Devaluation and revaluation expectations in

the Venezuela crawling band regime

M. Isabel Campos∗

Universidad de Valladolid and centrA

and

José L. Torres†

Universidad de Málaga and centrA

February 27, 2003

Abstract

The 90’s could be characterized as a decade in which both developed and emerging countries have suffered important episodes of

exchange rate instability; some of these episodes have resulted in exchange rate devaluations and others, in important exchange rate depreciations. This paper focuses on the study of devaluation and revaluation expectation in the crawling band system adopted by Venezuela

from 1996 until the first of 2002. We use a Binary Dependent Variable Model (Logit Method) to estimate the readjustment probability, in

which the dependent variable is calculated from two different methods:

Svensson simple credibility test and the drift adjustment method.

Keywords: Crawling-bands, Currency Crises, Readjustment Probability.

JEL: F31

∗

Dpto. de Fundamentos del Análisis Económico. Facultad de Económicas. Universidad

de Valladolid. Avda Valle Esgueva, 6, E-47.011-Valladolid- (Spain). Tf: +34 983 184458.

Fax: +34 983 423299. E-mail: maribel@eco.uva.es

†

Dpto. de Teoría e Historia Económica. Facultad de C. Económicas y EE. Universidad

de Málaga. El Ejido s/n, 29013. Málaga- (Spain). Tf: +34 952 131247. Fax: +34 952

131299. E-mail: jtorres@uma.es

1

�1

Introduction

The last decade could be characterized as an intense period of events

with respect to the International Financial System. Both emerging and

developed countries have suffered important episodes of exchange rate

instability resulting in realignment of parities or high volatilities. In either

case, the monetary authority has been forced to intervene at the expense of

huge losses in foreign reserves and/or large increases in interest rates. This

turbulence has renewed the debate about the reform of the International

Financial System, in order to avoid or lessen the virulence of currency crises.

In this context, both target zones and crawling bands are exchange

rate regimes which have been recently implemented by a large number

of countries, as a compromise between fixed and floating exchange rates.

Following Williamson (1996) an exchange rate crawling-band can be defined

as a system in which the exchange rate is forced to moves inside a band

and the band is adjusted in small steps with a view to keeping it in line with

the fundamentals. As in a target zone system, monetary authority intervenes

when the exchange rate reaches the limits of the band. Therefore, a crawlingband system is similar to a target zone except by the fact that the central

parity is not constant over time but increases at a constant positive rate (the

rate of crawl). Both the bandwidth and the rate of crawl are preannounced.

As it is pointed out by Williamson (1996), the principal cause of changes

in the parity (the crawl) is typically the inflation differential, to ensure that

high domestic inflation does not lead to a progressive erosion in international

competitiveness. The purpose of making parity changes in relatively small

steps is to avoid creating situations where the market is able to profit through

correct anticipation of an impending parity change. This exchange rate

system have been adopted by developing countries which experiences high

inflation rates. Examples are Chile, Colombia, Israel, Indonesia, Ecuador,

Russia and Venezuela. The bandwidth goes to the ±5.5% of Ecuador to

±15% of Chile and Russia.

In this paper, we study devaluation and revaluation expectations in the

Venezuela crawling band regime. During the period July 8, 1996-February 8,

2002 Venezuela adopted a crawling-band system to stabilize the exchange rate

with a band of fluctuation of ±7.5%. During this period the central parity

was readjusted several times, implying both revaluations and devaluations

(four revaluations and one small devaluation at the end of the period). In a

crawling band system readjustments of the central parity, others than the

2

�crawl, are provoked by an evolution of the exchange rate which departs

from the pre-fixed rate of depreciation. Therefore, when we speak about

a revaluation in a crawling band regime, this implies that the depreciation

rate of the exchange rate was lower than the expected devaluation rate by

the Central Bank.

The purpose of this paper we study the different moments of speculative

pressure in the crawling-band exchange rate system in Venezuela in order

to explain the behaviour of the Bolivar/US dollar exchange rate during

this regime. There are different methodologies which try to estimate the

realignment expectations in exchange rate bands regimes. The most popular

are the Svensson (1991) simple credibility tests and the drift adjustment

method developed by Bertola and Svensson (1993). These methods have

been widely applied in the target zone literature, among others, by Rose and

Svensson (1995), Bertola and Svensson (1993) and Lindberg, Soderlind and

Svensson (1993) to analyze ERM and Swedish devaluation risk.

Since the edition of Bertola and Svensson (1993), several new methods

for extracting information about market expectations in target zone systems

have been developed. Worthy of mention as perhaps the most relevant are:

Mizrach (1995), Gómez Puig and Montalvo (1997), Söderlind and Svensson

(1997) or Bekaert and Gray (1998). All of them study target zone models

with stochastic devaluation risk.

There are other approaches, with non-structural features, to estimate the

realignment probability which use a group of “ fundamental” variables of the

economy. We could point out two kinds of studies. First, Weber (1991),

applies a Bayesian approach with Kalman multiprocessor filter. Secondly,

we could mention the following: Edin and Vredin (1993) and Ayuso and

Pérez-Jurado (1997), who estimate a multinomial dependent variable model.

Non-structural models of currency crises fall into two broad categories:

those based on non-parametric tests e.g. Eichengreen, Rose and Wyplosz

(1994), Sachs, Tornell and Velasco (1996) or Kaminsky, Lizondo and Reinhart

(1998); all of which try to identify crises by looking at an index of exchange

market pressure; and others based on binary dependent variable models,

logit or probit, e.g. Eichengreen, Rose and Wyplosz (1996), Frankel and Rose

(1996) and Kruger, Osakwe and Page (1998). They applied this methodology

using data for emerging and/or developed countries, and all of them try

to associate speculative attacks with some exogenous variables, such as the

output growth, domestic credit growth, foreign interest rates, current account

or budget deficits. The first one and the third one also consider the possibility

3

�of contagion effects.

In this paper, we study the readjustment probability of the Bolivar/US

dollar exchange rate during the crawling band period. We use a Binary

Dependent Variable Model with a logistic distribution function. However,

given the special features of a crawling band regime, we have to take

into account the existence of both revaluations and devaluations episodes.

Therefore, we estimate two separate models: one for the devaluation

expectations and another for the revaluation expectations.

The first step in our research consists in the construction the dependent

variable in each case. We use two methods: the Svensson simple credibility

test and the drift adjustment method. From these methods we define the

periods in which there are expectations of devaluation and expectations

of revaluation, respectively. The estimated model predicts quite well the

revaluations which take place during this regime, showing during most of

the period the existence of a positive probability of revaluation. From this

point of view, this regime was highly successfully in controlling the long-run

depreciation of the Bolivar/US dollar exchange rate.

The structure of the paper is as follows. Section 2 presents the main

characteristics of the Venezuela crawling band regime. Section 3 develops

econometric specification we will use in the estimation. The results of the

estimation will be offered in Section 4. Finally, Section 5 contains some

concluding remarks.

2

The Venezuela Crawling Band Regime

On July 8, 1996, Venezuela adopted a crawling band system in order to

manage the exchange rate. The exchange rate was forced to move inside a

fluctuation band with an increasing central parity, significantly lower than

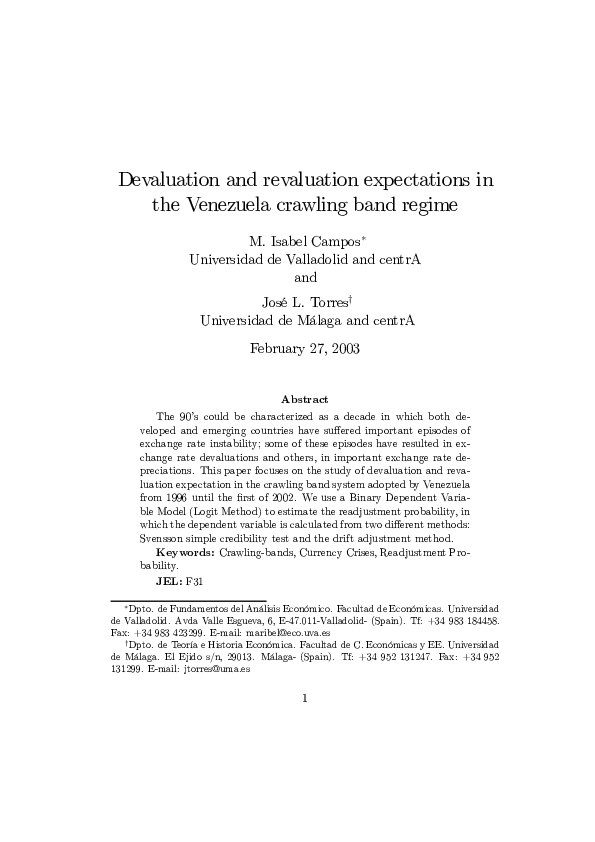

expected inflation. Figure 1 shows the crawling-band system of Venezuela

during the period. The solid line is the Bolivar/US dollar exchange rate.

The data consists of daily observations for the period July 1996 to February

2002 for the Bolivar/US dollar exchange rate, and interest rate for 3 months

to maturity. The data used have been obtained from the Venezuela Central

Bank. The central parity we initially set to 470 Bolivares per US dollar.

In order to fix this value (as an equilibrium exchange rate), the Venezuela

Central Bank leaves the currency to float during the period April-July, 1996,

that is, a few months before the system was established. The exchange rate

4

�Table 1: Venezuela crawling-band regimes [1996-2002]

Central parity Rate of crawl Realignment

July/08/96-Decem./31/96

Jan./02/97-July/31/97

Aug./01/97-Jan./12/98

Jan./13/98-Decem./29/00

Jan./02/01-Decem./31/01

Jan./02/02-Febr./08/02

(Bs/US$)

(Percent per day)

(Percent)

470

472

497.50

508.50

700

758

0.070

0.064

0.055

0.046

0.030

0.038

8.15

3.85

3.67

7.52

-0.93

Free float

Note: A positive value of realignment implies a revaluation and a negative value

a devaluation.

band was officially declared to be ±7.5 percent during all the period. The

system was abandoned on February 8, 2002.

As we can observe, during the period the central parity was realigned

several times. The four first realignments are revaluations, implying a

reduction in the central parity for the exchange rate. Some of these

revaluations are consequence that the exchange rate reaches the lower limit of

fluctuation, that is, the exchange rate was more stable than the depreciation

rate fixed by the monetary authority. However, the last realignment were an

increases in the central parity (i.e. a devaluation). Table 1 shows the regimes

and the date of realignments and the rates of crawl for each regime.

The initial rate of crawl was fixed to 1.5 percent per month, according

to the inflation target. However, during this initial period the exchange rate

was very stable, and in December 12, 1996, the central parity was reduced,

which at this time was fixed to be 513.87 Bolivares per US dollar given the

rate of crawl, to 472, that is a revaluation of 8.15 percent. In the second

regime, the rate of crawl was reduced to 1.32 percent per month. During

this period the Bolivar depreciates with respect to the US dollar but at a

rate lower than the rate of crawl. In July 31, 1997 the central parity was

again readjusted, with a revaluation of 3.85 percent. The new central parity

was set to a value of 497.5 Bolivares per US dollar, and the rate of crawl

was reduced to a 1.16 percent per month. In January 2, 1998 the exchange

rate was revaluated in a 3.67 percent, with a new central parity of 508.5

Bolivares per US dollar. During the period January 1998-December 2000,

the central parity was stable regardless some episodes of turbulences in the

5

�fall of 1998. In December 29, 2000, the central parity was readjusted again,

with a revaluation of 7.72 percent. However, in December 31, 2001, the

central parity was readjusted with a small devaluation of 0.93 percent.

By January 2002, this system appeared to be successful in managing

exchange rates. In fact, monetary authorities readjusted the central parity

four times as revaluations. This implies that the exchange rate depreciated at

a lower rate than the pre-announced one. However, the system was suspended

on February 8, 2002, mainly due to political factors.

Then, we shall now study whether a binary dependent variable model is

adequate for explaining the crises and credibility periods of the Bolivar/US

Dollar exchange rate during the sample crawling band.

3

Econometric Specification

The application of a binary dependent variable model means we have to

specify the moments in which the dependent variable will assume only two

values {1, 0}. Let jt be our dependent variable and jt = 1 if there is a lack

of credibility and then a high probability of readjustment [storm period if

we used the “ Currency Crises” name], and jt = 0 if it is a calm period with

high credibility. Note that in our sample, we have positive (devaluations)

and negative (revaluations) adjustments.

The logistic distribution function we shall use, F (κ, β), is the following:

Pr ob (jt = 1) = F (κ, β) =

exp [β 0 κ]

1 + exp [β 0 κ]

(1)

where Pr ob (jt = 0) = 1 − Pr ob (jt = 1), and κ is a vector of observed

exogenous variables that we will use in the analysis, β being the parameter

vector.

We use a Maximum Likelihood Estimation Method and the numerical

optimization is reached through the iterative algorithm known as “NewtonRaphson”. The log Likelihood function is given by:

ln L =

n

X

t=1

jt ln F (κ, β) +

n

X

t=1

(1 − jt ) ln [1 − F (κ, β)]

(2)

We will specify two moments in which jt = {1, 0}, because we find both

revaluation and devaluation moments. Then, we have to estimate the model

6

�twice, in one of them our dependent variable will be jrt = 1 if there is a lack

of credibility and then a high probability of revaluation, and jrt = 0 if it is

a calm period with high credibility. In the second case, jdt = 1 if there is a

high probability of devaluation, and jdt = 0 if it is a high credibility period.

We must specify the exogenous variables considered in the estimation.

One of them is the interest rate differential minus the preannounced rate of

crawl, (iτt − i∗τ

t − δτ ). We correct the interest rate differential with the rate

of crawl because, in a crawling-band system, the central parity growth at a

constant rate (the rate of crawl) between realignments, and this fact has to

be consider in the model. Even we consider the rate of crawl in the period,

(δ) as a exogenous variable. Other variable is the exchange rate deviation

from the central parity, xt defines as:

xt = st − ct

(3)

where st is (the natural logarithm of) the spot exchange rate in period t,

defined as the domestic currency per unit of foreign currency and ct = c0 + δt

denotes (the natural logarithm of) the central parity, where c0 represents

a jump in the central parity, positive for a devaluation and negative for

a revaluation, and δ is the rate of crawl. Finally, we consider as another

exogenous variable (the natural logarithm of) the international reserves, rvt .

We will show our results by calculating, as a first step, the dependent

variable values, using the Svensson Test and the Drift-Adjustment Method

results. Then, we will estimate, by the maximum likelihood procedure,

the readjustment probability of the exchange rate, calculating both the

revaluation and the devaluation probability.

4

Estimation Results

The purpose of this paper is to analyze whether a non-structural binary

dependent variable model is a suitable method to adequately explain the

turbulence and calm periods of the Bolivar/US dollar exchange rate during

the crawling band period. We have estimated the Log Likelihood function

expressed in equation (2).

7

�4.1

Estimation using the Svensson Test results

Svensson (1991) develops a set of simple credibility tests to target zones.

By computing the rate of return band, we can observe if domestic interest

rates are inside this band. By adding assumption of uncovered interest parity,

we can calculate the maximum and minimum expected rate of devaluation.

The same results are obtained.

The annualized effective domestic-currency ex-post rate of return on a

foreign currency investment period t of duration τ , Rtτ , is then given by

12/τ

Rtτ = (1 + i∗τ

−1

t )(St+τ /St )

(4)

where St is the spot exchange rate in period t, defined as the domestic

currency per unit of foreign currency, St+τ is the exchange rate at time t + τ ,

i∗τ

t is the foreign interest rate in period t for term τ . In a crawling-bands

system the exchange rate is restricted to a band with lower and upper bounds.

These bounds are not constant as in a target zone system, but they change

at a constant rate: the rate of crawl. However, as in a target zone system,

the existence of this exchange rate band implies bounds on the amount of

depreciation and appreciation of the domestic currency. This implies that

the rates of return, Rtτ , will also be restricted to a band:

τ

Rτt ≤ Rtτ ≤ Rt

(5)

which Svensson calls the rate-of-return band. In the case of a crawling-band

system, the lower and upper bounds on the rates of return are given by:

12/τ

Rτt = (1 + i∗τ

−1

t )(S t + δτ /St )

τ

12/τ

Rt = (1 + i∗τ

−1

t )(S t + δτ /St )

(6)

(7)

where S t + δτ is the lower band for the exchange rate at the duration of

the investment subject to no realignment and S t + δτ is the upper band for

the exchange rate that will exist at the end of the investment, under the

assumption that the central parity for the exchange rate will be increasing at

the rate of crawl. Under a completely credible crawling-band and with free

capital mobility, the domestic interest rate, iτt , it must lie inside the rate-ofreturn band. If indeed the domestic interest rate in some period is outside

the rate-of-return band and if capital is sufficiently internationally mobile,

8

�the exchange rate regime cannot be completely credible. In computing the

rate of return bands, as we use 3-months interest rates, we have to expand

the exchange rate band for each regime 66 period ahead.

Figure 2 shows the results of the above test, showing the Venezuela

three-month interest rate and the rate-of-return bands, computed as above.

Interest rate must fall within the rate-of-return bands if the exchange rate

regime is credible and the no arbitrage assumption holds. If the interest rate

is outside the bands, profit opportunities exist, and then, a readjustment

of the central parity (additionally to the crawl) is expected. If the interest

rate is above the band, an agent can make a profit by borrowing abroad and

lending at home. If it is below the band profits can be make by borrowing

at home and lending abroad. As we can observe, we obtain the crawlingbands system of the Bolivar during the period has a high level of credibility.

Most of the time the interest rate is inside the rate-of-return band. Note

that the rate-of-return band in decreasing with the exchange rate: a higher

exchange rate means a weaker domestic currency, which increases the scope

for domestic currency appreciation. This lowers the domestic currency rate

of return on foreign investments and shifts down the rate-of-return band.

During the period November 15, 1996 until January 2, 1997, the interest

rate was below the band, just in the period previous to the first revaluation.

This fact shows that the system was not credible during this period, and that

the market expected a revaluation. This can be interpreted as a fact which

indicates that the rate of crawl preannounced (1.5 percent per month) was

too high. A similar situation is found during the period October, 2000 until

December 29, 2000, just before the fourth revaluation.

On the other hand, we find two subperiods in which the interest rate

is above the band. The first subperiod is in August-September 1998. In

this period the interest rate and the exchange rate increase and therefore,

the rate-of-return band was decreasing. This fact shows a situation of lack of

credibility, with expectations of devaluation. However, the central parity was

not readjusted and the turbulences disappear rapidly. The other situation

reflecting no credibility and expectations of devaluation is found at the end

of the period, just before the abandon of the system in February 2002.

We have to specify a criterion to use in order to choose the dependent

variable values for the Logit Model. We shall assign the dependent variable

value jrt = 1 (high probability of revaluation) if the Venezuela three-month

interest rate is below the lower bound on the rates of return, and jrt = 0

if the interest rate is inside the rate-of-return band. On the other hand,

9

�jdt = 1 (high probability of devaluation) if the interest rate is above the

upper bound on the rates of return, and jdt = 0 if the interest rate is inside

the rate-of-return band.

Empirical research should begin with a specification of the relationship

to be estimated. The omitted variables test enable us to evaluate the set

of significant variables to explain the variation in the dependent variable.

Interpretation of the coefficient values is complicated by the fact that

estimated coefficients from a binary model can not be interpreted as the

marginal effect on the dependent variable. The marginal effect of κi on the

conditional probability is given by:

∂E (j | κi β)

= f (−κ 0 β) β i

∂κi

(8)

where f (κ, β) = dF (κ, β) /dκ is the density function associated with F.

Note that the direction of the effect of a change in κi depends only on the

sign of the β i coefficient. Positive values of β i imply that increasing κi will

increase the probability of the response; negative values imply the opposite.

For computing marginal effects, we have evaluated the marginal effects

at every observation and have used the sample average of the individual

marginal effects.1

Table 2 sets out the marginal effects of the explanatory variables. As

we can observe, the coefficient of the corrected interest rate differential is

negative in the revaluation model and positive in the devaluation model. As

interest rate differential increases, the probability of revaluation decreases

and the probability of devaluation increases. Second, the sign of the exchange

rate deviations is negative in the revaluation model and positive in the

devaluation model. The coefficient of the rate of crawl and the reserves

is positive in the revaluation model, and not significant in the devaluation

model.

Table 3 displays (2 x 2) table of correct and incorrect classification based

on a user specified prediction rule. Observations have been classified as

having predicted probabilities that are above or below the cutoff value of 0.3.2

1

For computing marginal effects, one can evaluate the expressions at the sample means

of the data or evaluate the marginal effects at every observation and use the sample

average of the individual marginal effects. In large samples these will give the same answer.

Current practice favors averaging the individual marginal effects when it is possible to do

so. [9, Greene, p.816]

2

We have used a cutoff value of 0.3 because our dependent variable (jt ) presents many

10

�Table 2: Readjustment probability using logit binary model from Svensson

test

Revaluation Probability Devaluation Probability

(iτt − i∗τ

0.071

δτ

)

−

−0.950

t

(−4.088)

(2.220)

xt

−1.663

0.847

rvt

0.395

0.071

δ

1.211

1.211

AIC

0.055

0.021

(3.249)

(−4.149)

(2.777)

(1.592)

(2.629)

(0.220)

Note: The value into the parentheses in the estimated parameters is the z

statistic; this statistic has a standard normal distribution. The AIC is the Akaike

info Criterion.

Table 3: Prediction evaluation using logit binary model from Svensson test

Revaluation Prob.

Devaluation Prob.

jrt = 0 jrt = 1 Total jdt = 0 jdt = 1 Total

p (jt = 1) ≤ 0.3

1281

1

1282

1348

1

1349

p (jt = 1) > 0.3

7

83

90

0

23

23

Total

1288

84

1372

1348

24

1372

% Correct

99.46

98.81 99.42 100.00

95.83 99.93

Note: Correct classifications are obtained when the predicted probability is

greater than 0.3 and the observed jt = 1, or when the predicted probability is

less than or equal to 0.3 and the observed jt = 0.

It provides a measure of the predictive ability of our model. The estimated

model correctly predicts almost 100% observations (99.46% of the jrt = 0

or 100% of the jdt = 0 and 98.81% of the jrt = 1 or 95.83% of the jdt = 1

observations).

Figures 3 and 4 illustrate the readjustment probability, revaluation and

devaluation probability respectively. Using the estimated probability of

revaluation we can observe in figure 3 that our model predicts the first,

second and four revaluations. Figure 4 shows the probability of devaluation.

more values of credibility (jt = 0) than values of realignment probability (jt = 1). Results

do not change significatively if we use other cutoff value.

11

�As we can observe, the model detects two episodes of a positive probability

of devaluation. First, we find a high probability of devaluation during

September 1998. In this date, the exchange rate depreciates and the interest

differential increases significantly. Second, we find some probability of

devaluation in September 2001.

4.1.1

Estimation using the drift adjustment method results

Let ct denotes (the natural logarithm of) the central parity. A

realignment is defined as a jump in the central parity, positive for a

devaluation and negative for a revaluation. In a crawling-band system

the central parity growths at a constant rate (the rate of crawl) between

realignments. The exchange rate deviation from the central parity, xt , can

be define as:

xt = st − ct

(9)

where ct = c0 + δt and δ is the preannounced rate of crawl. Bertola and

Svensson (1993) were the first to consider the possibility of realignment risk

in the context of a target zone. Their method of calculating this realignment

risk is based on the decomposition of the expected rate of depreciation

(appreciation) rate in two components: the expected rate of depreciation

within the band plus the expected rate of change in the central parity.

Et ∆st+τ = Et ∆xt+τ + Et ∆ct+τ

(10)

Additionally, in the case of a crawling-bands system, the expected rate

of change in the central parity has two components, one known, given the

preannounced rate of crawl and another unknown, representing the expected

rate of realignment:

Et ∆ct+τ = δτ + Et rt+τ

(11)

where Et rt+τ is the expected rate of realignment. One the value of the

expected change within the band is obtained, it can be used to correct the

interest rate differential for expectations of currency changes within the band

and for the preannounced change in the central parity in order to obtain the

expected rate of realignment:

Et rt+τ = iτt − i∗τ

t − Et ∆xt+τ − δτ

12

(12)

�From the above expression, it is clear that this method needs an

econometric estimate of the expected rate of depreciation within the band.

At it is noted by Svensson (1993), exchange rate within the band usually

take a jump at a realignment. Therefore, it is complicated to estimate the

expected rate of depreciation within the band inclusive of possible jumps

inside the band at realignments, since there may be relative few realignments.

Then expectations of realignment and jumps inside the band may introduce

a Peso problem in the estimation of the expected rate of depreciation within

the band. For these reasons it is necessary to estimate the expected rate of

depreciation within the band conditional upon no realignment.

Following Bertola and Svensson (1993), an estimate of the expected rate

of depreciation can be obtained by regressing the change in the exchange rate

on the current exchange rate, both measured relative to the central parity,

and on regime shift dummies. The estimated equation is as follows:

12 X

=

αj zj + β 1 xt + εt+τ

(13)

τ

The variable zj is a dummy for regime j, where a regime is the period

between two realignments. Note that since the maturity of the interest

rate is three months, the expected change in the exchange rate is based

on the same time interval. Therefore, the regressand is multiplied by 12/τ in

order to be annualized to maintain time consistency with the interest rate.

Since we need to estimate the expected future exchange rate conditional

upon no realignment, the observations within the time interval τ before each

realignment are excluded. This corresponds to 66 observations, given that

one month corresponds to about 22 daily observations.

Equation (13) was estimated using ordinary least-squares with standard

errors computed using a Newey-West estimator of the covariance matrix

which allow for heteroskedastic and serially correlated error terms.

The results are presented in table 4. The significant negative coefficient

of the level of the exchange rate deviation indicates that there is evidence of

mean reversion of the Bolivar/US dollar exchange rate within the band.3

Figure 5 gives time-series plot of the expected rate of realignment and

the 95 percent confidence interval. As we can observe, the comparison

of this estimation with the credibility test gives some differences. The

confidence interval is below zero just during all the period between the

(xt+τ − xt )

3

In fact, the ADF and PP unit root tests indicate that the null hypothesis that xt is

nonstationary is rejected.

13

�Table 4: Estimated parameters value of the expected rate of depreciation

within the band

Variables

z1

Estimated values

−0, 218

(−27,073)

−0, 118

z2

(−13,523)

−0, 112

z3

(−15,582)

−0, 058

z4

(−3,031)

z5

0, 007

(1,252)

−1, 184

xt

(−2,444)

2

R

F-statistic

0.434

155, 529

Durbin-Watson statistic

White heteroskedasticity test

0, 014

103.557

(0,000)

(0,000)

Note: The value in parentheses in the estimated parameters is the t statistic.

The value in parentheses in both the F-statistic and the White heteroskedasticity

Test is the p-value. Adjusted R-squared is used as a measure of goodness of fit.

14

�first and the third realignments (except at the beginning of the sample,

when the crawling band system was introduced), indicating the existence of

expectations of revaluations. In fact, during this period the central parity was

readjusted three times, as revaluations. On the other hand, the turbulences

period of lack of credibility occurring at the end of 1998 obtained from

the previous analysis, give an expectations of revaluations not significantly

different from zero. The analysis shows clearly that after this period of

turbulence, expectations of realignments are clearly negative, indicating

the existence of expectations of revaluations. However, situation changes

dramatically after the realignment of December 29, 2000. From this date

the estimated realignment expectations start to increases, and it becomes

significantly different from zero just at the end of the period, predicting the

realignment (devaluation) of December 31, 2002. Resuming, our estimation

of the realignment expectations predict all the realignments and their sign

(devaluation or revaluation) of the Venezuela crawling peg system. The

results we obtain demonstrate that the interest rate differential, corrected for

expected depreciation within the band, is a reasonable estimation of expected

realignment for Venezuela.

In order to specify a criterion to use in order to choose the dependent

variable values for the Logit Model, we shall assign the dependent variable

value jdt = 1 (high probability of devaluation) if the threshold is above zero.

Otherwise, we will consider jdt = 0. On the other hand, jrt = 1 (high

probability of revaluation) if the estimated realignment expectations is less

than zero, and jrt = 0 otherwise.

Table 5 sets out the marginal effects of the explanatory variables. As

we can observe, the sign of the variables is the expected. In the revaluation

model, the interest differential, the exchange rate deviation and the rate

of crawl show a negative coefficient, whereas the reserves show a positive

coefficient. In the devaluation model only the reserves show a negative sign,

as expected. Table 6 displays table of correct and incorrect classification

based on a user specified prediction rule.

Figures 6 and 7 illustrate the readjustment probability of revaluation

and devaluation, respectively. In this case, the revaluation model predict

all the realignments. As we can observe, during most of the sample period,

there are a positive probability of revaluation. Figure 7 shows the estimated

probability of devaluation. We observe a positive probability of devaluation

just at the beginning of the regime. It is natural to think that just at the

beginning of the crawling band regime the credibility is null, so the market

15

�Table 5: Readjustment probability using logit binary model from the drift

adjustment method

Revaluation Probability Devaluation Probability

(iτt − i∗τ

1, 042

δτ

)

−7, 952

−

t

(−5,552)

(3,527)

xt

−8, 804

1, 351

(−5,073)

(3,324)

rvt

0, 0881

−0, 038

δτ

−10, 844

1, 865

(−5,595)

(3,573)

0,275

0,026

(−3,570)

(5,511)

AIC

Note: The value into the parentheses in the estimated parameters is the z

statistic; this statistic has a standard normal distribution. The AIC is the Akaike

info Criterion.

Table 6: Prediction evaluation using logit binary model from the drift

adjustment method

Revaluation Prob.

Devaluation Prob.

jrt = 0 jrt = 1 Total jdt = 0 jdt = 1 Total

p (jt = 1) ≤ 0, 3

818

8

826

1179

1

1180

p (jt = 1) > 0, 3

66

480

546

4

188

192

Total

884

488

1372

1183

189

1372

% Correct

92,53

98,36 94,61 99,66

99,47 99,64

Note: Correct classifications are obtained when the predicted probability is

greater than 0, 3 and the observed jt = 1, or when the predicted probability is

less than or equal to 0, 3 and the observed jt = 0.

16

�expected a devaluation. However, this positive probability of devaluation

disappears rapidly. Second, we observe that after the third revaluation,

probability of devaluation becomes positive during a long period during

1998. Finally, probability of devaluation becomes positive just before the

devaluation realignment of January 2002 and just before the breakdowns of

the system.

5

Conclusions

During the 90’s, we have witnessed important episodes of exchange

rate instability in both developed and emerging countries. Some of these

periods have resulted in exchange rate devaluations and others, in important

exchange rate depreciations.

We have analyzed whether a non-structural binary dependent variable

model could be a suitable method to adequately explain the turbulence

and calm periods that the Bolivar/US Dollar exchange rate during the

crawling band period. During the period 1996-2002 Venezuela adopted a

crawling-band regime in which the exchange rate was forced to move inside

a fluctuation band with a increasing central parity. During this period, the

central parity was readjusted (other than the crawl) five times: four were

revaluations and one small devaluation at the end of the period.

We estimate two models: one for the probability of revaluation and

another for the probability of devaluation. In choosing the dependent

variables, we use two methods to estimate realignment expectations: the

Svensson credibility test and the drift adjustment method. The model of

revaluation shows that the interest differential, the exchange rate deviation

from the central parity, the level of reserves and the rate of crawl, explain the

probability of revaluation. The methodology could be considered as a mixture

of approaches which have studied and carried out research on currency crises

and credibility both of them widely applied to target zones.

References

[1] Ayuso, J. and M. Pérez Jurado (1997), Devaluations and Depreciation

Expectations in the EMS, Applied Economics, 29, 4, April: 471-484.

17

�[2] Bekaert, G. and S.F. Gray (1998), Target Zones and Exchange Rates:

an Empirical Investigation, Journal of International Economics, 45, 1,

June: 1-35.

[3] Bertola, G. and L.E.O. Svensson (1993), Stochastic Devaluation Risk

and the Empirical Fit of Target Zone Models, Review of Economics

Studies, 60, 3, July: 689-712.

[4] Eichengreen, B., A.K. Rose, and C. Wyplosz (1994), Speculative Attacks

on Pegged Exchange Rates: An Empirical Exploration With Special

Reference to the European Monetary System in M. Canzoneri, P.

Masson, y V. Grilli (eds.), The New Transatlantic Economy, Cambridge

University Press for CEPR, Cambridge.

[5] Eichengreen, B., A.K. Rose, and C. Wyplosz (1996), Contagions

Currency Crises, NBER w.p., 5681.

[6] Edin, P. and A. Vredin (1993), Devaluation Risk in Target Zones:

Evidence from the Nordic Countries, The Economic Journal, 103: 161175.

[7] Frankel, J. and A. Rose (1996), Currency Crashes in Emerging Markets:

An Empirical Treatment, Journal of International Economics, 41: 351366.

[8] Gómez Puig, M. and J.G. Montalvo (1997), A New Indicator to Assess

the Credibility of the EMS, European Economic Review, 41, 8, August:

1511-1535.

[9] Greene, W.H. (2000), Econometric Analysis, fourth edition, Prentice

Hall, New Jersey.

[10] Kaminsky, G., S. Lizondo and C.M. Reinhart (1998), Leading Indicators

of Currency Crises, IMF Staff Papers, 45, 1, March.

[11] Kruger, M., P.N. Osakwe and J. Page (1998), Fundamentals, Contagion

and Currency Crises: An Empirical Analysis, Working Papers, 98-10,

International Department, Bank of Canada.

[12] Krugman, P.R. (1991), Target Zones and Exchange Rate Dynamics,

Quarterly Journal of Economics, 106, 3, August: 669-682.

[13] Lindberg, H., L.E.O. Svensson and P. Söderlind (1993), Devaluation

Expectations: The Swedish Krona 1985-92, The Economic Journal, 103,

420, September: 1170-1179

[14] Mizrach, B. (1995), Target Zone Models with Stochastic Realignments:

an Econometric Evaluation, Journal of International Money and

Finance, 14, 5, October: 641-657.

18

�[15] Rose, A. and Svensson, L. (1995), Expected and predicted realignments:

The FF/DM exchange rte during the EMS 1979-93. Scandinavian

Journal of Economics, 97, 173-200.

[16] Sach, J., A. Tornell, and A. Velasco (1996), Financial Crises in Emerging

Markets: The Lessons from 1995, Brooking Papers on Economic

Activity, 16: 147-215.

[17] Söderlind, P. and L.E.O. Svensson (1997), New Techniques to Extract

Market Expectations from Financial Instruments, Journal of Monetary

Economics, 40, 2, November: 383-430.

[18] Svensson, L.E.O. (1991), The Simple Test of Target Zone Credibility,

IMF, Staff Papers, 38, 3: 655-665.

[19] Weber, A. (1991), Stochastic Process Switching and Intervention in

Exchange Rate Target Zones: Empirical Evidence Form the EMS,

CEPR, Discussion Papers Series, 554.

[20] Williamson, J. (1996), The crawling band as an exchange rate regime:

Lessons from Chile, Colombia and Israel, Washington: Institute for

International Economics.

850

800

750

Aug. 1, 97

700

Jan. 13, 98

650

Jan. 2, 97

Jan. 2, 01

600

Jan. 2, 02

550

500

450

400

08/07/96

12/12/96

29/05/97

05/11/97

Central parity

21/04/98

30/09/98

12/03/99

Exchange rate

26/08/99

04/02/00

Low er band

21/07/00

02/01/01

Upper band

Figure 1: Venezuela crawling-band system

19

15/06/01

27/11/01

�140

120

Aug. 1, 97

100

Jan. 2, 01

Jan. 13, 98

(Percent per year)

80

Jan. 2, 02

60

Jan. 2, 97

40

20

0

-20

-40

08/07/96

12/12/96

29/05/97

05/11/97

21/04/98

30/09/98

In terest rate

12/03/99

26/08/99

Low er rate of return

04/02/00

21/07/00

02/01/01

15/06/01

27/11/01

Upper rate of return

Figure 2: The rate of return band (Svensson Test)

1,00

Jan. 13, 98

Jan. 2, 01

0,80

Aug. 1, 97

0,60

Jan. 2, 02

Jan. 2, 97

0,40

0,20

0,00

-0,20

-0,40

08/07/96

12/12/96

29/05/97

05/11/97

21/04/98

30/09/98

12/03/99

Realignm ent expectations

26/08/99

Upper lim it

04/02/00

21/07/00

02/01/01

15/06/01

27/11/01

Low er lim it

Figure 3: Realignment expectations (Drift adjustment method)

20

�1,00

Jan. 2, 01

Aug. 1, 97

0,80

Jan. 2, 97

Jan. 2, 02

Jan. 13, 98

0,60

0,40

0,20

0,00

08/07/96

12/12/96

29/05/97

05/11/97

21/04/98

30/09/98

12/03/99

26/08/99

04/02/00

21/07/00

02/01/01

15/06/01

27/11/01

Probability of revaluation

Figure 4: Readjustment probability (Revaluation) from Svensson test

1,00

Jan. 2, 01

Aug. 1, 97

0,80

Jan. 2, 97

Jan. 2, 02

Jan. 13, 98

0,60

0,40

0,20

0,00

08/07/96

12/12/96

29/05/97

05/11/97

21/04/98

30/09/98

12/03/99

26/08/99

04/02/00

21/07/00

02/01/01

15/06/01

27/11/01

Probability of devaluation

Figure 5: Readjustment probability (Devaluation) from Svensson test

21

�1,00

Jan. 2, 01

Aug. 1, 97

0,80

Jan. 2, 02

Jan. 2, 97

Jan. 13, 98

0,60

0,40

0,20

0,00

08/07/96

12/12/96

29/05/97

05/11/97

21/04/98

30/09/98

12/03/99

26/08/99

04/02/00

21/07/00

02/01/01

15/06/01

27/11/01

Probability of revaluation

Figure 6: Readjustment probability (Revaluation) from drift adjustment

method

1,00

Jan. 2, 01

Aug. 1, 97

0,80

Jan. 2, 97

Jan. 13, 98

Jan. 2, 02

0,60

0,40

0,20

0,00

08/07/96

12/12/96

29/05/97

05/11/97

21/04/98

30/09/98

12/03/99

26/08/99

04/02/00

21/07/00

02/01/01

15/06/01

27/11/01

Probability of devaluation

Figure 7: Readjustment probability (Devaluation) from drift adjustment

method

22

�

Jose Torres

Jose Torres