Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell Jobman

Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell Jobman

Uploaded by

Luisa HynesCopyright:

Available Formats

Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell Jobman

Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell Jobman

Uploaded by

Luisa HynesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell Jobman

Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell Jobman

Uploaded by

Luisa HynesCopyright:

Available Formats

Indicator Soup: Enhance Your Technical Trading - September 2007 - By Darrell Jobman The first exposure many traders

have to technical analysis is identifying price trends and patterns on a chart, the visual portrayal of the open, high, low and close for a given period. But after trading for a while, they tend to seek out ways to delve a little deeper into the price data in an effort to gain some kind of edge over chart analysis used by the trading crowd. For many of these traders that means turning to technical indicators, a variety of mathematical studies that massage the price data in an attempt to get early clues about market direction and strength. These indicators are one step removed from looking at prices directly, but they generally attempt to indicate what a market might do in the future. They provide some specific, definable points for a trader to take action. Types of Indicators Some indicators try to pinpoint future price or time objectives and can be quite complex, such as Elliott Wave theory or Fibonacci ratios. Others may be based on identifying the repetitive movements of a market, such as cycles or seasonals, which project the timing of price highs or lows but not necessarily the amplitude of a move. Another type of indicator is not based on price but portrays market sentiment and the intensity of the trading masses at a given price. These indicators include volume and open interest, which reflect trading activity that validates or negates a chart signal; put/call ratios or advance/decline statistics for the stock market; or the Commitments of Traders report for futures, which reveals the total positions of commercials, large speculators and individual traders with the premise that the commercials are usually on the right side. Yet another type of indicator measures the volatility or the size of price fluctuations during a selected period. Changes in volatility often lead to changes in price. Bollinger bands and the Volatility Index (VIX) are examples of this type of indicator. Trending Versus Momentum It would be impossible to cover all the indicators in one article, so this primer will focus on only a few of the major indicators based on price that are included in many analytical software packages. For more details on these indicators and many others, you should see a reference work such as The Encyclopedia of Technical Market Indicators, second edition, by Robert W. Colby, an analyst for www.TraderEducation.com. I split the most popular types of technical indicators into two broad categories: trend-following indicators and momentum oscillators. Moving averages, moving average convergence/divergence (better known as MACD) and directional movement index are in the trending categorythey smooth out price data to provide an overall view of market direction. As their name..suggests, they tend to perform well in trending markets. Momentum oscillators provide a measure of the velocity at which prices change over a given time, indicating the strength or weakness of market movement. They indicate when a price move may be running out of steam or is starting a reversal and generally oscillate on a scale between 0 and 100. As their name suggests, these indicators work best in sideways markets or when prices are moving back and forth in a trending channel. Moving Averages Moving averages filter out the random noise in market data by mathematically smoothing out fluctuations and short-term volatility in price movement. They are probably the simplest, most reliable and most widely used technical indicator for spotting market direction over time and reduce short-term erratic market fluctuations based on the latest price alone.

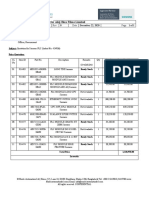

A simple moving average is the average of a price series over a selected time period and gives an equal weight to each price during the period. You just add the closing prices, for example, and divide by the number of prices to get the average. As a new price becomes available, it is added to the price series and the oldest price is dropped from the calculation, which allows the average to move over time. A weighted moving average gives more weight to the latest prices, because they logically are more important to the current situation than the older prices. For example, with a three-day weighted moving average, the latest price might be multiplied by three, the previous periods price by two and the oldest by one. The sum of these figures is divided by the sum of the weighting factorssix in this example. An exponential moving average (EMA) is another form of a weighted moving average that gives more importance to the most recent prices, but it retains all past prices in the series of prices used to calculate the average rather than dropping off the oldest prices. The current EMA is calculated by subtracting yesterdays EMA from todays price and then adding this result to yesterdays EMA to get todays EMA. An EMA line that carries at least a slight influence of all previous prices is generally smoother than other forms of moving averages. In an attempt to overcome the lag effect of moving averages, some traders use a displaced moving average. Normally, a moving average for a given day is placed on a chart on the same day as the price data for that day so the two are in alignment. A displaced moving average attempts to minimize the lag by displacing or shifting the moving average value forward in time on the chart, becoming sort of a target for actual price movement. Strategies using moving averages can be as simple as: buy if the current price is above the moving average or sell if the current price is below the moving average. Or the moving average line may be treated as support or resistance such as the 50-day and 200-day moving averages that many stock market analysts monitor. Many trading programs use combinations of moving averages in crossover trading systems. A buy signal occurs when the shorter-term moving average crosses from below to above a longer-term average. A sell signal is issued when the shorter-term moving average crosses from above to below the longer-term average. See Figure 1.

In some cases, traders use a combination of three moving averages, such as four-, nine- and 18-day; or five-, 10and 20-day moving averages. When the shortest moving average is above the intermediate-term moving average and the intermediate average is above the longest moving average, a trader should be long and vice versa for a short position. By their very nature, moving averages are changing all the time as each new price gets factored into the equation. With todays computer power, one danger is that traders over-optimize and curve-fit the data to a particular market

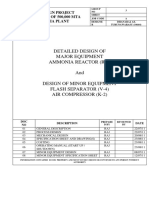

and/or time frame and then become disappointed if the chosen parameters dont perform as well in actual trading as they did during the testing period. Moving Average Convergence Divergence MACD uses moving averages but adds several concepts to the standard crossover techniques of moving averages to provide potential trading signals for market changes. MACD plots the difference between a longer-term exponential moving average (often 26 days) and a shorter-term exponential moving average (often 12 days) and then compares this line to an exponential moving average (often nine days) of this difference, which is generally used as a trigger line. Crossovers of the two lines themselves provide trading signals. When the MACD line crosses below the trigger line, it is a bearish signal; when it crosses above the trigger line, its a bullish signal. Crossing above or below a zero line can also be used as a signal, because it suggests the strength or weakness of a market. The relationship of the MACD line and the trigger line also offers trading signals. If the MACD line pulls away from the trigger line dramatically, it indicates the market may be getting overbought or oversold after a strong move and is likely due for a correction that will bring the two lines back together to a more normal position. More aggressive traders may trade as the length of histogram bars reflecting this difference in averages begins to get longer or shorter. One of the major uses of MACD, as with a number of other indicators, is to identify divergence between actual prices and the indicator. If the MACD turns positive and makes higher lows while prices are still moving lower, this could be a strong buy signal as MACD detects strength that is not evident on the price chart. If the MACD makes lower highs while prices are reaching new highs, this bearish divergence suggests a sell signal. Divergence is not an immediate call to action but suggests that you should be alert for a chart signal because the underlying tone of the market is changing. See Figure 2.

Directional Movement Index The directional movement index (DMI) generates two lines that measure upward price movement (+DI) and downward price movement (-DI). Crossovers of those two lines themselves can be used as trading signals.

From a trending perspective, the key line is the ADX line, which is a smoothed difference between the +DI and -DI lines. A rising ADX line indicates the market is in a trending modelong or shortand a falling ADX line indicates a non-trending mode. The ADX line does not indicate which direction a market may move but only rates directional trendiness on a scale of 0 to 100. If the... DX line gets above 40 and begins to drop, that typically suggests the trend in place is getting weaker and that a reversal may be imminent. An upturn from below 20 indicates a trend may be beginning. Combined with other indicators, the DMI system can be useful for trendfollowing programs to determine which market trend is the best to trade. Stochastics The premise of the stochastic indicator is based on the position of the current price relative to the price range during a specified period. When prices are declining, daily closes tend to accumulate near the extreme lows of the day; when prices are in a rising mode, closes tend to cluster toward the extreme highs of the day. The stochastic oscillator is designed to use these price tendencies to indicate oversold and overbought market conditions. Stochastics are measured and represented by two components, %K and %D. The %K linethe faster, more sensitive indicatoris calculated by taking the close minus the low for N periods and dividing that number by the high minus the low for N periods. Then multiplying the result by 100 to put the final figure on a scale ranging from 0 to 100. Some traders prefer slow stochastics, a line produced by calculating a short-term moving average of the %K line. The %D line is a longer-term moving average of the %K value. A high stochastics valueusually above 70 or 80indicates the market is overbought; a low stochastics reading usually below 20 or 30indicates an oversold market. When the %K line crosses over the slower-moving %D line in overbought or oversold territory, a market may be about to reverse course. One of the shortcomings of the stochastic indicator, as well as other indicators of its type, is that once it indicates an overbought or oversold situation, it cant tell you how much further the market might move in its current direction. It may show a signal for days or weeks at a time when the market is in a trending condition. %R %R is essentially a variation of stochastics. Instead of using the low for N days as stochastics does, %R is calculated by measuring the high minus the close for N days divided by the range for N days. Otherwise, %R acts much like the stochastics indicator. Relative Strength Index In some cases, a sharp price movement from the past may have a profound effect on a momentum indicator and cause it to flash false signals, even though recent prices have been relatively stable. In addition, an overbought or oversold level for one market may not be the same for some other market, and the way you read and use the momentum data may need to be adjusted. The Relative Strength Index (RSI) is designed to smooth out these sharp fluctuations in price movement to provide a measure of market strength or weakness on a constant scale ranging from 0 to 100. To calculate RSI, figure out the average of the up closes and the average of the down closes for a given period (typically 14 days), then divide the average of the up closes by the average of the down closes to get a relative strength figure. Add one to that relative strength figure, divide the sum into 100 and subtract that result from 100 to get the index reading. (It may sound complicated, but most analytical software programs do all that calculating for you in an instant.) As with other indicators, a high RSI readingtypically, above 70suggests an overbought situation or the potential for a weakening bull market; a low RSI...

igureusually below 30implies a market that is oversold or a potential weakening bear market. A move to those levels is not an automatic buy or sell signal but just suggests that market conditions may be ripe for a market top or bottom. Indicator Deficiencies No matter what indicator you use or how many permutations you have for them, indicators do have some general faults: Most technical indicators are based on only one thing: price. With price as the core input, many indicators tend to be just another rendition of what some other indicator shows and do not provide different information. Prices used in most indicators all occurred in the past so most indicators lag or trail current market action. In fastmoving markets, where the price is on the verge of rising or falling precipitously, this lag effect can become pronounced and costly because of the delay in indicator response. An indicator may work well in some market conditions but not in others. A moving average works well in trending situations but poorly when the market moves sideways. A momentum indicator such as stochastics works better in choppy conditions but does not do well in extended trending markets. Because you cannot determine which market condition will exist in the future, you cannot rely on just one type of indicator. Indicators are not likely to get you into or out of a position at the top or bottom. The best you can hope to do is capture part of a move and hope that part is significant enough to provide sufficient profits to justify the risk you take to get into the position. Indicators can generate false signals that can chew up your account with whipsaw losses. A moving average, for example, may provide several crossover signals that get you in and out of positions a number of times before giving you a valid signal at the beginning of a longer-term trend. This is not conducive to giving you confidence to trade, and you may give up on an indicator right before it provides a valid signal. Maximize Trading Performance Even with their limitations, the fact that indicators such as moving averages continue to be widely used by traders is testimony to their importance as quantitative tools in the financial industry. Experienced traders realize they cannot rely on only one indicator nor do they want to get tied up by using too many indicators giving contrary clues. Using several indicators that can deal with various market conditions, along with chart pattern analysis, can help traders get into and out of positions to minimize whipsaws and maximize profit potential. One thing is for sure: The number of permutations and combinations that can go into perfecting an indicators signals is staggering.

You might also like

- 2003 Ford F-150 Service & Repair ManualDocument8,681 pages2003 Ford F-150 Service & Repair ManualVernon Parker100% (5)

- Grand Slam Options Free ReportDocument14 pagesGrand Slam Options Free ReportMaria De LucaNo ratings yet

- Incredible Story of Transaction Cost MeasurementDocument7 pagesIncredible Story of Transaction Cost MeasurementWayne H WagnerNo ratings yet

- The Basics of Brining: How Salt, Sugar, and Water Can Improve Texture and Flavor in Lean Meats, Poultry, and SeafoodDocument2 pagesThe Basics of Brining: How Salt, Sugar, and Water Can Improve Texture and Flavor in Lean Meats, Poultry, and SeafoodMaria Lourdes VallarNo ratings yet

- Auto Trend ForecasterDocument15 pagesAuto Trend ForecasterherbakNo ratings yet

- SWOT Analysis For The MENA RegionDocument1 pageSWOT Analysis For The MENA RegionZekriNo ratings yet

- Wayne A. Thorp - The MACD A Combo of Indicators For The Best of Both WorldsDocument5 pagesWayne A. Thorp - The MACD A Combo of Indicators For The Best of Both WorldsShavya SharmaNo ratings yet

- Introduction To Technical Analysis: Andrew WilkinsonDocument37 pagesIntroduction To Technical Analysis: Andrew WilkinsonsmslcaNo ratings yet

- Chart Technical AnalysisDocument56 pagesChart Technical Analysiscool_air1584956No ratings yet

- Topic 4 Risk ReturnDocument48 pagesTopic 4 Risk ReturnBulan Bintang MatahariNo ratings yet

- What Is Technical Analysis?: Intrinsic Value PatternsDocument21 pagesWhat Is Technical Analysis?: Intrinsic Value PatternsAna Gabrielle Montenegro CascoNo ratings yet

- Tutorial 02 AnsDocument3 pagesTutorial 02 Anscharlie simoNo ratings yet

- Technical Trading Strategies Primer 1Document10 pagesTechnical Trading Strategies Primer 1JonNo ratings yet

- Technical Analysis ProgramDocument4 pagesTechnical Analysis ProgramKeshav KumarNo ratings yet

- 6560 LectureDocument36 pages6560 Lectureapi-3699305100% (1)

- The Ultimate Guide To Trend FollowingDocument28 pagesThe Ultimate Guide To Trend FollowingJose John100% (1)

- Technical ResearchDocument30 pagesTechnical Researchamit_idea1No ratings yet

- Bollinger BandsDocument8 pagesBollinger BandsOxford Capital Strategies LtdNo ratings yet

- Technical Analysis NotesDocument6 pagesTechnical Analysis NotesoptionscapeNo ratings yet

- 4 Factors That Shape Market TrendsDocument2 pages4 Factors That Shape Market TrendsApril Ann Diwa AbadillaNo ratings yet

- Quantitative Stock ScreeningDocument10 pagesQuantitative Stock ScreeningLello PacellaNo ratings yet

- The Efficient MarkeDocument50 pagesThe Efficient Markeliferocks232No ratings yet

- ATMASphere Sept 2014 PDFDocument25 pagesATMASphere Sept 2014 PDFdhritimohanNo ratings yet

- Cory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisDocument43 pagesCory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisRahul ChaudharyNo ratings yet

- NG Ee Hwa - How To Draw Trendlines 2007Document2 pagesNG Ee Hwa - How To Draw Trendlines 2007ansar99No ratings yet

- Does The Head & Shoulders Formation Work?: Detecting Trend Changes?Document5 pagesDoes The Head & Shoulders Formation Work?: Detecting Trend Changes?satish sNo ratings yet

- Bulkowsky PsicologiaDocument41 pagesBulkowsky Psicologiaamjr1001No ratings yet

- Technical TradingDocument9 pagesTechnical Tradingviníciusg_65No ratings yet

- A Look at What Constitutes Unfair Practice and How You Can Ensure You Always Play Fair in The Eyes of The LawDocument1 pageA Look at What Constitutes Unfair Practice and How You Can Ensure You Always Play Fair in The Eyes of The LawguptevaibhavNo ratings yet

- Moving Averages SessionDocument17 pagesMoving Averages SessionJaideep PoddarNo ratings yet

- Development and Analysis of A Trading Algorithm Using Candlestick PatternsDocument21 pagesDevelopment and Analysis of A Trading Algorithm Using Candlestick PatternsManziniLeeNo ratings yet

- The Rewards of Good Behavior - MAW 29th June - Sanjoy BhattacharyyaDocument25 pagesThe Rewards of Good Behavior - MAW 29th June - Sanjoy BhattacharyyaSAMCO ResearchNo ratings yet

- Bearish Stop LossDocument3 pagesBearish Stop LossSyam Sundar ReddyNo ratings yet

- Robinhood Trailing Stop LossDocument3 pagesRobinhood Trailing Stop Lossj39jdj92oijtNo ratings yet

- Evaluation of Systematic Trading Programs - 14-08-12Document42 pagesEvaluation of Systematic Trading Programs - 14-08-12Marcos MelloNo ratings yet

- ReversalCandlestickVietnam Updated PDFDocument7 pagesReversalCandlestickVietnam Updated PDFdanielNo ratings yet

- Book Trade Elder 2012 - 07 - 194ADocument5 pagesBook Trade Elder 2012 - 07 - 194ASierraNo ratings yet

- TA-Bar Chart InterpretationDocument12 pagesTA-Bar Chart InterpretationPaulo IlustreNo ratings yet

- 3 1 Heding With CfdsDocument8 pages3 1 Heding With CfdsSMO979No ratings yet

- Plan 415Document20 pagesPlan 415Eduardo Dutra100% (1)

- Title Meaning Short DescriptionDocument1 pageTitle Meaning Short DescriptionNassim Alami MessaoudiNo ratings yet

- Technical AnalysisDocument46 pagesTechnical AnalysisAnam Tawhid100% (1)

- RSI CalcDocument2 pagesRSI CalcregdddNo ratings yet

- The Bear Market BlueprintDocument4 pagesThe Bear Market Blueprintstash xieNo ratings yet

- Technical Analysis: Dr.D.S.PrasadDocument152 pagesTechnical Analysis: Dr.D.S.PrasadDrKunal Karade100% (1)

- Trendline BasicsDocument2 pagesTrendline BasicsAngelo NunesNo ratings yet

- Mastering RSI Indicator in TradingDocument2 pagesMastering RSI Indicator in TradingBiantoroKunartoNo ratings yet

- Moving Average Convergence DivergenceDocument3 pagesMoving Average Convergence DivergenceNikita DubeyNo ratings yet

- Market Indicator of Technical AnalysisDocument13 pagesMarket Indicator of Technical AnalysisMuhammad AsifNo ratings yet

- MACD RulesDocument1 pageMACD RulesJafrid NassifNo ratings yet

- Trading Strategies From Technical Analysis - 6Document19 pagesTrading Strategies From Technical Analysis - 6GEorge StassanNo ratings yet

- Bollinger Bands: #1 Measuring Volatility #2 Identifying Bottoms and Tops #3 Signaling The Strength of A TrendDocument7 pagesBollinger Bands: #1 Measuring Volatility #2 Identifying Bottoms and Tops #3 Signaling The Strength of A TrendJeremy NealNo ratings yet

- Trading ProcessDocument3 pagesTrading ProcessecuamantisNo ratings yet

- Combining RSI With RSIDocument39 pagesCombining RSI With RSIwayansiagaNo ratings yet

- CHAPTER 2 - Financial MarketDocument16 pagesCHAPTER 2 - Financial MarketHirai GaryNo ratings yet

- Ratio AnalysisDocument12 pagesRatio AnalysisMrunmayee MirashiNo ratings yet

- Breakfast With Dave 8/9/10Document12 pagesBreakfast With Dave 8/9/10ctringhamNo ratings yet

- 10 Stock Valuation Metrics and Ratios Every Investor Should KnowDocument16 pages10 Stock Valuation Metrics and Ratios Every Investor Should KnowgreatersolomonNo ratings yet

- Metallgesellschaft AG: A Case StudyDocument24 pagesMetallgesellschaft AG: A Case StudyTariq KhanNo ratings yet

- TopicsDocument10 pagesTopicsKiven M. GeonzonNo ratings yet

- Quiz #6Document7 pagesQuiz #6Michael MerlinNo ratings yet

- RisklogDocument3 pagesRisklogRuwani KarandanaNo ratings yet

- International Marketing Entry StrategiesDocument10 pagesInternational Marketing Entry Strategiesamitmonu1979100% (1)

- FLL PresentationDocument8 pagesFLL PresentationAnshi BinuNo ratings yet

- School Site Development PlanDocument3 pagesSchool Site Development PlanMayShael baynosaNo ratings yet

- Ca510 Atlas CopcoDocument249 pagesCa510 Atlas CopcoBruno RibeiroNo ratings yet

- 3001 Chemistry Paper With Answer EveningDocument6 pages3001 Chemistry Paper With Answer Eveninghtpkhw9No ratings yet

- UltrasonicsDocument17 pagesUltrasonicsKrishna Vijay Kumar Gangisetty100% (1)

- Haven Brochure 12 PDFDocument1 pageHaven Brochure 12 PDFAurelian BogdanNo ratings yet

- Course File BCA-IDocument23 pagesCourse File BCA-IKrishan Kant PartiharNo ratings yet

- Guideline Xper2Document6 pagesGuideline Xper2Ivan AguilarNo ratings yet

- LC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Document2 pagesLC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Mahadi Hassan ShemulNo ratings yet

- Word Features: Type of Paragraph Spacing Spacing Before Spacing After Line SpacingDocument2 pagesWord Features: Type of Paragraph Spacing Spacing Before Spacing After Line SpacingRonibeMalinginNo ratings yet

- 2023 08 30 NCSC Memorandum Circular No. 01 S. 2023 Guide For The 2023 Elderly Filipino Week CelebrationDocument9 pages2023 08 30 NCSC Memorandum Circular No. 01 S. 2023 Guide For The 2023 Elderly Filipino Week Celebrationgwen dela cruzNo ratings yet

- Chapter IVDocument11 pagesChapter IVHazel Kiah RasucayNo ratings yet

- Mi CaDocument380 pagesMi Cawilmer.dazaNo ratings yet

- People v. Dacudao, 170 SCRA 489Document4 pagesPeople v. Dacudao, 170 SCRA 489JNo ratings yet

- Basics of Maths - Pranav Popat - Full PDFDocument39 pagesBasics of Maths - Pranav Popat - Full PDFravishukla81No ratings yet

- Emd Micro Project FinalDocument15 pagesEmd Micro Project Finalom pawarNo ratings yet

- FINALLDocument24 pagesFINALLcintya trisantyNo ratings yet

- PDPII - May 2011 - Dhanaraj - 10644Document96 pagesPDPII - May 2011 - Dhanaraj - 10644Utibe basseyNo ratings yet

- Tanques de ExpancionDocument2 pagesTanques de ExpancionTonio MamalonNo ratings yet

- Assignment 12Document20 pagesAssignment 12sruthis_8No ratings yet

- Revolt Against The Modern WorldDocument406 pagesRevolt Against The Modern WorldkubanovmappingNo ratings yet

- Crane Duty Chart 21.02.2019Document9 pagesCrane Duty Chart 21.02.2019naren1202No ratings yet

- ME Soft ComputingDocument6 pagesME Soft Computingmarshel007No ratings yet

- Contoh CV Akademik S3Document2 pagesContoh CV Akademik S3Chrystian ChandraNo ratings yet