Eveready Industries India Balance Sheet - in Rs. Cr.

Eveready Industries India Balance Sheet - in Rs. Cr.

Uploaded by

Jb SinghaCopyright:

Available Formats

Eveready Industries India Balance Sheet - in Rs. Cr.

Eveready Industries India Balance Sheet - in Rs. Cr.

Uploaded by

Jb SinghaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Eveready Industries India Balance Sheet - in Rs. Cr.

Eveready Industries India Balance Sheet - in Rs. Cr.

Uploaded by

Jb SinghaCopyright:

Available Formats

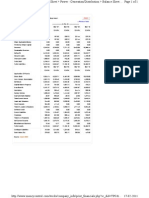

Eveready Industries India

Balance Sheet ------------------- in Rs. Cr. -------------------

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Sources Of Funds

Total Share Capital 35.87 36.34 36.34 36.34 36.34

Equity Share Capital 35.87 36.34 36.34 36.34 36.34

Share Application Money 0.00 5.52 2.61 2.61 0.00

Preference Share Capital 0.00 0.00 0.00 0.00 0.00

Reserves 475.43 470.24 427.47 446.87 587.46

Revaluation Reserves 122.89 104.64 86.59 68.72 43.40

Networth 634.19 616.74 553.01 554.54 667.20

Secured Loans 347.17 400.07 369.00 275.22 250.47

Unsecured Loans 31.70 58.83 32.70 21.18 34.25

Total Debt 378.87 458.90 401.70 296.40 284.72

Total Liabilities 1,013.06 1,075.64 954.71 850.94 951.92

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Application Of Funds

Gross Block 1,196.98 1,197.88 1,346.76 1,353.52 1,311.43

Less: Accum. Depreciation 337.50 373.11 441.90 480.73 476.28

Net Block 859.48 824.77 904.86 872.79 835.15

Capital Work in Progress 21.40 78.89 9.54 11.72 12.95

Investments 47.47 47.47 1.47 0.00 41.10

Inventories 202.76 175.71 191.76 170.04 202.12

Sundry Debtors 44.62 45.25 35.69 37.12 37.21

Cash and Bank Balance 5.59 15.91 31.11 10.03 6.72

Total Current Assets 252.97 236.87 258.56 217.19 246.05

Loans and Advances 52.61 84.27 84.11 56.40 74.03

Fixed Deposits 1.01 0.50 1.93 2.23 1.72

Total CA, Loans & Advances 306.59 321.64 344.60 275.82 321.80

Deffered Credit 0.00 0.00 0.00 0.00 0.00

Current Liabilities 175.95 148.18 270.28 295.19 219.79

Provisions 47.26 49.98 39.97 17.17 39.27

Total CL & Provisions 223.21 198.16 310.25 312.36 259.06

Net Current Assets 83.38 123.48 34.35 -36.54 62.74

Miscellaneous Expenses 1.34 1.03 4.49 2.98 0.00

Total Assets 1,013.07 1,075.64 954.71 850.95 951.94

Contingent Liabilities 41.92 38.80 33.66 38.29 39.23

Book Value (Rs) 71.27 69.69 63.81 66.48 85.82

Eveready Industries India

Profit & Loss account ------------------- in Rs. Cr. -------------------

Mar

Mar '07 Mar '08 Mar '09 Mar '10

'06

12

12 mths 12 mths 12 mths 12 mths

mths

Income

Sales Turnover 827.16 873.87 946.36 925.31 1,018.46

Excise Duty 99.87 101.34 99.18 67.98 44.31

Net Sales 727.29 772.53 847.18 857.33 974.15

Other Income 73.35 2.15 3.54 2.05 97.69

Stock Adjustments 60.98 -41.21 20.44 -34.93 26.29

Total Income 861.62 733.47 871.16 824.45 1,098.13

Expenditure

Raw Materials 501.97 477.03 580.89 517.34 619.39

Power & Fuel Cost 18.06 12.13 13.20 12.36 11.58

Employee Cost 65.52 70.46 70.54 79.11 75.99

Other Manufacturing Expenses 9.71 9.67 10.06 9.24 9.46

Selling and Admin Expenses 101.05 104.18 110.16 110.62 145.78

Miscellaneous Expenses 12.87 12.20 19.20 14.92 11.58

Preoperative Exp Capitalised -11.41 0.00 -2.56 -4.25 -0.67

Total Expenses 697.77 685.67 801.49 739.34 873.11

Mar

Mar '07 Mar '08 Mar '09 Mar '10

'06

12

12 mths 12 mths 12 mths 12 mths

mths

Operating Profit 90.50 45.65 66.13 83.06 127.33

PBDIT 163.85 47.80 69.67 85.11 225.02

Interest 45.37 41.36 53.92 42.09 35.15

PBDT 118.48 6.44 15.75 43.02 189.87

Depreciation 18.31 19.95 27.63 24.94 24.13

Other Written Off 0.94 1.07 2.17 2.79 3.00

Profit Before Tax 99.23 -14.58 -14.05 15.29 162.74

Extra-ordinary items 0.25 1.39 9.64 5.94 1.25

PBT (Post Extra-ord Items) 99.48 -13.19 -4.41 21.23 163.99

Tax 19.84 0.23 14.91 1.83 21.78

Reported Net Profit 79.66 -13.43 -19.32 19.40 142.21

Total Value Addition 195.80 208.64 220.60 222.00 253.71

Preference Dividend 0.00 0.00 0.00 0.00 0.00

Equity Dividend 14.45 0.00 0.00 0.00 3.63

Corporate Dividend Tax 2.03 0.00 0.00 0.00 0.60

Per share data (annualised)

Shares in issue (lakhs) 717.47 726.87 726.87 726.87 726.87

Earning Per Share (Rs) 11.10 -1.85 -2.66 2.67 19.56

Equity Dividend (%) 40.00 0.00 0.00 0.00 10.00

Book Value (Rs) 71.27 69.69 63.81 66.48 85.82

Eveready Industries India

Cash Flow ------------------- in Rs. Cr. -------------------

Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

12 mths 12 mths 12 mths 12 mths 12 mths

Net Profit Before Tax 99.49 -13.20 -4.41 17.98 163.99

Net Cash From Operating

7.97 36.58 176.47 132.73 96.87

Activities

Net Cash (used in)/from

13.92 -59.77 -56.79 -10.97 -62.03

Investing Activities

Net Cash (used in)/from

-26.77 33.00 -106.76 -142.55 -38.65

Financing Activities

Net (decrease)/increase In Cash

-4.88 9.82 12.92 -20.78 -3.82

and Cash Equivalents

Opening Cash & Cash

11.47 6.59 20.12 33.04 12.26

Equivalents

Closing Cash & Cash

6.59 16.41 33.04 12.26 8.44

Equivalents

Eveready Industries India

Key Financial Ratios ------------------- in Rs. Cr. -------------------

Mar

Mar '07 Mar '08 Mar '09 Mar '10

'06

Investment Valuation Ratios

Face Value 5.00 5.00 5.00 5.00 5.00

Dividend Per Share 2.00 -- -- -- 0.50

Operating Profit Per Share (Rs) 12.61 6.28 9.10 11.43 17.52

Net Operating Profit Per Share

101.37 106.28 116.55 117.95 134.02

(Rs)

Free Reserves Per Share (Rs) 49.98 48.67 41.13 44.01 63.40

Bonus in Equity Capital 67.52 66.64 66.64 66.64 66.64

Profitability Ratios

Operating Profit Margin(%) 12.44 5.90 7.80 9.68 13.07

Profit Before Interest And Tax 9.91 3.31 4.52 6.76 10.57

Margin(%)

Gross Profit Margin(%) 6.47 0.99 4.54 6.77 10.59

Cash Profit Margin(%) 13.45 0.84 0.11 4.80 7.36

Adjusted Cash Margin(%) 3.59 0.83 0.11 4.80 7.36

Net Profit Margin(%) 10.93 -1.73 -2.27 2.25 14.57

Adjusted Net Profit Margin(%) 0.95 -1.87 -2.27 2.25 14.57

Return On Capital

8.10 2.78 4.60 7.34 11.18

Employed(%)

Return On Net Worth(%) 15.58 -2.62 -4.20 4.04 22.79

Adjusted Return on Net

1.35 -2.87 -6.27 2.81 7.16

Worth(%)

Return on Assets Excluding

6.44 69.55 63.19 66.07 85.82

Revaluations

Return on Assets Including

7.15 83.95 75.10 75.52 91.79

Revaluations

Return on Long Term

9.43 3.28 5.26 8.14 12.36

Funds(%)

Liquidity And Solvency Ratios

Current Ratio 0.65 0.75 0.70 0.63 0.81

Quick Ratio 0.45 0.73 0.49 0.34 0.44

Debt Equity Ratio 0.74 0.91 0.87 0.61 0.46

Long Term Debt Equity Ratio 0.49 0.62 0.64 0.46 0.32

Debt Coverage Ratios

Interest Cover 1.63 0.67 0.77 1.41 3.05

Total Debt to Owners Fund 0.74 0.91 0.87 0.61 0.46

Financial Charges Coverage

2.01 1.16 1.29 2.02 3.66

Ratio

Financial Charges Coverage

3.18 1.18 1.19 2.12 5.82

Ratio Post Tax

Management Efficiency Ratios

Inventory Turnover Ratio 3.59 4.41 5.08 5.61 5.17

Debtors Turnover Ratio 20.97 17.19 20.93 23.55 26.21

Investments Turnover Ratio 4.20 5.15 5.08 5.61 5.17

Fixed Assets Turnover Ratio 8.98 7.65 1.27 1.27 1.54

Total Assets Turnover Ratio 3.42 2.63 4.45 8.19 4.22

Asset Turnover Ratio 1.40 1.48 1.27 1.27 1.54

Average Raw Material

38.34 52.91 40.20 61.70 53.81

Holding

Average Finished Goods Held 58.73 34.43 45.18 30.60 40.46

Number of Days In Working

41.27 57.54 14.60 -15.34 23.18

Capital

Profit & Loss Account Ratios

Material Cost Composition 69.01 61.75 68.56 60.34 63.58

Imported Composition of Raw

16.47 31.44 17.10 16.25 19.56

Materials Consumed

Selling Distribution Cost

10.15 10.26 9.69 9.52 11.82

Composition

Expenses as Composition of

1.31 1.84 1.89 2.05 1.84

Total Sales

Cash Flow Indicator Ratios

Dividend Payout Ratio Net

20.68 -- -- -- 2.98

Profit

Dividend Payout Ratio Cash

16.65 -- -- -- 2.50

Profit

-

Earning Retention Ratio -- -- 100.00 90.52

137.82

Cash Earning Retention Ratio 37.06 100.00 100.00 100.00 94.10

AdjustedCash Flow Times 14.47 70.98 407.45 7.18 3.96

Mar

Mar '07 Mar '08 Mar '09 Mar '10

'06

Earnings Per Share 11.10 -1.85 -2.66 2.67 19.56

Book Value 71.27 69.69 63.81 66.48 85.82

You might also like

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- SolucionesDocument3 pagesSolucionesangelaNo ratings yet

- 2 - Aditya - Balaji TelefilmsDocument12 pages2 - Aditya - Balaji Telefilmsrajat_singlaNo ratings yet

- 32 - Akshita - Sun Pharmaceuticals Industries.Document36 pages32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNo ratings yet

- Finance Satyam AnalysisDocument12 pagesFinance Satyam AnalysisNeha AgarwalNo ratings yet

- Balance Sheet of TCSDocument8 pagesBalance Sheet of TCSAmit LalchandaniNo ratings yet

- Balance Sheet of TCSDocument8 pagesBalance Sheet of TCSSurbhi LodhaNo ratings yet

- Balance Sheet - in Rs. Cr.Document72 pagesBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Asian Paints Money ControlDocument19 pagesAsian Paints Money ControlChiranth BhoopalamNo ratings yet

- Balance Sheet of Essar Oil: - in Rs. Cr.Document7 pagesBalance Sheet of Essar Oil: - in Rs. Cr.sonalmahidaNo ratings yet

- Arvind LTD: Balance Sheet Consolidated (Rs in CRS.)Document8 pagesArvind LTD: Balance Sheet Consolidated (Rs in CRS.)Sumit GuptaNo ratings yet

- Arch PharmalabsDocument6 pagesArch PharmalabsChandan VirmaniNo ratings yet

- 15 - Manish - DLFDocument8 pages15 - Manish - DLFrajat_singlaNo ratings yet

- Balance Sheet of Empee DistilleriesDocument4 pagesBalance Sheet of Empee DistilleriesArun PandiyanNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNo ratings yet

- Sagar CementsDocument33 pagesSagar Cementssarbjeetk21No ratings yet

- BajajDocument22 pagesBajajPulkit BlagganNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- Balance Sheet of Allahabad BankDocument26 pagesBalance Sheet of Allahabad BankMemoona RizviNo ratings yet

- Capital and Liabilities:: United Western BankDocument15 pagesCapital and Liabilities:: United Western BankAbhishek KarumbaiahNo ratings yet

- Balance Sheet of Gitanjali GemsDocument5 pagesBalance Sheet of Gitanjali GemsHarold GeorgeNo ratings yet

- Ambuja & ACC Final RatiosDocument23 pagesAmbuja & ACC Final RatiosAjay KudavNo ratings yet

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Document11 pages12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNo ratings yet

- Appl Ication Mon EyDocument14 pagesAppl Ication Mon EyDevesh PantNo ratings yet

- Apollo Hospitals Enterprises: PrintDocument2 pagesApollo Hospitals Enterprises: Printm kumarNo ratings yet

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaNo ratings yet

- FM WK 5 PmuDocument30 pagesFM WK 5 Pmupranjal92pandeyNo ratings yet

- Mar '05 Mar '06 12 Mths 12 Mths Sources ofDocument13 pagesMar '05 Mar '06 12 Mths 12 Mths Sources ofJack and Master of AllNo ratings yet

- Indian Oil Corporation LTDDocument50 pagesIndian Oil Corporation LTDpriyankagrawal7No ratings yet

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaNo ratings yet

- Indigo FSADocument8 pagesIndigo FSAKarthik AnanthNo ratings yet

- PCBL - Valuation 2Document6 pagesPCBL - Valuation 2Sagar SahaNo ratings yet

- Balance Sheet - in Rs. Cr.Document3 pagesBalance Sheet - in Rs. Cr.jelsiya100% (1)

- Balance Sheet of Cipla 1Document6 pagesBalance Sheet of Cipla 1anjalipawaskarNo ratings yet

- Balance Sheet of Larsen and Toubro: - in Rs. Cr.Document3 pagesBalance Sheet of Larsen and Toubro: - in Rs. Cr.Ashirvad MayekarNo ratings yet

- Balance Sheet of Balrampur Chini MillsDocument1 pageBalance Sheet of Balrampur Chini MillsAsrar Ahmed HamidaniNo ratings yet

- Lakshmi Machine Works: PrintDocument9 pagesLakshmi Machine Works: Printlaxmi joshiNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- Analysis of Financial StatementsDocument7 pagesAnalysis of Financial StatementsGlen ValereenNo ratings yet

- Term Paper Sandeep Anurag GautamDocument13 pagesTerm Paper Sandeep Anurag GautamRohit JainNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of FundsAbhisek SarkarNo ratings yet

- Hero Motocorp FinancialsDocument41 pagesHero Motocorp FinancialssahilkuNo ratings yet

- Financial Modelling CIA 2Document45 pagesFinancial Modelling CIA 2Saloni Jain 1820343No ratings yet

- Balance Sheet: Sources of FundsDocument7 pagesBalance Sheet: Sources of FundsAvanti GampaNo ratings yet

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978No ratings yet

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaNo ratings yet

- Balance Sheet of Apollo Tyres2010Document2 pagesBalance Sheet of Apollo Tyres2010shivamgupt18No ratings yet

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata MotorsVivek SinghNo ratings yet

- Ashok Leyland Ltd.Document9 pagesAshok Leyland Ltd.Debanjan MukherjeeNo ratings yet

- Aditya nuVODocument12 pagesAditya nuVOPriyanshi yadavNo ratings yet

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNo ratings yet

- Bob P&LDocument4 pagesBob P&Lindusingh6880No ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- HTTP WWW - MoneycontrolDocument1 pageHTTP WWW - MoneycontrolPavan PoliNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- CV Assignment - Agneesh DuttaDocument14 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- Adani PowerDocument9 pagesAdani PowerCa Aspirant Shaikh UsamaNo ratings yet

- Top Companies in Oil and Natural Gas SectorDocument24 pagesTop Companies in Oil and Natural Gas SectorSravanKumar IyerNo ratings yet

- Gujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Document128 pagesGujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Riya ShahNo ratings yet

- Signs Signals BarricadesDocument11 pagesSigns Signals BarricadesNauman AbbasiNo ratings yet

- People v. Melissa ChuaDocument1 pagePeople v. Melissa ChuaElaine Belle OgayonNo ratings yet

- Work Plan and Monitoring MatrixDocument8 pagesWork Plan and Monitoring MatrixromeeNo ratings yet

- CLI Commands Cisco Vs Juniper Router WilDocument8 pagesCLI Commands Cisco Vs Juniper Router Wiliqbal apriansyahNo ratings yet

- Isai Lopez-Hernandez, A046 620 341 (BIA Sept. 1, 2017)Document9 pagesIsai Lopez-Hernandez, A046 620 341 (BIA Sept. 1, 2017)Immigrant & Refugee Appellate Center, LLC100% (1)

- Liubov Denisova, Irina Mukhina - Rural Women in The Soviet Union and Post-Soviet RussiaDocument234 pagesLiubov Denisova, Irina Mukhina - Rural Women in The Soviet Union and Post-Soviet Russialuiz100% (1)

- Iron - Fly - (If) - Deploy - Thread - by - Suresh - Kumar047 - Dec 10, 22 - From - RattibhaDocument11 pagesIron - Fly - (If) - Deploy - Thread - by - Suresh - Kumar047 - Dec 10, 22 - From - RattibhasandeepNo ratings yet

- Personal Growth PlanDocument15 pagesPersonal Growth PlanShakes SM100% (1)

- 12 Distribution SystemDocument27 pages12 Distribution SystemPao Castillon100% (1)

- Agreement Between Builders Developers and Members of SocietyDocument10 pagesAgreement Between Builders Developers and Members of SocietyDeepak BhanushaliNo ratings yet

- 11804Document12 pages11804ayman saberNo ratings yet

- Summary of The Brief History of Mindanoa IslandDocument2 pagesSummary of The Brief History of Mindanoa IslandCristina RocheNo ratings yet

- 英文短剧格式范本Document6 pages英文短剧格式范本33427781No ratings yet

- SIP On Recruitment & Selection in HRM in Elcon Academy 2023 PDFDocument41 pagesSIP On Recruitment & Selection in HRM in Elcon Academy 2023 PDFMayuri PanditNo ratings yet

- Myanmar Business Guide PDFDocument109 pagesMyanmar Business Guide PDFMay HninNo ratings yet

- Research 2 Request Letter FinalDocument6 pagesResearch 2 Request Letter FinalJacqueline Acera BalingitNo ratings yet

- 92 People V SandiganbayanDocument2 pages92 People V SandiganbayanAnonymous cSksGWhANo ratings yet

- 6months statement-DESKTOP-30B06L9Document23 pages6months statement-DESKTOP-30B06L9karanracer001No ratings yet

- Janina NarrativeDocument24 pagesJanina NarrativeSheryl LlauderNo ratings yet

- Napoles Hazelle O. - FolkdanceDocument2 pagesNapoles Hazelle O. - FolkdanceHazelle NapolesNo ratings yet

- The Twitter CPDocument13 pagesThe Twitter CPDean DoneenNo ratings yet

- Dunes AdjustedDocument8 pagesDunes AdjustedbigkstrongNo ratings yet

- Economía Política Syllabus I JuradoDocument9 pagesEconomía Política Syllabus I JuradoFELIPENo ratings yet

- 2019 Remedial Law Bar QuestionsDocument8 pages2019 Remedial Law Bar QuestionsRecobd100% (4)

- Second Summative Test in English 8Document4 pagesSecond Summative Test in English 8Jane Jumawan100% (1)

- Assignment 3Document9 pagesAssignment 3api-472363434No ratings yet

- Middle Angular DeveloperDocument3 pagesMiddle Angular DeveloperAndreea IoteNo ratings yet

- Safety & JeeptechDocument19 pagesSafety & JeeptechCesar HinojosaNo ratings yet

- Susan Chong Becomes First Female President of Enterprise 50 AssociationDocument1 pageSusan Chong Becomes First Female President of Enterprise 50 AssociationWeR1 Consultants Pte LtdNo ratings yet