Ucs Factsheet

Ucs Factsheet

Uploaded by

Douglas AshburnCopyright:

Available Formats

Ucs Factsheet

Ucs Factsheet

Uploaded by

Douglas AshburnOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Ucs Factsheet

Ucs Factsheet

Uploaded by

Douglas AshburnCopyright:

Available Formats

Commodity Futures Trading Commission

Office of Public Affairs

Three Lafayette Centre

1155 21st Street, NW

Washington, DC 20581

www.cftc.gov

Proposed Rule on Protection of Collateral

of Counterparties to Uncleared Swaps

The Commodity Futures Trading Commission (Commission) is proposing rules establishing regulations concerning

protection of collateral of counterparties to uncleared swaps, and other matters.

Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act)

Section 724(c) of the Dodd-Frank Act amends the Commodity Exchange Act (CEA) by inserting a new section

4s(1), which requires that swap dealers (SDs) and major swap participants (MSPs) notify their counterparties

that such counterparties have a right to require that any initial margin which they post to guarantee uncleared

swaps be segregated at an independent custodian.

Requirements for a Segregated Account

If a counterparty elects segregation for its initial margin, the account must be held at a custodian that is

independent of both the counterparty and the SD or MSP. There must be a written custody agreement

between the counterparty posting the initial margin, the SD or MSP, and the custodian, which meets certain

minimum standards of clarity.

Investment of Segregated Margin

The proposed regulations provide that segregated margin may only be invested pursuant to the Commission’s

Rule 1.25, which governs investment of customer property of futures customers. The proposed regulations do

not, however, limit the types of margin collateral that a customer may post. Nor do they limit any commercial

arrangements between the parties concerning allocation of gains and losses resulting from such investments.

Other Matters

Section 713(c) of the Dodd-Frank Act added Section 20(c) of the CEA, which specifies that the Commission

“shall exercise its authority to ensure that securities held in a portfolio margining account carried as a futures

account are customer property and the owners of those accounts are customers for the purposes of” the

commodity broker provisions of the Bankruptcy Code. The Commission proposes amendments to its Part 190

Regulations (concerning commodity broker bankruptcies) that clarify those points.

Public Law 111-16, the Statutory Time-Periods Technical Amendments Act of 2009, changed (among other

things) the time period in the commodity broker provisions of the Bankruptcy Code during which the

Commission could approve a transfer of customer funds in a commodity broker bankruptcy from five business

days to seven calendar days. The Commission is proposing amendments to its Part 190 Regulations to

conform to that statutory change.

Commodity Futures Trading Commission ♦ Office of Public Affairs ♦ 202-418-5080

You might also like

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- AS 9706 Theory FINALDocument11 pagesAS 9706 Theory FINALNew Id0% (1)

- EMI ProjectDocument27 pagesEMI Projectasta1234100% (7)

- Ucs QaDocument1 pageUcs QaDouglas AshburnNo ratings yet

- SDMSPT FactsheetDocument1 pageSDMSPT FactsheetMarketsWikiNo ratings yet

- SB FactsheetDocument2 pagesSB FactsheetMarketsWikiNo ratings yet

- Dcodpcp QaDocument1 pageDcodpcp QaMarketsWikiNo ratings yet

- Federal Register / Vol. 77, No. 162 / Tuesday, August 21, 2012 / Proposed RulesDocument19 pagesFederal Register / Vol. 77, No. 162 / Tuesday, August 21, 2012 / Proposed RulesMarketsWikiNo ratings yet

- Federal Register 102312Document413 pagesFederal Register 102312MarketsWikiNo ratings yet

- Federalregister 022411 BDocument38 pagesFederalregister 022411 BMarketsWikiNo ratings yet

- PCTCP QaDocument1 pagePCTCP QaMarketsWikiNo ratings yet

- Ri QaDocument1 pageRi QaMarketsWikiNo ratings yet

- Credit Ratings FactsheetDocument1 pageCredit Ratings FactsheetMarketsWikiNo ratings yet

- 18-14 - 0 CFTC Advisory Letter On Virtual CurrencyDocument7 pages18-14 - 0 CFTC Advisory Letter On Virtual CurrencyCrowdfundInsiderNo ratings yet

- Proposed Rules: I. BackgroundDocument18 pagesProposed Rules: I. BackgroundMarketsWikiNo ratings yet

- Cacpocta QaDocument1 pageCacpocta QaMarketsWikiNo ratings yet

- Pest FactsheetDocument1 pagePest FactsheetMarketsWikiNo ratings yet

- Federal Register / Vol. 76, No. 26 / Tuesday, February 8, 2011 / Proposed RulesDocument13 pagesFederal Register / Vol. 76, No. 26 / Tuesday, February 8, 2011 / Proposed RulesMarketsWikiNo ratings yet

- U.S. Commodity Futures Trading Commission: Etter O Dvisories CtoberDocument6 pagesU.S. Commodity Futures Trading Commission: Etter O Dvisories CtoberMichaelPatrickMcSweeneyNo ratings yet

- Federalregister 042711 CDocument147 pagesFederalregister 042711 CMarketsWikiNo ratings yet

- Cs QaDocument1 pageCs QaMarketsWikiNo ratings yet

- Fbot FactsheetDocument2 pagesFbot FactsheetMarketsWikiNo ratings yet

- MFADocument6 pagesMFAMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Pest QaDocument1 pagePest QaMarketsWikiNo ratings yet

- Dco QaDocument1 pageDco QaMarketsWikiNo ratings yet

- 34 63825frDocument123 pages34 63825frMarketsWikiNo ratings yet

- Dcoim FactsheetDocument2 pagesDcoim FactsheetMarketsWikiNo ratings yet

- PCTCP FactsheetDocument2 pagesPCTCP FactsheetMarketsWikiNo ratings yet

- Federal Register / Vol. 77, No. 167 / Tuesday, August 28, 2012 / Rules and RegulationsDocument13 pagesFederal Register / Vol. 77, No. 167 / Tuesday, August 28, 2012 / Rules and RegulationsMarketsWikiNo ratings yet

- P1a FactsheetDocument2 pagesP1a FactsheetMarketsWikiNo ratings yet

- Federal Register / Vol. 76, No. 42 / Thursday, March 3, 2011 / Proposed RulesDocument5 pagesFederal Register / Vol. 76, No. 42 / Thursday, March 3, 2011 / Proposed RulesMarketsWikiNo ratings yet

- Creditratings QaDocument1 pageCreditratings QaMarketsWikiNo ratings yet

- Um FactsheetDocument2 pagesUm FactsheetMarketsWikiNo ratings yet

- RM FactsheetDocument2 pagesRM FactsheetMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Vol. 79 Friday, No. 192 October 3, 2014Document40 pagesCommodity Futures Trading Commission: Vol. 79 Friday, No. 192 October 3, 2014MarketsWikiNo ratings yet

- Black RockDocument4 pagesBlack RockMarketsWikiNo ratings yet

- Ecp FactsheetDocument2 pagesEcp FactsheetMarketsWikiNo ratings yet

- STRD QaDocument1 pageSTRD QaMarketsWikiNo ratings yet

- CR FactsheetDocument2 pagesCR FactsheetMarketsWikiNo ratings yet

- Cco FactsheetDocument1 pageCco FactsheetMarketsWikiNo ratings yet

- By Commission Website: Futures Industry AssociationDocument4 pagesBy Commission Website: Futures Industry AssociationMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Vol. 78 Tuesday, No. 107 June 4, 2013Document28 pagesCommodity Futures Trading Commission: Vol. 78 Tuesday, No. 107 June 4, 2013MarketsWikiNo ratings yet

- Via Electronic SubmissionDocument8 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- Craig Do No HueDocument15 pagesCraig Do No HueMarketsWikiNo ratings yet

- Futures Industry AssociationDocument8 pagesFutures Industry Associationenglishbob618No ratings yet

- SB QaDocument2 pagesSB QaMarketsWikiNo ratings yet

- RRDTR QaDocument1 pageRRDTR QaMarketsWikiNo ratings yet

- Sat QaDocument2 pagesSat QaMarketsWikiNo ratings yet

- MFA3Document8 pagesMFA3MarketsWikiNo ratings yet

- Proposed Rules: Commodity Futures Trading Commission 17 CFR Chapter IDocument5 pagesProposed Rules: Commodity Futures Trading Commission 17 CFR Chapter IMarketsWikiNo ratings yet

- Coi QaDocument1 pageCoi QaMarketsWikiNo ratings yet

- Tara HairstonDocument6 pagesTara HairstonMarketsWikiNo ratings yet

- Sat FactsheetDocument2 pagesSat FactsheetMarketsWikiNo ratings yet

- Federal Register / Vol. 76, No. 147 / Monday, August 1, 2011 / Proposed RulesDocument9 pagesFederal Register / Vol. 76, No. 147 / Monday, August 1, 2011 / Proposed RulesMarketsWikiNo ratings yet

- Eue Factsheet FinalDocument2 pagesEue Factsheet FinalDouglas AshburnNo ratings yet

- Pidtp FactsheetDocument1 pagePidtp FactsheetMarketsWikiNo ratings yet

- Re: Antidisruptive Practices Authority Proposed Interpretive OrderDocument9 pagesRe: Antidisruptive Practices Authority Proposed Interpretive OrderMarketsWikiNo ratings yet

- Re: Antidisruptive Practices Authority Contained in The Dodd-Frank Wall Street Reform and Consumer Protection Act RIN No. 3038-AD26Document6 pagesRe: Antidisruptive Practices Authority Contained in The Dodd-Frank Wall Street Reform and Consumer Protection Act RIN No. 3038-AD26MarketsWikiNo ratings yet

- Glba Factsheet FinalDocument2 pagesGlba Factsheet FinalMarketsWikiNo ratings yet

- William HenleyDocument3 pagesWilliam HenleyMarketsWikiNo ratings yet

- By Commission Website: Futures Industry AssociationDocument13 pagesBy Commission Website: Futures Industry AssociationMarketsWikiNo ratings yet

- Proposed Rules: (Regulation TT Docket No. R-1457) RIN 7100-AD-95Document10 pagesProposed Rules: (Regulation TT Docket No. R-1457) RIN 7100-AD-95Douglas AshburnNo ratings yet

- Exemptiveorder Factsheet FinalDocument2 pagesExemptiveorder Factsheet FinalDouglas AshburnNo ratings yet

- Eue Factsheet FinalDocument2 pagesEue Factsheet FinalDouglas AshburnNo ratings yet

- Eue Qa FinalDocument1 pageEue Qa FinalDouglas AshburnNo ratings yet

- Securities and Exchange Commission: Vol. 77 Wednesday, No. 124 June 27, 2012Document35 pagesSecurities and Exchange Commission: Vol. 77 Wednesday, No. 124 June 27, 2012Douglas AshburnNo ratings yet

- Federal Register 070312Document23 pagesFederal Register 070312Douglas AshburnNo ratings yet

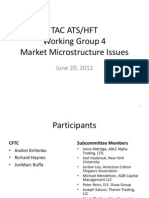

- WG 4 Presentation 062012Document9 pagesWG 4 Presentation 062012Douglas AshburnNo ratings yet

- Wg2presentation1 062012Document17 pagesWg2presentation1 062012Douglas AshburnNo ratings yet

- Federal Register / Vol. 77, No. 122 / Monday, June 25, 2012 / Rules and RegulationsDocument1 pageFederal Register / Vol. 77, No. 122 / Monday, June 25, 2012 / Rules and RegulationsDouglas AshburnNo ratings yet

- Federal Register / Vol. 77, No. 124 / Wednesday, June 27, 2012 / Proposed RulesDocument8 pagesFederal Register / Vol. 77, No. 124 / Wednesday, June 27, 2012 / Proposed RulesDouglas AshburnNo ratings yet

- WG 1 Presentation 062012Document10 pagesWG 1 Presentation 062012Douglas AshburnNo ratings yet

- WG 3 Presentation 062012Document12 pagesWG 3 Presentation 062012Douglas AshburnNo ratings yet

- CCD Tac CMRM Factsheet FinalDocument2 pagesCCD Tac CMRM Factsheet FinalDouglas AshburnNo ratings yet

- Bruce SternDocument5 pagesBruce SternDouglas AshburnNo ratings yet

- Writer's Direct Dial +1 212 225 2820Document37 pagesWriter's Direct Dial +1 212 225 2820Douglas AshburnNo ratings yet

- Proposed Rules: WWW - Regulations.gov. Follow TheDocument8 pagesProposed Rules: WWW - Regulations.gov. Follow TheDouglas AshburnNo ratings yet

- Financials Infosys Last 5 Years Annual Revenue History and Growth RateDocument7 pagesFinancials Infosys Last 5 Years Annual Revenue History and Growth RateDivyavadan MateNo ratings yet

- AP Macroeconomics: Fun!!! With The MPC, MPS, and MultipliersDocument29 pagesAP Macroeconomics: Fun!!! With The MPC, MPS, and MultipliersHonya ElfayoumyNo ratings yet

- Fin440 Chapter 4Document23 pagesFin440 Chapter 4sajedulNo ratings yet

- Industrial Sector of PakistanDocument35 pagesIndustrial Sector of PakistanAwan NadiaNo ratings yet

- Financial Ratios and The State of Health of Nigerian BanksDocument15 pagesFinancial Ratios and The State of Health of Nigerian BanksvatsonwizzluvNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Lahore University of Management Sciences ACCT 100 - Principles of Financial AccountingDocument6 pagesLahore University of Management Sciences ACCT 100 - Principles of Financial AccountingAli Zain ParharNo ratings yet

- Module 2 Math of InvestmentDocument17 pagesModule 2 Math of InvestmentvlythevergreenNo ratings yet

- Q1 Busfin PT 2021-2022Document10 pagesQ1 Busfin PT 2021-2022Romano AbalosNo ratings yet

- The Role of Financial Behavior in Mediating The Influence of Socioeconomic Characteristics and Neurotic Personality Traits On Financial SatisfactionDocument21 pagesThe Role of Financial Behavior in Mediating The Influence of Socioeconomic Characteristics and Neurotic Personality Traits On Financial SatisfactionSamuel HasibuanNo ratings yet

- Assignment Subsequent To Date of AcquisitionDocument5 pagesAssignment Subsequent To Date of AcquisitionTrelle DiazNo ratings yet

- PIYUSHDocument58 pagesPIYUSHPiyush Chauhan100% (1)

- hp12c QcardDocument8 pageshp12c QcardWeera WuNo ratings yet

- MODULE 3 Step 1Document7 pagesMODULE 3 Step 1yugyeom rojasNo ratings yet

- Creative AccountingDocument6 pagesCreative AccountingBOBBY212No ratings yet

- Modyul 1 (Ikatlong Markahan)Document29 pagesModyul 1 (Ikatlong Markahan)delgadojudithNo ratings yet

- How Has This Company Returned Cash To Its Owners? Has It Paid Dividends or Bought Back Stock?Document3 pagesHow Has This Company Returned Cash To Its Owners? Has It Paid Dividends or Bought Back Stock?Mackaingar WalkerNo ratings yet

- IIFT 2011-13 Admission Test Solved PaperDocument64 pagesIIFT 2011-13 Admission Test Solved PaperRaghuNo ratings yet

- Bike ExchangeDocument184 pagesBike ExchangeJuan PerezNo ratings yet

- Cityland: Annual ReportDocument205 pagesCityland: Annual ReportBusinessWorldNo ratings yet

- Unit 3 Capital BudgetingDocument34 pagesUnit 3 Capital BudgetingRishikesh MundekarNo ratings yet

- Exam Real Estate Laws PDFDocument2 pagesExam Real Estate Laws PDFjade123_129100% (1)

- Assessment On Accounting For Shareholders' Equity: Problem Solving RequirementsDocument4 pagesAssessment On Accounting For Shareholders' Equity: Problem Solving RequirementsErika Mae LegaspiNo ratings yet

- International Financial AnalysisDocument36 pagesInternational Financial AnalysisPriyaGnaeswaran100% (1)

- People Make PlacesDocument41 pagesPeople Make PlacesStakeholders360No ratings yet

- Lesson 2-The Global Economy Objectives at The End of The Lesson, The Students Will Be Able ToDocument9 pagesLesson 2-The Global Economy Objectives at The End of The Lesson, The Students Will Be Able ToKen Iyan C.No ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet