0 ratings0% found this document useful (0 votes)

5 viewsTime & Value of Supply

Time & Value of Supply

Uploaded by

Rahul NegiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Time & Value of Supply

Time & Value of Supply

Uploaded by

Rahul Negi0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

5. Time & Value of Supply

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views2 pagesTime & Value of Supply

Time & Value of Supply

Uploaded by

Rahul NegiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

5.

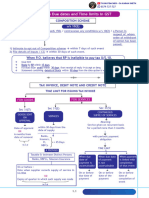

TIME AND VALUE OF SUPPLY BY- CANOTESCOMMUNITY

Time of supply of goods & services

Sec 12 (2) Time of supply of goods under Forward Charge Sec 13 (2) Time of supply of services under Forward Charge

Mechanism Mechanism

• Date of issue of invoice or • Invoice issued within 30 days from provision of service

• last date for issue of invoice whichever is earlier – Whichever is earlier

u/s 31 ✓ Date of issue of invoice

Last Date of issue of Invoice ✓ Date of receipt of payment [bank or books of

Sec 31(1) Taxable supply of Goods before or at the time of account whichever is earlier]

Removal or delivery of goods • Invoice not issued within 30 days from provision of

Sec 31(4) Continuous supply of Goods Before or at the service [banking /insurance org.] – Whichever is earlier

time of: Each successive statement of accounts or Receipt ✓ Date of completion of service + 45Days

of each successive payment ✓ Date of receipt of payment [bank or books of

Sec 31(7) Goods sent on approval basis, invoice should be account whichever is earlier]

raised Supply of good or 6 months from removal,

whichever is earlier

Sec 12 (3) Time of supply of goods under Reverse charge An insurer/bank/NBFC/telecom operator supplying service to

mechanism distinct person

• Date of receipt of goods • Before or at the time such supplier records in books of

• Date of Payment i. Books of account ii. Bank, account

whichever is earlier • Before the expiry of quarter in which such supply is

• 31st day from date of issue of invoice [invoice made

date+31 Days] Whichever is earlier

Sec 12 (4) Time of supply of voucher exchangeable for Sec 31(5) continuous supply of service [services for 3 months or

goods more]

• Supply of good is identifiable at the time of • If due payment is ascertained by contract- on or before

issue of voucher Time of supply =date of issue of the due date of payment

voucher • If due payment is not ascertained by contract -on or

• Other cases, Time of supply =date of redemption before or at the time of receipt of payment

of voucher • If payment is linked to completion of an event – on or

before the date of completion of event

Sec 12(5) Residual case in case of supply of goods Sec 31 (6) supply of service ceases before completion of

• For registered person – due date of filling of supply

return • At the time when supply ceases

• For unregistered person – date of payment of • Invoice issued to the extent of supply made before

tax such cessation

NOTE

1. Advance payment is always taxable for service

2. Advance payment up to Rs. 1000 – option of taking

invoice date as time of supply

Sec 12(6) Enhancement in value on account of interest, Sec 13 (3) Time of supply of services under Reverse charge

Fee etc for delayed payment of consideration mechanism – earlier of

• Time of supply on the date supplier received ✓ Date of payment [bank or books of account

such payment whichever is earlier]

• No GST if interest/penalty waived off ✓ Date on which entered in books of recipient

✓ Date of invoice+ 61 Days

Services received from associated enterprise outside India

✓ Date of payment [bank or books of account

whichever is earlier]

✓ Date on which entered in books of recipient

Sec 13 (4) (5) (6) – same as Sec 12 (4) (5) (6) respectively [Read word service in place of goods for sec 13 (4) (5) (6)]

JOIN US ON TELEGRAM FOR CA NOTES & UPDATES-CANOTESCOMMUNITY

1

5. TIME AND VALUE OF SUPPLY BY- CANOTESCOMMUNITY

Value of supply of goods & services- Sec 15

Sec 15 (1) transaction value Means price actually paid or payable for supply of goods or service or both between

unrelated party.

• Supplier & recipient should not be related

• Price is sole consideration

Sec 15 (2) inclusion in transaction value

• any type of taxes, duties other than taxes under this act

• any amount that supplier is liable to pay but which has been incurred by recipient not already included in price.

• incidental expenses such as commission and packing charged by supplier to recipient at the time or before

delivery.

• interest or late fee for delayed payment of consideration

• subsidy directly linked to price except subsidies provided by central government/state government

Sec 15 (3) Exclusion of discounts from transaction value

• Any discount given before/at the time of supply- deductible from value

• Any discount given after supply

✓ Agreed at/before time of supply – deductible if linked to invoice & ITC reversed by recipient

✓ Not agreed – not deductible

Conditions for post-supply discount

✓ Known at the time of supply &

✓ can be calculated invoice wise

⑉⑉⑉⑉⑉⑉⑉⑉༄༄༄⑉⑉⑉⑉⑉⑉⑉⑉⑉⑉

@CANOTESCOMMUNITY

⑉⑉⑉⑉⑉⑉⑉⑉༄༄༄⑉⑉⑉⑉⑉⑉⑉⑉⑉⑉

JOIN US ON TELEGRAM FOR CA NOTES & UPDATES-CANOTESCOMMUNITY

2

You might also like

- Winfield CaseDocument8 pagesWinfield CaseAbhinandan Singh67% (3)

- Lesson 11 International Aspects of Corporate FinanceDocument17 pagesLesson 11 International Aspects of Corporate Financeman ibe0% (1)

- New Earth Mining Inc.Document16 pagesNew Earth Mining Inc.Asif Rahman100% (1)

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- Levy in GST S.No Particulars 1 Time of SupplyDocument7 pagesLevy in GST S.No Particulars 1 Time of SupplyAnonymous ikQZphNo ratings yet

- Chapter 6 - Time of SupplyDocument7 pagesChapter 6 - Time of SupplyDrafts StorageNo ratings yet

- GST 4Document3 pagesGST 4likithaggowdaaNo ratings yet

- 5 Time of SupplyDocument18 pages5 Time of SupplyDhana SekarNo ratings yet

- Time of Supply of ServicesDocument10 pagesTime of Supply of ServicesShiwang AgrawalNo ratings yet

- Time of SupplyDocument31 pagesTime of SupplyNalin KNo ratings yet

- UNIT 2 (4) Time of SupplyDocument15 pagesUNIT 2 (4) Time of SupplySania KhanNo ratings yet

- Time of Supply PDFDocument16 pagesTime of Supply PDFNaveed AnsariNo ratings yet

- GST - Time of Supply of Goods (Summary)Document1 pageGST - Time of Supply of Goods (Summary)Saksham KathuriaNo ratings yet

- All The Due Dates and Time Limits in GSTDocument10 pagesAll The Due Dates and Time Limits in GST2d77gp69kzNo ratings yet

- GST - Documents & Records-May 18Document29 pagesGST - Documents & Records-May 18Sanjay DwivediNo ratings yet

- Time of SupplyDocument23 pagesTime of SupplyvarunagarwalNo ratings yet

- Time of SupplyDocument7 pagesTime of SupplyAghila R.S.No ratings yet

- 4 GST Time and Value of Supply NotesDocument6 pages4 GST Time and Value of Supply NotesMurali Krishnan RNo ratings yet

- Tax Points - Reference Material: Pro Forma InvoicesDocument2 pagesTax Points - Reference Material: Pro Forma Invoicesanon_178447188No ratings yet

- New PPTX PresentationDocument9 pagesNew PPTX PresentationdataprotaxNo ratings yet

- Time of SupplyDocument28 pagesTime of SupplySam RockerNo ratings yet

- Invoicing Under Goods and Service TAXDocument21 pagesInvoicing Under Goods and Service TAXMichealNo ratings yet

- GST For Nov 2022 & May 2023 Exams (GST Time of Supply of ServicesDocument1 pageGST For Nov 2022 & May 2023 Exams (GST Time of Supply of ServicesVikasNo ratings yet

- Time of SupplyDocument6 pagesTime of SupplygriefernjanNo ratings yet

- Time of SupplyDocument7 pagesTime of SupplyTushar MadanNo ratings yet

- TH02TOSDocument2 pagesTH02TOSjainviren34No ratings yet

- Time of SupplyDocument4 pagesTime of SupplyAarushi GuptaNo ratings yet

- Transitional Provisions in GST S.No Particulars 1 Transitional ProvisionsDocument8 pagesTransitional Provisions in GST S.No Particulars 1 Transitional ProvisionsAnonymous ikQZphNo ratings yet

- GST - Lecture 5 - Time of SupplyDocument6 pagesGST - Lecture 5 - Time of SupplyPoke GuruNo ratings yet

- GST Seminar: Hosted By:-Akola Branch of WICASA of ICAIDocument40 pagesGST Seminar: Hosted By:-Akola Branch of WICASA of ICAINavneetNo ratings yet

- EIDT Unit 2 (Notes)Document4 pagesEIDT Unit 2 (Notes)Samarth SahuNo ratings yet

- Transitional ProvisionsDocument21 pagesTransitional ProvisionsRahul AkellaNo ratings yet

- Uncommon GST TopicsDocument36 pagesUncommon GST TopicsEugeniePaxtonNo ratings yet

- Finance DepartmentDocument16 pagesFinance DepartmentAkriti SrivastavaNo ratings yet

- WorksContractServices PraDocument22 pagesWorksContractServices PraManikantaNo ratings yet

- Klein Construction Act Reforms 1Document26 pagesKlein Construction Act Reforms 1hasanNo ratings yet

- Ilovepdf MergedDocument9 pagesIlovepdf Mergedm37384965No ratings yet

- GST PresentationDocument22 pagesGST PresentationSakshi SinghNo ratings yet

- Time of Supply-IDocument50 pagesTime of Supply-IVaibhav GawadeNo ratings yet

- Time and Value of Supply-4Document73 pagesTime and Value of Supply-4Muhammad MehrajNo ratings yet

- Chapter 11 Tax Invoice, Credit and Debit NotesDocument24 pagesChapter 11 Tax Invoice, Credit and Debit Notesjabbi2100No ratings yet

- Time of Supply NotesDocument5 pagesTime of Supply NotesAishuNo ratings yet

- Impact of GST On Real Estate Sector: by Ca Umesh SharmaDocument58 pagesImpact of GST On Real Estate Sector: by Ca Umesh SharmaRavindra PoteNo ratings yet

- 7 Input Tax CreditDocument16 pages7 Input Tax CreditinstainstantuserNo ratings yet

- Ifrs 2Document44 pagesIfrs 2samrawithagos2002No ratings yet

- Basic Concepts of Transition & Invoice I20177804Document28 pagesBasic Concepts of Transition & Invoice I20177804vishalNo ratings yet

- Changes in Service Tax Laws: Prepared By: CA - Narottam Rawat & CA - Ritesh DagaDocument12 pagesChanges in Service Tax Laws: Prepared By: CA - Narottam Rawat & CA - Ritesh DagaAkhil PrasharNo ratings yet

- Finance Quick Guide For Customers English RevDocument3 pagesFinance Quick Guide For Customers English RevMarcelo BorsiniNo ratings yet

- Input Tax credit-GSTDocument17 pagesInput Tax credit-GSTSandhya DangiNo ratings yet

- Recognition of Revenue From Non-Exchange TransactionsDocument31 pagesRecognition of Revenue From Non-Exchange TransactionsRemon ValmonteNo ratings yet

- GST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFDocument78 pagesGST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFSapna MalikNo ratings yet

- Minerals Australia Guidance Note Supportive Arrangements For Supplier Payment TermsDocument4 pagesMinerals Australia Guidance Note Supportive Arrangements For Supplier Payment Termskhk84jfxchNo ratings yet

- 13 Time of Supply of SerDocument2 pages13 Time of Supply of SerSachin KumarNo ratings yet

- Point of TaxationDocument11 pagesPoint of TaxationAmrit TejaniNo ratings yet

- Tax Invoice, Debit Note and Credit Note PDFDocument29 pagesTax Invoice, Debit Note and Credit Note PDFNaveed AnsariNo ratings yet

- Time of Supply: CMA Bhogavalli Mallikarjuna GuptaDocument5 pagesTime of Supply: CMA Bhogavalli Mallikarjuna Guptagurusha bhallaNo ratings yet

- GSTDocument40 pagesGSTdurairajNo ratings yet

- Idt 3Document10 pagesIdt 3manan agrawalNo ratings yet

- Taxpayer Being Provided Goods or Services?Document2 pagesTaxpayer Being Provided Goods or Services?ycho1992No ratings yet

- GST Handbook EnglishDocument8 pagesGST Handbook EnglishMohd AsadNo ratings yet

- Chapter - 5 Time & Value of SupplyDocument16 pagesChapter - 5 Time & Value of SupplyRaja BahlNo ratings yet

- Charge Under Companies ActDocument13 pagesCharge Under Companies ActAsma SaeedNo ratings yet

- Toa 38 40Document17 pagesToa 38 40Mary Joy AlbandiaNo ratings yet

- Homework - Set - Solutions Finance 2.2 PDFDocument18 pagesHomework - Set - Solutions Finance 2.2 PDFAnonymous EgWT5izpNo ratings yet

- Capital Budgeting 1st PartDocument8 pagesCapital Budgeting 1st PartPeng Guin100% (1)

- The New Swap MathDocument5 pagesThe New Swap MathbrohopparnNo ratings yet

- CFA Level III Mock Exam 5 June, 2017 Revision 1Document35 pagesCFA Level III Mock Exam 5 June, 2017 Revision 1menabavi2No ratings yet

- Project IdentificationDocument89 pagesProject Identificationtadgash4920100% (3)

- 11 ReceivablesDocument4 pages11 ReceivablesuncianojhezrhyllemhaeNo ratings yet

- FM09-CH 21Document4 pagesFM09-CH 21Mukul KadyanNo ratings yet

- SNL Permitting Delay Report-OnlineDocument32 pagesSNL Permitting Delay Report-OnlineheatherNo ratings yet

- Role of Actuary in InsuranceDocument14 pagesRole of Actuary in Insurancerajesh_natarajan_4100% (1)

- Deterministic Cash Flows and The Term Structure of Interest RatesDocument15 pagesDeterministic Cash Flows and The Term Structure of Interest RatesC J Ballesteros MontalbánNo ratings yet

- Model Solutions: Cma December, 2020 Examination Professional Level - I Subject: 101. Intermediate Financial AccountingDocument7 pagesModel Solutions: Cma December, 2020 Examination Professional Level - I Subject: 101. Intermediate Financial AccountingTaslima AktarNo ratings yet

- Partnerships-1Document20 pagesPartnerships-1samuelNo ratings yet

- Mihir Desai - The Finance Function in A Global CorporationDocument5 pagesMihir Desai - The Finance Function in A Global CorporationkaitlinkaitlinflynnNo ratings yet

- Current-Liabilities-Management, Jessa, LausDocument14 pagesCurrent-Liabilities-Management, Jessa, LausAldrin Jon Madamba, MAED-ELMNo ratings yet

- Module 5 - Ia2 Final CBLDocument13 pagesModule 5 - Ia2 Final CBLErik Lorenz Palomares0% (1)

- Cash Management Theory and QuestionsDocument9 pagesCash Management Theory and QuestionsAyush PrakashNo ratings yet

- Chu de 3 Nhom 6 Hay PDFDocument10 pagesChu de 3 Nhom 6 Hay PDFNhư NhưNo ratings yet

- Question BankDocument453 pagesQuestion BankkaushikagarwalNo ratings yet

- Exercise InvestmentsDocument14 pagesExercise InvestmentsAlizah Lariosa Bucot43% (7)

- Chapter 10 (Stock Valuation) ClassDocument58 pagesChapter 10 (Stock Valuation) ClasswstNo ratings yet

- PPT-Economics - Unit 1Document53 pagesPPT-Economics - Unit 1Karan SinghNo ratings yet

- ACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarDocument14 pagesACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarchimbanguraNo ratings yet

- Metals and Engineering Corporation: Feasibility Study ONDocument15 pagesMetals and Engineering Corporation: Feasibility Study ONkinfegetaNo ratings yet

- Valuations - DamodaranDocument308 pagesValuations - DamodaranharleeniitrNo ratings yet

- Quiz 4 With SolutionDocument5 pagesQuiz 4 With SolutionKarl Lincoln TemporosaNo ratings yet