4594_255212_7 michigan.gov documents taxes

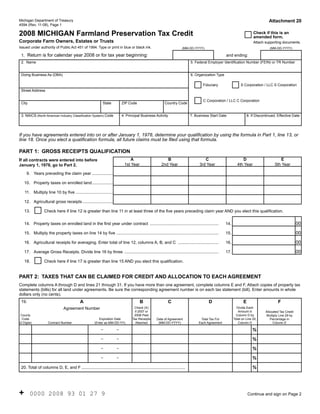

- 1. Reset Form Attachment 20 Michigan Department of Treasury 4594 (Rev. 11-08), Page 1 2008 MICHIGAN Farmland Preservation Tax Credit Check if this is an amended form. Corporate Farm Owners, Estates or Trusts Attach supporting documents. Issued under authority of Public Act 451 of 1994. Type or print in blue or black ink. (MM-DD-YYYY) (MM-DD-YYYY) 1. Return is for calendar year 2008 or for tax year beginning: and ending: 2. Name 5. Federal Employer Identification Number (FEIN) or TR Number Doing Business As (DBA) 6. Organization Type Fiduciary S Corporation / LLC S Corporation Street Address C Corporation / LLC C Corporation City State ZIP Code Country Code 3. NAICS (North American Industry Classification System) Code 4. Principal Business Activity 7. Business Start Date 8. If Discontinued, Effective Date If you have agreements entered into on or after January 1, 1978, determine your qualification by using the formula in Part 1, line 13, or line 18. Once you elect a qualification formula, all future claims must be filed using that formula. PART 1: GROSS RECEIPTS QUALIFICATION A B C D E If all contracts were entered into before 1st Year 2nd Year 3rd Year 4th Year 5th Year January 1, 1978, go to Part 2. 9. Years preceding the claim year .................. 10. Property taxes on enrolled land .................. 11. Multiply line 10 by five ................................ 12. Agricultural gross receipts .......................... 13. Check here if line 12 is greater than line 11 in at least three of the five years preceding claim year AND you elect this qualification. 00 14. Property taxes on enrolled land in the first year under contract ........................................................... 14. 00 15. Multiply the property taxes on line 14 by five ........................................................................................ 15. 00 16. Agricultural receipts for averaging. Enter total of line 12, columns A, B, and C ................................... 16. 00 17. Average Gross Receipts. Divide line 16 by three ................................................................................. 17. 18. Check here if line 17 is greater than line 15 AND you elect this qualification. PART 2: TAXES THAT CAN BE CLAIMED FOR CREDIT AND ALLOCATION TO EACH AGREEMENT Complete columns A through D and lines 21 through 31. If you have more than one agreement, complete columns E and F. Attach copies of property tax statements (bills) for all land under agreements. Be sure the corresponding agreement number is on each tax statement (bill). Enter amounts in whole dollars only (no cents). A B C D E F 19. Agreement Number Check (X) Divide Each if 2007 or Amount in Allocated Tax Credit County 2008 Paid Column D by Multiply Line 29 by Code Expiration Date Tax Receipts Total on Line 20, Date of Agreement Total Tax For Percentage in (2 Digits) Contract Number (Enter as MM-DD-YY) Attached (MM-DD-YYYY) Each Agreement Column D Column E - - % - - % - - % - - % % 20. Total of columns D, E, and F ......................................................................................... + 0000 2008 93 01 27 9 Continue and sign on Page 2

- 2. 4594, Page 2 FEIN or TR Number 21. Taxes from line 19, column D, on land enrolled after December 31, 1977. Enter zero unless you 00 checked the box on line 13 or line 18 ................................................................................................... 21. 00 22. Taxes from line 19, column D, on land enrolled before January 1, 1978 .............................................. 22. 00 23. Taxes qualifying for credit. Add lines 21 and 22 ................................................................................... 23. PART 3: TAXES THAT CANNOT BE CLAIMED FOR CREDIT 24. Business Income Tax base from Form 4567, line 30c (or Business Income Tax Base Worksheet, 00 see instructions). ................................................................................................................................... 24. 00 25. Depletion allowance claimed on your federal income tax return .......................................................... 25. 26. Compensation of shareholders that is not included in the Business Income Tax base ......................... 26. 00 00 27. Total. Add lines 24 through 26. If less than zero, enter zero ................................................................. 27. 00 28. Taxes that cannot be claimed for credit. Multiply line 27 by 3.5% (0.035) ............................................ 28. PART 4: CREDIT 29. Farmland Preservation Tax Credit. Subtract line 28 from line 23. If line 28 is greater than line 23, 00 enter zero ............................................................................................................................................... 29. 30. Amount of credit applied to Michigan Business Tax liability. Enter here the lesser of line 29 00 or the amount on Form 4567, line 38. Enter this amount on Form 4574, line 17 ................................... 30. 00 31. Amount of credit to be REFUNDED. Subtract line 30 from line 29......................................................... 31. PART 5: CERTIFICATION AND SIGNATURE Taxpayer Certification. Preparer Certification. I declare under penalty of perjury that the information in I declare under penalty of perjury that this this return and attachments is true and complete to the best of my knowledge. return is based on all information of which I have any knowledge. Preparer’s PTIN, FEIN or SSN By checking this box, I authorize Treasury to discuss my return with my preparer. Taxpayer Signature Preparer’s Business Name (print or type) Taxpayer Name (print or type) Date Preparer’s Business Address and Telephone Number (print or type) Title Telephone Number If using this credit, or a portion of this credit, to pay the MBT liability, attach this form to the MBT Refundable Credits (Form 4574) as part of the annual tax filing along with the MBT annual return (either the MBT Simplified Return (Form 4583) or the MBT Annual Return (Form 4567)). If requesting a refund of the entire amount of the credit, mail this form to: Michigan Department of Treasury P.O. Box 30783 Lansing, MI 48909 For assistance, visit Michigan Department of Treasury’s Web site at www.michigan.gov/taxes or call toll-free 1-800-827-4000 for questions about Michigan income tax and credit forms. Persons who have hearing or speech impairments may call 517-636-4999 (TTY). + 0000 2008 93 02 27 7

- 3. 4594, Page 3 Instructions for Form 4594 Michigan Farmland Preservation Tax Credit Fiscal Year Filers: See “Supplemental Instructions for Initial Fiscal MBT Filers” in the MBT Instruction Booklet for Standard Taxpayers (Form 4600) at www.michigan.gov/taxes. • Trusts created by the death of a spouse if the Trust requires Purpose 100 percent of the income from the Trust to be distributed each To allow the taxpayer to claim the Farmland Preservation Tax year to the surviving spouse. Credit. Form MI-1040CR-5 can be found on the Department of The Farmland Preservation Tax Credit gives a share of the Treasury Web site at www.michigan.gov/treasuryforms or property tax paid on farmland back to farmland owners. call 1-800-827-4000. Farmland owners qualify for credit by agreeing to keep the Claiming the Credit land as farmland and not develop it for another use. Complete Form 4594. If applying this credit or a portion of this Requirements credit to MBT liability, attach this form to the MBT Refundable To qualify, the following requirements must be met: Credits (Form 4574). Attach a copy of U.S. Form 1120 or 1041, page 1, and copies of all the federal schedules completed for the • Taxpayer must own farmland, and federal tax return. The following must also be included: • Taxpayer must have entered into a Farmland Development • A copy of the taxpayer’s 2008 property tax statement(s) Rights Agreement (FDRA) with the Michigan Department of (bills) with corresponding agreement numbers listed on each. Agriculture (MDA). • A copy of the receipt showing that 2007 or 2008 property If agreements were entered into on or after January 1, 1978, the taxes were paid. If property taxes have not been paid or gross receipts qualifications in Part 1 must be met. receipt(s) are not attached, the Department will mail a check Farmland Development Rights Agreement made jointly payable to the Corporation, estate or Trust AnD the county treasurer for the county where the property is Through an FDRA, a taxpayer may receive property tax relief located. (A new check payable only to the Corporation, estate in return for a pledge not to change the use of the taxpayer’s or Trust will not be issued if it is later proved that the taxes had lands. been paid.) Note: The FDRA restricts development of land. Before • If the property tax statement (bill) includes property that making any changes to property covered under this agreement is not covered under an FDRA, the taxpayer must show what or to its ownership, consult the MDA. Some changes may make portion of total acreage and property tax is for land enrolled in property ineligible for credit. the FDRA. A local equalization officer or local assessor must give this information on official letterhead if it is not listed Filing the Correct Form separately on property tax bills. The following should file using Form 4594: When to Claim a New Agreement • Estates, include property taxes from the date of death and new agreements must be approved by the local government farm income required to be reported on the entity’s U.S. Form by november 1, 2008, to claim a 2008 credit. But the FDRA 1041. is not final until a copy that has been recorded at the Register • Corporations other than S Corporations. of Deeds is received from the MDA. Credit for the new FDRA • S Corporations that had an FDRA before January 1, 1989, will not be allowed unless a copy of the recorded agreement and in 1991 elected to file under the Single Business Tax (SBT) is attached to the return. If the taxpayer doesn’t get a notice Act on the Farmland Preservation Tax Credit (Form C-8022). before April 30, file the return without that agreement. File a • Trusts, except as noted below. new Form 4594 with the amended box checked when the FDRA is received. The following should file using the MI-1040CR-5: Jointly Payable Checks • Individuals who own a farm independently. The taxpayer should take the check, check stub, and a copy • Representatives of deceased single persons. Include property of the FDRA(s) to the county treasurer(s) who will have the taxes and income from January 1 to the date of death. taxpayer endorse the check and then use the refund to pay any • Partnerships. delinquent taxes. Any remaining amount will be returned to the • Joint owners. taxpayer. • S Corporation shareholders, except shareholders of Property Taxes That Can Be Claimed for Credit S Corporations who had an FDRA before January 1, 1989, and in 1991 elected to file under the SBT Act on Form C-8022. The property taxes levied in 2008 on enrolled land are eligible for the 2008 credit, regardless of when they are paid. • Grantor Trusts (if treated as an owner under Internal Revenue Code (IRC) 671 to 679).

- 4. 4594, Page 4 line 3: Enter the entity’s six-digit north American Industry Ad valorem property taxes that were levied in 2008 including collection fees up to 1 percent of the taxes can be claimed for Classification System (NAICS) code. For a complete list of credit. Special assessments (those not based on taxable value), six-digit nAICS codes, see the U.S. Census Bureau Web site at www.census.gov/epcd/www/naics.html, or enter the same penalties, and interest cannot be claimed. NAICS code used when filing the entity’s U.S. Form 1120, Taxes on land not eligible for either the principal residence Schedule K, U.S. Form 1120S, U.S. Form 1065, or U.S. Form or qualified agricultural property exemptions most likely are 1040, Schedule C. not eligible for the Farmland Preservation Tax Credit. The line 6: Check the box that describes the organization type. A exception is rental property where the tenant spends at least 1,040 hours per year participating in the farming operation. To Trust or Limited Liability Company (LLC) should check the compute the taxes that can be claimed for credit, exclude the appropriate box based on its federal return. school operating tax and multiply the balance by the percentage PART 1: GRoss RECEIPTs QuALIFICATIoN of exemption allowed by the local taxing authority. Applies only to agreements entered into on or after example: January 1, 1978. If agreements were entered into on or after January 1, 1978, Taxes levied $2,000 eligibility for a Farmland Preservation Tax Credit must School operating tax $350 be determined using one of the two qualification formulas Principal residence exemption 60% provided below. If all agreements began before January 1, 1978, skip to Part 2. $2,000 $1,650 ImpoRtaNt: Once a qualification formula is elected, all - 350 x 60% future claims must be filed using that formula. $1,650 $990 can be claimed for credit total Receipts Formula on line 13: This formula compares If the taxpayer has entered into more than one agreement with agricultural gross receipts to property taxes on the enrolled the MDA, the sum of the taxes under each agreement is used land in each of the tax years preceding the tax year of this to compute the credit. The amount of credit the taxpayer will claim. If gross receipts are more than five times property taxes receive is based on adjusted business income. Taxes levied on in at least three of the five tax years, this formula may be used. rental property cannot be claimed for credit unless the tenant is average Receipts Formula on line 18: This compares the involved in the farm operation. average of the agricultural gross receipts for three tax years Claiming a Credit for Farms Purchased in 2008 preceding the tax year of this claim to property taxes on the That Were Already Enrolled in the Program enrolled land in the first year under the agreement. If average receipts are more than five times property taxes in the first year, The Farmland Preservation Tax Credit will be processed only this formula may be used. if there is a farmland agreement on file with the MDA IN THE line 9: Enter each of the years immediately preceding the SAME NAME AS THE TAXPAYER’S DEED. The taxpayer claim year. Enter the most current year in column A. must prorate the 2008 taxes for the period the land was owned and claim credit based on those taxes only. line 10: Enter the property taxes for each year reported on line 9 that are attributable to land enrolled on or after Line-by-Line Instructions January 1, 1978. Do not include property taxes on land enrolled Lines not listed are explained on the form. before January 1, 1978, or property taxes on structures or any other lands not enrolled in an FDRA. Dates must be entered in MM-DD-YYYY format. line 12: Enter the agricultural gross receipts for the tax years amended Returns: Check the box (upper right corner, immediately preceding the tax year of this claim. Agricultural page 1) if this is an amended return, and attach a separate sheet gross receipts are receipts from the business of farming as explaining the reason for the changes. Include any supporting defined in the IRS Regulation 1.175-3. documents including an amended federal return or a signed and dated Internal Revenue Service (IRS) audit document. If the taxpayer’s farm operation was incorporated during this five-year period and the ownership before and after date of Country Code: If other than the United States, enter the incorporation is identical, report gross receipts for all five tax country code. See the list of country codes in the MBT years. If the ownership changed, enter gross receipts only for Instruction Booklet for Standard Taxpayers (Form 4600) on the those tax years since incorporation. Web at www.michigan.gov/taxes. PART 2: TAXEs THAT CAN BE CLAIMED FoR CREDIT line 1: Tax year of claim. Enter the ending month, day and AND ALLoCATIoN To EACH AGREEMENT year of the annual accounting period in which this credit is claimed. Complete columns A through D and lines 21 through 31. If the entity has more than one agreement, complete columns E example: A participant with a tax year ending and F. Attach copies of property tax statements (bills) for all December 31 claims a credit for the 2008 property taxes in the land under agreements. Be sure the corresponding agreement tax year ending in December 2008. number is on each tax statement (bill). Enter amounts in whole dollars only (no cents).

- 5. 4594, Page 5 line 19: Attach additional forms if entering more than four Enter on lines 24 through 28 the amounts for the tax year of agreements on line 19. this claim (the year entered on line 1). • Column a: Enter the farmland preservation agreement line 24: Enter the amount of Business Income Tax base from number assigned by the MDA. Agreement number or contract Form 4567, line 30c. (If not required to file Form 4567, use number is found in the lower right corner of each agreement. the “Business Income Tax Worksheet” on page 5 to assist in The first two numbers represent the county where the property determining the base). This amount can be less than zero. is located. The middle set of numbers is the actual contract line 30: If filing this form separately from the annual return number. The final six numbers are the year of expiration i.e. and the amount of the liability has not been determined, 123108 (December 31, 2008). The contract number retains its estimate the amount of the liability and enter on this line. It will original series throughout the term of the agreement. However, be treated as a credit available when the annual return is filed. a letter may be added to indicate that the agreement was split Unitary Business Groups (UBGs): If the eligible taxpayer is a into multiple agreements. The final six numbers change when the agreement is reduced or extended. Always use the contract member of a UBG, a pro forma calculation must be performed number on the most recently recorded agreement, and attach a to determine the tax liability of the eligible taxpayer prior to copy of each 2008 tax statement (bill) that corresponds to the this credit. This supporting pro forma calculation should be agreement number listed. provided in a statement attached to this form. However, this calculation should never be transferred to a Form 4567 or • Column B: For each agreement, check the box if paid displayed as such. tax receipts for 2007 or 2008 are attached. The Farmland Preservation Credit will be issued jointly to the taxpayer and Attachments the treasurer for the county where the property is located if the Assemble the return and attachments in the following order, receipts are not attached. beginning on top: Note: 2008 property tax statements (bills) must be attached. 1. MBT Annual Return (Form 4567) and MBT Schedule of • Column C: Enter the date each agreement was entered into Shareholders and Officers (Form 4577), if applying this credit (MM-DD-YYYY). to MBT liability. • Column D: Enter the total amount of tax on land and 2. Michigan Farmland Preservation Tax Credit (Form 4594). structures under agreement from tax statements (bills). Do not 3. Business Income Tax Worksheet (page 5 of these include penalties, interest or special assessments. Collection instructions). fees may be included. If the taxpayer is a joint owner, enter only the taxpayer’s share of taxes. 4. A copy of page 1 of 2008 U.S. Form 1120, U.S. Form 1120S or U.S. Form 1041, and all supporting schedules. Notes: If the property tax statement (bill) includes taxes for land not covered by an FDRA, the taxes reported in column D 5. A copy of any recorded Farmland Development Rights must be reduced accordingly. The amount of taxes that cannot Agreement(s) (FDRAs) not claimed on the previous year’s be claimed must be determined by the local assessor’s office return. and submitted on his or her official letterhead. The 1 percent 6. A copy of the 2008 property tax statement(s) (bills) that collection fee may be included. Do not include penalties, show the taxable value, the property taxes levied, and the interest or special assessments. corresponding agreement numbers. If the property tax statement (bill) includes taxes for land on 7. An official allocation of the tax statement amount between more than one agreement, the taxes reported in column D property subject to an FDRA and property not covered by an must be separated according to land in each agreement. The FDRA. local assessor will be able to determine what the breakdown is 8. A copy of the receipt showing payment of years 2007 or based on the legal descriptions of the land enrolled under each 2008 property taxes. agreement. For assistance, visit our Web site at www.michigan.gov/taxes or line 20: If multiple pages of Form 4594, lines 20D, 20E, and call toll-free 1-800-827-4000 for answers to questions about 20F are included, bring the total of all line entries to the main Michigan income tax and credit forms. Persons who have Form 4594. hearing or speech impairments may call 517-636-4999 (TTY). line 21: Taxes on land enrolled After December 31, 1977. If Mailing This Form qualified under one of the gross receipts formulas (line 13 or If using this credit, or a portion of this credit, to pay the MBT line 18), enter the taxes from column D on land and structures liability, attach this form to the MBT Refundable Credits (Form enrolled after December 31, 1977. Otherwise, enter zero. 4574) as part of the annual tax filing along with the MBT PART 3: TAXEs THAT CANNoT BE CLAIMED FoR annual return (either the MBT Simplified Return (Form 4583) or CREDIT the MBT Annual Return (Form 4567)). If filing Form 4567, the amounts used in this computation are If requesting a refund of the entire amount of the credit, mail available on the return and schedules. If not filing an MBT this form to: annual return, complete the MBT Schedule of Shareholders and Michigan Department of Treasury Officers (Form 4577) and attach it to this claim. P.O. Box 30783 Lansing, MI 48909

- 6. 4594, Page 6 E-filing MBT Returns To optimize operational efficiency and improve customer service, the Department of Treasury is supporting e-file for the first year of MBT by participating in the Internal Revenue Service (IRS) Federal/State Modernized e-File (MeF) program. Check with your software provider to see if it supports MBT e-file, or visit the e-file Web site at www.MIfastfile.org to view a list of approved software providers. The e-file mandate for SBT is being continued for software developers supporting MBT, effective January 1, 2010, for the 2009 tax year. Software developers producing MBT preparation software will need to support e-file for all eligible MBT forms that are included in their tax preparation software. Therefore, all eligible MBT returns prepared using software must be e-filed. new this year, the Department will accept certain Portable Document Format (PDF) attachments with MBT e-filed returns. For a current list of defined attachments, visit the e-file Web site at www.MIfastfile.org, and select “Business Taxpayer.” Follow your software instructions for submitting attachments with an e-filed return. If the MBT return includes supporting documentation or attachments that are not on the predefined list of attachments, the return can still be e-filed. Follow your software instructions for including additional attachments. The preparer or taxpayer should retain file copies of all documentation or attachments. For more information and program updates, including exclusions from e-file, visit the e-file Web site at www.MIfastfile.org. The taxpayer may be required to e-file its federal return. Visit the IRS Web site at www.irs.gov for more information on federal e-file requirements and the MeF program.

- 7. 4594, Page 7 FEIN or TR Number Business Income Tax Base Worksheet If not required to file the Michigan Business Tax (MBT) Annual Return (Form 4567), use this worksheet to calculate the Business Income Tax base reported on the Farmland Preservation Tax Credit (Form 4594), line 24. Instructions for completing specific lines are found in the Form 4567 instructions (corresponding lines are referenced in the line instructions below) and the “Supplemental Instructions for Standard Initial Fiscal MBT Filers,” which are both found in the Michigan Business Tax Instruction Booklet (Form 4600) and on the Michigan Department of Treasury’s Web site at www.michigan.gov/taxes. A copy of this worksheet must be attached to Form 4594. 1. Apportionment Percentage (Form 4567, lines 10a through 10d). a. Michigan Sales ................................................................................................................................................... 1a. 00 b. Total Sales .......................................................................................................................................................... 1b. 00 c. Apportionment %. Divide line 1a by line 1b ........................................................................................................ 1c. % 2. Proration Percentage (Form 4567, lines 10e through 10h, and the Supplemental Instructions for Standard Initial Fiscal MBT Filers). a. Check this box if fiscal year filer using the annual method, and complete lines 2b through 2d. (Tax year 2008 only.) b. Number of months in MBT tax period ................................................................................................................. 2b. 12 c. Total months ....................................................................................................................................................... 2c. d. Proration Percentage. Divide line 2b by line 2c .................................................................................................. 2d. % 3. Business Income (use Worksheets 1 through 3 on page 136 of the MBT Instruction Book for assistance) ............. 3. 00 4. Additions to Income (Form 4567, lines 22a through 22f). a. Interest income and dividends derived from obligations or securities of states other than Michigan ................ 4a. 00 b. Taxes on or measured by net income................................................................................................................ 4b. 00 c. Tax imposed under MBT.................................................................................................................................... 4c. 00 d. Any carryback or carryover of a federal net operating loss ............................................................................... 4d. 00 e. Losses attributable to other taxable flow-through entities ................................................................................. 4e. 00 Account Number f. Royalty, interest, and other expenses paid to a related person......................................................................... 4f. 00 5. Total Additions to Income. Add lines 4a through 4f ................................................................................................... 5. 00 6. Business Income Tax Base after Additions. Add lines 3 and 5 ................................................................................. 6. 00 7. Subtractions from Income (Form 4567, lines 25a through 25d). a. Dividends and royalties received from persons other than United States persons and foreign operating entities 7a. 00 b. Income attributable to other taxable flow-through entities ................................................................................. 7b. 00 Account Number c. Interest income derived from United States obligations .................................................................................... 7c. 00 d. Net earnings from self-employment. If less than zero, enter zero ..................................................................... 7d. 00 8. Total Subtractions from Income. Add lines 7a through 7d ........................................................................................ 8. 00 9. Subtract line 8 from line 6. If not using apportionment or the Qualified Affordable Housing Deduction, this is the Business Income Tax base to be entered on Form 4594, line 24. Otherwise, continue and use amount on line 13c . 9. 00 10. If box 2a is checked, multiply line 9 by percentage on line 2d. All others enter amount from line 9 ......................... 10. 00 11. Apportioned Business Income Tax Base. Multiply line 10 by percentage on line 1c ................................................ 11. 00 12. Available MBT business loss carryforward from previous MBT return. Enter as a positive number (Form 4567, line 29.) 12. 00 13. Business Income Tax base to be entered on Form 4594. a. Subtract line 12 from line 11. If negative, enter here as a negative number ...................................................... 13a. 00 b. If line 13a is a positive number, enter the Qualified Affordable Housing Deduction (Form 4567, line 30b.) ....... 13b. 00 c. Subtract line 13b from line 13a. This is the Business Income Tax base to be entered on Form 4594, line 24 .. 13c. 00