Edfpp1422r 2024

Edfpp1422r 2024

Uploaded by

GOUTHAM HEGDECopyright:

Available Formats

Edfpp1422r 2024

Edfpp1422r 2024

Uploaded by

GOUTHAM HEGDEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Edfpp1422r 2024

Edfpp1422r 2024

Uploaded by

GOUTHAM HEGDECopyright:

Available Formats

Data updated till 30-May-2024

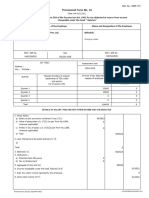

Annual Tax Statement

Permanent Account Number (PAN) EDFPP1422R Current Status of PAN Active and Operative Financial Year 2023-24 Assessment Year 2024-25

Name of Assessee ASUTOSH PANDEY

Address of Assessee NO 19 FLAT NO 302, VASHANTH VIHAR APTMNT, 5TH CRS NEAR EDEZENER, CHURCH CHINNAPANAHALLI,

MARATHAHALLI BANGALORE, KARNATAKA, 560037

Above data / Status of PAN is as per PAN details. For any changes in data as mentioned above, you may submit request for corrections

Refer www.tin-nsdl.com / www.utiitsl.com for more details. In case of discrepancy in status of PAN please contact your Assessing Officer

(All amount values are in INR)

PART-I - Details of Tax Deducted at Source

Sr. No. Name of Deductor TAN of Deductor Total Amount Paid/ Total Tax Deducted # Total TDS

Credited Deposited

1 BROADRIDGE FINANCIAL SOLUTIONS (INDIA) PRIVATE LIMITED HYDB03188D 870383.00 38521.00 38521.00

Sr. No. Section 1 Transaction Date Status of Booking* Date of Booking Remarks** Amount Paid / Tax Deducted ## TDS Deposited

Credited

1 192 31-Mar-2024 F 25-May-2024 - 70500.00 4076.00 4076.00

2 192 29-Feb-2024 F 25-May-2024 - 92815.00 6527.00 6527.00

3 192 31-Jan-2024 F 25-May-2024 - 70504.00 4271.00 4271.00

4 192 31-Dec-2023 F 22-Jan-2024 - 70503.00 4315.00 4315.00

5 192 30-Nov-2023 F 22-Jan-2024 - 70503.00 4348.00 4348.00

6 192 31-Oct-2023 F 22-Jan-2024 - 70503.00 4374.00 4374.00

7 192 30-Sep-2023 F 18-Oct-2023 - 70503.00 4395.00 4395.00

8 192 31-Aug-2023 F 18-Oct-2023 - 89068.00 6215.00 6215.00

9 192 31-Jul-2023 F 18-Oct-2023 - 60461.00 0.00 0.00

10 192 30-Jun-2023 F 23-Jul-2023 - 84101.00 0.00 0.00

11 192 31-May-2023 F 23-Jul-2023 - 60461.00 0.00 0.00

12 192 30-Apr-2023 F 23-Jul-2023 - 60461.00 0.00 0.00

Sr. No. Name of Deductor TAN of Deductor Total Amount Paid/ Total Tax Deducted # Total TDS

Credited Deposited

2 PROBO MEDIA TECHNOLOGIES PRIVATE LIMITED RTKP10560E 30.00 9.00 9.00

Sr. No. Section 1 Transaction Date Status of Booking* Date of Booking Remarks** Amount Paid / Tax Deducted ## TDS Deposited

Credited

1 194BA 19-Nov-2023 F 03-Mar-2024 - 30.00 9.00 9.00

PART-II-Details of Tax Deducted at Source for 15G / 15H

Sr. No. Name of Deductor TAN of Deductor Total Amount Paid / Total Tax Deducted # Total TDS

Credited Deposited

Sr. No. Section 1 Transaction Date Date of Booking Remarks** Amount Paid/Credited Tax Deducted ## TDS Deposited

No Transactions Present

PART-III - Details of Transactions under Proviso to section 194B/First Proviso to sub-section (1) of section 194R/ Proviso to sub-section(1) of section 194S/Sub-section (2) of section 194BA

Sr. No. Name of Deductor TAN of Deductor Total Amount Paid / Credited

Sr. No. Section 1 Transaction Date Status of Booking* Remarks** Amount Paid/Credited

No Transactions Present

PART-IV -Details of Tax Deducted at Source u/s 194IA/ 194IB / 194M/ 194S (For Seller/Landlord of Property/Contractors or Professionals/ Seller of Virtual Digital Asset)

Sr. No. Acknowledgement Name of Deductor PAN of Transaction Date Total Transaction Total TDS

Number Deductor Amount Deposited***

Sr. No. TDS Certificate Section 1 Date of Deposit Status of Date of Booking Demand Payment TDS Deposited***

Number Booking*

Gross Total Across Deductor(s)

No Transactions Present

PART-V - Details of Transactions under Proviso to sub-section (1) of section 194S as per Form-26QE (For Seller of Virtual Digital Asset)

Sr. No. Acknowledgement Number Name of Buyer PAN of Buyer Transaction Date Total Transaction Amount

Sr. No Challan Details mentioned in the Statement Status of Booking*

BSR Code Date of Deposit Challan Serial Number Total Tax Amount

Gross Total Across Buyer(s)

Assessee PAN: EDFPP1422R Assessee Name: ASUTOSH PANDEY Assessment Year: 2024-25

No Transactions Present

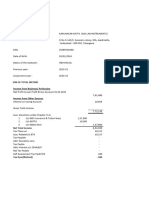

PART-VI-Details of Tax Collected at Source

Sr. No. Name of Collector TAN of Collector Total Amount Paid/ Total Tax Collected + Total TCS

Debited Deposited

1 KALYANI MOTORS PRIVATE LIMITED BLRK07461G 1254500.00 12545.00 12545.00

Sr. No. Section 1 Transaction Date Status of Booking* Date of Booking Remarks** Amount Paid/ Tax Collected ++ TCS Deposited

Debited

1 206CL 24-Aug-2023 F 18-Oct-2023 - 1254500.00 12545.00 12545.00

PART-VII- Details of Paid Refund (For which source is CPC TDS. For other details refer AIS at E-filing portal)

Sr. Assessment Year Mode Refund Issued Nature of Refund Amount of Refund Interest Date of Payment Remarks

No.

No Transactions Present

PART-VIII-Details of Tax Deducted at Source u/s 194IA/ 194IB /194M/194S (For Buyer/Tenant of Property /Person making payment to contractors or Professionals / Buyer of Virtual Digital

Asset)

Sr. Acknowledgement Name Of Deductee PAN of Transaction Total Transaction Total TDS Total Amount ###

No. Number Deductee Date Amount Deposited*** Deposited other

than TDS

Sr. TDS Certificate Section 1 Date of Deposit Status of Date of Booking Demand Payment TDS Deposited*** Total Amount ###

No. Number Booking* Deposited other

than TDS

Gross Total Across Deductee(s)

No Transactions Present

PART-IX - Details of Transactions/Demand Payments under Proviso to sub-section (1) of section 194S as per Form 26QE (For Buyer of Virtual Digital Asset)

Sr. Acknowledgement Name of Seller PAN of Seller Transaction Date Total Transaction Total Amount Deposited ###

No. Number Amount other than TDS

Sr. No Challan Details Status of Booking* Demand Payment Total Amount Deposited ###

other than TDS

BSR Code Date of Deposit Challan Serial Total Tax Amount

Number

Gross Total Across Seller(s)

No Transactions Present

PART X-TDS/TCS Defaults* (Processing of Statements)

(All amount values are in INR)

Sr. No. Financial Year Short Payment Short Interest on TDS/ Interest on TDS/TCS Late Filing Fee u/s Interest u/s 220(2) Total Default

Deduction/ TCS Payments Deduction/Collection 234E

Collection Default Default

Sr. No. TANs Short Payment Short Interest on TDS/ Interest on TDS/TCS Late Filing Fee u/s Interest u/s 220(2) Total Default

Deduction/ TCS Payments Deduction/Collection 234E

Collection Default Default

No Transactions Present

*Notes:

1.Defaults related to processing of statements, do not include demand raised by the respective Assessing Officers.

2.For more details please log on to TRACES as taxpayer.

Contact Information

Part of Annual Tax Statement Contact in case of any clarification

I Deductor

II Deductor

III Deductor

IV Deductor

V Buyer

VI Collector

VII Assessing Officer / Bank

VIII NSDL / E-Filing/ Concerned Bank

Branch

IX E-Filing/ Concerned Bank Branch/

Seller

X Deductor

Legends used in Annual Tax Statement

*Status Of Booking

Legend Description Definition

U Unmatched Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only

when payment details in bank match with details of deposit in TDS / TCS statement

M Matched Particulars of challan details provided in TDS statement have matched with the challan details available in OLTAS

Assessee PAN: EDFPP1422R Assessee Name: ASUTOSH PANDEY Assessment Year: 2024-25

P Provisional Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to

Final (F) on verification of payment details submitted by Pay and Accounts Officer (PAO)

F Final In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductors have matched with the

payment details mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of

TDS / TCS booked in Government account have been verified with payment details submitted by Pay and Accounts Officer

(PAO)

O Overbooked Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS

statement but the amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces

claimed amount in the statement or makes additional payment for excess amount claimed in the statement

Z Mismatch Particulars of challan details provided in TDS statement have not matched with the challan details available in OLTAS. Status

of challan will be updated as "M" (Matched), once correction is done by the deductor.

**Remarks

Legend Description

'A' Rectification of error in challan uploaded by bank

'B' Rectification of error in statement uploaded by deductor

'D' Rectification of error in Form 24G filed by Accounts Officer

'E' Rectification of error in Challan by Assessing Officer

'F' Lower/ No deduction certificate u/s 197

'G' Reprocessing of Statement

'T' Transporter

'W' For Part III, Details shown are as per details submitted by Deductor

# Total Tax Deducted includes TDS, Surcharge and Education Cess

## Tax Deducted includes TDS, Surcharge and Education Cess

+ Total Tax Collected includes TCS, Surcharge and Education Cess

++ Tax Collected includes TCS, Surcharge and Education Cess

*** Total TDS Deposited will not include the amount deposited as Fees and Interest

### "Total Amount Deposited other than TDS" includes Fees, Interest and Other etc.It also includes any default amount paid by deductor in case of Transactions covered under Proviso to

sub-section (1) of section 194S

Notes for Annual Tax Statement

a. Figures in brackets represent reversal (negative) entries

b. Tax Credits appearing in Part I, II, IV and VI of the Annual Tax Statement are on the basis of details given by deductor/collector in the TDS / TCS statement filed by them. The same

should be verified before claiming tax credit and only the amount which pertains to you should be claimed

c. Date is displayed in dd-MMM-yyyy format

d. Part II of Annual Tax Statement contains details of transactions related to Form 15G/15H furnished by the deductor in the TDS statement.

1.Sections

Section Description Section Description

192 Salary 194LD TDS on interest on bonds / government securities

192A TDS on PF withdrawal 194M Payment of certain sums by certain individuals or Hindu Undivided Family

193 Interest on Securities 194N Payment of certain amounts in cash other than cases covered by first proviso or

third proviso

194 Dividends

194N Payment of certain amounts in cash to non-filers except in case of co-operative

194A Interest other than 'Interest on securities'

First societies

194B Winning from lottery or crossword puzzle, etc Proviso

194BA Winnings from online games 194N Payment of certain amounts in cash to co-operative societies not covered by

Third first proviso

194BB Winning from horse race Proviso

194C Payments to contractors and sub-contractors 194N Payment of certain amount in cash to non-filers being co-operative societies

194D Insurance commission First

Proviso

194DA Payment in respect of life insurance policy read

194E Payments to non-resident sportsmen or sports associations with

Third

194EE Payments in respect of deposits under National Savings Scheme Proviso

194F Payments on account of repurchase of units by Mutual Fund or Unit Trust of 194O Payment of certain sums by e-commerce operator to e-commerce participant

India

194P Deduction of tax in case of specified senior citizen

194G Commission, price, etc. on sale of lottery tickets

194Q Deduction of tax at source on payment of certain sum for purchase of goods

194H Commission or brokerage

195 Other sums payable to a non-resident

194I(a) Rent on hiring of plant and machinery

196A Income in respect of units of non-residents

194I(b) Rent on other than plant and machinery

196B Payments in respect of units to an offshore fund

194IA TDS on Sale of immovable property

196C Income from foreign currency bonds or shares of Indian

194IB Payment of rent by certain individuals or Hindu undivided family

196D Income of foreign institutional investors from securities

194IC Payment under specified agreement

196DA Income of specified fund from securities

194J(a) Fees for technical services

206CA Collection at source from alcoholic liquor for human

194J(b) Fees for professional services or royalty etc

206CB Collection at source from timber obtained under forest lease

194K Income payable to a resident assessee in respect of units of a specified mutual

fund or of the units of the Unit Trust of India 206CC Collection at source from timber obtained by any mode other than a forest

lease

194LA Payment of compensation on acquisition of certain immovable

206CD Collection at source from any other forest produce (not being tendu leaves)

194LB Income by way of Interest from Infrastructure Debt fund

206CE Collection at source from any scrap

194LC(2 Income under clause (i) and (ia) of sub-section (2) of section 194LC

)(i) and 206CF Collection at source from contractors or licensee or lease relating to parking

(ia) lots

194LC(2 Income under clause (ib) of sub-section (2) of section 194LC 206CG Collection at source from contractors or licensee or lease relating to toll plaza

)(ib) 206CH Collection at source from contractors or licensee or lease relating to mine or

194LC(2 Income under clause (ic) of sub-section (2) of section 194LC quarry

)(ic) 206CI Collection at source from tendu Leaves

Assessee PAN: EDFPP1422R Assessee Name: ASUTOSH PANDEY Assessment Year: 2024-25

194LBA Certain income from units of a business trust 206CJ Collection at source from on sale of certain Minerals

194LBB Income in respect of units of investment fund 206CK Collection at source on cash case of Bullion and Jewellery

194LBC Income in respect of investment in securitization trust 206CL Collection at source on sale of Motor vehicle

194R Benefits or perquisites of business or profession 206CM Collection at source on sale in cash of any goods(other than bullion/jewelry)

194S Payment of consideration for transfer of virtual digital asset by persons other 206CN Collection at source on providing of any services(other than Chapter-XVII-B)

than specified persons

206CO Collection at source on remittance under LRS for purchase of overseas tour

Proviso Winnings from lotteries and crossword puzzles, etc where consideration is program package

to made in kind or cash is not sufficient to meet the tax liability and tax has been

206CP Collection at source on remittance under LRS for educational loan taken from

section paid before such winnings are released

financial institution mentioned in section 80E

194B

206CQ Collection at source on remittance under LRS for purpose other than for

First Benefits or perquisites of business or profession where such benefit is provided

purchase of overseas tour package or for educational loan taken from financial

Proviso in kind or where part in cash is not sufficient to meet tax liability and tax

institution

to sub- required to be deducted is paid before such benefit is released

section(1 206CR Collection at source on sale of goods

) of

section 206CT Collection at source on remittance under LRS is for the purposes of education

194R or medical treatment and not covered under Code P

Proviso Payment for transfer of virtual digital asset where payment is in kind or in

to sub- exchange of another virtual digital asset and tax required to be deducted is paid

section(1 before such payment is released

) of

section

194S

Sub- Net Winnings from online games where the net winnings are made in kind or

section cash is not sufficient to meet the tax liability and tax has been paid before such

(2) of net winnings are released

section

194BA

2.Minor Head 3.Major Head

Code Description Code Description

200 TDS/TCS 0020 Corporation Tax

400 Tax on regular assessment 0021 Income Tax (other than companies)

800 TDS on sale of immovable property

Glossary

Abbreviation Description Abbreviation Description

AY Assessment Year TDS Tax Deducted at Source

TCS Tax Collected at Source

You might also like

- Numbers For Successful BusinessDocument172 pagesNumbers For Successful Businessddimitrova243100% (2)

- RFBT Reviewer - Revised Corporation CodeDocument57 pagesRFBT Reviewer - Revised Corporation CodeDanna De Pano50% (2)

- Module 1 Law On Obligations and Contracts by Atty. CampanillaDocument5 pagesModule 1 Law On Obligations and Contracts by Atty. CampanillaKayerah Kaye100% (1)

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- 556salary Slip Template AADocument5 pages556salary Slip Template AARameshNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- Form 26ASDocument10 pagesForm 26ASdhaval.shahNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document2 pagesHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971sumit keshriNo ratings yet

- Salary Slip NOVDocument1 pageSalary Slip NOVdefinetrading2022.coNo ratings yet

- Madan PayslipDocument1 pageMadan PayslipBADI APPALARAJUNo ratings yet

- Sandhata Payslip Nov 2023Document1 pageSandhata Payslip Nov 2023seethalakshmik32No ratings yet

- Unknown HuhaahabaDocument11 pagesUnknown HuhaahabaAakash GuptaNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- May 2020 PDFDocument1 pageMay 2020 PDFshaklainNo ratings yet

- ArchanaDocument2 pagesArchanaARCHANA CHAUHANNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sanjay SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnil vaddiNo ratings yet

- Salary September2023Document2 pagesSalary September2023depiha5135No ratings yet

- Form 16Document7 pagesForm 16Finisher SquadNo ratings yet

- Bala Murugan (100637)Document1 pageBala Murugan (100637)CLS AKNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Immanuel Suman ShijuNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- Nidhi Form 16 UpdateDocument3 pagesNidhi Form 16 UpdateAbhinav NigamNo ratings yet

- 3M 1Document1 page3M 1SureshNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Rapid Methodical Testing Private Limited: Payslip For The Month of July-2017Document6 pagesRapid Methodical Testing Private Limited: Payslip For The Month of July-2017goblinsNo ratings yet

- TCS Payslip Jul-OctDocument4 pagesTCS Payslip Jul-OctSharad WasreNo ratings yet

- HJBHJHJBDocument1 pageHJBHJHJBRaju UllengalaNo ratings yet

- ItrDocument33 pagesItrzeno samaNo ratings yet

- PDF 341994620020723Document1 pagePDF 341994620020723karan patelNo ratings yet

- Ganesh PayslipDocument1 pageGanesh PayslipBADI APPALARAJUNo ratings yet

- G29206Document1 pageG29206Iyanar ANo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Palani KumarNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- Foray Software Private Limited: Payslip For The Month of July 2021Document1 pageForay Software Private Limited: Payslip For The Month of July 2021pavanhNo ratings yet

- Salary ComponentDocument1 pageSalary Componentpravin shahiNo ratings yet

- From 16Document10 pagesFrom 16Mandeep SinghNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 392007Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 392007vipin agarwal0% (1)

- Payslip India January - 2024Document2 pagesPayslip India January - 2024Krishna ReddyNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- Mar PDFDocument1 pageMar PDFreddy_vemula_praveenNo ratings yet

- S Feb 2017 PDFDocument1 pageS Feb 2017 PDFHanumanthNo ratings yet

- Mahesh Shinde Salary Slip February 2024-1Document1 pageMahesh Shinde Salary Slip February 2024-1Mahesh ShindeNo ratings yet

- SRS Business Solutions (India) PVT - LTD: Attendance Details ValueDocument1 pageSRS Business Solutions (India) PVT - LTD: Attendance Details ValueraghavaNo ratings yet

- JunDocument1 pageJunkallinath nrNo ratings yet

- Pay Slip (G8049)Document1 pagePay Slip (G8049)yaashNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- Salary Slip Deloitte AprilDocument1 pageSalary Slip Deloitte AprilNikitha NikithaNo ratings yet

- PaySlip DecDocument2 pagesPaySlip Deckaransharma690No ratings yet

- 2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFDocument1 page2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFMurali KrishnaNo ratings yet

- Pay SlipDocument1 pagePay Slipkuchbhi6769No ratings yet

- Anupama Payslip - AugustDocument1 pageAnupama Payslip - Augustjohn surgenNo ratings yet

- Part B PDFDocument3 pagesPart B PDFDebesh KuanrNo ratings yet

- Balance SheetDocument6 pagesBalance SheetBARMER BARMENo ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- Simpal Itr 2022 23Document1 pageSimpal Itr 2022 23prateek gangwaniNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Salary Slip SepDocument1 pageSalary Slip Sepdefinetrading2022.coNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountsiva krishnaNo ratings yet

- Ciops4677r 2024Document4 pagesCiops4677r 2024dkhpg0229rNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Borrower and Lo To Sign Initial DisclosurDocument110 pagesBorrower and Lo To Sign Initial DisclosurNicola NaunauNo ratings yet

- ReSA B43 AFAR First PB Exam Questions, Answers & SolutionsDocument22 pagesReSA B43 AFAR First PB Exam Questions, Answers & SolutionsBella Choi100% (1)

- Compromise Agreement - AguinaldoDocument6 pagesCompromise Agreement - AguinaldoPatrice Noelle RamirezNo ratings yet

- Ask Fy 2022-23 FNLDocument3 pagesAsk Fy 2022-23 FNLsgnvsureshNo ratings yet

- Form AOC-4-08112022 - SignedDocument14 pagesForm AOC-4-08112022 - SignedHsuytarp LattimNo ratings yet

- David E. Gumpert's Concept and Definition of A Business PlanDocument3 pagesDavid E. Gumpert's Concept and Definition of A Business PlanChe Insik RecabarNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Cred Trans Digest DELA PAZ V. L&J Credit TransactionsDocument2 pagesCred Trans Digest DELA PAZ V. L&J Credit TransactionsHazel GacayanNo ratings yet

- Insolvency Law Assignment 2ND Year BcomlawDocument23 pagesInsolvency Law Assignment 2ND Year BcomlawkaykeneshagreenNo ratings yet

- 會計科目中英對照表Document4 pages會計科目中英對照表yuxuan1228.yxwNo ratings yet

- Comparative Balance Sheet QuestionsDocument3 pagesComparative Balance Sheet QuestionsMr PrajwalNo ratings yet

- JAIIB Paper 3 AFM Module C Financial ManagementDocument82 pagesJAIIB Paper 3 AFM Module C Financial ManagementGaurav MishraNo ratings yet

- Accounting Mnemonics DR CR Rules Accounting Mnemonics DR CR RulesDocument31 pagesAccounting Mnemonics DR CR Rules Accounting Mnemonics DR CR Ruleswiz wizNo ratings yet

- Financing Source - Debt ValuationDocument56 pagesFinancing Source - Debt ValuationTacitus KilgoreNo ratings yet

- Topic 1: Liabilities: Unit Number/ HeadingDocument15 pagesTopic 1: Liabilities: Unit Number/ HeadingPillos Jr., ElimarNo ratings yet

- Lecture - Negotiable Instrument (Sections 152-189 Summary)Document6 pagesLecture - Negotiable Instrument (Sections 152-189 Summary)Edeza FameroNo ratings yet

- RFBT - Review Partnership DissolutionDocument3 pagesRFBT - Review Partnership DissolutionteumaetocarrotNo ratings yet

- 1 Meaning Classification Nature and Function of CreditDocument7 pages1 Meaning Classification Nature and Function of CreditMartije MonesaNo ratings yet

- PrE6 Module 4 Partnership Liquidation Schedule of Safe PaymentsDocument9 pagesPrE6 Module 4 Partnership Liquidation Schedule of Safe PaymentsCJ GranadaNo ratings yet

- Answer (Question) MODULE 4 - Quiz 2Document2 pagesAnswer (Question) MODULE 4 - Quiz 2kakaoNo ratings yet

- B.SC & Bca Degree Examination: Fourth SemesterDocument11 pagesB.SC & Bca Degree Examination: Fourth SemesterStudents Xerox ChidambaramNo ratings yet

- Fortuitous Events: Act of God (Calamities) and Act of Man (Robbery, Riots, Etc.)Document6 pagesFortuitous Events: Act of God (Calamities) and Act of Man (Robbery, Riots, Etc.)DISEREE AMOR ATIENZANo ratings yet

- Corporate Governance MechanismsDocument16 pagesCorporate Governance MechanismsNthambi MiriamNo ratings yet

- Gonzales v. PCIBDocument2 pagesGonzales v. PCIBmishiruNo ratings yet

- Cgble Descriptive Q/A: All Chapters IncludedDocument12 pagesCgble Descriptive Q/A: All Chapters Includedayesha riazNo ratings yet

- PARTNERSHIP Session 5 SECTION 3 Obligations of The Partners With Regard To Third PersonsDocument4 pagesPARTNERSHIP Session 5 SECTION 3 Obligations of The Partners With Regard To Third Persons박은하No ratings yet

- Treasury Rules Vol-II PDFDocument300 pagesTreasury Rules Vol-II PDFAneela TabassumNo ratings yet