Audit of Construction Companies

Audit of Construction Companies

Uploaded by

nicole bancoroCopyright:

Available Formats

Audit of Construction Companies

Audit of Construction Companies

Uploaded by

nicole bancoroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Audit of Construction Companies

Audit of Construction Companies

Uploaded by

nicole bancoroCopyright:

Available Formats

1. Acceptance of client develops overall audit strategy.

Output audit plan

Focus of auditor: Planning aspect

1. Understanding the client. May specialty din ang construction companies.

2. Knowing the environment what is considered the peculiarity of the construction company.

3. Internal control

2. Planning stage the auditor must also consider the going concern capability of the client.

Conditions manifesting on the going concern. The more common danger signal: 1. Continuous

losses 2. Negative na ang she and net cash flow sa operating activities.

3. Audit output of audit committee. Usually 3 members one chairman. Sa kanila nag rereport ang

internal audit ng company si audit committee ang magfifinal assessment and will report on the

board of directors. Concern ng audit committee: financial reporting risk and judgement na part

ng fs. May impact sya sa external auditor.

INTERNAL CONTROL

After ng assessment ng audit risk deretcho sa evaluation of internal control. Focus on

construction company auditor:

1. Revenue process ng construction starts on biding. Focus dapat ni auditor na measure nya na may

reasonable assurance sa bids formulated dapat in compliance with the necessary requirement such as

estimated cost, revenue and profitability. Questionable if the company bids lower than the minimum

required. (Adequate documentation and verification especially the estimated cost)

2. Project management assuming nanalo sa bidding conducting the consruction. Walang nanakaw

walang wasted man power and walang delay. 10% ang dagdag if natapos ng maaga ang project if

government same din if delayed.

3. Substantive testing gathering of supporting evidence.

1. Visitng the job site.

2. Specific account title primary concerns such as contract cost estimates on biding, income

recognition (percentage of completion method), and last concentration on accounts receivables

specifically aging. (May retention policy and advance payment policy) meron pa din unbilled recievable

upon finish kelan mo sya pwedeng I bill? Basta may sales covered ng ifrs 15. Ang focus sa construction

company is the reasonable estimate, quantitative discussion according to standard, earning on

contracts, contracting progress and completed contract, disclosed dapat ang subsequent collection and

lastly the backlog of the company it means yung lateness sa schedule of the company.

Other audit considerations: 1. Capitalizations

2. Compliance on legal and regulatory pd1746 and regular eo’s.

3. related party transactions.

You might also like

- Cooperative Housing Societies Manual - ExtractDocument5 pagesCooperative Housing Societies Manual - Extractsagarlangore81No ratings yet

- Approval For Signing The Audit Report: M Jones 25.7.11Document52 pagesApproval For Signing The Audit Report: M Jones 25.7.11Kwasi Boatey100% (1)

- Template - Auditors Declaration of IndepenceDocument3 pagesTemplate - Auditors Declaration of IndepenceJeffrey Rouie CerdenaNo ratings yet

- Epson PLQ-50 Part List & DiagramDocument7 pagesEpson PLQ-50 Part List & DiagramRyanNo ratings yet

- Conceptual Framework Lecture Notes: The Framework at A GlanceDocument11 pagesConceptual Framework Lecture Notes: The Framework at A Glancenicole bancoro100% (1)

- 8ap - Audit Engagement Planning TemplateDocument3 pages8ap - Audit Engagement Planning TemplateIsaac100% (2)

- Internal Audit Program Accounts Receivable/Credit & Collections ReviewDocument5 pagesInternal Audit Program Accounts Receivable/Credit & Collections ReviewIrwansyah IweNo ratings yet

- IA Audit Process LISDDocument4 pagesIA Audit Process LISDmehmet1983No ratings yet

- DS Lab 12 - The DSW AlgorithmDocument14 pagesDS Lab 12 - The DSW AlgorithmASIM ZUBAIR 111100% (1)

- Audit Program - Revenue Particulars Test Required Y/N Results Satisfactory Y/N SCH Ref Comments Initials and Date IncomeDocument27 pagesAudit Program - Revenue Particulars Test Required Y/N Results Satisfactory Y/N SCH Ref Comments Initials and Date IncomeShohag RaihanNo ratings yet

- ##1) An Overview of Insurance Audit in Bangladesh (Document10 pages##1) An Overview of Insurance Audit in Bangladesh (Asc RaihanNo ratings yet

- QuizDocument7 pagesQuizJun Ladrillo100% (1)

- Program Internal Audit GovernanceDocument10 pagesProgram Internal Audit GovernanceAbdul SyukurNo ratings yet

- Internal Audit ChecklistDocument1 pageInternal Audit Checklistkarthik_ia20000% (1)

- Ayman Ystems: Sample - Courtesy Marc Smith Cayman Systems - 513 777-3394Document1 pageAyman Ystems: Sample - Courtesy Marc Smith Cayman Systems - 513 777-3394Camarada KolobanovNo ratings yet

- Engagement Partner Review ChecklistDocument5 pagesEngagement Partner Review ChecklistHARSHA REDDYNo ratings yet

- Lecture 10 Audit FinalisationDocument21 pagesLecture 10 Audit FinalisationShibin Jayaprasad100% (1)

- Audit ProgrammeDocument12 pagesAudit ProgrammeAnapratama Hesameilita Sipayung0% (1)

- Ac1 Client Acceptance or ContinuanceDocument7 pagesAc1 Client Acceptance or ContinuanceArvin L. CelinoNo ratings yet

- Accepting An EngagementDocument4 pagesAccepting An EngagementRalph Ean BrazaNo ratings yet

- Audit Plan SampleDocument5 pagesAudit Plan SampleWiratmojo NugrohoNo ratings yet

- Communicating Internal Audit ResultsDocument86 pagesCommunicating Internal Audit ResultsDilanniranga100% (1)

- Audit of The Inventory and Warehousing CycleDocument54 pagesAudit of The Inventory and Warehousing CycleIbnu NugrohoNo ratings yet

- Audit Program PropertyDocument12 pagesAudit Program PropertyVanessa GapasNo ratings yet

- Auditing FlowchartDocument2 pagesAuditing FlowchartJessica Ddw FianzaNo ratings yet

- ABC Internal Audit CharterDocument4 pagesABC Internal Audit CharterVamsi Krishna0% (1)

- Hyderabad 30062016Document29 pagesHyderabad 30062016Pratigya KoiralaNo ratings yet

- Aud Qlfy Exam RWDocument7 pagesAud Qlfy Exam RWYeji BabeNo ratings yet

- Audit Planning TechniquesDocument12 pagesAudit Planning TechniquesRahul KadamNo ratings yet

- Assurance Ch-1-7Document14 pagesAssurance Ch-1-7tusher pepolNo ratings yet

- Audit of Plant Property and EquipmentDocument17 pagesAudit of Plant Property and EquipmentChristian Lim0% (1)

- Roles of Internal AuditorDocument3 pagesRoles of Internal AuditorPonnaresy MuthusamyNo ratings yet

- Audit Program Inventory ObjectivesDocument2 pagesAudit Program Inventory Objectivesnicole bancoroNo ratings yet

- Audit ChecklistDocument2 pagesAudit ChecklistJahaziNo ratings yet

- Risk Audit PlanDocument6 pagesRisk Audit Planblackphoenix3030% (1)

- BSBLDR523 - Assessment Task 2Document34 pagesBSBLDR523 - Assessment Task 2assessment.4sep20240% (1)

- Auditing Project Sem 3Document33 pagesAuditing Project Sem 3Vivek Tiwari50% (2)

- Independent Confirmation ChecklistDocument5 pagesIndependent Confirmation Checklistbiged53723No ratings yet

- Internal Auditing Chapter 26 of Arens Chapter 8 and 11:internal Audit Practices in MalaysiaDocument86 pagesInternal Auditing Chapter 26 of Arens Chapter 8 and 11:internal Audit Practices in MalaysiacuixiNo ratings yet

- Psa 300Document22 pagesPsa 300Joanna CaballeroNo ratings yet

- Audit Evidence: The Third Standard of Field Work StatesDocument3 pagesAudit Evidence: The Third Standard of Field Work StatesMaria TeresaNo ratings yet

- Internal Audit Procedure 1Document2 pagesInternal Audit Procedure 1mrawaf balasmehNo ratings yet

- Gotts2BeKidding LTD SolutionsDocument3 pagesGotts2BeKidding LTD SolutionsPikinisoNo ratings yet

- Audit ProcessDocument21 pagesAudit ProcessCarmelie CumigadNo ratings yet

- Audit ProgrammeDocument12 pagesAudit ProgrammeCA Nagendranadh TadikondaNo ratings yet

- PPT. Chapter 2 AuditingDocument21 pagesPPT. Chapter 2 AuditingJerlmilline Serrano Jose100% (2)

- Multiple Choice Questions PDFDocument6 pagesMultiple Choice Questions PDFabdul majid khawajaNo ratings yet

- Auditing S2 - Chapter 5Document11 pagesAuditing S2 - Chapter 5p aloaNo ratings yet

- Audit CompletionDocument37 pagesAudit CompletionMahabubnubNo ratings yet

- Commissions Audit Work ProgramDocument15 pagesCommissions Audit Work ProgramJoseph Takunda ChidemboNo ratings yet

- Name: - Date: - Year &sec. - ScoreDocument9 pagesName: - Date: - Year &sec. - ScoreFordan AntolinoNo ratings yet

- Cpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Document10 pagesCpa Review School of The Philippines: Related Psas: Psa 300, 310, 320, 520 and 570Dyte DiamanteNo ratings yet

- Construction Internal Audit ProgramDocument15 pagesConstruction Internal Audit ProgramNiloy Ahmed100% (1)

- Audit and Assurance June 2009 Past Paper Answers (ACCA)Document15 pagesAudit and Assurance June 2009 Past Paper Answers (ACCA)Serena JainarainNo ratings yet

- Final Audit - Insurance Audit Notes PDFDocument9 pagesFinal Audit - Insurance Audit Notes PDFBhavin Nilesh PandyaNo ratings yet

- Abc Service Agency Audit of Overtime Worked Audit Program: Activities Apr May Jun Jul Aug SepDocument6 pagesAbc Service Agency Audit of Overtime Worked Audit Program: Activities Apr May Jun Jul Aug SepMary Grace Caguioa AgasNo ratings yet

- Bank Audit Program-FRPDocument20 pagesBank Audit Program-FRPHazel R. TanilonNo ratings yet

- Internal Audit Progress Report and Quarter 2 PlanDocument10 pagesInternal Audit Progress Report and Quarter 2 PlanPitt Si EndutNo ratings yet

- The 7 Es of Operational Audit ExcellenceDocument18 pagesThe 7 Es of Operational Audit ExcellenceShiela Jane CrismundoNo ratings yet

- Lesson 1 - Overview of The Risk-Based Audit ProcessDocument7 pagesLesson 1 - Overview of The Risk-Based Audit ProcessYANIII12345No ratings yet

- External Audit Annual Audit PlanDocument23 pagesExternal Audit Annual Audit Plankevin digumberNo ratings yet

- Chapter Three - Auditing IDocument12 pagesChapter Three - Auditing ITesfaye DiribaNo ratings yet

- DocxDocument4 pagesDocxnicole bancoro100% (1)

- Management and Its FunctionsDocument25 pagesManagement and Its Functionsnicole bancoroNo ratings yet

- Luzon Glass Company December 31, 2010Document6 pagesLuzon Glass Company December 31, 2010nicole bancoroNo ratings yet

- Accounting For Joint Products and By-ProductsDocument14 pagesAccounting For Joint Products and By-Productsnicole bancoroNo ratings yet

- FAR04 01.5 Operating SegmentDocument5 pagesFAR04 01.5 Operating Segmentnicole bancoroNo ratings yet

- FAR04 01.4 Interim ReportingDocument9 pagesFAR04 01.4 Interim Reportingnicole bancoroNo ratings yet

- Auditing Application Special ExamDocument3 pagesAuditing Application Special Examnicole bancoroNo ratings yet

- FAR04-01.3b - Presentation of Financial StatementsDocument14 pagesFAR04-01.3b - Presentation of Financial Statementsnicole bancoroNo ratings yet

- FAR04-01.2b - Conceptual Framework - QuestionsDocument7 pagesFAR04-01.2b - Conceptual Framework - Questionsnicole bancoroNo ratings yet

- FAR04-01 - Development of Financial Reporting Framework Standard & Regulation of Accountancy ProfessionDocument4 pagesFAR04-01 - Development of Financial Reporting Framework Standard & Regulation of Accountancy Professionnicole bancoro100% (1)

- Chapter 4Document15 pagesChapter 4nicole bancoro100% (1)

- Laila Nicole Bancoro Bsa 4BDocument1 pageLaila Nicole Bancoro Bsa 4Bnicole bancoroNo ratings yet

- Instruction: Answer The Following Questions Problem 1Document11 pagesInstruction: Answer The Following Questions Problem 1nicole bancoroNo ratings yet

- Income Taxation FinalsDocument3 pagesIncome Taxation Finalsnicole bancoroNo ratings yet

- Avilaortiz 2022 American Academy of PeriodontologyDocument8 pagesAvilaortiz 2022 American Academy of PeriodontologyShengNo ratings yet

- VPM Best PractisesDocument53 pagesVPM Best PractisesAshraf SaeedNo ratings yet

- Check, PleaseDocument39 pagesCheck, PleaseMarcus SmithNo ratings yet

- JD - Privileged Access Management SMEDocument4 pagesJD - Privileged Access Management SMEShahbazNo ratings yet

- Laporan Penggunaan Apd BMHPDocument4 pagesLaporan Penggunaan Apd BMHPayu willekaNo ratings yet

- Financial Accounting A Managerial Perspective 6 EDocument452 pagesFinancial Accounting A Managerial Perspective 6 ERNo ratings yet

- PP V Sy Juco DigestDocument1 pagePP V Sy Juco Digestalma navarro escuzarNo ratings yet

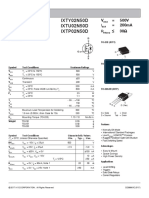

- IXTY02N50D IXTU02N50D IXTP02N50D: High Voltage Power MOSFET V 500V 200maDocument5 pagesIXTY02N50D IXTU02N50D IXTP02N50D: High Voltage Power MOSFET V 500V 200maUĞUR EYİBARDAKÇINo ratings yet

- Bha TirkDocument1 pageBha TirkRakesh BhatiNo ratings yet

- ERP Financials: SAP FICO Transaction CodesDocument24 pagesERP Financials: SAP FICO Transaction CodesAnand DuttaNo ratings yet

- Sepsis Criterios de Phoenix 2024Document43 pagesSepsis Criterios de Phoenix 2024erika100% (1)

- Creating Christmas Card Using Microsoft Word Inserting Images From The InternetDocument5 pagesCreating Christmas Card Using Microsoft Word Inserting Images From The InternetFighter GirlNo ratings yet

- Laboratory Chemical Hygiene Plan - 2012Document99 pagesLaboratory Chemical Hygiene Plan - 2012Kaka BabaNo ratings yet

- Vormetric Transparent Encryption For AWS Getting Started Guide PDFDocument83 pagesVormetric Transparent Encryption For AWS Getting Started Guide PDFNishant RanaNo ratings yet

- B6. HTML5 Audio and VideoDocument23 pagesB6. HTML5 Audio and VideoHuỳnh Tôn Minh QuânNo ratings yet

- Aking Tatayahin:: Jenny Rose Batalon Grade 11-Humss Dickens October 19, 2021Document4 pagesAking Tatayahin:: Jenny Rose Batalon Grade 11-Humss Dickens October 19, 2021Jenny Rose BatalonNo ratings yet

- 3GPP TS 32.645: Technical SpecificationDocument16 pages3GPP TS 32.645: Technical SpecificationPaul RiosNo ratings yet

- Sample Maths SBADocument12 pagesSample Maths SBAJahiem Durrant100% (1)

- XII ACC QP SET 1 (16.12.24)Document10 pagesXII ACC QP SET 1 (16.12.24)ushadinakar30No ratings yet

- 4.4.power AmplifierDocument29 pages4.4.power AmplifierPhương Nguyễn HữuNo ratings yet

- KMP 259 Build ManualDocument382 pagesKMP 259 Build ManualnicehornetNo ratings yet

- MMPC 007 SolvedDocument17 pagesMMPC 007 SolvedParneet kaurNo ratings yet

- (FREE PDF Sample) Network Programmability and Automation Skills For The Next Generation Network Engineer 1st Edition Jason Edelman EbooksDocument62 pages(FREE PDF Sample) Network Programmability and Automation Skills For The Next Generation Network Engineer 1st Edition Jason Edelman Ebookssplitteliett100% (2)

- 2023 Toyota CrownDocument9 pages2023 Toyota CrownM. AathilNo ratings yet

- BaruDocument4 pagesBaruFredyNo ratings yet

- SDM - 750 - A - 016 - TDocument2 pagesSDM - 750 - A - 016 - TgeorgerouseNo ratings yet

- Ensto Cubo X: Extreme Safety For Extreme ConditionsDocument9 pagesEnsto Cubo X: Extreme Safety For Extreme ConditionsVincent HeNo ratings yet

- Travel - Overseas Businessl Risk AssessmentDocument7 pagesTravel - Overseas Businessl Risk Assessmentapuesto726No ratings yet