HDFC Annual Report 2024-290-299

HDFC Annual Report 2024-290-299

Uploaded by

kakashihatake911921Copyright:

Available Formats

HDFC Annual Report 2024-290-299

HDFC Annual Report 2024-290-299

Uploaded by

kakashihatake911921Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

HDFC Annual Report 2024-290-299

HDFC Annual Report 2024-290-299

Uploaded by

kakashihatake911921Copyright:

Available Formats

SCH

SECD

HUE LDEUSL ET S

O TTO

H ET HSET AFNI N

DAAN

LOCN

I AEL BSATLAAT N

ECMEE NSTHSE E T

For theAs

year

at ended

March March

31, 2024

31, 2024

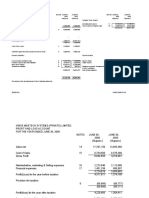

SCHEDULE 1 - CAPITAL

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

Authorised capital

11,90,61,00,000 (31 March, 2023: 6,50,00,00,000) Equity Shares of ` 1/- each 11,906,100 6,500,000

Issued, subscribed and paid-up capital

7,59,69,10,662 (31 March, 2023: 5,57,97,42,786) Equity Shares of ` 1/- each 7,596,911 5,579,743

Total 7,596,911 5,579,743

SCHEDULE 2 - RESERVES AND SURPLUS

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Statutory Reserve

Opening balance 626,280,835 516,009,081

Additions on amalgamation 18 (1) 80,557,280 -

Additions during the year 18 (5) 152,030,697 110,271,754

Total 858,868,812 626,280,835

II General Reserve

Opening balance 248,677,940 204,569,238

Additions on amalgamation 18 (1) 229,023,281 -

Additions during the year 18 (5) 60,825,698 44,108,702

Total 538,526,919 248,677,940

III Share Premium

Opening balance 665,394,291 631,191,682

Additions on amalgamation 18 (1) 517,288,313 -

Additions during the year 87,850,318 34,202,609

Total 1,270,532,922 665,394,291

IV Special Reserve

Opening balance 5,000,000 -

Additions on amalgamation 18 (1) 227,681,815 -

Additions during the year 18 (5) 30,000,000 5,000,000

Total 262,681,815 5,000,000

V Amalgamation Reserve - I

Opening balance 10,635,564 10,635,564

Additions / (deductions) during the year - -

Total 18 (5) 10,635,564 10,635,564

294 HDFC Bank Limited

Statutory Reports and

Overview Introduction Our Performance How We Create Value Our Strategy Responsible Business

Financial Statements

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

VI Amalgamation Reserve - II

Opening balance - -

Additions / (deductions) on amalgamation 18 (1) (139,470,590) -

Total 18 (5) (139,470,590) -

VII Capital Reserve

Opening balance 56,275,415 56,229,288

Additions on amalgamation 18 (1) 414 -

Additions during the year 18 (5) 41,665,955 46,127

Total 97,941,784 56,275,415

VIII Investment Reserve Account

Opening balance - 2,947,976

Additions during the year 18 (5) 5,294,222 1,077,231

Deductions during the year - (4,025,207)

Total 5,294,222 -

IX Investment Fluctuation Reserve

Opening balance 37,010,000 36,190,000

Additions on amalgamation 18 (1) 9,530,000 -

Additions during the year 18 (5) 3,780,000 820,000

Total 50,320,000 37,010,000

X Foreign Currency Translation Reserve

Opening balance 7,788,451 3,471,355

Additions during the year 1,012,629 4,317,096

Total 18 (5) 8,801,080 7,788,451

XI Cash Flow Hedge Reserve

Opening balance (922,314) (976,777)

Additions on amalgamation 18 (1) 9,370,530 -

Additions / (deductions) during the year (45,071) 54,463

Total 18 (5) 8,403,145 (922,314)

XII Balance in Profit and Loss Account 1,395,798,306 1,129,599,963

Total 4,368,333,979 2,785,740,145

Integrated Annual Report 2023-24 295

S C H E D U L E S T O T H E S TA N D A L O N E B A L A N C E S H E E T

As at March 31, 2024

SCHEDULE 3 - DEPOSITS

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

A I Demand deposits

(i) From banks 37,047,391 30,978,596

(ii) From others 3,063,109,564 2,703,982,886

Total 3,100,156,955 2,734,961,482

II Savings bank deposits 5,987,472,923 5,624,927,280

III Term deposits

(i) From banks 177,670,784 240,911,098

(ii) From others 14,532,562,102 10,233,146,603

Total 14,710,232,886 10,474,057,701

Total 23,797,862,764 18,833,946,463

B I Deposits of branches in India 23,575,937,441 18,661,516,437

II Deposits of branches outside India 221,925,323 172,430,026

Total 23,797,862,764 18,833,946,463

SCHEDULE 4 - BORROWINGS

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Borrowings in India

(i) Reserve Bank of India 45,560,000 90,200,000

(ii) Other banks 1,158,049,831 4,396,822

(iii) Other institutions and agencies 1,387,550,400 914,824,500

(iv) Tier 1 and Tier 2 capital instruments 250,536,249 250,000,000

(v) Other bonds and debentures 2,710,439,699 236,750,000

Total 5,552,136,179 1,496,171,322

II Borrowings outside India 1,069,394,572 571,484,333

Total 6,621,530,751 2,067,655,655

Secured borrowings included in I and II above: Nil (previous year: Nil) except borrowings of ` 5,654.13 crore (previous year: ` 9,020.00 crore) under

repurchase transactions (including tri-party repo) and transactions under Liquidity Adjustment Facility.

296 HDFC Bank Limited

Statutory Reports and

Overview Introduction Our Performance How We Create Value Our Strategy Responsible Business

Financial Statements

SCHEDULE 5 - OTHER LIABILITIES AND PROVISIONS

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Bills payable 141,013,564 117,907,577

II Interest accrued 222,810,099 102,677,907

III Contingent provisions against standard assets 106,637,109 69,886,560

IV Others (including provisions) 883,918,531 666,750,433

Total 1,354,379,303 957,222,477

SCHEDULE 6 - CASH AND BALANCES WITH RESERVE BANK OF INDIA

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Cash in hand (including foreign currency notes) 130,246,313 132,428,370

II Balances with Reserve Bank of India:

(a) In current accounts 1,318,925,915 943,919,336

(b) In other accounts 337,660,000 95,260,000

Total 1,656,585,915 1,039,179,336

Total 1,786,832,228 1,171,607,706

SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I In India

(i) Balances with banks:

(a) In current accounts 2,448,844 7,521,052

(b) In other deposit accounts 3,020,199 9,277,570

Total 5,469,043 16,798,622

(ii) Money at call and short notice:

(a) With banks 2,000,000 -

(b) With other institutions - 455,275,401

Total 2,000,000 455,275,401

Total 7,469,043 472,074,023

II Outside India

(i) In current accounts 103,044,784 135,527,627

(ii) In other deposit accounts 118,589,699 38,902,627

(iii) Money at call and short notice 175,538,427 119,538,848

Total 397,172,910 293,969,102

Total 404,641,953 766,043,125

Integrated Annual Report 2023-24 297

S C H E D U L E S T O T H E S TA N D A L O N E B A L A N C E S H E E T

As at March 31, 2024

SCHEDULE 8 - INVESTMENTS

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Investments in India in:

(i) Government securities 6,448,063,974 4,373,698,175

(ii) Other approved securities - -

(iii) Shares 19,729,997 4,954,258

(iv) Debentures and bonds 200,747,321 582,809,906

(v) Subsidiaries / joint ventures 126,342,133 38,264,875

(vi) Others (Units of Mutual funds / AIFs / REITs, CDs, CPs, PTCs and security 210,241,598 155,277,108

receipts)

Total 7,005,125,023 5,155,004,322

II Investments outside India in:

(i) Government securities (including local authorities) 2,480,394 797,242

(ii) Subsidiaries / joint ventures abroad 54,061 -

(iii) Other investments

(a) Shares 215,336 26,426

(b) Debentures and bonds 16,274,773 14,186,290

Total 19,024,564 15,009,958

Total 7,024,149,587 5,170,014,280

SCHEDULE 9 - ADVANCES

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

A (i) Bills purchased and discounted 240,329,232 207,200,377

(ii) Cash credits, overdrafts and loans repayable on demand 6,272,383,851 5,571,329,186

(iii) Term loans 18,335,902,105 10,227,329,437

Total 24,848,615,188 16,005,859,000

B (i) Secured by tangible assets* 19,143,339,472 10,754,504,079

(ii) Covered by bank / government guarantees 415,985,170 454,536,329

(iii) Unsecured 5,289,290,546 4,796,818,592

Total 24,848,615,188 16,005,859,000

* Including advances against book debts

C I Advances in India:

(i) Priority sector 7,755,713,447 5,324,689,476

(ii) Public sector 1,405,546,990 1,359,077,400

(iii) Banks 25,671,224 64,038,765

(iv) Others 15,275,192,176 8,840,564,067

Total 24,462,123,837 15,588,369,708

298 HDFC Bank Limited

Statutory Reports and

Overview Introduction Our Performance How We Create Value Our Strategy Responsible Business

Financial Statements

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

C II Advances outside India:

(i) Due from banks 27,561,578 22,962,853

(ii) Due from others:

(a) Bills purchased and discounted 7,148,584 6,040,889

(b) Syndicated loans 11,804,945 19,882,368

(c) Others 339,976,244 368,603,182

Total 386,491,351 417,489,292

Total 24,848,615,188 16,005,859,000

SCHEDULE 10 - FIXED ASSETS

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Premises (including land)

Gross block

At cost on 31st March of the preceding year 24,353,113 21,820,786

Additions on amalgamation 18 (1) 17,158,133 -

Additions during the year 3,914,363 2,799,840

Deductions during the year (245,880) (267,513)

Total 45,179,729 24,353,113

Depreciation

As at 31st March of the preceding year 8,155,263 7,511,937

Additions on amalgamation 18 (1) 5,053,311 -

Charge for the year 886,959 850,084

On deductions during the year (198,345) (206,758)

Total 13,897,188 8,155,263

Net block 31,282,541 16,197,850

II Other fixed assets (including furniture and fixtures)

Gross block

At cost on 31st March of the preceding year 179,030,451 146,059,692

Additions on amalgamation 18 (1) 5,868,936 -

Additions during the year 43,904,034 39,285,273

Deductions during the year (4,798,123) (6,314,514)

Total 224,005,298 179,030,451

Integrated Annual Report 2023-24 299

S C H E D U L E S T O T H E S TA N D A L O N E B A L A N C E S H E E T

As at March 31, 2024

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

Depreciation

As at 31st March of the preceding year 115,062,891 99,531,806

Additions on amalgamation 18 (1) 3,547,773 -

Charge for the year 27,216,269 21,583,108

On deductions during the year (4,528,972) (6,052,023)

Total 141,297,961 115,062,891

Net block 82,707,337 63,967,560

III Assets on lease (plant and machinery)

Gross block

At cost on 31st March of the preceding year 4,546,923 4,546,923

Additions during the year - -

Deductions during the year (4,546,923) -

Total - 4,546,923

Depreciation

As at 31st March of the preceding year 4,104,467 4,104,467

Charge for the year - -

On deductions during the year (4,104,467) -

Total - 4,104,467

Lease adjustment account

As at 31st March of the preceding year 442,456 442,456

Charge for the year - -

On deductions during the year (442,456) -

Total - 442,456

Unamortised cost of assets on lease - -

Total 113,989,878 80,165,410

SCHEDULE 11 - OTHER ASSETS

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Interest accrued 221,272,886 186,091,208

II Advance tax / tax deducted at source (net of provisions) 170,135,924 51,569,656

III Stationery and stamps 641,440 427,902

IV Non banking assets acquired in satisfaction of claims 11,405,574 464,532

V Security deposit for commercial and residential property 8,002,888 6,461,751

VI Others 18 (21) 1,586,543,323 1,222,110,102

Total 1,998,002,035 1,467,125,151

300 HDFC Bank Limited

Statutory Reports and

Overview Introduction Our Performance How We Create Value Our Strategy Responsible Business

Financial Statements

SCHEDULE 12 - CONTINGENT LIABILITIES

(` in ‘000)

As at As at

Schedule

March 31, 2024 March 31, 2023

I Claims against the bank not acknowledged as debts - taxation 40,608,619 13,064,965

II Claims against the bank not acknowledged as debts - others 1,509,529 1,411,952

III Liability for partly paid investments - -

IV Liability on account of outstanding forward exchange contracts 12,125,527,858 9,052,221,414

V Liability on account of outstanding derivative contracts 8,700,000,919 6,727,143,987

VI Guarantees given on behalf of constituents - in India 1,260,307,896 1,009,875,470

- outside India 2,874,204 2,643,350

VII Acceptances, endorsements and other obligations 710,083,810 614,555,453

VIII Other items for which the Bank is contingently liable 126,670,528 60,386,588

Total 22,967,583,363 17,481,303,179

Integrated Annual Report 2023-24 301

SCHEDULES TO THE STANDALONE PROFIT AND LOSS ACCOUNT

For the year ended March 31, 2024

SCHEDULE 13 - INTEREST EARNED

(` in ‘000)

Year ended Year ended

Schedule

March 31, 2024 March 31, 2023

I Interest / discount on advances / bills 2,072,200,137 1,270,958,563

II Income on investments 443,642,848 313,111,583

III Interest on balance with RBI and other inter-bank funds 20,404,735 9,967,869

IV Others 47,158,035 21,817,352

Total 2,583,405,755 1,615,855,367

SCHEDULE 14 - OTHER INCOME

(` in ‘000)

Year ended Year ended

Schedule

March 31, 2024 March 31, 2023

I Commission, exchange and brokerage 281,606,512 238,440,461

II Profit / (loss) on sale of investments (net) 105,826,427 (5,853,298)

III Profit / (loss) on revaluation of investments (net) 9,434,922 (5,458,202)

IV Profit / (loss) on sale of building and other assets (net) 1,983,223 936,105

V Profit / (loss) on exchange / derivative transactions (net) 40,011,265 40,818,516

VI Income earned by way of dividends from subsidiaries / associates and /or joint 13,323,911 8,109,753

ventures abroad / in India

VII Miscellaneous income 40,223,734 35,154,916

Total 492,409,994 312,148,251

SCHEDULE 15 - INTEREST EXPENDED

(` in ‘000)

Year ended Year ended

Schedule

March 31, 2024 March 31, 2023

I Interest on deposits 994,329,551 615,178,622

II Interest on RBI / inter-bank borrowings 502,603,949 131,371,625

III Other interest 1,147,508 882,926

Total 1,498,081,008 747,433,173

SCHEDULE 16 - OPERATING EXPENSES

(` in ‘000)

Year ended Year ended

Schedule

March 31, 2024 March 31, 2023

I Payments to and provisions for employees 222,402,099 155,123,633

II Rent, taxes and lighting 26,790,093 20,952,892

III Printing and stationery 9,405,133 7,045,362

IV Advertisement and publicity 3,456,411 2,359,697

V Depreciation on bank's property 28,100,988 22,424,793

VI Directors' fees / remuneration, allowances and expenses 78,014 73,068

302 HDFC Bank Limited

Statutory Reports and

Overview Introduction Our Performance How We Create Value Our Strategy Responsible Business

Financial Statements

(` in ‘000)

Year ended Year ended

Schedule

March 31, 2024 March 31, 2023

VII Auditors' fees and expenses 177,927 78,184

VIII Law charges 3,571,829 3,118,459

IX Postage, telegram, telephone etc. 8,678,881 6,581,683

X Repairs and maintenance 31,626,821 21,177,787

XI Insurance 28,135,719 22,478,649

XII Other expenditure* 271,436,325 215,106,637

Total 633,860,240 476,520,844

*Includes professional fees, commission to sales agents, card and merchant acquiring expenses and system management fees.

Integrated Annual Report 2023-24 303

You might also like

- DCF Template BofA - VFDocument1 pageDCF Template BofA - VFHunter Hearst LevesqueNo ratings yet

- Orion XO XO PVT LTD - 24-23Document6 pagesOrion XO XO PVT LTD - 24-23CeylonX Digital Ventures Pvt LtdNo ratings yet

- Risk of Material Misstatement Worksheet - Overview General InstructionsDocument35 pagesRisk of Material Misstatement Worksheet - Overview General Instructionswellawalalasith100% (1)

- Rakesh Jhunjhunwala PDFDocument52 pagesRakesh Jhunjhunwala PDFmatrixitNo ratings yet

- Dobank Business PlanDocument7 pagesDobank Business PlanSankary CarollNo ratings yet

- 1TCS India Separation Kit PDFDocument18 pages1TCS India Separation Kit PDFSiva chowdaryNo ratings yet

- Schedules Forming Part of The Balance Sheet: Schedule 1 - CapitalDocument6 pagesSchedules Forming Part of The Balance Sheet: Schedule 1 - CapitalKumar BharathNo ratings yet

- Vitrox q22015Document12 pagesVitrox q22015Dennis AngNo ratings yet

- Half Year Financials 2018 - Kenya WebDocument1 pageHalf Year Financials 2018 - Kenya WebdouglasNo ratings yet

- Bangladesh q1 Report 2020 Tcm244 553014 enDocument7 pagesBangladesh q1 Report 2020 Tcm244 553014 entdebnath_3No ratings yet

- 4th Quarter Results 2024Document21 pages4th Quarter Results 2024Quint WongNo ratings yet

- Bank of Baroda Financials 2021Document1 pageBank of Baroda Financials 2021Timothy KawumaNo ratings yet

- 3rd QTR Financials PDFDocument2 pages3rd QTR Financials PDFSubash AryalNo ratings yet

- Previous GAAP 79.80Document7 pagesPrevious GAAP 79.80Yam Raj BoharaNo ratings yet

- Smartivity - Signed Balance SheetDocument48 pagesSmartivity - Signed Balance Sheetsanya shahNo ratings yet

- Chapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchDocument5 pagesChapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchAcchu RNo ratings yet

- Schedules (Standalone)Document45 pagesSchedules (Standalone)ileshrathod0No ratings yet

- PHOENIX FINANCE 1st MUTUAL FUND 31.03.19Document1 pagePHOENIX FINANCE 1st MUTUAL FUND 31.03.19Abrar FaisalNo ratings yet

- Asl Marine Holdings Ltd.Document30 pagesAsl Marine Holdings Ltd.citybizlist11No ratings yet

- CAL BankDocument2 pagesCAL BankFuaad DodooNo ratings yet

- Statements of Changes in Equity PDFDocument2 pagesStatements of Changes in Equity PDFJanine padronesNo ratings yet

- UPDC PLC Q1 2024 Unaudited Financial StatementsDocument23 pagesUPDC PLC Q1 2024 Unaudited Financial StatementsDABERECHI GOLDANo ratings yet

- Brief ST 00Document2 pagesBrief ST 00farhad.hossain.hstu43No ratings yet

- Beyond: BoardersDocument10 pagesBeyond: Boardersanjugunathilaka523No ratings yet

- Balance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022Document1 pageBalance Sheet As at 31 March 2022 Profit and Loss Account For The Year Ended 31 March 2022burhan mattooNo ratings yet

- NCC Urban May Fair - Financial Statements - Dec 31, 2023Document5 pagesNCC Urban May Fair - Financial Statements - Dec 31, 2023sri rajani swarna lathaNo ratings yet

- Unaudited Audited: (Amounts in Philippine Peso)Document40 pagesUnaudited Audited: (Amounts in Philippine Peso)Louie SalazarNo ratings yet

- Half Yearly Financial Statements As On 30 June 2021 (Unaudited)Document1 pageHalf Yearly Financial Statements As On 30 June 2021 (Unaudited)Sheikh NayeemNo ratings yet

- Orion XO XO PVT LTD - 23-22Document14 pagesOrion XO XO PVT LTD - 23-22CeylonX Digital Ventures Pvt LtdNo ratings yet

- PYQ May 23 & Nov 23 Supplementary FileDocument60 pagesPYQ May 23 & Nov 23 Supplementary Fileharshitatamwar66No ratings yet

- Q1 2023 Puma Energy Results ReportDocument11 pagesQ1 2023 Puma Energy Results ReportKA-11 Єфіменко ІванNo ratings yet

- Financial-Results 0Document20 pagesFinancial-Results 0ranvijaygalgotias27No ratings yet

- PLCL Issued FS - 2018Document30 pagesPLCL Issued FS - 2018Shah JehanNo ratings yet

- Misc Accounts FilesDocument229 pagesMisc Accounts Filesapi-19622983No ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- 1020 1731412331681.xlsbDocument18 pages1020 1731412331681.xlsbRohan DiasNo ratings yet

- 2018 q2 Servus Financial StatementsDocument13 pages2018 q2 Servus Financial Statements1flailstarNo ratings yet

- Previous GAAP 80.81Document7 pagesPrevious GAAP 80.81Yam Raj BoharaNo ratings yet

- Eeff Ilustrativos Niif PymesDocument16 pagesEeff Ilustrativos Niif PymesjgilzamoraNo ratings yet

- Vitrox q12019Document15 pagesVitrox q12019Dennis AngNo ratings yet

- QIB FS 30 June 2022 English SignedDocument26 pagesQIB FS 30 June 2022 English SignedMuhammad AbdullahNo ratings yet

- Mobile Telecommunications Company Saudi ArabiaDocument28 pagesMobile Telecommunications Company Saudi ArabiaAliNo ratings yet

- 457_1660128020994Document12 pages457_1660128020994Udara WijesekaraNo ratings yet

- Q3 Interim Condensed Consolidated FS 2019Document8 pagesQ3 Interim Condensed Consolidated FS 2019FaizanSulNo ratings yet

- Vitrox q12015Document12 pagesVitrox q12015Dennis AngNo ratings yet

- Annual Report 2008 2009Document4 pagesAnnual Report 2008 2009Al MamunNo ratings yet

- Unga Group Financial Report Year Ended June 2018Document1 pageUnga Group Financial Report Year Ended June 2018Ian MutukuNo ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- Annual Report Sikkim UniversityDocument54 pagesAnnual Report Sikkim UniversityAnirban LahiriNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Financial Analysis of Ogdcl and SSGCLDocument24 pagesFinancial Analysis of Ogdcl and SSGCLShahid MehmoodNo ratings yet

- Sapnrg-Fs q4 31 Jan 2023Document33 pagesSapnrg-Fs q4 31 Jan 2023Mohd Faizal Mohd IbrahimNo ratings yet

- Atwima Kwanwoma 2020 Annual ReportDocument2 pagesAtwima Kwanwoma 2020 Annual ReportSinapi AbaNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- EWI Q2-2018 ResultsDocument20 pagesEWI Q2-2018 ResultskimNo ratings yet

- Vitrox q32016Document12 pagesVitrox q32016Dennis AngNo ratings yet

- Decent Final Accounts 2018Document29 pagesDecent Final Accounts 2018Ali RazaNo ratings yet

- OGDC-Financial Results For The Quarter Ended September 30 2024Document2 pagesOGDC-Financial Results For The Quarter Ended September 30 2024jhassan50No ratings yet

- Website Public Disclosure Mar-2022 BupaDocument101 pagesWebsite Public Disclosure Mar-2022 BupaYash DoshiNo ratings yet

- UBL Annual Report 2018-119Document1 pageUBL Annual Report 2018-119IFRS LabNo ratings yet

- For Fiscal Year Ending On 31 December 2017Document4 pagesFor Fiscal Year Ending On 31 December 2017Quỳnh NhưNo ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- NKR Engineering (Private) Limited - June 2020Document19 pagesNKR Engineering (Private) Limited - June 2020Mustafa hadiNo ratings yet

- BoA Financial Report 2021-22-40Document1 pageBoA Financial Report 2021-22-40Sintayehu MeseleNo ratings yet

- Ultimate Guide To Robo-Advisor Platform Development ProcessDocument13 pagesUltimate Guide To Robo-Advisor Platform Development ProcessPovana KokaleraNo ratings yet

- Pip 2011-2016Document100 pagesPip 2011-2016Arangkada Philippines100% (1)

- GARP FRR Program April 2024Document2 pagesGARP FRR Program April 2024sathish kumarNo ratings yet

- SSRN Id4165367Document28 pagesSSRN Id4165367Eve AthanasekouNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- ICAEW - Chapter 12 - Company Financial Statement Under IFRSDocument28 pagesICAEW - Chapter 12 - Company Financial Statement Under IFRSvothituongnhi7703No ratings yet

- Transaction Statement 6523cd38 1d29 A757 A256 1050ec5d7e03 en Ie F2ccceDocument1 pageTransaction Statement 6523cd38 1d29 A757 A256 1050ec5d7e03 en Ie F2ccceragduarte25No ratings yet

- Namal College Mianwali Namal College Mianwali Namal College MianwaliDocument1 pageNamal College Mianwali Namal College Mianwali Namal College MianwaliAnsar NiaziNo ratings yet

- Acct3044 Final AssignmentDocument8 pagesAcct3044 Final Assignmentkarupa maharajNo ratings yet

- Auctionhome Ibapi MSTC Emd Fee Payment Print - JSPDocument2 pagesAuctionhome Ibapi MSTC Emd Fee Payment Print - JSPRK RajNo ratings yet

- Microfinance & Rural Banking Conventional and IslamicDocument20 pagesMicrofinance & Rural Banking Conventional and IslamicIstiaqueNo ratings yet

- A Seminar Report ON A Contemporary Management Issue Titled: Quickly Changing View of Banking Sector in India'Document38 pagesA Seminar Report ON A Contemporary Management Issue Titled: Quickly Changing View of Banking Sector in India'Vlkjogfijnb LjunvodiNo ratings yet

- Crawford, Ian Peter - Davies, Tony - Corporate Finance and Financial Strategy-Pearson (2014) PDFDocument975 pagesCrawford, Ian Peter - Davies, Tony - Corporate Finance and Financial Strategy-Pearson (2014) PDFaleknaumoskiNo ratings yet

- Mgt101-3 - Double Entry Bookkeeping System - Rules of Dr. and CRDocument55 pagesMgt101-3 - Double Entry Bookkeeping System - Rules of Dr. and CRShahid ShafiNo ratings yet

- Private Equity Investment Banking Hedge Funds Venture CapitalDocument26 pagesPrivate Equity Investment Banking Hedge Funds Venture Capitalpankaj_xaviersNo ratings yet

- Application For Approval To Form A Credit UnionDocument21 pagesApplication For Approval To Form A Credit UnionRanjeet MudholkarNo ratings yet

- Chapter 2 - Statement of Comprehensive IncomeDocument13 pagesChapter 2 - Statement of Comprehensive IncomeAngel Klein100% (1)

- SMEDA Montessori School PDFDocument18 pagesSMEDA Montessori School PDFAna Paula Dantas PassosNo ratings yet

- Notice: Mortgagee Review Board Administrative ActionsDocument3 pagesNotice: Mortgagee Review Board Administrative ActionsJustia.comNo ratings yet

- Report For Shriram Life Insurance InternshipDocument38 pagesReport For Shriram Life Insurance InternshipBritto PrashanthNo ratings yet

- L-Y Subscription Agreement-1Document3 pagesL-Y Subscription Agreement-1sdysangco100% (1)

- A190827 PDFDocument24 pagesA190827 PDFjade cahucomNo ratings yet

- CH 12 HWDocument45 pagesCH 12 HWHannah Fuller100% (1)

- 10.1 AXIATA IA Manual V3Document86 pages10.1 AXIATA IA Manual V3aroshansNo ratings yet

- Analysis of Financial Statement OGDCL ReportDocument13 pagesAnalysis of Financial Statement OGDCL ReportIjaz Hussain Bajwa100% (1)