0%(1)0% found this document useful (1 vote)

149 viewsComputation of Total Income Income From Other Sources (Chapter IV F) 392007

Computation of Total Income Income From Other Sources (Chapter IV F) 392007

Uploaded by

vipin agarwalThis document is an income tax return for Amita Chauhan for the 2019-2020 assessment year. It summarizes their personal details, sources of income which include interest income and tuition income totaling Rs. 392007, applicable deductions, and tax calculations. The total income amount is Rs. 390230 and the total tax payable is Rs. 0 after accounting for deductions and taxes prepaid through advance tax payments of Rs. 7290.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Computation of Total Income Income From Other Sources (Chapter IV F) 392007

Computation of Total Income Income From Other Sources (Chapter IV F) 392007

Uploaded by

vipin agarwal0%(1)0% found this document useful (1 vote)

149 views2 pagesThis document is an income tax return for Amita Chauhan for the 2019-2020 assessment year. It summarizes their personal details, sources of income which include interest income and tuition income totaling Rs. 392007, applicable deductions, and tax calculations. The total income amount is Rs. 390230 and the total tax payable is Rs. 0 after accounting for deductions and taxes prepaid through advance tax payments of Rs. 7290.

Original Title

New Microsoft Office Word Document.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document is an income tax return for Amita Chauhan for the 2019-2020 assessment year. It summarizes their personal details, sources of income which include interest income and tuition income totaling Rs. 392007, applicable deductions, and tax calculations. The total income amount is Rs. 390230 and the total tax payable is Rs. 0 after accounting for deductions and taxes prepaid through advance tax payments of Rs. 7290.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0%(1)0% found this document useful (1 vote)

149 views2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 392007

Computation of Total Income Income From Other Sources (Chapter IV F) 392007

Uploaded by

vipin agarwalThis document is an income tax return for Amita Chauhan for the 2019-2020 assessment year. It summarizes their personal details, sources of income which include interest income and tuition income totaling Rs. 392007, applicable deductions, and tax calculations. The total income amount is Rs. 390230 and the total tax payable is Rs. 0 after accounting for deductions and taxes prepaid through advance tax payments of Rs. 7290.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

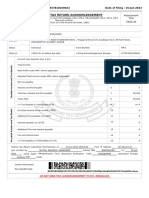

Name of Assessee AMITA CHAUHAN

Father's Name SH CHANDAN SINGH NEGI

Address KUND COLONY,GOPESHWAR,CHAMOLI,UTTARAKHAND,246424

Status Individual Assessment Year 2019-2020

Ward Year Ended 31.3.2019

PAN AULPC9175H Date of Birth 11/06/1986

Residential Status Resident Sex Male

Filing Status Original

Aadhaar No: 962472612856 Passport No.:

Bank Name State Bank of India, ROSHNABAD HARIDWAR, A/C NO:32207555429 ,Type:

Saving ,IFSC: SBIN0004198

Tele: Mob:8449292844

Computation of Total Income

Income from Other Sources (Chapter IV F) 392007

Interest From Saving Bank A/c 1777

Tution Income 390230

392007

Gross Total Income 392007

Less: Deductions (Chapter VI-A)

u/s 80TTA (Interest From Saving Bank Account.) 1777

1777

Total Income 390230

Round off u/s 288 A 390230

Adjusted total income (ATI) is not more than Rs. 20 lakh hence AMT not applicable.

Tax Due 7012

Health & Education Cess (HEC) @ 4.00% 280

7292

Round off u/s 288B 7290

Deposit u/s 140A 7290

Tax Payable 0

Tax calculation on Normal income

Exemption Limit :250000

Tax @5% on (390230 -Exemption Limit) =7011

Due Date for filing of Return July 31, 2019

Prepaid taxes (Advance tax and Self assessment tax)26 AS Import Date:29 May 2019

Sr.No. BSR Code Date Challan No Bank Name & Branch Amount

1 . 7290

Total 7290

You might also like

- E FDRDocument1 pageE FDRktsingh2024No ratings yet

- Chapter 3Document21 pagesChapter 3Carlo Baculo50% (4)

- PDF 192659360280722Document1 pagePDF 192659360280722MILTON MOHANTYNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- TATA Docomo BillDocument3 pagesTATA Docomo Billanon_338262634No ratings yet

- RR 2-98Document85 pagesRR 2-98Elaine LatonioNo ratings yet

- COI Narinder Bhatia 22-23Document5 pagesCOI Narinder Bhatia 22-23Ashwani KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Ack Cdhpa3843f 2022-23 220950670290722Document1 pageAck Cdhpa3843f 2022-23 220950670290722rtaxhelp helpNo ratings yet

- It Computation Sheet Fy 2020-21 - LopamudraDocument3 pagesIt Computation Sheet Fy 2020-21 - LopamudraGirija Prasad SwainNo ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVINAY verma100% (1)

- Itr of FatherDocument9 pagesItr of FatherPARAMJEETSINGHNo ratings yet

- Part B PDFDocument3 pagesPart B PDFDebesh KuanrNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- Itr Copy Ay 2023-24Document1 pageItr Copy Ay 2023-24mkbokaro1745No ratings yet

- PDF 115914800310723Document1 pagePDF 115914800310723jayanto chowdhuryNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearAEN TRACKNo ratings yet

- ACK138389790080523Document1 pageACK138389790080523Vishal GoyalNo ratings yet

- ITR AY 2024-25 Prabhjeet SinghDocument1 pageITR AY 2024-25 Prabhjeet SinghBishalNo ratings yet

- Acknowledgement AY 22-23Document1 pageAcknowledgement AY 22-23Nirav RavalNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- ACK131773880020523Document1 pageACK131773880020523Ritu RajNo ratings yet

- BalajiGollapalli 3429 F16 2022-23Document10 pagesBalajiGollapalli 3429 F16 2022-23p. r ravichandraNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- PDF 467415410030922Document1 pagePDF 467415410030922QunalNo ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingDocument1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingKrishna KalyanNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- August 2022Document1 pageAugust 2022amitdesai92No ratings yet

- Ca ReportDocument4 pagesCa Reportbdsconsultant1313No ratings yet

- PDF 237557810150623Document1 pagePDF 237557810150623sgkv vasaNo ratings yet

- Deepak ItrDocument6 pagesDeepak Itrakhtarnadeem5636No ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearBrajesh kumar sharmaNo ratings yet

- Nishar ItrDocument1 pageNishar ItrE-Ticket 40 RTNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNANDAN SALESNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- Dharmbir Itr 23-24Document1 pageDharmbir Itr 23-24Ashish SehrawatNo ratings yet

- Ciby HDFC PDFDocument3 pagesCiby HDFC PDFTina PhilipNo ratings yet

- ACK833415090290723Document1 pageACK833415090290723prashanth.financialpanditNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- Mar PDFDocument1 pageMar PDFreddy_vemula_praveenNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- A-Radha@dxc - Com F16Document9 pagesA-Radha@dxc - Com F16Radha PraveenNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurumahesh bhorNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearsubhash mandwalNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Itr 23Document1 pageItr 23vikash pandeyNo ratings yet

- Itr 21-22Document1 pageItr 21-22MoghAKaranNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- XXGP PF Statement 051119Document1 pageXXGP PF Statement 051119VishwasKashyapNo ratings yet

- Umesh ITR A.Y. 2023-2024Document1 pageUmesh ITR A.Y. 2023-2024swatigrv2004No ratings yet

- MeharwanDocument1 pageMeharwanSteve BurnsNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- ComputationDocument3 pagesComputationsaurabh240386No ratings yet

- Itr 23-24Document1 pageItr 23-24Ruloans VaishaliNo ratings yet

- Ay 2023-24 ComputationDocument3 pagesAy 2023-24 Computationsainijaswant326No ratings yet

- Chevron vs. CIRDocument1 pageChevron vs. CIRJan EchonNo ratings yet

- Deliveroo Order Receipt 1467474759Document3 pagesDeliveroo Order Receipt 1467474759Basma MohammedNo ratings yet

- DocumentDocument2 pagesDocumentkapil jainNo ratings yet

- Estmt - 2020 03 24Document10 pagesEstmt - 2020 03 24ellenpanchot71No ratings yet

- Document FlowchartDocument3 pagesDocument FlowchartEna BuslonNo ratings yet

- Sam's Club Acquisition Landing PageDocument1 pageSam's Club Acquisition Landing PageNisarNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay CertificateMuhammad Ramzan Burfat100% (2)

- GST BrochureDocument2 pagesGST BrochureNagendra KrishnamurthyNo ratings yet

- QuestionnaireDocument2 pagesQuestionnaireArun RameshNo ratings yet

- Invoice No. - 409851Document2 pagesInvoice No. - 409851Ajay rawatNo ratings yet

- The Way The World PaysDocument22 pagesThe Way The World Paysrainasanjeev_1No ratings yet

- S140215681 0 PDFDocument2 pagesS140215681 0 PDFShirley RobertsNo ratings yet

- Nature and Scope of GST: by Amandeep DrallDocument8 pagesNature and Scope of GST: by Amandeep DrallAman SinghNo ratings yet

- InvoiceDocument1 pageInvoiceriteshdere2No ratings yet

- Sample Questions For Final Exam of PGD in CVITM 12th Batch-PartDocument20 pagesSample Questions For Final Exam of PGD in CVITM 12th Batch-PartnayeemNo ratings yet

- Tax Assignment 4Document5 pagesTax Assignment 4pfungwaNo ratings yet

- Partnership TaxDocument24 pagesPartnership TaxMadurikaNo ratings yet

- Nfcu 633Document1 pageNfcu 633Akinwumi AdeyemiNo ratings yet

- Instructions For Completing Form 4506-C (Individial Taxpayer)Document1 pageInstructions For Completing Form 4506-C (Individial Taxpayer)GlendaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Saurav ShuklaNo ratings yet

- 2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaDocument33 pages2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaMia Jeruve Javier BautistaNo ratings yet

- Capital Allowance Powerpoint PresentationDocument21 pagesCapital Allowance Powerpoint PresentationKaycia HyltonNo ratings yet

- NotingDocument160 pagesNotingdpkonnetNo ratings yet

- Statement For Ufone # 03335127990: Account DetailsDocument8 pagesStatement For Ufone # 03335127990: Account DetailsIrfan ZafarNo ratings yet

- PbpinvoiceDocument9 pagesPbpinvoiceCarlos HenriqueNo ratings yet

- Quotation: Your ReferencesDocument1 pageQuotation: Your ReferencesyarkinozyorukNo ratings yet