Digital Customer Copy: I Confirm That

Digital Customer Copy: I Confirm That

Uploaded by

Tarun KumarCopyright:

Available Formats

Digital Customer Copy: I Confirm That

Digital Customer Copy: I Confirm That

Uploaded by

Tarun KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Digital Customer Copy: I Confirm That

Digital Customer Copy: I Confirm That

Uploaded by

Tarun KumarCopyright:

Available Formats

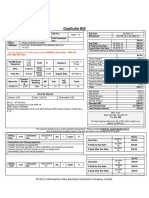

Date : 10-Feb-2023

DIGITAL CUSTOMER COPY Branch Contact No: null

BRANCH Hastal Village - Delhi

LOCATION 57-B Ground floor, Hastal Village Uttam Nagar New Delhi - 110059

I TARA VATI,CUSTOMER ID: 992876 DO HEREBY CONFIRM HAVNG AVAILED A LOAN ON THE BELOW TERMS

PLEDGE DATE 10-FEB-23 LOAN ACCOUNT NO FEDGL05030000410 TENURE 360Days

LOAN 61496 EMAIL ID DOB 23-SEP-77

UCICID 12920950 PRIVILEGE CARD NO NA

22CT

GROSS WEIGHT CONVERTED Ornament Broken

SL NO ORNAMENT DESCRIPTION UNITS REMARKS

(in Grams) WEIGHT

1 NECKLACE - without stones 1 19.9 15.817 No

Total 1 19.9 15.817

FOR RELEASE OF ORNAMENT SUBMIT YOUR ORIGINAL GPC OF LOAN ACCOUNT NO:FEDGL05030000294

SCHEDULE OF PROCESSING FEE: Rs. 0 STAMP DUTY(If applicable):Rs. 0 PRIVILEGE CARD:Rs. 0.00

CHARGES

(Including of 18% GST) DUPLICATE GPC (If applicable): NIL

SCHEME MONTH MONTH MONTH MONTH MONTH MONTH MONTH MONTH MONTH MONTH MONTH MONTH Interest Annualized

1 2 3 4 5 6 7 8 9 10 11 12 Lock In Interest Rate

Period

ROI RMRB 19% 22% 22% 24% 24% 24% 24% 24% 24% 24% 24% 24% 7Days 24%

12

1. To know your interest/Principal Due & Pay Online: Visit https://www.fedfina.com/quick-pay/

2.Please note, non-service of interest on the respective due dates, would attract change in interest rate to the next slab (as per the aforesaid table) for the scheme chart opted by you. The revised

interest shall be applicable from the date of service of full interest or from the date of disbursement of the aforesaid loan. However, if you make payment of full interest, as a service gesture, Fedfina at

its sole discretion may consider to reverse the interest rate to the rate as applicable on the date of disbursal of the aforesaid loan (i.e., on-boarding interest rate).

3. Month1, Month2...represents 30 Days Cycle

4. Penal interest @36% pa will be charged from maturity date 04-FEB-24

Irrespective of due date of interest payment and frequency mentioned above, I hereby confirm and undertake that I shall maintain adequate margin in my loan account by servicing the account at

regular intervals.

I confirm that:

1.I have been explained about all the loan schemes and applicable rate of interests in complete detail.

2.The rate of interest will be as per the rate card on increasing basis. However in case of regular servicing of interest on monthly/quarterly basis then the rate of interest of immediate last period will be

applicable for next period.

3.In certain schemes interest for the first month will be deducted from the loan amount irrespective of the date of closure.

4.In certain schemes processing fee @ applicable rate will be collected at time of disbursement.

5.I confirm that I have read and have been explained in detail the terms and conditions mentioned overleaf and having understood these, have agreed to the same.

6.I acknowledge receipt of a copy of this Gold Pledge Card with terms and conditions printed overleaf.

7.I am the Iawful owner of the ornament(s) mentioned herein above. I do hereby confirm that these Ornaments were INHERITED by me. I also confirm that I am authorized to raise a loan against the

ornament(s).

*This is a computer generated GPC and does not require signature.

Terms & Conditions

1.The loan shall carry interest rate specified in the Demand Promissory Note executed by the borrower or such other rates as may be specified by the Company from time to time. For this purpose

365 days constitute a year. Interest shall be charged on simple interest basis/ compounded on monthly rest or such other method as may be communicated by the Company at the time of sanction

and through display at its branch/ website.

2.In case of any delay in repayment of interest/principal/other charges after the due date, the Company reserves the right to charge a penal interest @36% per annum on the dues outstanding.

3.If borrower wants to repay the loan before the maturity of tenure then borrower has to serve minimum interest applicable as per scheme or till foreclosure date, whichever is higher. Further any

amount paid by the borrower will be adjusted first, towards the charges, penalty and interest and balance left out amount will be adjusted towards loan principal.

4.If full repayment of the loan together with interest and other accumulated charges is not made within the loan tenure/if interest is not serviced on a monthly/Quarterly/half-yearly or within such period

as may be demanded by the Company from time to time, the Company reserves the right to sell off the pledged gold ornaments through auction by giving a notice of 21 days and apply the proceeds

towards the outstanding liability under the loan account and /or any other liability that the borrower either himself or jointly with others may owe to the Company including incidental charges on any

account whatsoever at any of its offices. Auctions shall be conducted in the same town or taluka in which the branch had extended the loan. In any event, auction fails at the town or taluka of the

branch, the Company shall have an option to pool gold jewellery from different branches in the district and auction it at any location within the district. The Company reserves the right to change the

auction date and venue. If auction does not get completed at the district for whatsoever reason, the Company shall conduct auction at a suitable location with prior intimation to the borrower. In case

the proceeds are not sufficient to discharge the liability in full, the borrower will be personally liable for the deficit.

5.In case of fall in gold prices, the Company reserves right to recall the loan along with interest and charges applicable for the said loan even before completion of tenure in the event of fall in gold

price, can add the differential value of ornaments to the existing loan or by payment of cash as and when Company demands. If differential value is not added by borrower and Company is convinced

that the realizable amount through sale of the pledged ornaments is inadequate to cover the total amount receivable from the borrower, after serving due notice through registered post/speed post /

courier, the Company reserves the right to sell off the ornaments through auction at any point of time even before expiry of the loan tenure.

6.Borrower shall be liable to repay the loan as per demand notice. Notice in respect of the loan shall be deemed to have been duly served if the letter containing the notice of demand is posted to the

address given in the loan application unless any subsequent change of the address is intimated to the Company in writing under acknowledgement from the Company.

7.The Company has the right to retain the pledged security to set off against any other liability that the borrower may either himself or jointly with others owe to the Company or any of it's group

Companies, irrespective of whether such a liability has been demanded or not.

8.The Company has the right to transfer / assign the loan accounts to any other branch of the Company for further servicing to the Borrower by giving adequate notice to the borrower before such

transfer or assignment. Borrower will not raise any issues in this respect.

9.The Company has the right to restructure/rebook the loan, assign, sell, charge or transfer the rights under this agreement and all other documents executed by the borrowers in the favour of the

Company and to obtain necessary advances from any bank/ financial institution etc. at any time and in any manner without notice to the borrower.

10.The employees/auditors/empaneled valuators of the Company have right to verify the pledged ornaments from time to time with regard to purity and deductions

11.The Company shall verify the Gold at the time of pledge by the borrower internally or through external valuators. The purity of the Gold as certified in the Pledge Card after translating the same to

22 carat is based on the preliminary verification done by the Company. Company reserves right to verify purity after pledge is complete. If Company finds-out in sub-sequent verification that the

ornaments pledged as security are of spurious/inferior nature and/or of less-purity as specified in the loan application and/or pledge card, then in such an event Company at its own discretion may

initiate civil and/or criminal proceedings against the borrower and the borrower shall be responsible for all the losses suffered by the Company in this regard including the costs pertaining to recovery

measures.

12.The borrower shall bear, pay and reimburse all charges relating to administration charges, interest , duties (including stamp duty), and other applicable taxes (of any description as may be levied

from time to time by government or other Authority) and all other costs and expenses whether in connection with (a) application for and the grant of loan; (b) recovery and realization of loan together

with interest; (c) enforcement of security; (d) clearance of arrears of all taxes and any other charges and levies of the government in respect of security and insuring the security.

13.In the event of loss due to theft, burglary or otherwise, the liability of the Company is limited to compensate the borrower by payment of market value of the ornament pledged basis net weight and

purity assessed at the time of loan sanction subject to subsequent audit findings, if any, or any other fair method as may be decided by the Company, post adjustment of outstanding dues.

14.Only the borrower who has pledged the ornaments will get back the ornaments given as security once the loan is repaid fully. The Company may at its sole discretion consider requests for 3rd

party release, provided necessary indemnity bond with sureties as required by the Company is given.

15.If the branch of the Company is closed due to fire, explosion, flood, act of God, act of terrorism, war, rebellion, riot, sabotage or strike or lock-out or events or circumstances which are wholly

outside the control of the Company, then any amount due under this loan shall be payable and the ornaments will be released, if any, on the following day when the branch is opened without any

consequent liability on the Company.

16.The Gold Pledge Card must be returned to the Company at the time of redeeming the loan and getting back the gold ornaments. The Company shall not be responsible in case of Gold Pledge

Card being misplaced/damaged/misused. The Company may at its discretion consider requests for release without GPC, provided necessary indemnity bond with sureties as required by the

Company is given.

17.The Company reserves the right to use/share the information acquired through this application for the purpose of marketing research etc. Also to report details to regulators, under provision of law,

other credit bureaus as also to publicize for internal consumption or interest of the Company or public at large.

18.The borrower and all relevant persons irrevocably submit themselves to the Jurisdiction of Courts and Tribunals of Mumbai with regard to any litigation in relation to the subject Gold Loan. The

Company however reserves the right to constitute any legal action or proceeding before appropriate courts and forums at its discretion. In case a particular provision/ term does not apply/ is

unenforceable in a particular jurisdiction, barring that terms/ provision in that jurisdiction, the other terms/ provisions shall continue the remain in force.

19.In the event of any dispute, difference or question arising out of or in respect of this loan or commission of any breach of terms thereof or in any manner whatsoever in connection with it either

during the continuance of the loan or after termination or purported termination hereof shall be referred to the sole Arbitrator to be appointed by the lender, according to the provisions of Arbitration

and Conciliation Act,1996 and rules there under and any amendment thereof from time to time shall apply. The award of the arbitrator shall be final, conclusive and binding on the parties, and the

venue of the arbitration shall be decided by the lender.

20.The Loan (or any part thereof) shall not be used for any purpose other than the Purpose specified in the Application Form, Nor for any speculative, improper or illegal or unlawful

purposes/activities.

21.The repayment/ payment of Borrower's Dues shall not be affected, impaired or discharged by insolvency or death or otherwise of the Borrower.

22.The Decision of the Company as to whether or not an Event of Default has occurred shall be final and binding upon the Borrower.

23.The Company may at its sole discretion, make/allow disbursements/ withdrawals under the Loan by any of the following modes-cash/account transfer etc.

24.The ornaments embedded with Diamonds and precious stones will not be accepted. The Company will not take into account the claims with regard to such ornaments with diamonds and precious

stones.

You might also like

- 0129450730004260Document3 pages0129450730004260Deependra Singh100% (1)

- E Ticket ReceiptDocument3 pagesE Ticket ReceiptNEERUNo ratings yet

- Emudhra Limited: One Year - Unlimited SigningDocument1 pageEmudhra Limited: One Year - Unlimited SigningNivash KrishnanNo ratings yet

- Ogl 046821567831680558Document3 pagesOgl 046821567831680558Deependra SinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Arvind MiraseNo ratings yet

- Gail SF s5Document6 pagesGail SF s5sunny KumarNo ratings yet

- StatementDocument4 pagesStatementSUBHAM CHAKRABORTYNo ratings yet

- April Elect Bill PDFDocument1 pageApril Elect Bill PDFAbhijitNo ratings yet

- NVPI1167676 - ForeClosure Archna VajeDocument2 pagesNVPI1167676 - ForeClosure Archna VajeVARUN KALENo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Himanshu JainNo ratings yet

- Acknowledgement 1572947362960Document3 pagesAcknowledgement 1572947362960grand physicist100% (1)

- Mrunal PDFDocument4 pagesMrunal PDFPrajwal LanjewarNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377rahuljaiswal20097313No ratings yet

- PANform PDFDocument1 pagePANform PDFsagar KumarNo ratings yet

- .NP 2077 Result With MarksheetDocument2 pages.NP 2077 Result With MarksheetSAMIM ANSARI0% (1)

- Invoice 1Document1 pageInvoice 1Anupam PriyamNo ratings yet

- Print PDFDocument2 pagesPrint PDFAmit SanjanaNo ratings yet

- Tax Invoice: Vijaya Indane Gas AGENCY (0000125369)Document2 pagesTax Invoice: Vijaya Indane Gas AGENCY (0000125369)Venkat DaimondNo ratings yet

- Arun ResumeDocument2 pagesArun ResumevigneshNo ratings yet

- Od126520774203945000 1 PDFDocument2 pagesOd126520774203945000 1 PDFMuthukumaresan ANo ratings yet

- View PDFServletDocument1 pageView PDFServletDevansh MishraNo ratings yet

- Tripura State Electricity Corporation Ltd. (A GOVT. of Tripura Enterprise)Document1 pageTripura State Electricity Corporation Ltd. (A GOVT. of Tripura Enterprise)Anonymous nrvHJVz9No ratings yet

- Rtps-Reesa 2023 93322 PDFDocument2 pagesRtps-Reesa 2023 93322 PDFSakhil AhesanNo ratings yet

- HP 15q APU Dual Core E2 - (4 GB/1 TB HDD/Windows 10 Home) 15q-by010AU LaptopDocument1 pageHP 15q APU Dual Core E2 - (4 GB/1 TB HDD/Windows 10 Home) 15q-by010AU LaptopvscomputersNo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)S CYBER CAFENo ratings yet

- Commercial Invoice: Tape Drive FailedDocument1 pageCommercial Invoice: Tape Drive FailedKhang DươngNo ratings yet

- Leave Revised FloricelDocument2 pagesLeave Revised FloricelLJ AggabaoNo ratings yet

- 114 WPIF-MO-01 VGG Application FormDocument6 pages114 WPIF-MO-01 VGG Application FormJithu RajNo ratings yet

- Loan Account Statement For LACHD00039394344Document4 pagesLoan Account Statement For LACHD00039394344abhishek parasarNo ratings yet

- VTU ResultDocument1 pageVTU Resultwaqar sarwarNo ratings yet

- Loan Account Statement For LUCHD00037184487Document4 pagesLoan Account Statement For LUCHD00037184487abhishek parasarNo ratings yet

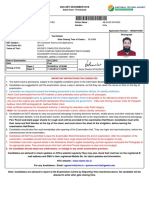

- Examination Hall Ticket PDFDocument2 pagesExamination Hall Ticket PDFZunaid PathanNo ratings yet

- EMS ResultDocument1 pageEMS ResultRitvikNo ratings yet

- LL BillDocument3 pagesLL BillAravind PhoenixNo ratings yet

- Student ResultDocument4 pagesStudent ResultRakesh MauryaNo ratings yet

- Ranjodh SinghDocument2 pagesRanjodh Singhranjodh singhNo ratings yet

- Aadhaar FormDocument3 pagesAadhaar FormNABIN DEURINo ratings yet

- Sta. Cruz Elementary SchoolDocument1 pageSta. Cruz Elementary SchoolLourence Jay EvioNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document6 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Prashant SinghNo ratings yet

- Statement of Account - 18 - 03 - 14 PDFDocument2 pagesStatement of Account - 18 - 03 - 14 PDFShantesh AroraNo ratings yet

- CBSE NET ApplicationDocument1 pageCBSE NET ApplicationRidan DasNo ratings yet

- Quotation - S01783 - Al Faisal UniversityDocument2 pagesQuotation - S01783 - Al Faisal UniversityahmedNo ratings yet

- Click Here To Print LogoutDocument1 pageClick Here To Print LogoutAyush swainNo ratings yet

- िवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument2 pagesिवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptmalkeetNo ratings yet

- OJEE2019C AdmitCardDocument1 pageOJEE2019C AdmitCardAswini Kumar PaloNo ratings yet

- Engineering Services (Main) Examination, 2019: Union Public Service Commission Detailed Application FormDocument5 pagesEngineering Services (Main) Examination, 2019: Union Public Service Commission Detailed Application FormVivekMishraNo ratings yet

- Acknowledgement 1691049985290Document4 pagesAcknowledgement 1691049985290JHARNA DASNo ratings yet

- Personal Data SheetDocument12 pagesPersonal Data Sheetdarwin dela cruzNo ratings yet

- HDFC Bank LTDDocument1 pageHDFC Bank LTDKhushi JainNo ratings yet

- Federal University of Technology, Owerri: Student Payment ReceiptDocument1 pageFederal University of Technology, Owerri: Student Payment ReceiptOkoronkwo AugustineNo ratings yet

- Msu PDFDocument2 pagesMsu PDFTaarak Mehta Ka Ooltah ChashmahNo ratings yet

- Invoice For PO#868Document4 pagesInvoice For PO#868Didik Tri WahyudiNo ratings yet

- British CouponDocument45 pagesBritish CouponKakouris AndreasNo ratings yet

- AdmitCard 180520418581Document1 pageAdmitCard 180520418581Rather AarifNo ratings yet

- Timir MannaDocument5 pagesTimir MannaAmalkumar BeraNo ratings yet

- Graduate Pharmacy Aptitude TestDocument1 pageGraduate Pharmacy Aptitude TestKumar LuckyNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument1 pageTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- Letter of Credit Bank Specific !Document17 pagesLetter of Credit Bank Specific !JOEMEETSMONUNo ratings yet

- Bill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Document4 pagesBill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Keshaw RajNo ratings yet

- FEDGL05030000410 GPCDocument2 pagesFEDGL05030000410 GPCTarun kumarNo ratings yet

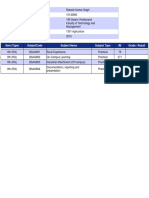

- My Home Branch Information My Information: Ms. DeeptiDocument4 pagesMy Home Branch Information My Information: Ms. DeeptiTarun KumarNo ratings yet

- Train Ticket TK216525928Q23Document3 pagesTrain Ticket TK216525928Q23Tarun KumarNo ratings yet

- Revenue Application RecieptDocument1 pageRevenue Application RecieptTarun KumarNo ratings yet

- Hall TicketDocument1 pageHall TicketTarun KumarNo ratings yet

- Detailed AdvertisementDocument13 pagesDetailed AdvertisementTarun KumarNo ratings yet

- E-Passbook-2023 17-03-2023Document1 pageE-Passbook-2023 17-03-2023Tarun KumarNo ratings yet

- Im 38 BCDocument3 pagesIm 38 BCTarun KumarNo ratings yet

- Ladli30 10 2009Document2 pagesLadli30 10 2009Tarun KumarNo ratings yet

- HQ Pune Notification For Agniveer Army Recruitment Rally For Men at Ahmednagar From 23 Aug To 11 Sep 2022Document19 pagesHQ Pune Notification For Agniveer Army Recruitment Rally For Men at Ahmednagar From 23 Aug To 11 Sep 2022Tarun KumarNo ratings yet

- New Introduction ApplicationDocument24 pagesNew Introduction ApplicationTarun KumarNo ratings yet

- Uttarakhand Transport Corporation E-Ticket: Fare DetailDocument1 pageUttarakhand Transport Corporation E-Ticket: Fare DetailTarun KumarNo ratings yet

- FEDGL05030000085 GPCDocument1 pageFEDGL05030000085 GPCTarun KumarNo ratings yet

- Uttarakhand Transport Corporation E-Ticket: Fare DetailDocument1 pageUttarakhand Transport Corporation E-Ticket: Fare DetailTarun KumarNo ratings yet

- An Indian Army Publication: No. 07/2022 July 2022Document16 pagesAn Indian Army Publication: No. 07/2022 July 2022Tarun KumarNo ratings yet

- The Online RegistrationDocument1 pageThe Online RegistrationTarun KumarNo ratings yet