Lady M

Lady M

Uploaded by

Məhəmməd Əli HəzizadəCopyright:

Available Formats

Lady M

Lady M

Uploaded by

Məhəmməd Əli HəzizadəOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Lady M

Lady M

Uploaded by

Məhəmməd Əli HəzizadəCopyright:

Available Formats

12.1.

2017

FARID

SHAHBALAYEV

LADY M CONFECTIONS

ADA University | Elmir Musayev

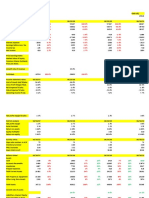

Question 1: Assuming sales in year one are break-even, how quickly would sales need to grow after the first year to

pay the start-up costs within 5 years. Is this growth rate feasible? (Include break-even calculation for year 1 n your

answer)

Rent $310,600 (annual escalation of 3%)

Utility cost $38,644 (annual escalation of 5%)

Labor cost $594,750 (annual escalation of 5%)

Contribution Margin = 50%

Break-even sale=(310,600+38,644+594,750)/50%=1,887,988

Growth rate required = 13,26%

This growth rate is feasible if the company grows 20% as it’s predicted. However, there is also possibility of failing and

having only 5% growth sales.

2. Prepare a financial forecast of free cash flows from 2015-2019.

ncial f

2014 2015 2016 2017 2018 2019

Sales $ 11,000,000 $ 13,200,000 $ 18,480,000 $ 23,100,000 $ 28,875,000 $ 36,093,750

COGS $ 2,397,476 $ 3,300,000 $ 4,620,000 $ 5,775,000 $ 7,218,750 $ 9,023,438

Gross Profit $ 8,602,524 $ 9,900,000 $ 13,860,000 $ 17,325,000 $ 21,656,250 $ 27,070,313

SG&A $ 6,376,493 $ 7,519,791 $ 10,342,908 $ 12,697,635 $ 15,583,294 $ 19,118,180

R&D $ - $ 13,200 $ 18,480 $ 23,100 $ 28,875 $ 36,094

EBITDA $ 2,226,031 $ 2,367,009 $ 3,498,612 $ 4,604,265 $ 6,044,081 $ 7,916,039

Depreciation $ 156,457 $ 164,280 $ 172,494 $ 181,119 $ 190,175 $ 199,684

Operating income (EBIT) $ 2,069,574 $ 2,202,728 $ 3,326,118 $ 4,423,146 $ 5,853,907 $ 7,716,356

Tax 35% $ 724,351 $ 770,955 $ 1,164,141 $ 1,548,101 $ 2,048,867 $ 2,700,724

After Tax Profit $ 1,345,223 $ 1,431,773 $ 2,161,977 $ 2,875,045 $ 3,805,039 $ 5,015,631

Capital Expenditures $ 33,000 $ 1,000,000 $ 55,440 $ 69,300 $ 86,625 $ 108,281

Increase in Working Capital $ 68,000 $ 81,600 $ 114,240 $ 142,800 $ 178,500 $ 223,125

Free Cash Flows $ 1,400,680 $ 514,454 $ 2,164,791 $ 2,844,064 $ 3,730,089 $ 4,883,909

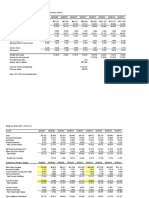

3. Estimate Lady M’s enterprise value using DCF method

Terminal value

Discounted Cash flows $ 1,400,680 $ 459,334 $ 1,725,758 $ 2,844,064 $ 3,730,089 $ 4,883,909 $ 48,126,142

Enterprise Value $ 63,169,976

Terminal Value= FCF of last year*(1+g)/(discount rate-g)

4. Do you think they should take the Chinese investors’ offer? Why/why not?

The interest of business loans in the US is 3.25%, which means for Lady M company it is cheaper and better to focus

borrowing rather than issuing new equity. Additionally, accepting Chinese investors offer will result in losing their

franchising right. Lady M should reject Chinese investor’s offer.

You might also like

- Robert Reid Lady M Confections SubmissionDocument13 pagesRobert Reid Lady M Confections SubmissionSam Nderitu100% (1)

- Lady M Confections Case SolutionDocument11 pagesLady M Confections Case SolutionRahul Sinha40% (10)

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti Rahayu100% (3)

- Valuation of Lady M Case Questions PDFDocument3 pagesValuation of Lady M Case Questions PDFJane Susan Thomas25% (4)

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti RahayuNo ratings yet

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Wildcat Capital InvestorsDocument18 pagesWildcat Capital Investorsokta hutahaeanNo ratings yet

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Pacific Grove Spice Company SpreadsheetDocument7 pagesPacific Grove Spice Company SpreadsheetAnonymous 8ooQmMoNs10% (1)

- Tire City Inc. Case StudyDocument8 pagesTire City Inc. Case StudyKyeli TanNo ratings yet

- Snooker ProjectDocument19 pagesSnooker ProjectJason Amaral50% (4)

- Caso Jackson Automotive SystemDocument7 pagesCaso Jackson Automotive SystemDiego E. Rodríguez100% (2)

- RESUELTO New Heritage Doll Company Student SpreadsheetDocument13 pagesRESUELTO New Heritage Doll Company Student SpreadsheetDaniel InfanteNo ratings yet

- New Heritage Doll Company Case SolutionDocument31 pagesNew Heritage Doll Company Case SolutionSoundarya AbiramiNo ratings yet

- Polar Sports Inc.Document4 pagesPolar Sports Inc.Talia100% (1)

- The Valuation and Financing of Lady M. Confections PDFDocument1 pageThe Valuation and Financing of Lady M. Confections PDFHasbi AsidikNo ratings yet

- John M Case ExhibitsDocument5 pagesJohn M Case ExhibitsMichael Connors100% (1)

- Lady M Confections - v3Document29 pagesLady M Confections - v3Shamsuzzaman Sun75% (4)

- Cartwright Lumber Company PaperDocument5 pagesCartwright Lumber Company PaperJose Sermeno50% (2)

- Polar Sports, IncDocument15 pagesPolar Sports, IncJennifer Jackson91% (11)

- Landmark Facilityexcel12sDocument23 pagesLandmark Facilityexcel12sAnonymous oPk2SRw6100% (8)

- Dividend Policy at Linear Technology - Case Analysis - G05Document2 pagesDividend Policy at Linear Technology - Case Analysis - G05Srikanth Kumar Konduri60% (5)

- Lady M Case - 08.07.2016Document14 pagesLady M Case - 08.07.2016Sabyasachi Mukerji40% (5)

- FM B19030Document1 pageFM B19030Nikhil JindalNo ratings yet

- Unit 2 Case Study Guidelines - Lady M Confections Revised 10.4.18Document11 pagesUnit 2 Case Study Guidelines - Lady M Confections Revised 10.4.18Neel PatelNo ratings yet

- Tire City IncDocument12 pagesTire City IncMahesh Kumar Meena100% (1)

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Clarkson Lumber Co Calculations1560944145Document9 pagesClarkson Lumber Co Calculations1560944145lauraNo ratings yet

- Tire City Spreadsheet SolutionDocument6 pagesTire City Spreadsheet Solutionalmasy99100% (1)

- John M. Case Co Case QuestionsDocument1 pageJohn M. Case Co Case QuestionsRazi Ullah0% (3)

- Mehak Bluntly MediaDocument18 pagesMehak Bluntly Mediahimanshu sagarNo ratings yet

- Project Report of Share KhanDocument111 pagesProject Report of Share Khanchintan782% (11)

- The Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Document4 pagesThe Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Rahul VenugopalanNo ratings yet

- Lady M CaseDocument8 pagesLady M CaseEvelyn MonzonNo ratings yet

- Lady M SolutionDocument4 pagesLady M SolutionRahul VenugopalanNo ratings yet

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroNo ratings yet

- Clarkson LumberDocument6 pagesClarkson Lumbercypherious67% (3)

- (Holy Balance Sheet) Lady M ConfectionsDocument34 pages(Holy Balance Sheet) Lady M ConfectionsVera Lúcia Batista Santos100% (1)

- Book1Document6 pagesBook1Bharti SutharNo ratings yet

- Tax-Motivated Rexford StudiosDocument6 pagesTax-Motivated Rexford StudiossrikanthpsrNo ratings yet

- Polar SportDocument4 pagesPolar SportKinnary Kinnu0% (2)

- Case Pacific Grove Spice CompanyDocument68 pagesCase Pacific Grove Spice CompanyJose Luis ContrerasNo ratings yet

- Outreach NetworksDocument3 pagesOutreach NetworksPaco Colín50% (2)

- Polar Sports: Where Does Polar Sports Fit in The Course?Document21 pagesPolar Sports: Where Does Polar Sports Fit in The Course?Hugo100% (1)

- Millions of Dollars Except Per-Share DataDocument17 pagesMillions of Dollars Except Per-Share DataWasp_007_007No ratings yet

- Pacific Grove Spice Company SpreadsheetDocument13 pagesPacific Grove Spice Company SpreadsheetSuziNo ratings yet

- Landmark Facility SolutionsDocument25 pagesLandmark Facility SolutionsGaurav Gupta8% (13)

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- Jackson Auto Motives ReportDocument12 pagesJackson Auto Motives ReportNajat Muna100% (1)

- Pacific Spice CompanyDocument15 pagesPacific Spice CompanySubhajit MukherjeeNo ratings yet

- M&A in Wine Country Starshine Base Case Valuation: Expanded: Pro FormaDocument2 pagesM&A in Wine Country Starshine Base Case Valuation: Expanded: Pro Formakatherine quevedoNo ratings yet

- Strategic ManagementDocument9 pagesStrategic ManagementdiddiNo ratings yet

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Midland Energy ResourcesDocument21 pagesMidland Energy ResourcesSavageNo ratings yet

- Question 1Document9 pagesQuestion 1Minh HàNo ratings yet

- Tutoring Business Plan ExampleDocument21 pagesTutoring Business Plan ExampleDaniella DeakNo ratings yet

- Ballerina Tech Assumptions & SummaryDocument48 pagesBallerina Tech Assumptions & Summaryapi-25978665No ratings yet

- Tutoring Business Plan ExampleDocument23 pagesTutoring Business Plan Example24 Alvarez, Daniela Joy G.No ratings yet

- Instruksi: Baca Cara Penggunaan Software Secara SeksamaDocument24 pagesInstruksi: Baca Cara Penggunaan Software Secara SeksamaditaNo ratings yet

- Bill Snow Financial Model 2004-03-09Document35 pagesBill Snow Financial Model 2004-03-09nsadnanNo ratings yet

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocument24 pagesWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668No ratings yet

- Income Statement: Financial StatementsDocument15 pagesIncome Statement: Financial StatementsMahnoorNo ratings yet

- Index:: Introduction To Universal BankingDocument49 pagesIndex:: Introduction To Universal BankingRakeshNo ratings yet

- Case Studies Full Book PDFDocument288 pagesCase Studies Full Book PDF靳雪娇No ratings yet

- Rural Entrepreneurship in IndiaDocument57 pagesRural Entrepreneurship in Indianikita sharmaNo ratings yet

- Finance AP T-CodesDocument9 pagesFinance AP T-CodesifrahimNo ratings yet

- Financial Report Barilla PDFDocument98 pagesFinancial Report Barilla PDFPietro Pit NocetiNo ratings yet

- Environmental AccountingDocument10 pagesEnvironmental AccountingValentinaNo ratings yet

- Customer Inquiry ReportDocument2 pagesCustomer Inquiry ReportSPORT INFERNONo ratings yet

- The India Startup ReportDocument88 pagesThe India Startup ReportnkmeenaNo ratings yet

- Test 2 CH 1 & 2 Part IIDocument5 pagesTest 2 CH 1 & 2 Part IIAshwin JainNo ratings yet

- Amazon Financial Statement Analysis PT 2 PaperDocument5 pagesAmazon Financial Statement Analysis PT 2 Paperapi-239699796100% (1)

- Summer Training Report: Jsel Securities LTDDocument59 pagesSummer Training Report: Jsel Securities LTDmee709No ratings yet

- CDVAT Calculation SheetDocument4 pagesCDVAT Calculation SheetSaifur RahmanNo ratings yet

- Introduction To EconomicsDocument37 pagesIntroduction To Economicsnunyu bidnesNo ratings yet

- Victor Fasciani (Last) Interview With Manual of IdeasDocument6 pagesVictor Fasciani (Last) Interview With Manual of IdeasVitaliyKatsenelsonNo ratings yet

- Chapter 1Document13 pagesChapter 1Ella Marie WicoNo ratings yet

- Republic Act No. 6713: Code of Conduct and Ethical Standards For Public Officials and EmployeesDocument28 pagesRepublic Act No. 6713: Code of Conduct and Ethical Standards For Public Officials and EmployeesTristanMaglinaoCantaNo ratings yet

- Programmable Set-Back Thermostat Rebate Form: Shrewsbury Electric and Cable OperationsDocument1 pageProgrammable Set-Back Thermostat Rebate Form: Shrewsbury Electric and Cable OperationssandyolkowskiNo ratings yet

- PCA & RD Bank PDFDocument86 pagesPCA & RD Bank PDFmohan ks100% (2)

- Reporting Construction Cost EngineeringDocument3 pagesReporting Construction Cost Engineeringsiomairice991No ratings yet

- SBI Life InsuranceDocument41 pagesSBI Life InsuranceSandeep Mauriya0% (1)

- Screenshot 2023-01-07 at 7.33.02 AMDocument5 pagesScreenshot 2023-01-07 at 7.33.02 AMhchandiramani3No ratings yet

- What Is The Objective of The Scheme?: Frequently Asked Questions-Gold Harvest SchemeDocument4 pagesWhat Is The Objective of The Scheme?: Frequently Asked Questions-Gold Harvest SchemekdanushhNo ratings yet

- Gloria Hotels QuotationDocument2 pagesGloria Hotels QuotationAasif AliNo ratings yet

- MR Questionnaire DiponDocument7 pagesMR Questionnaire DiponKalyani Gogoi67% (3)

- Madras Labour UnionDocument4 pagesMadras Labour UnionPraneeth ProdduturuNo ratings yet

- Planning An Employee Benefits Program (Various Perspectives)Document20 pagesPlanning An Employee Benefits Program (Various Perspectives)Xtian PastorinNo ratings yet

- RIJO Receipt PDFDocument6 pagesRIJO Receipt PDFajimon 00971No ratings yet

- Entrepreneurship in Midwifery 2009Document19 pagesEntrepreneurship in Midwifery 2009Shawnn Bulaon75% (12)