CHAPTER 13 - Principles of Deduction

CHAPTER 13 - Principles of Deduction

Uploaded by

Deviane CalabriaCopyright:

Available Formats

CHAPTER 13 - Principles of Deduction

CHAPTER 13 - Principles of Deduction

Uploaded by

Deviane CalabriaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

CHAPTER 13 - Principles of Deduction

CHAPTER 13 - Principles of Deduction

Uploaded by

Deviane CalabriaCopyright:

Available Formats

BUSINESS EXPENSES PERSONAL EXPENSES

- are costs of doing trade, business or practice of -include the living family expenses of individual

profession. taxpayers.

Employee salaries, office utilities, supplies and Family food, personal recreation and

rent, taxes, losses, bad debts, depreciation on transportation, medication, home rentals and

business properties, research and development. utilities, tuition fees of dependents, and other

similar expenses.

BUSINESS EXPENSE CAPITAL EXPENDITURE

-benefit only the current accounting period. -are expenses that benefit future accounting

-are costs of generating income or gains for the periods.

current period. -are initially recorded as assets upon acquisition

-these are deductible against gross income in the then later deducted against future gross income

current period. when used in the trade, business or profession of

-examples: the taxpayer.

*salaries and wages expense -the advances deduction of capital expenditures is

*utilities (electricity, telephone, internet, gas, not warranted as it contradicts the Lifeblood

water) Doctrine

*selling expenses (delivery and commission -examples:

expense) *Items of PPE

*rent *Inventory

*local taxes and permits *Investments

*Prepayments

*Acquisition of intangible assets (patent or

franchise, costs of defending the same in court)

*expenses to promote business goodwill

*rentals on capital lease or finance lease that

transfers ownership

NON-DEPRECIABLE ASSET DEPRECIABLE PROPERTIES

-the cost of assets that do not depreciate by usage -the “depreciable cost” or the acquisition cost, net

or by passage of time such as land is deducted of expected salvage value, is allocated as

against the selling price when sold. deduction over the useful life of the property. The

useful life of the property is the length of time it is

expected to be serviceable or its legal life, is

applicable, whichever is lower.

INVENTORY METHOD

For goods inventory and supplies, their costs are deducted when sold or used in the business using the

inventory method or the specific identification method with the aid of a Point-of-Sale (POS) machine

COMMON DEPRECIATION METHODS

1. Straight line method The depreciable cost is simply spread equally over the useful life.

The annual depreciation expense is computed as:

(Acquisition cost – salvage value) / useful life in years

2. Sum-of-the-years-digit method The depreciation charge is computed as a fraction of the remaining

useful life over the total of the annual remaining useful life of the

asset.

3. Declining balance method A declining rate not exceeding double of the straight line rate is

applied to the book value of the property. For every period,

depreciation expense is computed by multiplying the depreciation

rate to the declining book value of the property. The salvage value

is initially ignored in computing depreciation expense, but is

considered in the terminal year of the property.

4. other methods which may be prescribed by the Secretary of Finance upon recommendation of the

Commissioner of Internal Revenue

INTANGIBLE ASSETS

Amortizable intangible assets or those that lose their value over time should be expensed over their

legal life or expected usage life whichever is lower.

Intangible assets that do not lose their value such as franchise of public utility vehicles shall not be

amortized.

COMPUTATION OF COST OF GOODS MANUFACTURED AND SOLD

Raw materials, beginning P xxx,xxx

Add: Net purchases xxx,xxx

Raw materials available for use xxx,xxx

Less: Raw materials, ending xxx,xxx

Raw materials used xxx,xxx

Direct Labor (direct worker’s salaries) xxx,xxx

Factory Overhead (all other plant costs) xxx,xxx

Total manufacturing costs xxx,xxx

Add: Cost of work in-process, beginning xxx,xxx

Total cost of goods placed into process xxx,xxx

Less: Cost of work in-process, ending xxx,xxx

Cost of goods manufactured (finished) xxx,xxx

Add: Cost of finished goods, beginning xxx,xxx

Total cost of goods available for sale xxx,xxx

Less: Cost of finished goods, ending xxx,xxx

Cost of goods sold xxx,xxx

PROPERTY REPAIRS AND IMPROVEMENTS

-that significantly increase the value or prolong the useful life of properties are capital expenditures.

-repairs that merely restore the value or functionality of the property without causes increase in fair

value or useful life of the property shall be deducted as outright expense.

-if fair value increases, the cost of RIA should be capitalized no to exceed the appreciation in fair value.

-if fair value is not determinable, the excess of the actual repair cost over the tax basis of the property is

presumed a capitalizable increase in fair value.

-improvements and additions to properties normally increase the value or useful life of properties;

hence, these are capitalized and depreciated.

REPLACEMENTS OF OLD OR DESTROYED PROPERTIES

The tax basis of the old property is deductible as a loss, but the cost of the replacement property is

capitalized subject to future provisions for depreciation.

COST OF DEMOLISHING OLD BUILDINGS

The cost of demolishing the old building , net of any salvage scrap, are treated as additional cost of

acquisition of the land.

The cost of razing or removing an old building to give way for the erection of another in its place is not a

deductible expense, but capitalized as part of the cost of the replacement building.

ASSET ACQUISITION-RELATED COSTS

All costs directly related to the acquisition of an item of PPE are capitalized as part of the cost of the

property subject to depreciation.

Expenses incurred which are directly related to the acquisition of goods are expensed through COGS

when sold.

Cost of financing asset acquisition (interest expense) may, at the option of the taxpayer, be expensed

outright or capitalized and depreciated.

CASH BASIS ACCRUAL BASIS

Cash expenses (paid) P xxx,xxx Accrual expenses (paid or unpaid) P xxx,xxx

Amortization of prepayments xxx,xxx Amortization of prepayments xxx,xxx

Depreciation of properties xxx,xxx Depreciation of properties xxx,xxx

Cash basis deductions P xxx,xxx Accrual basis deductions P xxx,xxx

FOUR GENERAL PRINCIPLES OF DEDUCTIONS FROM GROSS INCOME

1. Expenses must be legitimate, ordinary, actual and necessary (LOAN)

2. The Matching Principle

only business expenses which contribute to, or are incurred in connection with the generation of

income, gain, or profits subject to regular income tax are deductible.

3. The Related Party Rule

In case of transactions between related parties, gains are taxable but losses are not deductible. Also,

pursuant to the transfer pricing rule, non-arm’s length expenses incurred between associated

enterprises may be restated to their arm’s length fair values to reflect the correct income of each of the

associated enterprises.

4. The Withholding Rule

No deduction is allowed unless the withholding tax required by the law or regulations to be withheld

on the income payment (i.e., expense) is withheld and remitted by the taxpayer.

ORDINARY EXPENSE NECESSARY EXPENSE

-it is normal in relation to the business of the -if reasonable and essential to the development,

taxpayer and the surrounding circumstances. management, operation, or conduct of the trade,

- it is normally incurred by other taxpayers under business, or exercise of profession of the taxpayer.

the same line of business.

ACTUAL EXPENSE

-it is paid or resulted to an incurrence of an obligation to the taxpayer.

-in case of a loss, it must be sustained or realized by the taxpayer in a closed and completed transaction.

CLOSE AND COMPLETED TRANSACTION

-when no further transaction emanates from its occurrence.

-no right of recourse for indemnification or reimbursement from other parties exists.

THE MATCHING PRINCIPLE

-only business expenses that are incurred for the generation of items of gross income subject to regular

tax are deductible.

THE RELATED PARTY RULE

-Gains realized between related parties are taxable, but losses are non-deductible.

-examples:

1. members of a family (brothers and sisters, spouse, lineal ascendants and descendants)

2. Except in cases of distribution in liquidation, the direct or indirect controlling individual of a

corporation.

3. Except in cases of distribution in liquidation, corporations under direct or indirect common control

by or for the same individual.

4. Grantor or fiduciary of any trust.

5. Fiduciaries of trusts with the same grantor.

6. Fiduciary of a trust and the beneficiary of such trust.

TAX REPORTING CLASSIFICATION OF DEDUCTIONS

1. Cost of sales or cost of services

Is deducted outright against sales, revenues, receipts or fees of individual taxpayers in the

measurement of gross income from operations.

2. Regular allowable itemized deductions

Pertain to all necessary and ordinary expenses paid or incurred during the taxable year including

directly attributable costs in carrying on the development, management operation and/or conduct of

the trade, business or exercise of profession. E.g. administrative and selling expenses

3. Special allowable itemized deductions

Are additional deductions as provided under the NIRC or special laws.

a. Actual compliance expense (actual payments or transfers of funds)

b. Deduction incentives (are merely allowed to encourage taxpayers to support government programs)

4. Net Operating Loss Carry Over (NOLCO)

Pertains to the excess of expenses deduction over gross income during a taxable year which is allowed

by the law to be deducted against the net income of the following three years.

MODE OF CLAIMING DEDUCTIONS FROM GROSS INCOME

1. Itemized Deductions

Taxpayers list every time of business expense they claim as deductions. Deductions are strictly

construed against the taxpayer.

2. Optional Standard Deductions

In lieu of the itemized deductions, regular or special, including NOLCO.

Merely presumes as a fixed percentage of gross income for corp and gross sales or gross receipts for

individuals.

You might also like

- Distribution Waterfall 5 ExamplesDocument14 pagesDistribution Waterfall 5 ExamplesChristian Leon PalominoNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument52 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsyosepjoltNo ratings yet

- Naqdown Final QuestionsDocument16 pagesNaqdown Final QuestionsDiether ManaloNo ratings yet

- The Financial Reporting Standards CouncilDocument15 pagesThe Financial Reporting Standards CouncilPrincess Joy VillaNo ratings yet

- Chapter 3 Effects of The Contract When The Thing Sold Has Been LostDocument9 pagesChapter 3 Effects of The Contract When The Thing Sold Has Been Lostjohn llaneraNo ratings yet

- Chapter 2 Taxes Tax Laws and Tax AdministrationDocument29 pagesChapter 2 Taxes Tax Laws and Tax Administrationdexter padayaoNo ratings yet

- P - Chapter II Capacity To Buy or SaleDocument11 pagesP - Chapter II Capacity To Buy or SaleClaireNo ratings yet

- Appendix 7 - REGISTRY OF REVENUE AND OTHER RECEIPTS-SUMMARYDocument1 pageAppendix 7 - REGISTRY OF REVENUE AND OTHER RECEIPTS-SUMMARYPau PerezNo ratings yet

- Gross Compensation Income Summary IIDocument7 pagesGross Compensation Income Summary IITriciaNo ratings yet

- Tax 02-Lesson 06 - Donors TaxDocument53 pagesTax 02-Lesson 06 - Donors TaxMama MiyaNo ratings yet

- 2 Value Added TaxDocument216 pages2 Value Added TaxnichNo ratings yet

- Sales Part 8: Coverage of Discussion: Obligations of The VendeeDocument7 pagesSales Part 8: Coverage of Discussion: Obligations of The VendeeAmie Jane MirandaNo ratings yet

- CMPC 321 Prelim Quiz 1.DocxDocument20 pagesCMPC 321 Prelim Quiz 1.DocxTimeeh TurnerNo ratings yet

- Aboitiz Power Corporation 2022 FSDocument9 pagesAboitiz Power Corporation 2022 FSPrincess Alyssa BarawidNo ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- Testbank Finals 2021 Income TaxDocument11 pagesTestbank Finals 2021 Income Taxynasings.21No ratings yet

- INCOME TAX OF INDIVIDUALS Part 2 PDFDocument3 pagesINCOME TAX OF INDIVIDUALS Part 2 PDFADNo ratings yet

- CTT Examination Reviewer (Notes) Page A - 30Document13 pagesCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNo ratings yet

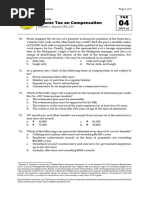

- TAX04 - Income Tax on CompensationDocument6 pagesTAX04 - Income Tax on CompensationJamela EricaNo ratings yet

- BAM 242 Credit TransactionsDocument18 pagesBAM 242 Credit TransactionsAndrea GarinNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- TAX.2814 Community-Taxes AnswersDocument1 pageTAX.2814 Community-Taxes AnswersCams DlunaNo ratings yet

- Compensation Income Activity and QuizDocument2 pagesCompensation Income Activity and QuizJean Diane JoveloNo ratings yet

- Chapter 6Document23 pagesChapter 6Yay YayNo ratings yet

- Deductions From Gross IncomeDocument23 pagesDeductions From Gross IncomeAidyl PerezNo ratings yet

- RMC 72-2004 Issues On Withholding RatesDocument9 pagesRMC 72-2004 Issues On Withholding RatesEva HubadNo ratings yet

- De Minimis Benifit AssignmentDocument9 pagesDe Minimis Benifit AssignmentJoneric RamosNo ratings yet

- Professiona Review & Training Center, IncDocument14 pagesProfessiona Review & Training Center, IncBryan Christian MaragragNo ratings yet

- Sme VS PFRSDocument17 pagesSme VS PFRSDesai SarvidaNo ratings yet

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- A. Assessment B. Collection: Remedies of The GovernmentDocument10 pagesA. Assessment B. Collection: Remedies of The GovernmentGianna CantoriaNo ratings yet

- BoA Guidelines On CPD For CPAsDocument4 pagesBoA Guidelines On CPD For CPAsMJ0% (1)

- (AFAR) (P02) - Joint and By-Product, ABC, Backflush, and Service Department Cost AllocationDocument21 pages(AFAR) (P02) - Joint and By-Product, ABC, Backflush, and Service Department Cost AllocationAngelica SumatraNo ratings yet

- Strategic Tax Management - Week 3Document14 pagesStrategic Tax Management - Week 3Arman DalisayNo ratings yet

- Rmo 19-2007Document3 pagesRmo 19-2007Jema Abreu50% (2)

- Vat Relief Bir Transmittal Form Annex A 1 PDFDocument1 pageVat Relief Bir Transmittal Form Annex A 1 PDFJoselito Pastrana100% (1)

- Income Taxation Chapter 1 3Document65 pagesIncome Taxation Chapter 1 3Abegail Joy CabalfinNo ratings yet

- Module 2 Ease of Paying TaxDocument4 pagesModule 2 Ease of Paying TaxJam HailNo ratings yet

- RR 2-01Document3 pagesRR 2-01matinikkiNo ratings yet

- Chapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSDocument3 pagesChapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSAlyssa BerangberangNo ratings yet

- Chapter 9 Term PaperDocument3 pagesChapter 9 Term PaperMardy TarrozaNo ratings yet

- Penalties For Late Filing of Tax ReturnsDocument3 pagesPenalties For Late Filing of Tax Returnsghingker_blopNo ratings yet

- Accounting For Special Transactions (Corporate Liquidation) : Lecture AidDocument7 pagesAccounting For Special Transactions (Corporate Liquidation) : Lecture AidmoNo ratings yet

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- Chapter 1 - Fundamental Concepts of Donor's Taxation (Notes)Document3 pagesChapter 1 - Fundamental Concepts of Donor's Taxation (Notes)Angela Denisse FranciscoNo ratings yet

- RFBT (Pinnacle Notes)Document1 pageRFBT (Pinnacle Notes)Justz LimNo ratings yet

- Regular Allowable Itemized DeductionsDocument29 pagesRegular Allowable Itemized Deductionsdelacruzrojohn600No ratings yet

- Payable Confirmation LetterDocument2 pagesPayable Confirmation LetterGeralyn BulanNo ratings yet

- Operation Assessment of Almont Inland Resort ButuanDocument54 pagesOperation Assessment of Almont Inland Resort ButuanBeberlie LapingNo ratings yet

- Compensation IncomeDocument5 pagesCompensation IncomePaula Mae Dacanay100% (1)

- Practice Quiz 1 Part II. PROBLEM SOLVING 1211 ACCCOB3 K33 BASIC MANAGEMENT ACCOUNTING PDFDocument6 pagesPractice Quiz 1 Part II. PROBLEM SOLVING 1211 ACCCOB3 K33 BASIC MANAGEMENT ACCOUNTING PDFAaron HuangNo ratings yet

- CPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutDocument29 pagesCPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutMark LapidNo ratings yet

- WWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewDocument2 pagesWWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewSudip AdhikariNo ratings yet

- CHAPTER 11 Compensation IncomeDocument15 pagesCHAPTER 11 Compensation IncomeGIRLNo ratings yet

- Week 4 - Inclusions To Gross IncomeDocument31 pagesWeek 4 - Inclusions To Gross Incomestephensze14No ratings yet

- Other Percentage TaxesDocument9 pagesOther Percentage TaxesLeonard CañamoNo ratings yet

- Steps For EfpsDocument3 pagesSteps For EfpsMarites Domingo - PaquibulanNo ratings yet

- Essential Requisites of ContractsDocument16 pagesEssential Requisites of ContractsAmie Jane MirandaNo ratings yet

- Sec Memo No. 2, s2012 - Guidelines On Securities Deposit of Branch Offices of Foreign CorporationsDocument7 pagesSec Memo No. 2, s2012 - Guidelines On Securities Deposit of Branch Offices of Foreign CorporationsfroilanrocasNo ratings yet

- DEDUCTIONSDocument13 pagesDEDUCTIONSmigueltanfelix149No ratings yet

- Chapter 3 Performance Management and Strategic PlanningDocument3 pagesChapter 3 Performance Management and Strategic PlanningDeviane CalabriaNo ratings yet

- CHAPTER 5 Measuring Results and BehaviorsDocument3 pagesCHAPTER 5 Measuring Results and BehaviorsDeviane Calabria100% (1)

- Chapter 1 Performance Management and Reward SystemDocument3 pagesChapter 1 Performance Management and Reward SystemDeviane CalabriaNo ratings yet

- CHAPTER 6 Gathering Performance InformationDocument3 pagesCHAPTER 6 Gathering Performance InformationDeviane Calabria100% (1)

- CHAPTER 4 Defining Performance and Choosing A Measurement ApproachDocument2 pagesCHAPTER 4 Defining Performance and Choosing A Measurement ApproachDeviane CalabriaNo ratings yet

- Sample Problems ACC 121Document1 pageSample Problems ACC 121Deviane CalabriaNo ratings yet

- ACC 118 (SALES) ReviewerDocument3 pagesACC 118 (SALES) ReviewerDeviane CalabriaNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- Performance Management ProcessDocument2 pagesPerformance Management ProcessDeviane CalabriaNo ratings yet

- CHAPTER 13 B - Special Allowable Itemized Deductions and NOLCODocument2 pagesCHAPTER 13 B - Special Allowable Itemized Deductions and NOLCODeviane CalabriaNo ratings yet

- CHAPTER 13 C - Optional Standard DeductionDocument2 pagesCHAPTER 13 C - Optional Standard DeductionDeviane CalabriaNo ratings yet

- Notes For DepreciationDocument28 pagesNotes For DepreciationDeviane CalabriaNo ratings yet

- Chapter 13 - DeductionsDocument5 pagesChapter 13 - DeductionsDeviane CalabriaNo ratings yet

- Notes For Land and BuildingDocument6 pagesNotes For Land and BuildingDeviane CalabriaNo ratings yet

- CHAPTER 10 - Compensation IncomeDocument3 pagesCHAPTER 10 - Compensation IncomeDeviane CalabriaNo ratings yet

- Quiz 14 Property Plant and Equipment PDF FreeDocument18 pagesQuiz 14 Property Plant and Equipment PDF FreeDeviane CalabriaNo ratings yet

- Property, Plant & Equipment and Tangible AssetsDocument4 pagesProperty, Plant & Equipment and Tangible AssetsDeviane CalabriaNo ratings yet

- Ias 38 Intangible AssetsDocument3 pagesIas 38 Intangible AssetsDeviane CalabriaNo ratings yet

- June2023 - Dec 2020 FinanceDocument105 pagesJune2023 - Dec 2020 FinancebinuNo ratings yet

- The New CEO's First 100 Days by Deirdre KennyDocument3 pagesThe New CEO's First 100 Days by Deirdre KennyJulie OneillNo ratings yet

- FM120 ActivityDocument3 pagesFM120 ActivityMarjonNo ratings yet

- Session 4 Financial Statement Analysis 2024-04-27 04 - 33 - 28Document5 pagesSession 4 Financial Statement Analysis 2024-04-27 04 - 33 - 28sarahzaki011No ratings yet

- Company History - Asahi India GlassDocument3 pagesCompany History - Asahi India GlassRajeev MenonNo ratings yet

- PR CH 1Document2 pagesPR CH 1Mahmoud IbrahimNo ratings yet

- Blcok-3 MCO-7 Unit-1Document23 pagesBlcok-3 MCO-7 Unit-1Tushar SharmaNo ratings yet

- G-6, Assignment Ratio Analysis - Corporate Financial StrategyDocument43 pagesG-6, Assignment Ratio Analysis - Corporate Financial StrategytashnimNo ratings yet

- 40 Marks QP - 9CIE (ACC) (20.9.23) - MID TERM EXAM - 23-24Document3 pages40 Marks QP - 9CIE (ACC) (20.9.23) - MID TERM EXAM - 23-24vedamandaliyaNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Valuation of Goodwill: (1) Few Years' Purchase of Average Profits Method: Under ThisDocument5 pagesValuation of Goodwill: (1) Few Years' Purchase of Average Profits Method: Under Thisabhi_cool7864757No ratings yet

- At 3 Completing-The-Audit XDocument6 pagesAt 3 Completing-The-Audit XKim PeriaNo ratings yet

- 4.1 Other Percentages Taxes PDFDocument15 pages4.1 Other Percentages Taxes PDFJocelyn Verbo-AyubanNo ratings yet

- Ind Nifty EnergyDocument2 pagesInd Nifty EnergyAmit SharmaNo ratings yet

- SME Handbook Vol - 1Document99 pagesSME Handbook Vol - 1Nguyễn Minh ĐứcNo ratings yet

- MCQS Chapter 5 Company Law 2017Document6 pagesMCQS Chapter 5 Company Law 2017BablooNo ratings yet

- MN Drayage CarriersDocument12 pagesMN Drayage CarriersjaneNo ratings yet

- Process Flow Analysis - Additional Problems 2021-FinanceDocument15 pagesProcess Flow Analysis - Additional Problems 2021-FinanceFrancis NyekoNo ratings yet

- Accounting Class-Xi Assignment 1 Chapter: 3 Theory Base of Accounting Application Based QuestionsDocument4 pagesAccounting Class-Xi Assignment 1 Chapter: 3 Theory Base of Accounting Application Based QuestionsAparna Singhal100% (1)

- EQT AB Year-End Report 2023Document33 pagesEQT AB Year-End Report 2023Ftu NGUYỄN THỊ NGỌC MINHNo ratings yet

- TVSM 2004 2005 1ST InterimDocument232 pagesTVSM 2004 2005 1ST InterimMITCONNo ratings yet

- Ratio. AnalysisDocument72 pagesRatio. AnalysisRaveendhar.S -MCANo ratings yet

- Managerial Finance SYLLABUSDocument3 pagesManagerial Finance SYLLABUSealselwiNo ratings yet

- Irrevocable Special Power of AttorneyDocument2 pagesIrrevocable Special Power of AttorneyOrlando Paylip100% (3)

- Business Finance - Sources and Uses of Short-Term and Long-Term FundsDocument35 pagesBusiness Finance - Sources and Uses of Short-Term and Long-Term Fundssmpaderna78No ratings yet

- 5 Chapter Five - OwnershipDocument6 pages5 Chapter Five - OwnershipLixieNo ratings yet

- Cash FlowDocument35 pagesCash FlowsiriusNo ratings yet

- May 2017Document15 pagesMay 2017Cayden FavaNo ratings yet

- Pricing Model For A Credit-Linked Note On A CDX TrancheDocument6 pagesPricing Model For A Credit-Linked Note On A CDX TranchechertokNo ratings yet