Dede Hertina-Company Performance Impact of Capital Structure, Profitability and Company Size

Uploaded by

Fajar HadiyusufCopyright:

Available Formats

Dede Hertina-Company Performance Impact of Capital Structure, Profitability and Company Size

Uploaded by

Fajar HadiyusufOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Dede Hertina-Company Performance Impact of Capital Structure, Profitability and Company Size

Uploaded by

Fajar HadiyusufCopyright:

Available Formats

Solid State Technology

Volume: 63 Issue: 4

Publication Year: 2020

Company Performance Impact of Capital

Structure, Profitability and Company Size

Dede Hertina*, Carissa Novia Damayanti, Fajar Hadiyusuf

Widyatama University, Bandung, Indonesia

*dede.hertina@widyatama.ac.id

Abstract

This study aims to determine the effect of capital structure, profitability, company size on the

performance of the cigarette sub-sector companies listed on the IDX for the 2014-2018

period. This research uses descriptive and verification methods with regression analysis tools

and the coefficient of determination. The results of the analysis of the coefficient of

determination state that there is a strong and unidirectional relationship between the

independent variable and the dependent variable and has a determination coefficient value of

47.91%. The results of testing the F test hypothesis indicate that the capital structure,

profitability and company size simultaneously have a significant effect on company

performance. Hypothesis testing using t test shows that the capital structure has no

significant effect on company performance, profitability has a significant effect on company

performance and company size has a significant effect on company performance.

Keywords: Capital Structure, Profitability, Company Size, Company Performance.

Introduction

The company will do various ways to maintain its existence in obtaining profits. Company

owners need capital that will be used for company operational costs which will strengthen the

company in obtaining profits. The way to get additional capital is by going public, in this

case the company sells its shares to the public and can be owned by the public. The goal is to

go public to get expansion funds to improve the company's capital structure with additional

capital through investors who are interested in buying the shares offered and to increase the

company's shareholder value. Companies take various ways to achieve their goals, including

by analyzing financial ratios. Financial ratios are a tool for analyzing and measuring

company performance using company financial data, in addition to assessing the financial

decisions taken. The company should review the company's performance in any given period.

Company performance is the result of a management activity in a company. The performance

results can be used as a parameter in assessing the success of company management. The

company's success can be seen from the level of profitability in generating profits (Saudi,

2018). The level of profitability affects investors' perceptions of the company's growth

prospects in the future. Companies that have good prospects in the future usually have a high

level of profitability. The company's performance is viewed based on the size of the

company, which determines the use of external funds that will be used by the company. This

is because large companies will need large funds to be able to run the company. Fulfillment

4101

of these funds can be made available through external funding. In general, total assets are

used as a basis for measuring the size of a company because it has long-term characteristics.

According to Kartikaningsih (2013), company size has an influence on company

performance, the more assets owned and the smoother the turnover rate of assets, the greater

the profit the company gets. This is contrary to Helen (2016) who stated that company size

Archives Available @ www.solidstatetechnology.us

Solid State Technology

Volume: 63 Issue: 4

Publication Year: 2020

has no influence on company performance. The purpose of analyzing financial ratios by the

company is to determine the financial condition so that the company's performance in a

certain period can be found. Financial ratios consist of several types, including profitability

ratios, solvency ratios, liquidity ratios and activity ratios. The purpose of analyzing financial

ratios by the company is to determine the financial condition so that the company's

performance in a certain period can be found. Financial ratios consist of several types,

including profitability ratios, solvency ratios, liquidity ratios and activity ratios. Research

conducted by Achmad Komara et al. (2016) shows that capital structure has a significant

negative effect on company performance. Earning Per Share and Debt / Equity Ratio have

increased from 2016-2018. This shows a positive relationship between Earning Per Share and

Debt / Equity Ratio, so this is contrary to research conducted by Achmad Komara et al.

(2016).

Conceptual Framework

Company Performance

Company performance is a complete display of the state of the company for a certain period

of time, is a result or achievement that is influenced by the company's operational activities in

utilizing its resources. Dedi Suhendro (2017) argues that company performance is an

achievement that the company achieves in a certain period as a result of the work process

during that period. Jumingan (2006) in Salma Tawqa (2016) company performance is a

description of the company's financial condition in a certain period, both regarding the

aspects of collection and distribution of funds which are usually measured by indicators of

capital adequacy, liquidity and profitability. Good management performance can improve

control within the company, but in the implementation of procedures that are implemented it

is often not in accordance with company performance and also the division of tasks and

responsibilities. Company performance is something that is produced by the company in a

certain period by referring to the established standards. In achieving company goals,

company performance is very important. One of the efforts made is by implementing a GCG

system in company performance.

Effect of Capital Structure on Company Performance

Capital structure is a balance or comparison between foreign capital and own capital. Foreign

capital is debt long term or short term, equity is divided into retained earnings and ownership

of the company. The optimal capital structure is a capital structure that optimizes the balance

between risk and return so as to maximize share prices. In determining the capital structure of

a company, it is necessary to consider the various variables that influence it. The capital

structure is the financial proportion between short-term debt, long-term debt and equity that

is used to meet corporate spending needs. Bambang Riyanto (2013) defines own capital as

basically capital that comes from the owner of the company and which is embedded in the

company for an indefinite period of time. Own capital is the capital used by a company for its

operational activities that comes from the owner of the company. The optimal capital

structure is a capital structure that optimizes the balance between risk and return so as to

maximize share prices. In determining the capital structure of a company, it is necessary to

consider the various variables that influence it. With an optimal capital structure, it will

4102

maximize the company's performance so that the welfare of the owners will also increase.

Research conducted by Achmad et al. (2016) states that capital structure has a significant

influence with the direction of a negative relationship on company performance, while

research by Selly et al. (2017) shows that capital structure has an effect on company

performance.

Archives Available @ www.solidstatetechnology.us

Solid State Technology

Volume: 63 Issue: 4

Publication Year: 2020

Effect of Profitability on Company Performance

Profitability is the company's ability to make a profit during a certain period. It is important

for companies to keep their profitability stable and even increase to fulfill obligations to

shareholders, increase the attractiveness of investors in investing, and increase public

confidence in saving excess funds owned by the company (Agustiningrum, 2013). In the

research chosen is the ROE indicator as a measure of profitability, the ROE ratio can

determine the company's ability to generate profits with its own capital. Profitability shows

the company's ability to obtain net income from its net sales and can also measure the

company's management's ability to carry out its operational activities by minimizing

company expenses and maximizing company profits. This is what can improve the

company's performance so that investors are also more interested in investing in the

company. The higher the profitability of a company, the better, because the prosperity of

shareholders or shareholders increases with the higher profitability of the company. The level

of profitability affects investors' perceptions of the company's growth prospects in the future.

Research conducted by Yunina et al. (2009) shows that profitability by using ROA and ROE

ratios has an effect on company performance by using the EPS ratio as a measuring tool.

Effect of Company Size on Company Performance

Company size is a determination of the size of a company. The higher the total assets, the

more assets owned by the company can indicate that the greater the assets owned by the

company so that investors will be safer in investing in the company, the size of the company

can be measured using the Ln of total assets. Helen (2016) states that company size is the

average total net sales for the year concerned to several years. Sales are greater than variable

costs and fixed costs, the amount of income before tax will be obtained. Conversely, if the

sales are smaller than the variable costs and fixed costs, the company will suffer losses.

Company size is a scale which can be classified as a company according to various ways,

including total assets, log size, stock market value and others. Based on total assets, the size

of the company is divided into three categories, namely large companies, medium companies

and small companies. Company size is the average sales yield in the current period up to

several years to come and is a determination of the size of a company. Company size as

measured by company assets shows how much assets the company owns. Companies that

have large assets will be able to optimize existing resources to obtain maximum business

profits and companies with small assets will of course also generate profits in accordance

with their relatively small assets. Research conducted by Tulus et al. (2017) states that

company size affects company performance.

Hypothesis

H1: Capital Structure (DER) has an influence on Company Performance (EPS)

H2: Profitability (ROE) has an influence on Company Performance (EPS)

H3: Company size has an influence on Company Performance (EPS)

H4: Capital Structure (DER), Profitability (ROE) and Company Size have an influence on

Company Performance (EPS)

4103

Methodology

The research method used in this research is descriptive and verification methods. The

sampling technique used in this study was purposive sampling, according to Komariah

(2011), purposive sampling determines the subject or object according to the objective.

The sample in this study were 4 companies that met the requirements set. The criteria used

Archives Available @ www.solidstatetechnology.us

Solid State Technology

Volume: 63 Issue: 4

Publication Year: 2020

for sampling are as follows:

1. Cigarette companies listed on the Indonesia Stock Exchange in the study period, namely

the 2014-2018 period.

2. Cigarette companies that issue quarterly financial reports during the study period, namely

the 2014-2018 period.

3. Cigarette companies that have the data needed to calculate the variables studied during

the study period, namely the 2014-2018 period.

Data analysis method

In this study, the data analysis method used is multiple regression techniques to examine the

effect of capital structure, profitability and company size on the dependent variable, namely

company performance. Multiple regression model is a regression analysis technique that

explains the relationship between the dependent variable and several independent variables.

RESULTS AND DISCUSSION

Research results

Multiple Regression Analysis

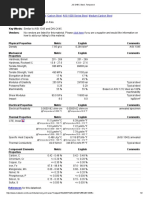

Table 1. Multiple Regression Results

Dependent Variable: EPS

Method: Panel Least Squares

Date: 01/22/20

Time: 22:00

Sample: 2014Q1 2018Q4

Periods included: 20

Cross-sections included: 4

Total panel (balanced) observations: 80

Source: Results of Data Processing (2020)

4104

From Table 1, the regression equation is obtained as follows:

EPS= 0.468628 + 0.015405 DER + 0.003758 ROE - 0.021321 SIZE

Archives Available @ www.solidstatetechnology.us

Solid State Technology

Volume: 63 Issue: 4

Publication Year: 2020

The interpretation of the multiple regression equation is as follows:

1. A constant of 0.468628 states that if the DER, ROE and Size variables are zero and there

is no change, then the EPS is 0.468628.

2. The DER variable has a positive multiple regression coefficient value of 0.015405. This

means that a one-unit change in the DER variable will increase the EPS by 0.015405,

assuming the other variables are constant.

3. The ROE variable has a positive multiple regression coefficient value of 0.003758. This

means that a one-unit change in the ROE variable will increase the EPS by 0.003758,

assuming the other variables are constant.

4. The variable Size has a negative multiple regression coefficient value of 0.003758. This

means that a one-unit change in the SIZE variable will decrease the EPS by 0.003758,

assuming the other variables are constant.

Effect of Profitability on Company Performance in the Cigarette Sub-Sector Listed on

the IDX for the 2014-2018 Period

To be able to determine the effect of profitability (X2) partially, a partial Hypothesis Testing

(t test) was carried out, the test was carried out using the following hypothesis:

a. H0: r1 = 0, meaning that there is no influence between the Profitability variable (X2) on

Company Performance (Y) in the Cigarette Sub-Sector Manufacturing Company listed on

the IDX for the 2014-2018 Period.

b. Ha: r1 ≠ 0, meaning that there is an influence between the Profitability variable (X2) on

Company Performance (Y) in the Cigarette Sub-Sector Manufacturing Company listed on

4105

the IDX for the 2014-2018 Period.

The level of significance used for this study was 5% (0.05). The results of data processing for

the t test can be seen in table 4.4. From table 4.4, it can be seen that the ROE Probability is

Archives Available @ www.solidstatetechnology.us

Solid State Technology

Volume: 63 Issue: 4

Publication Year: 2020

0.0000 <α (0.05) so that H0 is rejected, which means that partially Profitability (ROE) has a

significant effect on Company Performance (EPS). The results of this study are in accordance

with the hypothesis so that the hypothesis is accepted.

Effect of Profitability on Company Performance

To be able to determine the effect of Company Size (X3) partially, a Partial Hypothesis

Testing (t test) was carried out, the test was carried out using the following hypothesis:

a. H0: r1 = 0, meaning that there is no influence between the variable company size (X3) on

the company performance (Y) in the cigarette manufacturing companies listed on the IDX

for the 2014-2018 period.

b. Ha: r1 ≠ 0, meaning that there is an influence between the variable company size (X3) on

company performance (Y) in the cigarette manufacturing companies listed on the IDX for

the 2014-2018 period.

The level of significance used for this study was 5% (0.05). The results of data processing for

the t test can be seen in Table 1. From Table 1, it can be seen that the SIZE Prob. is 0.0155 <

α (0,05) so that H0 is rejected, which means that Company Size partially has a significant

effect on Company Performance (EPS).

Research Implications

Assessing company performance is an important task for company leaders. Periodic

performance appraisals allow company leaders to know the current position of the company

compared to the targets or targets that have been set or compared to competitors and the

industry average. By knowing the achievement of the company's goals and position, the

company leader can make improvements to reach the desired level. For companies engaged

in the cigarette sub-sector, it turns out that the involvement of capital structure variables,

profitability and company size has an influence on company performance. With a good level

of profitability, it shows that the company is able to generate profits in a certain period. The

use of measuring instruments in accordance with the needs of the company will help to

determine the efficiency in the use of own capital and / or foreign capital. Companies need to

pay attention to the total assets owned because the greater the total assets of the company, the

greater the size of the company. A large total asset means that it can generate better profits.

The factors already mentioned should be a matter of concern for companies, particularly the

cigarette sub-sector in an effort to improve company performance. Future research is

expected to use other variables that have not been used in this study, or can add other

variables so that the research is more varied so that it can find results that have not been

found in this study.

Conclusion

1. Based on the results of the F test, the DER statistics, ROE and SIZE simultaneously affect

the EPS of Cigarette Companies Listed on the IDX for the 2014-2018 period.

2. The magnitude of the influence of DER, ROE and SIZE on EPS seen from the coefficient

of determination (R-squared) is 47.91%, the rest or 52.09% is influenced by other factors

not included in the study.

4106

3. Partially DER does not have a significant effect on EPS on the cigarette companies listed

on the IDX for the 2014-2018 period.

4. ROE partially has a significant effect on EPS in cigarette companies listed on the IDX for

the 2014-2018 period.

5. SIZE partially has a significant effect on EPS in the cigarette companies listed on the IDX

Archives Available @ www.solidstatetechnology.us

Solid State Technology

Volume: 63 Issue: 4

Publication Year: 2020

for the 2014-2018 period.

References

1. Achmad Komara, Sri Hartoyo and Trias Andati. 2016. Analisis Pengaruh Struktur Modal

Terhadap Kinerja Keuangan Perusahaan. Jurnal Keuangan dan Perbankan. Insititut

Pertanian Bogor.

2. Fahmi, Irham. 2015. Pengantar Manajemen Keuangan Teori dan Soal Jawab. Bandung:

Alfabeta.

3. Ghozali, Imam. 2012. Aplikasi Analisis Multivariate dengan Program IBM SPSS 20.

Semarang: Badan Penerbit Universitas Diponegoro.

4. Oktaviana, H. (2016). Pengaruh struktur modal, ukuran perusahaan dan corporate

governance terhadap kinerja perusahaan pada perusahaan manufaktur yang terdaftar di

bursa efek Indonesia Studi empiris pada perusahaan yang terdaftar di bursa efek

Indonesia. Jurnal Bisnis dan Manajemen, 53(12).

5. Nugroho, H. (2011). Pengaruh Return On Equity dan Debt to Equity Ratio Terhadap

Earning Per Share, Studi Kasus Pada Kelompok Industri Farmasi yang Terdaftar di Bursa

Efek Indonesia. Jurnal Ekonomi & Bisnis PNJ, 10(1), 13438.

6. Kasmir. 2019. Pengantar Manajemen Keuangan. Jakarta: Prenada Media Group.

7. Riduwan. 2012. Pengantar Statistika untuk Penelitian Pendidikan, Sosial, Ekonomi

Komunikasi dan Bisnis. Bandung: Alfabeta.

8. Taqwa, S. (2016). Pengaruh Struktur Modal Terhadap Kinerja Perusahaan Pada

Perusahaan Manufaktur. Wahana Riset Akuntansi, 4(1).

9. Saudi, M.H.M, Sinaga, O. Jabarullah, N.H., The Role of Renewable, Non-renewable

Energy Consumption and Technology Innovation in Testing Environmental Kuznets

Curve in Malaysia, International Journal of Energy Economics and Policy, 9(1):299-307,

2018.

10. Haryono, S. A., Fitriany, F., & Fatima, E. (2017). Pengaruh Struktur Modal Dan Struktur

Kepemilikan Terhadap Nilai Perusahaan. Jurnal Akuntansi dan Keuangan Indonesia, 14(2),

119-141.

11. Prijanto, T., & Veno, A. (2017). Pengaruh Ukuran Perusahaan dan Likuiditas Terhadap

Kinerja Perusahaan (Studi Empiris pada Perusahaan Manufaktur yang terdaftar di Bursa

Efek Indonesia Tahun 2013–2015). Jurnal Akuntansi dan Sistem Teknologi Informasi,

13(4).

12. Yunina, N., & Syamni, G. (2007). Pengaruh Return on Assets dan Return on Equity

terhadap Earning Per Share pada PT. Bank Muamalat Indonesia.

https://core.ac.uk/download/pdf/300562549.pdf.

4107

Archives Available @ www.solidstatetechnology.us

You might also like

- Andy,+Journal+Manager,+Jurnal+ +Mario+HasangaponNo ratings yetAndy,+Journal+Manager,+Jurnal+ +Mario+Hasangapon15 pages

- Corporate Governance Profitability and Firm ValueNo ratings yetCorporate Governance Profitability and Firm Value12 pages

- The Effect of Capital Expenditure Company Growth ANo ratings yetThe Effect of Capital Expenditure Company Growth A9 pages

- Financial Performance On Company Value With CSRNo ratings yetFinancial Performance On Company Value With CSR13 pages

- The Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableNo ratings yetThe Influence of Financial Performance On Company Value With Capital Structure As A Mediation Variable8 pages

- Effect of Capital Structure and Sales Growth On Firm Value With Profitability As MediationNo ratings yetEffect of Capital Structure and Sales Growth On Firm Value With Profitability As Mediation11 pages

- IJEBD, Eko Edy Susanto, Anita de Grave, Dan Bambang PrihanantoNo ratings yetIJEBD, Eko Edy Susanto, Anita de Grave, Dan Bambang Prihananto10 pages

- The Effect of Profitability, Capital Structure, Company Size, and Dividend Policy On Company Value On The Indonesia Stock ExchangeNo ratings yetThe Effect of Profitability, Capital Structure, Company Size, and Dividend Policy On Company Value On The Indonesia Stock Exchange7 pages

- Effect of Company Size, Profitability and Capital Structure On Firm Value in IndonesiaNo ratings yetEffect of Company Size, Profitability and Capital Structure On Firm Value in Indonesia6 pages

- Mediation Effects of Capital Structure and Profitability On The Influence of Sales Growth On Firm Value in Consumer Goods CompaniesNo ratings yetMediation Effects of Capital Structure and Profitability On The Influence of Sales Growth On Firm Value in Consumer Goods Companies14 pages

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisNo ratings yetImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data Analysis8 pages

- The Effect of Capital Structure, Dividend PolicyNo ratings yetThe Effect of Capital Structure, Dividend Policy18 pages

- The Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in BangladeshNo ratings yetThe Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in Bangladesh5 pages

- Capital Structure and Firm Size On Firm Value Moderated by ProfitabilityNo ratings yetCapital Structure and Firm Size On Firm Value Moderated by Profitability18 pages

- 1326-Article Text-1446-1-10-20160730 PDFNo ratings yet1326-Article Text-1446-1-10-20160730 PDF5 pages

- The Influence and On Financial Performance at PT Indocement Tunggal Prakarsa TBKNo ratings yetThe Influence and On Financial Performance at PT Indocement Tunggal Prakarsa TBK26 pages

- The Effect of Debt Equity Ratio, Dividend Payout Ratio, and Profitability On The Firm ValueNo ratings yetThe Effect of Debt Equity Ratio, Dividend Payout Ratio, and Profitability On The Firm Value6 pages

- The Effect of Capital Structure and Agency Cost Towards ProfitabilityNo ratings yetThe Effect of Capital Structure and Agency Cost Towards Profitability19 pages

- Examining The Factors Affecting Firm Values: The Case of Listed Manufacturing Companies in IndonesiaNo ratings yetExamining The Factors Affecting Firm Values: The Case of Listed Manufacturing Companies in Indonesia11 pages

- ENGLISH ESOP Company Performance EvaluationNo ratings yetENGLISH ESOP Company Performance Evaluation15 pages

- Analysis of The Effects of Trade Receivable Policies, Funding Policies and Investment Policies on Company Profitability Case Study on PT. Astra International, Tbk, PT. Astra Otoparts, Tbk, And PT. Gajah Tunggal, TbkNo ratings yetAnalysis of The Effects of Trade Receivable Policies, Funding Policies and Investment Policies on Company Profitability Case Study on PT. Astra International, Tbk, PT. Astra Otoparts, Tbk, And PT. Gajah Tunggal, Tbk10 pages

- Mini Research Report Formulatrix SemarangNo ratings yetMini Research Report Formulatrix Semarang15 pages

- Devident Policy - The - Effect - of - Capital - Structure - Financial - PerformaNo ratings yetDevident Policy - The - Effect - of - Capital - Structure - Financial - Performa6 pages

- 45.+607-640+Anita,+Ratna+Fatmasari_The+Moderating+Effect+of+Corporate+GovernanceNo ratings yet45.+607-640+Anita,+Ratna+Fatmasari_The+Moderating+Effect+of+Corporate+Governance34 pages

- 20impact of Capital Structure On Firm Performance - Evidence From IndiaNo ratings yet20impact of Capital Structure On Firm Performance - Evidence From India6 pages

- NI LUH 2021 Company Value Profitability ROANo ratings yetNI LUH 2021 Company Value Profitability ROA11 pages

- Investment Decisions Funding Decisions and ActivitNo ratings yetInvestment Decisions Funding Decisions and Activit16 pages

- Ni Putu Ayu Yuniastri I Dewa Made Endiana Putu Diah KumalasariNo ratings yetNi Putu Ayu Yuniastri I Dewa Made Endiana Putu Diah Kumalasari11 pages

- Dividend Policy As A Mediator Between Profitability, Firm Size, and Firm Value in Indonesian Manufacturing CompaniesNo ratings yetDividend Policy As A Mediator Between Profitability, Firm Size, and Firm Value in Indonesian Manufacturing Companies5 pages

- Dangote Cement PLC Capital Structure and Financial Performance Link in Nigeria: Empirical AnalysisNo ratings yetDangote Cement PLC Capital Structure and Financial Performance Link in Nigeria: Empirical Analysis10 pages

- Annisa Ayunitha-Does The Good Corporate Governance Approach PDFNo ratings yetAnnisa Ayunitha-Does The Good Corporate Governance Approach PDF11 pages

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- Tutorial 3 - Thermodynamics 2022 Answers - SuggestedNo ratings yetTutorial 3 - Thermodynamics 2022 Answers - Suggested8 pages

- Table Z Troubleshooting Chart For Air ConditionersNo ratings yetTable Z Troubleshooting Chart For Air Conditioners7 pages

- 1971 1974 FIAT 1.6L 1.8L Banda de TiempoNo ratings yet1971 1974 FIAT 1.6L 1.8L Banda de Tiempo2 pages

- CIGRE 2012: 21, Rue D'artois, F-75008 PARISNo ratings yetCIGRE 2012: 21, Rue D'artois, F-75008 PARIS6 pages

- Questions To Answer: The Distance Moved by The Bubble Along The Graduated PipetteNo ratings yetQuestions To Answer: The Distance Moved by The Bubble Along The Graduated Pipette7 pages

- November 2023 (v2) QP - Paper 2 CAIE Chemistry IGCSENo ratings yetNovember 2023 (v2) QP - Paper 2 CAIE Chemistry IGCSE16 pages

- The Effect of Capital Expenditure Company Growth AThe Effect of Capital Expenditure Company Growth A

- The Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableThe Influence of Financial Performance On Company Value With Capital Structure As A Mediation Variable

- Effect of Capital Structure and Sales Growth On Firm Value With Profitability As MediationEffect of Capital Structure and Sales Growth On Firm Value With Profitability As Mediation

- IJEBD, Eko Edy Susanto, Anita de Grave, Dan Bambang PrihanantoIJEBD, Eko Edy Susanto, Anita de Grave, Dan Bambang Prihananto

- The Effect of Profitability, Capital Structure, Company Size, and Dividend Policy On Company Value On The Indonesia Stock ExchangeThe Effect of Profitability, Capital Structure, Company Size, and Dividend Policy On Company Value On The Indonesia Stock Exchange

- Effect of Company Size, Profitability and Capital Structure On Firm Value in IndonesiaEffect of Company Size, Profitability and Capital Structure On Firm Value in Indonesia

- Mediation Effects of Capital Structure and Profitability On The Influence of Sales Growth On Firm Value in Consumer Goods CompaniesMediation Effects of Capital Structure and Profitability On The Influence of Sales Growth On Firm Value in Consumer Goods Companies

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data Analysis

- The Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in BangladeshThe Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in Bangladesh

- Capital Structure and Firm Size On Firm Value Moderated by ProfitabilityCapital Structure and Firm Size On Firm Value Moderated by Profitability

- The Influence and On Financial Performance at PT Indocement Tunggal Prakarsa TBKThe Influence and On Financial Performance at PT Indocement Tunggal Prakarsa TBK

- The Effect of Debt Equity Ratio, Dividend Payout Ratio, and Profitability On The Firm ValueThe Effect of Debt Equity Ratio, Dividend Payout Ratio, and Profitability On The Firm Value

- The Effect of Capital Structure and Agency Cost Towards ProfitabilityThe Effect of Capital Structure and Agency Cost Towards Profitability

- Examining The Factors Affecting Firm Values: The Case of Listed Manufacturing Companies in IndonesiaExamining The Factors Affecting Firm Values: The Case of Listed Manufacturing Companies in Indonesia

- Analysis of The Effects of Trade Receivable Policies, Funding Policies and Investment Policies on Company Profitability Case Study on PT. Astra International, Tbk, PT. Astra Otoparts, Tbk, And PT. Gajah Tunggal, TbkAnalysis of The Effects of Trade Receivable Policies, Funding Policies and Investment Policies on Company Profitability Case Study on PT. Astra International, Tbk, PT. Astra Otoparts, Tbk, And PT. Gajah Tunggal, Tbk

- Devident Policy - The - Effect - of - Capital - Structure - Financial - PerformaDevident Policy - The - Effect - of - Capital - Structure - Financial - Performa

- 45.+607-640+Anita,+Ratna+Fatmasari_The+Moderating+Effect+of+Corporate+Governance45.+607-640+Anita,+Ratna+Fatmasari_The+Moderating+Effect+of+Corporate+Governance

- 20impact of Capital Structure On Firm Performance - Evidence From India20impact of Capital Structure On Firm Performance - Evidence From India

- Investment Decisions Funding Decisions and ActivitInvestment Decisions Funding Decisions and Activit

- Ni Putu Ayu Yuniastri I Dewa Made Endiana Putu Diah KumalasariNi Putu Ayu Yuniastri I Dewa Made Endiana Putu Diah Kumalasari

- Dividend Policy As A Mediator Between Profitability, Firm Size, and Firm Value in Indonesian Manufacturing CompaniesDividend Policy As A Mediator Between Profitability, Firm Size, and Firm Value in Indonesian Manufacturing Companies

- Dangote Cement PLC Capital Structure and Financial Performance Link in Nigeria: Empirical AnalysisDangote Cement PLC Capital Structure and Financial Performance Link in Nigeria: Empirical Analysis

- Annisa Ayunitha-Does The Good Corporate Governance Approach PDFAnnisa Ayunitha-Does The Good Corporate Governance Approach PDF

- How to Align Employee Targets to the StrategyFrom EverandHow to Align Employee Targets to the Strategy

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance Sector

- Tutorial 3 - Thermodynamics 2022 Answers - SuggestedTutorial 3 - Thermodynamics 2022 Answers - Suggested

- Table Z Troubleshooting Chart For Air ConditionersTable Z Troubleshooting Chart For Air Conditioners

- Questions To Answer: The Distance Moved by The Bubble Along The Graduated PipetteQuestions To Answer: The Distance Moved by The Bubble Along The Graduated Pipette

- November 2023 (v2) QP - Paper 2 CAIE Chemistry IGCSENovember 2023 (v2) QP - Paper 2 CAIE Chemistry IGCSE