Lecture Notes - IAS 40

Uploaded by

Muhammed NaqiLecture Notes - IAS 40

Uploaded by

Muhammed NaqiIAS 40 – Class notes

SCOPE

This standard does not apply to:

(a) biological assets related to agricultural activity (IAS 41); and

(b) mineral rights and mineral reserves such as oil, natural gas and similar non-regenerative resources

IMPORTANT DEFINITIONS

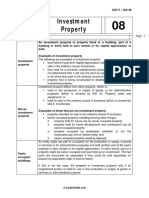

Investment property is property (land or a building or part of a building or both) held (by the owner or by

the lessee as a right-of-use asset) to earn rentals or for capital appreciation or both, rather than for:

(a) use in the production or supply of goods or services or for administrative purposes; or

(b) sale in the ordinary course of business.

Owner‑occupied property is property held (by the owner or by the lessee as a right-of-use asset) for use

in the production or supply of goods or services or for administrative purposes.

Important difference:

Investment property is held to earn rentals or for capital appreciation or both. Therefore, an investment

property generates cash flows largely independently of the other assets held by an entity. This

distinguishes investment property from owner‑occupied property. The production or supply of goods

or services (or the use of property for administrative purposes) generates cash flows that are

attributable not only to property, but also to other assets used in the production or supply process.

CLASSIFICATION OF PROPERTY

Examples of investment property

(a) land held for long‑term capital appreciation rather than for short‑term sale in the ordinary course of

business.

(b) land held for a currently undetermined future use. (If an entity has not determined that it will use the

land as owner‑occupied property or for short‑term sale in the ordinary course of business, the land is

regarded as held for capital appreciation.)

(c) a building owned by the entity (or a right-of-use asset relating to a building held by the entity) and

leased out under one or more operating leases.

(d) a building that is vacant but is held to be leased out under one or more operating leases.

(e) property that is being constructed or developed for future use as investment property.

Example of items that are not investment property

(a) property intended for sale in the ordinary course of business or in the process of construction or

development for such sale (see IAS 2 Inventories), for example, property acquired exclusively with a

view to subsequent disposal in the near future or for development and resale.

Nasir Abbas FCA Page 1 | 5

IAS 40 – Class notes

(b) owner‑occupied property (see IAS 16 and IFRS 16)

(c) property held for future use as owner‑occupied property

(d) property held for future development and subsequent use as owner‑occupied property

(e) property occupied by employees (whether or not the employees pay rent at market rates)

(f) owner‑occupied property awaiting disposal.

(g) property that is leased to another entity under a finance lease.

Intra-group property transfers:

In some cases, an entity owns property that is leased to, and occupied by, its parent or another

subsidiary. The property does not qualify as investment property in the consolidated financial

statements, because the property is owner‑occupied from the perspective of the group. However,

from the perspective of the entity that owns it, the property is investment property if it meets the

definition. Therefore, the lessor treats the property as investment property in its individual financial

statements.

Composite properties

1. If a property comprises of two portions; one is held to earn rentals or for capital appreciation and

other is held as owner occupied:

Portions can be sold or leased out under a Portions cannot be sold or leased out under a

finance lease separately: finance lease:

Portions are accounted for as “investment Property is accounted for as “investment

property” and “owner-occupied property” property”, if only an insignificant portion is

accordingly. owner-occupied.

2. If an entity provides services to the occupants of a property it holds:

If services are insignificant to the arrangement If services are significant to the arrangement as

as a whole: a whole:

Property is accounted for as “investment Property is accounted for as “owner-occupied

property”. property”.

[For example, when owner of the building [For example, if entity owns and manages a

provides security and maintenance services to hotel, services provided to guests are significant

the lessees] to the arrangement as a whole]

Nasir Abbas FCA Page 2 | 5

IAS 40 – Class notes

Subjectivity involved:

It may be difficult to determine whether ancillary services are so significant that a property does

not qualify as investment property. For example, the owner of a hotel sometimes transfers some

responsibilities to third parties under a management contract. The terms of such contracts vary

widely. At one end of the spectrum, the owner’s position may, in substance, be that of a passive

investor (i.e. investment property). At the other end of the spectrum, the owner may simply have

outsourced day‑to‑day functions while retaining significant exposure to variation in the cash flows

generated by the operations of the hotel (i.e. owner-occupied property).

RECOGNITION

An owned investment property shall be recognised as an asset when, and only when:

(a) it is probable that the future economic benefits that are associated with the investment property will

flow to the entity; and

(b) the cost of the investment property can be measured reliably.

MEASUREMENT – Initial

An owned investment property shall be measured initially at its cost. Transaction costs shall be included

in the initial measurement.

[Components of cost are same as earlier studied for property, plant and equipment IAS 16]

MEASUREMENT – Subsequent

An entity shall choose as its accounting policy either the fair value model or cost model and shall apply

that policy to all of its investment properties.

Fair value model

1. An entity shall measure all of its investment property at end of every year at fair value, except in the

case discussed below as “exception”.

2. When a lessee uses the fair value model to measure an investment property that is held as right-of-

use asset, it shall measure the right-of-use asset, and not the underlying property, at fair value.

3. Any gain or loss from change in fair value shall be recognized in profit or loss for the period. No

depreciation is charged.

4. In determining the carrying amount of investment property under the fair value model, an entity does

not double‑count assets or liabilities that are recognised as separate assets or liabilities. For example:

(a) equipment such as lifts or air‑conditioning is often an integral part of a building and is generally

included in the fair value of the investment property, rather than recognised separately as

property, plant and equipment.

(b) if an office is leased on a furnished basis, the fair value of the office generally includes the fair

value of the furniture, because the rental income relates to the furnished office. When furniture

is included in the fair value of investment property, an entity does not recognise that furniture as

a separate asset.

Nasir Abbas FCA Page 3 | 5

IAS 40 – Class notes

(c) the fair value of investment property excludes prepaid or accrued operating lease income,

because the entity recognises it as a separate liability or asset.

(d) the fair value of investment property held by a lessee as a right-of-use asset reflects expected

cash flows (including variable lease payments that are expected to become payable). Accordingly,

if a valuation obtained for a property is net of all payments expected to be made, it will be

necessary to add back any recognised lease liability, to arrive at the carrying amount of the

investment property using the fair value model.

Exception:

• If there is clear evidence at initial recognition of investment property, that the fair value of an

investment property is not reliably measurable on a continuing basis, the entity shall measure that

investment property using cost model and continue to apply cost model until disposal of the

property. The residual value shall be assumed to be zero.

• If any entity determines that the fair value of an investment property under construction is not

reliably measurable but expects the fair value to be reliably measurable when construction is

complete, it shall measure that property under construction at cost until the earlier of:

When its fair value becomes reliably measurable; or

When its construction is completed.

Cost model

It is same as studied in IAS 16, IFRS 5 or IFRS 16 whichever is applicable.

TRANSFERS

An entity shall transfer a property to, or from, investment property when, and only when, there is a change

in use. A change in use occurs when the property meets, or ceases to meet, the definition of investment

property and there is evidence of the change in use.

In isolation, a change in management’s intentions for the use of a property does not provide evidence of

a change in use.

Examples of evidence of a change in use include:

(a) commencement of owner‑occupation, or of development with a view to owner-occupation [transfer

from investment property to owner‑occupied property];

(b) commencement of development with a view to sale [transfer from investment property to

inventories];

(c) end of owner‑occupation [transfer from owner‑occupied property to investment property]; and

(d) inception of an operating lease to another party [transfer from inventories to investment property].

Nasir Abbas FCA Page 4 | 5

IAS 40 – Class notes

Transfer out

--------------------- Property is now transferred to -----------------------

Property was carried at: Inventory Owner-occupied property

Carrying amount of property as Carrying amount of property as

Cost model per IAS 40 is now considered as per IAS 40 is now considered as

cost of inventory carrying amount of owner-

occupied property.

Property is remeasured at fair Property is remeasured at fair

value at the date of transfer as value at the date of transfer as

per IAS 40. per IAS 40.

Fair value model

This fair value at the date of This fair value at the date of

transfer is deemed as cost of transfer is deemed as cost of

inventory. owner-occupied property.

Transfer in

--------------------- Property is transferred from -----------------------

Property will be carried at: Inventory Owner-occupied property

Carrying amount of inventory as Carrying amount of owner-

Cost model per IAS 2 is now considered as occupied property is now

cost of investment property considered as carrying amount

of investment property

Property is remeasured at fair Owner-occupied property is

value at the date of transfer and revalued to fair value in

resulting gain/loss is recognized accordance with revaluation

Fair value model in P&L. model of IAS 16.

(If revaluation surplus arises, it

This fair value at the date of stays there in equity till property

transfer is now the value of is subsequently disposed)

investment property.

This fair value at the date of

transfer is now the value of

investment property.

DERECOGNITION

It is same as studied in IAS 16.

Nasir Abbas FCA Page 5 | 5

You might also like

- Acudeen Investment Deck With Impact MetricsNo ratings yetAcudeen Investment Deck With Impact Metrics22 pages

- Investment Property Accounting StandardNo ratings yetInvestment Property Accounting Standard18 pages

- 3 - IAS 40 - Investment Property - SV PDFNo ratings yet3 - IAS 40 - Investment Property - SV PDF16 pages

- Topic 4 - Accounting For Derivative Instruments - A211100% (1)Topic 4 - Accounting For Derivative Instruments - A21194 pages

- Important Notes For Consolidation and Business CombinationNo ratings yetImportant Notes For Consolidation and Business Combination10 pages

- Managerial Accounting and The Business Environment: Chapter OneNo ratings yetManagerial Accounting and The Business Environment: Chapter One26 pages

- Chapter 6 Accounting For Franchise Operations - Franchisor-PROFE01No ratings yetChapter 6 Accounting For Franchise Operations - Franchisor-PROFE017 pages

- Module 05 - Inventories, Agricultural Assets and ImpairmentNo ratings yetModule 05 - Inventories, Agricultural Assets and Impairment21 pages

- Financial Reporting in Hyperinflationary EconomiesNo ratings yetFinancial Reporting in Hyperinflationary Economies7 pages

- Fair Value (Pfrs 13) :: PAS 41: AgricultureNo ratings yetFair Value (Pfrs 13) :: PAS 41: Agriculture2 pages

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)100% (1)Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)3 pages

- Chapter 4 Investment in Equity SecuritiesNo ratings yetChapter 4 Investment in Equity Securities8 pages

- Chapter 9 - Financial Reporting in Hyperinflationary Economies (Tagumpay, Caperal, Pegollo, Jimenez)No ratings yetChapter 9 - Financial Reporting in Hyperinflationary Economies (Tagumpay, Caperal, Pegollo, Jimenez)74 pages

- (Guide - 4) - Intro - S4HANA - Using - Global - Bike - Notes - FI - en - v4.2No ratings yet(Guide - 4) - Intro - S4HANA - Using - Global - Bike - Notes - FI - en - v4.213 pages

- Complete Topic 1 - Cost - Cost Classification100% (1)Complete Topic 1 - Cost - Cost Classification12 pages

- Q.6Articulation and How Financial Statements Articulate100% (1)Q.6Articulation and How Financial Statements Articulate1 page

- Chapter 3 - Statement of Financial Position and Income Statement75% (4)Chapter 3 - Statement of Financial Position and Income Statement28 pages

- Materials: Controlling, Costing, and PlanningNo ratings yetMaterials: Controlling, Costing, and Planning8 pages

- Chapter Three The Balance Sheet and Financial DisclosuresNo ratings yetChapter Three The Balance Sheet and Financial Disclosures33 pages

- Full Download Principles of Cost Accounting 17th Edition Vanderbeck Solutions Manual All Chapter 2024 PDF100% (23)Full Download Principles of Cost Accounting 17th Edition Vanderbeck Solutions Manual All Chapter 2024 PDF44 pages

- Advanced Accounting and Financial ReportingNo ratings yetAdvanced Accounting and Financial Reporting5 pages

- Data Science Course and Machine Learnign Using PythonNo ratings yetData Science Course and Machine Learnign Using Python3 pages

- Cheat Sheet Financial Statement ModellingNo ratings yetCheat Sheet Financial Statement Modelling8 pages

- Financial Accounting Volume 2 by Valix Soluti 1No ratings yetFinancial Accounting Volume 2 by Valix Soluti 13 pages

- BSE Company Research Report - Saurashtra Cement LTDNo ratings yetBSE Company Research Report - Saurashtra Cement LTD5 pages

- BIR RULING NO. 317-92: Sycip, Gorres, Velayo & CoNo ratings yetBIR RULING NO. 317-92: Sycip, Gorres, Velayo & Co3 pages

- ACT16H - Review for final exam - formatNo ratings yetACT16H - Review for final exam - format42 pages

- FIELD WORK (Vaibhav Mali and Khushi Jain)No ratings yetFIELD WORK (Vaibhav Mali and Khushi Jain)38 pages

- WinningStrategie toTradeSyntheticIndicesNo ratings yetWinningStrategie toTradeSyntheticIndices6 pages

- Capital Allowance 1. Condition To Get The Capital AllowanceNo ratings yetCapital Allowance 1. Condition To Get The Capital Allowance2 pages

- Tata Consultancy Tcs In: Positive Thesis Well On TrackNo ratings yetTata Consultancy Tcs In: Positive Thesis Well On Track8 pages

- Forte FutureInFinance Print Update PassNo ratings yetForte FutureInFinance Print Update Pass40 pages

- Auditing The Financing/Investing ProcessNo ratings yetAuditing The Financing/Investing Process34 pages

- Introductory Econometrics For Finance © Chris Brooks 2008 1No ratings yetIntroductory Econometrics For Finance © Chris Brooks 2008 117 pages

- Leadership Quiz Questions Answers - Quiz 1No ratings yetLeadership Quiz Questions Answers - Quiz 13 pages

- Topic 4 - Accounting For Derivative Instruments - A211Topic 4 - Accounting For Derivative Instruments - A211

- Important Notes For Consolidation and Business CombinationImportant Notes For Consolidation and Business Combination

- Managerial Accounting and The Business Environment: Chapter OneManagerial Accounting and The Business Environment: Chapter One

- Chapter 6 Accounting For Franchise Operations - Franchisor-PROFE01Chapter 6 Accounting For Franchise Operations - Franchisor-PROFE01

- Module 05 - Inventories, Agricultural Assets and ImpairmentModule 05 - Inventories, Agricultural Assets and Impairment

- Financial Reporting in Hyperinflationary EconomiesFinancial Reporting in Hyperinflationary Economies

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)

- Chapter 9 - Financial Reporting in Hyperinflationary Economies (Tagumpay, Caperal, Pegollo, Jimenez)Chapter 9 - Financial Reporting in Hyperinflationary Economies (Tagumpay, Caperal, Pegollo, Jimenez)

- (Guide - 4) - Intro - S4HANA - Using - Global - Bike - Notes - FI - en - v4.2(Guide - 4) - Intro - S4HANA - Using - Global - Bike - Notes - FI - en - v4.2

- Q.6Articulation and How Financial Statements ArticulateQ.6Articulation and How Financial Statements Articulate

- Chapter 3 - Statement of Financial Position and Income StatementChapter 3 - Statement of Financial Position and Income Statement

- Chapter Three The Balance Sheet and Financial DisclosuresChapter Three The Balance Sheet and Financial Disclosures

- Full Download Principles of Cost Accounting 17th Edition Vanderbeck Solutions Manual All Chapter 2024 PDFFull Download Principles of Cost Accounting 17th Edition Vanderbeck Solutions Manual All Chapter 2024 PDF

- Data Science Course and Machine Learnign Using PythonData Science Course and Machine Learnign Using Python

- BSE Company Research Report - Saurashtra Cement LTDBSE Company Research Report - Saurashtra Cement LTD

- Capital Allowance 1. Condition To Get The Capital AllowanceCapital Allowance 1. Condition To Get The Capital Allowance

- Tata Consultancy Tcs In: Positive Thesis Well On TrackTata Consultancy Tcs In: Positive Thesis Well On Track

- Introductory Econometrics For Finance © Chris Brooks 2008 1Introductory Econometrics For Finance © Chris Brooks 2008 1