Credit Card Comparison: 0% For 6 Mo, 16.24% To 27.24% After

Credit Card Comparison: 0% For 6 Mo, 16.24% To 27.24% After

Uploaded by

Elise Smoll (Elise)Copyright:

Available Formats

Credit Card Comparison: 0% For 6 Mo, 16.24% To 27.24% After

Credit Card Comparison: 0% For 6 Mo, 16.24% To 27.24% After

Uploaded by

Elise Smoll (Elise)Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Credit Card Comparison: 0% For 6 Mo, 16.24% To 27.24% After

Credit Card Comparison: 0% For 6 Mo, 16.24% To 27.24% After

Uploaded by

Elise Smoll (Elise)Copyright:

Available Formats

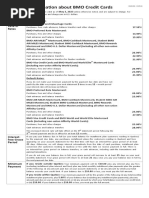

CREDIT CARD COMPARISON

Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit Card information:

https://www.nerdwallet.com/. Store Cards and Pay Day Lenders search individually on internet.

Type of Credit & APR (%) Annual Fee Other Fees Balance Finance Grace Other

Company Transfer Charge Period

Example Visa Signature, 0% for 9 mo, None Cash adv. 3% No fees 0.50 20 days Earn double miles on

Capital One – No 13.9% after Late fees $29- purchases, Fly on any

Hassle 35 airline, No blackout

dates, Seat restriction

Credit Card

0% for 15 None ???

Chase mo, 18.74% $5 ??? ???

- 27.49%. None

Freedom

Unlimited® after

Credit Card

Wells Fargo 0% for 15 none

Active mo, 19.24%, $5

Cash® Card 24.24% or none ??? ??? ???

29.24%. after

Credit Card Cash adv.

0% for 6 29.24%

none Late fees ??? ???

mo,

16.24% up to $41 3% to 5%

???

Discover it®to

Balance 27.24%

Transfer after

Store Card

Store Card

Payday

Lender

1. Which credit option appeals to you most? Why?

Chase Freedom Unlimited®. because it seem like less money spent

2. Which piece of information (annual fees, APR, other) would you pay more attention to? Why?

APR. ???

3. What techniques do the credit companies use to market their credit?

Introductory low APR rates

4. Find three pieces of information that is in the “fine print” that you, the consumer, would need to know.

a.

The standard APR.

b. The balance transfer APR and balance transfer fees.

The cash advance APR and cash advance fees.

c.

5. Name three things that consumers need to be aware of when applying for a credit card. a. b. c. 6. What did you learn from this exercise?

minimum repayment.

a.

b.

annual fee.

c. charges.

You might also like

- CALCULATE: Impact of Credit Score On LoansDocument2 pagesCALCULATE: Impact of Credit Score On LoansElise Smoll (Elise)100% (1)

- A211 Tutorial 2 (JiaLe)Document9 pagesA211 Tutorial 2 (JiaLe)Chee Zhi QianNo ratings yet

- INTERACTIVE: FICO Credit ScoresDocument4 pagesINTERACTIVE: FICO Credit ScoresElise Smoll (Elise)No ratings yet

- A Salary-Based Budget: NGPF Activity Bank BudgetingDocument39 pagesA Salary-Based Budget: NGPF Activity Bank BudgetingElise Smoll (Elise)No ratings yet

- Credit ReportDocument3 pagesCredit Reportapi-404605618No ratings yet

- Credit Card Assignment PDF WeeblyDocument2 pagesCredit Card Assignment PDF Weeblyapi-371069146No ratings yet

- Credit Card Assignment-3Document3 pagesCredit Card Assignment-3404332No ratings yet

- Credit Card Comparison InstructionsDocument2 pagesCredit Card Comparison InstructionsMichelle StubbsNo ratings yet

- Sample Offer 2Document1 pageSample Offer 2api-360140319No ratings yet

- Visa Rewards App DisclosureDocument4 pagesVisa Rewards App Disclosureznb2015No ratings yet

- Credit CardsDocument3 pagesCredit Cardsapi-371057862No ratings yet

- Credit Card Information 1Document3 pagesCredit Card Information 1api-3710686770% (1)

- Rcc Scc Schumer AgreementDocument16 pagesRcc Scc Schumer Agreementderekmann1999No ratings yet

- 03.04 - Credit - OfferDocument2 pages03.04 - Credit - Offereniqueperry7No ratings yet

- TermsDocument3 pagesTermsbuffalogeeksNo ratings yet

- Example of Credit Card Agreement For Bank of America® Secured ...Document14 pagesExample of Credit Card Agreement For Bank of America® Secured ...Maestro Unico1No ratings yet

- Credit CardsDocument3 pagesCredit Cardsapi-371057922No ratings yet

- Citi Secured MasterCard Pricing Information TableDocument2 pagesCiti Secured MasterCard Pricing Information TableEthelyn SalternNo ratings yet

- Credit Card AssignmentDocument6 pagesCredit Card Assignmentapi-371068606No ratings yet

- Cost of Borrowing enDocument2 pagesCost of Borrowing enjordan.longo15No ratings yet

- PDF MC 7613 Cob Insert eDocument2 pagesPDF MC 7613 Cob Insert eFaizul RahmanNo ratings yet

- Credit CardDocument3 pagesCredit Cardapi-371068989No ratings yet

- Cost of Borrowing enDocument2 pagesCost of Borrowing enKhalid BNo ratings yet

- My CCPayDocument6 pagesMy CCPayMyCCPay customer service phone number100% (1)

- AffirmDocument1 pageAffirmfranciswezzybwoyNo ratings yet

- Cardmember Agreement Rates and Fees TableDocument15 pagesCardmember Agreement Rates and Fees TableMatt D FNo ratings yet

- ChaseDocument4 pagesChaseemilybella822No ratings yet

- Balance Transfer Special Rate - HomeDocument2 pagesBalance Transfer Special Rate - Hometech.filnipponNo ratings yet

- Credit Cards: Presented By: Abhishek VijayvargiyaDocument15 pagesCredit Cards: Presented By: Abhishek VijayvargiyaAbhishek VijayvagiyaNo ratings yet

- The Home Depot Consumer Credit Card Disclosures: Interest Rates and Interest ChargesDocument1 pageThe Home Depot Consumer Credit Card Disclosures: Interest Rates and Interest ChargesKontolNo ratings yet

- CHFinal PPTDocument7 pagesCHFinal PPTVivaan BattishNo ratings yet

- De-Mos: Credit Card Industry PracticesDocument2 pagesDe-Mos: Credit Card Industry PracticesSimply Debt SolutionsNo ratings yet

- Discover It For StudentsDocument1 pageDiscover It For StudentsVinod ChintalapudiNo ratings yet

- Credit Card PdsDocument12 pagesCredit Card Pds9z95x4pt4jNo ratings yet

- Interest Rates and Interest Charges: Capital One Application TermsDocument4 pagesInterest Rates and Interest Charges: Capital One Application TermsAnonymous Nr3DEEszTNo ratings yet

- CreditUnionVsBankWebquest 1Document5 pagesCreditUnionVsBankWebquest 1Christian MilamNo ratings yet

- Interest Rates and Interest Charges: Capital One Application TermsDocument6 pagesInterest Rates and Interest Charges: Capital One Application TermsMohammad Azam khanNo ratings yet

- Kami Export - Comparing-Checking-Accounts-WorksheetDocument1 pageKami Export - Comparing-Checking-Accounts-Worksheet326838No ratings yet

- Nfcu Secured Credit Card Application - 800nDocument2 pagesNfcu Secured Credit Card Application - 800nKako The 66th Channel100% (2)

- Project ReportDocument12 pagesProject ReportMitali RajNo ratings yet

- Consumer Lending in IndiaDocument22 pagesConsumer Lending in IndiadeepakNo ratings yet

- Disclosure.28589.en USDocument5 pagesDisclosure.28589.en USminhajraza128No ratings yet

- Application Terms and ConditionsDocument2 pagesApplication Terms and ConditionsGregory SMithNo ratings yet

- Disclosure.26469.en USDocument5 pagesDisclosure.26469.en UShurlashineNo ratings yet

- 11 Dirty Little Secrets Your Credit CardDocument7 pages11 Dirty Little Secrets Your Credit CardrajivermaNo ratings yet

- 03.04_credit_offerDocument3 pages03.04_credit_offergalore.blox.gamingNo ratings yet

- Credit CardsDocument36 pagesCredit Cardsapi-371069119No ratings yet

- Preguntas FrecuentesDocument2 pagesPreguntas FrecuentesAnthony PetitNo ratings yet

- Terms ElitePremCreditCardDocument1 pageTerms ElitePremCreditCardAaron Aureliano VijayanNo ratings yet

- Project Submitted in Partial Fulfillment of The Requirement of The Award of The Degree ofDocument28 pagesProject Submitted in Partial Fulfillment of The Requirement of The Award of The Degree ofmehrozeNo ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument7 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaNikhil Jain100% (1)

- Account Opening DisclosuresDocument8 pagesAccount Opening DisclosuresshivasabharwakNo ratings yet

- Credit Card PdsDocument12 pagesCredit Card PdsZainuddin HanifaNo ratings yet

- See If You Are Pre-ApprovedDocument1 pageSee If You Are Pre-Approvedmilerichard793No ratings yet

- Account Opening DisclosuresDocument9 pagesAccount Opening Disclosuresolaunlimited01No ratings yet

- First Delivery Financial Mathematics ProjectDocument16 pagesFirst Delivery Financial Mathematics ProjectScribdTranslationsNo ratings yet

- Disclosure.29131.en USDocument6 pagesDisclosure.29131.en USmelchizedek560No ratings yet

- Credit CardsDocument33 pagesCredit Cardsapi-359023534No ratings yet

- DisclosuresDocument4 pagesDisclosuresMd jahied islamNo ratings yet

- 3.03 Personal FinanceDocument3 pages3.03 Personal FinanceObed AlmodovarNo ratings yet

- Awareness: 1. Are You Aware of Net Banking Services Offered by The Banks ?Document12 pagesAwareness: 1. Are You Aware of Net Banking Services Offered by The Banks ?AasimNo ratings yet

- The Truth About Zero Percent Car FinacingDocument2 pagesThe Truth About Zero Percent Car FinacingStea100% (4)

- Money 911: Tested Strategies to Survive Your Financial EmergencyFrom EverandMoney 911: Tested Strategies to Survive Your Financial EmergencyNo ratings yet

- ECON: in Ation, Spending, and Wages: NGPF Econ Collection BudgetingDocument2 pagesECON: in Ation, Spending, and Wages: NGPF Econ Collection BudgetingElise Smoll (Elise)No ratings yet

- UntitledDocument2 pagesUntitledElise Smoll (Elise)No ratings yet

- UntitledDocument2 pagesUntitledElise Smoll (Elise)No ratings yet

- Globalization Positive Aspects of Globalization Negative Aspects of GlobalizationDocument1 pageGlobalization Positive Aspects of Globalization Negative Aspects of GlobalizationElise Smoll (Elise)No ratings yet

- Topic/Title - Rising Seas - : Observations: ConclusionsDocument2 pagesTopic/Title - Rising Seas - : Observations: ConclusionsElise Smoll (Elise)No ratings yet

- A Developing World: Child MortalityDocument2 pagesA Developing World: Child MortalityElise Smoll (Elise)No ratings yet

- UntitledDocument1 pageUntitledElise Smoll (Elise)No ratings yet

- Previous NextDocument5 pagesPrevious NextElise Smoll (Elise)No ratings yet

- COMPARE: Needs vs. Wants: Part I: Assess Your ValuesDocument4 pagesCOMPARE: Needs vs. Wants: Part I: Assess Your ValuesElise Smoll (Elise)No ratings yet

- Scarcity and Opportunity Cost: The Economic ProblemDocument10 pagesScarcity and Opportunity Cost: The Economic ProblemElise Smoll (Elise)100% (1)

- Climate Change Document Analysis and QuestionsDocument3 pagesClimate Change Document Analysis and QuestionsElise Smoll (Elise)No ratings yet

- Imports, Export, and Exchange Rate Positive Aspects of Trade Negative Aspects of TradeDocument1 pageImports, Export, and Exchange Rate Positive Aspects of Trade Negative Aspects of TradeElise Smoll (Elise)No ratings yet

- Identifying International Organizations: The Products & Services That You Use On A Daily BasisDocument2 pagesIdentifying International Organizations: The Products & Services That You Use On A Daily BasisElise Smoll (Elise)No ratings yet

- Foreign Aid and Remittance: Crash Course Economics Video AnalysisDocument7 pagesForeign Aid and Remittance: Crash Course Economics Video AnalysisElise Smoll (Elise)No ratings yet

- Observations: ConclusionsDocument2 pagesObservations: ConclusionsElise Smoll (Elise)No ratings yet

- Some Infectious Diseases No Longer Pose Major Threats. Access To Health Care MattersDocument1 pageSome Infectious Diseases No Longer Pose Major Threats. Access To Health Care MattersElise Smoll (Elise)No ratings yet

- Terrorists or Freedom FighterDocument3 pagesTerrorists or Freedom FighterElise Smoll (Elise)No ratings yet

- Types of ConflictDocument3 pagesTypes of ConflictElise Smoll (Elise)No ratings yet

- Types of TerrorismDocument2 pagesTypes of TerrorismElise Smoll (Elise)No ratings yet

- Week 8 Political CartoonDocument2 pagesWeek 8 Political CartoonElise Smoll (Elise)No ratings yet

- What Do Terrorists Have in CommonDocument2 pagesWhat Do Terrorists Have in CommonElise Smoll (Elise)No ratings yet

- Restoration Magazine Jan 2022Document56 pagesRestoration Magazine Jan 2022Elise Smoll (Elise)100% (1)

- The Tools of Foreign PolicyDocument8 pagesThe Tools of Foreign PolicyElise Smoll (Elise)No ratings yet

- Common Based Assessment - Causes and Forms of ConflictDocument7 pagesCommon Based Assessment - Causes and Forms of ConflictElise Smoll (Elise)No ratings yet

- CBA DocumentDocument1 pageCBA DocumentElise Smoll (Elise)No ratings yet

- Forms of Modern ConflictDocument3 pagesForms of Modern ConflictElise Smoll (Elise)No ratings yet

- You DecideDocument4 pagesYou DecideElise Smoll (Elise)No ratings yet

- CH 5 - HomeworkDocument4 pagesCH 5 - HomeworkAxel OngNo ratings yet

- Bài tập Unit 1Document7 pagesBài tập Unit 1gducky04No ratings yet

- International Financial Management PPT Chap 1Document26 pagesInternational Financial Management PPT Chap 1serge folegweNo ratings yet

- Wto & Its Implications On AgricultureDocument20 pagesWto & Its Implications On Agriculturepremsukhgodara_iabmNo ratings yet

- Discussion and Solutions For Investment in Associate - Hand - Out 1Document19 pagesDiscussion and Solutions For Investment in Associate - Hand - Out 1Teresa AlbertoNo ratings yet

- Sales and Distribution Accounting Entries: A) at The Time of Delivery of Goods (PGI)Document5 pagesSales and Distribution Accounting Entries: A) at The Time of Delivery of Goods (PGI)bhaskarraosatyaNo ratings yet

- Alghorfa July EnglowresDocument60 pagesAlghorfa July EnglowresMiraz HassanNo ratings yet

- Accounts Assign RatiosDocument58 pagesAccounts Assign Ratiosmamtachaudhary6966No ratings yet

- Introduction To Investing 2.1 What Is An Investment V2Document5 pagesIntroduction To Investing 2.1 What Is An Investment V2Anaaya SinghaniaNo ratings yet

- Chapter 6 Time Value of MoneyDocument39 pagesChapter 6 Time Value of Moneyjhogonnath.saha.65No ratings yet

- Ce316 03Document27 pagesCe316 03Kelvin Kindice MapurisaNo ratings yet

- History of TRADE and COMMERCEDocument16 pagesHistory of TRADE and COMMERCEGaming Pro100% (2)

- DR AlliDocument20 pagesDR AlliDr K. Mamatha Prof & Hod FMTNo ratings yet

- The Ontology of Money by Geoffrey Ingham - TWILL #14Document8 pagesThe Ontology of Money by Geoffrey Ingham - TWILL #14Edward HillNo ratings yet

- La Crisis Del Siglo XVII - HobsbawmDocument22 pagesLa Crisis Del Siglo XVII - HobsbawmMartin CortesNo ratings yet

- 803E Incoterms 2020 Wallchart A4Document1 page803E Incoterms 2020 Wallchart A4bd6999No ratings yet

- Practical Financial Management 7th Edition Lasher Solution ManualDocument27 pagesPractical Financial Management 7th Edition Lasher Solution Manualharold100% (33)

- Net Interest MarginDocument2 pagesNet Interest MarginAnanta Panigrahi100% (1)

- Globalisation and The Indian Economy Day 17 2024Document2 pagesGlobalisation and The Indian Economy Day 17 2024justpeppezzNo ratings yet

- GLOBALIZATIONDocument4 pagesGLOBALIZATIONHimanshu DarganNo ratings yet

- Business Taxation 3Document47 pagesBusiness Taxation 3Prince Isaiah JacobNo ratings yet

- RMC-No-57 - Annexes-A-C - ANABELLA S. FERNANDEZDocument6 pagesRMC-No-57 - Annexes-A-C - ANABELLA S. FERNANDEZVicky Tamo-oNo ratings yet

- Balance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Document1 pageBalance Transfer Application Form: (Please Use Capital Letters To Fill The Application)Ali Khan AKNo ratings yet

- Rajkot Chemicals and Manufactureing PDFDocument3 pagesRajkot Chemicals and Manufactureing PDFDarshan ShethNo ratings yet

- WiseDocument5 pagesWisedanikarim99No ratings yet

- Exim ManualDocument110 pagesExim ManualShubham ShuklaNo ratings yet

- Statement 22399810Document1 pageStatement 22399810Vaijayanthi GrNo ratings yet

- Get Rich QuizDocument12 pagesGet Rich Quizmichaela1811No ratings yet

- FAR.2917 Bank-ReconciliationDocument4 pagesFAR.2917 Bank-ReconciliationmarielleNo ratings yet