pagesAccreditation Process Manual 2020 Updated 26may2021Zoha AliNo ratings yet

- BSBMGT502Document20 pagesBSBMGT502suyogNo ratings yet

- BSBHRM506 Manage Recruitment Selection and Induction ProcessesDocument13 pagesBSBHRM506 Manage Recruitment Selection and Induction ProcessesGhieNo ratings yet

- Bsbmgt502 Manage People Performance Student Assessment TasksDocument6 pagesBsbmgt502 Manage People Performance Student Assessment Tasksinnocent jassNo ratings yet

- BSBRSK501 Manage Rish Learner Assessment WorkbookDocument7 pagesBSBRSK501 Manage Rish Learner Assessment WorkbookEvanzelist Ipsita86% (7)

- JawhdgfajsgfasfDocument25 pagesJawhdgfajsgfasfNubia DiazNo ratings yet

- Bsbwor501 Task 4Document7 pagesBsbwor501 Task 4ajay100% (2)

- Introduction of Performance AppraisalDocument7 pagesIntroduction of Performance AppraisalMichael BobNo ratings yet

- Employee EngagmentDocument17 pagesEmployee Engagmentahmed HammoudNo ratings yet

- Performance Evaluation CommentsDocument48 pagesPerformance Evaluation Commentsutkarsh230% (1)

- PPTDocument50 pagesPPTNiomi Golrai100% (1)

- Assessment Task 2 - BSBHRM512 HandoutDocument20 pagesAssessment Task 2 - BSBHRM512 HandoutAna Paula VianaNo ratings yet

- BSBHRM501 AssessmentDocument27 pagesBSBHRM501 AssessmentJenny Yip100% (1)

- BSBLDR511 Assessment Task 3Document19 pagesBSBLDR511 Assessment Task 3Rahul Malik100% (1)

- Assessment II - Business Environment 1 - REVISED T318Document18 pagesAssessment II - Business Environment 1 - REVISED T318iqraNo ratings yet

- Performance Management - Assignment2Document19 pagesPerformance Management - Assignment2peter mulilaNo ratings yet

- BSBOPS504 Manage Business RiskDocument2 pagesBSBOPS504 Manage Business RiskPriyanka ThakurNo ratings yet

- BSBLDR511 - Task 3Document24 pagesBSBLDR511 - Task 3ottoNo ratings yet

- BSBWRT401 Learner Workbook V1.6 - EIPDocument19 pagesBSBWRT401 Learner Workbook V1.6 - EIPJelta JamesNo ratings yet

- BSBRSK501 Assement Unit Risk MGMTDocument20 pagesBSBRSK501 Assement Unit Risk MGMTChathuri De AlwisNo ratings yet

- Healthcare Risk AssessDocument16 pagesHealthcare Risk AssessKelvin RaoNo ratings yet

- Assessment Submission Sheet: Australian Ideal CollegeDocument41 pagesAssessment Submission Sheet: Australian Ideal Collegefhc munnaNo ratings yet

- Risk Briefing Report TemplateDocument1 pageRisk Briefing Report TemplatehemantNo ratings yet

- Bsbadm 502 Manage Meeting Bsbadm 502 Manage MeetingDocument20 pagesBsbadm 502 Manage Meeting Bsbadm 502 Manage MeetingS MNo ratings yet

- BSBHRM506 - Assessment 3Document10 pagesBSBHRM506 - Assessment 3AbhisekNo ratings yet

- Risk Management Plan TemplateDocument2 pagesRisk Management Plan TemplateDimitris PapadopoulosNo ratings yet

- 01 SolutionDocument14 pages01 Solutionprof. justin100% (1)

- Product Identification and TraceabilityDocument5 pagesProduct Identification and TraceabilityAbegale MonaresNo ratings yet

- Stress Training For EmployeesDocument24 pagesStress Training For EmployeesJonasNo ratings yet

- Bsbwor502 Task 3 TinaDocument2 pagesBsbwor502 Task 3 TinaTina Xue0% (2)

- Risk Assessment PolicyDocument5 pagesRisk Assessment PolicyEffiong EmmanuelNo ratings yet

- TAEASS401B AssessTask.7 (B) AssessmentPlanDocument26 pagesTAEASS401B AssessTask.7 (B) AssessmentPlanShaher ShaikNo ratings yet

- Business Continuity Plan Administrator Complete Self-Assessment GuideFrom EverandBusiness Continuity Plan Administrator Complete Self-Assessment GuideNo ratings yet

- Template For Online Asynchronous Learning (Consolidated) : Advocacy AdvertisementDocument12 pagesTemplate For Online Asynchronous Learning (Consolidated) : Advocacy AdvertisementNyx ScheherazadeNo ratings yet

- Book+chapter CLIL-4-Desc 1Document2 pagesBook+chapter CLIL-4-Desc 1thamicpNo ratings yet

- EMC Pre Compliance TestingDocument12 pagesEMC Pre Compliance TestingMichael MayerhoferNo ratings yet

- Gfk2222u Pacsystems Rx3i Rx7i Cpu Ref ManualDocument708 pagesGfk2222u Pacsystems Rx3i Rx7i Cpu Ref ManualRaphael AvelinoNo ratings yet

- ANNEX 2m Guidelines On Home Monitoring and Clinical Protocol at Primary Care For Cat 1 and 2 Mild Confirmed COVID-19 Cases 02122021Document57 pagesANNEX 2m Guidelines On Home Monitoring and Clinical Protocol at Primary Care For Cat 1 and 2 Mild Confirmed COVID-19 Cases 02122021hoe hao keatNo ratings yet

- 6 Major Environmental Problems of AsiaDocument6 pages6 Major Environmental Problems of Asiajoeaguda80% (5)

- Nikhil SQL Assigment 4Document7 pagesNikhil SQL Assigment 4Nikhil RaiNo ratings yet

- WK 1 ProjgroupbDocument11 pagesWK 1 Projgroupbapi-281267078No ratings yet

- Introducing The - Get Strong - Kettlebell Program - The 10-5-3 Method - Chronicles of StrengthDocument7 pagesIntroducing The - Get Strong - Kettlebell Program - The 10-5-3 Method - Chronicles of StrengthCristian ŞerbuNo ratings yet

- List of Laws and Regulations Governing Business Activities in TanzaniaDocument9 pagesList of Laws and Regulations Governing Business Activities in TanzaniaSebastian_Lidu_7416No ratings yet

- Toyotomi Heater PS - KS-R26Document2 pagesToyotomi Heater PS - KS-R26limited.moiNo ratings yet

- A68HM-E33 V2: AMD A68H ChipsetDocument1 pageA68HM-E33 V2: AMD A68H ChipsetjoekajebeNo ratings yet

- Thesis About TV AdvertisingDocument4 pagesThesis About TV AdvertisingDoMyCollegePaperUK100% (2)

- TELOMEREDocument17 pagesTELOMEREPRATAPNo ratings yet

- Hcc20X Casing and Tooling HandlerDocument2 pagesHcc20X Casing and Tooling Handlersalvatore baldiNo ratings yet

- Bob Bratt - Chief Operating Officer - DLA Piper - XINGDocument2 pagesBob Bratt - Chief Operating Officer - DLA Piper - XINGRaj PablaNo ratings yet

- Company Directive: Standard Technique: Sd8A/3 Relating To Revision of Overhead Line RatingsDocument33 pagesCompany Directive: Standard Technique: Sd8A/3 Relating To Revision of Overhead Line RatingsSathish KumarNo ratings yet

- NUEWTKWCVFDocument2 pagesNUEWTKWCVFShadekul Islam AkasNo ratings yet

- Sindarin Phrase Book A5 2020 August 3Document76 pagesSindarin Phrase Book A5 2020 August 3luigi viray100% (1)

- Com 23Document3 pagesCom 23TAX INDIANo ratings yet

- Tmi-Sti3508 C708881Document7 pagesTmi-Sti3508 C708881Fafa MangstabNo ratings yet

- Magnetic DeclinationDocument17 pagesMagnetic DeclinationprasadNo ratings yet

- Recloser NOJADocument28 pagesRecloser NOJAPhan TiếnNo ratings yet

- Articulo Luis Diaz 2014Document8 pagesArticulo Luis Diaz 2014Andres CoboNo ratings yet

- Tle10 Eim10 Q1 M15Document11 pagesTle10 Eim10 Q1 M15Isabelle BanogonNo ratings yet

- Sas #25 - Accounting Information SystemDocument5 pagesSas #25 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- The Effectiveness of Administration and Cocurriculum in Sport To The Involvement of StudentsDocument6 pagesThe Effectiveness of Administration and Cocurriculum in Sport To The Involvement of StudentsUmi RasyidahNo ratings yet