Professional Documents

Culture Documents

Comparative Advantage: Increased Efficiency of Trading Globally

Comparative Advantage: Increased Efficiency of Trading Globally

Uploaded by

G & E ApparelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparative Advantage: Increased Efficiency of Trading Globally

Comparative Advantage: Increased Efficiency of Trading Globally

Uploaded by

G & E ApparelCopyright:

Available Formats

Comparative Advantage: Increased Efficiency of Trading

Globally

Global trade, in theory, allows wealthy countries to use their resources—whether labor,

technology, or capital— more efficiently. Because countries are endowed with different

assets and natural resources (land, labor, capital, and technology), some countries may

produce the same good more efficiently and therefore sell it more cheaply than other

countries. If a country cannot efficiently produce an item, it can obtain the item by

trading with another country that can. This is known as specialization in international

trade.

Let's take a simple example. Country A and Country B both produce cotton sweaters and

wine. Country A produces ten sweaters and ten bottles of wine a year while Country B

also produces ten sweaters and ten bottles of wine a year. Both can produce a total of 20

units without trading. Country A, however, takes two hours to produce the ten sweaters

and one hour to produce the ten bottles of wine (total of three hours). Country B, on the

other hand, takes one hour to produce ten sweaters and one hour to produce ten bottles of

wine (a total of two hours).

But these two countries realize by examining the situation that they could produce more,

in total, with the same amount of resources (hours) by focusing on those products with

which they have a comparative advantage. Country A then begins to produce only wine,

and Country B produces only cotton sweaters. Country A, by specializing in wine, can

produce 30 bottles of wine with its 3 hours of resources at the same rate of production per

hour of resource used (10 bottles per hour) before specialization. Country B, by

specializing in sweaters, can produce 20 sweaters with its 2 hours of resources at the

same rate of production per hour (10 sweaters per hour) before specialization. Total

output of both countries is now the same as before in terms of sweaters—20—but they

are making 10 bottles of wine more than if they did not specialize. This is the gain from

specialization that can result from trading. Country A can send 15 bottles of wine to

Country B for 10 sweaters and then each country is better off—10 sweaters and 15

bottles of wine each compared with 10 sweaters and 10 bottles of wine before trading.

Note that, in the example above, Country B could produce wine more efficiently than

Country A (less time) and sweaters as efficiently. This is called an absolute advantage in

wine production and at an equal cost in terms of sweaters. Country B may have these

advantages because of a higher level of technology. However, as the example shows

Country B can still benefit from specialization and trading with Country A.

The law of comparative advantage is popularly attributed to English political

economist David Ricardo and his book On the Principles of Political Economy and

Taxation in 1817, although it is likely that Ricardo's mentor James Mill originated the

analysis. David Ricardo famously showed how England and Portugal both benefit by

specializing and trading according to their comparative advantages. In this case, Portugal

was able to make wine at a low cost, while England was able to manufacture cloth

cheaply. Indeed, both countries had seen that it was to their advantage to stop their efforts

at producing these items at home and, instead, to trade with each other to acquire them.

A contemporary example: China’s comparative advantage with the United States is in the

form of cheap labor. Chinese workers produce simple consumer goods at a much lower

opportunity cost. The United States’ comparative advantage is in specialized, capital-

intensive labor. American workers produce sophisticated goods or investment

opportunities at lower opportunity costs. Specializing and trading along these lines

benefit each.

The theory of comparative advantage helps to explain why protectionism is typically

unsuccessful. Adherents to this analytical approach believe that countries engaged in

international trade will have already worked toward finding partners with comparative

advantages. If a country removes itself from an international trade agreement, if a

government imposes tariffs, and so on, it may produce a local benefit in the form of new

jobs and industry. However, this is not a long-term solution to a trade problem.

Eventually, that country will be at a disadvantage relative to its neighbors: countries that

were already better able to produce these items at a lower opportunity cost.

You might also like

- Sample Letter - Request To Remove Outdated InformationDocument2 pagesSample Letter - Request To Remove Outdated InformationJ Stocker100% (1)

- PUP JD Curriculum AY 2020 2021Document12 pagesPUP JD Curriculum AY 2020 2021Joseph CatabayNo ratings yet

- International Business Development GESI GuidelinesDocument27 pagesInternational Business Development GESI Guidelinesirwantoko100% (1)

- Theories of International BusinessDocument6 pagesTheories of International Businessrgayathri16100% (2)

- What Is International TradeDocument2 pagesWhat Is International TradeIngrid GarayNo ratings yet

- How International Trade WorksDocument4 pagesHow International Trade WorksfeNo ratings yet

- What Is International Trade?Document5 pagesWhat Is International Trade?Francisco J CarvajalNo ratings yet

- According To The Classical Theory of International TradeDocument5 pagesAccording To The Classical Theory of International TradeMukesh Lal100% (1)

- International EconomicsDocument23 pagesInternational EconomicsSantosh ChhetriNo ratings yet

- Absolute Advantage and Comp Cost AdvantageDocument33 pagesAbsolute Advantage and Comp Cost AdvantageWilson MorasNo ratings yet

- Comparative AdvantageDocument1 pageComparative AdvantageRahim MeghaniNo ratings yet

- International TradeDocument9 pagesInternational TradeParvesh Geerish100% (1)

- International Cha 2Document26 pagesInternational Cha 2felekebirhanu7No ratings yet

- The Theory of Comparative Advantage: Table 1Document4 pagesThe Theory of Comparative Advantage: Table 1KJ VillNo ratings yet

- International TradeDocument2 pagesInternational Tradeashley greyNo ratings yet

- Comparative Advantage: What Happens When A Country Has An Absolute Advantage in All GoodsDocument4 pagesComparative Advantage: What Happens When A Country Has An Absolute Advantage in All Goodsparamita tuladharNo ratings yet

- Comparative Advantage Theory of RicardoDocument5 pagesComparative Advantage Theory of RicardoBhavin PatelNo ratings yet

- Ricardo's Theory of Comparative Advantage - International TradeDocument10 pagesRicardo's Theory of Comparative Advantage - International TradeAnkita ShettyNo ratings yet

- Comparitive Advantage Theory FullDocument10 pagesComparitive Advantage Theory FullaakashsinghsolankiNo ratings yet

- National College of Business Administration & Economics: Reading 1Document4 pagesNational College of Business Administration & Economics: Reading 1Hamza HusnainNo ratings yet

- Need For International TradeDocument3 pagesNeed For International Tradeyasasrii45No ratings yet

- 14-International Trade TheoriesDocument24 pages14-International Trade Theoriesfrediz79100% (2)

- Trade NoteDocument5 pagesTrade Noteevelynna andrewNo ratings yet

- What Is International TradeDocument19 pagesWhat Is International TradeImran AzizNo ratings yet

- Comparative Cost AdvantageDocument4 pagesComparative Cost AdvantageSrutiNo ratings yet

- Basis of Intl - TradeDocument49 pagesBasis of Intl - TradeniranjaneratNo ratings yet

- CapitalDocument1 pageCapitalRahim MeghaniNo ratings yet

- Chapter-4.1 International TradeDocument9 pagesChapter-4.1 International TradeJeon KayttieeNo ratings yet

- International Trade TheoriesDocument26 pagesInternational Trade TheoriesparadeeptownNo ratings yet

- 2025 CFA SCH Prerequisite Program Notes and QbankDocument25 pages2025 CFA SCH Prerequisite Program Notes and QbankcraigsappletreeNo ratings yet

- Global Marketing - Class 2-14012020Document22 pagesGlobal Marketing - Class 2-14012020Sanket Sourav BalNo ratings yet

- An Analysis of Theories of International TradeDocument7 pagesAn Analysis of Theories of International TradeRummy 11No ratings yet

- Theory of MoneyDocument29 pagesTheory of MoneySaidislom SaidhonovNo ratings yet

- Ricardian Theory of Comparative AdvantageDocument6 pagesRicardian Theory of Comparative Advantagehajain53No ratings yet

- IT Final Ch.2.2024Document22 pagesIT Final Ch.2.2024Amgad ElshamyNo ratings yet

- WorkshopDocument8 pagesWorkshopScribdTranslationsNo ratings yet

- International Trade Is The Exchange of Goods and Services Between CountriesDocument2 pagesInternational Trade Is The Exchange of Goods and Services Between CountriesRukmini GottumukkalaNo ratings yet

- Theory of Comparative Advantage of International Trade: by David RicardoDocument10 pagesTheory of Comparative Advantage of International Trade: by David RicardoMansi PillayNo ratings yet

- IB Module 2Document9 pagesIB Module 2romnick g. cantaNo ratings yet

- International Trade TheoriesDocument47 pagesInternational Trade Theoriesdeoredevangi100% (1)

- International TradeDocument48 pagesInternational TradeBonny writerNo ratings yet

- Praktice 3.abs - Com.advDocument20 pagesPraktice 3.abs - Com.advСофи БреславецNo ratings yet

- Comparative Advantage TheoryDocument1 pageComparative Advantage TheoryShiela Mae SAANGNo ratings yet

- Comparative CostsDocument10 pagesComparative Costsmr_racchid1No ratings yet

- Lecture Note On Ecn 111-Analysis of International TradeDocument5 pagesLecture Note On Ecn 111-Analysis of International Tradewww.tobiwhiskeyNo ratings yet

- The Theory of Comparative AdvantageDocument8 pagesThe Theory of Comparative AdvantageKeir GaspanNo ratings yet

- 2 Classical International Trade TheoriesDocument55 pages2 Classical International Trade TheoriesRajiv PaulNo ratings yet

- Ricardo ArticleDocument2 pagesRicardo ArticleCarole McKennaNo ratings yet

- International Trade TheoryDocument7 pagesInternational Trade TheoryFiremandeheavenly InamenNo ratings yet

- Module 5 Notes - IEFT (Modified)Document18 pagesModule 5 Notes - IEFT (Modified)ammuttymalutty98No ratings yet

- Absolute Cost Advantage Trade TheoryDocument5 pagesAbsolute Cost Advantage Trade TheoryISsyndicateNo ratings yet

- What Is International TradeDocument6 pagesWhat Is International Traderash4ever2uNo ratings yet

- 20120223100254ECO 652 Chapter 2Document18 pages20120223100254ECO 652 Chapter 2kae7No ratings yet

- International Business ManagementDocument13 pagesInternational Business ManagementAshish KumarNo ratings yet

- International Trade TheoriesDocument27 pagesInternational Trade TheoriesMaddy ManojNo ratings yet

- IT Final Ch.1.2023Document16 pagesIT Final Ch.1.2023Amgad ElshamyNo ratings yet

- Difference Between Absolute and Comparative AdvantageDocument6 pagesDifference Between Absolute and Comparative AdvantageVũ Minh PhúcNo ratings yet

- David Ricardo's Theory of Comparative AdvantageDocument15 pagesDavid Ricardo's Theory of Comparative AdvantageclintonblouwNo ratings yet

- Absolute and Comparative AdvantageDocument2 pagesAbsolute and Comparative AdvantageCarla Mae F. DaduralNo ratings yet

- AbsoluteDocument2 pagesAbsoluteshahin317No ratings yet

- Comparative & Absolute AdvantageDocument2 pagesComparative & Absolute AdvantageJessalyn CabaelNo ratings yet

- The Theory of Comparative Advantage: Why specialisation is the key to successFrom EverandThe Theory of Comparative Advantage: Why specialisation is the key to successNo ratings yet

- Sss Services: Income Statement For The Year Ended December 31,201ADocument1 pageSss Services: Income Statement For The Year Ended December 31,201AG & E ApparelNo ratings yet

- NovelaDocument1 pageNovelaG & E ApparelNo ratings yet

- PS Music Journal Entries For The Month of July Date Account Title Post Ref. Debit Credit 11 31Document3 pagesPS Music Journal Entries For The Month of July Date Account Title Post Ref. Debit Credit 11 31G & E ApparelNo ratings yet

- OlleDocument1 pageOlleG & E ApparelNo ratings yet

- Human Resource Planning ProcessDocument3 pagesHuman Resource Planning ProcessG & E Apparel100% (1)

- Characteristics of PlanningDocument2 pagesCharacteristics of PlanningG & E ApparelNo ratings yet

- Model By-Laws For Primary Cooperatives in The PhilippinesDocument20 pagesModel By-Laws For Primary Cooperatives in The Philippinescarlos-tulali-1309100% (41)

- Elder Abuse - A Public Health PerspectiveDocument196 pagesElder Abuse - A Public Health PerspectiveFrancine100% (1)

- Nike Pestle AnalysisDocument10 pagesNike Pestle AnalysisAchal GoyalNo ratings yet

- Role of AI in Conducting Fair ElectionsDocument5 pagesRole of AI in Conducting Fair ElectionsManishaNo ratings yet

- Sample POLICY BRIEF DLSUDocument5 pagesSample POLICY BRIEF DLSURoel FabianNo ratings yet

- Culture and Language Are Deeply InterconnectedDocument7 pagesCulture and Language Are Deeply InterconnectedASSIANo ratings yet

- Contracts Test BankDocument5 pagesContracts Test BankDIOMARIS C. BASIONo ratings yet

- Lesson 1-Starting PointsDocument31 pagesLesson 1-Starting PointsMay-Ann S. CahiligNo ratings yet

- What Is Democracy? Why Democracy?: Very Short Answer Type QuestionsDocument16 pagesWhat Is Democracy? Why Democracy?: Very Short Answer Type QuestionsKaushiki ChakrabartyNo ratings yet

- Barreto Vs CA (Nego)Document1 pageBarreto Vs CA (Nego)Jani MisterioNo ratings yet

- Roque Quick Auditing Theory Chapter 10 PDFDocument69 pagesRoque Quick Auditing Theory Chapter 10 PDFSherene Faith Carampatan100% (1)

- Us Leadership Capability ModelingDocument6 pagesUs Leadership Capability ModelingLucky TalwarNo ratings yet

- Agustin V CA G.R. No. 162571 June 15, 2005Document1 pageAgustin V CA G.R. No. 162571 June 15, 2005JoeyBoyCruzNo ratings yet

- Manikad v. TanodbayanDocument1 pageManikad v. TanodbayanTasneem C Balindong100% (1)

- Test 1Document2 pagesTest 1tamusia1996No ratings yet

- 55 CIR v. Philex Mining Corp., G.R. No. 230016, November 23, 2020Document23 pages55 CIR v. Philex Mining Corp., G.R. No. 230016, November 23, 2020Lex LawNo ratings yet

- Cindefinido 2309 Castellano CDocument20 pagesCindefinido 2309 Castellano CnamoNo ratings yet

- Migration in Social Work, International SW, Human Trafficking and Cyber CrimeDocument37 pagesMigration in Social Work, International SW, Human Trafficking and Cyber CrimeElla CondezNo ratings yet

- GEE2 Module 1 - Sex and GenderDocument4 pagesGEE2 Module 1 - Sex and GenderGerald TamondongNo ratings yet

- CORONEL Vs CUNANANDocument2 pagesCORONEL Vs CUNANANMarkus Tran MoraldeNo ratings yet

- Shayan Zafar - 5th Year - Clinical III AssignmentDocument24 pagesShayan Zafar - 5th Year - Clinical III AssignmentShayan ZafarNo ratings yet

- DDGM MessageDocument7 pagesDDGM MessageSpongklong KulasNo ratings yet

- Mathematics Nine (9) Summative Assessment 9.4.3 I. MULTIPLE CHOICE. Choose The Correct Letter of Each ItemDocument3 pagesMathematics Nine (9) Summative Assessment 9.4.3 I. MULTIPLE CHOICE. Choose The Correct Letter of Each ItemGen-GenAlcantaraBaldadoNo ratings yet

- HBL-Vertical & Horizontal AnlyisDocument10 pagesHBL-Vertical & Horizontal AnlyismughalsairaNo ratings yet

- Title 8 - Crimes Against PersonsDocument6 pagesTitle 8 - Crimes Against PersonsAP CruzNo ratings yet

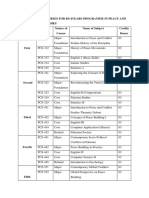

- BS Course OutlinesDocument3 pagesBS Course OutlinesAmir IqbalNo ratings yet

- Competence/#collapse - 1: Cultural Dimensions in Social WorkDocument7 pagesCompetence/#collapse - 1: Cultural Dimensions in Social WorkMarina PovedaNo ratings yet