0 ratings0% found this document useful (0 votes)

121 viewsBudgeted Lesson in Fabm1

Budgeted Lesson in Fabm1

Uploaded by

Marilyn Nelmida TamayoThis document outlines the budgeted lesson plan for Fundamentals of Accountancy, Business and Management 1 for the second semester of the 2017-2018 school year at SAN PEDRO APARTADO NATIONAL HIGH SCHOOL. The plan covers 12 topics related to accounting, including introduction to accounting, branches of accounting, users of accounting information, forms of business organizations, and the accounting cycle for service and merchandising businesses. Each topic includes the targeted learning competencies, estimated number of days to cover the topic, and the actual dates each topic will be taught.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Budgeted Lesson in Fabm1

Budgeted Lesson in Fabm1

Uploaded by

Marilyn Nelmida Tamayo0 ratings0% found this document useful (0 votes)

121 views5 pagesThis document outlines the budgeted lesson plan for Fundamentals of Accountancy, Business and Management 1 for the second semester of the 2017-2018 school year at SAN PEDRO APARTADO NATIONAL HIGH SCHOOL. The plan covers 12 topics related to accounting, including introduction to accounting, branches of accounting, users of accounting information, forms of business organizations, and the accounting cycle for service and merchandising businesses. Each topic includes the targeted learning competencies, estimated number of days to cover the topic, and the actual dates each topic will be taught.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document outlines the budgeted lesson plan for Fundamentals of Accountancy, Business and Management 1 for the second semester of the 2017-2018 school year at SAN PEDRO APARTADO NATIONAL HIGH SCHOOL. The plan covers 12 topics related to accounting, including introduction to accounting, branches of accounting, users of accounting information, forms of business organizations, and the accounting cycle for service and merchandising businesses. Each topic includes the targeted learning competencies, estimated number of days to cover the topic, and the actual dates each topic will be taught.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

121 views5 pagesBudgeted Lesson in Fabm1

Budgeted Lesson in Fabm1

Uploaded by

Marilyn Nelmida TamayoThis document outlines the budgeted lesson plan for Fundamentals of Accountancy, Business and Management 1 for the second semester of the 2017-2018 school year at SAN PEDRO APARTADO NATIONAL HIGH SCHOOL. The plan covers 12 topics related to accounting, including introduction to accounting, branches of accounting, users of accounting information, forms of business organizations, and the accounting cycle for service and merchandising businesses. Each topic includes the targeted learning competencies, estimated number of days to cover the topic, and the actual dates each topic will be taught.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

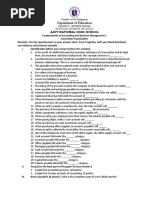

SAN PEDRO APARTADO NATIONAL HIGH SCHOOL

Brgy. San Pedro Apartado Alcala, Pangasinan 2425

Budgeted Lesson in Fundamentals of Accountancy, Business and Management 1

(Second Semester)

S.Y. 2017-2018

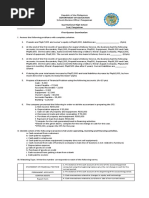

CONTENT LEARNING LC CODE Estimated Estimated Actual Target

COMPETENCIES no. of Days Days to be Days Days

to be taught taught

taught

1. Introduction to 1. define ABM_FABM11- 1 Nov. 2,

Accounting accounting 111a-1 2017

2. describe the ABM_FABM11- 1 Nov. 6,

nature of 111a-2 2017

accounting

3. explain the ABM_FABM11- 2 Nov. 7-

functions of 111a-3 8, 2017

accounting in

business

4. narrate the ABM_FABM11- 2 Nov.

history/origin of 111a-4 9,13,

accounting 2017

2. Branches of ABM_FABM11- 2 Nov. 14-

Accounting 1. differentiate 111a-5 15 2017

the branches of

accounting

ABM_FABM11- 2 Nov.

2. explain the 111a-6 16,20

kind/type of 2017

services rendered

in each of these

branches

3. Users of Accounting 1. define external ABM_FABM11- 1 Nov. 21,

Information users and gives 111a-7 2017

examples

2. define internal ABM_FABM11- 1 Nov. 22,

users and give 111a-8 2017

examples

3. Identify the ABM_FABM11- 1 Nov. 23,

type of decisions 111a-9 2017

made by each

group of users

4. describe the ABM_FABM11- 1 Nov. 27,

type of 111a-10 2017

information

needed by each

group of users

4. Forms of Business 1 Nov. 28,

Organizations 2017

1.differentiate the

forms of business

organization ABM_FABM11-

111b-11

2. Identify the ABM_FABM11- 1 Nov. 29,

advantages and 111b-12 2017

disadvantages of

each form

5. Types of Business 1. compare and ABM_FABM11- 2 Dec. 4-

According to Activities contrast the types 111b-13 5 , 2017

of business

according to

activities

2. identify the ABM_FABM11- 1 Dec. 6,

advantages, 111b-14 2017

disadvantages

and business

requirements of

each type

6. Accounting 1. explain the ABM_FABM11- 1 Dec. 7,

Concepts and varied accounting 111b-c-15 2017

Principles concepts and

principles

2. solve exercises ABM_FABM11- 1 Dec.11,

on accounting 111b-c-16 2017

principles as

applied in various

cases

7. The Accounting ABM_FABM11- 3 Dec. 12-

Equation 1.illustrate the 111b-c-17 14 2017

accounting

equation

2. perform ABM_FABM11- 3 Dec. 18-

operations 111b-c-18 20, 2017

involving simple

cases with the use

of accounting

equation

8. Types of Major 1.discuss the five ABM_FABM11- 1 Jan. 3,

Accounts major accounts 111d-e-19 2017

2. cite examples ABM_FABM11- 1 Jan. 4 ,

of each type of 111d-e-20 2017

account

3. prepare a chart ABM_FABM11- 1 Jan. 8,

of accounts 111d-e-21 2017

9. Books of Accounts 1. identify the ABM_FABM11- 2 Jan. 9-

uses of the two 111f-22 10, 2018

books of accounts

2. illustrate the ABM_FABM11- 2 Jan.

format of a 111f-23 11,15,

general and 2018

subsidiary

journals

3. illustrate the ABM_FABM11- 2 Jan. 16-

format of a 111f-24 17, 2018

general and

subsidiary ledger

10. Business 1.describe the ABM_FABM11- 1 Jan. 18,

Transactions and Their nature and gives 111g-j25 2018

Analysis as Applied to examples of

the Accounting Cycle business

of a Service Business transactions

a. Rules of

Debits and 2. identify the ABM_FABM11- 2 Jan. 22-

Credits different types of 111g-j26 23, 2018

b. Journalizing business

c. Posting documents

d. Preparation of

a Trial Balance 3. analyze ABM_FABM11- 2 Jan. 24-

common business 111g-j27 25, 2018

transactions using

the rules of debit

and credit

4. solve simple ABM_FABM11- 2 Jan. 29-

problems and 111g-j28 30, 2018

exercises in the

analyses of

business

transaction

11. Business 1. describes the ABM_FABM11- 1 Jan. 31,

Transactions and Their nature of 1Va-d-29 2018

Analysis as Applied to transactions in a

the Accounting Cycle service business

of a Service Business

a. Adjusting 2. records ABM_FABM11- 1 Feb. 1,

Entries transactions of a 1Va-d-30 2018

b. Adjusted Trial service business

Balance in the general

c. Preparation of journal

Basic Financial

Statements 3. posts ABM_FABM11- 2 Feb. 5-6,

(Income transactions in 1Va-d-31 2018

Statement) the ledger

4. prepares a trial ABM_FABM11- 2 Feb. 7-8,

balance 1Va-d-32 2018

5. prepares ABM_FABM11- 2 Feb. 12-

adjusting entries 1Va-d-33 13, 2018

6. complete the ABM_FABM11- 2 Feb. 14-

accounting cycle 1Va-d-34 15, 2018

12. Accounting Cycle 1.describes the ABM_FABM11- 2 Feb. 19-

of a Merchandising nature of 1Ve-j-35 20, 2018

Business transactions in a

merchandising

business

2. records ABM_FABM11- 2 Feb. 21-

transactions of a 1Ve-j-36 22, 2018

merchandizing

business in the

general and

special journals

3. posts ABM_FABM11- 3 Feb. 26-

transactions in 1Ve-j-37 28, 2018

the general and

subsidiary ledgers

4. prepares a trial ABM_FABM11- 2 March

balance 1Ve-j-38 1,5,

2018

5. prepares ABM_FABM11- 3 March

adjusting entries 1Ve-j-39 6-8,,

2018

6. completes the ABM_FABM11- 2 March

accounting cycle 1Ve-j-40 12-13,

of a 2018

merchandising

business

7. prepares the ABM_FABM11- 2 March

Statement of Cost 1Ve-j-41 14-15,

of Goods Sold and 2018

Gross Profit

Prepared by: Checked by: Noted by:

MARILYN N. TAMAYO LANI O. BERCILES ARLENE A. ABIANG

SHS-Teacher II Head Teacher III Principal III

You might also like

- GB929D Application Framework R17.5.1 PDFDocument338 pagesGB929D Application Framework R17.5.1 PDFLuciano de Oliveira100% (5)

- 2ND Quarter Exam BUSINESS MATH 2019-2020Document3 pages2ND Quarter Exam BUSINESS MATH 2019-2020Marilyn Nelmida Tamayo100% (7)

- 1ST Quarter Exam BUSINESS MATH 2019-2020Document2 pages1ST Quarter Exam BUSINESS MATH 2019-2020Marilyn Nelmida Tamayo95% (19)

- Diagnostic Test in Business MathematicsDocument2 pagesDiagnostic Test in Business MathematicsMarilyn Nelmida Tamayo50% (2)

- Diagnostic Test 1ST Quarter Business Math-2019-2020Document3 pagesDiagnostic Test 1ST Quarter Business Math-2019-2020Marilyn Nelmida TamayoNo ratings yet

- Tos Fabm1 First Quarter 2018-2019Document10 pagesTos Fabm1 First Quarter 2018-2019Marilyn Nelmida TamayoNo ratings yet

- DLL Ucsp 2018Document63 pagesDLL Ucsp 2018Marilyn Nelmida Tamayo100% (1)

- CHAPTER 2 Advanced AcctgDocument62 pagesCHAPTER 2 Advanced AcctgRuth Grace Cads100% (2)

- Elan Guides Formula Sheet CFA 2013 Level 2Document91 pagesElan Guides Formula Sheet CFA 2013 Level 2Igor Tchounkovskii100% (2)

- Adidas AG - MarketLine-110916Document45 pagesAdidas AG - MarketLine-110916Shawn Marcuss BarretoNo ratings yet

- BLP - Fabm 2Document2 pagesBLP - Fabm 2Glaiza Dalayoan FloresNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelNo ratings yet

- Fundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Document2 pagesFundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Sheena RobiniolNo ratings yet

- ABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFDocument4 pagesABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFjhomalynNo ratings yet

- ABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFDocument4 pagesABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFNiel FelicildaNo ratings yet

- Business Finance Q3 Module 1Document11 pagesBusiness Finance Q3 Module 1Ahrcelie FranciscoNo ratings yet

- Fabm1 W1Document5 pagesFabm1 W1Glaiza Dalayoan FloresNo ratings yet

- Week 1 - Business MathDocument5 pagesWeek 1 - Business MathHerson MadrigalNo ratings yet

- BMathDocument7 pagesBMathMichael GallardoNo ratings yet

- Accounting Cycle - Transactions: Fundamentals of Accountancy Business and Management 1 11 3 QuarterDocument4 pagesAccounting Cycle - Transactions: Fundamentals of Accountancy Business and Management 1 11 3 QuarterPaulo Amposta CarpioNo ratings yet

- Business Finance - 12 - Third - Week 4Document10 pagesBusiness Finance - 12 - Third - Week 4AngelicaHermoParasNo ratings yet

- Grades 1 To 12 Daily Lesson Log: I. ObjectivesDocument3 pagesGrades 1 To 12 Daily Lesson Log: I. ObjectivesJeffrey CabralNo ratings yet

- q4 Abm Fundamentals of Abm1 11 Week 3Document6 pagesq4 Abm Fundamentals of Abm1 11 Week 3Judy Ann Villanueva100% (1)

- Academic Handouts Business Ethics and Social Responsibility Quarter 4, Week 1Document5 pagesAcademic Handouts Business Ethics and Social Responsibility Quarter 4, Week 1Ericka Dela CruzNo ratings yet

- Business Finance - 12 - Third - Week 5Document11 pagesBusiness Finance - 12 - Third - Week 5AngelicaHermoParasNo ratings yet

- Fabm 1 LeapDocument4 pagesFabm 1 Leapanna paulaNo ratings yet

- Department of Education: Region XII K To 12 Regional Mass TrainingDocument2 pagesDepartment of Education: Region XII K To 12 Regional Mass TrainingMary Grace Pagalan Ladaran0% (1)

- Abm 12 Marketing q1 Clas2 Relationship Marketing v1 - Rhea Ann NavillaDocument13 pagesAbm 12 Marketing q1 Clas2 Relationship Marketing v1 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Session 1 Session 2 Session 3 Session 4 Session 5: I. ObjectivesDocument3 pagesSession 1 Session 2 Session 3 Session 4 Session 5: I. ObjectivesLeighyo An MegastinoNo ratings yet

- Module 9 - Business MathematicsDocument8 pagesModule 9 - Business MathematicsLillibeth LumibaoNo ratings yet

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- DLL March 20-23 - EthicsDocument5 pagesDLL March 20-23 - EthicsJEANNE PAULINE OABELNo ratings yet

- Statement of Comprehensive Income (SCI) : Quarter 1 - Module 2Document21 pagesStatement of Comprehensive Income (SCI) : Quarter 1 - Module 2Aestherielle MartinezNo ratings yet

- DAILY LESSON LOG BUSMATH (Week 7)Document3 pagesDAILY LESSON LOG BUSMATH (Week 7)Edna Grace Abrera TerragoNo ratings yet

- Adacuna DLP Fabm1 Wk3 July 6, 2017 Accounting PrinciplesDocument6 pagesAdacuna DLP Fabm1 Wk3 July 6, 2017 Accounting PrinciplesALMA ACUNANo ratings yet

- DLL Fabm2Document4 pagesDLL Fabm2JEAN DELMORONo ratings yet

- Fabm1 Quarter4 Module 10 Week 2Document16 pagesFabm1 Quarter4 Module 10 Week 2Princess Nicole EsioNo ratings yet

- Fabm 1 LeapDocument4 pagesFabm 1 Leapanna paulaNo ratings yet

- Semi Detailed Lesson Plan in Businessmath Cot 2 Sy 2020 2021Document4 pagesSemi Detailed Lesson Plan in Businessmath Cot 2 Sy 2020 2021Maria Lourdes PunayNo ratings yet

- FABM 1 Lesson-6-Accounting-Concepts-and-PrinciplesDocument3 pagesFABM 1 Lesson-6-Accounting-Concepts-and-PrinciplesPrincess Smaeranza Campos-DulayNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Document12 pagesFundamentals of Accountancy, Business and Management 1 (FABM 1)trek boiNo ratings yet

- Department of Education: Placido T. Amo Senior High SchoolDocument6 pagesDepartment of Education: Placido T. Amo Senior High Schoolfermo ii ramosNo ratings yet

- Q4 Principles of Marketing 12 - Module 5 (W2)Document18 pagesQ4 Principles of Marketing 12 - Module 5 (W2)Oreo McflurryNo ratings yet

- DLP Fundamentals of Accounting 1 - Q3 - W5Document10 pagesDLP Fundamentals of Accounting 1 - Q3 - W5Daisy PaoNo ratings yet

- BM - DLL - Week 5Document3 pagesBM - DLL - Week 5Nimrod CabreraNo ratings yet

- Qms-thr-Form09 Test Questionnaire. Final ExamDocument11 pagesQms-thr-Form09 Test Questionnaire. Final Examroselle nepomucenoNo ratings yet

- Business Math Mod6Document16 pagesBusiness Math Mod6garagejade29No ratings yet

- 2FABM1 DLL Nov 13-16Document3 pages2FABM1 DLL Nov 13-16Marilyn Nelmida TamayoNo ratings yet

- Fabm1 Summative ExamDocument8 pagesFabm1 Summative ExamAbegail PanangNo ratings yet

- Worksheet-Business Mathematics - Quarter1 - Week4Document2 pagesWorksheet-Business Mathematics - Quarter1 - Week4Dearla BitoonNo ratings yet

- ABM Business Math CGDocument9 pagesABM Business Math CGMs. Nickabelle PelisigasNo ratings yet

- Action PlanDocument2 pagesAction PlanDr. Meinrad BautistaNo ratings yet

- Chapter 2 July 15-19Document3 pagesChapter 2 July 15-19Francesnova B. Dela PeñaNo ratings yet

- FABM2 Budget of WorkDocument14 pagesFABM2 Budget of Worknorilyn.alapad24No ratings yet

- ABM - FABM11-IIIg - J - 28Document2 pagesABM - FABM11-IIIg - J - 28Mary Grace Pagalan Ladaran0% (1)

- Fabm1 LPDocument2 pagesFabm1 LPRaul Soriano CabantingNo ratings yet

- Quarter 1 Week 2 - Organization and ManagementDocument11 pagesQuarter 1 Week 2 - Organization and ManagementRomnick MagdaraogNo ratings yet

- Business Math DLL Week 4 q2Document3 pagesBusiness Math DLL Week 4 q2Jemar AlipioNo ratings yet

- Business Math Q2 W1-W2Document3 pagesBusiness Math Q2 W1-W2Audrey Angelique AndradaNo ratings yet

- LAS 1 To 5 FABM 1 GAGALACDocument11 pagesLAS 1 To 5 FABM 1 GAGALACAira Venice GuyadaNo ratings yet

- Week 1 To 8Document54 pagesWeek 1 To 8Andrea Galang100% (1)

- Lessonm Plan For COTDocument6 pagesLessonm Plan For COTGizellen Guibone100% (1)

- FABM 1 Summative AssessmentDocument1 pageFABM 1 Summative AssessmentCest La Vie AsumbraNo ratings yet

- FABM1-11 q3 Mod2 Accountingconcepts Principles v5Document26 pagesFABM1-11 q3 Mod2 Accountingconcepts Principles v5Anna May Serador CamachoNo ratings yet

- Learning Area Grade Level Quarter Date I. Lesson Title Ii. Most Essential Learning Competencies (Melcs)Document4 pagesLearning Area Grade Level Quarter Date I. Lesson Title Ii. Most Essential Learning Competencies (Melcs)Paulo Amposta CarpioNo ratings yet

- Accounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Document10 pagesAccounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Marilyn Nelmida TamayoNo ratings yet

- Key To Correction FABM2Document4 pagesKey To Correction FABM2Jomar Villena100% (1)

- FABM1 - wk1 ReflectionDocument3 pagesFABM1 - wk1 ReflectionEmarilyn BayotNo ratings yet

- 09 Books of AccountsDocument17 pages09 Books of AccountsKezia Gwyneth Bofill Oris100% (1)

- Citations From Curriculum Guides Eng 8, Talosig, Cherry L. Sy 19-20Document4 pagesCitations From Curriculum Guides Eng 8, Talosig, Cherry L. Sy 19-20LORAINE LACERNA GAMMADNo ratings yet

- 5QUIZDocument3 pages5QUIZMarilyn Nelmida TamayoNo ratings yet

- Accounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Document10 pagesAccounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Marilyn Nelmida TamayoNo ratings yet

- Fabm 2 Module 1Document14 pagesFabm 2 Module 1Marilyn Nelmida TamayoNo ratings yet

- 4types of Major Accounts-For Observation2Document13 pages4types of Major Accounts-For Observation2Marilyn Nelmida TamayoNo ratings yet

- Introduction To Accounting: Fundamentals of Accountancy, Business and Management 1Document9 pagesIntroduction To Accounting: Fundamentals of Accountancy, Business and Management 1Marilyn Nelmida TamayoNo ratings yet

- Tos Business Math - MidtermsDocument4 pagesTos Business Math - MidtermsMarilyn Nelmida Tamayo100% (2)

- Mulitiple Choice ExamDocument32 pagesMulitiple Choice ExamMarilyn Nelmida TamayoNo ratings yet

- Binalonan San Pedro Apartado National High School Alcala, PangasinanDocument1 pageBinalonan San Pedro Apartado National High School Alcala, PangasinanMarilyn Nelmida TamayoNo ratings yet

- 4QUIZDocument3 pages4QUIZMarilyn Nelmida TamayoNo ratings yet

- 7e's DLL - BANK RECONCILIATION For Observation 10-15-19Document2 pages7e's DLL - BANK RECONCILIATION For Observation 10-15-19Marilyn Nelmida Tamayo100% (1)

- 3FABM1 DLL Nov 20-23Document5 pages3FABM1 DLL Nov 20-23Marilyn Nelmida TamayoNo ratings yet

- 2FABM1 DLL Nov 13-16Document3 pages2FABM1 DLL Nov 13-16Marilyn Nelmida TamayoNo ratings yet

- 2QUIZ1Document3 pages2QUIZ1Marilyn Nelmida Tamayo100% (1)

- 1st Quarter ExaminationDocument2 pages1st Quarter ExaminationMarilyn Nelmida TamayoNo ratings yet

- Tos Business Math - FinalsDocument5 pagesTos Business Math - FinalsMarilyn Nelmida Tamayo100% (1)

- 5MAJORACCOUNTS For ObservationDocument2 pages5MAJORACCOUNTS For ObservationMarilyn Nelmida TamayoNo ratings yet

- PPT3 Operations of DecimalsDocument2 pagesPPT3 Operations of DecimalsMarilyn Nelmida TamayoNo ratings yet

- 1FABM1 DLL Nov 6-9Document3 pages1FABM1 DLL Nov 6-9Marilyn Nelmida TamayoNo ratings yet

- 4cash Flow StatementDocument8 pages4cash Flow StatementMarilyn Nelmida TamayoNo ratings yet

- 2QUIZ3 - With AnswerDocument1 page2QUIZ3 - With AnswerMarilyn Nelmida Tamayo100% (1)

- 1SFP Problem SolvingDocument1 page1SFP Problem SolvingMarilyn Nelmida TamayoNo ratings yet

- 2nd Quarter Exam in Fabm1Document3 pages2nd Quarter Exam in Fabm1Marilyn Nelmida Tamayo100% (2)

- 7e's DLL - BOOKS OF ACCOUNTS For Observation3Document3 pages7e's DLL - BOOKS OF ACCOUNTS For Observation3Marilyn Nelmida Tamayo100% (1)

- 7e's DLL - BOOKS OF ACCOUNTS For Observation3Document3 pages7e's DLL - BOOKS OF ACCOUNTS For Observation3Marilyn Nelmida Tamayo100% (1)

- Effective Recruitment Selection Placement Development Maintenance UtilizationDocument9 pagesEffective Recruitment Selection Placement Development Maintenance UtilizationPrecious Jaimie AsisNo ratings yet

- Chapter 3 Static TestDocument26 pagesChapter 3 Static TestYONG LONG KHAWNo ratings yet

- JIT Visible Planning VGDocument40 pagesJIT Visible Planning VGdspinelliNo ratings yet

- 4 Loan Application FormDocument3 pages4 Loan Application FormNicholas Ochieng BagayokoNo ratings yet

- Data Sheet - Warehouse Management PDFDocument4 pagesData Sheet - Warehouse Management PDFWagner MontielNo ratings yet

- Acc 491Document7 pagesAcc 491Maitham_Ali_3219No ratings yet

- Bem102 7Document22 pagesBem102 7Mellisa AndileNo ratings yet

- 2013 Sapteched Canada Sessions Day 3Document3 pages2013 Sapteched Canada Sessions Day 3Gaurav BansalNo ratings yet

- DIREÇÃO-GERAL DA EDUCAÇÃO Company Profile - LISBOA, Portugal - Competitors, Financials & Contacts - Dun & BradstreetDocument4 pagesDIREÇÃO-GERAL DA EDUCAÇÃO Company Profile - LISBOA, Portugal - Competitors, Financials & Contacts - Dun & BradstreetAna CristaNo ratings yet

- PoM Ch3Document38 pagesPoM Ch3Nikola DraskovicNo ratings yet

- Department of Project Management: Addis AbabaDocument36 pagesDepartment of Project Management: Addis Ababatesfu dargeNo ratings yet

- Capital Market ScamsDocument19 pagesCapital Market Scamssaibangaru25No ratings yet

- Integrated Marketing Communications Term PaperDocument12 pagesIntegrated Marketing Communications Term Papernabil saifNo ratings yet

- Cost of Production Price Analysis Using Job Order Costing Method in CV. Alam Lestari JayaDocument5 pagesCost of Production Price Analysis Using Job Order Costing Method in CV. Alam Lestari JayaLinda RosiNo ratings yet

- Senior Accountant/Internal AuditorDocument2 pagesSenior Accountant/Internal Auditorapi-78734628No ratings yet

- Reg. No.: Q.P. Code: (18 BBA 29/18 BBACA 28/ 18 BBAIB 47/18 BBARM 41)Document6 pagesReg. No.: Q.P. Code: (18 BBA 29/18 BBACA 28/ 18 BBAIB 47/18 BBARM 41)AK GAMINGNo ratings yet

- Vendor System Audit Report (Final) - Technico Ind., Bawal (T043)Document17 pagesVendor System Audit Report (Final) - Technico Ind., Bawal (T043)Ankit SainiNo ratings yet

- Asset Management Council 1812 TAJ1204 PDFDocument27 pagesAsset Management Council 1812 TAJ1204 PDFSumayyia QamarNo ratings yet

- Paid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Document3 pagesPaid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Catherine Acutim100% (1)

- Account Statement PDF 1130011573627 20 December 2019Document5 pagesAccount Statement PDF 1130011573627 20 December 2019ady firansyahNo ratings yet

- Macro Mind Maps PDFDocument18 pagesMacro Mind Maps PDFVanshaj RajvanshiNo ratings yet

- SMM Evaluation ReportDocument11 pagesSMM Evaluation Reportapi-245635419No ratings yet

- My ResumeDocument2 pagesMy ResumeMohit KumarNo ratings yet

- IMG - Financial Accounting (New) - General Ledger Accounting (New) - Periodic Processing - Valuate - Define Valuation MethodsDocument17 pagesIMG - Financial Accounting (New) - General Ledger Accounting (New) - Periodic Processing - Valuate - Define Valuation MethodsJyotiraditya BanerjeeNo ratings yet

- How To Be Future Proof - 2nd Edn - 2019 - Pritam MahureDocument86 pagesHow To Be Future Proof - 2nd Edn - 2019 - Pritam Mahurepmahure98100% (1)

- HR Analytics and Digital HR Practices: Digitalization Post COVID-19Document293 pagesHR Analytics and Digital HR Practices: Digitalization Post COVID-19Abu anasNo ratings yet