Porter Five Forces

Porter Five Forces

Uploaded by

shahhazm553Copyright:

Available Formats

Porter Five Forces

Porter Five Forces

Uploaded by

shahhazm553Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Porter Five Forces

Porter Five Forces

Uploaded by

shahhazm553Copyright:

Available Formats

PORTER FIVE FORCES

1 Introduction

The model of the Five Competitive Forces was developed by Michael E. Porter in his book „Competitive Strategy:

Techniques for Analyzing Industries and Competitors“ in 1980. Since that time it has become an important tool for

analyzing an organizations industry structure in strategic processes.

Porters model is based on the insight that a corporate strategy should meet the opportunities and threats in the

organizations external environment. Especially, competitive strategy should base on and understanding of industry

structures and the way they change.

Porter has identified five competitive forces that shape every industry and every market. These forces determine

the intensity of competition and hence the profitability and attractiveness of an industry. The objective of

corporate strategy should be to modify these competitive forces in a way that improves the position of the

organization. Porters model supports analysis of the driving forces in an industry. Based on the information derived

from the Five Forces Analysis, management can decide how to influence or to exploit particular characteristics of

their industry.

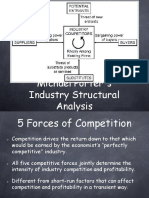

2 The Five Competitive Forces

The Five Competitive Forces are typically described as follows:

2.1 Bargaining Power of Suppliers

The term 'suppliers' comprises all sources for inputs that are needed in order to provide goods or services.

Supplier bargaining power is likely to be high when:

The market is dominated by a few large suppliers rather than a fragmented source of supply,

There are no substitutes for the particular input,

The suppliers customers are fragmented, so their bargaining power is low,

The switching costs from one supplier to another are high,

There is the possibility of the supplier integrating forwards in order to obtain higher prices and

margins. This threat is especially high when

The buying industry has a higher profitability than the supplying industry,

Forward integration provides economies of scale for the supplier,

The buying industry hinders the supplying industry in their development (e.g. reluctance to accept

new releases of products),

The buying industry has low barriers to entry.

In such situations, the buying industry often faces a high pressure on margins from their suppliers. The relationship

to powerful suppliers can potentially reduce strategic options for the organization.

2.2 Bargaining Power of Customers

Similarly, the bargaining power of customers determines how much customers can impose pressure on margins

and volumes.

Customers bargaining power is likely to be high when

They buy large volumes, there is a concentration of buyers,

The supplying industry comprises a large number of small operators

The supplying industry operates with high fixed costs,

The product is undifferentiated and can be replaces by substitutes,

Switching to an alternative product is relatively simple and is not related to high costs,

Customers have low margins and are price-sensitive,

Customers could produce the product themselves,

The product is not of strategical importance for the customer,

The customer knows about the production costs of the product

There is the possibility for the customer integrating backwards.

2.3 Threat of New Entrants

The competition in an industry will be the higher, the easier it is for other companies to enter this industry. In such

a situation, new entrants could change major determinants of the market environment (e.g. market shares, prices,

customer loyalty) at any time. There is always a latent pressure for reaction and adjustment for existing players in

this industry.

The threat of new entries will depend on the extent to which there are barriers to entry. These are typically

Economies of scale (minimum size requirements for profitable operations),

High initial investments and fixed costs,

Cost advantages of existing players due to experience curve effects of operation with fully

depreciated assets,

Brand loyalty of customers

Protected intellectual property like patents, licenses etc,

Scarcity of important resources, e.g. qualified expert staff

Access to raw materials is controlled by existing players,

Distribution channels are controlled by existing players,

Existing players have close customer relations, e.g. from long-term service contracts,

High switching costs for customers

Legislation and government action

2.4 Threat of Substitutes

A threat from substitutes exists if there are alternative products with lower prices of better performance

parameters for the same purpose. They could potentially attract a significant proportion of market volume and

hence reduce the potential sales volume for existing players. This category also relates to complementary

products.

Similarly to the threat of new entrants, the treat of substitutes is determined by factors like

Brand loyalty of customers,

Close customer relationships,

Switching costs for customers,

The relative price for performance of substitutes,

Current trends.

2.5 Competitive Rivalry between Existing Players

This force describes the intensity of competition between existing players (companies) in an industry. High

competitive pressure results in pressure on prices, margins, and hence, on profitability for every single company in

the industry.

Competition between existing players is likely to be high when

There are many players of about the same size,

Players have similar strategies

There is not much differentiation between players and their products, hence, there is much price

competition

Low market growth rates (growth of a particular company is possible only at the expense of a

competitor),

Barriers for exit are high (e.g. expensive and highly specialized equipment).

You might also like

- Functional Safety Management Plan - V1.0Document42 pagesFunctional Safety Management Plan - V1.0Natalie Scott Jones100% (8)

- Porter's Five Forces: Understand competitive forces and stay ahead of the competitionFrom EverandPorter's Five Forces: Understand competitive forces and stay ahead of the competitionRating: 4 out of 5 stars4/5 (10)

- BCS Business Analysis Foundation Certification Course - IndexDocument4 pagesBCS Business Analysis Foundation Certification Course - Indexutkarsh23No ratings yet

- Informatica VelocityDocument361 pagesInformatica VelocitynuluparthaNo ratings yet

- Risk Management Policy TemplateDocument3 pagesRisk Management Policy Templatealan dumsNo ratings yet

- Michael Porters Model For Industry and Competitor AnalysisDocument9 pagesMichael Porters Model For Industry and Competitor AnalysisbagumaNo ratings yet

- Michael Porter 5 Forces Model AnalysisDocument4 pagesMichael Porter 5 Forces Model AnalysisSheetal Siyodia100% (2)

- How Competitive Forces Shape StrategyDocument11 pagesHow Competitive Forces Shape StrategyErwinsyah RusliNo ratings yet

- Industry Analysis: Positioning The Firm Within The Specific EnvironmentDocument12 pagesIndustry Analysis: Positioning The Firm Within The Specific EnvironmentJann Aldrin Pula100% (1)

- Porter 3Document14 pagesPorter 3CJKNo ratings yet

- 5 ForcesDocument7 pages5 ForcesShreyas RaoNo ratings yet

- Porters 5 ForcesDocument12 pagesPorters 5 ForcesUtakarsh JayantNo ratings yet

- Porters 5 ForcesDocument21 pagesPorters 5 ForcesMy BảoNo ratings yet

- Porters Five Forces - Content, Application, and CritiqueDocument9 pagesPorters Five Forces - Content, Application, and CritiqueJosé Luís NevesNo ratings yet

- 5 Forces NotesDocument9 pages5 Forces NotesKshitij LalwaniNo ratings yet

- Porters 5 Forces AnalysisDocument6 pagesPorters 5 Forces AnalysisRobi MatiNo ratings yet

- 5 ForceDocument5 pages5 ForceMichael YongNo ratings yet

- 5 Force ModelDocument14 pages5 Force Modelsrilatha212No ratings yet

- MibDocument25 pagesMibjeet_singh_deepNo ratings yet

- Porter's Five Force ModelDocument52 pagesPorter's Five Force Modelpranaybhargava100% (11)

- Porters Five Forces Model For Industry CompetitionDocument15 pagesPorters Five Forces Model For Industry CompetitionShahid ChuhdryNo ratings yet

- Portersfiveforces PDFDocument7 pagesPortersfiveforces PDFBrian DsouzaNo ratings yet

- Industry Handbook: Porte: R's 5 Forces AnalysisDocument20 pagesIndustry Handbook: Porte: R's 5 Forces AnalysisAnitha GirigoudruNo ratings yet

- Chapter 7 - Organizational EnvironmentDocument8 pagesChapter 7 - Organizational EnvironmentSteffany RoqueNo ratings yet

- Five Competitive Forces That Shape StrategyDocument5 pagesFive Competitive Forces That Shape StrategyKAVIN KNo ratings yet

- 5 - Porter's 5 Force ModelDocument31 pages5 - Porter's 5 Force ModelSunil MauryaNo ratings yet

- Ranbaxy PorterDocument4 pagesRanbaxy PorterBhanu GuptaNo ratings yet

- Category AnalysisDocument42 pagesCategory AnalysisANJALINo ratings yet

- Porter 5 Forces-Model and ExplainationDocument10 pagesPorter 5 Forces-Model and ExplainationSarah AlsuiltyNo ratings yet

- Reviewer Compre 1Document30 pagesReviewer Compre 1Dexter AlcantaraNo ratings yet

- Porter 5 Force in Food ProcessingDocument2 pagesPorter 5 Force in Food ProcessingGaurav Gupta89% (9)

- SBA ReviewerDocument5 pagesSBA ReviewerBrigit MartinezNo ratings yet

- Five Forces Model by Michael PorterDocument3 pagesFive Forces Model by Michael PorterDeepika GhoshNo ratings yet

- Threat of EntryDocument2 pagesThreat of Entryshiraz shabbirNo ratings yet

- Industry AnalysisDocument13 pagesIndustry AnalysisKasiira HatimuNo ratings yet

- Industry Analysis: Positioning The FirmDocument5 pagesIndustry Analysis: Positioning The FirmDonrost Ducusin Dulatre100% (1)

- Competitive Force With ExampleDocument2 pagesCompetitive Force With ExamplezohuramouNo ratings yet

- Threat of Entry: ReviewDocument4 pagesThreat of Entry: ReviewJerome NaronNo ratings yet

- Report On Porters 5 ForcesDocument19 pagesReport On Porters 5 Forcesblue_devil8132409100% (1)

- Week 5Document5 pagesWeek 5Kaan SuersanNo ratings yet

- Micheal Porter 5 Force ModelDocument3 pagesMicheal Porter 5 Force ModelKasi BuvaneshNo ratings yet

- Overview of The Five Forces ModelDocument4 pagesOverview of The Five Forces ModelAnuj SrivastavaNo ratings yet

- Module-2 Lesson1Document17 pagesModule-2 Lesson1Laynard LopezNo ratings yet

- Strategy: Porter's Five Forces Model: Analysing Industry StructureDocument19 pagesStrategy: Porter's Five Forces Model: Analysing Industry StructureMalsha KularathnaNo ratings yet

- Michael Porter's "Five Forces" ModelDocument8 pagesMichael Porter's "Five Forces" ModelArpan ChatterjeeNo ratings yet

- Porter's Five Model AnalysisDocument5 pagesPorter's Five Model AnalysisSamia ShahidNo ratings yet

- Question: Explain Porter's Five Forces of Competitive Position Through A Diagram. AnswerDocument5 pagesQuestion: Explain Porter's Five Forces of Competitive Position Through A Diagram. Answerkazi A.R RafiNo ratings yet

- Maam Gelen ReortDocument23 pagesMaam Gelen Reorta cup of coffeeNo ratings yet

- Michael Porter's Industry Structural AnalysisDocument12 pagesMichael Porter's Industry Structural AnalysisRenell John Maglalang100% (1)

- Porter 5 Forces AnalysisDocument3 pagesPorter 5 Forces AnalysisWaleed AshourNo ratings yet

- Porter Five Forces AnalysDocument8 pagesPorter Five Forces Analysasimmba19No ratings yet

- Porter's Five Forces Model: Competitor Profiling & AnalysisDocument7 pagesPorter's Five Forces Model: Competitor Profiling & AnalysisSajad AzeezNo ratings yet

- Porters 5 Forces ModelDocument7 pagesPorters 5 Forces Model2003vishalkypNo ratings yet

- 3.3 - Five Forces ModelDocument6 pages3.3 - Five Forces ModelMinhal shafiqueNo ratings yet

- Competitive Structure of IndustriesDocument4 pagesCompetitive Structure of IndustriesPooja SheoranNo ratings yet

- SM 3. Environment ScanningDocument22 pagesSM 3. Environment ScanningAnuj NaikNo ratings yet

- Notes For Assignment 2Document15 pagesNotes For Assignment 2phyu trezaNo ratings yet

- Porter's Five Five Force Analysis (Part-1)Document4 pagesPorter's Five Five Force Analysis (Part-1)Pooja Rani-48No ratings yet

- Porter's Five Forces: A Model For Industry AnalysisDocument6 pagesPorter's Five Forces: A Model For Industry AnalysiskimsrNo ratings yet

- Competitive Analysis 1Document25 pagesCompetitive Analysis 1Md.Yousuf AkashNo ratings yet

- 3 - Analysis of External Environment - Industry and CompetitiveDocument37 pages3 - Analysis of External Environment - Industry and CompetitiveRochelle PonnamperumaNo ratings yet

- Porter's 5 Force ModelDocument4 pagesPorter's 5 Force ModelMai Mgcini BhebheNo ratings yet

- Lecture 2 SMDocument58 pagesLecture 2 SMadil azmiNo ratings yet

- External Environment AnalysisDocument23 pagesExternal Environment AnalysisMarc Eric RedondoNo ratings yet

- Problem 1-4 Multiple Choice (Iaa)Document2 pagesProblem 1-4 Multiple Choice (Iaa)Jao FloresNo ratings yet

- Strategic MarketingDocument10 pagesStrategic MarketingLOOPY GAMINGNo ratings yet

- The Five Trademarks of Agile Organizations - McKinseyDocument18 pagesThe Five Trademarks of Agile Organizations - McKinseyMehmet ZiysNo ratings yet

- ECM 523: Construction Project Management: Construction Documentation and Report WritingDocument39 pagesECM 523: Construction Project Management: Construction Documentation and Report WritingNishant KhadkaNo ratings yet

- Report On Internship Programme at Meriiboy Ice Creams ,: Master of Business Administration MBA 2017-2019 BatchDocument16 pagesReport On Internship Programme at Meriiboy Ice Creams ,: Master of Business Administration MBA 2017-2019 Batchrahul s nairNo ratings yet

- SugarCRM Training End UserDocument40 pagesSugarCRM Training End UserVarun GuptaNo ratings yet

- Why Workday For Retail Ebook EnusDocument18 pagesWhy Workday For Retail Ebook EnusmichaelvonsNo ratings yet

- MIS Final2Document57 pagesMIS Final2Alok JainNo ratings yet

- Boston Consulting Group MatrixDocument31 pagesBoston Consulting Group MatrixMic BaldevaronaNo ratings yet

- Open Book CatDocument7 pagesOpen Book CatDropsNo ratings yet

- Assignment in Corporate GovernanceDocument2 pagesAssignment in Corporate GovernanceAleya MonteverdeNo ratings yet

- C&B ManagerDocument3 pagesC&B Managerarvindk369No ratings yet

- VP Director Global Logistics Operations in Austin TX Resume William Doug DolanDocument3 pagesVP Director Global Logistics Operations in Austin TX Resume William Doug DolanWilliamDougDolanNo ratings yet

- Requirements Prioritization TechniquesDocument10 pagesRequirements Prioritization TechniquesBushra IqbalNo ratings yet

- Laporan Tahunan PT Nusa Raya Cipta TBK Tahun 2018Document238 pagesLaporan Tahunan PT Nusa Raya Cipta TBK Tahun 2018Vera CKNo ratings yet

- Understanding Reputation RiskDocument31 pagesUnderstanding Reputation RiskBenjamin PrattNo ratings yet

- Chapter 9 - Software Evolution: Lecturer: A.Prof. Dr. Amr ThabetDocument29 pagesChapter 9 - Software Evolution: Lecturer: A.Prof. Dr. Amr ThabetMohamed AbdelhamidNo ratings yet

- AuditingDocument41 pagesAuditingTina NendongoNo ratings yet

- Pewujudan Transparansi Dan Akuntabilitas Publik Melalui Akuntansi Sektor PublikDocument26 pagesPewujudan Transparansi Dan Akuntabilitas Publik Melalui Akuntansi Sektor PublikYodia NovieraNo ratings yet

- يوــــيــــــلعلا Note 1 Acc451 Accounting Information Systems AIS: An OverviewDocument8 pagesيوــــيــــــلعلا Note 1 Acc451 Accounting Information Systems AIS: An OverviewsararabeeaNo ratings yet

- Accounting Information System (Chapter 3)Document50 pagesAccounting Information System (Chapter 3)Cassie67% (6)

- Chapter 4 - Iso 9000Document3 pagesChapter 4 - Iso 9000anki23No ratings yet

- Duties & Responsibilities of Front Office Staff:Front Office ManagerDocument2 pagesDuties & Responsibilities of Front Office Staff:Front Office ManagerKenneth YasisNo ratings yet

- Customer ServicesDocument19 pagesCustomer ServicesAnda StancuNo ratings yet

- LogicManager SOC2 ComplianceChecklistDocument5 pagesLogicManager SOC2 ComplianceChecklistLakshman KumarNo ratings yet

- PMSA Knowledge Series - Benefit ManagementDocument50 pagesPMSA Knowledge Series - Benefit ManagementSMNo ratings yet