MBA-Final Accounts

MBA-Final Accounts

Uploaded by

kanikaCopyright:

Available Formats

MBA-Final Accounts

MBA-Final Accounts

Uploaded by

kanikaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

MBA-Final Accounts

MBA-Final Accounts

Uploaded by

kanikaCopyright:

Available Formats

AMITY UNIVERSITY HARYANA

AMITY BUSINESS SCHOOL

MBA-ACCOUNTING FOR MANAGEMENT

FINAL ACCOUNTS PREPARATION-QUESTION BANK

--------------------------------------------------------------------------------------------------------------------------------------

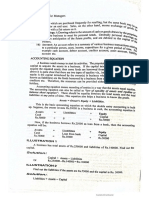

1.The following balances were extracted from the books of Rajaram on 31-12-2012.

Rs Rs

capital account 9,000 purchases 15,000

furniture 800 carriage outwards 200

creditors 1,600 salaries 2,000

premises 13,000 sales 18,000

bad debts 80 rent received 800

cash 40 discount allowed 180

drawings 900 loan 4,000

overdraft at bank 905 reserve for bad debts 100

debtors 1,500 expenses 705

adjustments:

a)make provision for bad debts@3%

b)salary due Rs 200

c)stock on 31-12-2012 Rs 3,500

d)write off 10% from furniture for depreciation

e)due from tenants rent Rs 100

2.From the following Trial Balance of Mr.Avinash as at 31st December

2012,

prepare the final accounts after considering the necessary

adjustments.

capital account 30,000

drawing account 2,600

plant and machinery 12,000

stock 1-1-2012 5,000

purchases 35,000

sales 50,000

returns inwards 2,000

returns outwards 1,000

sundry debtors 8,000

sundry creditors 6,000

carriage inwards 500

carriage outwards 500

wages 3,000

salaries 2,000

factory rent 200

office rent 500

insurance 500

discount received 600

discount allowed 300

furniture 2,000

bad debts 400

commission 300

buildings 8,000

bills payable 2,000

cash in hand 200

cash at bank 600

bills receivable 6,000

89,600 89,600

adjustments:

a)closing stock Rs 20,000

b)prepaid insurance Rs 200

c)interest on capitalat 5%

d)office rent oustanding Rs 400

e)depreciation on plant and machinery at

10% and furniture at 10%

3.The following balances are extracted from the books of Bharat& Co, on 31st

March, 2015.

Opening stock 500 Commission (Cr) 200

Bills receivable 2,250 Returns outward 250

Purchases 19,500 Trade expenses 100

Wages 1,400 Office Fixtures 500

Insurance 550 Cash in hand 250

Sundry Debtors 15,000 Cash at Bank 2,375

Carriage inward 400 Rent 550

Commission (Dr) 400 Carriage outward 725

Interest on capital 350 Sales 25,000

Stationery 225 Bills payable 1,500

Returns inward 650 Creditors 9,825

Capital 8,950

Closing stock was valued at Rs 12,500

prepare i) trading and profit and loss account for the year

ended 31-12-2015

ii) Balance sheet as on 31-03-2015

4.The trial balance of Mr.Sun as on 31st March 2013, was as follows:

particulars Dr(Rs) Cr(Rs)

purchases/sales 16,25,050 25,24,000

provision for doubtful debts 52,000

sundry debtors/creditors 5,02,000 3,05,260

bills payable 39,500

opening stock 2,67,250

wages 2,31,370

salaries 55,750

furniture 72,500

postage 42,260

power and fuel 13,500

trade expenses 58,310

bad debts 5,250

loan to Ram@10%(Dec1,2012) 30,000

cash in hand and at bank 1,00,000

trade expenses accrued but not paid 7,000

drawings/capital 44,250 1,00,000

outstanding wages 20,000

30,47,760 30,47,760

Required:

Prepare trading and profit and loss account for the year ending

31st March, 2013 and the

balance sheet as on that date afer taking into consideration the following information:

a)depreciation on furniture is to be charged @10%

b)sundry debotrs include as item of Rs 5,000 due from a customer who has become

insolvent.

c)provision for doubtful debts is to be maintained @5% on sundry debtors

d)goods of value of Rs 15,000 have been destroyed by fire and insurance company

admitted a claim for Rs 10,000

e)closing stock was Rs 1,25,500

You might also like

- Topic 2-Continuous Compounding, Nominal and Effective Rate of ItenrestDocument7 pagesTopic 2-Continuous Compounding, Nominal and Effective Rate of ItenrestHENRICK IGLENo ratings yet

- Debit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsDocument4 pagesDebit Balances Rs. Credit Balances RS.: Vijayam Junior College I Year Final Accounts Additional ProblemsM JEEVARATHNAM NAIDUNo ratings yet

- Accounting Fundamentals - PWS - 7Document11 pagesAccounting Fundamentals - PWS - 7Meet PatelNo ratings yet

- Practice Qns - Final AccountsDocument13 pagesPractice Qns - Final Accountscaphoenix mvpaNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- Question Paper Bharati Vidyapeeth 2nd Sem 2024 - NewDocument5 pagesQuestion Paper Bharati Vidyapeeth 2nd Sem 2024 - New100rub2015No ratings yet

- Problems On Final Accounts-Sole ProprietorshipDocument12 pagesProblems On Final Accounts-Sole ProprietorshipRishiShuklaNo ratings yet

- Final Ac P2Document5 pagesFinal Ac P2SudeepNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Question Paper Bharati Vidyapeeth 2nd Sem 2024 - NewDocument4 pagesQuestion Paper Bharati Vidyapeeth 2nd Sem 2024 - New100rub2015No ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- Final Accounts QuestionsDocument5 pagesFinal Accounts Questionsravikshabansal0806No ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Accounts QuestionDocument8 pagesAccounts QuestionMaitri SaraswatNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Practice Questions-IAS-1Document2 pagesPractice Questions-IAS-1Ayyan AzeemNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- Module - 3 Trial Balance QuestionsDocument7 pagesModule - 3 Trial Balance QuestionsMuskan Rathi 5100No ratings yet

- ACC2124 Mid-Term Test S2/17Document2 pagesACC2124 Mid-Term Test S2/17Niz IsmailNo ratings yet

- Final Accounts: Problem SheetDocument2 pagesFinal Accounts: Problem SheetSaransh MaheshwariNo ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- Tally Prime: Lab AssignmentsDocument32 pagesTally Prime: Lab AssignmentsGW LEGENDNo ratings yet

- Additional Questions AcctsDocument3 pagesAdditional Questions AcctsDEV NANKANINo ratings yet

- Unit Five: Final Accounts: Question-1: From The Following Information, Prepare TheDocument11 pagesUnit Five: Final Accounts: Question-1: From The Following Information, Prepare TheBinod KhatriNo ratings yet

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulNo ratings yet

- Financial Accounting - IDocument3 pagesFinancial Accounting - Isaascplacement41No ratings yet

- Financial Accounting Punjab University: Question Paper 2009Document5 pagesFinancial Accounting Punjab University: Question Paper 2009Abrar AliNo ratings yet

- Accounting For Mgt.Document3 pagesAccounting For Mgt.RNo ratings yet

- FS Withoutadj QuesDocument2 pagesFS Withoutadj QuesHimank SaklechaNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- BPOl 002Document3 pagesBPOl 002Devesh SoniNo ratings yet

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhNo ratings yet

- Grade 11 Erm Accounts October 2024Document2 pagesGrade 11 Erm Accounts October 2024Bhavya ChawlaNo ratings yet

- 12 Problems On Final AccountsDocument13 pages12 Problems On Final Accountspratham sainiNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- Unit 1 Practice QuestionsDocument3 pagesUnit 1 Practice Questionskbarrett20No ratings yet

- Homework 2Document2 pagesHomework 2Sudeep0% (1)

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed50% (4)

- The Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberDocument3 pagesThe Following Trial Balance Have Been Taken Out From The Books of XYZ As On 31st DecemberyogeshNo ratings yet

- Income Statement and Balance Sheet - Handout 4ADocument10 pagesIncome Statement and Balance Sheet - Handout 4AsakthiNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- Final Accounts AssignemntDocument7 pagesFinal Accounts Assignemntamruthavarshini2765No ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- 高一簿记模拟试卷Document6 pages高一簿记模拟试卷Carpenters ForeverNo ratings yet

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- Jayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsDocument2 pagesJayalakshmi Institute of Technology Accounting For Management Unit - Ii QuestionsJayalakshmi Institute of TechnologyNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingManish KushwahaNo ratings yet

- ADBM - FA - Questions CRADocument5 pagesADBM - FA - Questions CRAMahima SheromiNo ratings yet

- PART B Financial AccountingDocument11 pagesPART B Financial AccountingKavitha Kavi KaviNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Questions On Preparation of Financial Statements 1-4Document4 pagesQuestions On Preparation of Financial Statements 1-4LaoneNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Trial Balance and Final Accounts ProblemsDocument6 pagesTrial Balance and Final Accounts Problemsbhanu.chandu100% (2)

- At That Date. Ahmed's Assets andDocument7 pagesAt That Date. Ahmed's Assets andmuhammadbinharounNo ratings yet

- Sole Prop SumsDocument6 pagesSole Prop SumsSidhant KothriwalNo ratings yet

- Question IA 2 - Topic 4Document2 pagesQuestion IA 2 - Topic 4YAANESHWARAN A/L CHANDRAN STUDENTNo ratings yet

- AssignmentDocument3 pagesAssignmentER ABHISHEK MISHRANo ratings yet

- AFM Imp QuestionsDocument6 pagesAFM Imp Questionsbillavaishnavi123No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Private Company Vs Public CompanyDocument7 pagesPrivate Company Vs Public CompanykanikaNo ratings yet

- AFM-Module 2 IDocument10 pagesAFM-Module 2 IkanikaNo ratings yet

- AFM-Module 4-Part 1Document16 pagesAFM-Module 4-Part 1kanikaNo ratings yet

- AFM-Module 5 TheoryDocument7 pagesAFM-Module 5 TheorykanikaNo ratings yet

- AFM-Module 4 Part-B Ratio Analysis ProblemsDocument5 pagesAFM-Module 4 Part-B Ratio Analysis ProblemskanikaNo ratings yet

- AFM-Basic TerminologyDocument3 pagesAFM-Basic TerminologykanikaNo ratings yet

- Accounting BasicsDocument7 pagesAccounting BasicskanikaNo ratings yet

- AFM Module 5 ProblemsDocument4 pagesAFM Module 5 ProblemskanikaNo ratings yet

- European Clos 2.0 Bring Greater Simplicity and Flexibility: Structured FinanceDocument16 pagesEuropean Clos 2.0 Bring Greater Simplicity and Flexibility: Structured Financeapi-227433089No ratings yet

- Voluntary Winding Up in India-A Comparative Analysis: Cia IiiDocument6 pagesVoluntary Winding Up in India-A Comparative Analysis: Cia IiiJiss PalelilNo ratings yet

- Transfer of Property Act IIDocument33 pagesTransfer of Property Act IIAlok KumarNo ratings yet

- L - 6 Bond ValuationDocument14 pagesL - 6 Bond ValuationJagrityTalwarNo ratings yet

- Rekha V.V.I. Commerce (Hons.) Part-2Document13 pagesRekha V.V.I. Commerce (Hons.) Part-2NewshibeNo ratings yet

- Bondurant's Landlord Says $675K Loan Isn't Enough.Document7 pagesBondurant's Landlord Says $675K Loan Isn't Enough.StefNo ratings yet

- Basic of Sarfaesi ActDocument4 pagesBasic of Sarfaesi ActsrinivaspdfNo ratings yet

- Recent Measures To Tackle NPADocument3 pagesRecent Measures To Tackle NPAJyotiNo ratings yet

- Book 1Document4 pagesBook 1KyeyuneNo ratings yet

- M11GM IIf 3Document2 pagesM11GM IIf 3Mary bethany ocampoNo ratings yet

- Credit RiskDocument6 pagesCredit RiskBOBBY212No ratings yet

- Trắc nghiệm tieng anhDocument2 pagesTrắc nghiệm tieng anhMinh HoàngNo ratings yet

- Lesson3-Capital StructureDocument8 pagesLesson3-Capital StructureKiro ParafrostNo ratings yet

- FRIA QUIZ With AnswersDocument5 pagesFRIA QUIZ With AnswersAlimodin MalawaniNo ratings yet

- Quiz 3 - Bonds PayableDocument9 pagesQuiz 3 - Bonds PayableJam SurdivillaNo ratings yet

- Loan Agreement TemplateDocument4 pagesLoan Agreement TemplateMj Ong Pierson GarboNo ratings yet

- WC MGMT and ST FinancingDocument16 pagesWC MGMT and ST FinancingJanine CayabyabNo ratings yet

- International Storytelling Center - Chapter 11 Bankruptcy Filings - Amended Creditor MatrixDocument4 pagesInternational Storytelling Center - Chapter 11 Bankruptcy Filings - Amended Creditor MatrixTennesseeTuxedoNo ratings yet

- CH 10Document87 pagesCH 10Chang Chan ChongNo ratings yet

- Pure Obligation Is One Which Is Not SubjectDocument6 pagesPure Obligation Is One Which Is Not SubjectSheen Hezel MagbanuaNo ratings yet

- Sample Mortgage Violations LetterDocument9 pagesSample Mortgage Violations Letteracademicone100% (1)

- All Eco Problems OTDocument3 pagesAll Eco Problems OTdave0% (1)

- Loan Collection & Recovery in MalaysiaDocument24 pagesLoan Collection & Recovery in MalaysiaBilly Lee100% (2)

- Proof of DebtDocument1 pageProof of DebtpendrivemusfirahNo ratings yet

- Bonds Payable Practice TestDocument9 pagesBonds Payable Practice TestAl-Sinbad Bercasio100% (3)

- Real Estate Mortgage ContractDocument3 pagesReal Estate Mortgage ContractMarycris OrdestaNo ratings yet

- Personal Loan Agreement: BetweenDocument2 pagesPersonal Loan Agreement: BetweenAbarra MichelleNo ratings yet

- 2 IIIpiSeries-2BDocument67 pages2 IIIpiSeries-2BVbs ReddyNo ratings yet

- Questions 14,54,81, and 114Document5 pagesQuestions 14,54,81, and 114Damian Sheila MaeNo ratings yet