Maf 603 July 2022 Q2 Syahirah Binti Mayasin

Maf 603 July 2022 Q2 Syahirah Binti Mayasin

Uploaded by

Ira SyahirahCopyright:

Available Formats

Maf 603 July 2022 Q2 Syahirah Binti Mayasin

Maf 603 July 2022 Q2 Syahirah Binti Mayasin

Uploaded by

Ira SyahirahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Maf 603 July 2022 Q2 Syahirah Binti Mayasin

Maf 603 July 2022 Q2 Syahirah Binti Mayasin

Uploaded by

Ira SyahirahCopyright:

Available Formats

July 2022

Question

=>

2

a) Calculate the components of cost of capital for :

i. Bonds

NP: RM970 x 971. RM940.9

=

61.xkm1,000=RMO

I:

Kd =

60/940.9= 6.38).

ii. Preference shares

D

kp NPO

=

kp

=

(RM100 x 8%.)/ (RM110 + RM 5.50) =

6.931.

iii. Retained

earnings Do(1 + 9

po

7g or

Di

po g

+

NP= RM 5.20-RMO.CO =

RMS ke: (RM0.80/RMS) + 0.06:221.

D. =

R M0.80

g= 6

iv. New ordinary shares

kne

=

Doltg + g or p +g

kne: (RM080/(R M5.2xS0%) + 0.06: 36.77.

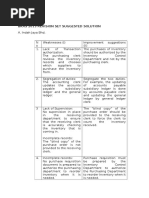

b) Determined the WACC if the company undertake this project

Maximum capex: Retained earnings available for investment

Equity weight of financing (NOF)

maximum capex: (RMS,000,000/(km8,000,000 + km2,000,000) /nmc5,000,000] =

RM12,500,000

cost of new project: RM2,950,000 + m30,000 + RM20,000: Rm3,000,000

↳ The retained earnings is sufficient to finance the new project of RM3,000,000. Therefore, no new share will be

issued to the public.WACC for the company is:

component of capital cost of capital-after tax weight of financing weighted cost

Kd 6.931. 10m/25m= 40 2.772

kp 221 sm/25m = 201. 4.4

Ke 36.771 (8m + 2m)/23m 40%

=

14. 708

wmcc =

21.88

C) No of new bond to be issued

bond of financing:40xRm3,000,000 km1,200,000

=

No of new bond:RM1,200,000 / km940.9= 1,275 units

B.

i. Recommend one of the proxy companies.

Since the economy isn't sure what will happen, the board wants to invest in a project with low risk. Mr. Izzat Danish should

recommend Angerik And because it has less risk, which is shown by both Ba and Be, which show that it has less business risk

and financial risk.Be for Anggerik And is lower because they only used 30% debt to pay for their assets. Since the shareholders

have less financial risk, the cost of equity is also lower.

ii calculate the project-specific cost of equity

ungeared beta Anggerik (proxy) =

0.62

Re-geared beta with current CS: Bax(retvalve]

Kemuning =0.62x (100160) = 1.03

cost of equity using CAOm= Rf+Geared BetaCkm-Rf)

51. + [1.03(7%.)]

=

12.211.

=

You might also like

- Ads653 Case StudyDocument14 pagesAds653 Case StudyAnis NajwaNo ratings yet

- Wipro IT Business: Organization StructureDocument40 pagesWipro IT Business: Organization StructureSarika S Nair69% (13)

- Chapter 5 Fkli Speculating Spreading and Arbitraging AnswersDocument6 pagesChapter 5 Fkli Speculating Spreading and Arbitraging AnswersWan Nur FatihahNo ratings yet

- 4a. Maf201 Fa - Jul2021 - Q Set1Document9 pages4a. Maf201 Fa - Jul2021 - Q Set1Natasha GabrielNo ratings yet

- FEB 2015 Maf151 Test 1Document3 pagesFEB 2015 Maf151 Test 1Aisyah Mohd YusreNo ratings yet

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- FAR460 - Feb 2021 - Q - Set 1Document7 pagesFAR460 - Feb 2021 - Q - Set 1Ahmad Adlan Bin RosliNo ratings yet

- Law485 c4 ConstitutionDocument25 pagesLaw485 c4 ConstitutionndhtzxNo ratings yet

- Law of Partnership: NatureDocument39 pagesLaw of Partnership: Natureschafieqah100% (1)

- Tutorial 5 Eco 415Document7 pagesTutorial 5 Eco 415ZhiXNo ratings yet

- Far570 SS Test December 2022Document5 pagesFar570 SS Test December 2022fareen farid100% (1)

- Far410 Test Oct 2018 - SolutionDocument3 pagesFar410 Test Oct 2018 - Solution2022478048No ratings yet

- Ais255 Case StudyDocument4 pagesAis255 Case StudyNoor SyazaniNo ratings yet

- Tmc451 Bab 2Document22 pagesTmc451 Bab 2Muhd Abdullah100% (1)

- Acc 7Document7 pagesAcc 7Izzah NawawiNo ratings yet

- Compilation Pyq - Far570Document109 pagesCompilation Pyq - Far570Nur SyafiqahNo ratings yet

- Test Far510 Sept 2019 SSDocument4 pagesTest Far510 Sept 2019 SS2022478048No ratings yet

- Elc590 Pitching Outline - 2018423522Document2 pagesElc590 Pitching Outline - 2018423522nurainNo ratings yet

- Law485 Jan 2012Document4 pagesLaw485 Jan 2012Khairul Ridzuan Bin Malik0% (1)

- Pyq Acc 116Document7 pagesPyq Acc 116HaniraMhmdNo ratings yet

- Test FAR570 Feb2021 Test FAR570 Feb2021Document5 pagesTest FAR570 Feb2021 Test FAR570 Feb2021Athira Adriana Bt RemlanNo ratings yet

- Maf 451 - Suggested Solutions: (A) Statement of Equivalent UnitsDocument7 pagesMaf 451 - Suggested Solutions: (A) Statement of Equivalent Unitsanis izzatiNo ratings yet

- 2019 - Dec 2019 - Fin645 - 541 - 651 - 630Document4 pages2019 - Dec 2019 - Fin645 - 541 - 651 - 630Allieya AlawiNo ratings yet

- Without Taxes With Taxes Unlevered Levered Unlevered LeveredDocument5 pagesWithout Taxes With Taxes Unlevered Levered Unlevered LeveredAnis SofiyaNo ratings yet

- Hak Clothing Assignment Far110Document44 pagesHak Clothing Assignment Far1101ANurul AnisNo ratings yet

- Topic 1 MIA by LawsDocument70 pagesTopic 1 MIA by LawsHanis ZahiraNo ratings yet

- Assignment Far 110 UitmDocument56 pagesAssignment Far 110 UitmFarah HusnaNo ratings yet

- Fin242 - Chapter 3 - ProformaDocument15 pagesFin242 - Chapter 3 - ProformaAin ShafikahNo ratings yet

- Maf603 Topic 2 Portfolio Management N Asset Pricing TheoryDocument75 pagesMaf603 Topic 2 Portfolio Management N Asset Pricing Theory2022920039No ratings yet

- Chapter 6 Membership of CompanyDocument26 pagesChapter 6 Membership of CompanyAmmar JeffriNo ratings yet

- Loan Capital (Debenture) : Wansal/law485/uitmsDocument34 pagesLoan Capital (Debenture) : Wansal/law485/uitmsElivia EgilipNo ratings yet

- This Study Resource Was: Common Test - Suggested Answers Aud 689 - Audit and Assurance ServicesDocument4 pagesThis Study Resource Was: Common Test - Suggested Answers Aud 689 - Audit and Assurance ServicesApril CaringalNo ratings yet

- ASM510 - Accss - Assignment 1 - TASNEEM MAISARA&NUR IZZATYDocument14 pagesASM510 - Accss - Assignment 1 - TASNEEM MAISARA&NUR IZZATYZaty RosmiNo ratings yet

- Finance 242Document11 pagesFinance 242norfitrahmNo ratings yet

- LMCE1072 GEO Template Set 42 Group Brown PDFDocument9 pagesLMCE1072 GEO Template Set 42 Group Brown PDFHani Karmilla KadirNo ratings yet

- Als 4083 Article Review L1 Ben Gan Rui Yang A20a1287Document15 pagesAls 4083 Article Review L1 Ben Gan Rui Yang A20a1287Ben GanNo ratings yet

- Maf151 Chapter 3Document63 pagesMaf151 Chapter 3Aiman Zikry bin AzmiNo ratings yet

- Final Exam Sta104 July 2022Document6 pagesFinal Exam Sta104 July 2022Farah FarzanaNo ratings yet

- Tax517 Test June 2022Document5 pagesTax517 Test June 2022Marlina RashidNo ratings yet

- Chapter 1 - MFRS 116Document60 pagesChapter 1 - MFRS 116Muhammad Hazlami0% (1)

- Format SOCI & SOFPDocument2 pagesFormat SOCI & SOFPafiqjr2No ratings yet

- Final Exam Sta104 Feb 2023Document6 pagesFinal Exam Sta104 Feb 2023Farah FarzanaNo ratings yet

- K00200 - 20211027174042 - Group Assignment Paf3113 A211Document5 pagesK00200 - 20211027174042 - Group Assignment Paf3113 A211huuuuuuuaaaaaaaNo ratings yet

- ASSESSMENT LAW 299 EditedDocument1 pageASSESSMENT LAW 299 Editedsyahiir syauqiiNo ratings yet

- Bkas 2013 - Revision Set Suggested SolutionDocument8 pagesBkas 2013 - Revision Set Suggested SolutionsyuhunniepieNo ratings yet

- Solution Maf653 - Dec 2019 - StudentDocument7 pagesSolution Maf653 - Dec 2019 - Studentdini ffNo ratings yet

- Individual Assignment Ent300Document15 pagesIndividual Assignment Ent300NURIN IRDINA MOHAMAD AMINNo ratings yet

- Sample Law446Document3 pagesSample Law446Nor Alia ShafiaNo ratings yet

- Far570 PresentatiionDocument29 pagesFar570 PresentatiionMuhamad DzulhazreenNo ratings yet

- ELC151 Reading SafiyyahDocument12 pagesELC151 Reading SafiyyahNur SafiyyahNo ratings yet

- FAR620 - Jun2023 - S - DR SHUKRIAH SAADDocument9 pagesFAR620 - Jun2023 - S - DR SHUKRIAH SAADNora ArifahsyaNo ratings yet

- MEMBERSHIP OF COMPANY NewDocument40 pagesMEMBERSHIP OF COMPANY NewRABIATULNAZIHAH NAZRINo ratings yet

- ASM657 Case Study (Assignment 2)Document1 pageASM657 Case Study (Assignment 2)2021481162No ratings yet

- Group Project AIS160Document8 pagesGroup Project AIS160NUR IRDINA SOFEA MOHD YUSRINo ratings yet

- Ent300 Financial PlanDocument32 pagesEnt300 Financial Planakaunsimpan123No ratings yet

- MAF603 2016 June SolutionDocument8 pagesMAF603 2016 June Solutionanis izzati100% (1)

- Q - TEST PSA662 Dec 2021Document3 pagesQ - TEST PSA662 Dec 2021Nurul NadziraNo ratings yet

- TUTORIAL - AIS615.CHAPTER 1 To CHAPTER3Document3 pagesTUTORIAL - AIS615.CHAPTER 1 To CHAPTER3Mon Luffy100% (1)

- Bank Kerjasama Rakyat Malaysia V Emcee Corporation SDN BHD PDFDocument2 pagesBank Kerjasama Rakyat Malaysia V Emcee Corporation SDN BHD PDFabdul rahim100% (1)

- Ais615 Test Oct2022Document7 pagesAis615 Test Oct2022ain madihahNo ratings yet

- PTRS Modul MATEMATIK T4Document6 pagesPTRS Modul MATEMATIK T4iffahNo ratings yet

- Mergers, Acquisitions and Corporate RestructuringDocument15 pagesMergers, Acquisitions and Corporate RestructuringSubrahmanya100% (2)

- Symbiosis Law School, Pune: Corporate Governance and FinanceDocument9 pagesSymbiosis Law School, Pune: Corporate Governance and FinancebashiNo ratings yet

- Amazing Place To WorkDocument7 pagesAmazing Place To WorkDan LabNo ratings yet

- Raising Capital: Multiple Choice QuestionsDocument17 pagesRaising Capital: Multiple Choice QuestionsCông Long NguyễnNo ratings yet

- Asian CompaniesDocument3 pagesAsian CompaniesRakesh RaiNo ratings yet

- IfciDocument6 pagesIfciIti TurgaliaNo ratings yet

- Economics of The Private Equity Market December 1995 - U.S. Federal ReserveDocument67 pagesEconomics of The Private Equity Market December 1995 - U.S. Federal ReserveAsiaBuyoutsNo ratings yet

- Corporation CodeDocument28 pagesCorporation CodeWreigh ParisNo ratings yet

- Cfpacket 1 SPR 16Document322 pagesCfpacket 1 SPR 16Sshankaranand AnandNo ratings yet

- Life Insurance Corporation - WikipediaDocument30 pagesLife Insurance Corporation - WikipediaTonu PawarNo ratings yet

- Executive Vice President Sales Marketing in Philadelphia PA Resume Paul BurkittDocument3 pagesExecutive Vice President Sales Marketing in Philadelphia PA Resume Paul BurkittPaulBurkittNo ratings yet

- Ascent Corporation: Business & ConsultancDocument7 pagesAscent Corporation: Business & ConsultancAscent CorporationNo ratings yet

- Hyundai Motor Company 1h 2020 Consolidated FinalDocument62 pagesHyundai Motor Company 1h 2020 Consolidated FinalshountyNo ratings yet

- c356641bd6315c8f2cba5eaed3c3ef1aDocument76 pagesc356641bd6315c8f2cba5eaed3c3ef1aRicardo murphy bell MurphyNo ratings yet

- Sales Management KPI Dashboard TemplateDocument112 pagesSales Management KPI Dashboard TemplateDiyanaNo ratings yet

- Dell SuppliersDocument21 pagesDell SupplierssreeNo ratings yet

- About LazadaDocument2 pagesAbout LazadaIffah NabilahNo ratings yet

- List Perusahaan Petrochemical Dan EnergyDocument2 pagesList Perusahaan Petrochemical Dan EnergyAditya Damar JatiNo ratings yet

- Valuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarDocument6 pagesValuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarAmit GuptaNo ratings yet

- ER FirmDocument2 pagesER FirmSharique NisarNo ratings yet

- Role of BOD in Corporate GovernanceDocument9 pagesRole of BOD in Corporate GovernanceJulienne AristozaNo ratings yet

- Introduction To Financial Management: Mcgraw-Hill/IrwinDocument20 pagesIntroduction To Financial Management: Mcgraw-Hill/IrwinPolly_Kong_6622No ratings yet

- Digital Marketing Reference v1.0 PDFDocument12 pagesDigital Marketing Reference v1.0 PDFRoyNo ratings yet

- Foreign Trade Policy Management AssignmentDocument15 pagesForeign Trade Policy Management AssignmentNargis NoordeenNo ratings yet

- Lista Apro CompletaDocument6 pagesLista Apro CompletaJoséSaffontNo ratings yet

- Quiz 1: Spring 1998: Business Average Beta Average D/E RatioDocument43 pagesQuiz 1: Spring 1998: Business Average Beta Average D/E RatioDenisse SánchezNo ratings yet

- LululemonDocument18 pagesLululemonNguyễn Phạm Minh NgânNo ratings yet

- Rangkuman Corporate GovernanceDocument21 pagesRangkuman Corporate GovernanceAlissa JanssensNo ratings yet

- Historic Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsArsh AgarwalNo ratings yet