Petrochemical Feedstock Outlook - A Tale of Two Markets: 7 November 2019 - Singapore

Petrochemical Feedstock Outlook - A Tale of Two Markets: 7 November 2019 - Singapore

Uploaded by

Nhân Trương VănCopyright:

Available Formats

Petrochemical Feedstock Outlook - A Tale of Two Markets: 7 November 2019 - Singapore

Petrochemical Feedstock Outlook - A Tale of Two Markets: 7 November 2019 - Singapore

Uploaded by

Nhân Trương VănOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Petrochemical Feedstock Outlook - A Tale of Two Markets: 7 November 2019 - Singapore

Petrochemical Feedstock Outlook - A Tale of Two Markets: 7 November 2019 - Singapore

Uploaded by

Nhân Trương VănCopyright:

Available Formats

Petrochemical Feedstock Outlook –

A Tale Of Two Markets

7 November 2019 | Singapore

Premasish Das

Executive Director, IHS Markit

Premasish.Das@ihsmarkit.com

Confidential. © 2019 IHS Markit®. All rights reserved.

2

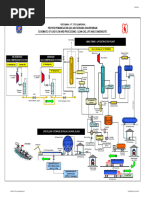

Naphtha data is often incomplete, so detailed supply and demand is key (and is the

basis of our analysis)

Comprehensive modeling of naphtha supply and demand

PRODUCTION SUPPLY UPGRADE DEMAND

Exp-Imp

NGL Natural Diluent

Gas plants LN market

gasoline

Solvent

GTL Hydrogen

LN-based

Condensate Et=

Condensate Steam

splitter cracking Pr=

Bu==

Crude Light Exp-Imp

Crude LN

naphtha Isomerization

distilling

(LN) Mogas and

Hydro- Reformer avgas pools

FCC Exp-Imp HN-based

cracking gasoline

Heavy Exp-Imp Raf

Alkylation Coking HN Benzene

naphtha Reformer

Aromatics Toluene

(HN) BTX-PX Mx

Hydro-

treating A9+

Refinery Exp-Imp

HN market

Note: Exp-Imp is export-import; LN is light naphtha; HN is heavy naphtha; Et= is ethylene; Pr= is propylene;

Bu== is butadiene; Mx is mixed xylenes; A9 is A9+ aromatics; Raf is raffinate. Exp-Imp

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

Demand drivers

Confidential. © 2019 IHS Markit®. All rights reserved.

4

Olefins demand will grow at robust pace with increasing use of light naphtha as

feedstock, particularly in long term

Global Ethylene Production By Feedstock

300 60

250 50

% Share of naphtha

200 40

MMt/a

150 30

100 20

50 10

0 0

2010 2018 2025 2030 2035 2040

Naphtha Ethane Propane Butane Other % Share of naphtha

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

5

More reformate (heavy naphtha) will be required to meet aromatics demand but its

share will decline with increasing alternative sources

Global Aromatics Production by Key Sources

250 60

% Share of Reformate

200 55

150 50

MMt/a

100 45

50 40

0 35

2010 2018 2025 2030 2035 2040

Reformate Extraction/Distillation Pygas Extraction Toluene Transalkylation Others % Share of Reformate Ext./Dist.

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

6

While reformate demand for gasoline will be capped by future peak demand & use of

other high octane components, light naphtha blending will reduce

Global Gasoline Demand Global Gasoline Blending - Rivalry

35 100%

30 80%

25

60%

20

MMb/d

40%

15

20%

10

0%

5 2010 2018 2025 2030 2035 2040

0 Others Oxygenates

2010 2015 2020 2025 2030 2035 2040 Return streams from Chemicals Isomerate/ Alkylate

Light Naphtha Cat. Gasoline

Rivalry Autonomy Reformate

Source: IHS Markit © 2019 IHS Markit Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

7

Reformate demand for aromatics production will be the key driver for growth in the

coming years, while the requirements for gasoline production will decline

Global Reformate demand by end use

600 70

65

500

% Share of Aromatics

60

400

55

MMt/a

300 50

45

200

40

100

35

0 30

2010 2018 2025 2030 2035 2040

Aromatics Gasoline % Share of Aromatics

Notes:

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

Supply drivers - Refining

Confidential. © 2019 IHS Markit®. All rights reserved.

9

Refinery crude runs will grow but at slower rate—tracking refined products demand

trend—thus reducing naphtha supply growth potential

Global Refined Product Demand by Sector

100 60%

% Share of Transportation

80 58%

60 56%

MMb/d

40 54%

20 52%

0 50%

2010 2018 2025 2030 2035 2040

Transformation Energy Industry Transportation International bunkers Other % Share of Transportation

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

10

Crude slate is getting lighter over next few years, but in the long term light crude

share likely to decline, resulting in lower naphtha supply

World Crude Production by Type

100 60%

Crude/Condensate

80 58%

Share of Light

60 56%

MMb/d

40 54%

20 52%

0 50%

2010 2018 2025 2030 2035 2040

Light Sweet Medium Sweet

Light Sour Medium Sour

Heavy Sour Heavy Sweet

Segregated Condensate % Share of Total Light Crude/Condensate

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

11

Large number of hydrocracking projects are expected to help meet distillate

demand growth and add to naphtha supply

World: Capacity Additions, 2018-2040

12

10

8

MMb/d

0

Crude Distillation Condensate Splitter Hydrocracker Coker Reformer

Announced Hypothetical

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

12

Increased production of natural gas liquids will directly or indirectly partially offset

growing naphtha requirements from refinery operation

Global NGL Supply By Product

700

600

500

400

MMt/a

300

200

100

0

2010 2018 2025 2030 2035 2040

Ethane Propane Butane Natural gasoline

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

Implications

Confidential. © 2019 IHS Markit®. All rights reserved.

14

Refinery will remain be the main source of naphtha but “business as usual” refining

operation will not be enough to meet demand growth in the long run

Global Light+Heavy Naphtha Supply

1600 Tight Supply 30%

1400 Oversupply 27%

1200 24%

% Naphtha Yield

1000 21%

800 18%

MMt/a

600 15%

400 12%

200 9%

0 6%

2010 2018 2020 2022 2024 2026 2030 2035 2040

Refinery - CDUs Refinery - Conv units Natural gasoline

Return from Aromatics Others % Naphtha yield from CDU

% Naphtha yield (for Chemicals)

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

15

Higher level of integration, changes in operating mode and new technologies would

be required to increase naphtha and chemicals yields

• COTC represents “ultimate” integration by merging refinery &

COTC petrochemical plants into one.

• COTC elevates petrochemical production to refinery scale.

Yield~40-80%

FULL Refining + Steam Cracking + PX Complex

Yield~25-40%

SINGLE Refining + Steam Cracking or Refining + PX Complex

Yield~15-25%

REFINING PLUS Refining + BTX + Propylene

Yield<15%

Refining

REFINING

Confidential. © 2019 IHS Markit®. All rights reserved.

16

As new large integrated refineries come onstream, existing facilities need to be

more competitive to avoid being marginalized

ILLUSTRATION

East-of-Suez Refinery Margin Analysis

4th Quartile

Net Cash Margins, $/Barrel of

1st Quartile 2nd Quartile 3rd Quartile

Crude

All refineries in the 1st quartile

are highly integrated with

petrochemicals

0 5,000 10,000 15,000 20,000 25,000 30,000 35,000

Cumulative crude capacity, thousand b/d

Fully Integrated Ethylene Integrated Paraxylene Integrated Non Integrated

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS Markit®. All rights reserved.

17

Key takeaways

Naphtha demand will While refinery will still be Significant changes in

continue to rise supported the main source of naphtha operation - both for

by strong demand growth of supply, its supply growth refining and petrochemical

petrochemicals but lower will move in tandem with manufacturers, trade,

demand from gasoline slowing or declining refined pricing and even in the

production in the long term products demand growth in business models are

will offset some the long term expected in the long term

Confidential. © 2019 IHS Markit®. All rights reserved.

Thank you

Confidential. © 2019 IHS Markit®. All rights reserved.

IHS Markit Customer Care

CustomerCare@ihsmarkit.com

Americas: +1 800 IHS CARE (+1 800 447 2273)

Europe, Middle East, and Africa: +44 (0) 1344 328 300

Asia and the Pacific Rim: +604 291 3600

Disclaimer

The information contained in this presentation is confidential. Any unauthorized use, disclosure, reproduction, or dissemination, in full or in part, in any media or by any means, without the prior written permission of IHS Markit or any of its affiliates ("IHS Markit") is strictly

prohibited. IHS Markit owns all IHS Markit logos and trade names contained in this presentation that are subject to license. Opinions, statements, estimates, and projections in this presentation (including other media) are solely those of the individual author(s) at the time of

writing and do not necessarily reflect the opinions of IHS Markit. Neither IHS Markit nor the author(s) has any obligation to update this presentation in the event that any content, opinion, statement, estimate, or projection (collectively, "information") changes or subsequently

becomes inaccurate. IHS Markit makes no warranty, expressed or implied, as to the accuracy, completeness, or timeliness of any information in this presentation, and shall not in any way be liable to any recipient for any inaccuracies or omissions. Without limiting the

foregoing, IHS Markit shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence), under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with any

information provided, or any course of action determined, by it or any third party, whether or not based on any information provided. The inclusion of a link to an external website by IHS Markit should not be understood to be an endorsement of that website or the site's

owners (or their products/services). IHS Markit is not responsible for either the content or output of external websites. Copyright © 2019, IHS Markit®. All rights reserved and all intellectual property rights are retained by IHS Markit.

You might also like

- Organic Chemistry Practice Question 0002Document11 pagesOrganic Chemistry Practice Question 0002JasonTenebroso100% (4)

- Ige TD 13Document73 pagesIge TD 13Anant RubadeNo ratings yet

- Unit 02 Karbala Refinery Project - Oct 3 17Document37 pagesUnit 02 Karbala Refinery Project - Oct 3 17noor taha100% (2)

- Uniflex Eliminate Fuel OilDocument20 pagesUniflex Eliminate Fuel Oilsantoso hadiNo ratings yet

- Pengenalan PLTU Teluk Sirih PDFDocument19 pagesPengenalan PLTU Teluk Sirih PDFDinata Putra100% (1)

- Steam AccumulatorsDocument3 pagesSteam Accumulatorsedi mambang daengNo ratings yet

- Corrosion Inhibitors For Refinery OperationsDocument15 pagesCorrosion Inhibitors For Refinery OperationsAnik AichNo ratings yet

- Petroleum Refining Process: Source: U.S. Department of LaborDocument2 pagesPetroleum Refining Process: Source: U.S. Department of LaborAmmr MahmoodNo ratings yet

- Trislot Reactor Internal Part PDFDocument12 pagesTrislot Reactor Internal Part PDFjonathanNo ratings yet

- Complex Refinery Flowchart - 2Document1 pageComplex Refinery Flowchart - 2Bilal AhmadNo ratings yet

- 4 FINAL Solvent de Asphalting Conversion VCMStudyDocument20 pages4 FINAL Solvent de Asphalting Conversion VCMStudyebik440No ratings yet

- CDUDocument41 pagesCDUsidhuysn100% (2)

- RIL JamnagarDocument21 pagesRIL JamnagarPiyu Sol100% (2)

- BFD of Kurnell RefineryDocument1 pageBFD of Kurnell RefineryMuhammad Ibad AlamNo ratings yet

- 3B 17644019 Proses MeroxDocument1 page3B 17644019 Proses MeroxMohammad Rezza PachruraziNo ratings yet

- Technology, Energy Efficiency and Environmental Externalities in The Pulp and Paper Industry - AIT, ThailandDocument140 pagesTechnology, Energy Efficiency and Environmental Externalities in The Pulp and Paper Industry - AIT, ThailandVishal Duggal100% (1)

- Air Liquide Syngas ProcessDocument1 pageAir Liquide Syngas ProcessAntonio MendesNo ratings yet

- BFD VgoDocument1 pageBFD VgoSALES OFFICER HPCLNo ratings yet

- Layout Zona Pengawasan K3LDocument1 pageLayout Zona Pengawasan K3Lpik.rijalpelangiNo ratings yet

- Overview KilangDocument6 pagesOverview KilangArShyhy Citcuit ArsyamaliaNo ratings yet

- MCR ProjectDocument40 pagesMCR ProjectHumair AhmedNo ratings yet

- Hydroprocessing: Hydrocracking & HydrotreatingDocument45 pagesHydroprocessing: Hydrocracking & HydrotreatingRobin ZwartNo ratings yet

- K131 312 CN 0003 01 - BDocument4 pagesK131 312 CN 0003 01 - BiffatNo ratings yet

- P&ID - EngDocument7 pagesP&ID - EngKanad PNo ratings yet

- Urea Process Split Flow LoopDocument7 pagesUrea Process Split Flow LoopCarlos A. VillanuevaNo ratings yet

- UOP Hydrocracking Technology: Upgrading Fuel Oil To Euro V FuelsDocument37 pagesUOP Hydrocracking Technology: Upgrading Fuel Oil To Euro V FuelsHimanshu Sharma100% (2)

- PFD LPG Limau TimurDocument1 pagePFD LPG Limau TimurwahyuNo ratings yet

- BFD of Lima RefineryDocument1 pageBFD of Lima RefineryMuhammad Ibad Alam100% (1)

- Block Flow Diagram of Lima PDFDocument1 pageBlock Flow Diagram of Lima PDFMuhammad Ibad AlamNo ratings yet

- LAY OUT PIPA CO2 RISE FLOOR Rev.1Document1 pageLAY OUT PIPA CO2 RISE FLOOR Rev.1dyashuntingNo ratings yet

- Project 1Document1 pageProject 1Yasir ShahzadNo ratings yet

- EXPO 2017 Airbus MBSE PDFDocument28 pagesEXPO 2017 Airbus MBSE PDFDebanand SinghdeoNo ratings yet

- Hydroprocessing: Hydrotreating & Hydrocracking: Chapters 7 & 9Document54 pagesHydroprocessing: Hydrotreating & Hydrocracking: Chapters 7 & 9Mo OsNo ratings yet

- 02 Feedstocks & Products PDFDocument124 pages02 Feedstocks & Products PDFdimasNo ratings yet

- Chemistry NoteDocument4 pagesChemistry Notevivektpramod3No ratings yet

- Fwmagpart 2 Q42013Document8 pagesFwmagpart 2 Q42013bourabiaazizNo ratings yet

- Delayed Coking: Chapter 5Document34 pagesDelayed Coking: Chapter 5Arumugam Ramalingam100% (1)

- No Jenis Crude Oil Cutting TBP (%) Gas-Light Gasoline Light Naptha Medium Naptha Heavy Naptha 1 Alc 9 5 8 8 2 Boni LT 9 7 10 10 3 BCF-17 4 1 1 4Document2 pagesNo Jenis Crude Oil Cutting TBP (%) Gas-Light Gasoline Light Naptha Medium Naptha Heavy Naptha 1 Alc 9 5 8 8 2 Boni LT 9 7 10 10 3 BCF-17 4 1 1 4popoNo ratings yet

- PhD. Victor Alva, Conferencia-Hydrocarbon Fundamentals San MarcosDocument62 pagesPhD. Victor Alva, Conferencia-Hydrocarbon Fundamentals San Marcosdaniel100% (1)

- Organic Conversion Ka DadaDocument7 pagesOrganic Conversion Ka Dadaxk71mqnecpNo ratings yet

- Adsorbents Solutions Refining Brochure PDFDocument2 pagesAdsorbents Solutions Refining Brochure PDFSALAM ALINo ratings yet

- HGU, DHT Units OverviewDocument36 pagesHGU, DHT Units OverviewTirumala SaiNo ratings yet

- First Upstream Projects-Epc PlanDocument13 pagesFirst Upstream Projects-Epc PlanRccg DestinySanctuaryNo ratings yet

- Plan of Eletrical PowerDocument3 pagesPlan of Eletrical PoweradventmanurungNo ratings yet

- Learning About The of Nghi Son Refinery: Rude Istillation NitDocument17 pagesLearning About The of Nghi Son Refinery: Rude Istillation NitTrường Tùng LýNo ratings yet

- Power Generation: Product Application NotesDocument6 pagesPower Generation: Product Application NotesmetkarchetanNo ratings yet

- 05 Delayed CokingDocument52 pages05 Delayed CokingRobin ZwartNo ratings yet

- Steam and Water Flow Circuit: Talwandi Sabo Power Limited 3 660Mw ProjectDocument2 pagesSteam and Water Flow Circuit: Talwandi Sabo Power Limited 3 660Mw ProjectHemantNo ratings yet

- 13 - fcc1Document28 pages13 - fcc1ananth2012No ratings yet

- Safety in Operations - Human Aspect - DorcDocument119 pagesSafety in Operations - Human Aspect - DorcAdanenche Daniel Edoh100% (1)

- Abs Sheets University Ar21060Document2 pagesAbs Sheets University Ar21060omkar surveNo ratings yet

- Gas Processing Operations Processing Plants: Prepared By: DSC PHD Dževad Hadžihafizović (Deng) Sarajevo 2024Document78 pagesGas Processing Operations Processing Plants: Prepared By: DSC PHD Dževad Hadžihafizović (Deng) Sarajevo 2024Ambreen SheikhNo ratings yet

- Wahyu Triaji Rahadianto NIM 061540411904 Dosen Pembimbing: Ahmad Zikri, S.T., M.TDocument15 pagesWahyu Triaji Rahadianto NIM 061540411904 Dosen Pembimbing: Ahmad Zikri, S.T., M.TfadilahNo ratings yet

- Pre-Treatment: Distilate HydrotreatingDocument2 pagesPre-Treatment: Distilate HydrotreatingTio BudiartoNo ratings yet

- Praktikum ToksikologiDocument3 pagesPraktikum ToksikologiIin Sakinah DewiNo ratings yet

- LNG Process OverviewDocument59 pagesLNG Process OverviewNhật Quang PhạmNo ratings yet

- PID Ver 1Document1 pagePID Ver 1Gillian AmbaNo ratings yet

- Zero Gasolene Refinery Configuration With SDA (Solvent Deashphaltene)Document9 pagesZero Gasolene Refinery Configuration With SDA (Solvent Deashphaltene)s k kumarNo ratings yet

- P 1 February 01Document1 pageP 1 February 01hlaldinmawiaNo ratings yet

- Roza Savitri - Tugas1Document1 pageRoza Savitri - Tugas1Roza SavitriNo ratings yet

- Imagining the Nation in Nature: Landscape Preservation and German Identity, 1885–1945From EverandImagining the Nation in Nature: Landscape Preservation and German Identity, 1885–1945No ratings yet

- Experiment 5 Chem 26.1Document2 pagesExperiment 5 Chem 26.1Collin Reyes HuelgasNo ratings yet

- Module 20 Reading AssignmentDocument2 pagesModule 20 Reading AssignmentDana M.No ratings yet

- 2014 Organogenesis in A Dish Modeling Development and Disease Using Organoid TechnologiesDocument10 pages2014 Organogenesis in A Dish Modeling Development and Disease Using Organoid TechnologiesDito AnurogoNo ratings yet

- Photosynthesis and The Carbon Cycle: Lower Secondary Checkpoint Year 8Document20 pagesPhotosynthesis and The Carbon Cycle: Lower Secondary Checkpoint Year 8Youssef MohamedNo ratings yet

- Anthesia Answer 2Document14 pagesAnthesia Answer 2Hamdy GowefilNo ratings yet

- IC Accounts Payable Ledger Template Updated 8552Document2 pagesIC Accounts Payable Ledger Template Updated 8552M Monjur MobinNo ratings yet

- Transport Safety Management (RR)Document16 pagesTransport Safety Management (RR)Andriy ShevaNo ratings yet

- The Effects of A Mobile Application For Patient Participation To Improve Patient SafetyDocument18 pagesThe Effects of A Mobile Application For Patient Participation To Improve Patient Safety'Amel'AyuRizkyAmeliyahNo ratings yet

- Comprehensive Neurology Board Review Flash CardsDocument202 pagesComprehensive Neurology Board Review Flash CardsDr. Chaim B. Colen78% (9)

- Elementary Firs AidDocument56 pagesElementary Firs AidSaptarshi BasuNo ratings yet

- Fit 111 Contents and Assessments (2)Document60 pagesFit 111 Contents and Assessments (2)quentkarl8No ratings yet

- 5 Rhenocure TMTD CDocument3 pages5 Rhenocure TMTD CKeremNo ratings yet

- Jfe 680Document94 pagesJfe 680harbhajan singhNo ratings yet

- Horizon Power Testing and Commissioning Manual PDFDocument78 pagesHorizon Power Testing and Commissioning Manual PDFmasimaha1379No ratings yet

- Calculations For Safe Bearing CapacityDocument3 pagesCalculations For Safe Bearing Capacityimran khanNo ratings yet

- Physioex Lab Report: Pre-Lab Quiz ResultsDocument5 pagesPhysioex Lab Report: Pre-Lab Quiz ResultsPavel Milenkovski100% (1)

- Bread and Pastry Production (Exploratory) : I. Introductory ConceptDocument3 pagesBread and Pastry Production (Exploratory) : I. Introductory ConceptJonaiza PangandianNo ratings yet

- Entropy EdexcelDocument6 pagesEntropy EdexcelKevin The Chemistry TutorNo ratings yet

- National Cheese Pizza DayDocument64 pagesNational Cheese Pizza Day018-2A Liensi PutriNo ratings yet

- Smart Walking Stick For Visually ImpairedDocument16 pagesSmart Walking Stick For Visually ImpairedAshwati Joshi100% (1)

- High Profits by Producing EggsDocument12 pagesHigh Profits by Producing EggsDonasian Mbonea Elisante MjemaNo ratings yet

- PHD Review LiteratureDocument27 pagesPHD Review LiteraturesalmanNo ratings yet

- Exercises Developing or Displaying Physical Agility and CoordinationDocument24 pagesExercises Developing or Displaying Physical Agility and CoordinationJhun PobleteNo ratings yet

- Effortless English: Lifestyle DiseasesDocument2 pagesEffortless English: Lifestyle DiseasesPedro De Oliveira AguiarNo ratings yet

- TBoxMS Technical Specification 2.15Document123 pagesTBoxMS Technical Specification 2.15eftamargoNo ratings yet

- Final Examination Rubric On The Zumba Exercises RoutineDocument1 pageFinal Examination Rubric On The Zumba Exercises RoutinePizzaTobacco123100% (1)

- आदिवासी PDFDocument122 pagesआदिवासी PDFSunNo ratings yet