0 ratings0% found this document useful (0 votes)

226 viewsForm 1

Form 1

Uploaded by

mdarsalankhan.hseThis document outlines Anil Harichandan's salary for October 2023 from Shapoorji Pallonji And Company Private Limited, including a basic salary of Rs. 15,000, allowances of Rs. 27,800, and statutory bonus of Rs. 6,067, with a PF contribution deduction of Rs. 1,800, resulting in a net salary of Rs. 47,067.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Form 1

Form 1

Uploaded by

mdarsalankhan.hse0 ratings0% found this document useful (0 votes)

226 views1 pageThis document outlines Anil Harichandan's salary for October 2023 from Shapoorji Pallonji And Company Private Limited, including a basic salary of Rs. 15,000, allowances of Rs. 27,800, and statutory bonus of Rs. 6,067, with a PF contribution deduction of Rs. 1,800, resulting in a net salary of Rs. 47,067.

Original Title

Form-1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document outlines Anil Harichandan's salary for October 2023 from Shapoorji Pallonji And Company Private Limited, including a basic salary of Rs. 15,000, allowances of Rs. 27,800, and statutory bonus of Rs. 6,067, with a PF contribution deduction of Rs. 1,800, resulting in a net salary of Rs. 47,067.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

226 views1 pageForm 1

Form 1

Uploaded by

mdarsalankhan.hseThis document outlines Anil Harichandan's salary for October 2023 from Shapoorji Pallonji And Company Private Limited, including a basic salary of Rs. 15,000, allowances of Rs. 27,800, and statutory bonus of Rs. 6,067, with a PF contribution deduction of Rs. 1,800, resulting in a net salary of Rs. 47,067.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

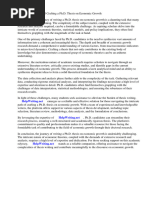

Salary for October 2023

Company Shapoorji Pallonji And Company Private Limited

Employee Anil Harichandan Employee Code 50001566

Location EPC-MMBU-PUNE PF Memb Cont.(YTD) 12,600.00

Department HSE Tax Regime Old Tax Regime

Designation Senior Officer (Safety) Income Y.T.D 305,667.00

Grade Payment Mode BankTransfer-Payroll

Leave Without Pay Deducted For P.F.A/c No. 270000018619

Bank Account No. E.S.I.C A/c No. 50001566

Bank Name HDFC BANK LTD UAN 101248013267

Pan Card AFXPH0648R DOJ

Earnings Period Amount

Basic Salary Oct/2023 15,000.00

House Rent Allowance Oct/2023 1,500.00

Furnishing Allowance Oct/2023 26,300.00

Statutory Bonus 22-23 Oct/2023 6,067.00

Deductions Period Amount

Ee PF contribution Oct/2023 1,800.00

Total Earnings 48,867.00 Total Deductions 1,800.00

Net Salary ( in Figures ) 47,067.00

Net Salary ( in Words ) Rupees FORTY SEVEN THOUSAND SIXTY SEVEN

Perks/Exmp/Reb Sec 10 Exemption / Loan Balance Form 16 Summary

Agg of Chapter VI 21600.00 Tax credit 9893.00 Gross Salary 519667.00

Balance 519667.00

Std Deduction 50000.00

Empmnt tax (Prof Tax) 208.00

Aggrg Deduction 50208.00

Incm under Hd Salary 469459.00

Gross Tot Income 469459.00

Agg of Chapter VI 21600.00

Total Income 447860.00

Tax on total Income 9893.00

You might also like

- Nick Williams PGE Bill 01.2023Document3 pagesNick Williams PGE Bill 01.2023César Dávila0% (1)

- Daily Check For Pick Carry (Farana) Check List TataDocument1 pageDaily Check For Pick Carry (Farana) Check List TataBiswaranjan SahooNo ratings yet

- JSA Coco-Cola - NewDocument2 pagesJSA Coco-Cola - Newsrinu degala100% (1)

- Annual Report Sample FullDocument4 pagesAnnual Report Sample Fullstreet_jam_hiphop91% (11)

- Proforma For Screening WorkmenDocument2 pagesProforma For Screening WorkmenAlok KumarNo ratings yet

- 1-CSM Procedure Final DraftDocument37 pages1-CSM Procedure Final DraftSri KanthNo ratings yet

- Checklist For Equipment Inspection BikeDocument1 pageChecklist For Equipment Inspection BikeHung Hoang0% (1)

- AV-SWP-42 Personal Protective Equipment Iss 1Document5 pagesAV-SWP-42 Personal Protective Equipment Iss 1Kevin DeLimaNo ratings yet

- Pre-Job Craft Safety Meeting FormDocument2 pagesPre-Job Craft Safety Meeting FormABDUL RISHAD KunduthodeNo ratings yet

- HSE Management System TemplateDocument8 pagesHSE Management System TemplateMyo LwinNo ratings yet

- Orwak 5030Document8 pagesOrwak 5030Enrique MurgiaNo ratings yet

- The Tamil Nadu Safety Officers (Duties, Qualifications and Conditions of Service) Rules, 2005Document7 pagesThe Tamil Nadu Safety Officers (Duties, Qualifications and Conditions of Service) Rules, 2005Manikandan.k KandanNo ratings yet

- HS 001 LTIFPD Safety AwardsDocument10 pagesHS 001 LTIFPD Safety AwardsgrantNo ratings yet

- Operators CompetencyDocument5 pagesOperators CompetencyikponmwonsaNo ratings yet

- HousekeepingDocument3 pagesHousekeepingomarfortnite2011No ratings yet

- PCD-OSH-SF-34 PTW For Blasting WorkDocument1 pagePCD-OSH-SF-34 PTW For Blasting Workrizal azizanNo ratings yet

- Form As-1 SMPV Rules 2016Document2 pagesForm As-1 SMPV Rules 2016Venugopal Sri100% (2)

- Aa & AaaDocument3 pagesAa & Aaaabraham.devadass33100% (1)

- Discharge Rod 11kv 3phaseDocument1 pageDischarge Rod 11kv 3phasewaytobhushan100% (1)

- India - Leave PolicyDocument10 pagesIndia - Leave Policyvipul8800No ratings yet

- JSA For Erection Activithy (PEB)Document5 pagesJSA For Erection Activithy (PEB)Brij bhushan TiwariNo ratings yet

- JSA 001 - UG Pipe Fabrication & ErectionDocument14 pagesJSA 001 - UG Pipe Fabrication & ErectionNitish SinghNo ratings yet

- Weekly EHS Statistics Report - 02Document9 pagesWeekly EHS Statistics Report - 02EHS AcefireNo ratings yet

- 048A COSHH Thinners-PaintDocument1 page048A COSHH Thinners-PaintanonNo ratings yet

- Evacuation Flow Chart 3Document1 pageEvacuation Flow Chart 3Abdul RhmanNo ratings yet

- Emergency Communication Flowchart 103Document4 pagesEmergency Communication Flowchart 103Ari Catur Priyambodo100% (1)

- The Mines and Minerals Operational Regulations Sierra LeoneDocument111 pagesThe Mines and Minerals Operational Regulations Sierra LeonelugardsunNo ratings yet

- Chairperson Appointment TemplateDocument4 pagesChairperson Appointment TemplatemimiNo ratings yet

- Toolbox Topic: C: Ardinal RulesDocument1 pageToolbox Topic: C: Ardinal RuleskoketsoNo ratings yet

- Self - Evaluation-Cum-Verification Report)Document13 pagesSelf - Evaluation-Cum-Verification Report)Rakesh PandeyNo ratings yet

- Work Permit Register TemplateDocument1 pageWork Permit Register TemplateAli TavakoliNo ratings yet

- How To Calculate The Average Number of EmployeesDocument8 pagesHow To Calculate The Average Number of EmployeesштттNo ratings yet

- Visitor ID CardDocument1 pageVisitor ID Cardsyed khaja misbhuddinNo ratings yet

- Ohs-Pr-09-03-F11 (A) Ra & JSP Daily Briefing - TBT RecordDocument1 pageOhs-Pr-09-03-F11 (A) Ra & JSP Daily Briefing - TBT RecordShafie ZubierNo ratings yet

- Training Registration Form - SARSDocument3 pagesTraining Registration Form - SARSammadNo ratings yet

- Employee Card Employee Card: Bishal Security Services Bishal Security ServicesDocument9 pagesEmployee Card Employee Card: Bishal Security Services Bishal Security Servicessai projectNo ratings yet

- Certificate of AppreciationDocument1 pageCertificate of AppreciationIdris AdeniranNo ratings yet

- QPMO-700-00-FM-030 Incident Report Rev 0Document6 pagesQPMO-700-00-FM-030 Incident Report Rev 0IslamAl-BazNo ratings yet

- 04 - Excavation Certificate (4022815 - v1)Document1 page04 - Excavation Certificate (4022815 - v1)Ali.N AlsaadyNo ratings yet

- Report - ON SITE EMERGENCY PLAN Report - 0Document63 pagesReport - ON SITE EMERGENCY PLAN Report - 0Dasari VenkateshNo ratings yet

- Contractor Personnel and Safety Statistics Monthly Summary - Form S2052Document1 pageContractor Personnel and Safety Statistics Monthly Summary - Form S2052Safety professionalNo ratings yet

- HIRA 17 - Pre-Stressing - Grouting of Post Tensioned I GirderDocument3 pagesHIRA 17 - Pre-Stressing - Grouting of Post Tensioned I Girdersanjeev.metrorblNo ratings yet

- TATA Steel Police Verification DeclarationDocument2 pagesTATA Steel Police Verification DeclarationHarshNo ratings yet

- Basis of Presentation: The Health and Safety AuditDocument25 pagesBasis of Presentation: The Health and Safety AuditsivaNo ratings yet

- 0.oshad ManualDocument20 pages0.oshad ManualABUBAKR ELSAIDNo ratings yet

- Job Safety Analysis: SKSA-JSA-23 - 171-001 00 05/10/2023 10-13173Document7 pagesJob Safety Analysis: SKSA-JSA-23 - 171-001 00 05/10/2023 10-13173skmohdmusthafaNo ratings yet

- Workmen Screening FormDocument2 pagesWorkmen Screening Formmech.cmrlug01No ratings yet

- Safe Work PermitDocument6 pagesSafe Work PermitMalefane Cortez TlatlaneNo ratings yet

- HIRADocument7 pagesHIRAAkhilesh DubeyNo ratings yet

- Weekly and Monthaly Check ListDocument76 pagesWeekly and Monthaly Check Listmuhammad.younisNo ratings yet

- Annexure 9 Q1FY23 - P514 2Document5 pagesAnnexure 9 Q1FY23 - P514 2TANWIR AHEMADNo ratings yet

- HSE Training Awareness & Competency ProcedDocument26 pagesHSE Training Awareness & Competency Procedm.umarNo ratings yet

- Abstract of Land Acquisition Proposed Railway Over Bridge at Kavalkinaru LC-74NDocument34 pagesAbstract of Land Acquisition Proposed Railway Over Bridge at Kavalkinaru LC-74NMATHAN100% (1)

- SOP - For - HygieneDocument1 pageSOP - For - HygieneELITE INDUSTRIAL CONSULTNo ratings yet

- JSA GI Earthstrip at PTAO&M Building 05Document5 pagesJSA GI Earthstrip at PTAO&M Building 05Saiyad RiyazaliNo ratings yet

- Emergency Communication Flow Chart HdGCP-3 Rev 2Document1 pageEmergency Communication Flow Chart HdGCP-3 Rev 2Sabre Alam0% (1)

- Hira - NRV ServicingDocument11 pagesHira - NRV ServicingAbzad HussainNo ratings yet

- Cold Work PermitDocument1 pageCold Work PermitherdianNo ratings yet

- 71heat Stress PolicyDocument4 pages71heat Stress PolicyAtep PurnamaNo ratings yet

- The Handbook of Safety Engineering: Principles and ApplicationsFrom EverandThe Handbook of Safety Engineering: Principles and ApplicationsRating: 4 out of 5 stars4/5 (1)

- February 2023Document1 pageFebruary 2023Pradeep Kumar malikNo ratings yet

- Pay Slip of August 2023Document1 pagePay Slip of August 2023alim.siddiquiNo ratings yet

- Profile For A Civil EngineerDocument3 pagesProfile For A Civil Engineermdarsalankhan.hseNo ratings yet

- Haran SureshDocument24 pagesHaran Sureshmdarsalankhan.hseNo ratings yet

- Sunrise UniversityDocument42 pagesSunrise Universitymdarsalankhan.hseNo ratings yet

- newJSA For Hot and HeightDocument4 pagesnewJSA For Hot and Heightmdarsalankhan.hseNo ratings yet

- N2 QC CAPA Plan Template FINAL - 2016.aug.19Document1 pageN2 QC CAPA Plan Template FINAL - 2016.aug.19mdarsalankhan.hseNo ratings yet

- Draft Teaching Timetable Sem One Ay 2024.2025Document100 pagesDraft Teaching Timetable Sem One Ay 2024.2025darijay034No ratings yet

- Tut 3 Group 15 Vietcombank ReportDocument22 pagesTut 3 Group 15 Vietcombank ReportNgọc LinhNo ratings yet

- Instant Access To (Original PDF) International Economics Theory and Policy 11th Edition Ebook Full ChaptersDocument41 pagesInstant Access To (Original PDF) International Economics Theory and Policy 11th Edition Ebook Full Chaptersmanzouvaira100% (8)

- Ghana Grid Company Ltd. (Gridco) : APRIL 2022Document25 pagesGhana Grid Company Ltd. (Gridco) : APRIL 2022Fuaad DodooNo ratings yet

- Jasa Armada Indonesia: Equity ResearchDocument4 pagesJasa Armada Indonesia: Equity ResearchyolandaNo ratings yet

- NIACL AO Prelims Memory Based Paper - English VersionDocument32 pagesNIACL AO Prelims Memory Based Paper - English VersionS.Millan KumarNo ratings yet

- Current ChargesDocument1 pageCurrent ChargesMajkel Benche Custodio MllNo ratings yet

- Multiple Choice Questions 1 Which of The Following Statements Is Correct ADocument2 pagesMultiple Choice Questions 1 Which of The Following Statements Is Correct ATaimour HassanNo ratings yet

- Bric Vs BriDocument19 pagesBric Vs BriNadir AliNo ratings yet

- Final PurposalDocument18 pagesFinal Purposalthesisfile01No ratings yet

- 12th Accountancy One Word Question Paper With Answer Keys English Medium PDF DownloadDocument6 pages12th Accountancy One Word Question Paper With Answer Keys English Medium PDF Downloadskrockers9056No ratings yet

- Alibaba Company AnalysisDocument47 pagesAlibaba Company AnalysisAsh100% (1)

- PHD Thesis On Economic GrowthDocument7 pagesPHD Thesis On Economic GrowthCustomNotePaperAtlanta100% (2)

- Essays Global Financial Crisis PDFDocument343 pagesEssays Global Financial Crisis PDFHeirene Cabusbusan100% (1)

- Cleaning BusinessDocument17 pagesCleaning BusinessScribdTranslationsNo ratings yet

- Financial Markets and ServicesDocument18 pagesFinancial Markets and ServicesChand .TandonNo ratings yet

- SAP Concur Expense Entity Relationship DiagramDocument2 pagesSAP Concur Expense Entity Relationship Diagramjay.sapfico1No ratings yet

- GBC ECON 101 S1 2023 AssignmentDocument6 pagesGBC ECON 101 S1 2023 AssignmentBonkNo ratings yet

- 12 ECO AK 27112024Document8 pages12 ECO AK 27112024kannavijay631919No ratings yet

- s6 Econ p2 Uace Internal Mocks Exam 2020 King's College - BuddoDocument3 pagess6 Econ p2 Uace Internal Mocks Exam 2020 King's College - Buddoayubuminka0No ratings yet

- LC 216520020037Document4 pagesLC 216520020037gohoji4169No ratings yet

- Financial Analysis: Alka Assistant Director Power System Training Institute BangaloreDocument40 pagesFinancial Analysis: Alka Assistant Director Power System Training Institute Bangaloregaurang1111No ratings yet

- Forest Metal Group 2016Document157 pagesForest Metal Group 2016Romulo AlvesNo ratings yet

- Payment of Bonus RulesDocument8 pagesPayment of Bonus RulesAshwani MorNo ratings yet

- Document 1Document29 pagesDocument 1meetjaswani876No ratings yet

- Summary Report On Material Variances and Its TypesDocument5 pagesSummary Report On Material Variances and Its Typesyoyoharshit255No ratings yet

- RISE With SAP For Wholesale - L1 PresentationDocument30 pagesRISE With SAP For Wholesale - L1 Presentationfelix.mNo ratings yet

- Investing in Apple, Forrest GumpDocument12 pagesInvesting in Apple, Forrest GumpAnna MuižnieceNo ratings yet